Management Discussion and Analysis

Operational Excellence

The COVID-19 pandemic brought with a host of unprecedented challenges. At the heart of it was balancing the Bank’s wider societal duty to provide continuity of service to our customers while, at the same time, fulfilling its responsibility to safeguard the health and wellbeing of Bank employees. The Bank’s efforts across the year – as indicated by the number of branches that remained open during lockdowns, the number of transactions conducted, the number of moratoriums and other relief measures processed and disbursed, etc. – led the way in the banking sector. This stands as a testament to the efficacy of our emergency response processes and the commitment, attitude, and energy of our people.

The backbone of the Bank’s success has long been its emphasis on operational excellence, and it is a crucial factor in its sustained profitability. In today’s banking landscape, where competition is fierce and an array of similar banking products and services saturate the market, speed, accuracy, and quality of delivery is a key differentiator. Meeting customer expectations while remaining cost efficient requires that the Bank continuously assess and streamline processes and make the most productive use of its resources.

Furthermore, while the Bank’s fundamental business of financial intermediation requires adherence to government regulations, operating in a community of stakeholders means that we also need a "Social Licence" – in other words, tangible evidence of ethical and conscientious behaviour. In this context, operational excellence cannot be narrowly defined, but requires, among other things, investments in the well-being of our stakeholders and environment. This balance of short-term and long-term interests is the very essence of the Bank’s profitability.

Highlights:

- Cost to income ratio and Revenue per Employee have improved during 2020.

- Recorded an average profit per employee of above Rs. 3 Mn. throughout the five years’ period.

Productivity and efficiency ratios

Table - 22

| Indicator | 2020 | 2019 | 2018 | 2017 | 2016 |

5 Year average |

| Cost to Income ratio (Including taxes on financial services) (%) | 39.96 | 49.41 | 46.35 | 49.82 | 51.06 | 47.32 |

| Cost to Income ratio (Excluding taxes on financial services) (%) | 33.95 | 38.51 | 36.85 | 40.06 | 42.67 | 38.41 |

| Revenue per Employee (Rs. Mn.) | 29.605 | 29.377 | 27.462 | 22.954 | 18.677 | 25.61 |

| Profit per Branch (Rs. Mn.) | 57.050 | 59.320 | 61.557 | 59.219 | 52.965 | 58.02 |

| Profit per Employee (Rs. Mn.) | 3.238 | 3.363 | 3.490 | 3.328 | 2.910 | 3.27 |

A Transformed Working Environment

At the onset of the first wave of COVID-19 infections and ensuing lockdown in March 2020, the Government declared banking as an Essential Service. The Bank’s response to the pandemic was spearheaded by the Business Continuity Management (BCM) Steering Committee, which is comprised of members of the Corporate Management team and comes under the strategic guidance of the Board. The Corporate Management team members represent all the different functions of the Bank from Personal and Corporate Banking to Operations, IT, HR, Services and Security. The Committee devised a plan providing guidance for maintaining essential functions and services during the pandemic that focused on three key areas:

(1) Infection Prevention and Control;

(2) Operational Support and Logistics; and

(3) Pandemic related Case/Incident Management.

The implementation of this plan was then tasked to the Business Continuity Management Unit (BCMU) and a specially-formed seven-member Special Pandemic Management Committee (SPMC).

The robust Pandemic Plan, which is a sub-section of the Bank’s Business Continuity Plan (BCP), enabled the Committee to swiftly identify the Bank’s mission critical operations that needed to be continued without interruption: Treasury, Digital Banking, Card Center, Contact Center, Data Centre, and certain designated branches, along with Trade Services (which was added to the Bank’s BCP list of mission critical operations after government directives, given the country’s requirement for trade under lockdown conditions). Banking functions were also prioritised according to need within this plan to enable the most efficient allocation of resources (for example, enabling cash withdrawals was considered essential).

Continuing operations while limiting exposure

To ensure continuity of operations and prevent infection exposure and spread, the most urgent task was for business units to split critical teams into smaller units and establish protocols for

(1) working at alternate sites;

(2) working from remote sites; and

(3) working from home.

