Human Capital

We consider our Team, our people, as our greatest strength that enabled us to reach the height of excellence, including the triple trillion (Assets, Deposits, Advances) during the year. Numbering 7,569 in total, their tireless efforts throughout the year and dedication to their tasks has made BoC undisputedly the No. 1 Bank in Sri Lanka and contributed to the increase in the financial capital. That is why, we go to great lengths to ensure that we select the right people and place them in the right place for the right job. The compensation and reward schemes at BoC are competitive and intended to keep all employees content at the work place. In other words, every effort is made to ensure the well-being of the staff, so that they can, in turn, give their best at the workplace.

All new recruits are provided with induction training so that they can easily blend into the culture and work ethics of the Bank. The compliance culture is inculcated in all employees from the stages of first joining. Furthermore, all staff are provided with job-related training to ensure that they have the requisite level of knowledge to perform their tasks.

Our content workforce is the greatest team of ambassadors of the No. 1 Brand, providing exemplary customer service to our worthy customers.

The attrition rate at BoC, which is below 1%, is one of the lowest in the industry, which speaks volumes of the effectiveness of our HR management process. Our commitment to taking care of our employees was recognised by being awarded the Asia Best Employer Brand by Employer Brand Institute and World HRD Congress in 2016, which encourages us immensely.

Our Team brought glory to BoC winning the Institute of Bankers of Sri Lanka (IBSL) Quiz in 2016.

Introduction of Automated Human Capital Management System

During the year, we made vast improvements to our process relating to human resource management. The automated Human Capital Management (HCM) system, which was an investment towards better managing our people, went live in 2016. This system facilitates the streamlining and organising of our human resource management process. The salient features provided by the HCM system are:

- Payroll administration (salary, pension, W/W&OP, bonus, incentive etc.)

- Benefit administration – medical and other staff payments

- Managing staff loans

- HR profile manager (employee details)

- Employee self-service (salary receipt/leave/PF balance/Employee Liability Report/medical balance)

- Competencies and job descriptions

With the operationalisation of the HCM System, talent management was rationalised and the HR management process is automated to the greatest extent possible.

It is intended to use the HCM System to create and manage a career portal thereby providing easy access to the management, the staff and future aspirants to identify career opportunities. This will provide a one stop tool for all HR related matters as training and development, too will be tracked through the system. All employee records will be available via the HCM System, paving the way for a greener HR management process.

