Social and Relationship Capital

Customers

Customers are the main stakeholders of the Bank, be it depositors or borrowers, comprising individuals, SMEs, micro enterprises large corporate entities and state-owned enterprises.

During the year, the industry remained highly competitive, with all banks striving aggressively to increase their market share. BoC has an edge over the other banks mainly in terms of geographical reach through the extensive branch network and superior financial strength. In addition, the strategies adopted to increase customer service and understand their financial requirements better helped us compete effectively.

Customer engagement –

- Primarily through the branch network. From simple savings account to assist the small time, savers’ unsophisticated banking needs to innovative, technology-based products to meet more advanced customer requirements.

- Customer visits by branch officers and Business Development Executives

- Workshops, awareness sessions conducted for customer segments

- Call centre

- BoC website

- Newspaper advertisements

- Social media

Objective of maintaining a sound relationship with the customers: build long term, sustainable relationships based on trust and confidence that will be mutually rewarding.

The Bank has three main core areas of operation. The first, retail banking, has been the one that the Bank is traditionally most known for and which has given it its wide reach. Our retail customers include people from all walks of life; urban professionals and executives, senior citizens, small scale entrepreneurs and farmers in the most remote villages. Such a diverse clientele demands diverse products. We need to leverage technology and develop sophisticated products for the more tech savvy customer. At the other end, we promote financial inclusiveness and literacy by bringing banking to the grass roots. The second core area is that of corporate and offshore banking. Although traditionally much of our lending in this area has been to the government and state owned enterprises, in the year under review there was slackening in this type of lending. However, the Bank successfully compensated for this by increased lending to the private sector. The final area, which encompasses many operations, is that of international, treasury, investment and overseas branches. These sections play a crucial role in the Bank’s portfolio of activities by handling the Rupee and foreign currency funds. With our massive deposit base we make a tremendous contribution to the national economy by developing the capital market as a key participant in government bonds. Having the largest share of inward remittances we also help sustain the Balance of Payments. The Treasury Division manages the foreign exchange operations of the Bank, including providing foreign exchange at concessionary rates for key sectors of the economy. Our overseas branches make their contribution to the Sri Lankan expatriate community by serving their banking needs.

