Our customers are at the centre of all our activities, and we aim to provide them with an unparalleled banking experience. This calls for deeply understanding our customer – their needs, their preferences, their concerns – and responding with products and services that meet and even exceed their expectations. It also involves transforming our own processes and remaining agile in a rapidly changing environment. Accordingly, the Bank carefully segments its diverse customer base and identifies and tailors its services to serve each group. This targeted approach is what allows us to differentiate our value proposition and build customer loyalty.

Customer segmentation Table – 08

| Criteria | High net-worth | Corporate | SME | Micro customers | Mass market |

| Income/Size of relationship/Business turnover/Exposure | Individuals with banking relationships above set thresholds | Annual business turnover> Rs. 750 Mn./Exposure> Rs. 250 Mn. | Annual business turnover< Rs. 750 Mn./ Exposure< Rs. 250 Mn. | Exposure< Rs. 500,000 | Individuals not falling into other categories |

| Price sensitivity | High | High | Moderate | Low | Low |

| Products of interest | Investment | Transactional, trade finance, and project finance | Factoring, leasing and project financing | Transactional | Transactional |

| Number of transactions | Low | High | Moderate | Low | Low |

| Level of engagement | High | High | Moderate | Low | Low |

| Objective | Wealth maximisation | Funding and growth | Funding and growth | Funding and advice | Personal financial needs |

| Background | Business community/Professionals |

Rated, large to medium corporates |

Medium business | Self-employed | Salaried employees |

| Number of banking relationships | Many | Many | Many | A few | A few |

| Level of competition from banks | High | High | Moderate | Low | Moderate |

The type of segmentation illustrated here enables the Bank to gain greater knowledge and understanding of the customer and better align with their unique banking requirements (refer Table 09).

Channel mix and target market on perceived customer preference Table – 09

| Customer segment | Branches | Internet banking | ATMs | Call centre | Mobile Banking | Relationship managers | Business promotion officers | Premier banking units |

| Corporates | √ | √ | √ | √ | √ | √ | X | X |

| SMEs | √ | √ | X | √ | X | X | √ | X |

| Micro | √ | X | √ | X | √ | X | X | X |

| Mass: | ||||||||

| Millennials | X | √ | √ | √ | √ | X | X | X |

| Others | √ | √ | √ | √ | √ | X | √ | X |

| High net-worth | √ | √ | √ | √ | √ | √ | √ | √ |

Remaining relevant in difficult times

In the midst of an unfavourable economic environment, our personal banking loan book growth was predictably hampered with a marginal growth of 2.73%. As the year progressed, our resources were directed towards addressing rising NPAs and debt recovery. We guarded against the tendency to constrict all lending activities, instead taking a long-term approach with this customer segment. We emphasised on asset quality and measured growth by consistently monitoring and tweaking our credit assessment criteria. Deposits, on the other hand, remained strong, and we finished the year with the highest CASA ratio of 37.10% within local private sector banks.

Throughout the year, we rolled out several new products and campaigns in an effort to enhance a visible presence in the mass market. We took a targeted approach to various demographics: for example, introducing the Yasasa Pensioners Savings Account exclusively for government pensioners and relaunching the Udara Senior Citizen’s Account encouraging children of Senior citizens to save for their parents; conducting new promotions for our women’s brand Anagi and our children’s savings account Arunalu; rolling out a new salary savings account for upwardly-mobile executives under the Bank’s ‘Achiever’ brand, offering benefits including salary advance facilities as well as loans and leasing facilities at lower interest rates; and tying up with education institutes to offer various education loans. We also carried out a variety of leasing, personal loan, and home loan campaigns, and re-launched our Gold Loans Pawning facility which posted a growth of 88.51% during the year. While the success of these ventures was, understandably, limited, we believe that they exposed a wide new segment of retail customers to the Bank, and this places us in a strong position for 2020.

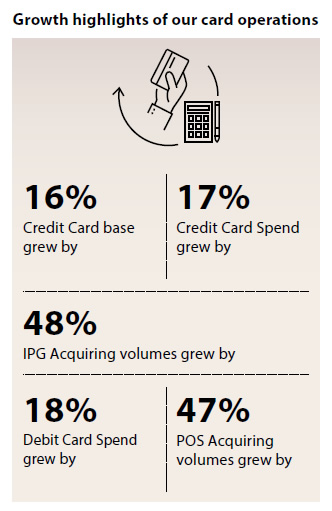

Cards continue to thrive

The growth in card spends did not expand at the expected levels due to the negative customer sentiments that prevailed in the market in 2019. However, the Bank managed to continue to remain the industry leader in the Debit Card market. We also strengthened our overall position as the market leader in both Debit and Credit Card spends on purchases. We continued to expand our POS network with over 12,000 POS machines across the country along with our Internet Payment Gateway (IPG) payment acceptance where we were able to establish ourselves as the market leader in IPG acquiring. The services offered through our ATM network for foreign Visa Cardholders were bolstered with the offering of Dynamic Currency Conversion (DCC) services.