Selection and Recruitment

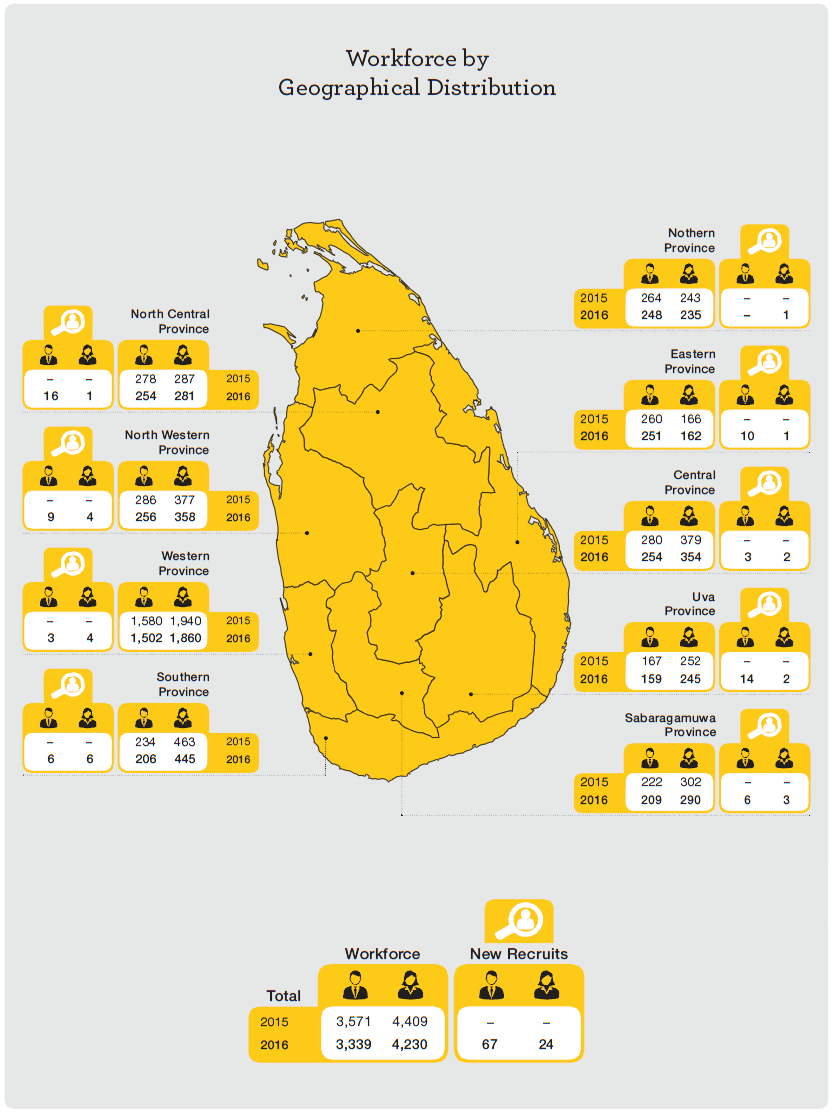

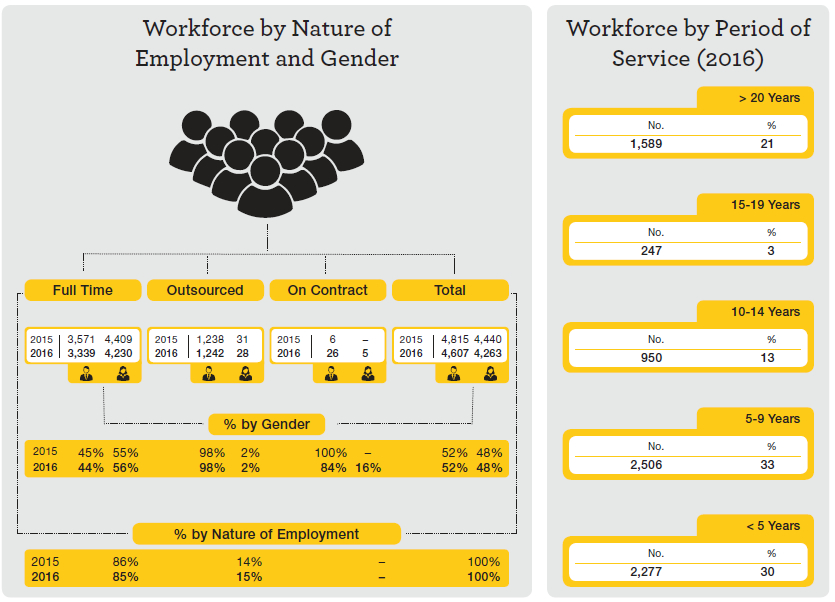

As a state bank, our process of recruitment is fair and transparent. We endeavour to ensure that we have the right mix of talent to suit the requirements of the Bank. Recruitment is mostly done at entry level, for management trainee positions and staff assistants. The talent acquisition process is fair and just, free of gender, age or ethnicity bias. The process also ensures geographic representation as far as possible so that employees can be positioned at branches close to their hometowns. Our team of employees is well diversified, consisting of 44% males and 56% females.

Recruitments done in 2016 consisted of the following:

- Trainee Development Assistants – 73

- Trainee Assistant Legal Officers – 10

- Trainee Court/Notary Clerks – 08

BoC prides itself in being an equal opportunity employer and selections are based on qualifications and suitability. Our non-discrimination policy is demonstrated in our distribution of employees.

With the emerging business needs the Bank has planed to provide employment opportunities for youth in 2017.

Training and Development

Identifying development needs and providing training is a key aspect of employee talent management at BoC. This enables our staff to keep their knowledge and skills updated in order to provide a better service to our customers. It also provides the opportunity to build up the knowledge and pursue their career aspirations. This indicates our commitment to educate, up skill the knowledge and talents of staff. Training requirements may be self-identified or on the recommendation of the supervisor.

The Bank has an in-house training centre, Central Training Institute (CTI) a fully-equipped training center with inhouse trainers to facilitate the training process. Over 700 training programs were conducted at the CTI during 2016, including 63 training programmes for security personnel on a wide range of subjects, some programmes by accredited trainers. Selected employees are also enrolled for training at various other local training institutions on a needs basis, while overseas training and secondments are also provided to enhance the skills and provide on the job training.

