Achieving the hallmark ‘Triple Trillion’ was no easy feat, it involved many hours of strategising and planning as well as meticulous execution. However, in order for this achievement to be meaningful, it needs to be sustainable in the long run. Our compliance with the governance framework ensures the sustainability of our achievements.

“Corporate governance involves a set of relationships between a company’s management, its board, its shareholders and other stakeholders. Corporate governance also provides the structure through which the objectives of the company are set, and the means of attaining those objectives and monitoring performance are determined.” –

OECD Principles of Corporate Governance

Our corporate governance is one of our strengths that has helped to bring us to the position we occupy within the Banking industry in Sri Lanka. We give great importance to adhering to best-in-class corporate governance practices. It guides us in all aspects of our operations, including the manner in which we interact with our stakeholders, in order to ensure transparency and conformance with applicable rules and regulations. When the new Basel III capital requirements issued by the Central Bank of Sri Lanka come into effect in 2017, Bank of Ceylon will be classified as a domestic systemically important bank. Thus, the Board of Directors realises the responsibility it carries in maintaining the soundness of the Bank vis–à–vis the soundness of the domestic banking sector. The governance standards that we have been following make us stand out in the industry.

Taking into cognisance the fact that we are a state entity, with higher level of accountability, every effort is made to conduct all operations in a fully transparent manner.

