Bankers to the Nation

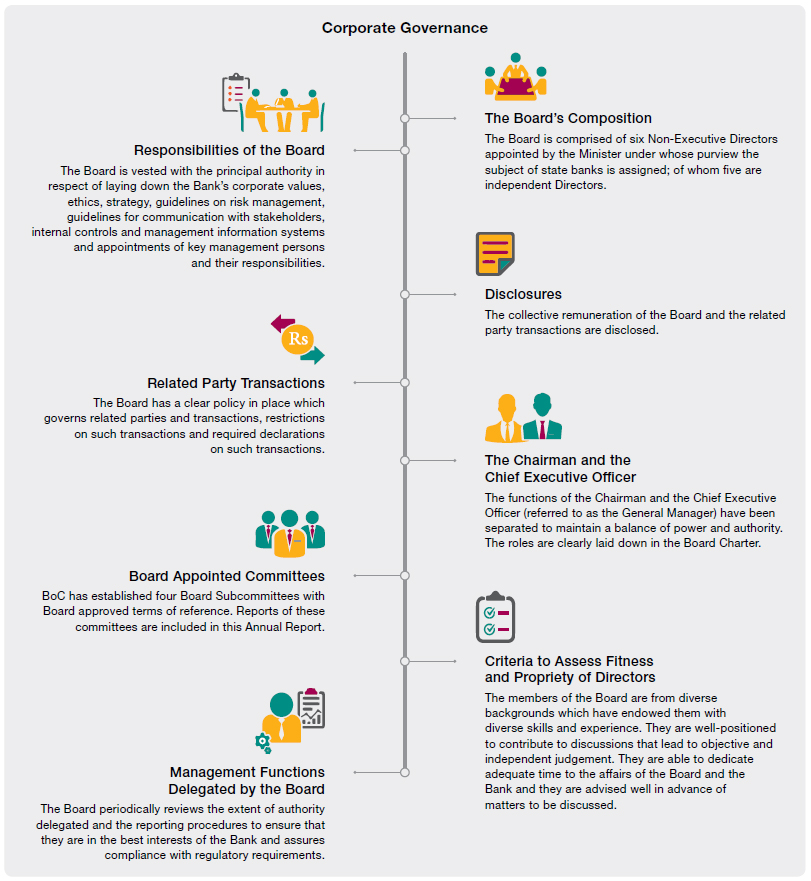

Corporate Governance

Introduction

Corporate governance is an internal system comprising of governance structures, policies, processes, systems and people which serves the interests of its shareholders and other stakeholders by directing them and directing management activities with good business proficiency, integrity and neutrality. It is the institution that should seek to inculcate a system of good corporate governance. The responsibility lies with the Board of Directors of an institution to have in place effective systems and controls to implement same in order to avoid any governance issues. The effectiveness with which the Boards discharge their responsibilities within a framework of effective accountability thus, determines the institution's competitiveness. The distinct nature of banks makes their corporate governance more complex given that this is one of the most highly regulated industries and due to the potential social implications that banking can have on the broader economy.

Corporate Governance Framework within the Bank

Being a state entity, Bank of Ceylon is committed towards upholding high standards of good corporate governance, business integrity and professionalism in all of its activities to protect the interests of all its stakeholders and ensuring long-term sustainability in order to retain the position that Bank of Ceylon currently occupies within the banking industry. There is a robust corporate governance framework underpinning ethical management practices inbuilt in its culture and values comprising of sound governance practices which facilitates greater transparency, promotes accountability and is continually evolving and improving each year to ensure that the governance framework within the Bank is abreast with recent developments in governance policies and practices, the maturity of the Bank and the evolving needs of all its stakeholders.

The corporate management of the Bank has undertaken the responsibility to uphold and foster this culture whilst the overall responsibility for governance, the formulation and execution of strategies and policies to comply with the applicable laws and regulations and the principal authority over the corporate affairs lies with the Board of Directors.

