Operating Environment

Operating Context and Outlook

Global economy

The COVID-19 global pandemic has been nothing short of an epochal event. It has precipitated a global recession that can only be compared to the two World Wars and the Great Depression of the twentieth century. At the time of the writing of this report, the virus had claimed over 2.4 million lives and infected over 110 million people across the globe. While there has been no segment of the population that has not been affected economically, the most vulnerable – women, youth, the poor, the informally employed, those employed in contact-intensive sectors – have been the most ravaged. Estimates fear that close to 90 million people will fall into extreme deprivation in the coming years, reversing gains made in poverty alleviation in the past decades, exacerbating economic equality, and leaving lasting scars on society. While some signs of recovery were evident during the middle of the year – a result of partial easing of lockdowns – resurgent waves of infection have made forecasting a difficult prospect. The roll out of vaccines offers some hope, but global recovery will be unevenly distributed due to emerging variants of the virus in many parts of the world and countries’ access to medical interventions, along with broader structural factors.

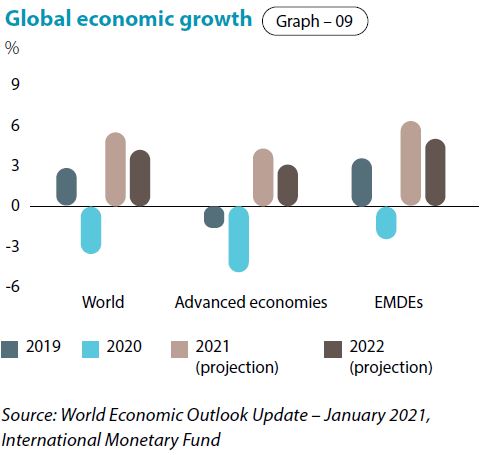

Nevertheless, bolstered by stronger than expected momentum in the second half of 2020, current estimates by the IMF puts global growth contraction at -3.5%, an upwards revision of 0.9% from 2020 third-quarter projections. The global economy is projected to rebound with 5.5% growth in 2021 (an upward revision of 0.3%) and then moderate to 4.2% in 2022. Global trade volumes are projected to grow by 8.1% in 2021 though services are expected to lag behind, a pattern consistent with restricted cross-border travel until transmission of the virus declines across the globe. It should also be noted that while some industries, like airlines and tourism, will continue to face challenges, others, such as telecommunications and pharmaceuticals, are expected to surge even higher. Subdued inflation is expected to be seen across 2021–22, with advanced economies projected to remain below 1.5% and emerging market and developing economies at just over 4.0%, which is lower than the historical average of the group. 2021 Oil prices are expected to increase to just over 20% of their low base in 2020, but will still remain well below their average for 2019. Non-oil commodity prices are also expected to rise, reflecting the projected global recovery. Major central banks are expected to maintain their current policy rate stances for the foreseeable future, promoting financial stability for advanced economies and improvement for emerging market and developing economies.

Sri Lankan economy

Just as it was starting to show signs of recovery from the shocks of the Easter Sunday 2019 attacks, the Sri Lanka economy was pummeled by the COVID-19 pandemic and contracted by 1.7% and 16.3% in the first and second quarters of 2020, respectively. Downward trends in the global economy had swift repercussions locally. Lockdowns during April-May impeded economic activity, the closure of airports to tourists from March 2020 to January 2021 brought the industry to a standstill, and global demand remained weak throughout. As a result, the country experienced reduced tourism and export earnings, capital outflows, and heightened pressure on government finances, and the rupee depreciated by 2.6% against the US dollar in 2020.

The economy rebounded in the third quarter of 2020 with a GDP growth of 1.5% as a result of monetary easing, government stimulus measures, lower global petroleum prices, and larger than expected remittances from migrant workers. The trade deficit contracted significantly during the year with a reduction in merchandise imports (in particular, fuel imports), contributing to a strengthened external current account balance.

