Sustainability

Our Environment and Our Process

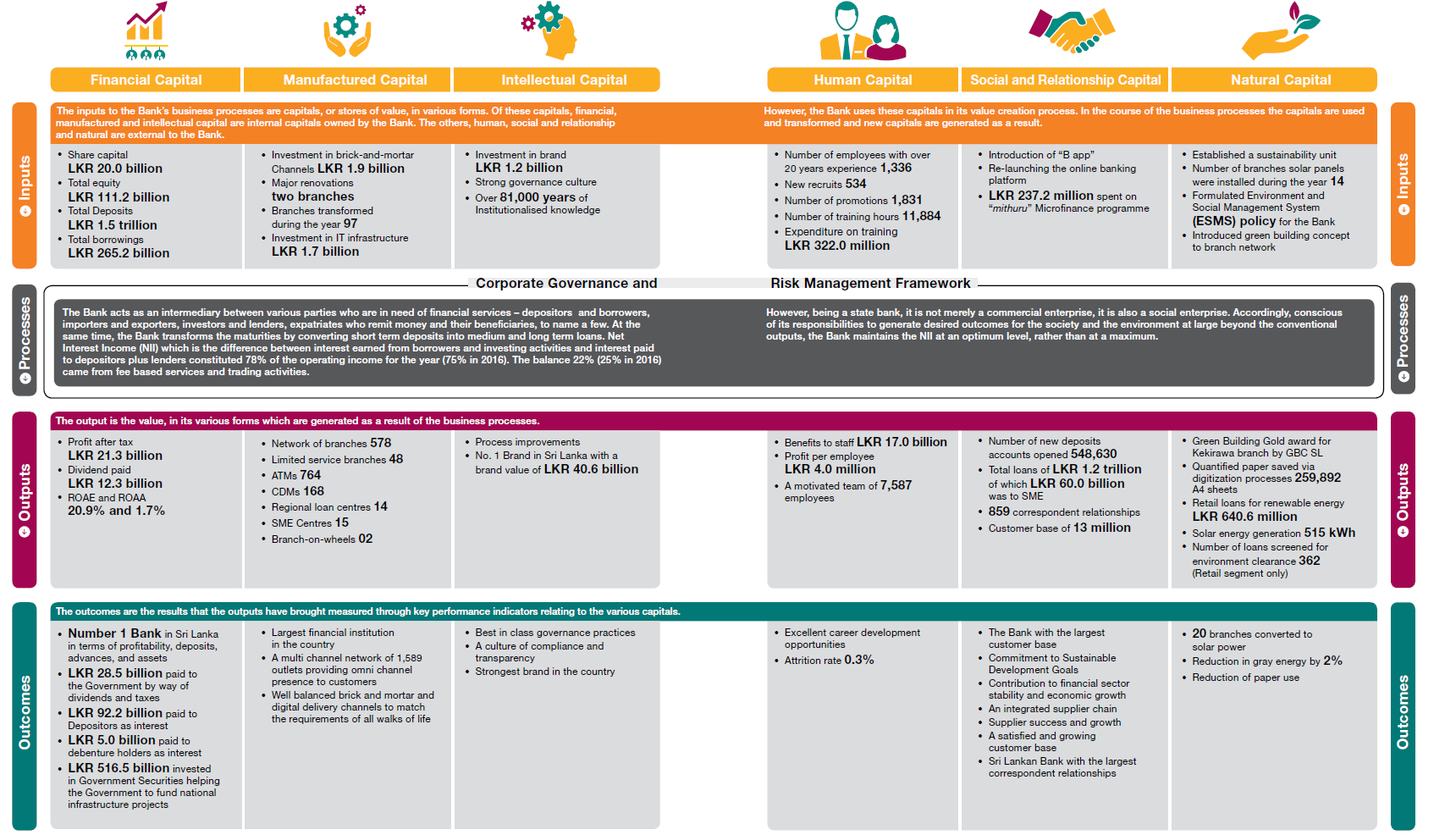

Business Model

The banking system plays a key role in the economy of any nation. It is banks which keep the wheels of business and commerce turning and steer the economic direction of the country. The core business process of the Bank of Ceylon, in common with other banks, is that of a financial intermediary. The Bank draws the savings of individuals or entities, who may be relatively risk averse, with the promise of safety and a satisfactory return. The savings are then lent to individuals or entities at rates which they would find affordable, but also give a reasonable return to the Bank.

This primary process brings several other important considerations. The time frames at which lenders lend to the Bank and borrowers borrow from the Bank usually vary. Typically, borrowing tends to be short term while lending tends to be long term. Banks need to prudently match their cash flows to ensure that funds are available for payments when they become due. The banking business carries inherent risks; risks that borrowers may default or that interest rates may fluctuate. Beyond these, there are risks that can have a much wider impact such as macroeconomic events having a negative impact on an entire industry or an entire economy. Careful balancing of risks and returns thus becomes of crucial importance. Procedures governing inherent risk of the business are inbuilt into the Bank’s governance structure. The Bank has a well-defined risk appetite, the level of risk the Bank is willing to take. Lending and investment strategies have to be tailored to the risk appetite.

The Bank provides certain other services, known as fee-based operations, such as foreign exchange trading, which do not involve lending of funds. The Bank handles over 45% of inward foreign exchange remittances of the country whereby we also perform a service to our expatriate population. Our trading portfolio also includes a large percentage of Treasury Bills and Bonds. Since these are gilt-edged securities, and therefore risk-free investments, they impact the capital requirement at minimal level.