Making a difference through innovations

We strengthened our market position with a slew of new technologies, products, and services, all aimed at making a tangible difference in the lives of our customers. A major first was our launch of ComBank Q+, the first Quick Response (QR) based payment App launched under LANKAQR. This App allows the Bank’s Credit and Debit cardholders to make a payment simply by scanning the merchant presented QR code with their mobile phones and selecting one of their registered cards.

In addition, we saw an exponential, ‘hockey-stick’ growth in ‘Tap n Go’ NFC (Near-Field Communication) transactions, rising from about 45,000 transactions a month in June 2019 to about 175,000 transactions by December. We are currently the largest NFC card issuer in the market, and our entire cardholder base has been already upgraded to NFC cards. Based on available statistics, around 40% of the total NFC transactions in the market originates through Combank cards. Both QR and NFC technology represent a new trend of ‘contactless’ card usage, eliminating the time and hassle of swiping cards and signing slips along with minimising the opportunities of card losses and card theft.

To support these innovations, Bank launched Sri Lanka’s first-ever Android-based Payment acceptance solution. This POS is a multi-function smart terminal through which merchants can accept standard Credit and Debit card-based payments, contactless ‘Tap and Go’ payments and QR code based payments. A particular highlight of the year was partnering with One Galle Face Mall – Colombo’s most prestigious retail development – to provide these Android-based payment acceptance solutions throughout the mall as the preferred acquiree.

Our pioneering efforts with both technologies place us in a prime position to capitalise on these emerging trends in 2020, and we expect our exponential growth to continue, aided by customer and merchant awareness and education efforts.

Productive partnerships

This year continued to be one of many firsts in our partnership with Asian payment brands. We became one of the first banks in Sri Lanka to have its point-of-sale (POS) network accept LankaPay-JCB (Japan Credit Bureau) co-branded cards issued under the national card scheme programme. Correspondingly, we upgraded our entire network of ATMs to enable worldwide holders of JCB Credit and Debit Cards to withdraw money from the Bank’s ATMs in Sri Lanka. We also continued to lead the market in creating multiple payment options through international payment platforms for our retail customers and vendors. We entered into an agreement with Tenpay Payment Technology Ltd. to enable payments through WeChat Pay and obtained the license to acquire payments through Alipay, for both leading Chinese mobile payment platforms (in partnership with Wells Digital Infrastructure (Pvt) Ltd., and Swift Pass Technologies Co. Ltd., a leading electronic payments solutions provider). These QR based payment solutions enable Chinese tourists and expatriates the benefit of purchasing and paying for goods and services through these platforms.

This year, we also launched Mastercard Send™, a facility that utilizes Mastercard’s global payment network and card products, to provide Sri Lankan Mastercard cardholders with a convenient, fast, safe and reliable way to receive money through cross-border, person-to-person money transfers. We also introduced pre-paid cards that can be topped up with funds online, allowing their users to better manage spending and their risk exposure. Overall, in a difficult year, our robust efforts to add new products and services positions us for strong growth in 2020.

We also partnered with Western Union during the year expanding our global footprint largely in the remittance business. With this tie up, the Bank ensured to be connected with all major global remittance players.

11.1%Net Interest Income |

7.3%Net Fee and Commission Income |

The prevailing challenge for the banking sector this year was the buildup of NPAs, a trend that started in late 2018 but was greatly exacerbated by Easter Sunday attacks in April 2019. To address this deteriorating situation in our corporate portfolio, we pursued a multifaceted approach that allowed us to finish the year on a strong note and created a template for the years ahead.

Consolidating our portfolio

The first initiative was a systematic analysis of our current portfolio and processes with a view of improving our credit quality. We considered both internal factors, like our own canvassing and evaluation procedures, as well as wider currents and cascading effects within the market to identify the segments under high stress.

