Performance Review

Financial Review 2020

This financial review provides details of the Bank’s financial performance across the year. It is meant to be read in conjunction with the Operating Environment, which explains the broader global, local, and sector trends that contextualise the Bank’s performance, and the Management Discussion and Analysis, which analyses how the Bank grew its financial and other capitals in relation to its strategic imperatives.

An overview

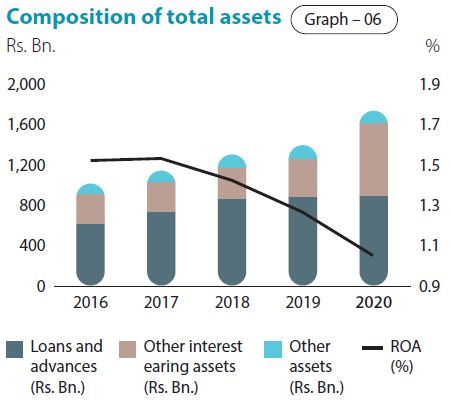

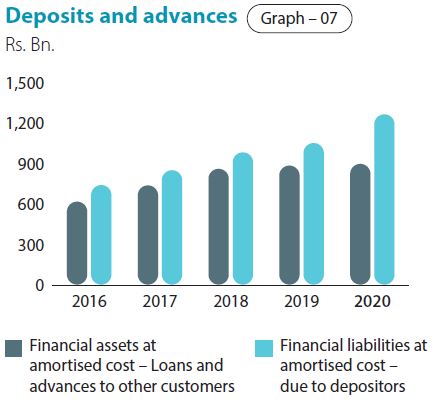

The Bank recorded the highest ever single-year growth in assets of Rs. 348.873 Bn. or 25.15% (2019: 6.43%) during the year under review and recorded Rs. 1,736.218 Bn. as at December 31, 2020. This was mainly funded by the growth in deposits of Rs. 212.658 Bn. or 20.19% (2019: 7.15%), which reached Rs. 1,265.966 Bn. as at the year end. However, as witnessed across the industry, net lending portfolio had only a marginal growth of 1.38% (2019: 2.73%) for the year.

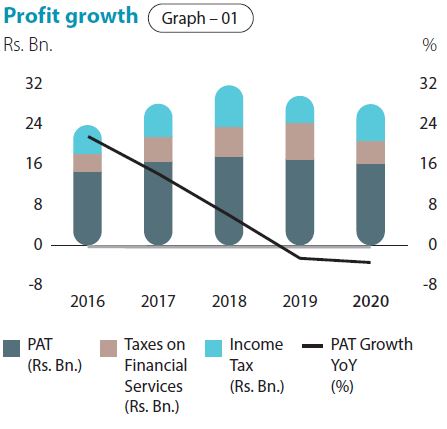

The profit after tax of the Bank decreased by 3.83% (2019: -2.96%) to Rs. 16.373 Bn. from the Rs. 17.025 Bn. reported in 2019. Yet, this can be considered a significant achievement when viewed against the magnitude of the challenges posed by the operating environment and the significant increase in impairment provision. Growth in total operating income by 13.52% was not sufficient to offset the increases in impairment provisions, causing the operating profit before taxes to decrease by 5.13% (2019: -6.68%).

In tandem with the lacklustre performance in the stock market during most part of the year, share prices of the Bank also decreased. However, the price to book value and the market capitalisation of the Bank remained the highest among peers in the Banking sector. The Bank’s market capitalisation ranked fifth among all listed companies on the Colombo Stock Exchange as at December 31, 2020.

With due consideration to the dividend policy and the Bank’s commitment to maintaining a consistent stream of dividends to shareholders, the Board of Directors has recommended a first and final dividend of

Rs. 6.50 per share, which is in line with the rate of dividend the Bank has been paying over the past eight years.

Given that the Bank accounted for 98.51% of the total assets and 95.83% of the profit of the Group, the analysis below provides a detailed account of the Bank’s financial performance, followed by a brief commentary on the performance of the Bank’s overseas operations, subsidiaries and the associate as given in the section on Financial Review 2020.

Given that the Bank accounted for 98.51% of the total assets and 95.83% of the profit of the Group, the analysis below provides a detailed account of the Bank’s financial performance, followed by a brief commentary on the performance of the Bank’s overseas operations, subsidiaries and the associate as given in the section on Financial Review 2020.

Income Statement

Financial intermediation

Gross income grew by only 0.68% (2019: 7.72%) to Rs. 149.711 Bn. for the year from Rs. 148.706 Bn. in 2019. Both interest income and the fee and commission income recorded a negative growth, which was more than off-set by other sources of income mainly due to the exceptional performance of the Treasury. Average assets for the year grew by a higher 16.08% (2019: 9.97%) to Rs. 1,561.782 Bn. from Rs. 1,345.415 Bn. in 2019. As a result, the financial intermediation margin (gross income/average total assets) decreased to 9.59% (2019: 11.05%), a drop of 146 bps. The financial intermediation margin for the banking sector for the year was 9.57% compared to 11.03% for 2019.