The Board being the chief decision making body of the Bank plays a guiding role in the culture, internal controls, audit, risk management, compliance, prevention of financial fraud, customer protection and initiation and strengthening of transformational changes reinforcing recent developments within the industry and international best practices in corporate governance. A formal code of conduct has been established to assist the Board in its conduct. Effective management information systems have also been developed to provide the necessary inputs for effective decision-making in a timely manner.

Board Subcommittees have been established in compliance with governance codes on best practice and international standards. Their limits of authority and lines of reporting have been clearly laid down. The Board also strives to ensure that, in laying down the processes and lines of reporting, the needs of compliance and external reporting are key considerations.

The Bank’s current Board comprising of individuals who are experienced professionals in their chosen fields of expertise, a majority of whom are Independent Non-Executive Directors, bring in “independent judgement” and a wider outlook from their respective fields of proficiency which are crucial for Board deliberations and for strengthening the decision-making and management functions of the Bank. The Bank will be looking into expanding the size of the Bank’s Board in the coming year to meet the growing needs of the Bank and governance requirements.

Achieving the Double Trillion Milestone

In 2016, Bank of Ceylon achieved a major milestone with assets, advances and deposits each exceeding one trillion. This was a great achievement which involved much effort. The next milestone the Bank looks forward to is exceeding two trillion in assets which it expects to achieve in 2018.

To pursue this target, the Bank needs to ensure that the Bank is stable and that its stakeholders continue to repose confidence in it. The continued ethical behaviour of its staff is necessary to ensure compliance. While the Bank is keeping its sight on this target it has to ensure that it is in compliance with the new regulatory developments and accounting standards introduced by Basel III and SLFRS 9. Judicious balancing of the Bank’s many objectives, which may involve trade-offs, is a key consideration in governance.

Regulatory Framework

The Bank’s commitment towards instilling a sound corporate governance regime and practices is not solely based on the need to comply with the regulatory requirements. It is also based on its commitment towards continually reviewing its procedures and systems to ensure accountability and transparency whilst updating the governance processes in line with the latest developments both nationally and globally and its recognition of sound corporate governance as an effective management tool.

The Bank of Ceylon being a licensed commercial bank has complied with the requirements imposed by the regulatory authorities of which the primary/lead regulator is the Central Bank of Sri Lanka. The regulatory framework applicable to the Bank consists mainly of the Banking Act No. 30 of 1988 and subsequent amendments thereto and other directives particularly the Banking Act Direction No. 11 of 2007 on Corporate Governance for Licensed Commercial Banks in Sri Lanka. The Bank of Ceylon Ordinance No. 53 of 1938, and its amendments also constitute a part of the regulatory framework. The soundness of the Bank and its commitment to good corporate governance is underlined by the fact that it has voluntarily complied with the Code of Corporate Governance 2013 issued jointly by the Securities and Exchange Commission of Sri Lanka and The Institute of Chartered Accountants of Sri Lanka, for the year ended 31 December 2017. Since it is complying with the above, the Bank is exempted from disclosure of compliances as stipulated in Section 7.10 of the Continuing Listing Requirements on Corporate Governance of the Colombo Stock Exchange.

