How We Create Value

The Decisive Numbers

Financial Capital

Bank of Ceylon, having had a successful record for many years, has now once again closed 2017 on another high note reporting the highest Profit Before Tax (PBT) in the industry. PBT stood at LKR 30.3 billion while Profit After Tax (PAT) stood at LKR 21.3 billion. The Bank has been able to continuously excel in the industry by maintaining its No. 1 position in profit, assets, deposits and loans and advances.

Return on Financial Capital

Total Income

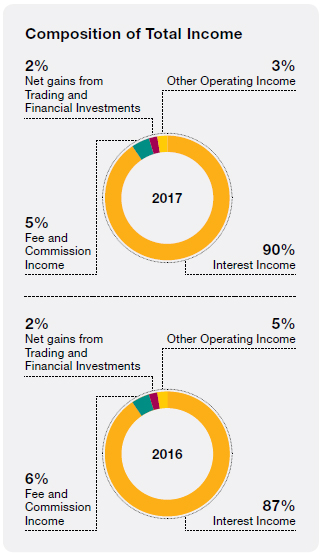

The Bank’s reported total income for the year 2017 stood at LKR 189.2 billion with a 23% growth YoY. Of the total income, 90% was comprised of interest income and 73% of the interest income has been derived through the loans and advances. Fee and commission income and net gains from trading and financial investments contributed 5% and 2% of the total income of the Bank respectively. Other operating income represents 3% of the total revenue.

Net Interest Income

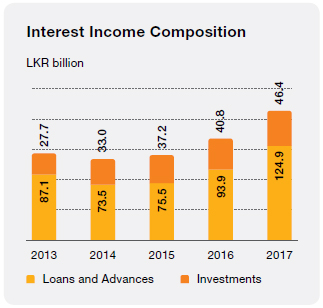

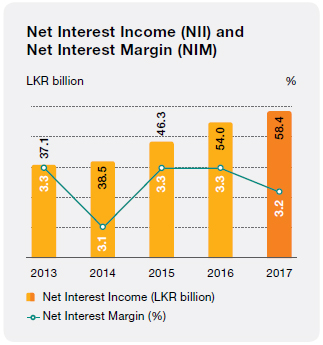

Interest income which is the main source of income of the Bank increased by 27% to LKR 171.3 billion during 2017. High interest rate scenario prevailed during the year consequent to an increase in the policy rates, i.e., Standing Lending Facility Rate (SLFR) and Standing Deposit Facility Rate (SDFR) were increased to 8.75% and 7.25% respectively. Whilst, the increasing trend in market interest rates resulted in an increase in both interest income and interest expenses, the Bank achieved a 8% growth in its net interest income over the previous year. Interest income from loans and advances increased by 33% during the year backed by 16% growth in the loan portfolio. Interest income from investments, which accounted for 27% of the total interest income grew by 14%, mainly backed by interest income from Government Securities.

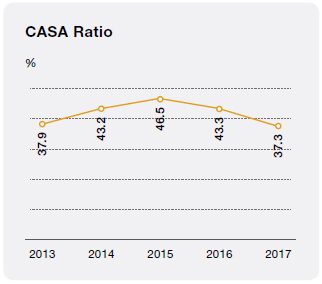

Due to the higher gap that prevailed between interest rates on time deposits and savings deposits, customers were attracted to time deposits than to low cost savings deposits. Hence, there was a shift in deposits from CASA (Current and Saving deposits in total deposits) to term deposits, the CASA ratio declined further to 37% from 43% in 2016 and 46% in 2015. This increased the interest expense of the Bank to LKR 113.0 billion, resulting in a 40% growth YoY. The composition of the Bank’s interest expense changed slightly during the year due to the repayment of the USD 500 million international bond; mainly as a consequence of this, the borrowing cost of the Bank reduced by 9%.

Despite the considerable increase in interest expense on deposits due to the high interest rate scenario, the Bank was able to manage the Net Interest Margin (NIM) only with a marginal drop from the previous level of 2016 through its continuous monitoring and development plans on its fund management activities.

Non-Interest Income

Non-interest income of the Bank is comprised of the fee and commission income, gains derived through trading activities and other operating income which accounted for 10% of total income. During the year, net fee and commission income showed a growth of 1% with the improvement in income from Debit and Credit cards. Net gains from trading increased by 36% compared to previous year, for which growth in foreign exchange income made a significant contribution. Net gains from financial investments grew by 231% in 2017 as a result of increased gains on sale of Government Securities and dividend income for the year.

Other operating income reported a decline of 40% in 2017. However, the decline is only 5% when excluded, LKR 3.1 billion one off gain recorded in the previous year through the disposal of the Associate Company, Mireka Capital Land (Private) Limited.

