In a rapidly changing environment, maintaining a constant dialogue with all our stakeholders is pivotal to shape our strategy to be fit for the time and for the future. The emerging trends, some of which are unprecedented in terms of magnitude and impact, affect our ability to sustainably deliver value to our stakeholders and in turn derive value from them.

When an individual or a group is significantly impacted by our actions, products, or services, we consider that party a stakeholder. At the same time, we are keenly aware that the stakeholders’ perceptions and behaviour can powerfully impact our ability to carry on our activities and meet strategic goals.

Accordingly, we consider the following to be our stakeholders –

- Investors

- Customers

- Employees

- Society and environment

- Business partners

- Government institutions and regulators

Though the range of stakeholders that may directly or indirectly impact our performance are vast, above grouping helps the Bank to effectively manage the interactions with the stakeholders that matter most

in our operations.

While formal mechanisms are in place to connect with our stakeholder groups (Figure 04), responsibility for such engagement is shared across the Bank at every stakeholder point of contact.

We strongly believe that by engaging with our stakeholders we are able to better gear ourselves for the future, adapt our business model, drive innovation, and garner invaluable insights for our strategic planning process for long-term value creation.

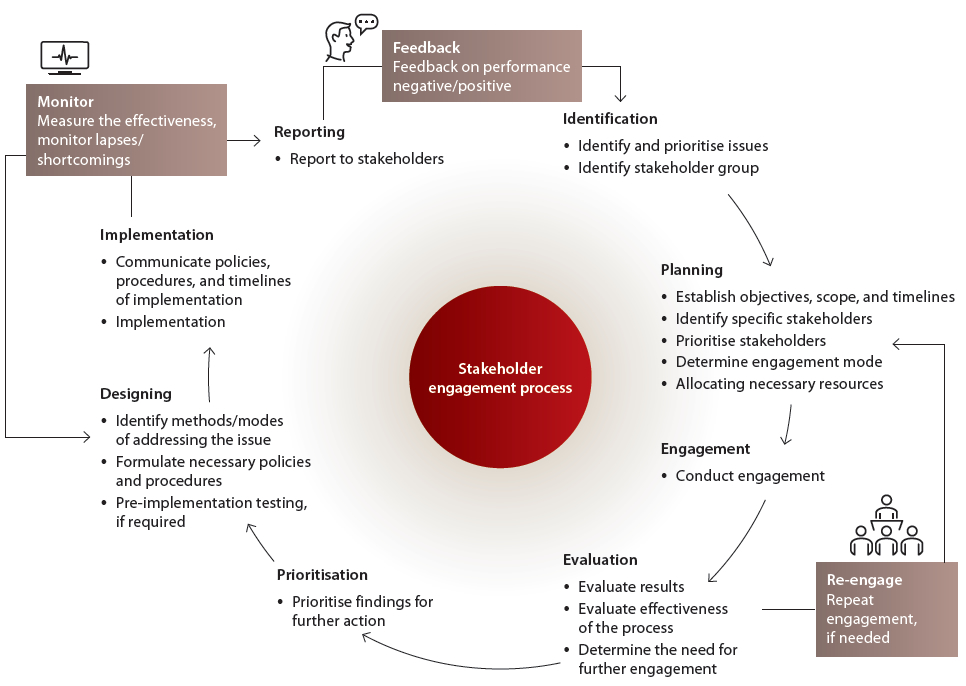

The mechanisms through which we engage with our stakeholders and our understanding on their aspirations are given in Figure 05.

