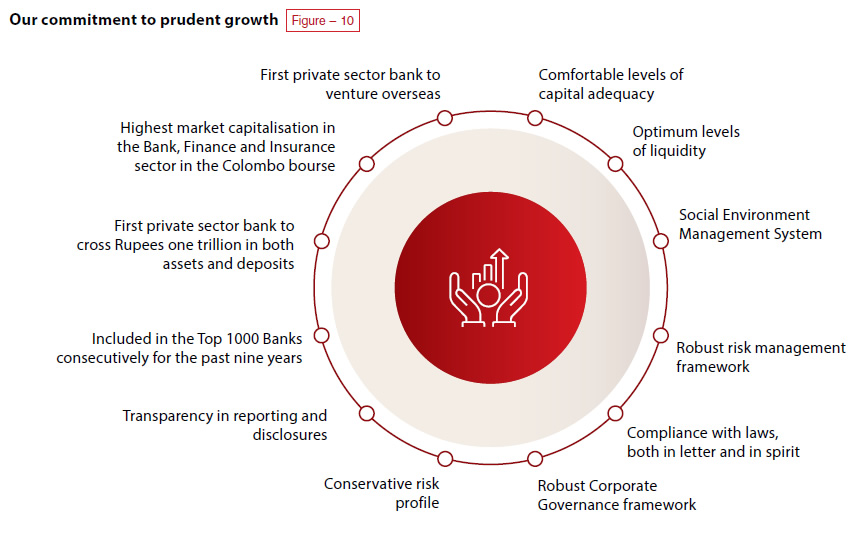

The Bank’s focus has always been on creating value for all its stakeholders in the short, medium, and long term. This approach requires a delicate balance of maximising our revenue and profitability in the present without compromising the Bank’s ability to keep delivering value year-over-year. We conceptualise this strategy as prudent growth. It is a strategy of creating long-term value through an emphasis on pure banking and a well-diversified asset base, supported by best in class risk management and corporate governance practices and underpinned by commensurate amounts of liquidity and capital. It is a strategy that is built on closely monitoring emerging economic, social, and technological trends and developments in both local and global markets, and taking an agile, pragmatic approach to growing our business in response. A prudent outlook and a conservative risk profile, after all, have been the key to our sustained, long-term performance, and have driven our growth at an even and healthy pace.

Our very identity rests on a commitment to prudence, and this quality has always been our hallmark; the Bank is deservingly famous for its compliance to both the letter and spirit of the law. The Bank places a premium on the trust and confidence of its customers – a strength we have carefully cultivated for a century. Our rigorous Codes of Ethics & Conduct guide the decisions and actions of our Board and the staff as well as our relationships with external partners, and ensure that the Bank remains untainted by corruption or malpractice. Through on-site audits and online surveillance – whose scope and frequency are determined using a risk-based model – the Inspection Department reinforces the anti-corruption provisions of the Code. Similarly, the Bank’s Anti-Money Laundering Unit, under the purview of the Compliance Officer, utilizes systems on par with global standards in its monitoring and reporting of suspicious activities to the Financial Intelligence Unit (FIU) of the CBSL.

It was our commitment to prudent growth that allowed us to stay the course in the midst of a challenging, unforgiving economic context this year, where many of our resources had to be redirected towards managing deteriorating asset quality and the consequent rising of NPAs. In this context, being prudent meant growing our business in a controlled fashion, with an emphasis on asset quality and stability, appropriate levels of deposit mobilisation, and a strong involvement from treasury to manage funding and excess liquidity. Moreover, we followed a prudent approach in all aspects of our operations, from touch-point expansion, cost management, recruitment, and upgrading our technology to support value creation in the future.

Our very identity rests on a commitment to prudence, and this quality has always been our hallmark; the Bank is deservingly famous for its compliance to both the letter and spirit of the law.

