Sustainability

Committing Our “Numbers” to Sustainability

BoC Sustainability Policy

The Bank of Ceylon has adopted the Sustainable Development Goals (SDGs) which were promulgated by the United Nations General Assembly in 2016. The SDGs include 17 individual goals which cover a wide range of social and economic issues; poverty, food security, education, health, environment, climate change, and governance. The SDGs do not see their role as being limited to Government, but also envisage that business too makes its contribution. The Bank has integrated the SDGs into all its activities. Details of how the individual SDGs are addressed are given under the respective capitals.

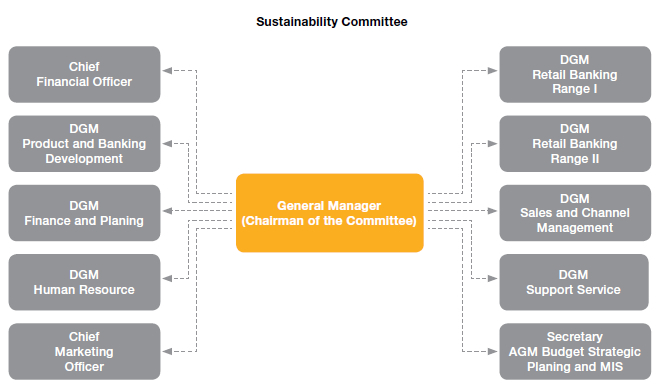

Organisationally, the task of implementing the SDGs is spearheaded by a Board appointed Sustainability Committee headed by the General Manager. The Committee is responsible for ensuring that sustainability considerations are embedded into all the Bank’s key business decisions and processes. This implies that all activities should be carried out not with a narrow bottom line focus, but also giving consideration to their broader economic, social and environmental impact. Such considerations should include both the short-term and the long-term perspectives. The SDGs provide a framework for an organisation to look at the value it is creating with a triple bottom line focus.

The Bank’s position as the largest bank in the country and as a financial intermediary gives it the potential to make a tremendous contribution. The Bank can play a part not only through its own activities; it can also do so throughout its value chain especially through its lending practices.

However, the most important aspect of sustainable value creation is the impact that the Bank’s operations, products, services and customer relationships is having on the financial sector. To achieve a positive impact in the long term, it is essential that the Bank acts ethically and transparently with customers, business partners, regulators and Government. It is therefore necessary that the Bank practices sound practices supported by well structured systems, rules and procedures.

The Bank therefore, has to conduct its activities, considering not only its own profitability but with a view to furthering the well being of society from a broader economic, social, and environmental perspective. It has to serve the underprivileged by promoting financial inclusiveness. It has to try to promote activities that safeguard the environment and combat climate change. When the Bank develops new products, services and lending practices it has to do so within a broad paradigm which takes the SDGs into account. It is then that the Bank can ensure its sustainability and continuance of value creation in the long term.