This exercise revealed deeper insights into the problem and its contextual nature. We believe our customer base is the strongest, and most durable set of accounts in the market; we found, for example, in many cases, clients were experiencing payment difficulties for the first time in our relationship with them. In an effort to productively sustain this customer base, we focused on re-segmenting our portfolio, monitoring at-risk accounts, and finding workable solutions to rehabilitate and sustain our assets.

This exercise had other carry-over benefits as well. With increased portfolio identification and de-cluttering, we are now able to better customise services to our clients (e.g. taking a closer look at their working capital cycles etc).

Considered, incremental growth

This portfolio consolidation flowed into our efforts at careful, incremental growth throughout the year. As a part of our analysis, we worked on deepening and expanding our relationships with existing customers, as well as targeting and canvassing new accounts in market segments in which we had low penetration (and, in particular, market segments that our analysis revealed had remained profitable in spite of the difficult economic situation in the country). Our emphasis was on quality growth, which was driven at all levels and supported by specialised training for our lending officers.

Our assets were further boosted this year by selectively taking over a portfolio of a bank, which closed down its Colombo operations, and we look to build on these new accounts in the coming year. Additionally, we prioritised on enhancing our fee-based income as a buffer against rising NPA and falling NIMs.

A Process-driven approach

Our efforts in a difficult environment were bolstered by improvements to our processes. This year, we invested in a new Document Tracking System (DTS) that notifies our corporate customers (via SMS alerts) at each stage of their documents’ journey through the processing circuit. After implementing DTS, it will then allow us to move to an Robotic Process Automation (RPA) system in the near future. Our automated Postdated Cheque Handling System also went online this year, allowing for a fully integrated and mapped process. We also conducted a resource optimisation exercise to streamline our workflow, infrastructure and back office processes. One of the first outcomes of this exercise is the concentration of document handling in a new Trade Administration landscape, freeing up personnel for Customer Relationship Management (CRM). We intend to build on these processes next year and streamline them to provide a more efficient and effective service to our corporate clients.

For further details on digital innovations for our corporate customers, please see Fortifying Digital Leadership.

SMEs was a customer segment badly affected by the country’s economic climate. As a result, our overall performance in this sector over the year was constrained and hampered.

However, during the year, we made some major strides that will revolutionise our approach to this sector. Our efforts revolved around a diagnostic study and transformation project conducted by a reputed global consultancy firm. While over the past several years our growth in the SME sector has been steady, we felt that an overhaul in our approach was needed to exponentially increase our portfolio. Here, our difficulties were a testament to our success. The Bank has a proven track record of graduating large SMEs to the corporate tier; the challenge has been to not simply replenish these accounts, but to develop our SME customer base as a whole.

A new sales culture

Our strategy this year was two-pronged. The first was to centralising our credit evaluation operations at our new processing centre at Maradana. Having released branch staff from the duties of evaluation, the second prong was to initiate a hands-on, target-driven sales culture throughout the Bank to drive the SME loan book growth. The benefits of this approach are many. Apart from the enhanced consistency and uniformity of evaluation – and more robust governance – that centralisation offers, the most immediate reward for our SME customers is the speed of credit delivery.

In addition, we set up SME units in each of our 14 regions this year to supplement our branch network with the specialized expertise needed in developing SME clients and canvassing for new business. To date, we have staffed these clusters with a first batch of specially selected and trained staff, and by next year, we plan to broaden this SME sales focus to every branch. This is particularly important in the case of smaller SMEs (particularly those we have graduated from our micro customer segment). With intensified competition in the SME financing market, we believe that the kind of rapid, customised service delivered by our new processes is exactly what is needed for the Bank to carve out a unique niche in this segment.

A data-driven approach

Centralisation also means that we can make much more productive use of the data at hand. This year, we prioritised a data-driven approach, taking a granular look at our portfolio for insights on growing our existing accounts as well as targeting new customers by sector and region. From this central point, leads were generated and then disseminated to the branches to pursue. Branches, in turn, delivered feedback and further information on these leads. This began the process of creating an institutional body of knowledge and data that will be an invaluable resource for the Bank going forward.

Responding to the demands of the sector

SMEs have a specific set of challenges that requires the Bank to take a broad, holistic approach. This year, we continued to support SMEs through a range of educational programs and networking opportunities. We conducted eight Financial Literacy and Entrepreneurial Skill Development programmes for Micro and Small & Medium Enterprises. We also conducted five networking events aimed at connecting SMEs to partners both upstream and downstream the value chain. Many of these events were organised through our Biz Club, a forum dedicated to providing a broad range of support services to SME clients. Instituted in 2017, this forum has grown from strength to strength, and we have seen marked increase in attendance at these events.

