How We Create Value

Leveraging Our Greatest Asset

Human Capital

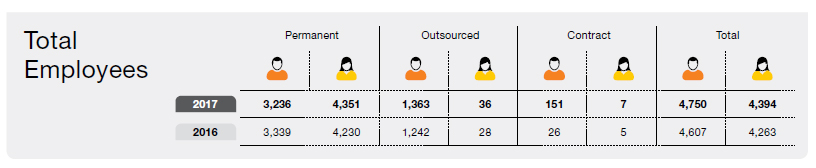

Whatever the assets the Bank possesses in the form of intellectual and manufactured capital, our human resources remain the key asset to our success and growth. The contribution made by our employees is demonstrated by the fact that from 2012 to 2017, while our assets increased from LKR 1.0 trillion to 1.9 trillion, our staff strength decreased from 7,790 to 7,587. Although the increasing use of modern technology was a contributing factor, this would not have been possible without the talents, skills, knowledge and dedication of our staff which enabled us to leverage the technology to obtain the maximum benefit. There is no doubt that the staff who has worked over the years contributed greatly to the brand image we have built up, and the accolades we have won. They should also take much of the credit for building up the financial capital.

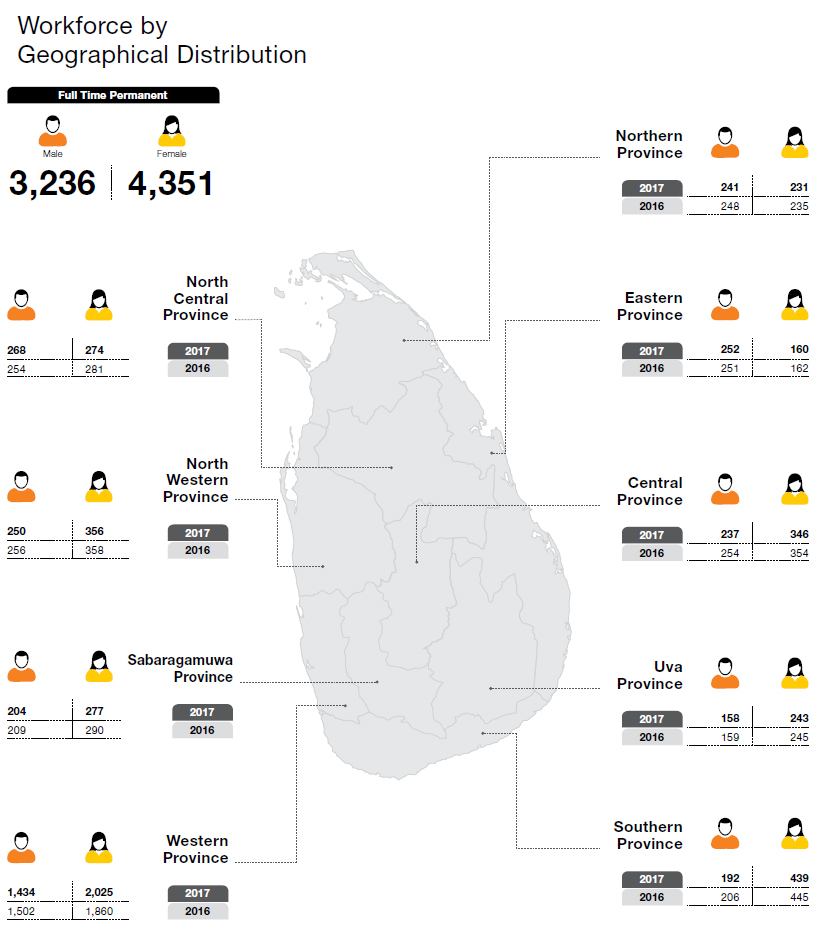

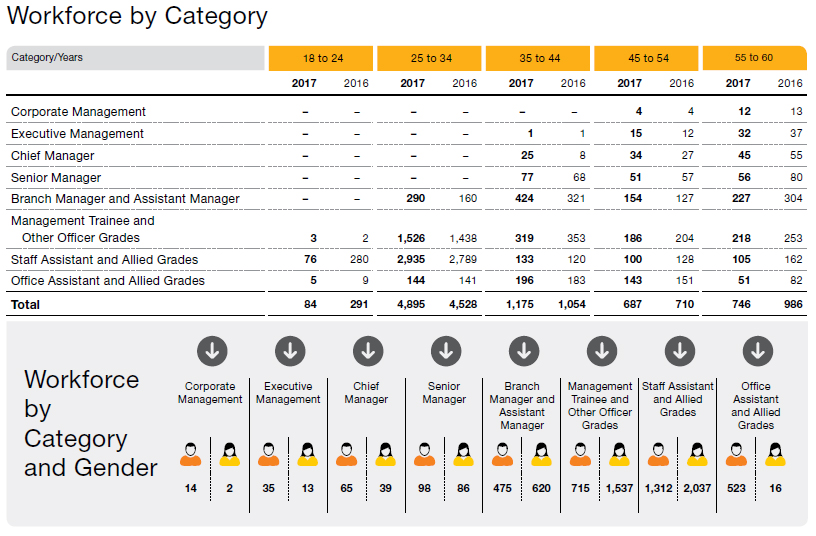

Our team consists of 43% males and 57% females which demonstrates absence of gender bias. This is reaffirmed by the fact that the average basic salary and total remuneration for males and females are on par within all categories of staff. All but two of the provinces have a majority of female staff. Considering some of the more senior categories of staff, the percentages of female staff for Branch Managers and Assistant Managers, Senior Managers and Chief Managers are 57%, 47% and 38% respectively.

Recruitment Processes

The Bank of Ceylon has a highly professional and structured recruitment process to ensure that we obtain the cream of the available talent. In our recruitment process, we give importance not only to knowledge in subject matter and technical skills but also to the soft skills. The majority of our new recruits are for management trainee and staff assistant positions. It’s the entry level recruits who get promoted to the higher levels with time. All recruits are Sri Lankans and therefore 100% of our recruits are from the local community. Our recruitment process is transparent and is free of all forms of bias. All who aspire to join the Bank compete on a level playing field, regardless of ethnicity, age, gender or the social class. We take great care to evaluate the skills of our new recruits carefully and place them in roles they are most suited for. On recruitment, all new recruits pass through an induction training where the culture and work ethics of the Bank is inculcated into them. In our recruitment, we also give emphasis to geographical distribution as far as possible so that employees can be posted to locations close to their hometowns.

Recruitment

| Job Category | Male | Female | Total | |

| System Analyst/Programmer | 15 | 10 | 25 | |

| Trainee Assistant Legal Officer | 2 | 17 | 19 | |

| Head of Security | 1 | 0 | 1 | |

| Assistant Secretary to the Board | 0 | 1 | 1 | |

| Trainee Multi Duty Assistant | 16 | 3 | 19 | |

| Security Assistant | 145 | 2 | 147 | |

| Management Trainees | 98 | 224 | 322 | |

| Total | 277 | 257 | 534 |

Training and Development