Fund-based operations

Interest income, which accounted for 81.71% (85.93% in 2019) of the gross income of Rs. 149.711 Bn., decreased to Rs. 122.330 Bn. during the year from Rs. 127.780 Bn. in 2019, recording a negative growth of 4.26% (2019: 8.78%). This was mainly attributable to the decline in the average rate of interest on interest-earning assets by 1.98%, partly off-set by a growth in average interest-earning assets of Rs. 220.975 Bn. The drop in market interest rates, the reduction in policy rates, and modification losses (Day One losses) as per the SLFRS 09 on Financial Instruments due to concessions granted to the borrowers affected by COVID-19 (including concessions prescribed by the regulator, as well as concessions and interest rebates granted at the Bank's discretion) all combined to exert pressure on the average rate of interest. The combined effect of the modification loss and interest rebates amounted to Rs. 2.641 Bn. Gradual deterioration in asset quality, which resulted in an increase of non-performing advances, and excess liquidity due to lower growth in advances being channelled to low interest earning assets also impacted the interest income.

Interest expenses, which accounted for 59.48% of the interest income (63.05% in 2019), decreased to Rs. 72.759 Bn. during the year from Rs. 80.571 Bn. in 2019, recording a negative growth of 9.70% (2019: 11.10%). This was mainly due to timely repricing of liabilities to reflect the decreasing interest rate regime and a significant improvement of the CASA ratio by 562 bps. Accordingly, the decline in the average rate of interest on interest-bearing liabilities by 1.66%, partly off-set by a growth in average interest-bearing liabilities by Rs. 186.405 Bn.

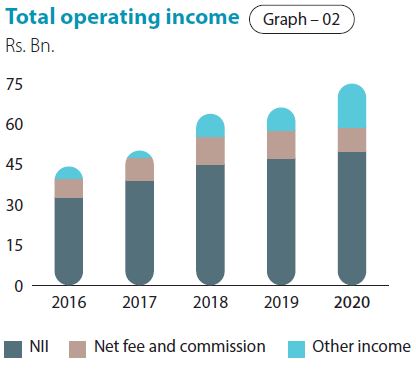

Consequently, net interest income grew by 5.01% (2019: 5.04%) to Rs. 49.571 Bn. from Rs. 47.208 Bn. in 2019, accounting for 66.15% of the total operating income (2019: 71.51%). Net interest margin dropped by 34 bps to 3.17% from 3.51% in 2019.

Fee-based operations

Fee and commission income recorded a negative growth of 9.17% (2019: 3.49%) to Rs. 11.269 Bn. from Rs. 12.407 Bn. for the year due to fee waivers and relatively lower card spending during the lockdown periods. However, the impact was partly off-set by an increase in the Bank’s market share in both the trade finance and remittance businesses during the year.

Fee and commission expenses, which relate mostly to credit and debit cards related services, decreased by 4.96% (2019 :15.19%) to Rs. 2.012 Bn. from Rs. 2.117 Bn. for the year. Consequently, net fee and commission income decreased by 10.04% (2019: 1.37%) to Rs. 9.256 Bn. from Rs. 10.290 Bn. accounting for 12.35% of the total operating income (2019: 15.59%).

Other income

The Bank recorded a substantial increase in other income for the year of 89.11% (2019: -0.88%) to Rs. 16.113 Bn., from Rs. 8.520 Bn. in 2019. This was made possible by net gains of Rs. 6.390 Bn. on derecognition of financial assets, growth of 462.66% (2019: 317.53%), net gains from trading increasing by 38.01% (2019: 144.86%) to Rs. 1.878 Bn. and net other operating income increasing by 30.23% (2019: -46.96%) to Rs. 7.844 Bn. from Rs. 6.024 Bn. as a result of foreign exchange income growing by 30.34% to Rs. 7.361 Bn. due to a 2.81% depreciation of the Sri Lankan Rupee against the US Dollar during 2020.

Total operating income

Total operating income grew by 13.52% (2019: 3.66%) to Rs. 74.940 Bn. from Rs. 66.018 Bn. in 2019. This was consequent to the increase in other income and net interest income being partly off-set by a decrease in net fee and commission income.

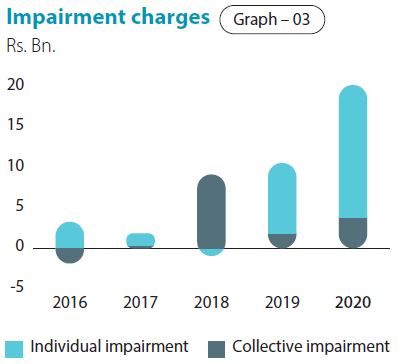

Impairment charges

Impairment charges and other losses for the year increased by Rs. 10.422 Bn. or 94.22% (2019: 28.99%) to Rs. 21.484 Bn. from Rs. 11.061 Bn in 2019 due to deterioration in asset quality as a result of the lacklustre economic activities and uncertainties associated with loan portfolio under moratorium. This is the highest ever Impairment provision the Bank has ever made for a single year in its history. This includes additional provisions made for expected credit losses as a management overlay of Rs. 5.189 Bn. to account for potential losses that the existing impairment models may not be capturing due to high level of uncertainty and volatility created by COVID-19 pandemic. The total impairment charge for the year includes Rs. 17.865 Bn. for individual and collective impairment of loans & advances and Rs. 3.287 Bn for other financial assets and off-balance sheet exposures. The provision for other financial assets includes a provision of Rs. 2.497 Bn. on account of FCY denominated securities issued by the Government of Sri Lanka consequent to the downgrading of the sovereign rating.