Number of Employees Trained

| No. of Employees | Average Hours of Training | |||||||

| 2016 | 2015 | 2016 | 2015 | |||||

| Male | Female | Male | Female | Male | Female | Male | Female | |

| Corporate management | 15 | 2 | 11 | 3 | 47 | 36 | 109 | 53 |

| Executive management | 40 | 10 | 44 | 6 | 25 | 36 | 60 | 75 |

| Senior management | 313 | 254 | 327 | 221 | 15 | 14 | 45 | 60 |

| Executives | 1,085 | 1,852 | 1,095 | 1,772 | 7 | 4 | 27 | 23 |

| Trainees and others | 1,886 | 2,112 | 1,738 | 1,930 | 5 | 4 | 30 | 25 |

| Total | 3,339 | 4,230 | 3,215 | 3,932 | 99 | 94 | 271 | 236 |

Number of Programmes and Participants in 2016

| Description | No. of Training Programmes | No. of Participants |

| In-house | 708 | 31,507 |

| Local institutions | 293 | 1,655 |

| Overseas | 138 | 413 |

| Total | 1,139 | 33,575 |

The training and development activities also take into account the succession planning for the Bank. Identified talented managerial staff are groomed and encouraged through the talent management process to build their skills to take up the next level challenges. This ensures that the Bank has a pool of talented people capable of taking up higher level challenges at all times.

This is especially crucial since recruitment is done mainly at entry levels and employees are promoted and appointed from within the existing cadre to fill in any positions that arise. Promotions to higher grades are made based on meritocracy on the basis of the results of examinations conducted to assess the preparedness and suitability of employees to take up such positions. During the year, two such promotion examinations were conducted. The Bank may recruit the services of consultants for specialised areas for skills that are not available within the Bank. During the year 729 promotions were executed.

Our staff at all levels are encouraged to acquire skills and knowledge and many facilities are provided to facilitate such learning. Library facilities are provided at the CTI, which all employees are encouraged to make use of. The e-Library was a new initiative introduced in 2016, which provides easy access to a vast array of reading material.

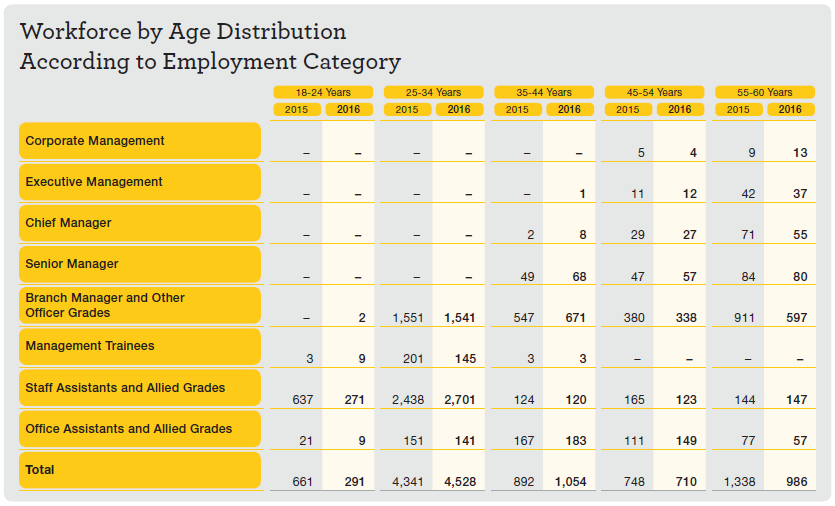

BoC has a mix of young blood and experienced hands, with a relatively young team at initial levels, nearly 64% of the workforce are below 35 years of age. At the same time, at senior levels, our management consists of well experienced, seasoned officers who add tremendous value to our operation. It gives us an ideal balance in terms of experience, maturity and dynamism. It also creates an obligation on the management to develop the new joiners to succeed to higher management positions and be the next generation leaders. This is well addressed in our talent management and development programme.

The Bank maintains an open door communication policy, which will foster better employer-employee communications and better staff morale.

Training to staff

The Best for the Best – Recognition and Reward

BOC is one of the most preferred employers in the industry and we continue to evolve our HRM processes at all times in order to continue in that position. Our ultimate objective is to create a win-win situation for both employees and the Bank through better HRM.

It is very significant that the average basic salary and total remuneration for males and females has a 1:1 ratio for all categories of staff. This demonstrates our commitment to gender equality.

One of the key aspects of the HRM process is the recognition and reward of staff to encourage and motivate them further.

How…the Process

We continue to align the employee reward and recognition process in line with achievement of business targets, inculcating a performance based culture.

Cordial Industrial Relations

The Bank always strives to maintain healthy industrial relations. Maintaining a cordial rapport with the Trade Unions, the management has a continuous dialogue and lends an ear to the issues raised by the union members. During the year, regular cordial meetings were held with the unions. Out of our employees, 97% hold a membership of a trade union.

