Management Discussion and Analysis

Customer Centricity

Providing an unparalleled banking experience calls for a deep understanding of our customers – their needs, their preferences, their concerns – and responding with products and services that meet and even exceed their expectations. It also involves transforming internal mindsets and processes to remain agile and relevant in a rapidly changing environment. Accordingly, the Bank carefully segments its diverse customer base and tailors its services to cater to each group. This targeted approach is about viewing relationships with customers as more than simply a sum of transactions, and it allows the Bank to differentiate its value proposition, build customer loyalty, and enhance its brand. And in 2020, this approach was more vital than ever.

Customer Segmentation

Table - 10

| Criteria | High net-worth | Corporate | SME | Micro customers | Mass market |

| Income/Size of relationship/Business turnover/Exposure | Individuals with banking relationships above set thresholds | Annual business turnover> Rs. 750 Mn./Exposure> Rs. 250 Mn. | Annual business turnover< Rs. 750 Mn./ Exposure< Rs. 250 Mn. | Exposure< Rs. 500,000 | Individuals not falling into other categories |

| Price sensitivity | High | High | Moderate | Low | Low |

| Products of interest | Investment | Transactional, trade finance, and project finance | Factoring, leasing and project financing | Transactional | Transactional |

| Number of transactions | Low | High | Moderate | Low | Low |

| Level of engagement | High | High | Moderate | Low | Low |

| Objective | Wealth maximisation | Funding and growth | Funding and growth | Funding and advice | Personal financial needs |

| Background | Business community/Professionals | Rated, large to medium corporates |

Medium business | Self-employed | Salaried employees |

| Number of banking relationships | Many | Many | Many | A few | A few |

| Level of competition from banks | High | High | Moderate | Low | Moderate |

The type of segmentation illustrated here enables the Bank to gain greater knowledge and understanding of the customer and better align with their unique banking requirements.

Channel mix and target market on perceived customer preference

Table - 11

| Customer segment | Branches | Internet banking | ATMs | Call centre | Mobile Banking | Relationship managers | Business promotion officers | Premier banking units |

| Corporates | v | v | v | v | v | v | X | X |

| SMEs | v | v | X | v | X | X | v | X |

| Micro | v | X | v | X | v | X | X | X |

| Mass: | ||||||||

| Millennials | X | v | v | v | v | X | X | X |

| Others | v | v | v | v | v | X | v | X |

| High net-worth | v | v | v | v | v | v | v | v |

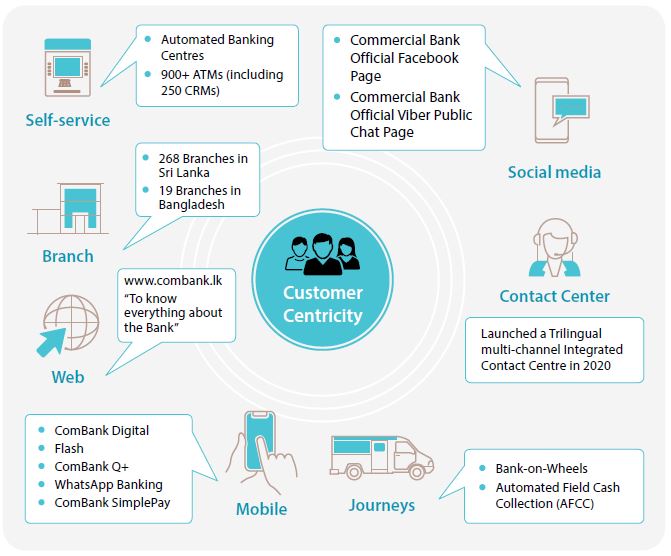

Figure - 11

Responding to the Need of the Hour

While it is commonplace to speak about the symbiotic relationship between a company and its stakeholders, this year provided ample evidence that the Bank and its customers genuinely depend on each other for their survival and success. There was no aspect of the local economy left untouched by the COVID-19 pandemic, and financial relief was urgently and desperately needed by many customer segments and business sectors. The banking industry itself was similarly impacted, but as a Domestic Systemically Important Bank (D-SIB), it was crucial that the Bank do everything within its capacity to ease the burden on customers and the national economy. The Bank viewed this as an opportunity to affirm its commitment to its customers and make a tangible difference in their lives at a moment of crisis.