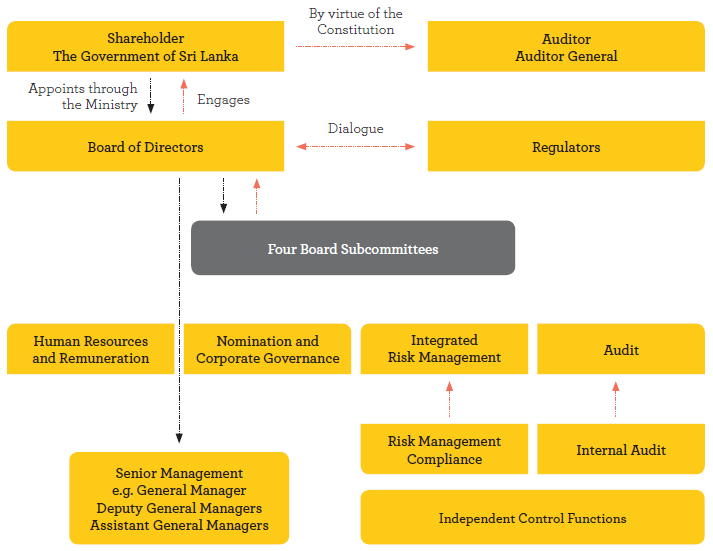

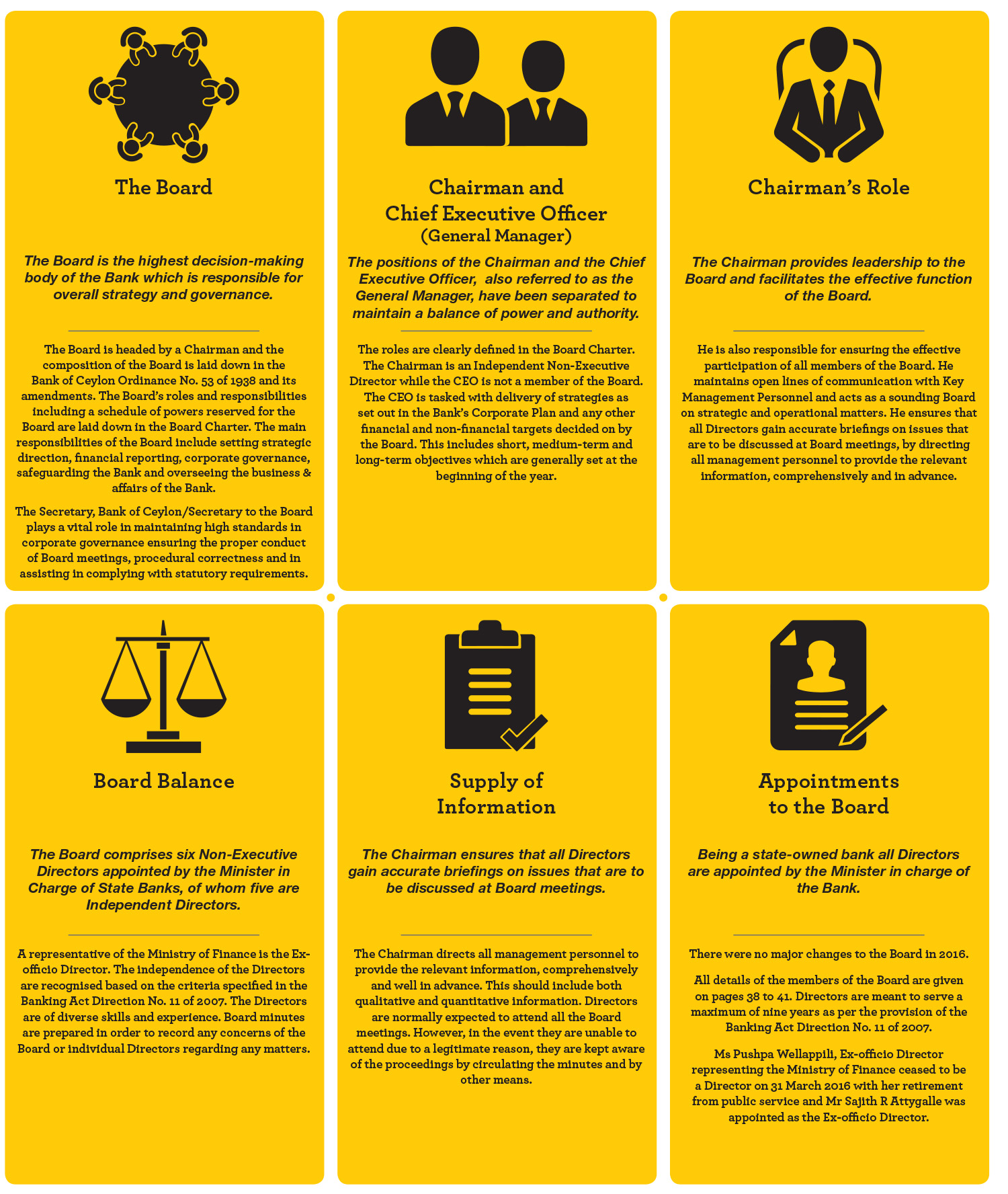

The Board of Directors, led by the Chairman, has the overall responsibility for the sound operation of the Bank including shaping the business strategy and formulating the policies. At the apex of the governance structure, the Board sets the tone for the culture, risk management, compliance, control environment and other related areas taking into account the interests of the shareholder, the depositors and other stakeholders. The well-experienced Board, with its diverse exposure, provides the necessary expertise to lead the Bank. A formal Code of Conduct is in place to guide the Board in their activities. The Board also directs the formulation of the policies and procedures to comply with applicable laws and regulations. It also exercises oversight over the management of the affairs of the Bank with the assistance of the Board Subcommittees. To facilitate its decision-making process, proper flow of information to the Board by way of an effective management information system is in place.

The Board Subcommittee meetings are convened on a regular basis to deliberate on matters coming under the purview of each Subcommittee.

The Role of Corporate Governance in the ‘Triple Trillion’

Achieving the hallmark ‘Triple Trillion’ was no easy feat, it involved many hours of strategising and planning as well as meticulous execution. However, in order for this achievement to be meaningful, it needs to be sustainable in the long run. Our compliance with the governance framework ensures the sustainability of our achievements. We have set ourselves the highest standards in all our operations and encourage as well as expect our employees to follow the highest ethical and professional standards throughout our day-to-day activities. Our commitment to transparency and timely disclosures will assist our stakeholders in assessing the financial condition and soundness of the Bank.

Regulatory Framework

Being a licensed commercial bank, BoC is subject to the prudential supervision of the primary banking regulator, the Central Bank of Sri Lanka. As such, the regulatory framework applicable to BoC mainly consists of the Banking Act No. 30 of 1988 and amendments thereto, regulations issued under the Banking Act, particularly Direction No. 11 of 2007 on Corporate Governance. The Bank of Ceylon Ordinance No. 53 of 1938 and its amendments also constitute a part of the regulatory framework. In addition, the Bank voluntarily complies with the Code of Corporate Governance issued jointly by The Institute of Chartered Accountants of Sri Lanka and the Securities and Exchange Commission. Bank is exempted from disclosure of compliances as stipulated in Section 7.10 of the Continuing Listing Requirements on Corporate Governance.

Assurance on compliance to the Regulator has been obtained from the Auditor General of Sri Lanka.

