From our humble beginnings in 1939 to serve the needs for financing of the Sri Lankan business community, who had till then been dependent on money lenders, we have evolved to become the largest financial institution in the country as well as the major custodian of the state funds today.

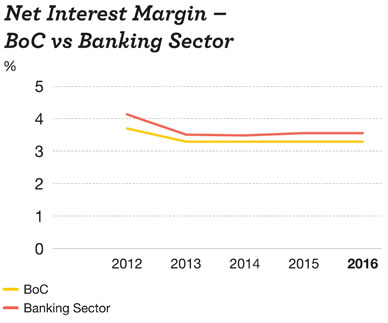

In common with much of the banking industry value generation by the Bank of Ceylon rests primarily on two key business processes; financial intermediation and maturity transformation. A financial intermediary facilitates financial transactions, directly or indirectly, between numerous parties. For example by receiving money from depositors and lending it to borrowers; handing payments from importers to suppliers and customers to exporters. Maturity transformation entails bridging the difference in timing of cash flows in the above process. This usually arises due to borrowing on a short-term basis and lending long term. The difference between the lending rate and the borrowing rate, the interest margin generates profits to the Bank on its lending operations. This should be adequate to compensate the Bank for credit risk, funding risk and interest rate risk.

The Bank also provides services which are not dependant on borrowed funds, known as fee based operations. Income streams generated by these activities have the advantage that they do not carry an interest rate risk. The Bank generated 87% of its income by way of interest income in 2016 and 6% from fee-based sources.

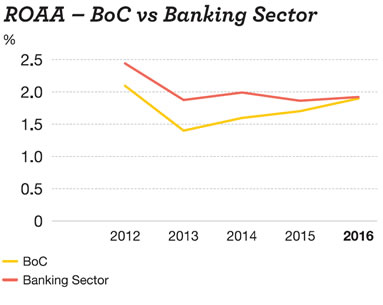

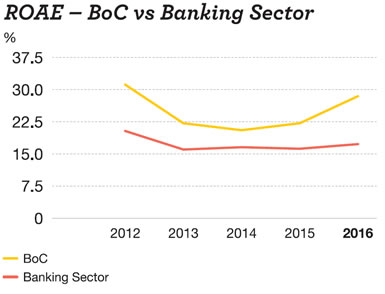

The nature of banking operations and its distinctive business model, causes the Return on Assets (ROA) to be much lower than that of other businesses. The norm for banks is not more than 2% while in other industries it tends to be in the range 10-20%. Hence the banks resort to growing their deposits and lending out these funds. This process, known as gearing, increases the return on equity. However, the process of gearing increases the risk to the Bank which makes having a sound risk management framework all the more important.

Bank of Ceylon was inaugurated in 1939, to serve the needs for financing of the Sri Lankan (then known as Ceylonese) business community, who had till then been dependent on money lenders.

From these beginnings we evolved to become the largest financial institution in the country as well as the major custodian of the state funds. Regarding the latter role we are also the premier banker to the public institutions as well the state-owned enterprises. We are commercially a very successful Organisation recording a profit before tax of LKR 31.2 billion in 2016, despite our net interest margin being lower than that of most other banks. However, as a state-owned institution we cannot concentrate solely on the bottom line. We have to adhere to Government policies, for example in lending to priority sectors such as youth and women. This however has a triple bottom line impact by way of the social contribution we make.

With technological, social and demographic changes the face of banking is changing worldwide, and we have to keep up with the trends. Today, customers are educated and, especially in the case of the younger generation, tech savvy and have the highest expectations. Therefore, we have to be geared to capitalise on major opportunities that will arise as we move into the future.

The Bank is faced with performing a balancing act in fulfilling our development role while maintaining profitability and stability.

As a Government-owned bank with a long history we enjoy public confidence. This coupled with our sprawling branch network makes us the Bank of choice for the rural population. Today we boast 580 branches with 48 other service points and 12 million account holders, which make us by far the largest retail bank in Sri Lanka. We also have branches in India, the Maldives and Seychelles as well as a subsidiary in London.

