BoC’s Commitment to SDGs

The Sustainable Development Goals (SDGs) are a set of social and development targets and aspirations for 2030, which were adopted by the United Nations General Assembly in 2015. They include 17 individual goals and are built on the Millennium Development Goals (MDGs) for 2015. They encompass a wide range of issues including poverty, health, education, the environment and climate change. However, a quantum leap from the MDGs has been that the SDGs call on business to make their contribution to achieve the goals. There has been wide international agreement on the SDGs but achieving the targets depends on the concerted action of a wide range of actors.

Business can use the SDGs as a framework to formulate strategies and to measure the value they deliver in a holistic manner. Using the SDGs companies can identify areas where, while generating profits for themselves, they can also deliver value to society. The SDGs can also motivate business to make more efficient use of resources, or switch to more renewable alternatives thus minimising the depletion of non-renewables.

As the SDGs become widely adopted worldwide they will be increasingly reflected in policy directives at international, national and regional levels. Companies that align their strategies with the SDGs can strengthen engagement with stakeholders. It will also give an effective platform for them to communicate with stakeholders regarding impacts and performance. On the other hand, lack of such alignment can bring legal and reputational risks. Business needs a corruption-free environment, good governance, transparency and rules based market to function efficiently and effectively. The SDGs will assist business in this respect by promoting a conducive environment for them to operate honestly, transparently and free of corruption and nepotism.

The contribution of the Bank towards the individual SDGs is described below:

Ending Poverty

This goal calls for an end to poverty throughout the globe and providing a minimum standard of living and basic social protection for everyone.

Providing access to credit and other banking services has been recognised globally as an essential step in economically uplifting those at the bottom of the social pyramid. The BoC has made its contribution in this direction by way of its Mithuru microfinancing programme, which gives a helping hand to the underprivileged in our society to become economically self-sufficient. Awareness of this programme was spread island-wide by 38 awareness campaigns in eight provinces which drew a total of 1,334 participants. Further, BoC ‘Mithuru Bakmaha Pola’ were conducted to help the small scale entrepreneurs sell their produce in the areas of Anuradhapura and Kilinochchi. Financial inclusion is also promoted through the ‘Samata Ginumak’ project which is aimed at drawing financially illiterate people into the financial net. During 2016, 94,000 accounts were opened under the project.

The Bank is very conscious of the role that the SME sector plays, especially at the grass roots level. Seven SME customer awareness programmes were also conducted including 707 participants in seven provinces.The Bank also made a contribution of LKR 30 billion to the national coffers, the benefits of which will reach every citizen through uplifting their social welfare.

Ending Hunger

The vision of this goal is to end hunger, all forms of malnutrition and achieve sustainable food production.

Ensuring a continuous supply of essential food items at an affordable price, plays a key role in alleviating hunger and malnutrition. By the financial assistance we give to farmers we are helping continuance of the food supply. A total of 20,777 loans were granted to the agricultural sector during the year.

The Bank also provided financing to the Paddy Marketing Board and Lanka Sathosa which are key links in the food supply chain and thereby contributed to ensuring food security in the country.

Promoting Health and Well-being

Goal three seeks to ensure sufficient healthcare facilities, enabling maintenance of a satisfactory level of health and well-being for the entire population.

BoC made major contributions to this goal through the loans to the health sector to facilitate continuance and expansion of health services. In addition, island-wide blood donation campaigns were conducted concurrently with the 77th anniversary of the Bank. The head office alone donated 163 pints of blood.

Keeping in mind the role that sports play in building a healthy nation, sponsorships were granted to national sports events as well as to events at universities, schools and private institutes. The Bank does not forget the health concerns of its own employees and strives to ensure their work life balance. Sports meets were conducted for Bank staff both at national and provincial level.

Ensuring Inclusive and Equitable Quality Education

This goal is directed towards provision of all types of education including general education, technical and vocational education and higher education and promoting access to education for all.

The Bank’s programmes under this goal are tailored to broadening access to education which will promote equality of opportunity and social mobility. The Ran Kekulu scholarship scheme for Grade 5 scholarship achievers is a major initiative to help students move up the ladder.

