| Engagement Mechanism | Frequency and Communication Channel | Engagement Framework | Identified Needs | Solutions/Needs Implemented |

| Employees | ||||

|

Annually When the need arises |

We will invest in developing our employees in an environment where they are treated with respect, while their professional development and economic well-being is enhanced |

|

|

| Customers | ||||

|

Regularly | We uphold the rights of our customers in line with our customer charter ensuring that they understand the terms and conditions relating to services accessed by them |

|

|

| Investors | ||||

|

When the need arises | We commit to providing a balanced review of our performance and prospects in our communications with investors ensuring a competitive return to their investment |

|

|

| Government and Regulators | ||||

|

Regularly | The Bank is committed to meet its economic, social and environmental obligations in line with the country’s strategy. The corporate plan of the Bank has adopted a sustainable integration programme with Government’s development programme |

|

|

| Community | ||||

|

When the need arises | We engage with local communities to develop economic activity providing opportunities and facilitating their socio economic well-being |

|

|

| Suppliers and Service Providers | ||||

|

When the need arises | We recognise excellence in service by our suppliers and look to support their growth through mutually rewarding partnerships |

|

|

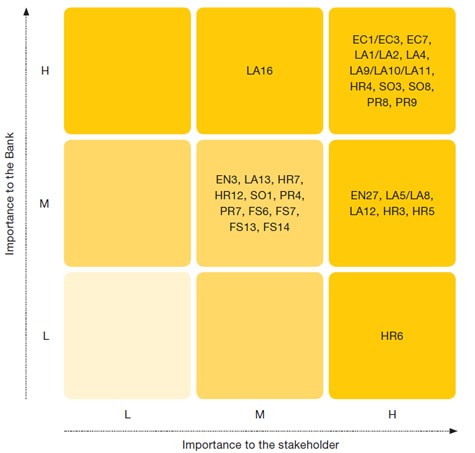

Determining Material Aspects

In identifying the material issues that may impact our Bank, we have considered all matters that are or are likely to be of relevance and significance to the ongoing business of the Bank, that could substantively influence the assessment made by our stakeholders. In this report, we have identified the relevance of the material issues that impact or have the potential to impact the Bank’s ability to create value over time. The material issues that may impact BoC are identified at an interactive session conducted for the formation and revision of the corporate plan attended by all Board members, Corporate Management Team and the Executive Management. The potential issues and events are discussed at length at this forum to determine the impact of each event. Identified events are assigned to the relevant Corporate Management Team member to monitor, measure and control the possible impact on the Bank’s performance and progress.

Events or issues that are considered material and may have an impact on financial reporting and sustainability reporting have been taken into consideration, if they are of such relevance and importance that they could affect the assessments of providers of financial capital and other stakeholders as well as our ability to create value. This process of value creation takes into account numerous factors including the Bank’s strategy, strengths and weaknesses, the resilience of our business model, sustainability in the context of the triple bottom line, various opportunities and threats in the environment as well as the risks we are exposed to, the quality of relationships with our stakeholders and assessments of these relationships.

Further, the involvement of senior management and those charged with governance in the materiality determination process is emphasised and detailed in the Bank’s Sustainability Policy. This enables us to determine the best disclosure mechanisms and the uniqueness of our value creation process in a meaningful and transparent way.

BoC’s Materiality Determination Process

Relevance

Identifying relevant matters and its impact on the past, present or future of the Bank’s ability to create value over time with reference to our strategy, business model, capitals and the impacts on those capitals.

Importance

Determining the importance by evaluating the magnitude of the impact based on past, present or future occurrence and/or the magnitude of the impact and likelihood of occurrence.

Prioritisation

Prioritising material matters, which is a process involving Senior Management and those charged with governance based on their importance, ensuring they are satisfied with the filters and processes in place to identify material matters requiring their attention.

Disclosure

Determining matters to be disclosed in the Report with reference to the importance these issues have to the Bank, its stakeholders and envisaged risk, frequency and impact on the value creation process.

The Bank follows the GRI G4 Sustainability Reporting Guidelines published by the Global Reporting Initiative (GRI) to give direction in determining material aspects and indicators for disclosure within this Report. This also spotlights the virtuous cycle for measurement, monitoring and improvement of the identified indicators. The annual procedure for determination also discusses, if necessary, the need for amendments, in order to reflect any changes to the Bank’s value creation model and stakeholder requirements and aspirations.

The Bank continues to report under the ‘In accordance core’ option of the GRI G4 Sustainability Reporting Guideline stipulations, as it remains the most suitable form of reporting in the current circumstances.

| Category | Economic | Environmental |

|

Aspect |

Economic performance (EC1/EC3) |

Energy (EN3) |

|

Indirect economic impacts (EC7) |

Products and services (EN27) |

| Category | Social | |||

| Subcategory | Labour Practices and Decent Work | Human Rights | Society | Product Responsibility |

| Aspect | Employment (LA1/LA2) | Non-discrimination (HR3) | Local communities (SO1)(FS13)(FS14) | Product and services labelling (PR4) (FS 6) (FS 7) |

| Labour management relations (LA4) | Freedom of association and collective bargaining (HR 4) | Anti-corruption (SO3) | Marketing Communication (PR7) | |

| Occupational health and safety (LA 5/LA 8) | Child labour (HR5) | Compliance (SO8) | Customer privacy (PR 8) | |

|

Training and education (LA 9/LA 10/LA 11) |

Forced or compulsory labour (HR 6) | Compliance (PR 9) | ||

| Diversity and equal opportunity (LA 12) | Security practices (HR7) | |||

| Equal remuneration for men and Women (LA 13) | Human rights grievance mechanisms (HR 12) | |||

| Labour practices and grievance mechanisms (LA 16) | ||||

Materiality Matrix

L - Low M - Medium H - High