The Integrated Reporting Framework

In the course of its operations a commercial organisation receives various inputs and converts them into value for itself and its stakeholders. This value creation can be over different time frames; short, medium and long. An integrated report describes this value creation process concisely including the business model, strategies, governance, processes, risks and opportunities.

Public sector organisations are recipients of state funds. They are also usually among the largest organisations in any country. In recent times, worldwide there has been increasing concern with the utilisation of funds by such organisations and increasing demands for good governance, transparency and accountability. Furthermore today, even in commercial sector organisations, the focus is not wholly on financial performance; stakeholders are concerned about their broader impact on the economy, the society and the environment. This makes integrated reporting all the more important since it brings out the organisational role in promoting sustainable development.

The key stakeholders of public sector enterprises include the Government, State-Owned enterprises, employees, regulatory authorities, private enterprises from the largest to the smallest and the general public. The fact that enterprises are publicly-owned makes keeping the trust and confidence of stakeholders, especially the general public, all the more important. The private sector is also greatly concerned regarding performance as they are providers of financial services and utilities.

Since the Bank of Ceylon is the largest financial institution, as well as the single entity making the largest profit, in the country it plays a vital role in the economy of the country. It also makes its presence felt at the grassroots level with its sprawling network of branches and its wide customer base. Therefore, it has an impact far beyond the bottom line. Being the Bank with largest customer base it is imperative, therefore, that the Bank reassures its stakeholders that it is safeguarding the public interest.

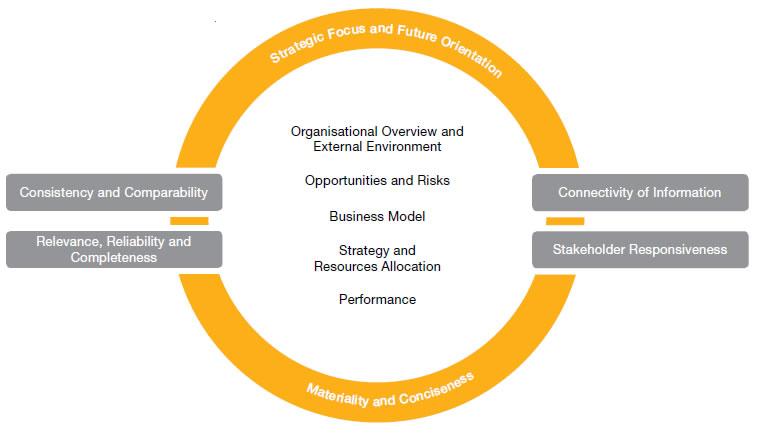

The topics that, this integrated report of the Bank captures are shown in the diagram below:

The capitals as defined in the International Integrated Reporting Framework and shown in the diagram below are covered in the report. However, some of the capitals may be described in the report under different headings.

In preparing this report, we have drawn on the following where applicable: Global Reporting Initiative Sustainability Reporting Guidelines, an early adoptation of GRI Standards (July 2018) [www.gloabalreporting.org], the International Integrated Reporting Framework (2013) [www.theiirc.org] and A Preparer’s Guide to Integrated Corporate Reporting of The Institute of Chartered Accountants of Sri Lanka.

In this report, performance and operations of the entire Group, covering Sri Lanka, India, Maldives, Seychelles and the United Kingdom vis a vis branch offices and subsidiaries are detailed. However, the larger amount of information relates to the Bank of Ceylon, which is the holding entity, as it is the BoC that, accounts for the vast majority of transactions and contributes the most to the profitability of the Group.

Our reporting focuses on aspects that are material or important, based on the extent to which they may substantively affect the ability of the Bank to create value over the short, medium or long term. The materiality determination process is discussed under the Stakeholder Engagement and Materiality.

The Bank’s Annual Report 2017 covers the 12-month period from 1 January 2017 to 31 December 2017 and is consistent with our usual annual reporting cycle for financial and integrated reporting. The most recent previous report was dated 31 December 2016.

There have been no significant changes during the reporting period regarding size or ownership.

The Bank applies a precautionary principle across the Group with regard to social and environmental sustainability. Before embarking on new ventures and initiatives an assessment of any potential impacts is carried out through adequate risk management processes, which are discussed in the section on Risk Management.

There have been no restatements of information provided in the previous reports. There have also been no significant changes from previous reporting periods in the scope and aspect boundaries.