Financial Capital

Bank of Ceylon, having completed

many fruitful years, now has closed 2016 with another trailblasing record of

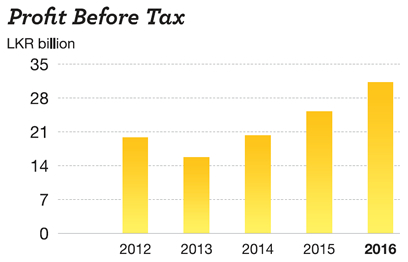

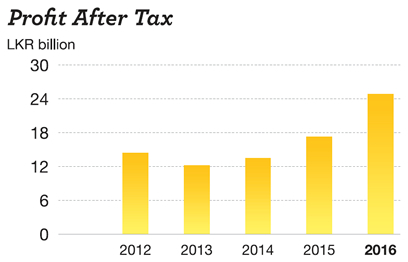

LKR 31.2 billion profit before tax with 23% growth. With this, BoC continues to break its own records by marking the highest ever profit made by a single entity. Profit After Tax (PAT) stood at LKR 24.8 billion resulting in 43% growth.

Return on Financial Capital

Total Income

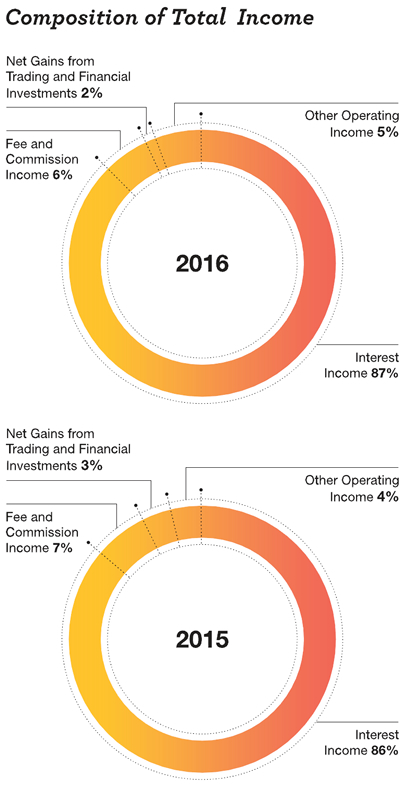

Total income of the Bank grew by 17% during the year. Interest income accounted for 87% of the Bank’s total income of which interest income generated through loans and advances, the core business of the Bank represented 61%.

Fee and commission income and net gains from trading and financial investments contributed 6% and 2% of the total income of the Bank respectively. Contribution made by other income has increased to 5% during the year showcasing the Bank’s ability of making its targets a reality through various avenues among challenges.

Net Interest Income

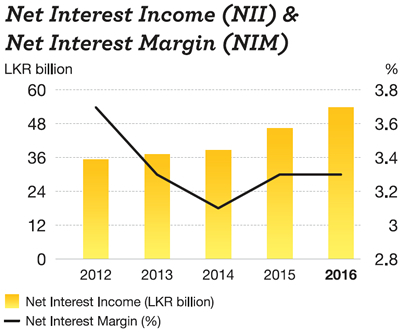

In 2016, many policy rates were changed affecting the market interest rate to move upward. In January 2016, Statutory Reserve Ratio (SRR) was increased by 150 basis points (bps) to 7.5% and Standing Lending Facility Rate (SLFR) and Standing Deposit Facility Rate (SDFR) also increased during the year up to 8.5% and 7.0%. Whilst, the increasing trend in market interest rates has resulted in an increase in both interest income and expenses, the Bank has managed to grow its net interest income by 17% from previous year. Interest Income from loans and advances increased by 24% during the year backed by 21% growth in loan portfolio. Interest income from investments, which accounted for 30% of the interest income grew by 10%, mainly backed by interest income from Government securities.

Interest expense increased to LKR 80.7 billion resulting in a 21% growth YoY. High interest rates scenario prevailed throughout the year encouraged the customers to move from saving deposits to time deposits which is high yielding investment source to them. As a result, the CASA ratio (Current and Savings deposits to total deposits) moved down from 46.5% to 43.4%. However, the Bank’s continuous monitoring and development plans on its fund management activities helped the Bank to continue its Net Interest Margin (NIM) at the same level as that of previous year. As a result, the Bank’s profitability was not impacted.