We believe in providing our staff the opportunity to develop their talents and capabilities to the maximum so that they can fulfil their career aspirations. We also give great importance to installing in them the knowledge and attributes to provide the best possible customer service. The Bank therefore has a systematic process of ascertaining training needs and planning training. Training requirements may be identified by the employees’ supervisor or by self. The Bank has a training plan whereby pre-planned programmes are conducted but ad-hoc training is also conducted when needs are identified. Training needs are identified during the performance review process by supervisors with the agreement of employees. Also if new regulatory changes or any new development takes place in the industry during the year, applicable staff are always nominated to relevant training by their supervisors to upgrade their knowledge.

In addition to the performance review applicable to all levels of employees, a special talent management process is conducted for those in senior manager grades and above who have completed two years of service in such grades. Since, this process is part of succession planning to groom next level leaders, the grades for which the process is to be conducted is based on the request of the Management. During 2017, talent management was conducted for senior managers. Major criteria on which the evaluation is done are; change orientation, result orientation, strategic planning, decision-making, leadership and professional conduct. This is a 360 degree evaluation where views of supervisors, subordinates and peers are evaluated by an Executive Management member (who is not in the direct reporting line of the reviewee). The review decision is then evaluated by a pool of reviewers of the talent management panel as well. The major objective of this process is to identify the training needs and suggesting the career progression path for the next level leaders.

The Bank has a well-equipped Central Training Institute (CTI) staffed with qualified trainers. It has full-time staff of five as well as 120 associate faculty members. CTI has an auditorium with a seating capacity of 100 and five lecture rooms with a total seating capacity of 260. Accommodation facilities are also provided for staff who participate to training from the distant provinces. In addition, the head office has an auditorium with a seating capacity of 225 and two training rooms with seating capacity of 80.

A total number of 442 in-house training programmes were conducted during the year accounting for 4,087 hours. In addition, training programmes are also conducted through other institutions both local and overseas, when a need for such training is identified. A total of 309 programmes were conducted through other local institutions accounting for 2,997 hours. In addition, 120 programmes were conducted through overseas training programmes and official visits on which the training hours spent were 4,800. The total cost of all three types of training was LKR 322.0 million. Some of the topics on which the greater proportion of the in-house training time was spent were banking operations, credit and recovery, compliance, information technology, internal control and skills development and management. At least three training programmes should be attended by an employee during the year.