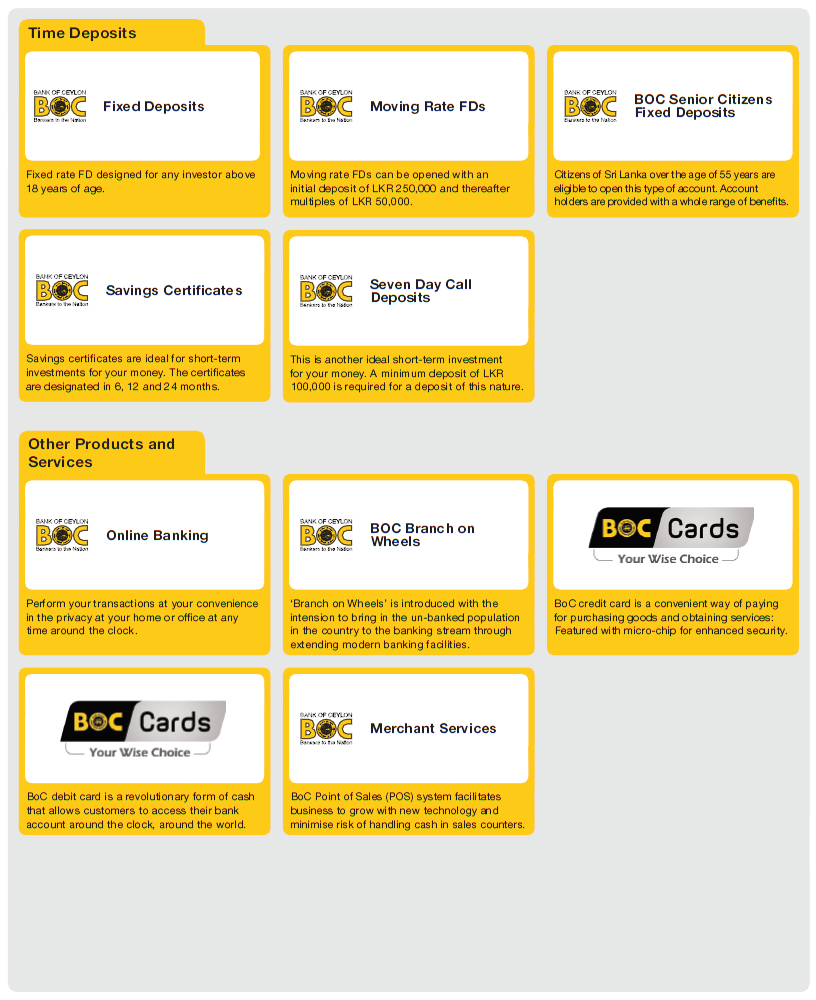

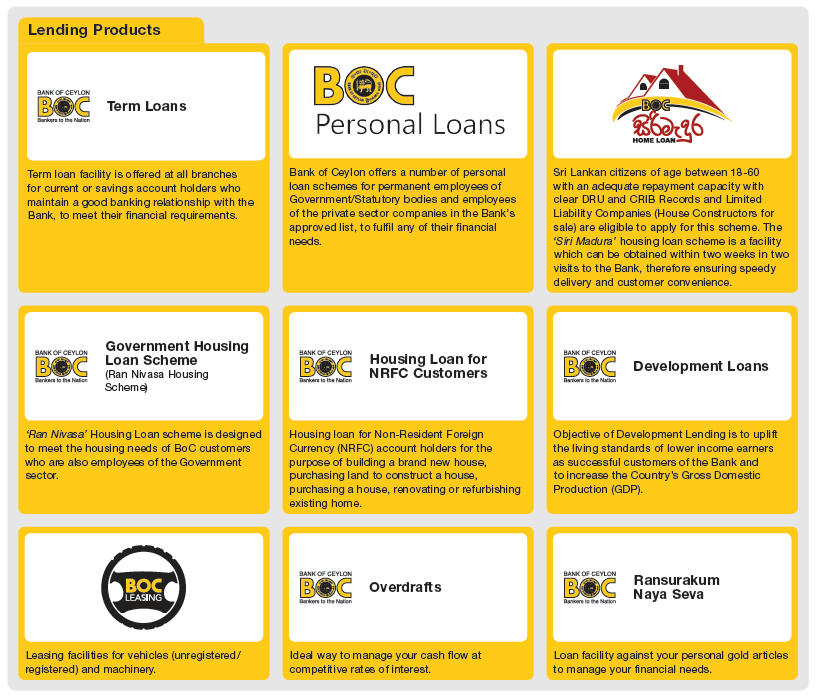

Retail Banking

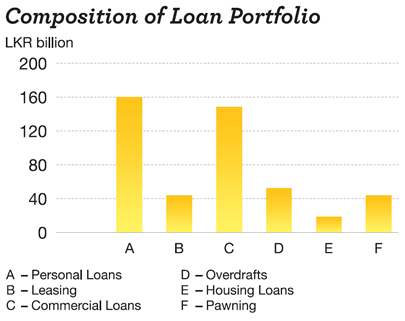

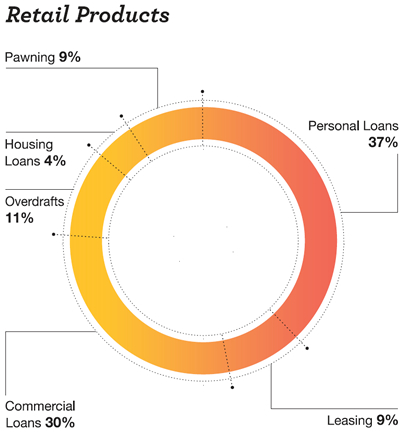

Serving a multitude of customers across the country, retail banking is of strategic importance to BoC, comprising 48% of the loan portfolio. A variety of products are offered under this segment, including personal loans, housing loans, commercial loans, pawning, leasing and credit cards. 2016 saw an almost 20% increase in the retail banking portfolio.

The retail segment has products to suit people of all walks of life, from the tech savvy, urban population including new generation young executives to villagers in remote areas who are fairly unsophisticated. Retail banking activities are organised under 10 provinces (Western province has been seperated in to two segments for administrative purposes) for the convenience of customers.

Strategic Priorities during the Year

The strategies adopted during the year were targeted mainly at improving customer service and introducing technology-based products. Promoting financial inclusion in line with Government policy priorities was also undertaken. Establishing Regional Loan Centres (RLCs) for processing of loans is a new initiative introduced in previous year to speed up the loan approval process. In line with this 11 such RLCs were established. The appointment of Business Development Executives (BDEs) is another initiative. The BDEs reach out to customers to understand their banking needs and refer them to branches.

Introducing Innovative Products to Meet Customer Needs

SmartGen is a revolutionary product that has been introduced targeting the younger generation who prefer technology-based banking products.

The marketing of this product was mainly done through the social media with the target customer in mind and proved to be a very successful strategy.

The Power Plus Investment Plan targeting higher education of children was a timely and useful product that gained popularity in 2016.

BoC participates actively in the development loan schemes funded by the Central Bank of Sri Lanka in order to contribute towards the development schemes promoted. New Comprehensive Rural Credit Scheme (NCRCS), Commercial Scale Dairy Development Lending Scheme (CSDDLS), Saubagya Loan Scheme, Self Employment Promotion Initiative Loan Scheme, Small-holder Plantation Entrepreneurship Development Programme, Working Capital Loan Scheme for Tea Factories and Poverty Alleviation Microfinance Project (PAMP I and II) are some examples for the Bank’s contribution towards customer needs.

Funding the SMEs

The SME sector is considered the backbone of an economy, and as done in the past, we made giant strides in increasing our focus on this sector. We introduced changes to our SME Policy that will enable us to significantly enhance our SME offering. The interest rate was also reduced to 8% providing a competitive rate of interest to fund the entrepreneurs. Furthermore, a sizable pool of funds was allocated for the sector. ‘Diriya’ and ‘Diyawara Diriya’ are loan schemes introduced especially to meet the needs of SME customers.

SME Lending

During the year, SME products have been developed and introduced in line with Government policies. Products to cater to the youth and women are among these. Bank had allocated LKR 5.0 billion from Bank funds focusing on SME startups, where young and women entrepreneurs are given priority. Afrorested fund also operates at a lower interest rate. These products enhance our SME offering in providing resources for small and medium enterprises to reach their potential. The Bank expects that these focussed efforts on SME sector would bear fruit in 2017.