Non-Interest Income

Non-interest income accounted for 13% of total revenue of the Bank comprising fee and commission income, gains derived through trading activities and other operating income. During the year net fee and commission income showed a decline of 8% due to subdued performance experienced across the export industry and increase in commission expense considerably on correspondent banking activities.

However, an impressive growth in other operating income of 59% demonstrated the diversity of the Bank’s sources of revenue. The Bank disposed its stake in Mireka Capital Land (Private) Limited which was acquired in 2003, one of its associate companies during the year and a capital gain of LKR 3.1 billion derived through this transaction was included in other operating income.

Impairment Charges

Reduction of 25% in total impairment charges through a reversal in provision following improved asset quality has also complemented the increase in net operating income. The reversal of collective impairment charges was as a result of persistent efforts in recoveries and sturdy follow ups, leading to significant improvements in quality of the loan portfolio at the branch level.

Gross NPA ratio which is calculated as per regulatory norms stood at 2.9% at the end of 2016 compared to 4.3% recorded as at 31 December 2015, bringing down the NPA ratio to industry level.

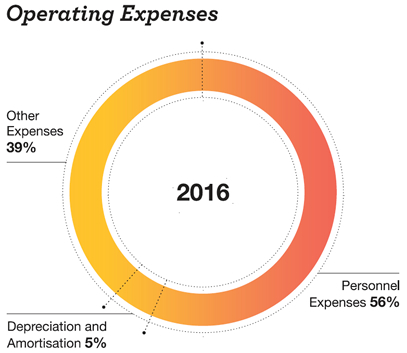

Operating Expenses

Operating expenses mainly consisting of personnel expenses and administrative expenses went up by 7% from previous year. Expenses on one of the Bank’s most valuable capitals i.e. employees amounted to LKR 16.8 billion for the year. Other operating expenses increased by 17% due to increase in fixed assets maintenance expenses, rent expenses and increase in deposit insurance premium with the increase in the deposit base.

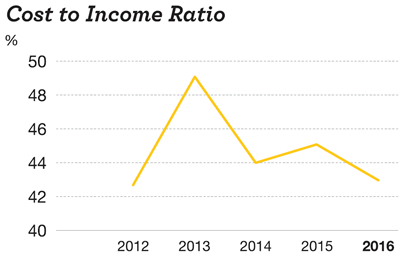

However, depicting the Bank’s effective cost benefit management, and capacity of utilisation cost to income ratio came down to 43% from 45% compared to previous year.

Profitability

BoC continues to maintain its profit momentum at the highest level in the industry. This year, the Bank recorded its highest ever PBT in the history of LKR 31.2 billion, a growth of LKR 5.9 billion or 23%. The Bank’s strategic plan for the year was aligned with the local and global environmental trends and depicting the Bank’s capability of crafting dynamic driving tool, BoC achieved all of its set targets for the year. It is noteworthy that the Bank has been able to record 5-year Compound Annual Growth Rates of 12% and 15% respectively in PBT and PAT.

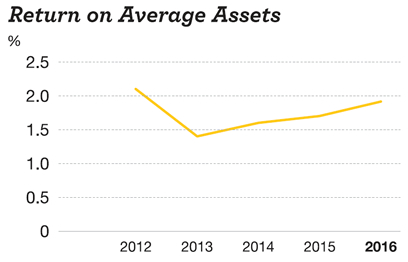

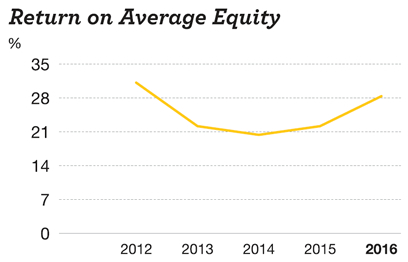

Return on Average Assets (RoAA) and Return on Average Equity (RoAE)

Both RoAA and RoAE improved over the year’s consequent to the improved profitability. This demonstrates the Bank’s strength and capability of generating better return to its shareholder.