Given the capital intensive business the Bank is in, profitability is a key determinant of its future well-being and is the deciding factor of the extent to which it is able to sustain value creation in the short, medium and long term. In order for the Bank to profitably deliver this value proposition, it promotes integrated thinking within the Organisation by creating awareness among all its staff categories of the role they play in this process. Social and environmental considerations too are integrated into all the Bank’s core business activities while employees are encouraged to pursue activities that range from responsible lending, investments, new product development, procurement etc. to social and environmental initiatives such as recycling, use of renewable energy, and the support of culture, health, and education etc. This ensures that the Bank successfully achieves its role as an intermediary by balancing the conflicting interests of stakeholders and optimising the trade-off between risk and return.

The Social and Environmental Management System (SEMS), an integral part of the loan approval process, is pivotal for managing the Bank’s risk profile and making the lending and investment activities responsible. It evaluates the feasibility of projects based on cash flows while also screening all business and project loans to ensure that they are monitored on an ongoing basis. This process has proved to be efficient in helping entrepreneurs and customers maintain the sustainability of their operations. In addition, the Bank also offers facilities for the adoption of environment-friendly technologies on concessionary terms and conditions.

For further details on our wider approach to prudent growth, please see discussions under the strategic imperatives of Customer Centricity, Leading through innovation and Operational Excellence.