In order to broad base the customer base and cater to the specific market segment, Islamic Banking activities were revived during the year, targeting Islamic Banking customers through the branch network and meeting their enhanced financial requirements. Introducing diminishing Musharaka products and automation of foreign currency Ijra are some of the initiatives during the year. The target is to achieve an Islamic Banking portfolio of LKR 4.0 billion by 2018.

Housing Loans

We increased our focus on the home loan segment, helping our customers to fund a shelter of their own. The portfolio saw a 25% increase during the year with the increase in the outbound sales force and continued emphasis on reducing turnaround times. The marketing strategy for this segment concentrated on increasing our visibility as the first choice for housing loans.

Credit Cards

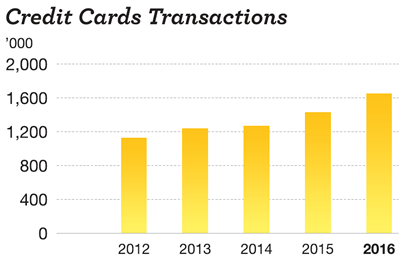

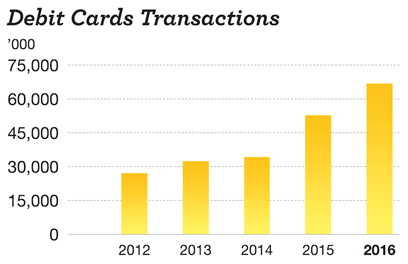

We improved our card offering providing a convenient payment method for the discerning customers and enhanced our presence in the credit card segment firmly. Many initiatives were offered and as a result, the number of card holders increased by 88,620 recording an increase of 10% during the year. The ATM card, which doubles up as a debit card increased in popularity as a safe and reliable payment method.

Our targeted credit card campaigns aiming festive occasions such as the Sinhala and Tamil New Year, Ramzan festival and Christmas season provided opportunities for our customers to avail of festive purchases and enjoy substantial discounts.

Development lending

Deposits

Despite the stiff competition that prevailed in the banking industry, we managed to improve our deposit base by LKR 114 billion or 15% during 2016. Having surpassed one trillion deposits in 2015, we ended 2016 on a high note notching LKR 878 billion in deposits. Our retail focused business strategy which promotes financial inclusivity, coupled with the highest branch reach enabled us to reach depositors from all corners of the country.

Our concept of Branch on wheels, used mainly in remote areas with sparse transport facilities enables us to reach customers who would otherwise not be able to access the formal banking system.

Branch on the wheels

Our CASA ratio, at 52% of total deposits provides a good balance in terms of managing our interest cost. The savings accounts also provide a stable fund base for the Bank. A further increase in this ratio is targeted through the next few years.

An increase in fee based income to augment interest income in view of thinning interest margins is also planned which will be focused through the branch network.

Continued Focus on Serving the Customers’ Needs

Reinforcing our value addition to our esteemed stakeholders, improving customer service was another strategic priority during the year under review. Several staff training and workshops focusing on serving the customers were held. Building up the knowledge and capabilities of customer facing staff, capacity building programmes were conducted covering all provinces. Loan granting processes were streamlined while strengthening the credit standards to maintain a healthy loan portfolio.

Training Programmes Held for Staff in the Retail Sector

– Basic lending operations

– Advanced credit management

– Lease financing

– Credit operations

– Promoting credit/Debit cards at

branch level

– Special programme for negotiation skills and selling talks

Improving Customer Reach

With a large network of branches, we have the maximum potential in reaching out to customers and offering our financial services. Two new branches and one other service point were added to the network, bringing the total number of branches to 580 and other service points to 48. Working on modernising our existing network of branches to provide modern banking facilities on par with competitors, we completed the modernisation of 100 branches during the year while 200 are to be completed in 2017.

In terms of the new strategy, we intend to open 12 branches during the next 3 years, mostly in rural areas.

Improving customer reach by streamlining the sales and alternate channels was a strategy that was actively pursued. In line with the performance-based culture that was introduced, a Leader Board was instituted for branches that achieved the given targets.

Increasing the customer convenience and encouraging digitisation, e-pay and online banking was promoted actively. In line with Government action to promote financial inclusion, a campaign titled ‘Semata ginumak’ was carried out through the branches under which 94,000 accounts were opened for hitherto unbanked customers.

In order to improve the effectiveness and performance of the network, branch grading system was rationalised.

The largest network of ATMs enables our customers to conveniently withdraw cash. Other facilities offered through ATMs include bill payments and balance inquiries. In order to meet the requirements of the new generation of customers, we concentrated on improving our digital channels. The current suite of digital channels includes, internet banking and SMS banking. Our internet banking gained popularity as a convenient payment method for customers and added value to our digital channels.

Cash Deposit Machines (CDM) were introduced at branches which substantially increased customer convenience. CDMs offer real time deposit facilities in a convenient manner saving the time spent in queues. 109 CDMs were installed in 2016.

Green Banking Initiatives

Focusing on ‘green banking’ was yet another strategic move promoted in 2016 in order to give back to nature and embrace sustainability through our banking operations. Financing solar power projects and wind power projects are some initiatives in this regard. We provided finance for the National School of Business Management (NSBM), the first ever green university in Sri Lanka. Promoting e-banking, accounts that do not have paper-based statements or pass books were also pursued in order to promote green banking. We walked the talk by generating and using solar power at branches that are owned by the Bank.