Cash at the Customer’s Doorstep

During the first wave of COVID-19 infections in late March 2020 and the ensuing lockdowns, nearly 70% of the Bank’s branches in areas under curfew were kept open to provide uninterrupted service to customers in spite of the many challenges faced by the staff. Departments such as Imports, Exports and Treasury were operational throughout to ensure continuity of service for the Bank’s corporate clients. Online customer registration for Digital Banking was expedited to enable customers to conduct their transactions without visiting a branch. Social media played a critical role as the main channel for urgent communiqués to the Bank’s customers when print media was not available.

For customers in urgent need of cash, the Bank deployed its “Bank-on-Wheels” Mobile Banking Units immediately, and increased its existing fleet from 5 to 11 by outfitting vehicles with mobile POS units. A schedule with details of the routes of these units was posted daily on the Bank’s website and social media pages. Because card delivery was not possible during the lockdowns, expired cards were enabled for use at Bank ATMs for a limited period. Beginning in early April, the mobile units processed over 13,000 transactions

to the value of over Rs. 175 Mn. in little over a month.

Financial Relief Initiatives

The Bank consolidated its efforts under the umbrella of “Arunella”, a Financial Support Scheme that integrated multiple initiatives to provide sharper and more efficient relief to customers. These initiatives were guided by the CBSL directives, but went above and beyond them to capture as many pandemic-affected customers as possible. A crucial element of the Bank’s initiatives was a proactive communication campaign across all channels and forums to encourage customers to apply for relief schemes. The Bank’s goal was not to narrowly interpret eligibility criteria and strictly restrict borrowers but to take a deeper, holistic view of all customers affected by the pandemic and come to their aid. Between the two waves of the pandemic across the year, nearly 35% of the Bank’s portfolio was classified under moratorium, and by the year's end, 16% still remained in this position.

Segment analysis of Moratoriums Granted Under Covid-19

– As of December 31, 2020

(Wave –1 and 2)

Table - 12

| Value (Rs. Bn.) |

No of Advances |

|

| Corporate | 176.315 | 2,673 |

| SME | 136.156 | 15,045 |

| Retail | 127.580 | 59,431 |

| Agriculture | 3.180 | 768 |

| Micro | 0.642 | 3,470 |

| 443.873 | 81,387 |

Moratoriums granted under Covid-19 – As of December 31, 2020 (Wave –1 and 2)

Table - 11

| Value (Rs. Bn.) |

No. of Advances |

|

| Personal Banking | 311.810 | 2,716 |

| Corporate Banking | 132.063 | 78,671 |

| 443.873 | 81,387 |

In addition to debt moratoriums, concessions included flexible payment options, up to 20% rebates on accrued interest during the moratorium periods, reductions on minimum credit card repayments and applicable interest rates, waiving and reduction of fees charged, and debt consolidation plans. The Bank also reduced lending rates throughout the year (matching the downward trend of interest rates in Sri Lanka) in an effort to provide customers facing revenue losses with affordable access to funds. The rate cut encompassed all categories of new loans offered by the Bank, including loans for SMEs and micro enterprises, and even pawning, leases and overdrafts.

Helping SMEs and Micro Enterprises

The Bank, who has been a pioneer in providing financial solutions to SME and Micro enterprises, recognised that these sectors were in desperate need of relief. Already under severe pressure after the diminished economic growth in 2019, SMEs and Micros were pummelled by the effects of the pandemic. The veritable backbone of Sri Lanka’s economy, these sectors also remain the most vulnerable to economic shocks, and Bank sought to help bolster businesses at the grass-roots level.

Between both the CBSL-mandated schemes and Bank initiated schemes for COVID-19 support loans, the Bank disbursed a total of Rs. 29.6 Bn. to affected businesses throughout the year. Under the CBSL working capital loan scheme Saubagya COVID-19 Renaissance facility, the Bank registered 5,637 applications with a total value of Rs. 28 Bn. over the three phases of the programme and disbursed 5,387 loans with a value of Rs. 26.6 Bn. at the close of 2020. The Bank lent another Rs. 1.4 Bn. under the CBSL Liquidity Facility for eligible contractors in the construction sector and other suppliers to the Government.