The substantial increase in impairment provision and the lower growth in the total operating income resulted in a negative growth in the net operating income by 2.73% (2019: -0.28%) to Rs. 53.457 Bn. from Rs. 54.956 Bn. in 2019.

Operating expenses

Total operating expenses increased marginally by Rs. 14.330 Mn or 0.06% (2019: 8.34%) to Rs. 25.440 Bn. for the year from Rs. 25.426 Bn. in 2019. This was as a result of the increase in personnel expenses and depreciation and amortisation being off-set to a greater extent by a reduction in other operating expenses. Consequent to the substantial increase in total operating income and efforts taken to limit the increase in operating expenses, the Bank’s Cost to Income ratio for the year 2020 excluding taxes on financial services improved to 33.95% (2019 : 38.51%).

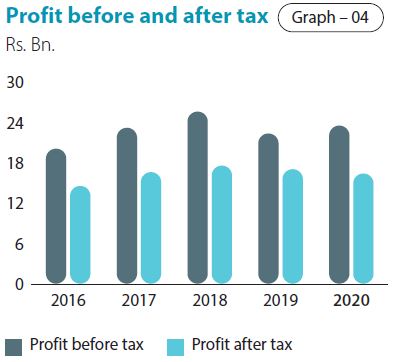

Profit before and after taxes

Negative growth in net operating income by 2.73% coupled with a marginal increase in total operating expenses by 0.06% saw operating profit before taxes on financial services decreased by 5.13% (2019: -6.68%). However, the decrease in taxes on financial services due to the timely abolition of the Debt Repayment Levy (effective from January 1, 2020) and the Nations Building Tax (effective from December 1, 2019), enabled the Bank to post an increase in the operating profit after taxes on financial services (Profit before tax) by 5.25% (2019: -12.71%) to Rs. 23.511 Bn. compared to Rs. 22.339 Bn. in 2019.

The Bank’s Cost to Income ratio for the year 2020 including taxes on financial services also improved to 39.96% (2019: 49.41%).

Income tax expense for the year increased by 34.32% (2019: -33.96%) to Rs. 7.138 Bn. from Rs. 5.314 Bn. in 2019. This was as a result of the tax expense for 2019 being considerably lower due to the favourable impact the entire banking industry enjoyed arising from the exemption of interest income from investments in Sri Lanka Development Bonds (SLDBs) retrospectively with effect from April 1, 2018. Consequently, the profit after tax for the year reported a negative growth of 3.83% (2019: -2.96%) and stood at Rs. 16.373 Bn. compared to Rs. 17.025 Bn. reported for 2019.

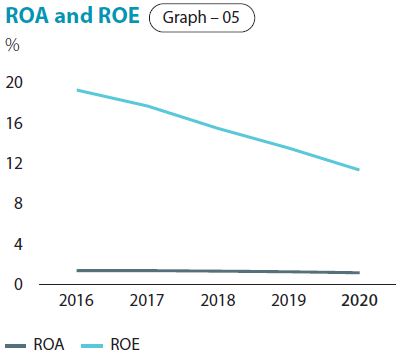

Profitability

Reflecting the drop in profit after tax and the substantial increases in assets and equity during the year, Return on Assets (ROA) and Return on Equity (ROE) reduced to 1.05% (2019: 1.27%) and 11.28% (2019: 13.54%), respectively. Nevertheless, these ratios compare well with the industry averages of 0.99% (2019: 0.93%) and 11.34% (2019: 10.26%).

Statement of Financial Position

Assets

Total assets of the Bank grew substantially by 25.15% (2019: 6.43%) during the year to reach Rs. 1.736 Tn. from Rs. 1.387 Tn. at the previous year end. This growth is well in excess of the industry growth of 17.12%. Given that the net loans and advances to customers recorded only a marginal growth of 1.38%, deposits mobilised during the year had to be invested in Government securities, which mostly accounted for the growth in assets.

Loans and advances to customers

Reflecting the continued slowdown in credit to the private sector and the significant increase in impairment provisioning, the growth in net loans and advances to customers was limited to 1.38% (2019: 2.73%) for the year. Accordingly, net loans and advances as at December 31, 2020 was Rs. 896.845 Bn. compared to Rs. 884.646 Bn. a year ago. Net loans and advances accounted for 51.66% (2019: 63.77%) of total assets as at December 31, 2020. The Bank’s efforts during the year were mostly directed towards granting concessions and accommodating moratorium requests to the borrowers affected by both the Easter Sunday attack and the COVID-19 pandemic, following the relief packages extended by the regulator as well as through the Bank’s own initiatives.

Asset quality

Quality of the loans and advances portfolio is a key determinant of the sustainability of the Bank’s operations. Deterioration in asset quality witnessed industry-wide during most of the year caused the Bank to also experience a further increase in NPLs. The Bank’s conservative risk profile, with a moderate risk appetite and a robust risk management framework, helped the Bank end the year with the gross and the net NPL ratios at 5.11% (2019: 4.95%) and 2.18% (2019: 3.00%), respectively, compared to industry averages of 4.93% and 2.44%, respectively.