Impairment Charges

Increase of 112% in total impairment charges is mainly a result of the increase in individual impairment for loans and advances. The Bank now has recognised some individually significant loan customers, who were formerly assessed collectively, under individually assessed category. The increase in individual impairment is largely a result of this and other prudential steps taken in preparation for the new Accounting Standard on Financial Instruments, SLFRS 09 which comes into effect from 2018.

Gross NPA ratio which is calculated as per the regulatory norms stood at 2.8% at the end of 2017 maintaining the NPA ratio at the industry level.

Operating Expenses

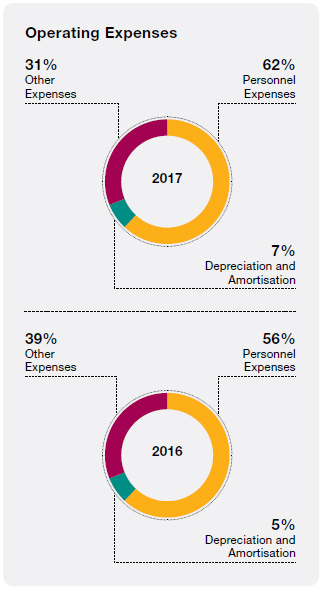

Operating expenses, mainly consisting of personnel expenses and administrative expenses decreased by 9% from the previous year. Expenses on one of the Bank’s most valuable capitals i.e., employees amounted to LKR 17.0 billion for the year. Other operating expenses decreased by 21% through the fair value adjustment on gold in hand which amounted to LKR 3.3 billion.

Cost to income ratio reduced during the year from 43% to 38% reflecting the Bank’s ability to manage the operating expenses in an effective manner.

Profitability

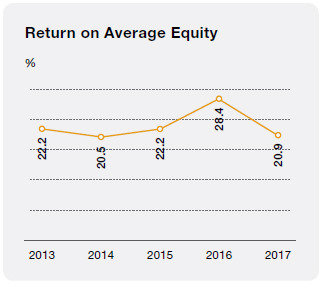

The Bank’s strategic priorities were implemented during the year aligning the Bank with new trends in the local and global markets while embedding the latest technology into the Bank’s operational activities. In 2017, BoC continued to maintain its profit impetus at the highest level in the industry by reporting PBT of LKR 30.3 billion. Given this record, the Bank was able to achieve its target for the year, despite the decrease reported in Return on Average Assets (RoAA) and Return on Average Equity (RoAE) consequent to the capital infusion close to year end.

Assets

The total assets increased to LKR 1.9 trillion from LKR 1.7 trillion with a remarkable growth of 17% in 2017. The Bank has achieved a strong assets base enriched with a healthy loan portfolio and highly secured financial investments that represent more than 90% of total assets.

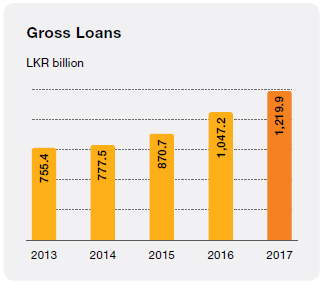

Loans and advances that represents 60% of the asset base increased by 16% during the period, demonstrating the robustness of the Bank’s primary business, the lending.

Bank maintains a diversified investment portfolio to earn capital gains and interest income and it widened with LKR 308.3 billion of held to maturity financial investments and LKR 213.2 billion of loans and receivables financial investments as at end 2017. During the year, financial investments grew by 20% with increased investments in securities purchased under resale agreements (Reverse Repos), Government Treasury Bills and Sri Lanka Development Bonds to sustain the Bank’s risk appetite at a lower rate.

Loans and Advances

Gross loans and advances reached LKR 1.2 trillion at the end of the year, ensuring growth momentum in the loan book of the Bank. The growth of 16% compared to the previous year is mainly backed by increase in personal loans, term loans and overdrafts. Enhanced access to credit facilities via different platforms, speedy service via automation of systems and novel changes to the sales culture of the Bank have notably contributed to this achievement.

A cluster of products on loans and advances has been made available by the Bank to cater to the different customer segments in the market. The portfolio presented a healthy balance between private and Government sectors during the year 2017.

During the year, overseas branches also reported a 10% growth in loans and advances to support the growth prospects of the overseas operations of the Bank.

Non-Performing Advances (NPA) ratio has marginally decreased demonstrating enhanced asset quality and sound administration and recovery procedures.

Deposits

The Bank has retained its market leadership in customer deposits with 20% of market share for the year 2017. Deposit base of the Bank expanded from LKR 1.3 trillion to LKR 1.5 trillion recording an impressive 23% increase YoY. This reflects the success of the endeavours of our sales force, complemented by a customer driven culture with innovative and attractive products, processes and procedures introduced throughout the year.