Governance Structure of the Bank

Compliance with Banking Act Direction No. 11 of 2007 on Corporate Governance

Specific disclosures in terms of the above regulations are provided on pages 294 to 315 of this Report and form an integral part of this report on Corporate Governance.

Compliance with Code of Best Practice on Corporate Governance issued by The Institute of Chartered Accountants of Sri Lanka and the Securities and Exchange Commission of Sri Lanka

Board Subcommittees

The Board is assisted in the discharge of its duties by four Board Subcommittees established in compliance with governance codes and best practice.

The responsibilities of the Subcommittees are formally laid down in written terms of reference to ensure that adequate attention is given to certain key areas. The terms of reference are reviewed annually to ensure that they keep up with any changes in the environment and ensure effective control and monitoring of the Bank’s operations.

Report of the Audit Committee is given on pages 69 to 71.

Report of the Nomination and Corporate Governance Committee (NCGC) is given on pages 76 and 77.

Report of the Integrated Risk Management Committee (IRMC) is given on pages 72 and 73.

Report of the Human Resources and Remuneration Committee (HRRC) is given on pages 74 and 75.

Regular Meetings

The Board meets routinely every fortnight in addition to which special Board Meetings are held when necessary. During the year, 30 Board Meetings, inclusive of special meetings were held. Details of meetings of Board and Board Subcommittees, specifying attendance by each Board Director are given below:

| Director | Board | Audit Committee | HRRC | IRMC | NCGC |

| Mr Ronald C Perera | 27 | – | 3 | – | 4 |

| Mr Ranel T Wijesinha | 25 | 15 | – | – | – |

| Mr Charitha N Wijewardane | 27 | 14 | 3 | 7 | – |

| Mr Sanjaya Padmaperuma | 26 | 12 | – | 5 | 4 |

| Mr Ajith Gunawardana | 26 | – | 3 | 7 | 4 |

| Mr Sajith R Attygalle (Ex-officio Director, appointed w.e.f. 27.04.2016 in place of Ms Pushpa Wellappili) |

10 | 5 | – | – | – |

| Ms Pushpa Wellappili (Ex-officio Director, resigned w.e.f. 31.03.2016) |

5 | 2 | 2 | – | – |

| Mr A P Kurumbalapitiya (Alternate Director to Ex-officio Director, resigned w.e.f. 31.03.2016) |

1 | 2 | – | – | – |

| Total No. of meetings conducted | 28 | 15 | 3 | 7 | 4 |

Executive/Management Committees

The management of BoC is facilitated by number of management committees entrusted with overseeing specifically defined areas of policy making and operations. These committees, which are given below, are expected to promote collaboration, information flow, exploration of alternatives and more informed decision-making:

| Name of the Committee | Purpose of the Committee |

| Corporate Management Committee | Corporate Management Committee is the highest level management committee in the Bank. Overall purpose of the Committee is to deal with vital matters which other management committees do not cover and make decisions regarding such matters. |

| Asset and Liability Management Committee (ALCO) | ALCO is the apex management committee of the Bank which has the overall responsibility of ensuring the Bank achieves targets regarding asset and liability management while working within the domestic and international environmental constraints. The primary objective of the ALCO is the management of liquidity risk and interest rate risk. To ensure that any risks taken are within prudent limits ALCO regularly assesses the Bank’s risk and risk bearing capacity. To this end specific financial risks involved such as market, interest rate, liquidity and exchange are managed. |

| Credit Committee | Subject to the approval of the Board of Directors, the Committee is responsible for drawing up policies for granting credit facilities, as well as reviewing and revising existing policies. This includes periodic reviewing of credit facilities to monitor and ensure maintenance of product and service quality. In this process the Committee has to comply with all statutory and regulatory requirements. Proposals formulated by the line management subject to their delegated authority limits are also forwarded to the Committee. The Committee is empowered to approve, decline or ratify such proposals or make appropriate recommendations to the Board of Directors. The Committee is also responsible for ensuring that the Bank maintains a well diversified and healthy credit portfolio. To achieve this it monitors, reviews and makes necessary adjustments to the overall portfolio exposure and concentration risk of the Bank. To ensure that adequate remedial action is taken in respect of non–performing advances. |

| Human Resource Policy Committee | The Committee has overall responsibility for HR management. It formulates, reviews and revises relevant policies and procedures and makes recommendations to the Board’s Human Resources and Remuneration Committee and also, occasionally, to the Board itself. |