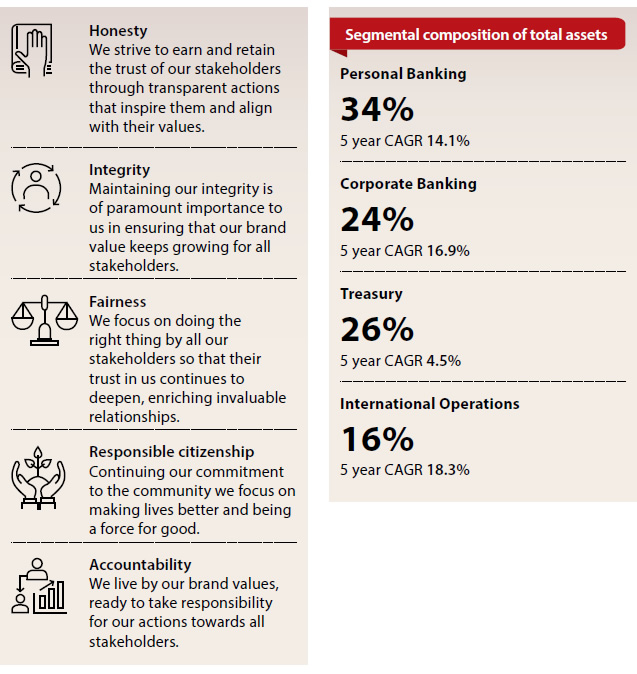

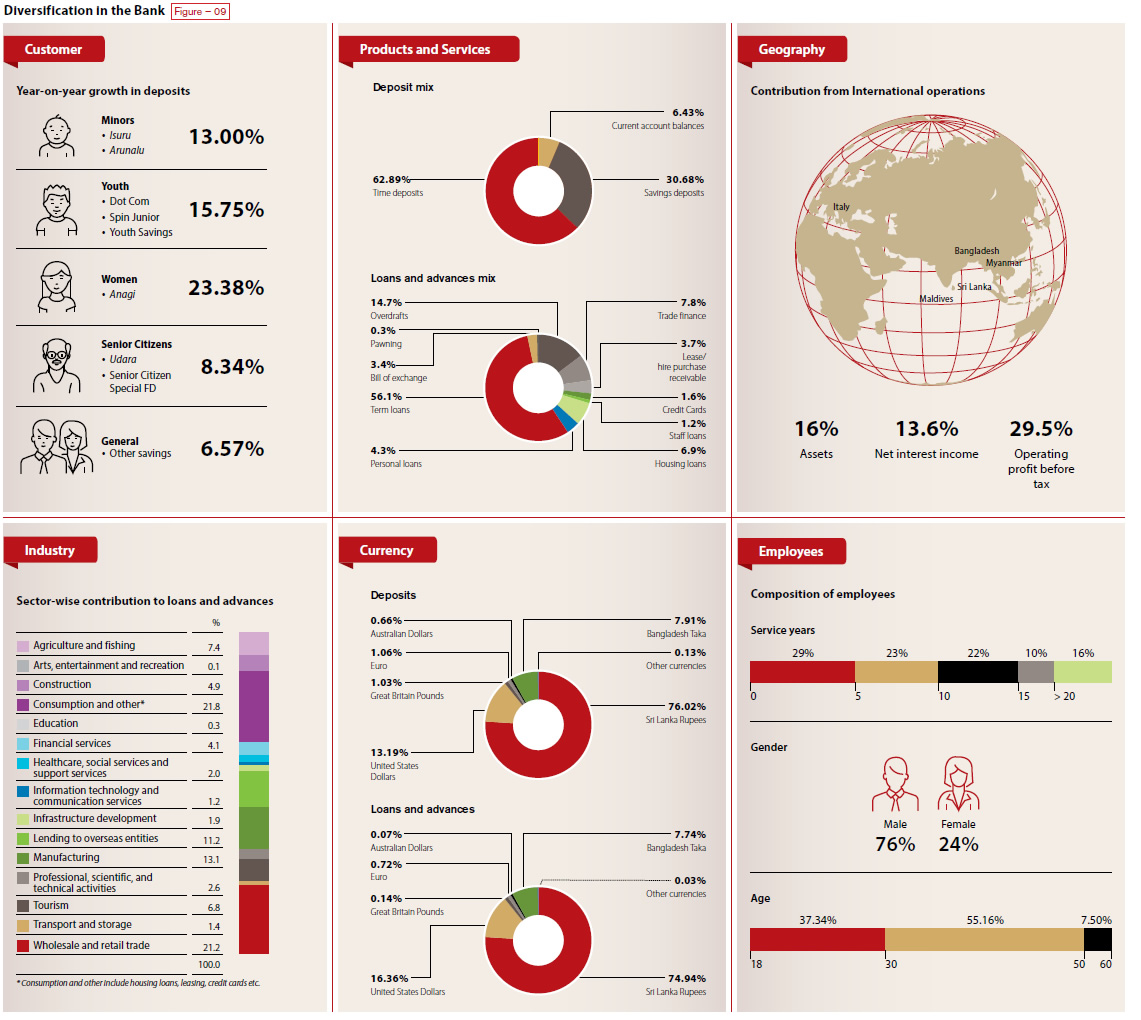

During the year under review, the total assets of the Bank grew by 6.43%, rising from Rs. 1.303 Tn. at the end of 2018 to Rs. 1.387 Tn. at December 31, 2019. Our market share in total assets, which stood at 11.1% at the end of 2018, remained flat at the end of 2019. In this context, the Bank’s International Operations played an increasingly vital role in our bottom line by contributing 16.06% to the Group’s total assets and 29.45% of profit before tax (refer the Financial Review for further details).

Loans to customers grew by a modest 2.73% this year; notably, however, loans as a proportion of total assets decreased to 63.77% from 66.06% in 2018, as rising NPLs and declining demand for credit meant heightened investment in Treasury bills and bonds. And, reflecting the wider trends, the Bank’s Non-Performing Loans (NPLs) ratio increased to 4.95% at end of the year, though there were encouraging signs that this rise had crested both for the Bank and the sector.

Deposits grew from Rs. 983.04 Bn. in 2018 to Rs. 1,053.31 Bn. this year, making the Commercial Bank the only private sector bank to cross Rupees one trillion. Deposits was the Bank’s largest source of funding, accounting for 75.92% of the total liabilities and equity (compared with 75.42% in 2018), signifying the stability of its financial intermediation role.