While the Bank has periodically updated and tested its Business Continuity Plan (BCP), such protocols have not been tested in scenarios of the scale and impact as those arising out of the pandemic. The proportion of staff that was required to work remotely exceeded what was envisaged while developing these protocols, and this brought with it a whole new realm of logistical needs (such as the provision of food, lodging, transport, medical safety equipment, etc). However, the Bank managed to promptly deploy effective and secure remote working solutions in order to provide uninterrupted services to customers. Some key elements of Bank’s immediate operational response to the pandemic included:

- Providing food, lodging, and transport for all mission critical staff throughout the lockdowns to ensure continuity of operations and business.

- Setting up three alternate operational sites, with support from IT, Logistics, Premises and the Business Continuity Management Unit (BCMU) to set up infrastructure, facilities, IT systems, networks.

- Providing food, lodging, and transport as needed for branch staff to commute during the curfew.

- Communicating with employees through an automated Call Tree System, which is capable of triggering SMS alerts to the entire Bank staff, to generate awareness, convey instructions on logistics on short notice, and mobilise staff for shift-based work.

Readiness of BCP Sites

Table - 23

| Location | Seating Capacity |

| Mount Lavinia | 38 |

| Piliyandala | 56 |

| Maradana | 40 |

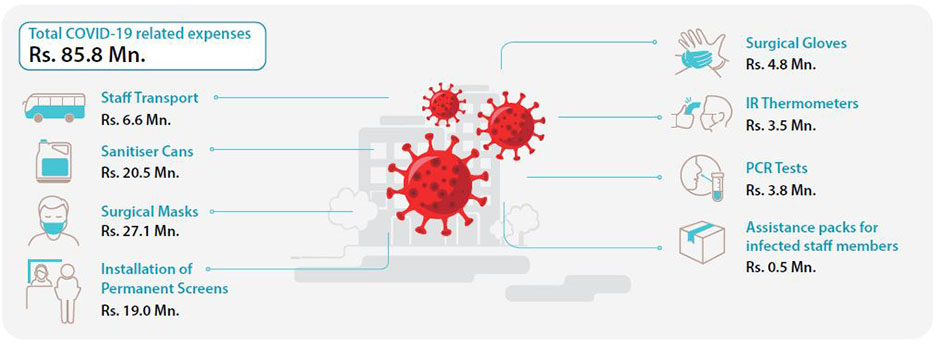

The COVID-19 pandemic also necessitated that health and safety measures be adopted across all locations of the Bank. These measures included the installation of sanitisation equipment such as foot-pedalled sanitisers at entry points and other locations of all buildings, mandatory temperature checks, and measures to minimise physical contact points and maintain social distancing. Anticipating that the pandemic situation would become the ‘new normal’, the Bank was among the first to install permanent glass partitions/screens at branches to safeguard staff who came into contact with external parties such as customers and suppliers. The Bank also devised other creative in-house solutions, such as providing toothpicks in elevators to press buttons, thereby minimising direct surface contact.

The Bank was very proactive in the early acquisition of Personal Protective Equipment (PPE) for employee and customer safety, and stocks were continuously replenished to ensure that all staff had ready access to items such as masks, hand sanitisers, and gloves. Since the second wave, the Bank also pays for a regimen of random PCR testing among head office and branch staff, and provides assistance to staff members infected by COVID-19. Branches and head office departments that have been exposed are thoroughly disinfected.

COVID-19 related expenses

Figure - 13

Furthermore, the Bank cancelled all social events that involve large gatherings, and encouraged all meetings to be conducted via virtual forums. The Bank also closed its lunch rooms at the Head Office and Union Place buildings to prevent large groupings of staff in confined spaces. When in-person meetings were necessary, they were conducted strictly according to social distancing guidelines.

Working securely from home

To facilitate remote working and working from home, the Bank identified an industry leading remote access solution, which offers multiple layers of security such as encrypted channels for communication between Bank and users, multi-factor based login authentication, restrictions on the transferring of data between user devices and Bank systems to control data loss and malware propagation, and centralised management and monitoring of remote users. Over 100 laptops and IP connectivity were provided to staff members along with Office 365, and Microsoft Teams was used as the primary virtual forum for regional and corporate meetings.