Concessionary funding programmes

Table - 14

| Loan Scheme | No. of loans |

Value (Rs. Bn.) |

| Saubagya C-19 Renaissance Facility | ||

| Phase I | 708 | 2.817 |

| Phase II | 3,878 | 17.711 |

| Phase III | 801 | 6.126 |

| 5,387 | 26.654 | |

| Liquidity Facility Scheme for Contractors | 30 | 1.467 |

| 5,417 | 28.121 |

The Bank facilitated easy access to loans and swifter processing with simple documentation supplied over e-mail or WhatsApp. The Bank’s website listed the names and mobile numbers of two senior officers (who frequently received in excess of 200 calls a day). The efficacy of the Bank’s response was reflected in the fact that in a market comprising 26 licensed banks, as much as 24% of the applications for the Saubagya scheme were submitted by the Bank and as much as 32% of the value of the total scheme was granted for customers of the Bank as of June 2020. By the year’s end, the Bank remained the leading lender for COVID-19 relief amongst the private sector banks.

Disbursement of loans under Saubagya Scheme

Table - 15

| Registered | Disbursed | |

| Total Value of Loans under Saubagya Scheme (Rs. Bn.) | 72.07 | 45.77 |

| Value of Loans applied for by for Commercial

Bank’s customers (Rs. Bn.) |

17.18 | 14.76 |

| % of Loans applied for by for Commercial Bank’s customers | 23.83 | 32.25 |

| Total Number of Loans under Saubagya Scheme | 26,291 | 18,007 |

| Number of Loans applied for by Commercial Bank’s customers | 3,958 | 3,557 |

| % of loans applied by Commercial Bank’s customers | 15.05 | 19.75 |

The above figures have been extracted as per the CBSL press release dated July 23, 2020.

Beyond the CBSL schemes, the Bank also initiated two major loan programmes for SMEs affected by the pandemic. The first was a commitment of Rs 10 billion funded via a loan of USD 50 million from the International Finance Corporation (IFC), who, throughout its 50 years of operations in Sri Lanka, has been a longstanding partner of the Bank. IFC has supported the Bank through multiple investments and advisory support, and currently holds a 14.45% equity stake in the Bank. This scheme was used to expand lending to SMEs, with over a third dedicated to businesses owned by women. This scheme also focused on those who were not eligible for the Saubagya Facility.

The second Bank-funded loan scheme, the Dirishakthi COVID-19 Support Loan Scheme, targeted micro enterprises. This scheme was designed to meet the working capital requirements and revive operations of businesses whose annual turnover was below Rs. 15 Mn. The scheme was implemented under the purview of the Bank’s 19 Agriculture & Micro Finance Units (AMFUs), which play a key role in helping the Bank identify specific needs of entrepreneurs who require assistance to develop their agriculture or micro businesses.

Bank funded relief Schemes

Table - 16

| Loan Scheme | No. of loans |

Value (Rs. Bn.) |

| “COVID-19 Support Loan” Scheme | 102 | 1.454 |

| “Dirishakthi COVID-19 Support Loan” Scheme | 313 | 0.034 |

In addition, the Business Rehabilitation Unit worked with 15 businesses to keep Rs. 2.15 Bn. worth of assets from falling into a non-performing category.

The Bank is supportive of the national initiative to build the SME sector for sustainable growth and developed its own SME strategy after a review by McKinsey Consultants. During 2020, seven new SME sales units were established to drive SME Sales initiatives in the Northern, Eastern and North Central Regions. Over 50 Tab devices were provided to SME Managers and SME Sales units to improve SME acquisition and expedite credit delivery.

To assist sales units, the Bank introduced the SME Lead Management System (SME LMS) in July 2020. This system will help manage the lead cycle in an effective manner while improving the conversion ratio and credit delivery, and will facilitate the collecting of information required for credit evaluation in a structured way in the field itself. With swifter migration to credit evaluation, credit delivery times will be reduced. Indeed, the results are already extremely promising. During the year under review, the average Turnaround Time (TAT) has been reduced through the Centralised Credit evaluation process from 50 days to 28 days as of December 2020. In addition, a new Credit Scoring Model was introduced for SME facilities below Rs. 10 Mn. to expedite credit delivery, and the end-to-end TAT under this evaluation was reduced to just 13 days.

