Corporate governance

Our dedication to corporate governance

We constantly endeavour to deliver optimised shareholder value through our commitment to highest Corporate Governance standards encompassed in our governance charters, policies, procedures and clearly defined responsibilities. The manner in which the objectives of the Company are set and achieved: risk is monitored, balanced and assessed, and performance is optimised is reflected in our Corporate Governance structure to ensure the delivery of sustainable stakeholder value and establish strong and balanced economic development of the Company with the ultimate goal of making trustworthy, positive and influential, contribution to financial system of the country.

Compliance statement

While we are relentlessly committed to uphold the highest standards of Corporate Governance within our organisation, we believe that building trust in our stakeholders is essential to maintain and improve the asset of the Company by constantly being focused on efficiency and transparency and increase of shareholder value. We have endeavoured to adhere with the corporate governance standards outlined in governance charters, policies and documents, the highlights and compliance to which are detailed in succeeding sections in this report.

The Board of Directors of the Company wishes to confirm that the Company has complied throughout the year with the provisions of the Finance Companies (Corporate Governance) Direction No. 03 of 2008 as amended by Directions No. 04 of 2008 and No. 06 of 2013, Code of Best Practice on Corporate Governance issued by The Institute of Chartered Accountants of Sri Lanka (CA Sri Lanka) and Corporate Governance Rules embedded in the Listing Rules of the Colombo Stock Exchange (CSE) to the extent hereinafter disclosed in this report.

The Board of Directors also wishes to confirm that, to the best of its knowledge and belief, the Company has complied with all the requirements under the Companies Act No. 07 of 2007 and satisfied all statutory payment obligations to the Government and the statutory/regulatory bodies.

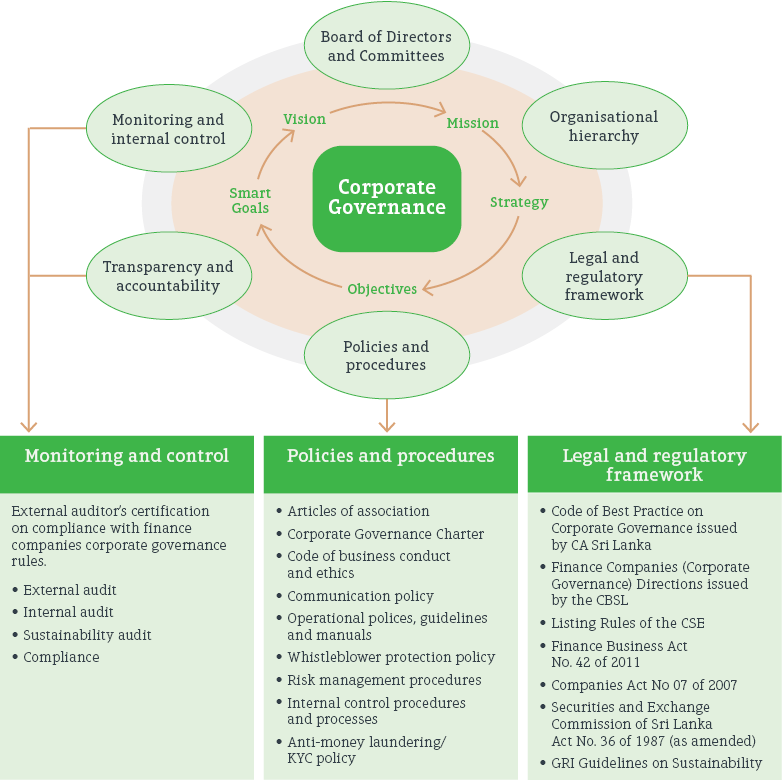

Corporate governance framework

We employ a dynamic corporate governance framework with strong set of policies, procedures along with an efficient mechanism focused on the protection of stakeholder interests by ensuring independency and transparency at all levels in the backdrop of regulation from external benchmarks and impact from internal benchmarks.