Our people rising to the occasion

The engine of the Bank’s successful value creation has always been its workforce. Our 5,057-strong team puts the Bank’s strategy into action, represents the Bank’s values and mission, and ensures that the Bank consistently delivers on its promises to its stakeholders. In turn, the Bank seeks to deliver value to and empower its employees. The Bank recognises that how its people think and feel about their work directly correlates with how satisfied its customers are. The Bank strives to create an environment where employees can perform exceptionally, fulfill their potential, and feel connected to their purpose, their colleagues, and the organisation. The Bank also works to enable its people to be adaptive to remain relevant in a rapidly evolving banking landscape by promoting a culture of continuous learning. These are the crucial elements in the Bank’s strategy to build a strong employee brand and be the preferred employer in the sector.

Retention Rate (Maternity Leave)

Table - 24

| Number of Employees | 2020 | 2019 |

| Availed for leave during the year | 69 | 84 |

| Due to return during this year | 73 | 64 |

| Returned during the year | 73 | 64 |

| Returned during prior year | 64 | 48 |

| Still employed after 12 months | 61 | 45 |

| Return ratio (%) | 100.00 | 100.00 |

| Retained ratio (%) | 95.31 | 93.75 |

Focusing on Employee Morale and safety

During the year under review, the commitment, resilience, and perseverance of the Bank’s staff was on full display. While details of the logistical challenges and health and safety precautions are provided above, it is worth commenting on the well-being and morale of the staff, which the Bank was mindful of during the year. Staff members were certainly not immune to the sense of confusion and uncertainty that gripped the wider society. Work and life rhythms were disrupted in unprecedented ways.

Beyond doing the utmost to ensure the safety of all employees, the Bank emphasised two aspects: clear communication and flexibility. The senior leadership took a hands-on approach, regularly communicating with staff, being personally available, and promoting a culture of openness and honesty about the situation. An important aspect of communication is, of course, listening to employees and enabling them to share their insights to help co-create a positive and productive work environment. Every effort was made to accommodate employee preferences in working environment in both location and hours. The Bank recognised that in a diverse, multi-generational workforce, employees will have different family situations, health conditions, etc. and a flexible approach was needed. Even with the pressures of the year and need to remain productive, the Bank believes that upholding recognised standards and principles for labour practices, human rights and occupational health and safety is essential. More than ever, it was important to prevent burnout and exhaustion and bolster morale, and provide employees with an environment where they could flourish and drive the success of the Bank. It is a powerful testament to the camaraderie and team spirit of the staff that even during these difficult circumstances, productivity remained high and consistent throughout the year.

More than ever in the year under review, it was important to ensure safe and fair working conditions and practices, to prevent burnout and exhaustion and bolster morale, and provide employees with an environment where they could flourish and drive the success of the Bank.

Remuneration and Job Security

The Bank also placed the highest importance on continuing remuneration and ensuring job security to its employees. This year, all appraisals were conducted, and all increments and bonuses paid. The Bank believes that passing on any share of its burden to its employees can have a corrosive effect on their motivation, which, in turn, can impact performance and service standards – and ultimately damage the Bank’s profitability down the line. In a time of crisis, more than ever, the Bank felt it important to affirm its financial commitments to its staff. A special bonus was also paid to all employees to mark the 100th anniversary of the Bank.

Collective Bargaining

A major success of the year was the timely negotiation of the Bank’s collective agreement with the Bank branch of the Ceylon Bank Employees’ Union (CBEU). The Bank and the CBEU were able to arrive at a package of increases spread over the span of the three-year agreement, which will last until December 2023. It must be noted that the negotiations were conducted in a spirit of compromise in light of the financial situation brought about by the pandemic. This once again demonstrates the strong and collaborative partnership that the Bank and CBEU have built over decades.

New Pension Fund

Another crucial initiative was the launch of the Defined Contribution Pension Fund for employees recruited after the year 2000, timed to coincide with the Bank’s 100th anniversary celebration event for employees. Employees’ outstanding balances in the gratuity provision is transferred to the fund of this new scheme and thereafter the Bank commenced to make a monthly contribution to this fund. Employees are required to remain in employment for over five years to claim the benefits of the fund and are guaranteed a return equal or above the existing gratuity scheme. Payment is made through a lump sum at resignation or retirement from employment. It is expected that with the accumulation of interest over the years, employees will receive a substantial benefit due to this initiative.