Assets

The Bank grew its assets base, the biggest in the industry, further to LKR 1.7 trillion with 6% growth rate. The Bank’s financial wealth is clearly apparent in its Balance Sheet, with interest earning loan portfolio and financial investments accounting for more than 90% of the assets base.

The Bank’s net loans and advances of LKR 1.0 trillion denotes 60% of the total assets contributing significantly to return on the assets. Further, the Bank maintains a diversified investment portfolio in order to capitalise on market gains and also to derive interest income. The Bank has LKR 243.2 billion of held to maturity financial investments and LKR 191.9 billion of loans and receivable financial investments.

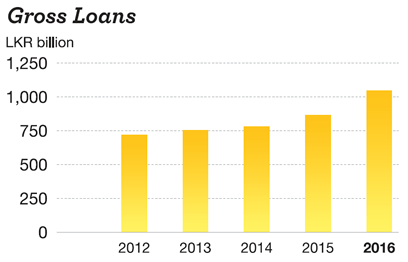

Loans and Advances

Gross loans and advances which stood at LKR 869.3 billion at the end of previous year went up to LKR 1.0 trillion during the year, which is the Bank’s third trillion in the Balance Sheet.

Loan growth of 21% is a rewarding growth considering the challenges that prevailed in the industry by way of high interest rates, low liquidity position and competitive pressure through innovative product strategies, etc. Personal loans, term loans and overdrafts contributed mostly to the growth momentum in the loan portfolio. Many process developments deployed in the recent past bore fruits as evident from the continuing growth momentum. The Bank’s strategy of maintaining an optimum mix exposure between private and Government portfolios resulted in a reduction in its Government exposure from 40% to 30% by end 2016.

Confirming the aptness of the Bank’s strategy of expanding its overseas presence, during the year our overseas branches showed tremendous improvement and contributed to the growth by reporting 42% growth in loans and advances.

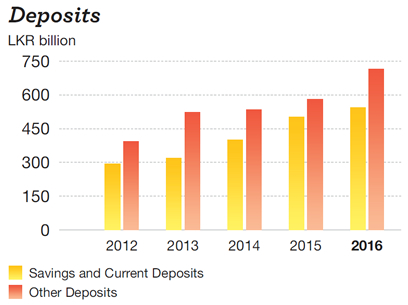

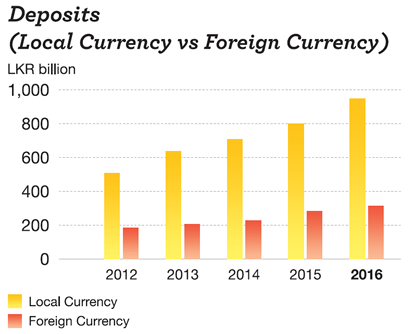

Deposits

The Bank possesses the biggest

deposit base in the industry and accounts for 20% of the market share. Deposit base grew by LKR 174.3 billion to LKR 1.3 trillion reporting 16% increase YoY. Out of the total deposit base 75% is represented by local currency deposits which have grown by 18% during the year. High interest rates that prevailed throughout the year led to increase in both local and foreign currency time deposits by LKR 133.3 billion reporting 23% growth. As a result, CASA ratio of the Bank moved downward which was experienced industry wide.

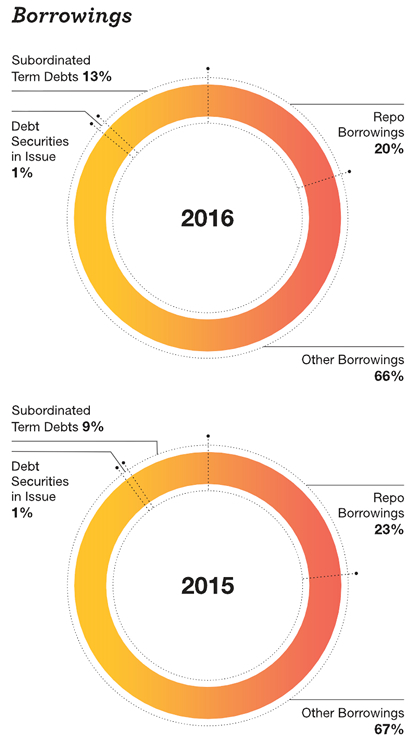

Borrowings

Borrowings of the Bank reduced by LKR 79.5 billion during the year which is 21% drop compared to previous year. This decline was reported mainly from the REPO borrowings and term borrowings from overseas banks.