While balancing the shareholder returns, the Bank’s dividend policy takes into account the capital-intensive nature of the business and seeks to support its business expansion in the long-term. A final dividend of Rs. 2.00 per share was proposed for 2019, which, together with Rs. 4.50 per share in interim dividends, amounted to a total dividend of Rs. 6.50 per share for the year. Following the lackluster performance, indices on the Colombo Stock Exchange (CSE) ended the year on a mixed note. ASPI gained marginal 1.27% to close the year at 6,129 (6,052 in 2018) and S&P SL20 lost 6.32% to 2,937 (3,135 in 2018). Banking, Finance and Insurance sector too followed a similar trend, losing 1.04%. Accordingly, the Bank’s shares were trading at a discount to its book value throughout the year. The price to book value stood at 0.73 times as of December 31, 2019 (0.98 times as at end 2018), the highest among the peer banks listed on the CSE.

Financial Soundness Indicators relating to capital adequacy, asset quality, earnings & profitability, liquidity and assets & funding structure Table 03 in Financial Review bear testimony to the Bank’s prudent growth.

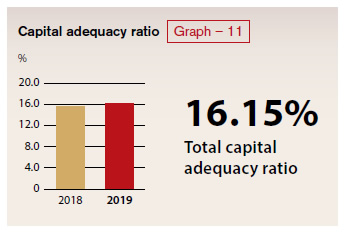

A strong base of capital is vital for a bank’s sustainability. It helps a bank acquire property and equipment to establish and perpetuate business, and offers protection against uninsured depositors; and, perhaps most importantly, it acts as a buffer to absorb unanticipated losses and serves as a regulatory restraint on unjustified asset expansion. But tightening regulatory requirements and more stringent reporting standards, while necessary and justifiable, have created new impediments to the growth of the banking industry.

As a result of more restrictive capital definitions, difficulty in raising fresh capital due to lacklustre market conditions, comparatively higher risk-weighted assets, additional capital buffers and higher capital adequacy ratios (CARs) required under Basel III regulations, higher impairment provisioning under SLFRS 9, and higher taxes, banks are being forced to take less risks and are bearing the brunt of higher costs and lower returns.

To remain solvent in such a landscape, the Bank considers it a priority to pro-actively manage the capital at its disposal. The Bank assesses its capital requirements through the Internal Capital Adequacy Assessment Process (ICAAP) and the annual strategic planning and budgeting exercise. The tools it deploys include: Risk Adjusted Return on Capital (RAROC), prudent capital allocation, controlled growth in risk-weighted assets, timely pricing, dividend policy, products and services portfolio and capital instruments. The Bank also recognises that a crucial aspect of its success is the loyal base of shareholders whom the Bank can rely on for more capital whenever the need for a capital infusion arises. Over the last five years, the Bank consistently maintained capital adequacy ratios well in excess of minimum requirements (see Table 03 for further details).

Capital management objectives

The objectives of the Bank’s Capital Management efforts are:

- Compliance with the regulatory requirements

- Maintaining internal capital targets that are more stringent than the regulatory requirements

- Optimum capital usage for maximum profitability (which meets investor expectations)

- Supporting future business expansion

- Supporting desired credit rating

- Satisfying Basel III capital requirements while bearing the impact of SLFRS 9 due to additional provisions under the expected credit loss model which requires provisions on loan commitments/off balance sheet exposures and foreign currency denominated Government securities as well.

During the year under review, the Bank’s core objective was to be compliant with the regulatory capital requirements, satisfying the BASEL III and absorbing the additional impact of SLFRS 9. This was carried out prudently, taking into consideration the business requirements while optimising profitability. Even though the Bank had initially planned to raise capital via BASEL III compliant debentures in 2019, the plans were shelved as the Bank’s capital remained at comfortable levels throughout the year. The CET 1 capital ratio stood at 12.30% (as against the regulatory requirement of 8.50%) and Total Capital ratio at 16.15% (as against the regulatory requirement of 14.00%) as of end December 2019.