Diversity

The Bank believes that a diverse workforce broadens perspectives, enhances resilience, and drives performance, and it remained committed to the principles of equal opportunity irrespective of gender, age, race or religion in all its HR management processes.

Employee by type and gender

Table - 25

| Sri Lanka | Bangladesh | Total | ||||

| Count | Percentage | Count | Percentage | Count | Percentage | |

| Female | 1,106 | 23.19 | 79 | 27.43 | 1,185 | 23.43 |

| Permanent | 1,105 | 23.17 | 63 | 21.88 | 1,168 | 23.10 |

| Contract | 1 | 0.02 | 16 | 5.55 | 17 | 0.33 |

| Male | 3,663 | 76.81 | 209 | 72.57 | 3,872 | 76.57 |

| Permanent | 3,662 | 76.79 | 174 | 60.42 | 3,836 | 75.86 |

| Contract | 1 | 0.02 | 35 | 12.15 | 36 | 0.71 |

| Employees-Bank | 4,769 | 100.00 | 288 | 100.00 | 5,057 | 100.00 |

| Outsourced Employees | ||||||

| Female | 203 | 37.66 | – | – | 203 | 37.66 |

| Male | 336 | 62.34 | – | – | 336 | 62.34 |

| Employees-Outsourced | 539 | 100.00 | – | – | 539 | 100.00 |

All employees of the Bank are full time employees.

Employee by category and gender

Table - 26

| Age 18-30 years | Age 31-50 years | Age over 50 years | Total | Percentage | ||||

| Male | Female | Male | Female | Male | Female | |||

| Corporate Management | – | – | 5 | – | 17 | 5 | 27 | 0.53 |

| Executive Officers | 104 | 53 | 1,413 | 335 | 172 | 86 | 2,163 | 42.78 |

| Junior Executive Assistants & Allied Grades | 942 | 271 | 845 | 282 | 22 | 57 | 2,419 | 47.83 |

| Banking Trainees | 298 | 95 | 5 | – | – | – | 398 | 7.87 |

| Office Assistants & Others | – | – | 15 | 1 | 34 | – | 50 | 0.99 |

|

|

1,344 | 419 | 2,283 | 618 | 245 | 148 | 5,057 | 100.00 |

Training and Development

The rapidly changing banking environment places new demands on Bank employees. In an increasingly digital age, our people risk obsolescence if they are not well-equipped with up-to-date, relevant skill-sets. Failure to keep pace with the necessary competencies can hamper succession planning and delay expansion into new spheres. This year, with all its contingencies and pressures, was not conducive for robust training programmes. With in-person sessions not possible, several modules were shifted online. The Bank plans to now switch the majority of its training to online forums in 2021, which, in addition to following social distancing guidelines, has the added benefit of following a more "anytime, anywhere" approach of providing multiple continuous training experiences for staff.