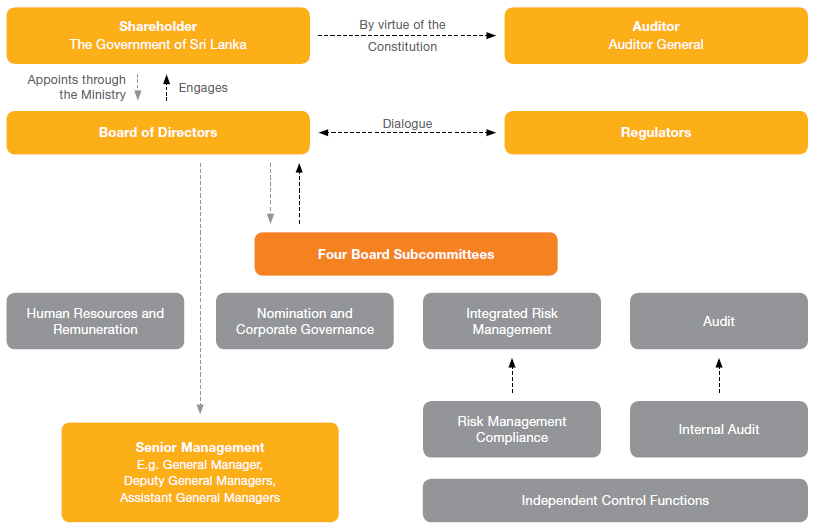

The Bank being a State-Owned bank, comes under the purview of the Auditor General of Sri Lanka who has provided assurance on the Financial Statements of the Bank and its subsidiaries and on the Directors’ Statement on Internal Control and certification that the Bank is in compliance with the Banking Act Direction No. 11 of 2007 on Corporate Governance for Licensed Commercial Banks issued by the Central Bank of Sri Lanka.

Compliance with Banking Act Direction No. 11 of 2007 on Corporate Governance

Specific disclosures in terms of the above regulations are provided in the section on Compliance Requirements as per Banking Act Direction No. 11 of 2007 of this Report and form an integral part of this Report on Corporate Governance.

Compliance with the Code of Best Practice on Corporate Governance 2013 issued jointly by The Institute of Chartered Accountants of Sri Lanka and the Securities and Exchange Commission of Sri Lanka

|

The Board is the apex decision-making body of the Bank which is responsible

for overall strategy and governance. The Board is headed by a Chairman and the composition of the Board is laid down in the Bank of Ceylon Ordinance No. 53 of 1938 and its amendments. The roles and responsibilities of the Board, including a schedule of powers reserved for the Board, are laid down in the Board Charter which was reviewed in the year under review. The main responsibilities of the Board include setting strategic direction, financial reporting, ensuring regulatory compliance, corporate governance, safeguarding the Bank and overseeing the business and affairs of the Bank. The Secretary, Bank of Ceylon/Secretary to the Board plays a vital role by maintaining high standards in corporate governance by ensuring the proper conduct of Board meetings, procedural correctness and by assisting in complying with statutory requirements. |

|

The roles of the Chairman and the Chief Executive Officer (referred to as the General Manager), have been separated to maintain a balance of power and authority. The roles are clearly defined in the Board Charter. The Chairman is an Independent Non-Executive Director while the Chief Executive Officer (CEO) is not a member of the Board. The CEO is tasked with execution of strategies as set out in the Bank’s Corporate Plan as well as other key financial and non-financial targets decided by the Board. This includes short, medium and long-term objectives which are generally established at the beginning of the year. |

|

The Chairman provides leadership to the Board and facilitates the effective functioning of the Board. He is also responsible for facilitating the effective participation of all members of the Board. He maintains open lines of communication with Key Management Personnel and makes his contribution on strategic and operational matters. He ensures that adequate information is made available to all Directors on issues that are to be discussed at Board meetings, by directing all management personnel to provide the relevant information, to an appropriate level of detail well in advance. |

|

The Board possesses the requisite financial acumen, knowledge, and experience to offer guidance on matters of finance, some of the Directors, being professionally qualified in the field of finance/ accounting and/or having held/holding senior management positions and/or directorships. |

|

The Board comprises six Non-Executive Directors appointed by the Minister in Charge of state banks, of whom five are Independent Directors. A representative of the Ministry of Finance is the Ex-officio Director. The independence of the Directors is recognised based on the criteria specified in the Banking Act Direction No. 11 of 2007 on Corporate Governance. The Directors possess diverse skills and experience to enable them to fulfil their responsibilities. |

|

The Chairman ensures that all Directors gain accurate briefings on issues that are to be discussed at Board meetings. The Chairman directs all management personnel to provide the relevant information, comprehensively and well in advance. The Board memoranda are circulated seven days prior to the Board Meeting through a secured electronic link. This includes both qualitative and quantitative information. Board minutes are prepared and circulated in order to record any concerns of the Board or individual Directors regarding any matter and also to ensure that all Board members are aware of the decisions taken and the proceedings. Directors are normally expected to attend all the Board meetings. However, in the event they are unable to attend due to a legitimate reason, they are kept aware of the proceedings by circulating the minutes and by other means. |