| Sustainability Committee | It bears overall responsibility, under the Board of Directors, for formulating and executing the Bank’s Corporate Sustainability Policies (principally environmental, social, ethical and economic matters). |

| Reward and Recognition Policy Committee | Motivating employees by recognising those who have made outstanding contributions to the organisation by appreciating/rewarding such employees/teams for their contribution. |

| Scholarship Programme Selection Committee | To select the required and appropriate overseas study and training programmes for the Bank. |

| Scholarship Committee | To select the appropriate training programme seminar/workshops/visits whether local or overseas and nominate suitable participants for the such programmes. |

| IT Steering Committee | To formulate and recommend to the Board the Information Technology plan for the financial year. To craft implementation plans for the above, prioritise activities within the IT Plan, implementation of such activities, forming teams and monitoring processes and their progress. To review policies relating to IT Operations periodically and recommend changes in policies to the Board of Directors. To monitor and control the progress of IT Projects. |

| Investment Committee | To assist the Board of Directors to discharge its statutory duties and its oversight responsibilities in relation to investment activities of the Bank excluding investments in equity of subsidiaries and Government securities. The Committee is guided in this by the implementation and monitoring of investment activities as stipulated in the Investment Policy of Bank of Ceylon. |

| Non–Performing Assets (NPA) Review Committee | Exercising supervisory control over NPA of the Bank by periodically reviewing the NPA status against set targets and making suitable recommendations to management to improve the asset quality or expedite the recovery of existing NPA. |

| Committee Dealing with Forged Cheques and Frauds | This Committee was established in order to write-off unrecoverable balances on Forged Cheques and Frauds after all possible ways of recovering the same have proved unsuccessful. Write-off decisions not arising from frauds are not within the purview of this Committee. |

| Idle Assets Committee | Ensuring that management and monitoring of the process of disposal of properties vested in the Bank are in conformance with rules stipulated in Bank of Ceylon Ordinance, Bank of Ceylon Act, Debt Recovery Act and Office Instruction Circular No. 62/2010 dated 17 January 2011 and its addenda. To provide necessary guidelines to arrive at settlements with the previous owners of such properties as mentioned above who are occupying the premises; this includes revesting the properties to them wherever possible in order to avoid costly and time consuming ejectment procedure. To provide necessary guidelines and instructions to the Foreclosed Properties Unit enabling them dispose the properties at an adequate price. |

| Business Continuity Management Steering Committee | Guiding and monitoring of Business Continuity Co-ordinating Committee, Business Continuity Implementation Committee, Technical and Operational Committee, Business Continuity Management Alternate Committee, Damage Assessment and Restoration Committee and Business Continuity Subcommittees at head office and province level. |

| Business Continuity Implementation Committee | Effective implementation of Business Continuity Plan (BCP) of the Bank. |

| Technical and Operational Committee | Taking appropriate measures to mitigate losses that may arise consequent to disruptions to operations. |

| Business Continuity Co-ordinating Committee | Managing and co-ordinating all aspects of Business Continuity Management (BCM) process of the Bank. |

| Business Continuity Management Alternate Committee | This Committee will function temporarily, immediately after any disaster, until the other Business Continuity Management Committees are established. |

| Damage Assessment and Restoration Committee | Assessment of Damages to Bank Properties and Restoration. |

| Marketing Committee | Providing a strategic direction to the Bank’s marketing activities. This includes planning appropriate marketing strategies, positioning the Bank and its products/services, identifying opportunities in the market to maximise the Bank’s turnover and be a forum to champion innovation/novel marketing concepts, planning and executing corporate social responsibility programmes and creating an effective communication platform to build the Bank’s corporate image. |

| Corporate Information Security Committee | Provides oversight in the form of management direction and support to drive the Information Security of the Bank. Accordingly, the Committee is expected to guide and monitor the application of processes and procedures specified in the Information Security Policy (ISP), review and communicate the Information Security Plans and conduct investigations of security breaches. |

| Operational Risk Management Executive Committee | Review, discuss and co-ordinate the various issues relating to Operational Risk Management Process for the purpose of ensuring better risk management and measurement of the various related operational risks. |

| Fraud Risk Committee | Scrutinise and review the adequacy and effectiveness of risk management and control processes within the Bank to eliminate, as far as possible, losses due to fraud. |