The value of each scholarship is LKR 15,000/- and a total of LKR 19.1 million was disbursed during the year. Another LKR 2.9 million was granted to 18+ scholarships for students to attend higher educational institutions. In addition, LKR 2.9 million was invested in the Grade 5 ‘Hapana’ seminar programmes. During the year, 75 such programmes were conducted in which 31,293 students participated. These programmes helped immensely in uplifting the skills of students in under privileged schools.

We also provide internship training programmes to university students and students of other professional institutions. During the year, 759 students were beneficiaries of such internships. Furthermore, the Bank also provides training of six months duration for school leavers; during 2016 the intake of such trainees (who received certified confirmation of their training) was 1,709.

The BoC Money and Banking Museum was opened on 1 August 2016 to coincide with the 77th anniversary of the Bank. During the first five months of operation, 4,200 visitors have visited the museum which seeks to promote financial awareness of the community.

Gender Equality

Goal 5 aims to ensure that women and girls are empowered to reach their full potential and safeguarded from all forms of discrimination and violence.

The Bank maintains a strictly non-discriminatory policy in its gender practices. This is demonstrated by the fact that out of our employees 4,320 are female whereas 3,339 are male. The Bank also conducts women empowerment programmes to improve their position in our society. Promotions were more or less equally distributed among men and women.

Conducted a special promotional programme celebrating International Women's Day – 2016 and 22,380 new ‘Kantha Ran Ginum’ were opened during the campaign.

Availability of Water and Sanitation for All

This goal is directed not only at provision of drinking water and sanitation but also at addressing the quality and sustainability of water resources.

Our major contribution to this goal is through the loans granted to the National Water Supply and Drainage Board (NWSDB) for state water projects. The Colombo City Water Project is one of the major projects being funded by the Bank.

As a contribution at the grass roots level, a CSR project was conducted at Maithrigama Village, Welikanda to provide water to the local residents through tube wells. Contributions to provision of safe drinking water were also made by loan facilities granted to private institutions to producing bottled drinking water.

Access to Reliable Sustainable and Modern Energy for All

This goal seeks to promote wide energy access and increased use of renewable energy.

Solar power has been introduced at the Tissamaharama and Kilinochchi Branches which has reduced dependence on fossil fuel-generated energy. The Bank also operates the Koladeniya Hydropower (Private) Limited Company as a subsidiary, which is another contribution to the generation of renewable energy.

The Bank also finances the generation of renewable power resources, including solar power, hydro power and wind power.

Promote Sustained, Inclusive and Sustainable Economic Growth

The objective of Goal 8 is to provide decent, productive and remunerative employment for all while eliminating undesirable labour practices.

We employ a total of 7,569 people, within the age range of 18 to 60 years, to whom we provide well-remunerated, satisfying and secure employment. The Asia’s Best Employer Brand Awards for 2016 recognised us as the best brand in the continent in 2016.

In addition, a large number of jobs have been created through our lending facilities, especially our lending to the SME sector which generates much employment in the rural sector. A total of LKR 4.2 million was spent on CSR to develop entrepreneurship activities during 2016.

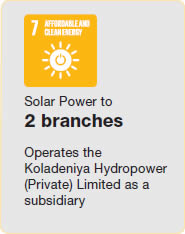

Building Resilient Infrastructure, Promoting Inclusive and Sustainable Industrialisation and Fostering Innovation

Goal 9 focuses on the promotion of infrastructure development and innovation.

In recent times the customer interface with the Bank has been radically changed through leveraging information technology and the spread of mobile phones. The Smart Zone is an innovation the Bank has introduced, which provides 24x365 Automated Banking service for cash deposits and cash withdrawals.

The SME sector, which reaches out into the rural hinterlands of the country, plays a key role in small scale industry and rural infrastructure. The Bank thus contributes to this goal by the lending and other facilities provided to this sector supported by the SME campaigns. The Bank also contributed to large scale infrastructure development by the loan facilities granted to subcontractors of the Central Expressway.

Reducing Inequality in the Society

The objective of the goal is to narrow disparities of income in society including those linked to age, sex, gender and social class.