|

The Bank of Ceylon, being a State-Owned bank, all Directors are appointed by the Minister in charge of the state banks. Changes to the Board that took place in 2017 are indicated in the Directors’ Report. All details of the members of the Board are given in the section on Board of Directors. The maximum period that Directors can serve is restricted to nine years as per the provisions of the Banking Act Direction No. 11 of 2007 on Corporate Governance. |

|

The Board annually conducts a self-appraisal of its own performance to ensure that they are discharging their responsibilities satisfactorily. The process is for each Director to fill a Performance Evaluation Form. The responses are collated and submitted to the Board. Evaluation for the year 2017 was carried out. The Board Subcommittees also completed Performance Evaluation Forms and submitted to the Board. |

|

In compliance with the Bank’s policy of being extremely transparent the following information on Directors is disclosed in the following links: Name, qualifications, expertise, material business interests and brief profiles in the sections on Board of Directors and Directors’ Interest in Contracts. Related party transactions. Membership on Board Subcommittees. Attendance at Board and Board Subcommittee meetings. |

|

The CEO is tasked with the execution of strategies to achieve goals as set out in the Bank’s Corporate Plan and any other financial and non-financial targets decided on by the Board. This includes short, medium and long-term objectives which are determined at the beginning of the year, and necessitates the CEO having a clear understanding of the expectations required from him. The new General Manager of BoC has been apprised of the expected results for the Bank for 2018, at the time of reporting. Evaluation is carried out annually. |

|

Directors’ remuneration is decided on in accordance with circulars and letters issued by the Government of Sri Lanka through the relevant Ministry and Bank of Ceylon Ordinance and its amendments and incorporated into the Directors’ Remuneration Policy. The Bank has reviewed the Remuneration Policy during the year under review. No Director is involved in determining his/her remuneration. The Board Human Resources and Remuneration Committee makes recommendations to the Board regarding the remuneration of the General Manager and Key Management Personnel, which are reviewed every three years. The Board approved Remuneration Policy for Key Management Personnel is in place. Based on these recommendations, the Board makes recommendations to the subject Minister who grants final approval in accordance with the provisions of the Bank of Ceylon Ordinance No. 53 of 1938 and its amendments. |

|

The sole shareholder of the Bank is the Government of Sri Lanka and hence this Annual Report is presented to Parliament through the Ministry of Public Enterprise Development under whose purview the Bank comes. |

|

While the Corporate Plan is a cornerstone of the operations of the Bank, future strategies are mapped out taking into account opportunities, risks, trends and gaps within the framework of the plan. The short, medium and long-term goals are laid down in the Corporate Plan. Major transactions that have impacted and may impact the Bank in the future are disclosed in: Chairman’s Message. General Manager’s Review. Outgoing General Manager’s Message. How We Create Value. |

|

All information in this Annual Report has been collated, analysed, presented and evaluated as far as possible, to ensure transparency, clarity, accuracy, completeness and accountability. This Annual Report presents a balanced and understandable presentation of the Bank’s financial position and an equitable assessment of performance and prospects in compliance with the numerous regulatory and voluntary codes prevalent for the banking industry. BoC complies with Sri Lanka Accounting Standards, the G4 Standard on Sustainability Reporting published by the Global Reporting Initiative and the Integrated Reporting Framework published by the International Integrated Reporting Council. |

|

While the Board is responsible for formulating and implementing internal control systems to safeguard the Bank’s assets, the Board Audit Committee assists the Board in this regard. The scope of the Board Audit Committee includes responsibility for financial reporting, internal controls, internal audit and external audit. The Terms of Reference for the Board Audit Committee have been drawn up to be aligned with the Code of Best Practice on Corporate Governance. The Committee assures the effectiveness of financial controls, integrity of the Bank’s assets, and the accuracy of Bank’s Financial Reports. Reviews of the internal control systems are conducted periodically by the Internal Audit Department and reported regularly to the Board Audit Committee. |