However, we are working in a dynamic environment and we cannot be complacent with our traditional modes of operation. In 2016, there was reduced demand for credit from the public sector bringing the sector’s share of total lending down to 30%. We therefore have to increase our penetration of the corporate and SME sectors. The size of our lending portfolio, and consequent large single borrower exposure give us an edge. However, we are facing increased competition from other state banks, private banks and non-bank financial institutions, and our competitors are constantly innovating new products and services. We have to be geared to capitalise on major opportunities that will open with the Colombo International Financial Centre, Megapolis, Private Free Trade Zones etc. With technological, social and demographic changes the face of banking is changing worldwide, and we have to keep up with the trends. Today customers are educated and, especially in the case of the younger generation, tech savvy and have the highest expectations. While seeking to attain international benchmarks we have to keep in mind the local requirements.

With the loan book crossing the rupees one trillion mark during the year, BoC became the first Bank in Sri Lanka to achieve the landmark of triple trillions with assets totalling to LKR 1.7 trillion, deposits to LKR 1.2 trillion and loans to

LKR 1.0 trillion. Foreign remittances of about USD 3.5 billion were also received through the Bank. We have also achieved a good balance in our lending in the different areas of the country ensuring that we lend back to the areas from where the savings come from. In the year under review we also paid a dividend to the Government of Sri Lanka of LKR 17.3 billion reflecting a payout ratio of 70%, a proud contribution to the nation’s coffers.

The corporate goals and targets should be aligned with the risk appetite of the Bank. The Bank’s credit risk is mainly derived from lending and investment activities which account for over 80% of the total risk weighted assets of the Bank. The Bank’s overall Non-performing Asset Ratio (NPA) is currently 2.9%; excluding Government exposure it is more than 5%. Increase in lending to the private sector will tend to increase the NPA ratio. Therefore it is necessary for us to be cautious in expanding such lending. We also need to maintain a prudent sectoral balance in lending since increase in retail lending for targeted segments may lead to concentration risk.

Our retail banking portfolio has a solid foundation in the confidence we enjoy by virtue of being a state bank and our wide network of branches. Whatever changes have happened in banking practices in recent years and whatever new channels have emerged, our brick and mortar branch network continues to be important. Therefore, we have made enhancements to our physical infrastructure, such as branch modernisation, increasing ATM/CDMs and the customer lobby.

We are targeting steady growth in our home loans, SME, commercial loan products, leasing and pawning portfolios. Our strategies and staff training in these areas have been crafted to spread the growth across all areas and provinces. Organisational changes have also been made to help drive the necessary changes. Retail banking has been divided into two ranges to introduce an element of competition and new DGM positions have also been created to strengthen the lending activities of the Bank in catering to the growing demand at provincial level.

Some of our lending programmes which have created a broad social impact are the Coconut Development Loan Scheme, NCRCS, Govishakthi (credit scheme for agricultural equipment) and pledge loans. A total of LKR 21 billion was granted under 16,559 pledge loans. The ‘Kantha Randiriya’ scheme helps women entrepreneurs to start or develop small or micro enterprises.

The BoC ‘Mithuru’ and ‘Divi Maga’ Programmes also seek to uplift the underprivileged members of our society through promoting entrepreneurship. Assistance to students has been granted through BoC Computer Loans and BoC Education Loans.

We have made our contribution to infrastructure development at a national level by our loans to Road Development Authority and Water Supply Project (Colombo). BoC also contributed to sustaining the power and energy sector by financing facilities to Ceylon Petroleum Corporation, wind power and hydro power projects. Our ‘Awakening North’ scheme provides credit facilities for resumption of economic activities in the war ravaged Northern Province.

With the new trends sweeping the banking industry we also need to be in the forefront of technology to keep up with the competition. The Bank of Ceylon has moved into internet banking and our new ‘Smart Gen’ product has enabled a customer to utilise new technology in their day-to-day banking needs. We have also introduced workflow systems to facilitate smooth processing of credit applications. However, we need to rapidly introduce a comprehensive mobile app on par with the other offerings in the market. Steps have already been taken to improve required IT resources, staff knowledge and other areas in this regard.

The Bank of Ceylon has over 7,000 employees and we recruit at a wide range of levels, educational qualifications and ages. We follow comprehensive procedures laid down by the Government in recruitment, and the entire process is fully transparent. Our staff possess technical skills and are dedicated to the Bank. We strive to achieve constant improvement in areas of customer care to better serve our customers. The entire reputation of the Bank rests on the impression that the customer forms at a counter or when applying for a loan.

The Bank is in an extremely competitive industry and one that is evolving with dizzying rapidity. However, we can go forward convinced that we possess the strengths to meet whatever challenges we face.