Cumulative impairment provisions for loans and advances as a percentage of the total loans and advances portfolio as at the end of the year amounted to 5.38% (2019: 3.89%). Further, total regulatory provisions to gross loans and advances portfolio stood at 3.32% (2019: 2.37%) as at the year end. Specific provision coverage ratio (based on regulatory provisions) increased to 57.42% (2019: 39.39%) in 2020 compared to 51.72% for the industry. This together with the increase in the Bank’s capital improved the open credit exposure ratio (which is net exposure on NPLs as a percentage of regulatory capital) to 11.88% (2019: 17.37%) at end 2020.

The loans-to-customers portfolio of the Bank is fairly well diversified across a wide range of industry sectors with no significant exposure to any particular sector.

Deposits

With a solid domestic franchise in Sri Lanka, customer deposits continued to be the single biggest source of funding for the Bank, accounting for 72.92% (2019: 75.92%) of the total assets as at December 31, 2020. Deposits grew by 20.19% (2019: 7.15%) to Rs. 1,265.966 Bn. as at December 31, 2020. The growth in deposits during the year was Rs. 212.658 Bn., which was the highest ever growth for any financial year in the history of the Bank. The CASA ratio also improved significantly to 42.72% (2019: 37.10%) as at December 31, 2020 compared to the industry average of 34.77%.

Other liabilities

The significant increase in deposit liabilities in contrast to the sluggish growth in loans and advances meant that the Bank had excess liquidity during most part of the year. As a result, external borrowings during the year was mainly limited to refinance borrowings of approximately Rs. 20 Bn. from the Central Bank of Sri Lanka under the Saubgaya – COVID-19 Renaissance facility to assist businesses affected by COVID-19 and a borrowing of USD 50 Mn. from the IFC to help small and medium businesses, with one third being earmarked to help Woman Entrepreneurs deal with the adverse impacts of COVID-19. This together with Repo and short-term borrowings from banks increased total other liabilities as at the current year end to Rs. 313.106 Bn. from Rs. 200.875 Bn. in 2019.

Capital

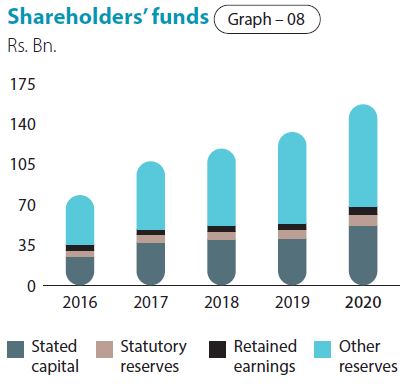

The Bank is guided by its Internal Capital Adequacy Assessment Plan and the Board approved dividend policy in maintaining capital commensurate with its current and projected business volumes. Accordingly, a capital infusion of Rs. 9.216 Bn. by way of the landmark private equity placement with IFC, which was a first for the Bank, profitability and the prudent dividend policy helped the Bank to significantly grow its equity capital by 18.01% (2019: 12.46%) from Rs. 133.162 Bn. as at December 31, 2019 to Rs. 157.146 Bn. as at December 31, 2020. With an on-balance sheet multiplier (gearing ratio) of 11.05 times, compared to the industry average of 11.69 times, equity funded 9.05% (2019: 9.60%) of the assets as at the current year end. The Bank ploughed back Rs. 12.401 Bn. out of profit for the year in 2019 after the payment of cash dividends and is expected to plough back Rs. 11.122 Bn. after the payment of cash dividends for the year 2020. Profits ploughed back include scrip dividends as well.

However, risk weighted assets of the Bank grew only by 4.77% (2019: 2.96%) to Rs. 1,019.068 Bn. as at December 2020. Consequently, both the Tier 1 and the total capital ratios improved to 13.217% (2019: 12.298%) (minimum requirement – 9.000% for 2020 and 10.000% for 2019) and 16.819% (2019 : 16.146%) (minimum requirement 13.000% for 2020 and 14.000% for 2019), respectively, as at December 31, 2020, which are in excess of the higher capital adequacy requirements imposed on the Bank under Basel III requirements as a Domestic Systemically Important Bank (D-SIB). The equity multiplier in terms of risk weighted assets to regulatory total capital marginally declined to 5.95 times from 6.19 times a year ago. As per the CBSL Basel III regulations, the Bank is a D-SIB, the highest grading currently assigned to a bank along with another Government Bank, showcasing the Bank’s importance to the economy in Sri Lanka.

Liquidity

Excess liquidity, a result of substantial growth in deposits coupled with limited lending opportunities, posed major challenges in optimal liquidity management, ultimately leading the Bank to invest excess liquidity in Government securities. Nevertheless, at a time of unprecedented uncertainty such as what we currently experience, excess liquidity provides a high level of comfort to the Bank and also, enables the Bank to benefit from the upturn envisaged in credit demand in the years ahead. Given its importance, review of liquidity is a permanent agenda item in the fortnightly ALCO meetings of the Bank.

Liquid assets ratios of the Domestic Banking Unit (DBU) and the Off-shore Banking Centre (OBC) were 44.99% (2019: 30.42%) and 32.70% (2019: 25.25%), respectively, as at end of 2020, compared to the statutory minimum requirement of 20%. Gross loans to deposits ratio stood at 74.87% (2019: 87.39%). Available stable funding based on definitions prescribed by the CBSL stood at Rs. 1,288.574 Bn. as at December 31, 2020, leading to a Net Stable Funding Ratio (NSFR) of 157.49% (2019: 137.05%), comfortably above the statutory minimum of 90% (2019: 100%). Demonstrating the availability of unencumbered high-quality liquid assets at the disposal of the Bank, the Liquidity Coverage Ratio (all currency) stood at 258.06% (2019: 224.74%) as at December 31, 2020 as against the statutory minimum of 90% (2019: 100%).