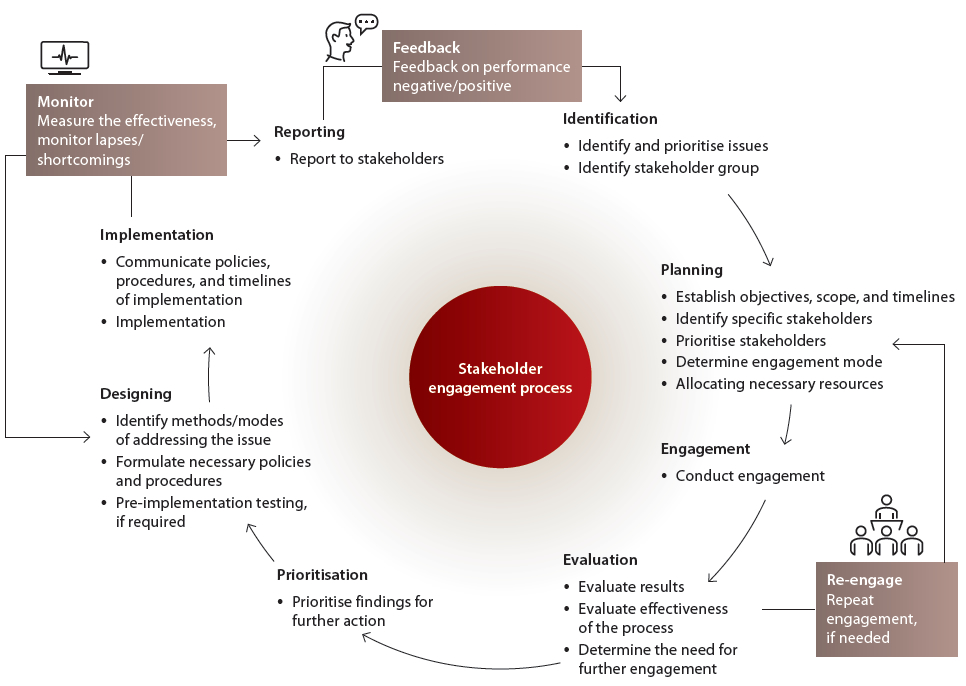

Our stakeholder engagement process

Figure – 04

How we connect with our stakeholders

Figure – 05

| |

|

|

|

| |

Investors |

Customers |

Employees |

| Stakeholder aspirations |

- Financial performance

- Governance

- Transparency and disclosure

- Business expansion plans

- Risk management

- Sustainable growth

|

- Swift service

- Customer security and privacy

- Service quality

- Financial inclusion

- Affordability of services and convenience

- Grievance handling mechanism

- Financial education and literacy

- Financial support for revival

of business

|

- Performance and reward management

- Training and development

- Career advancement opportunities

- Work-life balance

- Retirement benefit plans

- Value driven corporate culture

- Diversity and inclusion

- Perception of a prosperous future

for the Bank

|

| Mode and frequency |

| Engagement mechanism |

Frequency |

| Annual Reports and AGMs |

Annually |

| Extraordinary General Meetings |

As required |

| Interim financial statements |

Quarterly |

| Investor presentations |

As required |

| Press conferences and releases |

As required |

| Announcements to CSE |

As required |

| One-to-one discussions |

As required |

| Corporate website |

Continuous |

| Feedback surveys |

As required |

|

| Engagement mechanism |

Frequency |

| Customer visits |

As required |

| Complaints received |

As required |

| Complaints resolution officer, relationship managers |

As required |

| ComBank Biz Club |

Continuous |

| Branch network and call centre |

Continuous |

| Media advertisements |

As required |

| Corporate website |

Continuous |

| Customer workshops |

As required |

|

| Engagement mechanism |

Frequency |

| Manager’s Conference |

Annually |

| Town hall meeting |

Annually |

| Regional review meetings |

Quarterly |

| Branch marketing meeting |

Monthly |

| Training programmes |

As required |

| Intranet |

Continuous |

| Special staff events |

Annually |

| Trade union discussions |

As required |

| Employee satisfaction survey |

As required |

|

| |

|

|

|

| |

Society and environment |

Business partners |

Government institutions and regulators |

| Stakeholder aspirations |

- Responsible financing

- Commitment to community

- Financial inclusion, recruitment

- Microfinance and SME

- Ethics and business conduct

- Environmental performance

- Employment opportunities

|

- Contractual performance

- Future business opportunities

- Maintaining healthy relationships

- Timely settlement of dues

- Ease of working

- Growth potential

- Collaboration for new technological advances in the financial sector

|

- Compliance with directives and codes

- Local and overseas expansion

- Microfinance and SME development

- Supporting economic growth

|

| Mode and frequency |

| Engagement mechanism |

Frequency |

| Delivery channels |

Continuous |

| Press releases, conferences and media briefings |

As required |

| Informal briefings and communications |

As required |

| Public events |

As required |

| Corporate website |

Continuous |

|

| Engagement mechanism |

Frequency |

| Supplier relationship management |

As required |

| On-site visits and meetings |

As required |

|

| Engagement mechanism |

Frequency |

| On-site surveillance |

Annually |

| Directives and circulars |

As required |

| Meetings and consultations |

As required |

| Press releases |

As required |

| Periodic returns |

As specified |

| Submissions to policymakers |

As required |

| Responses to consultation papers on Directions and other regulations |

As specified |

|