Financial Inclusion

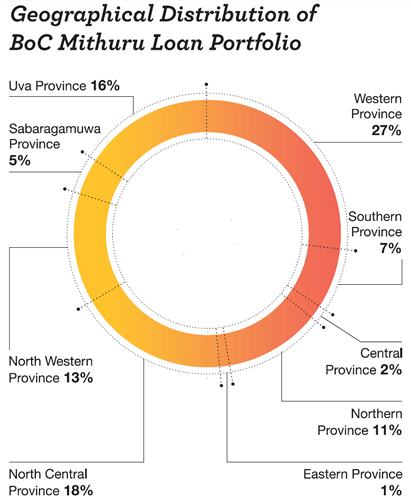

BoC has always been at the forefront of promoting inclusivity and bringing financial literacy to people who hitherto lacked same. These efforts are carried out through micro-financing. Group lending schemes such as ‘BoC Mithuru’ and PAMP-Revolving fund were adopted to uplift the lives of customers who lack financial strength and knowledge on matters relating to finance. We supported the Government initiative to bring the unbanked population to the banking stream through the ‘semata ginumak’ programme by opening 94,000 accounts for those who did not have bank accounts coinciding with the World Thrift Day 2016.

‘BoC Mithuru’ scheme was a novel concept introduced to assist micro-finance customers form small groups, encouraging such groups to inculcate savings habit; work together to resolve financial needs; build entrepreneurial skills and ultimately develop strong micro enterprises. During 2016, LKR 173.3 million of funds have been disbursed among the ‘BoC Mithuru’ societies.

BoC Mithuru Pola

Maintaining Asset Quality

The quality of the retail asset book improved according to targeted levels and NPA ratio stood at 3.4% of the portfolio as at end 2016, and is targeted to reduce further in 2017. The drought that prevailed in 2016 affected the loan repayments on some agricultural loan schemes, however, overall asset quality was improved.

Future Outlook

The Bank’s corporate plan envisages ambitious plans for growing the retail book further in 2017. It also plans to carve out a niche market by promoting personal loans targeting professionals. New corporate entities are being looked at in this regard in order to meet the targeted growth rate of 15% from 2017-2019. Loans for education purposes will continue to take an important role. Health sector is another segment that will be focused on in terms of the corporate plan. The Housing Loan portfolio grew by 14% in 2016. We will carry out an aggressive campaign to make BoC the first choice for housing loans and our aim is to increase the portfolio by 20% each year from 2017-2019. Our ambitious growth target for Commercial loans is 20% through the next three years. Aggressive marketing strategies are planned in this regard. Reducing the turn around time for processing loans is a key objective of the campaign. On the other hand, continuous process improvements to streamline the credit granting and approval process are being undertaken. Improving customer service levels will continue to be a priority for us.

SME sector will be focused on aggressively with targets for all branches. This portfolio is targeted to increase 100% year on year till 2019. We expect to work with development lending institutions such as the ADB for concessionary credit lines to fund our SME lending.

Increasing the outbound sales force in order to drive the expansion strategy and understand customer needs better will be a key priority going forward. Expansion of the number of RLCs to expedite customer service will continue.

The mobile app is to be introduced in 2017 in line with the digitisation strategy. Encouraging the use of internet banking as an alternate channel will greatly improve customer convenience. Measures to popularise the use of credit and debit cards in line with Government strategy to reduce the use of cash will be undertaken. This will also bring in additional interest and non-interest income for the Bank.

Improving customer service quality and levels will continue to be a priority in terms of the new corporate plan.

In order to spearhead this ambitious plan, it is also expected to attract young professionals to the Bank and groom them to drive service and sales standards.

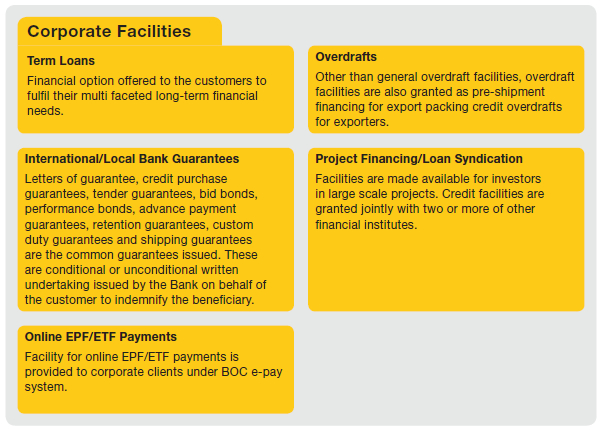

Corporate and Off-Shore Banking

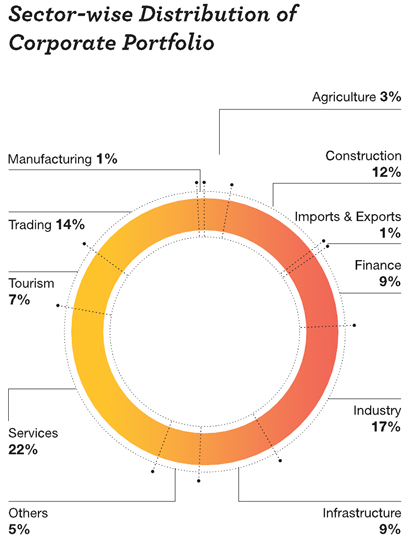

Constituting 46% of the loan portfolio, the corporate and off-shore banking makes a significant contribution to the overall performance of the Bank. In 2016, the sector contribution indicated a modest increase in both loans and advances as well as deposits and thereby contributed to the increase in the profitability of the Bank. This sector also makes a considerable impact on the overall economy of the country by financing large corporate sector entities and projects.