Segmental performance

The contributions of the Corporate Banking and Personal Banking divisions to the profit before tax of the Group significantly reduced to 11.95% (2019: 25.78%) and 25.11% (2019: 37.18%), respectively, mainly due to higher impairment charges and other losses and reduction in total operating income. However, the Bank’s Treasury division made a significant contribution to the profit before tax of the Group of 40.78% (2019: 14.77%) via capital gains on the sale of Government securities, trading activities, and foreign exchange profits. In the meantime, the Bank’s International Operations managed to maintain its contribution at the 20% level mainly due to the higher contribution from the Bangladesh and the Maldivian operations. The contribution from the International Operations accounted for 11.79% (2019: 12.06%) of total assets and 20.46% (2019: 20.84%) of the pre-tax profit of the Group.

(All the industry related figures mentioned above have been extracted/computed based on the information published by the CBSL as at December 31, 2020)

Core Financial Soundness Indicators (FSIs)

Financial soundness indicators given below provide further insights into the financial health and stability of the Bank.

Financial soundness indicators

Table - 02

| Financial soundness indicator (%) | 2020 | 2019 | 2018 | 2017 | 2016 |

| Capital Adequacy (under Basel II and Basel III) | |||||

| Common Equity Tier 1 ratio (Under Basel III) | 13.22 | 12.30 | 11.34 | 12.11 | N/A |

| Tier 1 capital ratio (Under Basel III) | 13.22 | 12.30 | 11.34 | 12.11 | 10.37 * |

| Total capital ratio (Under Basel III) | 16.82 | 16.15 | 15.60 | 15.75 | 14.87* |

| Non-performing loans [net of interest in suspense and specific provisions] to equity | 12.96 | 20.48 | 12.71 | 6.39 | 8.65 |

| Asset quality: | |||||

| Gross NPL ratio | 5.11 | 4.95 | 3.24 | 1.88 | 2.18 |

| Net NPL ratio | 2.18 | 3.00 | 1.71 | 0.92 | 1.09 |

| Total regulatory provisions ratio on gross loans and receivables (Based on regulatory provisions) | 3.32 | 2.37 | 1.97 | 1.40 | 1.53 |

| Specific provision coverage ratio (Based on regulatory provisions) | 57.42 | 39.39 | 47.21 | 51.05 | 50.11 |

| Provision coverage ratio (Based on SLFRS provisions) | 5.38 | 3.89 | 3.27 | 2.29 | 2.74 |

| Cost of risk of loans and advances | 1.88 | 1.09 | 0.91 | 0.25 | 0.24 |

| Open credit exposure ratio | 11.88 | 17.37 | 10.21 | 5.59 | 6.55 |

| Earnings and profitability: | |||||

| Net interest income to total operating income | 66.15 | 71.51 | 70.56 | 80.00 | 74.43 |

| Net fee and commission income to total operating income | 12.35 | 15.59 | 15.95 | 17.64 | 15.91 |

| Other income to total operating income | 21.50 | 12.91 | 13.50 | 2.37 | 9.66 |

| Financial intermediation margin (Gross income to average assets) | 9.59 | 11.05 | 11.28 | 10.61 | 9.85 |

| Interest margin (Net interest income to average assets) | 3.17 | 3.51 | 3.67 | 3.62 | 3.47 |

| Operating expenses to gross income | 16.99 | 17.10 | 17.00 | 17.33 | 20.20 |

| Impairment charge to total operating income | 28.67 | 16.76 | 13.46 | 1.39 | 3.47 |

| Return on assets (ROA) – before income tax | 1.51 | 1.66 | 2.09 | 2.15 | 2.12 |

| Return on assets (ROA) – after income tax | 1.05 | 1.27 | 1.43 | 1.54 | 1.53 |

| Return on equity (ROE) | 11.28 | 13.54 | 15.56 | 17.88 | 19.52 |

| Cost to income ratio (including taxes on financial services) | 39.96 | 49.41 | 46.35 | 51.08 | 51.06 |

| Cost to income ratio (excluding taxes on financial services) | 33.95 | 38.51 | 36.85 | 41.08 | 42.67 |

| Liquidity: | |||||

| Statutory liquid assets ratio (Domestic Banking Unit) | 44.99 | 30.42 | 24.47 | 27.28 | 27.19 |

| Statutory liquid assets ratio (Offshore Banking Unit) | 32.70 | 25.25 | 30.20 | 30.95 | 30.19 |

| Liquidity Coverage Ratio (LCR) – Rupee | 330.84 | 158.79 | 236.20 | 272.15 | 196.34 |

| Liquidity Coverage Ratio (LCR) – All currency | 258.06 | 224.74 | 238.69 | 209.17 | 150.45 |

| Net Stable Funding Ratio (NSFR) | 157.49 | 137.05 | 139.18 | 127.87 | N/A |

| CASA ratio (Current and Saving deposits as a % of total deposits) | 42.72 | 37.10 | 37.55 | 39.23 | 41.67 |

| Gross Loans and receivables to deposits ratio | 74.87 | 87.39 | 90.56 | 88.78 | 85.64 |

| Assets and funding structure: | |||||

| Deposits to gross loans and receivables | 133.56 | 114.43 | 110.43 | 112.64 | 116.76 |

| Deposits to total assets | 72.92 | 75.92 | 75.42 | 74.35 | 73.06 |

| Borrowings to total assets | 5.35 | 4.41 | 4.86 | 4.28 | 3.37 |

| Equity to total assets | 9.05 | 9.60 | 9.08 | 9.37 | 7.74 |

* Computed under Basel II guidelines.