Employee Engagement and Welfare Activities

Activities that promote staff engagement, in line with the Bank’s calendar of events, form an important component in promoting employee engagement. The following are some events that took place during the year.

- Sports meets in all provinces and inter-province sports meet

- Health awareness programmes

- Religious activities pertaining to all religions emphasing the multi-ethnic and multi-religious character of the Bank

- Colours Night - Rewarding the branches that excelled in their performance.

- It is our vision to remain a preferred employer in the industry, with a low staff turnover. We will continue to evolve our HR practices so that our staff will be content and contribute to the well being of the organisation, keeping our customers and stakeholders happy.

- With the emerging business needs, the Bank plans to provide additional employment opportunities for youth in 2017.

CSR activity by employees

IBSL Quiz winning team

BoC – Colours Night

Compensation and assistance is provided to staff who are affected by natural disasters, tragic circumstances and personal accidents.

In addition, activities that promoted corporate social responsibility were conducted such as the Blood Donation Campaign, which brought the Bank closer to the communities it serves and also promoted staff engagement.

The staff also took part in team building activities and team engagement activities that were conducted.

Health and Safety

Looking after the health of our employees to create a healthy work force and ensuring the safety of our employees at the work place take priority at BoC. An in-house Doctor is available for employees’ convenience in case of an unanticipated illness at work. The comprehensive medical insurance scheme available for all employees, covers employees and their family members for OPD treatments to surgeries.

Fire officers have been appointed for each division at head office and branches and regular fire drills are conducted to reiterate the safety procedures in case of an eventuality. In addition, all areas at head office and branches have CCTV surveillance. The Bank’s Security Services Department is staffed with personnel who are trained in the subject matter.

A comprehensive Business Continuity Plan is in place that could be activated to resume the business operations, including critical systems, from alternate locations, in the event of a disruption to normal business. This Plan is tested periodically to ensure prompt activation if the need arises.

Grievance Handling

Resolving employee problems at the workplace is handled primarily by the Human Resource Department. Employees are encouraged to voice their grievances so that they can be resolved.

Human Rights

BoC upholds the human rights of all employees and has taken all possible steps to ensure that employees are treated equally, with appropriate dignity and respect and without discrimination. The Bank continuously aligns its HR practices in line with local regulations and international best practices.

Human Rights Grievances

| Number | |

| Brought forward from 2015 | 7 |

| Total number of grievances reported in 2016 | 12 |

| Total number of grievances resolved in 2016 | 15 |

| Total number of grievances outstanding at the end of the year 2016 |

4 |

Work-Life Balance

It is our belief that a proper work-life balance will produce a contended workforce who will, in return give their best to the Organisation. Towards this end, our recruitment process tries to identify, as much as possible, people from the same geographical area. All permanent staff are required to utilise seven working days’ annual leave at one stretch as required by regulation and also as a means of improving work-life balance.

The Bank maintains 10 holiday resorts in different areas of the country. The facilities were availed to a total of 10,295 employees and their family members during the year.

Retirement Benefits

All employees of the Bank are members of the Bank of Ceylon Provident Fund, to which the Bank contributes 12% of employees’ monthly gross salary, while employees contribute 8%. All employees of the Bank are members of the Employees Trust Fund, to which the Bank/Group contributes 3% of the employees’ monthly gross salary.

All employees recruited to the Bank are entitled to a non-contributory pension on retirement, if they have completed a minimum of ten years of continuous service.

Turnover – Age Groups and Gender

| Age Distribution | 2016 | 2015 | ||||

| Male | Female | Total | Male | Female | Total | |

| 25-34 | 6 | 26 | 32 | 9 | 16 | 25 |

| 35-44 | 1 | – | 1 | 2 | 4 | 6 |

| 45-54 | – | 1 | 1 | – | – | – |

| 55-60 | 273 | 173 | 446 | 363 | 182 | 545 |

| Total | 280 | 200 | 480 | 374 | 202 | 576 |

| % | 58 | 42 | 65 | 35 | ||

Reasons for Turnover

| Reasons | 2016 | 2015 |

| Joining other competitive organisations | – | – |

| Joining other organisations | 5 | 8 |

| Migration | 17 | 18 |

| Higher studies | 3 | – |

| Personal reasons | 9 | 5 |

| Retirement | 446 | 545 |

| Total | 480 | 576 |

Our Vision for Our Team – 2017 and Beyond

Going forward, we will continue to align the HR strategy in line with the business strategy of the Bank. The staff acquisition policy as well as training and development activities will be targeted towards developing the skill set required to carry out the business strategy. This will help us rationalise the staff costs.