How We Create Value

Helping to Preserve the Planet

Natural Capital

It is the responsibility of all of us to preserve a habitable and healthy natural environment for future generations. Today the world is faced with the threat of global warming among other environmental issues. In 2015, the UN promulgated the 17 Sustainable Development Goals (SDGs) to alleviate poverty and hunger, protect the environment and promote sustainable development among other laudable socio-economic objectives.

Given our status as the largest bank, as well as the single entity making the highest profit in Sri Lanka, we have the potential and a duty to make a major contribution in this regard. Hence, we have adopted the SDGs to our sustainability ethos and thereby have embedded those into our business model.

Organisational Structure

The Green Banking concept is supported at a Senior Management level, being led by the Sustainability Committee of the Bank. Implementation is carried out through the operating divisions under the guidance of the Corporate Management.

During the year the Bank formed aSustainability Unit to further strengthenthe implementation and operationalisation of the decisions taken by the Sustainability Committee. Sustainability Unit also acts as the focal point for reporting on sustainability and it coordinates with all respective divisions, province offices and the branches for this purpose. Progress is constantly monitored with each division by the Sustainability Unit which reports back to the Sustainability Committee on a quarterly basis.

Our Green Initiatives

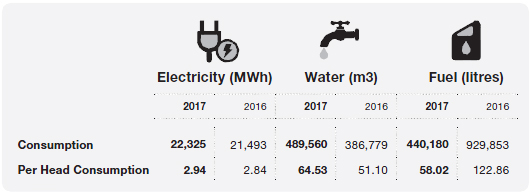

The Bank has a substantial direct resource consumption and environmental impact by way of electricity, air conditioning, water and paper. We seek to reduce our carbon footprint by minimising the impact through direct emission reductions by increasing fuel efficiencies in our vehicle fleet, careful maintenance of air conditioners etc., and indirect emission reductions by reducing use of non-renewable energy. This is implemented through our Green Banking Policy which was launched in 2016. As at end of the year 2017, total of 20 branches have converted to solar energy. The initiative has generated total 515 kWs of renewable energy which is 2% of our total energy consumption. Some of the other initiatives have been paper recycling, e-Waste management, use of non-toxic materials in construction, installing eco-friendly equipment and energy efficient lighting systems and maintaining green gardens with rain water harvesting systems. During the year a total of 16,930 kgs of waste paper were recycled.

We instill environmental consciousness and awareness of green banking in our staff by way of emails and postings on the intranet. Reuse of paper, use of double sides for making copies and printing were some of the practices we have sought to implement. The Bank also has conducted training via its e-Learning portal during the year, reducing use of paper and also fuel consumption in logistics used in training.

Going Green in Our Products and Procedures

Our digitisation initiatives contributed greatly by replacing paper usage with a digital interface. As an example our “SmartGen” product eliminated passbooks from savings accounts. During 2017 a total of 94,395 “SmartGen” accounts were opened bringing the total number to 196,343.Other digital initiatives such as launching the Smart Passbook and continuous promotion of e-Statements also further move us away from paper intensive banking towards a resource efficient banking culture.

(Refer Social and Relationship Capital)

Workflow automation also contributes to reduction in paper work. Introduction of the online Document Management System (DMS) and e-Learning have also contributed to reducing usage of paper. During the year 2017, personal loan and home loan orientation by the DMS has contributed to saving of 178,297 sheets of photocopy paper. Practice of BoardPAC has contributed to saving of 81,595 A4 sheets during the year.

During the year e-Audits were introduced and the initiative saves large amount of paper used in manual audit procedures. It is estimated that this process when completed would save 348,480 sheets of paper. The Bank ceased the manual posting of leave approvals during the year and the automation of this process also generates large savings in paper.

Green Lending

However, the Bank’s concern for the environment is not limited to its own operations. We show our commitment by incorporating environmental concernsin all our activities. The Bank offers dedicated loan products to cater eco-friendly initiatives such as installation of solar panels. We have also under taken initiatives to fund environmental friendly projects such as waste-to-energy projects, wind power projects and construction of green buildings. We also encourage customers, including those in the SME and corporate segment, to use renewable energy, practice waste management, practice recycling and economise on energy usage. Furthermore,we also perform environmental screening for our credit products. Retail segment has screened 362 credit proposals for compliance with environmental regulations and 25 credit proposals have been rejected due to non-compliance. Retail segment alone has funded LKR 640.6 million during the year for renewable energy and environmental friendly projects.

The Way Forward and the Future

The Bank also took an important initiative during the year to formulate its Environment and Social Management System (ESMS). ESMS policy is now completed and to be implemented from the early 2018. The ESMS will further strengthen the environmental and social screening we conduct in evaluating our credit proposals. It will help the Bank to manage its social and the environmental risk in a prudential manner.

Due to issues such as global warming coming to the forefront, preserving the environment will become of increasing importance in the years to come. We will have to face increasing challenges in aligning environmental concerns with our activities throughout our value and yet remaining profitable. Yet, it is a must that we face these challenges to ensure our long-term sustainability.