Our training programmes are drawn up with career development of employees and succession planning in mind. Staff who stand out are identified and groomed for next-level positions. Through this process, not only the career progression of staff is furthered but the Bank also proactively provides for filling vacancies due to staff retiring. Apart from entry level positions appointments are made by promotion, of the existing staff. Exceptions are made only when there is a need for specialised skills; in such cases outside expertise is drawn with external consultants being appointed. Promotions are made based on examinations and subsequent interviews conducted to assess the knowledge and skills of the employees. Nine of such examinations were conducted during 2017. During the year, a total of 1,831 staff were promoted.

Outbound training for our staff

In addition to the formal training sessions, we provide the staff with other opportunities to develop themselves. The CTI has a well-equipped library which all staff are encouraged to make use of. Also, we have installed an e-Library which gives our employees access to a great collection of useful material.

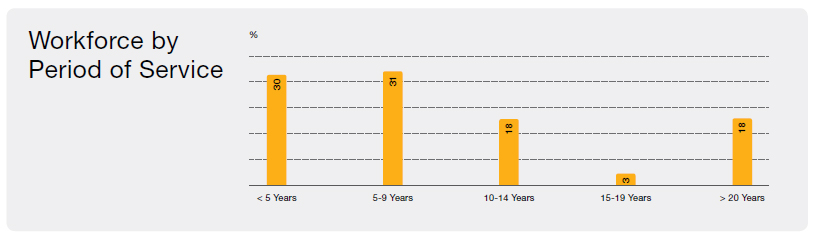

We have an extremely diverse mix of staff in terms of age levels and experience. It is noteworthy that 65% of our staff are below 34 years of age. This means that at junior levels we have a relatively young team. This brings with it the advantage that the younger generation is technology savvy and better able to deal with the transition to the digital and mobile mode. The other side of the coin is that we yet do have a substantial number of more matured staff to fill the senior ranks. This blend of youth and maturity gives us both dynamism and resilience. Our development programmes also address the need to prepare the younger generation to take over the more senior positions.

During the year 14 outbound training programmes were conducted and a total of 1,239 staff were benefited by these.

Human Rights

Bank of Ceylon respects the human rights of all its employees and has implemented systems to ensure all its employees are treated equally, with appropriate dignity and respect without any discrimination. We do not use child labour in any form. All our human resources practices are in line with local and international standards. Collective and bargaining decision-making is implemented and 98% of our employees represent either of the trade unions of the Bank, and cordial relationships are also maintained with the trade unions. The employees benefits including salaries, allowances and medical benefits are reviewed and revised once in 3 years under the collective agreement.

Also, we have established grievance handling mechanisms to address the grivances raised by our employees.

Grievances

| Number | ||

| Brought forward from 2016 | 04 | |

| Total number of grievances reported in 2017 | 19 | |

| Total number of grievances resolved in 2017 | 14 | |

| Total number of grievances outstanding at the end of the year 2017 | 09 |

Induction programme to newly recruited Management trainees

Motivating Our Staff

Our strategy is to align what is best for the employees with what is best for the Bank. Our reward and recognition process has been developed to motivate employees to pursue goals that will enable the Bank to achieve its goals. Our development and training activities also contribute to the same objective in the longer term. Thus, we have built a performance-based culture that will support both short term and long-term value creation.

Welfare and Work-Life Balance

The Bank also conducts and sponsors activities that improve staff morale, promote employee engagement and give the staff an opportunity to unwind. These include events to recognise outstanding performance of staff, sports events, religious and cultural activities pertaining to all communities and religions and health awareness programmes.

Some of such activities that took place during the year are: best branch competition, long service award, annual sport meets in every province and also the all island sports meet of the Bank which was held at Anuradhapura during the year. At the best branch competition, 21 branches and 165 staff members were felicitated. A total of 234 staff members were also felicitated at the long-service award. The Buddhist society of the Bank conducted a “One Day Sil Observing Programme for Wesak” this year as well, where staff and their family members took part in religious activities throughout the day at Head Office complex. Also Christmas Carols were conducted by the Christian Society in celebration of Christmas. A special Pooja was organised by the Hindu Association to celebrate Maha Shiva Rathri Festival.

Staff and their families observing “Sil” for Wesak 2017

Hindu pooja in celebration of 78th Anniversary of the Bank

Christmas Carols 2017

Best branch competition 2017

In times of need such as bereavement, natural disasters, and personal accidents we lend a helping hand to our staff.

Our staff also actively engage in CSR initiatives of the Bank. By promoting such events we improve the work-life balance of the staff. Following are some of the CSR activities which were conducted in which our staff also participated:

- During May 2017 disaster situation, employees contributed their one day’s salary and also their labour in providing essential dry rations to displaced communities across all affected districts.