Total RWA for Credit Risk of the Bank registered only a minimal increase of 1.69% during 2019, due to the lackluster economic performance and lower growth in loans and advances. The RWA for Operational Risk meanwhile increased to Rs. 41.12 Bn. during 2019 compared to Rs. 38.53 Bn. in 2018. The overall increase in RWA during 2019 was Rs. 28.00 Bn., compared with Rs. 167.30 Bn. in 2018. Since the business environment was not conducive for expansion of the asset book, the Bank strategically invested the excess liquidity generated in both LKR and FCY in Government Securities that did not attract a capital charge.

Overall, due to lower growth in credit, there was less pressure on capital and as a result, the Bank ended the year with sufficient level of capital to accommodate the expected credit growth rebound in 2020, while meeting the Higher Loss Absorbency ratio required of a Domestic Systemically Important Bank (see the Operating Environment – Outlook for further details).

For further details on our Capital Management and Risk Control Self Assessment (ICAAP), please see the section on Risk Governance and Management.

Please also see Disclosure 7 – Summary discussion on adequacy/meeting current and future capital requirements.

The circumstances that led to the financial crisis in 2007 and the events that followed underscored the fact that funding and liquidity are as important, if not more so, than capital for the financial services industry. Yet, unlike for capital, there had been no internationally agreed-upon standards for funding and liquidity. As a result, Basel III included provisions to strengthen the funding and liquidity risk management of banks. Its aim was to promote resilience in a bank’s short-term and long-term liquidity risk profile through the introduction of the Liquidity Coverage Ratio (LCR, 2015) and the Net Stable Funding Ratio (NSFR, 2019), respectively. In addition to the conventional Statutory Liquid Assets Ratio, these measures are designed to prevent banks from relying excessively on short-term wholesale funding to support long-term assets.

The Bank accords as much importance to funding and liquidity as it does to capital, ensuring that it has sustainable sources of funding and that it maintains adequate levels of liquidity at all times. The Bank will not compromise on liquidity in its drive to generate returns for investors, and this tenet has contributed greatly towards public trust in the Bank.

The Bank accords as much importance to funding and liquidity as it does to capital, ensuring that it has sustainable sources of funding and that it maintains adequate levels of liquidity at all times.

To actively monitor the funding, liquidity requirements and pricing of assets and liabilities, the Assets and Liabilities Committee (ALCO) of the Bank meets fortnightly. It extensively deliberates on developments such as market liquidity, current and perceived interest rates, changes in policy rates, credit growth and facilities in the pipeline, capital market developments, projected capital expenditure etc. that affect funding and liquidity.

Over the past several years, the Bank has further strengthened its funding and liquidity by encouraging the use of electronic cash and cards to reduce cash holdings and establishing credit lines with strong overseas counterparties (enabling it to access foreign currency funds at attractive prices). Funding sources of the Bank for onward lending, in order of their assessed stability, include:

- Retail deposits through the branch network

- Low-cost foreign currency borrowing (provided the interest and swap cost attached to such borrowing is cheaper as compared to the cost of wholesale deposits)

- Selected long-term wholesale deposits

Funding and Liquidity Management Objectives

Objectives of the Bank’s funding and liquidity management efforts are:

- Honouring customer deposit maturities/withdrawals and other cash commitments efficiently under both normal as well as challenging operating conditions

- Compliance with the regulatory requirements

- Maintaining internal funding and liquidity targets which are more stringent than the regulatory requirements

- Optimum usage of liquid assets to maximise profitability

- Funding future business expansion at optimum cost

- Supporting desired credit rating

- Ensuring smooth transition to Basel III funding and liquidity requirements

Client Deposits remained the main source of funding for the Bank’s assets. Along with the slowdown of loans to customers and the healthy, above industry average deposit growth, the Bank did not require large funding sources during the year. As such, the Bank only borrowed USD 25 Mn. from the multilateral lending agency, PROPARCO, a French Development Financial Institution, meeting its funding requirements through USD/LKR swaps and other short to medium term borrowings.