This planned reduction was initiated in line with fund management strategies that the Bank has been adopting.

During the year, the Bank issued LKR 8.0 billion worth of unsecured subordinated redeemable debentures.

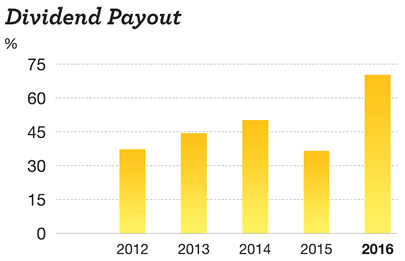

Dividends

During the year 2016, the Bank has paid a significant dividend amount of LKR 17.3 billion to its sole shareholder, the Government of Sri Lanka which is an increase of LKR 11.0 billion from the year 2015. The Bank has identified its responsibility towards the nation’s development and being the No. 1 Bank in the Country has supported the Government initiatives.

The dividend payout ratio for the year 2016, stood at 70%, whereas the same is 36% for the previous year. This denotes the Bank’s contribution towards the Government for its growth momentum.

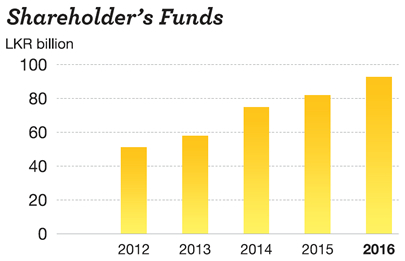

Shareholders’ Funds

A significant increase of 14% was reported in shareholder’s funds which stood at LKR 92.8 billion at the end of year 2016 moving upwards from LKR 81.5 billion from last year. This upward movement was backed by the increase in retained profits and the capital infusion of LKR 5.0 billion to the Bank by the Government of Sri Lanka.

Tier I capital adequacy ratio stood at 8.7% at the year end, against the regulatory requirement of 5%. Tier I & II capital adequacy ratio stood at 12.3% which is also above the regulatory requirement of 10%. As such, the Bank has been able to maintain its compliance to regulatory requirements as directed by the Central Bank of Sri Lanka. In addition, the statutory liquid assets ratio stood at 21.6%, above the regulatory minimum of 20%.

Further, the Bank was closely monitoring its capital adequacy ratio throughout the year, in view of the impending regulatory requirements under Basel III.

BoC Group structure

BoC has ten subsidiary companies as well as four associate companies that together, form the BoC Group. Group companies constitute 3% of total Group’s assets and have been established over the history of BoC for strategic purposes. Of the ten subsidiary companies, five are fully-owned by BoC.

Group Structure

The subsidiary companies are engaged in diverse activities such as financial services (MBSL), travel related services (BOC Travels), hydropower generation [Koladeniya Hydropower (Private) Limited] and the UK Subsidiary that carries on regulated financial services activities, to name a few. Some of the activities engaged by the associate companies include management of Unit Trust funds, stock brokering and property-related activities.

In line with the good governance practices followed by BoC, the subsidiary companies are managed under a subsidiary charter that includes an annual comprehensive subsidiary performance review. A representative from the Bank sits on most of the Boards to ensure that the interests of the Bank are taken care of and that the activities of the subsidiaries and associate companies are also conducted at the highest standards that are followed by the Bank. The financial performance of each subsidiary and associate is monitored by the Bank as the parent company and any indicators of financial distress are promptly brought to the attention of the management for corrective action. Simultaneously, risk management information is reported to the Chief Risk Officer of the Bank in order to ensure that the risks of Group companies are managed within acceptable levels and that the Group companies do not pose any undue risk to the Bank.

Manufactured Capital

Manufactured capital is the stock of goods that we have built up to be used in our operations to add value to the stakeholders. Our physical infrastructure such as the branches, equipment that we use in our operations and our investment in technology fall under this category. This capital has a significant bearing on the value creation process as it enables us to enhance our services and provide a superior customer experience whether the customer visits a BoC branch or if he chooses to avail of our facilities on line. Investment made therein has also enabled us to achieve cost efficiencies in our operations and become environment friendly.