Tightening of monetary policy by the Government through increased Statutory Reserve Ratio and raising interest rates saw the industry growth rate being curbed. Our corporate portfolio grew by 20% during the year, while the industry credit growth was 18%.

The year under review saw a decline in exposure to the Government sector and as a result we increased our focus on the private sector, canvassing new corporate customers. These efforts resulted in a corresponding increase in exposure to the private sector.

Capitalising on the higher single borrower exposure limit applicable for the Bank, additional customers were onboarded successfully. We helped finance large infrastructure projects by arranging syndicate facilities.

Our reach of customers enabled us to provide services to corporates in various sectors in infrastructure, education, construction, tourism, plantation, trading and commerce.

The deposit base saw a year on year growth of 15% against the previous year.

The NPA ratio reduced from 2.05% in 2015 to 1.53%, marking an improvement in the health of the portfolio. This was a result of improving the credit standards, monitoring and follow up. This compares with the industry average of 2.6%.

Initiatives During 2016

We targeted new high networth corporate entities during the year. Customer interactions by way of customer felicitations were held during the year as well as improvements to branches to provide a superior customer service in a friendly atmosphere.

Investment in continuous training for the staff, including overseas training was provided. Motivation of staff engaged in the corporate banking sector took place with performance-based rewards, CSR activities etc.

A risk-based pricing system was introduced in order to align price to the perceived risk and to increase the Bank’s competitiveness.

Significant investments in technology

was undertaken to bring about technology-driven process improvements. A new Trade Finance system and credit administration system are among these investments.

Future Strategies

The Corporate Plan includes challenging targets for the coming years, including a 50% increase in exposure to the private sector. We are confident of achieving these targets given the experienced staff strength and the continuous staff development through training. Our objective is to develop the corporate banking portfolio to achieve a well balanced portfolio with a diversified product range. We will forge ahead with automation to provide a fully-automated solution that blends with the business of the clients.

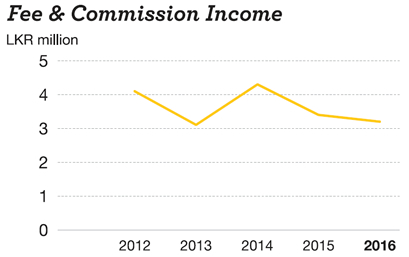

Given the renewed focus on project financing, we also plan to set up a separate division specialising in the subject area. In order to diversify our stream of income and meet new challenges, we are working on increasing non-fund-based income or fee income.

Trade finance is a priority area in our new corporate plan. Improvements to process and controls to maintain NPA at low levels will be a key priority.

We will continuously focus on providing tailor-made solutions to meet our corporate clientele. Towards this end, we will keep on developing our staff skills.

It is also intended to use our corporate banking channel to cross sell our retail products thereby increasing effectiveness.

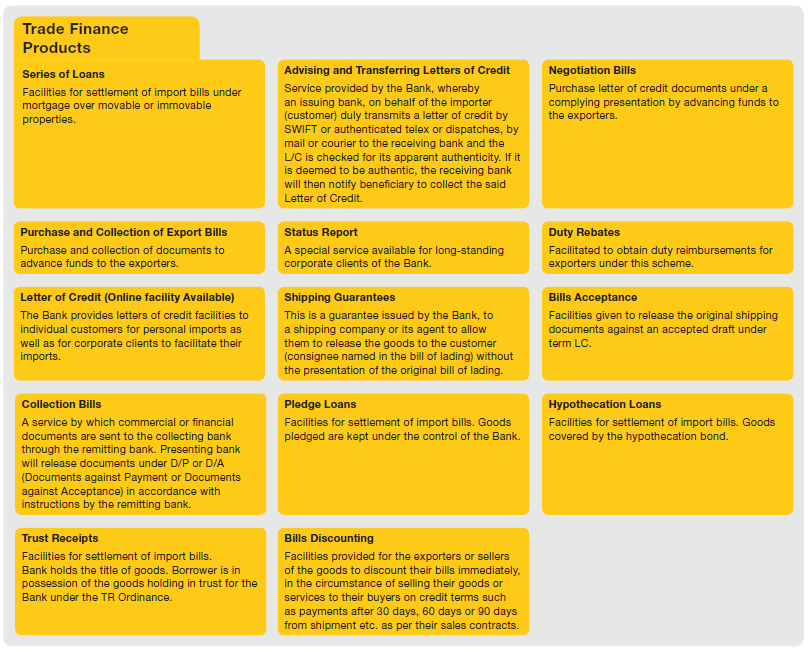

Trade Finance Division

The Trade Finance Division is a key Division for the Bank facilitating Import and export trade services. Apart from its core business it also provides advisory and other consultation services to the Government, customers, other stakeholders and to the industry at large. The BoC Trade Services Division has continuously maintained the market leadership position and also the highest ethical standards relating to Trade Operations and comply with all rules and regulations issued by regulatory authorities. It also gives us great pride that our trade services team has the best knowledge and largest experience pool in the local trade finance industry and also the highest negotiation abilities that allow competitive pricing for customers. Our excellent long standing relationships with the extensive correspondent banking network enables us to meet the most complex customer requirements effectively. Given the stature of our Trade Services Division, Bank also facilitates to develop trade-related Government policy.