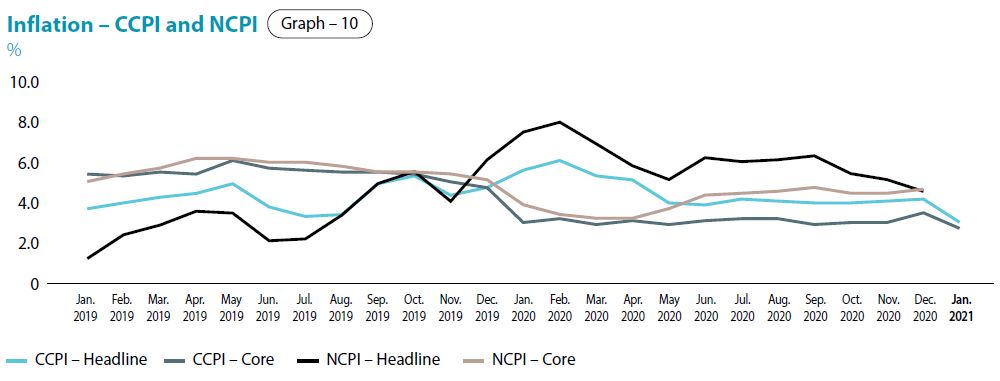

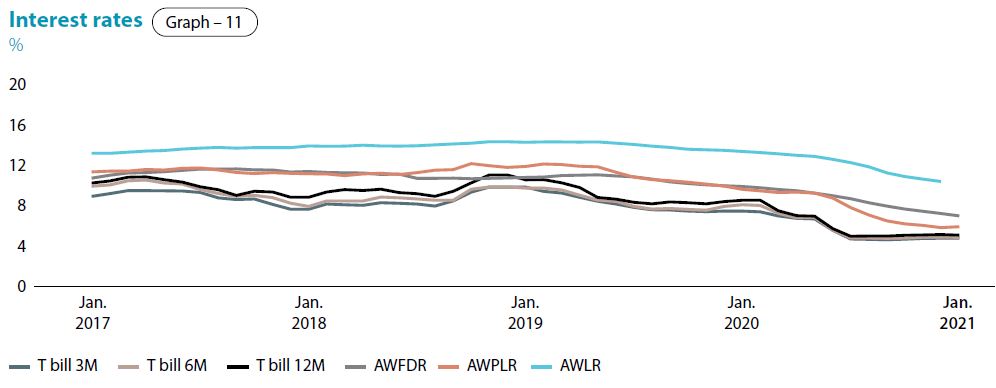

Despite some acceleration in food inflation, headline inflation remained muted in 2020. Under the current flexible inflation targeting framework, the Colombo Consumer Price Index (CCPI) based headline inflation remained broadly within 4-6% across the year, and low levels of demand-drive inflationary pressures meant that core inflation remained subdued. This enabled the CBSL to ease monetary policy to historic levels to buoy the ailing economy. The Standing Deposit Facility Rate (SDFR) and the Standing Lending Facility Rate (SLFR) were both reduced 5 times during the year by a total of 250 bps (4.5% and 5.5%, respectively, at year’s end) and the Statutory Reserve Ratio (SRR) was reduced twice by a total of 300 bps (2% at year’s end). In addition, the CBSL introduced loan moratoriums, special lending schemes at concessionary rates, and interest rate caps on selected lending products to quicken the transmission of the monetary policy.

The economy is projected to have contracted by around 3.9% according to the Central Bank of Sri Lanka (CBSL) in 2020, though other sources project a more severe impact in a range from 4.6% (IMF) to 6.7% (World Bank). While the second wave of COVID-19 infections from October onwards hampered momentum, the CBSL anticipates a strong growth of 6% in 2021. The CBSL envisages continuing its accommodative monetary policy stance to drive the country’s economic recovery. In this low inflation, low-interest rate environment, credit to the private sector is expected to expand by around 14.0% in 2021 and by about 12.0 -12.5% annually over the medium-term. Particular attention will be given to the micro, small and medium scale enterprises (MSME) sector, which is the backbone of the country’s economy.