Investing in Customer Relationships

The total array of moratoriums and concessions understandably impacted the Bank’s profitability. As described in the section on “Financial Review”, interest income declined by 4.26% from Rs. 127.780 Bn. to Rs. 122.330 Bn., due in part to the Bank’s own decisions for the customers’ benefit. Fee income dropped by 9.17% from Rs. 12.407 Bn. to Rs. 11.269 Bn. as a result of the impact of the COVID-19 pandemic on import and export income, the waivers and reductions of fees and charges by the Bank and a drop in commissions on credit cards. The Bank does not, however, view this as a mere loss. The Bank views this decline in profitability as a trade-off – redirecting financial capital towards building customer and relationship capital. The Bank believes that to focus on immediate profitability is to compromise the long-term mutual success of the Bank and its customer base.

Non-Financial Support for SMEs and Micros

Beyond direct financial assistance, the Bank continued to cater to the SME sector in several other ways. Membership in BizClub, a Bank forum dedicated to providing a broad range of support services to SME clients, grew to 4,076, representing an increase of 1,613 SMEs during 2020. An SME Dashboard, which monitors the account performance of Biz Club members, was developed and introduced to the Branches in December 2020. The dashboard allows early warning signals to be detected and identifies new borrowing needs. In addition, two new AMFUs were established (at Nawalapitiya and Maravila).

A major step for the Bank’s SME customer base was the launch of ComBank Simple Pay, a new platform to help SMEs digitise their business and engage in e-commerce (also see Leading Through Innovation). This product, the first of its kind in Sri Lanka, enables SMEs to create their own online store without a large outlay on web development and design. The Bank also launched a MasterCard-branded credit card for entrepreneurs that fall into the SME category.

Nevertheless, around 70%-80% of the country’s population is rural. Despite the rapid increase in demand for digital products and services after the onset of the pandemic, rural demographics remain reluctant to adopt digital channels for a variety of reasons. Though the Bank is committed to providing and promoting the benefits of digital to its rural customer base, it also understands that it needs to meet current customer expectations. During the year under review, the Bank introduced the "Automated Field Cash Collection" (AFCC) process to better serve the micro and small businesses segment, and two AFCC sites were opened at Chankani and Kodikaman. This initiative was launched with the intention of reducing customer transaction costs and it opportunity costs of visiting a branch, and is also expected to strengthen the doorstep operation of the AMFUs.

The Bank continued its partnership with Hayleys Agriculture Holdings Ltd to provide a series of joint leasing promotions to enable farmers to purchase new agricultural machinery at low rentals with special discounts and flexibility. The Bank also joined hands with Associated Motorways (Private) Limited for an "Agri Lease" promotion offering farmers an opportunity to enjoy the lowest monthly lease rentals and other benefits when purchasing tractors.

The Bank’s goal was not to narrowly interpret eligibility criteria and strictly restrict borrowers but to take a deeper, holistic view of all customers affected by the pandemic and come to their aid.

The Bank, through a variety of channels, has conducted awareness, vocational training, and financial literacy programmes and workshops for SMEs and micros in different sectors of business across the country for many years. The Bank organised three Skill Development Programs during the 1st quarter of 2020 covering the Northern, Eastern, South-Western regions of the country, which benefitted more than 300 SMEs. As in-person gatherings were subsequently curtailed, the Bank continued to provide support to the sector through webinars. The Bank conducted a webinar on "Financial Literacy and Banking Solutions for Small, Medium and Micro Entrepreneurs" in collaboration with the Institute of Certified Management Accountants (CMA) of Sri Lanka, and a webinar exclusively for women entrepreneurs to help them adapt to the requisites of the ‘new normal’ after the COVID-19 pandemic in collaboration with the Women’s Chamber of Industry and Commerce (WCIC). The latter built on the success of an in-person programme held in January 2020, prior to the wave of lockdowns and restrictions, titled "WomEntrepreneur," also in collaboration with the Women’s Chamber of Industry & Commerce (WCIC). This programme was aimed at women entrepreneurs engaged in SMEs with an emphasis on steering a vision towards sustainable business. The Bank also organised a webinar in collaboration with the National Chamber of Exporters to support SME exporters during the pandemic.