Our customer relationships are maintained mainly through corporate client get-togethers, providing advisory services and quoting competitive rates for high net worth customers.

This is the only division of the Bank to possess the ISO 9001 2008 certification, which is being maintained since 2011. Our staff in this Division are provided with local and international training along with Outbound Training to constantly upgrade their levels of knowledge and skills.

BoC Trade Finance is also represented on the Trade Finance Association, ICC which enables our staff to gain knowledge relating to the latest international practices.

We provide a national service by being the banker for foreign funded government projects and also through conducting seminars on trade finance for university students.

Activities in 2016

Programmes were conducted to disseminate knowledge on Trade Finance for branch staff in order for them to effectively promote import and export services to branch customers. Private sector exposure increased by 4% during the year. Although the overall non-fund based income for the Bank declined, income from export related services recorded an impressive 22.6% growth, while import related income declined. The reduction in import related income was mainly due to policy initiatives by the Government to reduce vehicle imports and decline in import of crude oil/petroleum. Our initiatives to target export customers through the branch network and the increased private sector exposure resulted in increase in export related income.

Future Strategies

The Bank is in the process of acquiring a state-of-the-art trade platform to enhance the service quality offered to customers. In addition, BoC Trade Services Division is in the process of developing an export diversification plan for the country together with public and private sector institutions which is aimed at diversifying export products and destinations. In line with Government strategy to develop SME sector, our Trade Services Division is also planning to enhance the coordination with Export Development Board to address exporters in the SME sector as a strategic move to capture potential future customers for sustainable growth in the trade finance sector.

International, Treasury, Investment and Overseas Branches

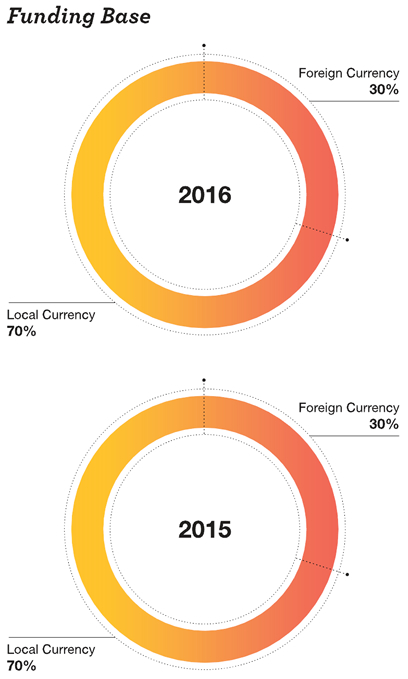

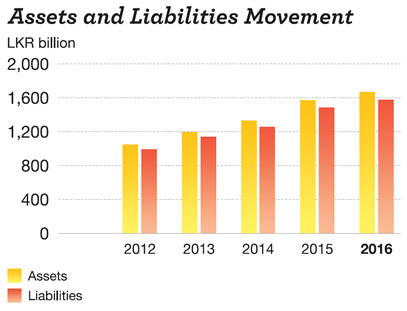

Handling the rupee and foreign currency funds, these key divisions play a critical role for the Bank. Having the largest deposit base for a financial institution, and amounting to over Rupees one trillion, the operations of these divisions are critical for the stability of the Bank and render an invaluable service to the economy. Access to customer deposits through the largest branch network certainly places us at an advantageous position. The investment of the Bank’s funds, foreign exchange management and Asset and Liability management are key functions handled by these divisions. Treasury Division generates 36% of total income. Therefore, the strategies that are adopted for these divisions are critical. BoC also joined the on-line USD clearing system in order to process transactions faster.

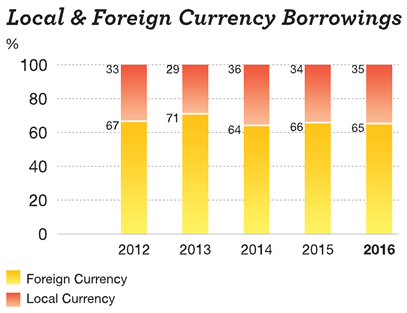

During the year, the deposits recorded an increase of 13% over the previous year while borrowings decreased by 21% improving the gearing ratio. Accordingly, deposits constituted 76% of the funding structure for BoC with borrowings at 18%.

Remittances

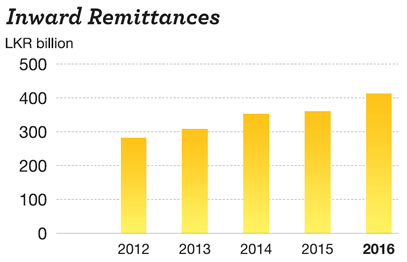

Having the largest market share of 43.5% of the inward remittances from migrant employees, BoC plays a pivotal role in boosting the FX reserves and the Balance of Payments (BOP) of the country. Our remittances sector grew at over 14% as against the industry growth of 11% indicating the success of strategies adopted, through the overseas branches as well as the tie ups with Exchange Houses in other countries. During 2016, significant increases were observed in remittances from Korea and Italy.