As of end 2016, our total investment in Property, Plant and Equipment including leasehold property stood at LKR 15.5 billion. This has a direct bearing on both the current value creation process as well as our future potential.

Our recent strategic focus on improving our technological offering in products in order to increase customer convenience and investment in the latest software to back our operations as well as the ongoing branch modernisation programme have increased our manufactured capital significantly. These investments ensure that our branches have state-of-the-art technology and modern conveniences for the benefit of our customers. Furthermore, our widespread ATM network as well as the CDMs ensure customer convenience and speed of service. Our digital channels, too provide convenience as well as speed of access.

Further, the investments made by us in the latest technology for operations and data management has strengthened our ability to successfully respond to regulatory changes relating to risk management and our compliance with statutory obligations such as Anti-Money Laundering requirements.

Global megatrends such as evolving role of information and communication technology in the provision of financial services and demographic shifts will call for significant investments in manufactured capital to stay ahead. The Bank will continuously review these development and take necessary steps to upgrade and augment the systems as required in order to add value to our stakeholders.

However, given that banking is fast becoming a capital-intensive business in the wake of ever increasing regulations, Bank is conscious of the financial capital that needs to be invested therein and the pressure it will exert on managing available capital and returns thereon and hence, the need to achieve the optimum trade-off.

Intellectual Capital

Intellectual capital refers to the intangible assets that we have built up over the years such as the brand equity, business ethics, corporate culture, the value system, the intrinsic knowledge and integrity. By nature, these are hard to quantify but add tremendous value to our value creation process. They are the core values that set us apart and constitute the core of our franchise.

Brand Equity

BoC has been named as the No. 1 Brand in Sri Lanka for eight consecutive year by Brand Finance Lanka, a subsidiary of Brand Finance (UK). Our Brand value is estimated to be LKR 41.4 billion, the highest value for a company in Sri Lanka. This encompasses the values, ethics and trust that we have built over the years as the ‘Bankers to the Nation’.

Business Ethics, Corporate Culture and Values

Our culture is built upon inculcating professionalism across the organisation and encourages transparency and ethical behaviour. We encourage superior customer service at all levels and has been the ingredient for our success. With a young and dynamic workforce, we inculcate a learning culture to groom the younger recruits to be the next generation leaders. We encourage creativity, openness and responsiveness to customer requirements. The receptiveness of the younger employees to embrace advancing technology is a definite advantage. A culture of compliance with applicable rules and regulations is inculcated in all employees from the time of joining. Integrity of all employees is encouraged through a code of conduct applicable to all employees and encouraged at all times.

Intrinsic Knowledge

We encourage and provide various opportunities for our staff to further their knowledge and skills at all times. The learning and development process at BoC is structured and take into account the knowledge and skill gaps identified through the talent management process. Training programmes are conducted at the in-house training centre while more specialised trainings are conducted by guest lecturers. Employees are also nominated for training at other training institutes as well as for overseas training. Staff is rewarded for advancing their knowledge and acquiring further qualifications. The knowledge thus built up in employees and institutionalised becomes a valuable resource in the process of our value creation.

Over its 77-year history, Bank of Ceylon has rendered an invaluable service to the nation, providing banking services to Sri Lankans in all corners of the country, driving financial inclusivity, always lending a helping hand and uplifting and enriching their lives. At the same time, we have helped with the development of our national economy by partnering with the Government in their development activities, facilitating trade and other commercial activity. Our operations have always been conducted prudently and responsibly, upholding the highest ethical and professional standards, to the satisfaction of all stakeholders. Our financial strength lends us the stature to be the leader in the industry, adding value to our stakeholders. By fostering our relationship with the stakeholders we build mutually rewarding and lasting relationships.

By engaging effectively with our stakeholders we are able to identify how we can add value to each segment of stakeholders.

Our operations have always been conducted prudently and responsibly, upholding the highest ethical and professional standards, to the satisfaction of all stakeholders. Our financial strength lends us the stature to be the leader in the industry, adding value to our stakeholders.