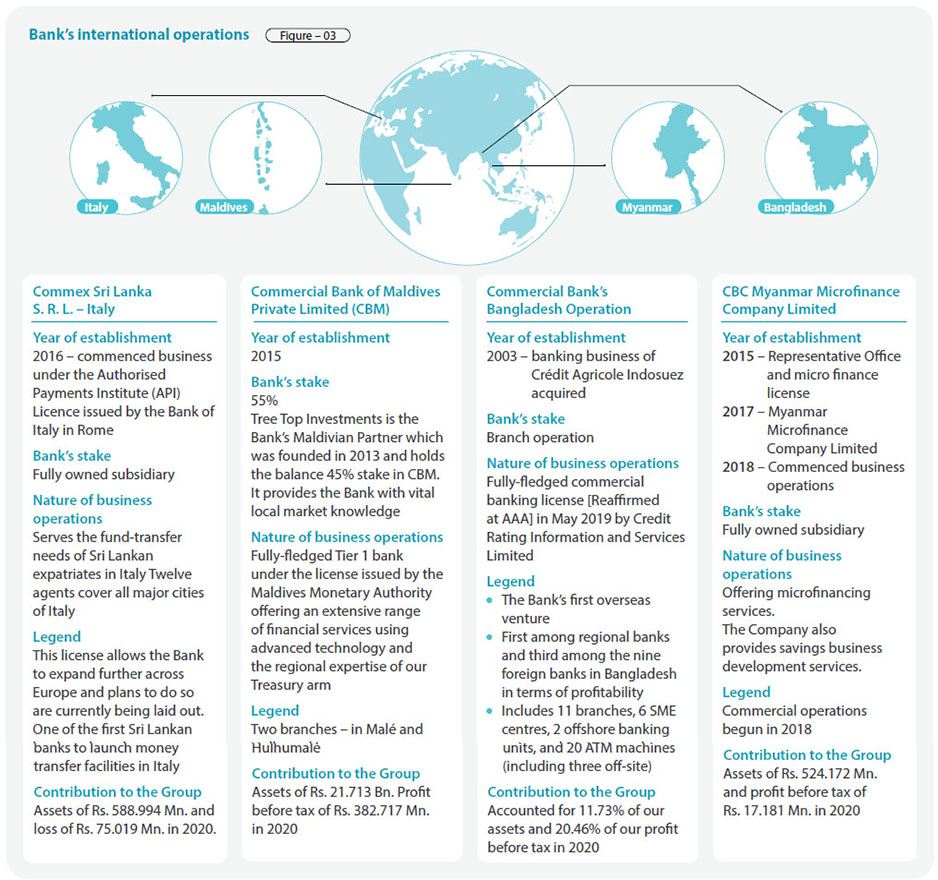

Performance of the subsidiaries, associate and overseas operations

Performance of the Bank’s Bangladesh Operations

Performance of the Bangladesh Operations will have to be reviewed in the context of the operating environment given in the section on Operating Context and Outlook of this report.

Commercial Bank of Ceylon PLC (CBC) commenced its operations in Bangladesh (CBC Bangladesh) by acquiring the banking business of Crédit Agricole Indosuez, a French multi-national Bank, in November 2003.

During the past 17 years of operations, CBC Bangladesh has established its position well above the other Regional Banks operating in the country with 11 Branches, 6 SME Centers and 2 Offshore Banking Units. Presently, CBC Bangladesh has its presence in five main districts in the country i.e. Dhaka, Chittagong, Sylhet, Narayanganj and Gazipur. Despite severe competition among international and large local banks, CBC Bangladesh has recorded a consistent growth in business especially by catering to multinationals and large local corporates by offering better services and commitments. With the expansion of branch network, CBC Bangladesh operations has managed to attract more SME and Retail clientele to the Bank, allowing it to improve its low-cost deposit base, which has resulted in lower cost of funds and improved profitability.

Twenty ATM machines have been installed in Bangladesh (including three in off-site locations). In addition, an Automated Banking Centre (ABC) which comprises a real time Cash Deposit Machine, Cheque Deposit Machine, KIOSK machine and a digital signage in its Motijheel Branch.

During the year 2020, the Bank’s Bangladesh Operations has been adjudged the Best Foreign Bank 2019 in Bangladesh by “The Global Economics Ltd.”, a UK based financial publication. A comparison of the performance of Regional Banks operating in the country reveals that the performance of our Bangladesh Operations is ahead of its peers in many aspects including deposits, advances, asset quality and profitability, a reflection of our excellent service and commitment.

Credit Rating Information and Services Ltd (CRISL) rated CBC Bangladesh operations AAA for the 10th consecutive year based on financial performance for 2019.