The Bank also encouraged the SME sector through value chain support offered by the AMFUs to tea small holders, dairy, and fishing communities while also funding them through a special loan scheme dedicated for SMEs with attractive interest rates launched under the brand ‘Biz Loans for SMEs from ComBank’ at reduced interest rates.

Part of our approach was to listen to and respond to the demands of our SME clients. For example, to alleviate some of the macroeconomic pressures on our SME clients post Easter Sunday attack in April 2019, we reduced interest rates on loans of up to Rs. 250 Mn. for this customer segment. To address SME-specific issues with financial reporting and Employee Group Protection, we partnered with Bileeta (Pvt) Ltd. and Janashakthi Insurance to provide customised solutions for our clients. We also partnered with a few corporates to offer entrepreneurs in the agriculture sector an opportunity to purchase new equipment or upgrade existing machinery at concessionary rates.

A focus on women entrepreneurs

We also placed a concerted effort on women entrepreneurs at both SME and micro level, through the development of a gender based market strategy and worked to combat the specific challenges faced by this demographic. This year, we partnered with IFC to build a model to onboard SMEs and micros headed by women and provide them with resources to build their enterprises. Special focus is to be given to assisting Women SMEs in developing their skills and to increase their awareness in specialised areas such as business sustainability. To this end we conducted capacity building programmes on a range of useful topics, from succession planning to financial management, working closely with CBSL on several events. The first programme of this series titled ‘Womentrepreneurs: Your Vision Towards a Sustainable Business’ was held in collaboration with the Women’s Chamber of Industry and Commerce in November this year. We also worked to develop our women-specific brand Anagi to specifically highlight women entrepreneurs within its reach. This long term view, we believe, allows the Bank to form productive, mutually beneficial, and durable partnerships, as well as more broadly strengthen financial inclusion and gender equality in the country.

The Bank was successful in assisting women entrepreneurs through the We- Fi grant made available under the ADB funded SME line of credit, through which, funds were distributed to 42 women entrepreneurs as a grant for their project expansions.

Developing new products

Our increased data mining this year made it clear to us that, as far as the SME sector is concerned, we need to think of collateralisation differently. SMEs, especially at the lower tiers of the segment, do not always have access to the kinds of securities banks have traditionally demanded. There is a sector-wide shift internationally towards considering cash flow as the more acceptable form of collateral, and Commercial Bank is also evolving with these trends. To that end, we have, over the latter part of 2019, developed a new, semi-secured product along the lines of models that have been successful in Bangladesh and other parts of Asia and Africa. We plan to roll this product out early 2020, and it promises to be a pilot in how we approach the difficult question of securitisation in the SME sector.

Strengthening ties with micro customers

Our approach to micro customers was closely aligned to our activities in the SME sector. As more top-tier SME customers move into the Bank’s corporate customer segment, new micro customers are graduated into the group while others are groomed to do so in the near future, a process of upward mobility that is a part of a larger vision of the country’s economic development. Our focus on financial inclusion over the years has already provided us with a wealth of potential customers for the micro customer segment. The Bank’s Agricultural and Micro Finance Units (AMFUs) have extended banking services to the unbanked and under-banked in the rural areas of the country and this year we added a new unit to our operations taking the total to 17. We also added a new mobile banking unit, bringing our total fleet to 3. This unit provides a full range of services and operates in the Uva-Sabaragamuwa Region. Taking into account the particular needs of micro customers, the most vulnerable segment of our customer base, we held eight awareness and education programmes across the country to aid in their development.

The Bank introduced the “Divisaru” account in 2015, as an exclusive savings account designed to support micro and agriculture entrepreneurs while promoting financial inclusivity. This is the only such product among private banks, which provides opportunities for those who have limited access to funds by linking savings to loans offered to micro entrepreneurs as a compulsory value addition. The year saw an increase in the Divisaru deposit base by 35% together with an increase in accounts

of over 6,500.

With the intention of offering a digital experience and reducing the opportunity cost to micro entrepreneurs in rural and semi urban areas, an Automated Field Cash Collection (AFCC) process was introduced in 2019 through the AMFUs of the Bank. This system allows micro entrepreneurs to repay their loan instalments and make deposits to their savings accounts without having to visit a branch. This process will help rural communities to save time and cost, and overcome transport difficulties faced in visiting a branch location.