Some of the strategic initiatives that we have adopted to increase remittances include, tying up with major Exchange Houses overseas and global money transfer operation, direct SWIFT links with overseas banks to speed up the process, increasing the number of BoC representatives in overseas and improvement of customer service and staff training. In addition, ‘BoC Triple Vasi’ raffle draw was organised to promote inward remittances including Non-Resident Foreign Currency deposits (NRFC). Town storming campaigns were conducted to make people aware of the facilities available for inward remittances through the banking system. This campaign also covered other banking facilities available to expatriates and their families such as housing loans for the construction of residences and basic information such as investing money. It was expected to bring in remitters those who make use of non-banking channels such as hawala and undial to the banking system.

Also the International Division conducted awareness programmes regularly at Sri Lanka Bureau of Foreign Employment Training Centre for prospective migrant employees on foreign currency deposit and remittances through banking channels.

The competition in the banking industry remained high for attracting foreign currency deposits. However, BoC maintains a sizeable market share amounting to 31%. The foreign currency deposits amounted to 25% of the total deposit base of the Bank.

Correspondent Banking

Correspondent banks are financial institutions overseas that facilitate wire transfers, conduct business transactions, accept deposits and facilitate trade transactions on behalf of our customers. BoC is proud of its largest network of correspondence relationships totaling 762 with financial institutions facilitating international banking transactions of which seven new relationships were established in 2016. The sector indicated a growth of 45% over the previous year.

Treasury Division

The Treasury of a bank plays a vital role in managing the foreign exchange (FX) operations of the Bank and ensuring that the business of the Bank runs smoothly and that the Bank has sufficient liquidity to meet its obligations by managing inflows and outflows of funds. Whilst satisfying compliance requirements, it also ensures the optimal pricing of products. In this context, Treasury also plays a key role in managing relevant business and financial risks.

With the ever increasing pace of change to regulation, compliance and technology in the financial sector, Treasury Division has increasingly become a strategic business partner across all areas of the Bank, adding value across the operation.

Apart from handling the foreign exchange transactions, the general functions of the Treasury Division encompass money market dealing, equity trading, fund management, investment in Government Securities, pricing of products and maintenance of the Statutory Reserve and liquidity ratios.

With investment in state–of-the-art technology, the Treasury Division contributes significantly to the overall profitability of the Bank. Given the magnitude of the operation, BoC Treasury has commanded a leadership status in the banking industry for over a decade.

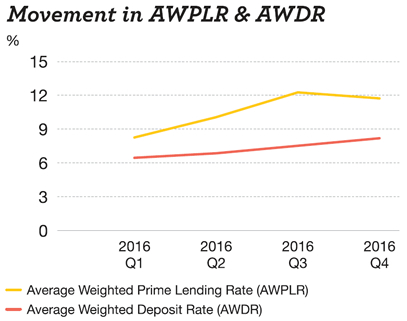

During the year under review, the lending and deposit rates of commercial banks indicated an upward trend, in line with the movement of Policy Rates. The Average Weighted Fixed Deposit Rate (AWFDR) edged upward at the end of 2016 to 10.46% from 7.57% in previous year. Also the Average Weighted Prime Lending Rate (AWPLR) increased to 11.52% from 7.53%. The Monthly Average Weighted Deposit Rate (AWDR) increased to 8.17% by end 2016.

In quoting FX rates, consideration is given for priority sectors of the economy, such as petroleum and pharmaceuticals etc.; that involve large amounts of exchange. In line with the social responsibility that BoC has taken upon itself, the rates quoted are not only targeted at profit generation, but more in line with social responsibility.

The biggest challenge faced during 2016 was managing the narrowing net interest margins (NIM). The key factors that affected interest rates during the year were inflation, the hike in policy rates and the withdrawal of foreign funds from the bond market. As such, the key concerns for Treasury Division were managing liquidity ratios subsequent to the increase in the Standing Deposit Facility Rate (SDFR) and Standing Lending Facility Rate (SLFR) in February and July 2016 by 0.50% respectively.

Treasury is in the process of implementing a new system for Asset and Liability Management (ALM) Unit which will facilitate the generation of required reports and will invariably enhance the decision-making function of the Bank.

While actively participating in the Government Securities market in both Treasury Bills and Bonds, the Treasury was able to secure a significant capital gain from the Government Securities portfolio in comparison to previous year.

The uncertainties surrounding the exchange rate movement and the pressure exerted on both supply and demand sides increased the volatility of the exchange rate.