The global economy is projected to rebound with 5.5% growth in 2021 (an upward revision of 0.3%) and then moderate to 4.2% in 2022.

It is of some concern, however, that Fitch, Moody’s and S&P downgraded Sri Lanka’s sovereign rating in 2020, highlighting Sri Lanka’s increasingly challenging external debt repayment position. The government’s external debt obligations amount to USD 23.2 bn between 2021 and 2025 (about USD 4 bn annually). Fitch is of the view that Sri Lanka’s financing and debt service challenges are exacerbated by its existing financing model, which has resulted in high government interest to revenues ratios. The average interest to revenue ratio from 2016 to 2020 is about 50%. The downgrading of Sri Lanka’s sovereign credit rating will increase the country’s external borrowing costs, though it should be noted that the Government has challenged these downgrades.

Sri Lanka's Sovereign Ratings

Table - 6

| Rating Agency | Newly assigned Rating | Previous Rating |

| Fitch | CCC in Nov 2020 | B (-) (Negative) – Apr 20 |

| S&P | CCC+ (Stable) in Dec 2020 | B (-) (Stable) – May 20 |

| Moody’s | Caa1 (Stable) in Sep 2020 | B2 (Negative) – Nov 18 |

Sri Lankan Banking Sector

As a result of the implementation of prudent regulatory requirements, the banking sector was well placed with capital and liquidity buffers at the start of the year. The sector recorded an overall expansion in credit, although much of this must be attributed to the increase in loans and advances to the Government and State-Owned Enterprises (SOEs). Credit was concentrated in six sectors, comprising 73.1% of loans (as of the end of September 2020): consumption, construction, trade, manufacturing, infrastructure and agriculture. Rupee loans and Foreign Currency (FC) loans (in USD terms) grew at 13.5% and 15.1%, respectively, on a year-on-year basis as of the end of September 2020 compared to 6.9% and 13.0% growth recorded at the end of September 2019.

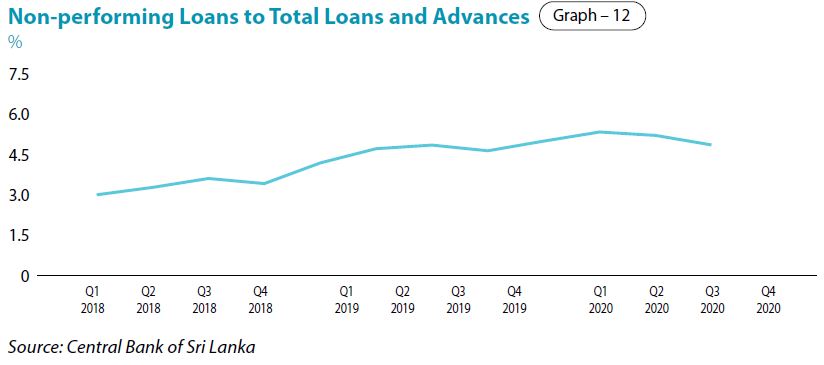

The overall NPL ratio of the banking sector reached 5.3% in September 2020, with the manufacturing sector reporting the highest NPL ratio of 9.0%, followed by agriculture (7.3%), trade (7.3%), tourism (7.1%), construction (6.7%), and consumption (5.2%). The specific provision coverage ratio increased from 38.2% as of the end of September 2019 to 45.9% by end September 2020.