The progress of the Bank’s Bangladesh operations in core banking areas over the past five years is summarised below.

Key Performance Indicators - Bangladesh Operations

Table - 03

| Indicator |

2020 BDT Mn. |

2019 BDT Mn. |

2018 BDT Mn. |

2017 BDT Mn. |

2016 BDT Mn. |

5-year CAGR % |

| Total Deposits | 50,997.50 | 45,362.98 | 35,221.65 | 28,808.18 | 23,124.88 | 18.38 |

| Gross Advances | 55,039.33 | 47,449.60 | 38,448.10 | 32,113.53 | 24,456.51 | 19.46 |

| Profit Before Tax | 2,898.24 | 2,744.68 | 2,440.56 | 1,758.56 | 1,381.93 | 12.72 |

| Profit After Tax | 1,709.47 | 1,697.40 | 1,407.23 | 988.40 | 785.13 | 13.58 |

Key Financial Ratios – Bangladesh Operations Table -04

| Indicator | 2020 | 2019 | 2018 | 2017 | 2016 |

| Cost to Income ratio (%) | 24.76 | 24.74 | 25.27 | 28.62 | 32.76 |

| Net Interest Margin (%) | 4.01 | 4.27 | 4.53 | 4.46 | 5.11 |

| NPL ratio (%) | 1.04 | 0.70 | 0.96 | 1.22 | 2.03 |

| ROA (%) | 3.46 | 3.53 | 4.31 | 3.81 | 3.74 |

| ROE (%) | 13.32 | 14.82 | 13.97 | 11.18 | 9.90 |

All information given in Tables 03 and 04 above is based on Management Accounts of the Bangladesh Operations.

Commercial Bank Bangladesh marks a decade at the top with 10th successive "AAA" rating.

CBC Bangladesh has planned the automation of the Treasury department, automation of Central Bank reporting, Card personalisation, implementing a call centre solution, Fiserv Digital Access, e-Leave and e-attendance

in 2021.

Subsidiaries and associate of the Group

Given below is a brief overview of the operations of the subsidiaries and the associate of the Bank.

Local subsidiaries

Commercial Development Company PLC (CDC)

Established in 1980 as the Bank’s first subsidiary, CDC owns the Head Office building of Commercial Bank, “Commercial House”, and has two other properties in Negombo and Tangalle. The Bank holds a stake of 90% in CDC.

CDC is the only listed Subsidiary of the Group, with a market capitalisation of Rs. 1.404 Bn. as of end 2020. The principal business activities of CDC include renting of premises, hiring of vehicles, outsourcing non-core staff and provision of other utility services to the Bank.

CDC recorded a post-tax profit of Rs. 122.582 Mn. for the year 2020, recording a drop of 66.25% from Rs. 363.217 Mn. reported in 2019. The decrease in profit was primarily attributable to the fair value loss recognised on revaluation of investment property in 2020.

CBC Tech Solutions Limited

CBC Tech Solutions Limited is a fully owned subsidiary of the Bank and provides Information Technology services and solutions to the Bank, its subsidiaries and to a few selected corporates.

The main lines of business of CBC Tech Solutions are providing Information Technology support, supply of hardware, licensed software, hardware maintenance, Point of Sale (POS) Maintenance, software development, and outsourcing of professional and skilled manpower to the Bank. Presently, the company operates from four regional support centers in Colombo, Galle, Kandy, and Jaffna to ensure prompt service. The Company is mainly focused on the contemporary technologies such as mobile apps, data analytics, dynamic websites, IOT and cloud computing to further strengthen its business in the future.

CBC Tech Solutions recorded a post-tax profit of Rs. 94.648 Mn. for the year 2020, recording a growth of 18.76% from Rs. 79.699 Mn. reported in 2019.

CBC Finance Limited (CBCF) (Formerly Serendib Finance Ltd.)

CBC Finance Limited is a fully-owned subsidiary of the Bank and is a Licensed Finance Company (LFC) under the Finance Business Act No.42 of 2011. Since the acquisition of the Company in 2014 by the Bank, business plans and strategies of the Company were aligned with the Bank’s strategies, governance and risk management policies and practices.

The Company name and logo change from Serendib Finance Limited to CBC Finance Limited was one of the strategically important milestones during the year, and will enable the Company to establish its presence more visibly as a fully-owned subsidiary of the Bank.

Another remarkable accomplishment of the Company during the year was being rated AA-(lka) by Fitch Ratings Lanka Limited. This rating will enable CBCF to be one of the highest-rated Finance Companies in the country on the strength of the parent.

2020 was one of the most challenging years in the recent past for the Company due to COVID-19-related business disruptions and adverse impacts on its customer base. Being a responsible corporate entity, the Company has identified the importance of assisting its customers who were affected due to the pandemic and accommodated a substantial number of capital and interest moratorium requests. As a result, the Company recorded a post-tax profit of

Rs. 58.477 Mn. compared to Rs.79.129 Mn. recorded last year. However, the Company managed to reduce the impact to the bottom line by significantly growing its business volumes.

Since the commencement of accepting of public deposits from the latter part of 2019, the Company managed to increase its deposits portfolio to Rs. 3.357 Bn. as at December 31, 2020, thereby changing the main funding source of the Company from bank borrowings to customer deposits and enabling the Company to gradually reduce its funding cost during the year under review.