The Bank managed its funding and liquidity ratios on a daily basis and monitored the Liquid Assets Ratio to ensure adequate sources of funding to maintain liquidity at the desired levels. The Bank’s Asset and Liability Management Committee also deliberates on pricing strategy, interest rate view, changes in policy rates, Bank and market liquidity positions, credit growth and other important economic indicators, along with local and international market developments to arrive at the most prudent method to manage funding and liquidity requirements.

The Bank has heavily relied on retail deposits generated by the extensive branch network as a stable source of funding. In addition, the Bank was also able to raise low cost Foreign Currency (FCY) funding by way of overseas borrowings, repurchase of FCY investment book and trade-backed funding lines. In 2019, the Bank has also managed to widen its relationships and now has established counterparties covering Asia, Middle East and Europe for funding requirements. In addition, the Bank has lined up contingency reciprocal funding lines for any stressed liquidity situation. The Bank has classified substantial amount of its liquid assets under the Fair Value Through Other Comprehensive Income (FVOCI) category which will enable the Bank to realise the assets in the liquid secondary market in a stressed scenario.

Both LCR and NSFR were much higher than the required levels in 2019, indicating that the Bank has high quality liquid assets at its disposal. The Bank maintained LCR (all currencies) at 224.74% and NSFR at 137.05% as of December 31, 2019 as against the minimum requirements of 100% for both ratios, respectively.

Another dimension of the Bank’s prudent growth is its commitment to diversification. Apart from it being a risk management tool to avoid excessive concentrations, diversification has helped the Bank in responding better to the changing market conditions and generating better returns, thereby reducing volatility of performance and augmenting the sustainability of its value creation.

The Bank has successfully accomplished a higher level of diversification in its operations across many parameters which, inter alia, include;

- Geographically

- Customer profile

- Banking channels

- Currency wise

- Products and services portfolio

- Funding profile

- Maturity profile

- Economic sector

- Sources of revenue

Apart from it being a risk management tool to avoid excessive concentrations, diversification has helped the Bank in responding better to the changing market conditions and generating better returns, thereby reducing volatility of performance and augmenting the sustainability of its value creation.

Commercial Bank of Ceylon PLC is committed to maintaining the highest ethical standards and integrity in its business activities. The Bank takes a zero-tolerance approach for corruption, bribery and fraud. The Bank, its Board of Directors and all of the employees are dedicated to act professionally, ethically and with integrity in all business dealings and relationships with all stakeholders.

The Bank has established formal policies and procedures with regard to ethics, gifts and hospitality, facilitation payments, duty of secrecy, conduct of staff accounts etc. These policies and procedures are periodically reviewed in order to ensure its suitability, adequacy and appropriateness for an effective anti-corruption program.

The Bank also conducts its Money Laundering and Terrorist Financing (ML/ TF) Risk assessment as per the established ML/TF Risk Assessment Policy. Risk reviews are conducted and reported to the Board on a quarterly basis considering the risk exposures arising from its customers, delivery channels, products and services and geographical locations in which it operates business.

Training is provided to all employees and the members of the Board of Directors on AML/CFT, Compliance and Anti Bribery & Corruption from time to time.

Employees of the Bank are responsible and accountable to uphold the reputation of the Bank and to conduct business in a professional and ethical manner with utmost commitment to comply with laws and regulations applicable in all jurisdictions in which the Bank conducts its business.

Through on-site audits and online surveillance, the Inspection Department reinforces the provisions of the Code of Ethics. The scope and frequency of audits are determined using a risk-based model and this approach ensures that customers continue to benefit from the highest levels of integrity.

In addition to the above, a Whistle Blower Charter is in place to allow employees to report unethical or any known or suspected frauds or misappropriations by staff members to the Compliance Officer of the Bank to safeguard the interest of the Bank and all its stakeholders.