|

The Bank has two Codes of Ethics; one applicable to the Directors and the other to the employees. The Nomination and Corporate Governance Committee of the Board is responsible for reviewing the Codes. A strong culture of integrity, eschewing bribery and corruption prevails in the Bank. A number of mechanisms are in place to swiftly identify and deal with any possible infringements. All officers are required to submit an assets and liability declaration annually to the Human Resource Department while all Directors are required to submit the same to the relevant Ministry. Transparent procurement procedures are also in place to safeguard against any malpractices. A policy of Whistleblowing is in place covering procedure for the receipt, retention and treatment of complaints. |

|

The Directors are required to disclose the extent to which the Bank adheres to established principles and practices of good corporate governance. This is described in Corporate Governance Section of this Report. Compliance with the “Code of Best Practice on Corporate Governance 2013” issued by The Institute of Chartered Accountants of Sri Lanka and the Securities and Exchange Commission of Sri Lanka is given in the section on Corporate Governance. Compliance with the Banking Act Direction No. 11 of 2007 on Corporate Governance is given in the chapter on Compliance Annexes. |

|

The Bank abides by the principles of sustainability reporting which are also followed in this Report. The sustainability approach takes a holistic approach to value creation. It considers the economic, social and environmental value that the Bank creates for its stakeholders in the short, medium and long term. The sustainability reporting process involves recognising, measuring, disclosing and being accountable to internal and external stakeholders for organisational performance towards the goal of sustainable development. |

Board Subcommittees

Four Board Subcommittees have been established to assist the Board in its duties. This has been done in compliance with the governance codes and best practice. The duties and responsibilities of the subcommittees are clearly laid down, in written terms of reference, in such a manner as to ensure that adequate attention has been given to certain key areas. The terms of reference are subject to annual review to ensure that any changes in the environment that impact them are taken care of. Thereby continued effective control and monitoring of the Bank’s operations is ensured, contributing to its long-term sustainability.

Report of the Audit Committee is given in the section on Board Subcommittee Reports.

Report of the Nomination and Corporate Governance Committee (NCGC) is given in the section on Board Subcommittee Reports.

Report of the Integrated Risk Management Committee (IRMC) is given in the section on Board Subcommittee Reports.

Report of the Human Resources and Remuneration Committee (HRRC) is given in the section on Board Subcommittee Reports.

Regular Meetings

The Board of Directors meets every fortnight as a routine, in addition to which special meetings are held when the need arises. During the year, 28 Board meetings, inclusive of special meetings, were held. Details of meetings of the Board and Board Subcommittees, specifying attendance by each Board Director are given below:

Attendance of Directors at Board and Subcommittee Meetings for the year 2017

Board and Subcommittee Meetings for the year 2017

| Name of the Director | Board | Audit Committee | HRRC | IRMC | NCGC |

| Mr Ronald C Perera PC – Chairman | 28 | N/A | 3 | N/A | 3 |

| Mr Sajith R Attygalle – Ex-Officio Director | 24 | 6 | 1 | – | – |

| Mr Ranel T Wijesinha – Director | 27 | 10 | N/A | N/A | N/A |

|

Mr Charitha N Wijewardane – Director (Resigned on 21 July 2017) |

15 | 6 | 1 | 4 | N/A |

|

Mr Sanjaya Padmaperuma – Director (Resigned on 30 June 2017) |

10 | 2 | N/A | 3 | 1 |

| Mr H P Ajith Gunawardana – Director | 27 | N/A | 3 | 5 | 3 |

|

Mr Mano Sekaram – Director (Appointed w.e.f. 6 July 2017) (Resigned on 8 September 2017) |

3 | N/A | N/A | N/A | N/A |

|

Mr Samantha Rajapaksa – Director (Appointed w.e.f. 25 July 2017) |

13 | 3 | N/A | 1 | N/A |

|

Mr Mohan Wijesinghe – Director (Appointed w.e.f. 24 November 2017) |

1 | N/A | N/A | N/A | N/A |

| Total number of meetings conducted | 28 | 11 | 3 | 5 | 3 |