In continuation with the Company’s growth strategy, advancing towards becoming a larger player has been the focus for this year despite unprecedented challenges in the business and macro-economic environment. Total assets grew by Rs. 1.051 Bn., which is a notable 14.14% growth over 2019. The Company’s net loans grew by 15.27% despite the growth of our core product - finance leasing – being curtailed with the regulatory restrictions on the Loan to Value ratio. However, timely shifting towards other products such as mortgage and business loans paved the way to overcome possible unfavourable impacts. Furthermore, the gross NPL ratio of the Company significantly improved from 22.56% in 2019 to 16.52% as at December 31, 2020.

Commercial Bank launches CBC Finance as successor to Serendib Finance.

Commercial Insurance Brokers (Pvt) Ltd. (CIBL)

The Bank acquired the 20% stake in CIBL held by the Bank’s subsidiary, CDC, during the year 2020, which, together with the stake of 40% already by the Bank, increased the Bank’s total stake in CIBL to 60%. The principal business activity of CIBL is insurance brokering for all types of insurance through reputed life and general insurance companies in Sri Lanka.

CIBL recorded a post-tax profit of Rs. 32.078 Mn. for the year ended December 31, 2020, a negative growth of 47.33% from

Rs. 60.903 Mn. in 2019. The CIBL’s total assets stood at Rs. 711.027 Mn. as at December 31, 2020.

Local associate

Equity Investments Lanka Ltd. (EQUILL)

The Bank owns a 22.92% stake in EQUILL, a venture capital company established 30 years ago. EQUILL invests in equity and equity-featured debt instruments.

The Company recorded a post-tax profit of Rs. 17.006 Mn. in 2020 as against a loss of Rs. 1.480 Mn. reported for the previous financial year.

Foreign subsidiaries

Commex Sri Lanka S.R.L. (Commex)

Commex, a fully-owned subsidiary of the Bank, commenced business under the Authorised Payments Institute (API) Licence issued by the Bank of Italy in 2016. As a result, Commercial Bank became the first Sri Lankan bank to be licensed by the Bank of Italy to operate as a money transfer company. The license allows Commex to expand across the European Union using passporting rights.

During 2020, Commex recorded a loss of Rs. 104.460 Mn. and it is taking steps to improve its performance once normalcy returns after COVID-19 related disruptions subside.

Commercial Bank of Maldives Private Limited (CBM)

In partnership with Tree Top Investments (TTI), CBM was founded in the Republic of Maldives as the second foreign subsidiary of the Bank. TTI contributes vital local market knowledge to the Company and has a stake of 45%, while the Bank holds a 55% stake in the Company. Established during the latter part of 2016, CBM opened its Head Office and first branch in the capital, Malé. By the end 2020, CBM had two branches.

While offering an extensive range of financial services, CBM’s goal is to be the most technologically-advanced, innovative, customer-friendly, and the most sought-after financial service organisation in the Republic of Maldives.

As a tourism-based economy, the Maldives was severely affected due to the COVID-19 pandemic. The Government of Maldives initiated a nation-wide lockdown from April 2020 for two months. The Maldives Monetary Authority (MMA) has announced several measures to ease the stress on its financial system, including enhancing system liquidity, moratoriums of six months on loan repayments for specific borrower segments, freezing asset classification of overdue accounts for which moratoriums have been granted and relaxation in the liquidity coverage requirement. The impact of the COVID-19 pandemic on the Bank’s performance, including credit quality and provisions, remains uncertain and dependent on the spread of COVID-19 and the ultimate economic recovery once the pandemic subsides. The Bank’s capital and liquidity position remains strong and will continue to be a focus area for the Bank during this period.

Commercial Bank Maldives honoured for Excellence in Finance at Maldives Business Awards.

During the year 2020, CBM was able to record a growth in its deposits and advances by 9.19% and 12.97% respectively. Total assets of CBM recorded a growth of 8.42% in 2020 and stood at MVR 1.790 Bn. as at December 31, 2020. In 2020, CBM recorded a post-tax profit of MVR 22.723 Mn., compared to the post-tax profit of MVR 28.368 Mn. reported in 2019. Given the extremely challenging operating environment, the performance can be considered remarkable compared to other peer banks in the country.

CBC Myanmar Microfinance Company (CBC Myanmar)

CBC Myanmar was established in July 2018 with the opening of its Head Office and a Branch in Lewe Township in Naypyitaw as a fully owned subsidiary of the Bank with the focus of capitalising on opportunities in the Microfinance sector. A temporary Microfinance license from the Financial Regulatory Department (FRD) of Myanmar was obtained initially. The Company was subsequently able to secure a permanent microfinance license from the government of Myanmar with the recommendation of the Financial Regulatory Department (FRD).

CBC Myanmar now operates with four total branches, including a newly opened branch. The microfinance industry was badly affected due to the COVID-19 pandemic and the suspension of recovery activities for one month by the regulators. The Company was able to robustly manage the effects of the pandemic by the tireless efforts of our staff members in recoveries and by providing COVID-19 special repayment arrangements. The Company opened the Pyinmana branch in July 2020 and was able to break even in November 2020. The loan book grew by USD 784,920 in 2020, a 49.91% YoY growth. CBC Myanmar was able to expand its customer base to over 19,000 by December 2020 compared to about 10,000 customers a year ago.