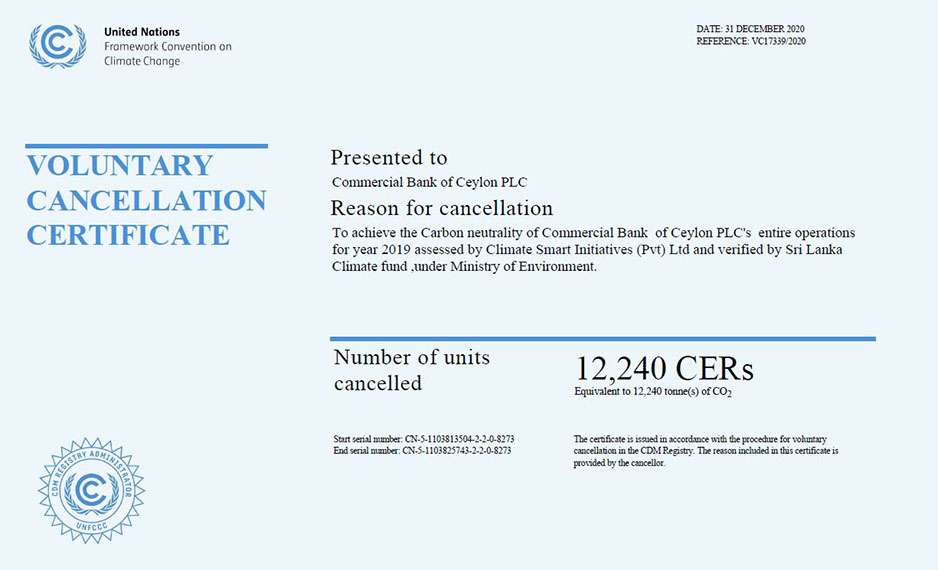

Attaining Carbon Neutral Status

In 2017, the Bank took a significant step in its environmental agenda by commissioning a study by an external consultant to measure its carbon footprint. The study measured all three realms (Scope 1, 2 and 3) of Direct Fuel use, Purchased Electricity and Indirect Transportation. The calculations covered the Head Office as well as the branches through a regionally representative sample and the report was concluded for 2018 and 2019. Based on this study, the Bank set out an ambitious goal to become the first bank in Sri Lanka with a carbon neutral business operation by the end of 2020 and a completely paperless operation by 2030.

The Bank is proud to announce that it met its goal of carbon neutrality on December 31, 2020.

In 2019, the Bank acquired carbon credit of 12,240 tCO2e to become carbon neutral.

Emission category [GHG emissions (tCO2e)]

Table - 27

| 2017 | 2018 | 2019 | |

| Total direct emissions | 1,304.99 | 1,369.27 | 1,282.32 |

| Total indirect emissions | 12,395.08 | 10,838.46 | 10,957.05 |

| Total emission | 13,700.07 | 12,207.73 | 12,239.37 |

Green Buildings and initiatives

During the year under review, the Bank was presented with the "Excellent Green Commitment Award" for the Banking Sector for 2019 by the Green Building Council of Sri Lanka (GBCSL), the country’s leading authority on implementing green concepts and green building practices. The award recognises the Bank’s leadership in multifaceted Green initiatives encompassing lending to support eco-friendly operations, migrating customers to paperless banking, reducing consumption of non-renewable energy, water and other resources in its own operations, and support to community initiatives that help conserve habitats and the environment. The Bank was the only bank to receive this special award in the banking industry, establishing once again its pioneering efforts in this field.

Following the construction of the Bank’s first Green Building in 2015, the Bank commenced the construction of three more Green Buildings during 2019: the Galle Fort Branch, the Jaffna Branch, and the Trincomalee Branch (which was opened in February 2021), all of which target Platinum level certifications from the GBCSL. The restoration of the Galle Fort Branch was completed during the year under review and uses natural material, maximises natural lighting, and has VRV air conditioners installed, and was awarded Platinum Status by the GBCSL.

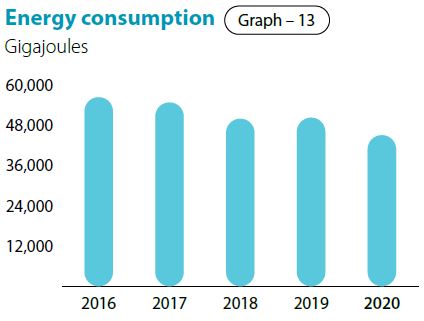

Managing our Footprint

The Bank adopts a two-pronged effort to manage its energy footprint: reducing its energy consumption and adopting and promoting renewable energy sources. Additionally, the Bank conducts initiatives to migrate customers to digital platforms, invests in automated technology that minimise the use of paper and encourages paperless banking, and only contracts with waste management companies that follow international standards in the disposal of e-waste and paper. During 2020, the Bank expanded its renewable energy programme by installing solar panels in 13 new branches, including Head Office. This brings the number of branches powered partially or entirely by solar energy to 64; 28% of our branch network is either completely or partially powered by solar energy. As a result, the Bank’s energy consumption has reduced by 5,251 gigajoules in 2020. However, reduced working hours due to lockdown has also contributed towards this reduction.