Women Entrepreneurship Programme

The Bank itself worked on developing its own internal capacities by participating in a United Nations Development Programme (UNDP) webinar on supporting the SME sector – and was the only Sri Lankan bank to participate in this discussion. The Bank also participated in the INNEX 2020 SME Exhibition and Workshop in Kandy organised by Central Province Industrial Ministry in collaboration with Ministries of Youth Affairs, Women’s Affairs, Rural Development, Cooperative Development & Industries, and in an economic summit in Hambantota organised by the CMA under the theme of "Solutions to meet challenges faced by SMEs in Financial Management, Bank Funding and Entrepreneurial Leadership in the Post COVID New Economy". At the latter event, the Bank set up a Help Desk to provide information and banking solutions for the more than 400 SMEs who were in attendance. The Bank also provided funding for two programmes organised by Women in Management (WIM) together with the Ministry of Women’s Affairs, which provided support for more than 90 micro-level women entrepreneurs.

Banking on Women

The Bank has recognised the importance of having a more gender-specific approach, as evidenced by the number of seminars and webinars conducted by the Bank described above. Women make up the majority of Sri Lanka’s population, and the Bank realises that meeting their aspirations for empowerment and success also benefits the economic growth of the country.

During the year under review, the Bank opened a special Women Vertical and is in the process of formulating a 360-degree approach to serve requirements of this demographic. This all-inclusive approach will involve all segments from Women SMEs and micros to housewives and working women.

Prioritising Customer Experience

Despite the trying conditions, the Bank continued to develop new products and services that catered to different customer segments. A full description of the Bank’s digital projects is provided in the next section, but some of the broader customer initiatives conducted during 2020 are noted here.

The centrepiece of the Bank’s efforts was the launch, early in the year, of its one-stop trilingual Integrated Contact Centre to serve its customers and stakeholders 24/7. The Centre is staffed by customer service representatives to handle both inbound and outbound, calls, written communication, and requests and feedback routed through social media, and includes a robust leadership and training group to provide better supervision and monitoring. The aim of the Centre is to ensure that customers receive a positive experience in each and every interaction with the Bank. Despite the many challenges of staffing during the lockdowns and beyond, the Centre was able to provide uninterrupted service to customers throughout the year.

Card and Cashless Initiatives

The Bank made significant strides in championing credit and debit card and other cashless payments during the year under review. While the move to cashless transactions was already an exponentially growing practice across the world, this year it took on additional significance since the use of currency notes was discouraged to reduce COVID-19 spread. The Bank, together with PAYable (Pvt) Ltd, launched an all-in-one, fully integrated Android POS machine, one of the first devices to accept contactless payment card transactions in Sri Lanka. The NFC-enabled machine supports the highest number of card payment options available in the country as well as the QR-based payments of LankaQR, VisaQR, Masterpass (MasterCard QR), WechatPay and Alipay. The Bank also introduced an Android Mini Point-of-Sale (POS) device, which features similar functionality, to enable merchants anywhere in Sri Lanka to accept card payments. This mini-POS is strategically positioned to cater to the Micro and SME industry, providing them with a cost-effective mechanism to access the cashless ecosystem.

Other card-related customer initiatives include:

- Converting the Bank’s entire debit and credit card base to NFC Technology.

- Introducing a "Card Balance by Missed Call" service for credit card holders.

- Enabling credit and debit card holders to automate payments to the Ceylon Electricity Board (CEB).

- Allowing credit card holders to self-register for e-statements, thus reducing the use of paper statements (this initiative was promoted by entering all registered users into a prize draw).

- Launching a Pre-Paid Travel Card with the latest NFC and PIN technology.

Other initiatives of note include:

- Introducing a "Cash on Fixed Deposits" facility that enables depositors to withdraw against their FD value through a debit or credit card linked to their accounts. This facility was especially designed to allow customers facing unforeseen financial issues to be able to withdraw funds from their FD without terminating the entire contract.

- Launching "Vibe", a youth savings account that can be opened by any Sri Lankan between the ages of 18-35 years with

a range of attractive rates and concessions. - Offering free Accident Cover of up to

Rs. 500,000 to holders of "Anagi" Women’s Savings Accounts, subject to maintaining

a minimum account balance.

Vibe Account launch