Our recruitment includes people from all areas of the country, from all social levels, with educational qualifications ranging from school level to the cream of university graduates and in the age range from 18 to 40. Similarly, the Bank caters to all segments of society, all age groups and all geographical areas of the country through its diverse products and services not to mention its far flung network. This diversity in our recruitment, as well as our banking services, contributes to reducing inequality in the society, especially by way of providing opportunities to the underprivileged and women by way of special development credit facilities.

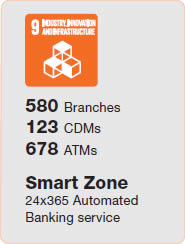

Sustainable Cities and Communities

This goal is directed at renewing and planning human cities and settlements in a way that minimises conflict and fosters personal security while stimulating employment.

We contribute to this goal through supporting affordable housing; our loan scheme ‘Sirimedura’ is tailored for housing loans. Our housing loan portfolio amounted to LKR 48.8 billion while it also recorded a growth of 14% during the year. Further, we have provided funding to North East development projects and human settlement in the region.

Ensure Sustainable Consumption and Production Patterns

Goal 12 seeks to foster production and consumption patterns that will minimise use of resources and generation of materials that are toxic to the environment.

We contribute to sustainable consumption through streamlining our procedures to minimise the use of paper by recycling and moving towards a paperless environment. A total of 95,272 kg of paper has been recycled resulting in saving of trees, electricity, water and landfills. Usage of paper has also been reduced through the SmartGen paperless account which has exceeded 100,000 accounts. The Bank takes continuous efforts to move towards paperless processes and products

The paper saved has been the equivalent of 1,620 full grown trees, 167,202 litres of oil, 381,088 KwH of electricity, 3,027,744 litres of water and 286 m3 of Landfill.

We also practice responsible waste management, reducing environmental damage.

Action to Combat Climate Change

This goal addresses what is probably the biggest global challenge of today, the impact that human activities are having on the planet Earth.

The Bank has systems and procedures in place to minimise our carbon footprint. We are constantly seeking to reduce natural resource usage and dumping of waste to the environment through digital initiatives such as eLearning, eStatement and altering internal systems and processes to be tech-savvy.

The quantity of paper recycled, 95,272 kgs has resulted in a reduction of greenhouse gas emissions of 95,272 kgs of carbon equivalent.

Life Below Water

Goal 14 focuses on conserving and sustainably using the oceans, seas and marine resources for sustainable development.

BoC sponsored the ‘Miridiya Waruna’ Award Ceremony organised by National Aquaculture Development Authority of Sri Lanka. This award gives recognition to fresh water fish cultivators, enhances fresh water fish harvests and will thereby act as a deterrent to illegal marine fishing.

The Bank also continues with the ‘Diyawara Diriya’ loan scheme to assist fishermen to develop their fisheries activities in conformance with the accepted legal framework and environmental guidelines.

Promote Sustainable Use of Terrestrial Ecosystems

Goal 15 is aimed at eliminating the destruction of the natural environment such as reducing the forest cover and combating desertification.

The North Central Province Staff of the BoC planted 1,000 saplings in the Thisawewa area with the collaboration of Government Departments. In addition, 100,000 plants were planted to commemorate the 75th Anniversary.

Peace and Justice

Goal 16 envisages the building of a peaceful and cohesive society based on non-discrimination, respect for human rights, the rule of law and good governance at all levels.

The Bank promotes national integration and reconciliation by a variety of cultural and religious events. These activities include festivals of all communities and religions such as Wesak, Poson, Christmas Carols, Hadji, Ifthicar, Thaipongal and Mahasivarathree which are organised by internal societies of the Bank representing all religions.

A total of LKR 2.1 million was spent on social, cultural and religious activities of staff during the year.

The Bank also sponsored overseas Sinhala and Hindu New Year events.

Bank has a Whistle Blowing Policy and a property laid down grievance handling procedure in place.

Partnerships for Sustainable Development

Achievement of the goals will rest on collaboration of a large number of stakeholders including business, Government, civil society and the international organisations.

As a state bank, BoC maintains a close mutual relationship with the Government of Sri Lanka. The Bank also enters into collaborations with international organisations. These networks enable the Bank to play a vital role in sustainable development of the country.

Achieving the goals of the Bank will need the commitment of staff and management at all levels. The Board, Corporate and Senior Management and every employee have been educated about the importance of the goals and our commitment to them.