Energy consumption

Table - 28

| Indicator (Gigajoules) | 2020 | 2019 | 2018 |

| Energy consumption | 45,045 | 50,296 | 49,958 |

| Solar Power Generated | 5,613 | 6,530 | 1,767 |

| Solar Power Generated as a % of Energy Consumption | 12.46 | 12.98 | 3.54 |

Aligning with the UN Sustainable Development Goals (SDGs)

As a leader in the country’s banking sector, the Board of Directors and Management of the Bank recognises its position of responsibility as a financial institution in influencing and shaping the transition to a more sustainable green, and inclusive economy. Thus, we have also committed to the global mandate of achieving the United Nation’s Sustainable Development Goals (SDGs) by the year 2030, agreed on by 193 countries, and have also aligned our sustainability priorities and operations with the SDGs. The Bank’s commitment is based on a process of principled prioritisation. To that end, it has identified the following SDGs as most aligned to its sustainability and responsible banking ethos and operations, allowing for a more focused and targeted approach yielding a greater impact:

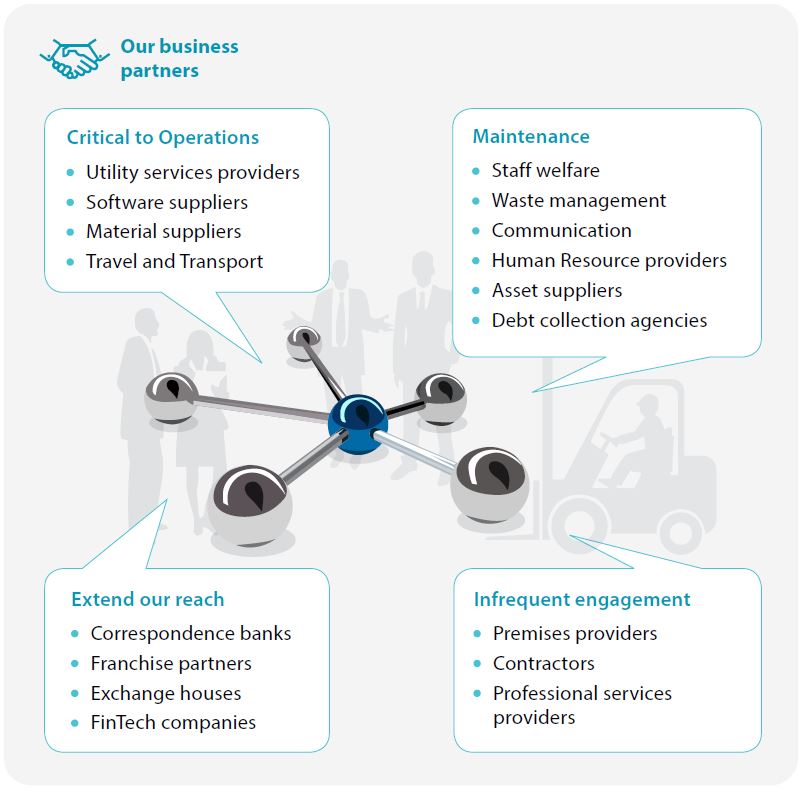

Partnership for the Goals

The Bank’s business partners facilitate the smooth operations of our business, providing technology platforms, market access and necessary materials and other services. We engage with a wide range of firms, SMEs and individuals in support of our business activities – they may be routine or ad hoc, small or large-scale, critical or non-critical to the normal course of business – but all create important links in the supply chain that ultimately delivers value to our stakeholders. The Bank has been able to build strong relationships with them over the years, which was proven by the Bank being able to sustain its operations without any major disruption during the pandemic.

During the year, the Bank engaged with an over 1,250 business partners and delivered Rs. 9.6 Bn. worth of value, with over 90% of value being delivered to suppliers of local origin in both Sri Lanka and Bangladesh.

The Bank always seeks to enhance partnerships of mutual interest for the greater good of society and the environment, and takes pride in being an active member of the following platforms:

- Sri Lanka Banks’ Association Sustainable Banking Initiative – Core Group Member since inception

- UN Global Compact Sri Lanka – Steering Committee Member

- Biodiversity Sri Lanka – Founder Member

The Bank’s Business Partners

Figure - 15