Local currency deposits, which constitute 78% of total deposits, grew by 28% during the year. Both local and foreign currency time deposits grew by LKR 258 billion reporting 36% growth in the wake of the market trend of shifting for high yield time deposits from CASA deposits. As a result, a decrease in CASA ratio can be observed which is in par with industry norms.

Borrowings

Borrowings comprising subordinated term debts, debt securities issued, REPO borrowings and other borrowings reduced by LKR 31.7 billion during the year. This resulted in a decline of 11% compared to the previous year that came from the drop in REPO borrowings and term borrowings from senior notes.

During the year, the Bank issued LKR 10.0 billion worth of unsecured subordinated redeemable debentures under private placement.

Dividends

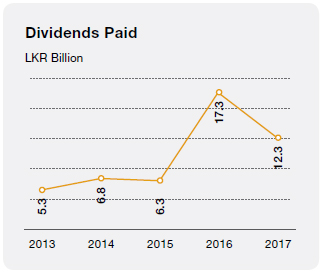

During the year 2017, the Bank paid a dividend of LKR 12.3 billion to its sole shareholder, the Government of Sri Lanka reporting a dividend payout ratio of 58% for the year 2017.

Shareholders’ Funds

An impressive increase of 20% was reported in shareholders’ funds which stood at LKR 111.2 billion at the end of the year which was backed by the increase in retained profits and the capital infusion of LKR 5.0 billion to the Bank by the Government of Sri Lanka.

Capital and Liquidity

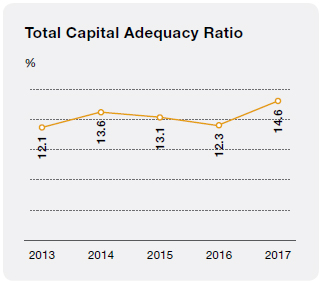

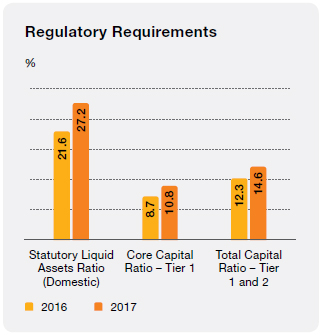

Surpassing regulatory requirements of the Central Bank of Sri Lanka under Basel III, the Bank has been able to meet the capital adequacy and the liquidity norms.

Tier 1 capital adequacy ratio was at 10.8% and Total capital adequacy ratio stood at 14.6% the year end, against the regulatory requirement of 7.75% and 11.75% respectively. Further, the statutory liquid assets ratio remained at 27.2% at the year end whereas the minimum regulatory requirement is 20%.

Also during the year, a Liquidity Coverage Ratio (LCR) was newly introduced as a result of Basel III regulations. The Bank has been able to meet this new regulation by reporting LCR for all currency at 105% and LCR (LKR) at 141.5%, which are well above the required number of norm of 80%.

This remarkable achievement in capital adequacy and liquidity reflects the Bank’s capability of coping with any stress situation and manage the capital and maintain the resilience of the Bank’s balance sheet.

* 2013 to 2016 figures are based on Basel II guidelines and the 2017 figures are based on Basel III guidelines.

BoC Group Structure

BoC has ten subsidiary companies and four associate companies that together form the BoC Group. These companies constitute 2% of total Group’s assets and have been established over the history of BoC for strategic purposes. Of the ten subsidiary companies, five are fully-owned by BoC.

Principal Activities

The subsidiary companies are engaged in diverse activities such as financial services (MBSL), travel-related services (BOC Travels), hydropower generation [Koladeniya Hydropower (Private) Limited] and the BoC (UK) Limited that carries on regulated financial services activities. Some of the activities engaged by the associate companies include management of Unit Trust funds, stock brokering and property-related activities.

In line with the good governance practices followed by BoC, the subsidiary companies are managed under a subsidiary charter that includes an annual comprehensive subsidiary performance review. A representative from the Bank sits on most of the Boards to ensure that the interests of the Bank are taken care of and that the activities of the subsidiaries and associate companies are also conducted in accordance with the standards that are followed by the Bank. The financial performance of each subsidiary and associate is monitored by the Bank as the parent company and any indicators of financial distress are promptly brought to the attention of the Bank’s management for corrective action. Simultaneously, relevant information is reported to the Chief Risk Officer of the Bank in order to ensure that the risks of Group companies are managed within acceptable levels and that the Group companies do not pose any undue risk to the Bank.

The total assets increased to LKR 1.9 trillion from LKR 1.7 trillion with a remarkable growth of 17% in 2017. The Bank has achieved a strong assets base enriched with a healthy loan portfolio and highly secured financial investments that represent more than 90% of total assets.