The Bank of Ceylon, as a State-Owned organisation, has certain social responsibilities. It therefore cannot operate with a narrow focus on accounting profit. It has to instead adopt a strategy of seeking an optimum return, balancing both the commercial aspects and the social return. One indication of this balancing act that we have to perform is that our net interest margin is less than that of most other banks. Sustainability is at the heart of the Bank’s strategy. The Sustainability Development Goals (SDGs), which cover economic, social, and environmental values are incorporated as considerations in all our products, services, activities and processes. Sustainability is promoted not only in our direct operations but across our value chain. We address each of the SDGs individually with focused initiatives. The Bank pays special attention to hitherto underserved sections of society such as women, youth, and small entrepreneurs.

Today technology is evolving with dizzying rapidity, and this is reflected in changes in banking operations. With over 30 banks in the industry we have to constantly feel the pulse of our customers and innovate new products and services to retain our market position. Customers are increasingly moving to new banking channels such as ATMs, CDMs, internet and mobile banking. While this is especially true among the millennial generation it is by no means confined to them. The trend cuts across age groups, social classes and location. We have found that customers from all walks of life are equally receptive to cash deposit machines. Through our new Document Management System we have automated many transactions such as loan applications and account opening. However, we always ensure that our business model and our offerings balance the expectations of both the millennials and our legacy customers who still prefer the traditional banking channels.

From our beginnings in 1939 as a Bank created to serve the needs of the national business community, who were then not catered by the foreign banks, we have grown to serve a diverse clientele. While our growth was previously mainly driven by serving the state sector, today the corporate and SME sectors have also become key target market segments. The economic model of the country is shifting from being a Government and corporate driven one to a model more based on SME driven growth. Hence, considering the long-term sustainability of our business model we have stretched our exposure to SME sector. We drive financial inclusion, which is embedded in our business model, via the SME sector. Within the sector we have a wide portfolio of offerings to cater to diverse customer groups. To cite one example, within the agricultural sector we have separate credit schemes for paddy, dairy farming, each of the three main plantation crops and many other crop species such as maize and chillie. Spreading our portfolio across Government, corporate and SME sectors also helps us to diversify and balance risks.

Bank of Ceylon is not only the largest bank in the country, we are also the highest profit making single entity. In 2017 our profit before tax amounted to LKR 30.3 billion. The Bank also made a contribution to Government revenue of LKR 28.5 billion by way of dividends and tax. We have a brick and motar network of 578 branches and 48 limited service branches. We have also expanded our network overseas to the London, Maldives, Seychelles, and Chennai. and we are continuously evaluating the opportunities we have for further expansion.

Our business model is robust as it is built on an ethos of sustainability. The Bank borrows from the public and lends it back to the public in a socially and environmentally responsible manner. Furthermore, our profits are also routed back to the community through taxes, and since we are a state bank also through the dividends we pay to our only shareholder, the Government. Through all our activities we drive the economic growth of the country, help uplift the less fortunate in society, play a part in narrowing socio-economic disparities and contribute to preserving the environment. With our achievements and strengths, we can look to the future with confidence that the Bank will continue to grow and generate value, both in the short and long term for itself and all its stakeholders.

Our Corporate Plan 2018-2020

We are a strategy driven Bank. Strategy has given significant momentum to our growth trajectory in the past. Our 2010 strategic plan “One 10 twelve” is a case in point where we announced targeting one trillion in assets and Rupees 10 billion in profits to be achieved by 2012 which was duly achieved by the target date. In 2016, we achieved another milestone of the triple trillion – one trillion in each of assets, deposits and loans.

In 2017, we drew our corporate plan for the next three years against the canvas of the rapid evolution currently taking place in the banking landscape; effectuated by unprecedented developments in information and communication technology, changing demographics leading to changes in customer expectations, unorthodox competition and so on. We are cognisant that there are the necessary transformations in our value proposition in terms of product and service offering, reach, service standards and internal processes. This plan contains meticulous strategies to do that.

Since the customer is at the core of our business, we have given special focus to taking the service quality and service standards to the next level. We will integrate service standards across all the channels and outlets in the network to provide a uniform customer experience. We will endeavour to meet expectations of each customer. Another aspect in customer interfacing is improving our credit quality and culture. We will thereby give value to our customers across the entire spectrum retail, corporate, SME and microfinancing while improving our asset quality, keeping in mind the stringent requirements of SLFRS 9.

Under the Corporate plan, we also intend to expand our geographical boundaries by being open to potential new business models, innovative processes and delivery channels, enabling provision of 24x7 global service.

Today, technology is a major component of the competitive edge of any bank. With millennials being an increasing percentage of our customer base, we have to cater to their expectations and it requires leveraging cutting edge technology. The other side of the coin however, is that technology brings risks with it. We will go the extra mile, to ensure our assets and those of our customers are secure and sensitive information is protected.

To ensure efficient and effective operation of the Bank we need systems and processes that operate seamlessly. This is another focus area where we will concentrate on identifying pain points and gaps, and make the necessary modifications.

However, we are very conscious that technology can only take us so far, only with the human touch. Accordingly, we will also give great emphasis on developing our human resources. The skills, knowledge and attributes of our staff will be honed further to enable them thrive in this rapidly evolving business milieu; there is a need for developing soft skills as well as technical skills.

To safeguard the financial stability and the reputation of the Bank, good governance and ethical conduct are imperative. While we already have high standards in these areas, we have set our benchmarks as the best in class practices in the world. We will renew and re-energise our focus on sustainability by ensuring that we continue to maintain a judicious balance between economic, social and environmental objectives.

The end result of all the above will be the enhancement of our brand. The brand is a mirror of our image in the eyes of our customers, both legacy and millennials, and the general public. Through the strategies spelt out in our corporate plan we will forge ahead, building our brand, increasing our assets and profitability, while delivering increasing value to all our stakeholders.

Refining and defining the Bank for future.