Investment Activities

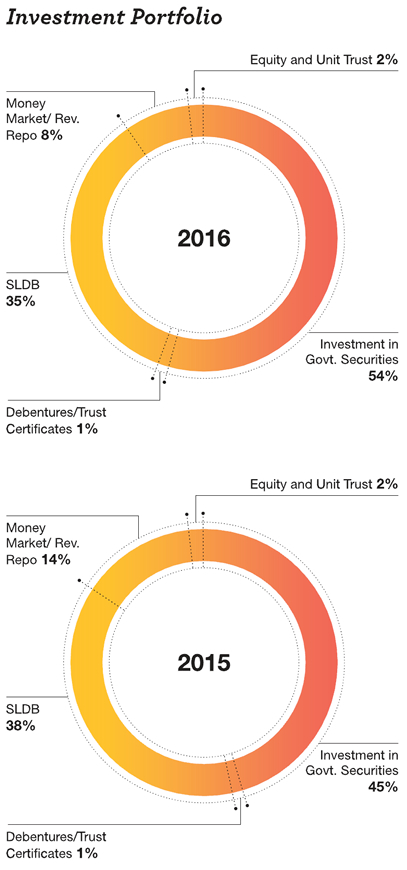

This division invests the funds of the Bank in line with the Bank’s investment policy. BoC assists the Government to develop the capital market as a key participant in Sri Lanka Development Bonds (SLDBs) and raise foreign currency funds for the Government for its activities. The key activities during the year were raising LKR 8 billion worth of debentures to augment the Tier II capital for the Bank, increasing investment in fixed income securities by 71% and commencing portfolio management activities for high net worth (HNW) clients. The latter activity helps HNW clients manage their investments in line with their preferred risk/return appetite and earns fee-based income for the Bank.

The Bank’s investments are also chanelled into Government Securities, Debentures and the capital market. Through the investment activities of BoC, the Bank’s asset and liability management is carried out and also provides liquidity to the market.

During the year, the investment portfolio indicated an overall decline mainly due to factors affecting investments not being up to the expectation of the Bank, compared to opportunities available.

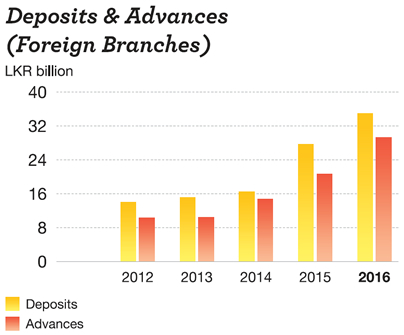

Overseas Operations

Bank’s overseas branches in Malé, Chennai and Seychelles and the subsidiary in UK improved their performance in 2016 and the momentum is expected to continue in 2017. Malé Branch recorded the highest ever profit notching it up by 83% while Chennai Branch also increased its profitability.

Future Strategies

Under the corporate plan for 2017-2019, BoC plans to expand into new markets, rationalise equity investment portfolio by deploying investment advisors, enhance trustee/custodian service-business through Unit Trusts and institutional investors, expand portfolio management services in a customised manner to HNW individuals and pension funds etc. Staff training to enhance the investment skills of staff will also be a strategic priority.

We plan to expand our overseas presence to new locations and new countries under the Government initiative on sectoral Dialogue Partnership with ASEAN. It is also expected that the overseas operations will be economically viable providing a sufficient return to the Bank. This is to be supported by a strengthening of the reporting and control oversight by Head Office.

The Treasury Division intends to optimise the Asset – Liability structure to maintain a net interest margin (NIM) of over 3.6% in 2017. This is to be achieved through automation of the ALM process for high levels of data accuracy. Conducting awareness programmes for HNW customers in respect of the services available under portfolio management and treasury products as well as training for dealers to enhance their knowledge in treasury operations/products will also be carried out. Explore possibilities of arranging syndicate loans or issuing international USD bonds for funding requirements will also be undertaken.

Business Partners

Third parties who supply goods and services to the Bank, outsourced service providers and correspondent banks, are considered our partners who engage with us in carrying out our business.

It is important to maintain a good relationship with business partners in order to ensure that the goods or services supplied are of the required standard, enabling BoC in turn to carry on its activities smoothly and in an uninterrupted manner. Building

long-term relationships with business partners will enable both parties to build lasting relationships based on trust.

Correspondent banks provide services to the Bank to facilitate transactions in foreign currencies.

As a state bank, all procurements for the Bank have to be carried out in a transparent manner, in accordance with laid down procedures. Calling for tenders for the procurement of goods and services is a requirement.

Engagement

- Press advertisements, notices

- Notices on the web site

- Meetings with suppliers and service providers

- Bank outsourcing policy and other internal procedure documents

- Written communications with correspondent banks

Regulators

As a licensed commercial bank, BoC is primarily regulated by the Central Bank of Sri Lanka (CBSL). The Bank is subject to the prudential regulations, Directions and guidelines issued by CBSL. Following these regulations are key to ensuring the safety and soundness of the Bank and thereby that of the financial system. Any breaches of regulations could lead to penalties being imposed on the Bank, other regulatory actions such as sanctions on operations and subject the Bank to reputational risk.

BoC has to also follow directives and guidelines issued by other institutions such as the Inland Revenue Department, Colombo Stock Exchange and the Credit Information Bureau.

Maintaining a healthy relationship with these institutions will facilitate the smooth functioning of the day-to-day operations of the Bank and avoid any reputational risk to the Bank.

Engagement

- Primarily through written correspondence

- Meetings and discussions

Membership in Industry Related Associations

- Asia Pacific Rural and Agricultural Credit Association (APRACA)

- Association of Banking Sector Risk Professionals, Sri Lanka

- Institute of Bankers of Sri Lanka

- International Chamber of Commerce, Sri Lanka

- The National Chamber of Commerce, Sri Lanka

- Sri Lanka Banks Association (Guarantee) Limited

- Sri Lanka Law Library

- The Ceylon Chamber of Commerce

- The Financial Ombudsman of Sri Lanka (Guarantee) Limited

- Association of Compliance Officers of Banks, Sri Lanka

- Bar Association of Sri Lanka