Rupee deposits were the major source of funding for the banking sector and showed a marked increased over the year. This increase was driven by the drop in discretionary spending due to the pandemic and by the movement of deposits from the Non Bank Financial Institution (NFBI) Sector to the banking sector. The growth in rupee deposits increased from 7.9% in 2019 to 19.3% in September 2020 YoY (foreign currency deposits showed a growth from 14.0% to 14.3% across the same period). This surge of deposits meant that the loan-to-deposit ratio fell from 88.2% in December 2019 to 84.8% in September 2020. The overall profitability of the banking sector declined due to the falling Net Interest Margin resulting from policy measures taken by the Monetary Board, though this was balanced somewhat by an increase in non-interest income and a decrease in non-interest expenses and taxes during the nine month period ending September 2020 (compared to the corresponding period of the previous year). In spite of the difficult macroeconomic climate, the sector maintained healthy capital adequacy ratios (CAR), recording a Tier 1 CAR of 13.0% and a total CAR of 16.5% as of the end of September 2020. Return on Assets (ROA) of the sector increased marginally from 0.93% to 0.97% YoY in September 2020, while Return on Equity (ROE) increased from 10.5% to 10.9% YoY during the same period. Continued drops in lending rates, implementation of special loan schemes, and improving investor sentiment is expected to drive credit growth in all sectors of the economy in 2021.

Bangladesh Economy and Banking

The economy of Bangladesh faced challenges during the year 2020 especially from the second quarter on. Before the pandemic hit the country, Bangladesh’s economy maintained a steady 6% plus growth rate during FY10-FY15, 7.0% plus growth rate during FY16-FY18, and 8.15% in FY19. However, the COVID-19 pandemic severely impacted nationwide mobility since early March and slowed the GDP growth rate to 5.24%. Despite the government’s optimistic projections of 8.2% GDP growth for FY21, experts foresee Bangladesh’s annual rate of GDP growth to be approximately 7% between 2021 and 2025.

The Dhaka Stock Exchange (DSEX) generated a 21.3% return in 2020 after two bearish years (2018: -13.8%, 2019: -17.3%) which is the second-highest return of the world (after USA NASDAQ 43.4%). UK’s Centre for Economics and Business Research (CEBR) has made a recent projection that Bangladesh’s economy will be the 28th largest in the world by 2030 and the 25th largest by 2035. Moreover, Goldman Sachs forecasts Bangladesh as one of the countries in "N11" after BRICS who will dominate the future world economy.

The government debt to GDP ratio rose to 39.6% in 2020, which was 35.80% of the GDP in 2019. The Bangladesh Bank injected BDT 540 Bn. into the market through buying around USD 6.37 Bn. from the banks in 2020. The foreign currency reserve stood at USD 43 Bn. in December 2020 in contrast to USD 32.68 Bn. a year ago. The exchange rate for USD/BDT had been quite stable at 84.95 for entire 2020. The country’s current account balance recorded a surplus for the fifth consecutive month, reaching USD 4.10 Bn. in November 2020. Bangladesh issued the Islamic shariah compliant instrument, Sukuk Bond for the first time in December 2020.

The COVID-19 pandemic which engulfed Bangladesh’s economy and society is expected to be brought under control in 2021. Market experts anticipate the country’s exports to revive along with a leap in the private sector credit growth, which was hovering at 8.37% by the end of 2020 against the fiscal target of 14.80%. The confidence factor is returning to the capital market with a number of firm and directed regulatory measures and is expected to touch 6,500 points. The internally funded Padma multi-purpose bridge is expected to be open in 2022 and will contribute around 2.00% to the annual GDP growth. Liquidity is expected to remain excess in the market allowing the interest rates to be in the lower single digits. The foreign exchange market is also expected to be steady throughout 2021.

Bangladesh Bank has given the nod to two new privately owned commercial bank, raising the total number of banks to 61. Agent Banking – which provides limited scale banking and financial services to the mostly underserved population – is booming in Bangladesh. Banks in the country are now focusing on agent banking for its popularity among people, especially in remote areas. Bangladesh is also receiving a significantly large portion of the remittance through agent banking.

Climate change is a priority for Bangladesh’s development objectives, as it is one of the countries most vulnerable to extreme weather events. Increased investments in adaptation have made the country more resilient to natural disasters.