Economic Value Added

Economic Value Added (EVA) indicates the true economic profit of an organisation. EVA is an estimate of the amount by which earnings exceed or fall short of required minimum return for shareholders at comparable risks. EVA of the Bank stood at LKR 15,761 million as of 31 December 2016 against LKR 15,128 million in 2015.

| 2016 LKR million | 2015 LKR million | Change % | |

| Invested capital | |||

| Average Shareholders’ funds | 87,167 | 78,145 | 12 |

| Add: Cumulative provision for loan losses and provision for impairment and other losses | 47,832 | 43,252 | 11 |

| 134,999 | 121,397 | 11 | |

| Return on invested capital | |||

| Profit after taxation | 24,791 | 17,357 | 43 |

| Add: Provision for loan losses | 4,397 | 5,904 | (26) |

| Less: Loans written off | (31) | (109) | (72) |

| Total return on invested capital | 29,157 | 23,152 | 26 |

| Opportunity cost of invested capital* | (13,396) | (8,024) | 67 |

| Economic Value Added | 15,761 | 15,128 | 4 |

*Calculated based on weighted average 12 months treasury bill rate 2016 – 9.92% (2015 – 6.61%)

Value Added Statement

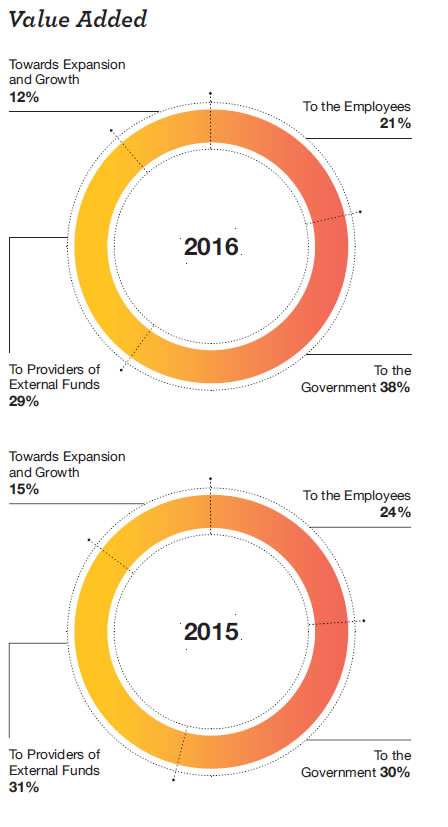

An analysis of the Bank's value creation and allocation among the key stakeholders is depicted below.

| 2016 LKR million | 2015 LKR million | Change % | |

| Value added | |||

| Income earned by providing banking services | 147,554 | 126,664 | 16 |

| Cost of services | (71,164) | (55,361) | 29 |

| Value added by banking services | 76,390 | 71,303 | 7 |

| Non-banking Income | 6,568 | 4,838 | 36 |

| Impairment charges for loans and other losses |

(4,397) | (5,904) | (26) |

| 78,561 | 70,237 | 12 | |

| Value allocation | |||

| To employees | |||

| Salaries, wages and other benefits | 16,844 | 16,744 | 1 |

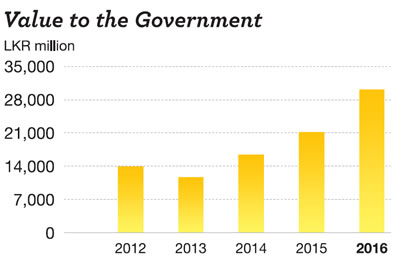

| To Government | |||

| Dividends to Government of Sri Lanka | 17,346 | 6,346 | 173 |

| Super gain tax | – | 2,016 | (100) |

| Income tax | 6,453 | 7,951 | (19) |

| VAT and NBT on financial services | 6,265 | 4,816 | 30 |

| 30,064 | 21,129 | 42 | |

| To providers of external funds | |||

| Interest on other borrowings | 18,239 | 16,971 | 7 |

| Interest on debt issued | 4,571 | 5,037 | (9) |

| 22,810 | 22,008 | 4 | |

| To expansion and growth | |||

| Retained profit | 7,445 | 8,995 | (17) |

| Depreciation and amortisation | 1,453 | 1,391 | 4 |

| Deferred taxation | (55) | (30) | 83 |

| 8,843 | 10,356 | (15) | |

| 78,561 | 70,237 | 12 |