Organisational Overview

About the Bank

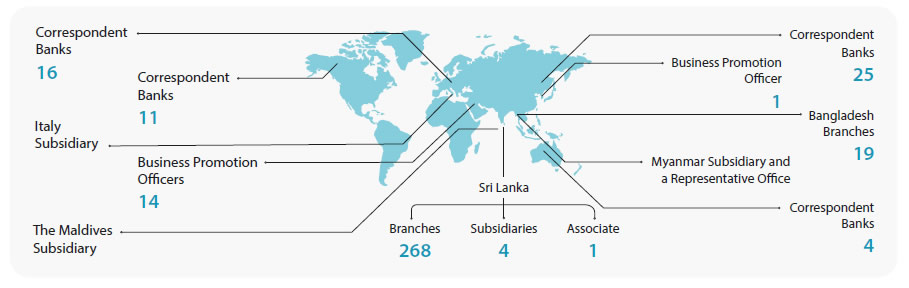

Our regional presence and global connectivity

Figure – 01

Largest and Systemically Important Bank

Commercial Bank of Ceylon PLC is the largest private sector commercial bank – and the third largest bank overall – in Sri Lanka in terms of total assets, which stood at Rs. 1.736 Tn. (USD 9.285 Bn.) as at the end of 2020. It is the only private sector Bank that has been designated by the Central Bank of Sri Lanka as a higher-tier Domestic Systemically Important Bank (D-SIB). The Bank accounts for approximately 10.7%, 11.2% and 11.8% of sector loans and advances, deposits and assets, respectively.

Over Hundred Year Legacy

The Bank’s origins date back to 1920, and it marked just over a half-century of operations under its present name in 2020. The total staff cadre of the Bank stood at 5,057 as at end 2020 and they serve over 3.5 million plus customers through a wide local and international network of branches, subsidiaries, agency arrangements, Business Promotion Officers, and correspondent banking relationships.

Growing International Footprint

With the acquisition of the Bangladesh operations of Crédit Agricole Indosuez in 2003, the Bank began its expansion beyond Sri Lanka’s shores and became the first private sector bank to establish a branch operation outside the country. Since then, it has established three subsidiaries in Italy, the Maldives and Myanmar.

Risk Profile

Fitch Ratings Lanka Ltd., (Fitch) revised the National Long-term Rating of the Sri Lankan financial institutions following the recalibration of its Sri Lankan national rating scale. As a result, Fitch revised the National Long-term Rating of the Bank to AA-(lka) from AA+(lka) and its outlook from negative to stable in January 2021 and it is on par with the highest rating for any local private sector bank. The Bank’s Bangladesh Operations’ credit rating was reaffirmed at AAA by Credit Rating Information Services Ltd in June 2020 for the 10th consecutive year. The Bank’s risk profile reflects a restrained risk appetite, a robust funding base, a secure level of liquidity, a sound domestic franchise and stable, consistent performance.

Diversification

The Bank’s business is well diversified across four main business segments: Personal Banking, Corporate Banking, Treasury, and International Operations. The International Operations of the Bank covers operations in Bangladesh, Maldives, Italy, and Myanmar, which now account for 11.79% of consolidated assets and 20.46% of consolidated profit before taxes. Besides geographical diversification, the Bank has successfully accomplished a high level of diversification in its operations across many other parameters such as customer profile, currency, products and services portfolio, funding profile, maturity profile, economic sectors and the sources of revenue.

Vibrant financial intermediation

Having being the first private sector Bank to cross Rs. 1 Tn. mark in assets and deposits in 2016 and 2019 respectively, during the first half of 2020, the Bank became the first private sector bank in Sri Lanka to cross the Rs. 1.5 Tn. mark in total assets which reached to Rs. 1.736 Tn. at the end of 2020. Customer deposits fund 72.92% of total assets, demonstrating the Bank’s strong role as a financial intermediary. For the past five years, the Bank’s loans to deposits ratio was over 80% on average, reflecting a growth in loans commensurate with the growth in deposits. The Bank’s asset quality is one of the best in the industry, while its Current Accounts and Savings Accounts (CASA) make up 42.72% of total deposits, the highest among the peer banks.

Strong capitalisation

The Bank’s Tier 1 Capital Ratio and Total Capital Ratio stood at 13.217% and 16.819%, respectively, as at December 31, 2020, compared to the regulatory minimum ratios of 9% and 13% applicable for the year. The Bank’s growth was prudent with gearing in terms of on-balance sheet assets as well as risk-weighted assets remaining at 11.05 times and 5.94 times, respectively, as of the end of 2020. Demonstrating the strength of the franchise, the Bank’s shares reported the highest price to Book Value of 0.60 times and the highest market capitalisation of Rs. 94 Bn. (USD 500 Mn.) among banking, finance and insurance institutions on the Colombo Stock Exchange at year’s end (the Bank is the fifth largest institution listed on the CSE overall).

Ownership of the Bank

Of the 16,820 ordinary voting shareholders of the Bank at end of 2020, DFCC Bank PLC held 12.02% and entities related to the State, including Employees’ Provident Fund, Employees’ Trust Fund Board and Sri Lanka Insurance Corporation, collectively held 19.49% of Bank’s shares. While Mr Y S H I Silva (8.87%), the International Finance Corporation (7.12%), Citibank New York S/A Norges Bank Account 2 (4.16%), Melstacorp PLC (4.14 %), CB NY S/A IFC Emerging Asia Fund LP (3.67%) and CB NY S/A IFC Financial Institutions Growth Fund LP (3.67%) are the other major shareholders, holding a combined ownership stake of 31.63%. Notably, the Bank has a substantial foreign shareholding, with foreign shareholders owning a combined 23.66% stake in the Bank.