- During the year “Guide to Future” seminar series were conducted in selected schools across all provinces where specially-trained branch managers participated as the resource personal on a volunteer basis.

- Kahatagasdigiliya branch staff conducted a CSR project at the Diyamailagaswewa Vidyalaya and opened 60 RKG accounts for students as a generous donation by the branch staff.

District basis recruitments that we follow, also serves to improve the work-life balance of employees by minimising their travelling time. The Bank maintains 11 holiday resorts spread throughout the country, which are available to our employees and their families. A total of 14,872 staff bookings were recorded during 2017. Kayts and Trincomalee holiday resorts were newly opened during the year. The regulatory requirement that all permanent staff utilise seven days annual leave at a stretch that BoC has also rigidly enforced, in a way contributes to work-life balance as well.

Health and Safety

A healthy and contented workforce is likely to be a productive workforce.Therefore the Bank gives much importance to the health and safety of its staff. All confirmed employees and their families are covered by a comprehensive medical scheme for OPD treatments to surgeries. The services of an in-house doctor is available at the head office in the event of medical problems arising while at work. Comprehensive safety procedures have also been implemented. The Head Office provides Gymnasium, Yoga and Aerobics facilities to staff and during the year a total of 1,269 staff have utilised these facilities.

Each branch and each division at head office has a fire officer and regular fire drills are conducted to familiarise staff with the safety procedures in case of an emergency. All branches and all areas of the head office are equipped with CCTV cameras. The Bank’s Security Service Department is staffed by experienced and knowledgeable personnel who are capable of handling any security-related issue.

Retirement Benefits

Each staff member of the Bank is a member of the Bank of Ceylon Provident Fund, to which employees contribute 8% of monthly gross salary while the Bank contributes 12% of same. All staff are also members of the Employees’ Trust Fund to which the Bank contributes 3% of gross salary. All Bank employees are entitled to a non-contributory pension on retirement, provided that they have completed 10 years of continuous service.

The quality of our HR management is reaffirmed not only by the accolades we won for the best HR practices during the year but also by our attrition rate which is well below the industry average.

Turnover – Age Groups and Gender

| 2017 | 2016 | ||||||

| Male | Female | Total | Male | Female | Total | ||

| Age Distribution | – | – | – | – | – | – | |

| 25-34 | 14 | 22 | 36 | 6 | 26 | 32 | |

| 35-44 | 01 | 02 | 03 | 1 | – | 1 | |

| 45-54 | 01 | 02 | 03 | – | 1 | 1 | |

| 55-60 | 205 | 98 | 303 | 273 | 173 | 446 | |

| Total | 221 | 124 | 345 | 280 | 200 | 480 | |

| % | 64 | 36 | 100 | 58 | 42 | – | |

Reasons for Turnover

| Reasons | 2017 | 2016 | ||

| Joining other competitive organisations | – | – | ||

| Joining other organisations | 9 | 5 | ||

| Migration | 8 | 17 | ||

| Higher studies | 2 | 3 | ||

| Personal reasons | 3 | 9 | ||

| Retirement | 303 | 446 | ||

| Other | 20 | – | ||

| Total | 345 | 480 |

Automated Human Capital Management System

We have a Human Capital Management (HCM) System in place which automates many of our HR functions. The system has been developed to upgrade the efficiency and effectiveness of utilisation of our human resources. As at end of the year,employee performance management, learning management, staff competencies and job description, payroll administration, employee self-services and benefit administration modules in HCM are in the live phase. Employee dynamics, HR planning and charts, career portal and HR business intelligence reports modules are in the development and testing phases and are to be implemented to the live environment soon.

It is envisaged that the HCM system will lead to the creation of a career portal which will enable both employees and management to identify, pursue and facilitate career opportunities. All HR related matters such as training and development will be brought into the system to facilitate the process. All HR records will be made available to authorised persons through the HCM system to minimise use of paper.

Leave application and approval process is fully-automated through the HCM system during the year.

Way Forward

In our Corporate Plan 2018-2020, we aim to develop our human capital with the view of strengthening skills, attitudes and abilities of our workforce to enable the Bank to be sustainable and thrive in today’s fast changing business environment. Focus has been given on developing professional, job-related specialised knowledge as well as soft skills of the staff; we also emphasise on improving physical infrastructure which is important for training and development. Each employee is to receive training with the following weightages in the future; Current job role – 40%, Personal development – 30% and Service offerings and delivery – 30%. Also while we will focus on maintaining a pool of employees for specialised areas, at the same time we will also give importance to developing multidisciplinary exposure among our staff.

-web-resources/image/128-1.jpg)