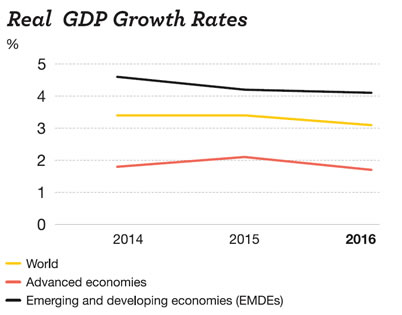

During the year, the global economy saw a growth of 3.1% – a moderately satisfactory performance. Advanced economies performed better than expected with the United States achieving near full employment by the end of the second half of 2016. The European Union did not see much growth during the year, with the exception of the United Kingdom in the aftermath of the Brexit vote. China, although initial outlook feared a slowdown, performed better than expected.

Global Economy at a Glance

The global economy achieved a moderately satisfactory performance in 2016 with an estimated growth of 3.1%, albeit one that showed much variation between regions. The advanced economies did somewhat better than expected, with the US especially achieving near full employment by the end of the year. However, the European Union as a whole did not do too well, though one exception was the UK economy in the aftermath of the Brexit vote.

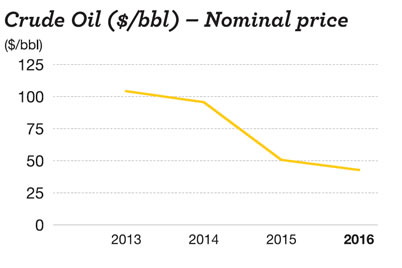

Though there were initially fears of a slowdown in China, the country performed better than expected. However there are still uncertainties surrounding addressing the problems of corporate debt and imposing budgetary constraints on the state-owned enterprises. The Russian economy also received a boost from higher and more stable oil prices. A modest recovery of 3.1% is expected for East and North Africa with oil importers registering stronger gains. India’s economy has continued to grow benefiting from the large improvement in terms of trade, implementation of key structural reforms and reduction of supply side constraints. A real GDP growth of 2.7% is expected for 2017. However, expectations may have to be toned down in view of the cash shortages and the recent currency note withdrawal.

With the recovery in commodity prices headline inflation rates picked up in advanced economies and in China.

Real and nominal interest rates showed an upward trend after August 2016. In the same period the US dollar appreciated against key currencies. The Brexit vote caused wide fluctuations in the British pound, while the Euro and the Japanese yen have weakened.

Looking at the prospects for 2017, there is cautious optimism about increased growth in advanced as well as emerging economies. There is however much uncertainty regarding the policies of the new administration in the US particularly regarding trade.

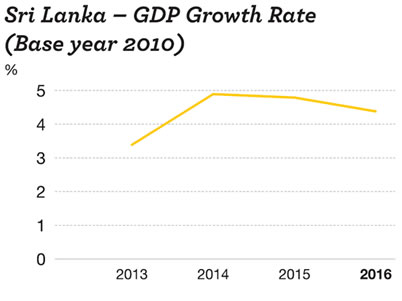

Conditions in the Sri Lankan economy remained dampened with GDP growth dropping to 4.4% in 2016 as against the growth of 4.8% achieved in 2015. Despite some upward pressures due to adverse weather and Government tax policy inflation was moderate during the year. The balance of payments recorded a surplus compared with a deficit in the previous year. Gross official reserves as at end 2016 stood at USD 6.4 billion amounting to an average of 3.1 months imports of goods and services.

The Sri Lankan Economy

The performance of the Sri Lankan economy was somewhat dampened during the year, with a growth of only 4.4% for 2016 as against an annual growth of 4.8% in 2015. The agricultural sector suffered a contraction in the first part of the year; however the industrial and service sectors grew by 6.7% and 4.2% respectively. Despite some upward pressures due to adverse weather and Government tax policy inflation was moderate during the year. Inflation on an average annual basis was 4.0% in December 2016. Overseas workers’ remittances recorded an increase of 3.7% over the previous year. Tourism continued to perform well as it did in the previous year.

The Balance of payments recorded a lower deficit of USD 500 million for 2016 compared with a deficit in the previous year of USD 1,489 million. Gross official reserves as at end 2016 stood at USD 6.4 billion amounting to an average of 3.1 months imports of goods and services. Total foreign assets stood at USD 8.4 billion at end 2016, which was equivalent to 5.2 months of imports of goods and 4.3 months of imports of goods and services. The rupee slid by 3.8% against the US dollar during the year while it appreciated by 17% against the British pound as a result of the depreciation of the pound against the US dollar.

A growth rate of 6.3% is expected for 2017 bolstered by growth in the areas of tourism, financial services, transport, telecommunication and ports. Growth is expected to be driven by the proposed special economic zone in Hambantota, the Colombo International Financial City and the Megapolis in the Western Province.

The Banking Sector

The Sri Lankan banking sector, which consists of 32 licensed banks, performed well during the year with total assets of

LKR 9 trillion. The sector also recorded over LKR 700 billion in capital funds,

over LKR 2.3 trillion in total investments and over LKR 100 billion in profits.

The profits of the sector showed an increase over the previous year by 17.4%. This was driven mainly by an increase of net interest income through expansion of lending.

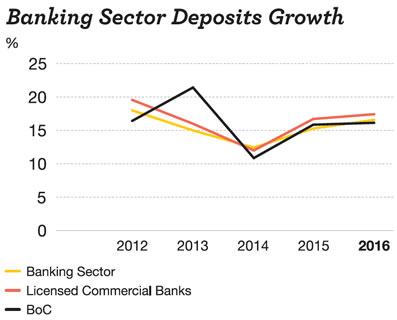

Total loans as at end 2016 was LKR 5,541 billion showing a growth of 17.5% over the prior year. Though there was a decrease in lending to the Government and state-owned enterprises this was compensated by an increase in lending to the private sector. The overall growth however, was less than in 2015. Deposits on the other hand, which grew by 16.5% in 2016 grew faster than in 2015. Time deposits accounted for 60.6% of total deposits continuing the trend of the past. Banking sector borrowing which was LKR 1,696 billion as at end 2016, reduced 3.5% over the previous year.

Recording the lowest Non-performing loans (NPL) ratio in the past two decades, assets quality of the sector improved tremendously.

Increasing financial literacy and awareness of financial services is exerting pressure for the banking sector to expand, especially into rural areas. During the year, opened 70 new banking outlets (excluding student savings units) and 366 new ATMs were installed. The total number of banking outlets and ATMs reached 6,659 and 3,843 respectively by the end of 2016.

The global trend is towards more and more automation in the banking sector and the younger generation especially is becoming increasingly tech savvy. To keep up with the trends, banks need to be on the cutting edge of technology and innovate new products and services. They need to strike the balance between expanding through bricks and mortar networks and expanding through the internet and mobile banking. However, while going with the technology, banks also need to be vigilant about the risks. They need to secure their IT systems to ensure customer privacy and safeguard financial assets. With environmental issues coming to the forefront, banks also need to make their contribution by developing green banking products, especially to encourage generation of clean energy.

The banking sector recorded over LKR 700 billion in capital funds, over LKR 2.3 trillion in total investments and over LKR 100 billion in profits in 2016.