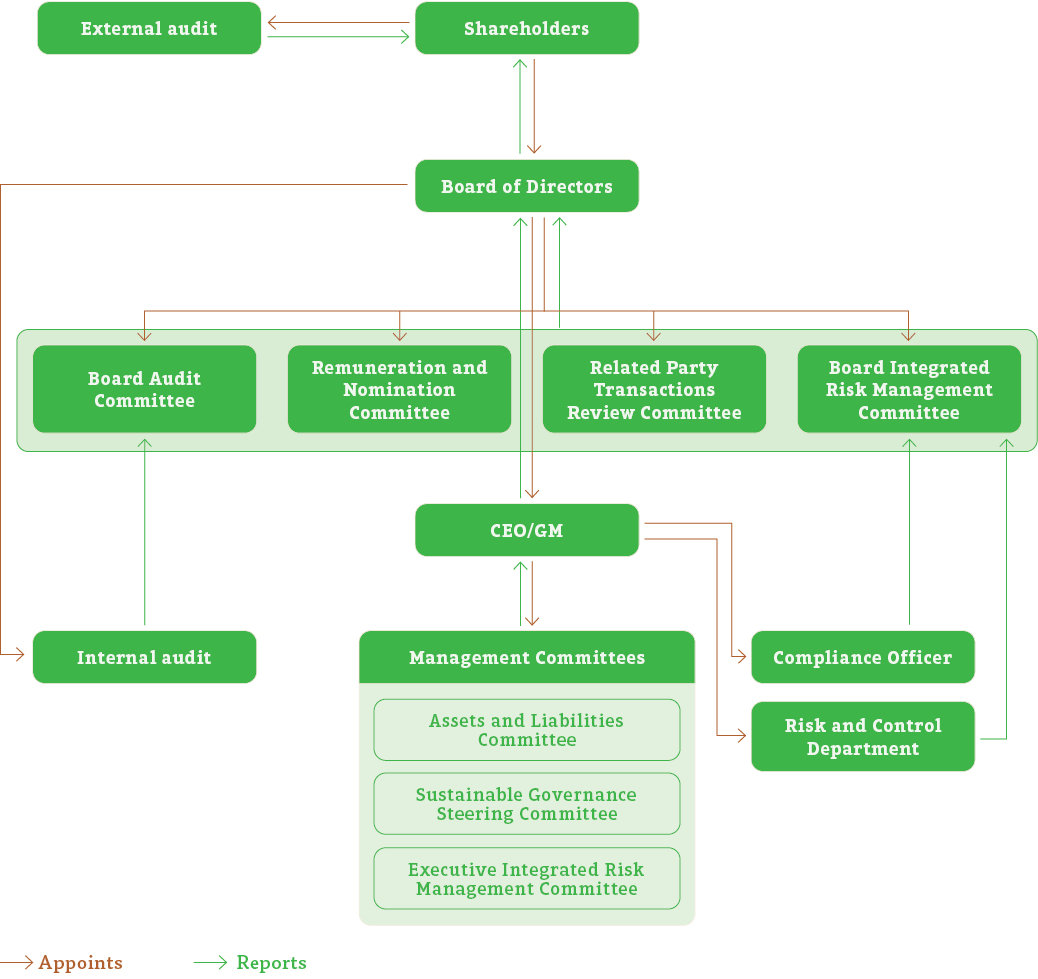

Our internal governance structure

Our governance structure provides a strong foundation for good governance with oversight, accountability, and improved decision-making ensuring sustainable behaviour combined with effective risk management, internal controls, and compliance.

The Board and subcommittees

The Board

The commitment of our Board to Corporate Governance is an integral element for the achievement of the Group’s strategy in an ethical and effective manner to ensure the continued satisfaction of the stakeholders.

As the drivers of the Corporate Governance, all Directors pay significant caution and allocate time to attend the meetings and provide independent judgment on matters relating to strategy, performance, risk management, governance and business conduct.

The Board concedes the responsibility to ensure that the annual report represents a balanced and accurate view of Corporate Governance practices and the salient matters which are expected to affect the stakeholders.

During the period under review the Board was reconstituted two times with effect 30 December 2019 and with effect 19 February 2020. Pleas refer pages 80 and 81 for details on appointments and the resignations of Directors.

Key areas of the Board during the financial year 2019/20| Governance |

|

| Strategy and Business |

|

| Risk and Oversight |

|

| Stakeholder engagement |

|

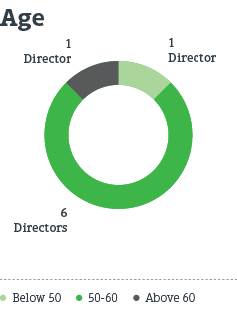

Composition of the Board and financial acumen

The present Board is comprised of eight (8) qualified professionals who possess experience and skills in diversified areas including banking, accounting and finance, business administration, management consulting, marketing, human resource management and legal. All the eight members of the Board are Non-Executive Directors of whom three members are independent. Thus, the capability to compete with dynamic business environment is guaranteed by a well-balanced Board.

Four members of the Board including the Chairman are Chartered Accountants with sound knowledge in finance to offer guidance to the Board in matters relating to Finance, and the members are continuously updated on revisions to accounting and regulatory standards.

Board meetings

Board meetings are held on a regular basis to discuss and take appropriate decisions covering the spheres of strategy, financial risk, governance and compliance. Board meetings are held within an interval of one month except in situations where the Board calls for special deliberations on significant matters. At the monthly meeting the Board reviews the performance in line with economic, environmental and social aspects, opportunities arising from them and associated risk. The Chairman sets the agenda for Board meeting with the assistance of the Company Secretary.

Managing effectiveness of meetings

From 1 April 2019 to 31 December 2019

| Name of the Director | Date of Appointment | Retirement/Resignation | Executive/ Non-Executive | Independent/ Non-Independent | Board Meetings | Board Audit Committee Meetings | Board Integrated Risk Management Committee Meetings | Remuneration and Nomination Committee Meetings | Related Party Transactions Review Committee Meetings | ||||||||||

| 1. | Mr Hemasiri Fernando | 8 April 2015 | 12 Oct. 2019 | Non-Executive | Non-Independent | 6/6 | – | – | – | – | |||||||||

| 2. | Mr Pradeep Amirthanayagam | 8 April 2015 | 19 Feb. 2020 | Non-Executive | Independent | 7/8 | 3/4 | 2/2 | 3/4 | 2/2 | |||||||||

| 3. | Mr Anise Rizwan | 8 April 2015 | 30 Dec. 2019 | Non-Executive | Independent | 8/8 | 4/4 | 2/2 | – | 2/2 | |||||||||

| 4. | Mr Johnson Fernando | 8 April 2015 | 30 Dec. 2019 | Non-Executive | Non-Independent | 7/8 | – | – | 4/5 | 0/2 | |||||||||

| 5. | Mr Jehan Amaratunga | 8 April 2015 | 30 Dec. 2019 | Non- Executive | Non-Independent | 8/8 | 4/4 | – | 5/5 | – | |||||||||

| 6. | Mr Rasitha Gunawardena | 29 Aug. 2016 | 25 June 2020 | Non-Executive | Non-Independent | 8/8 | – | 2/2 | 1/1 | – | |||||||||

| 7. | Dr Kennedy Gunawardana | 9 Oct. 2018 | 30 Dec. 2019 | Non-Executive | Independent | 8/8 | – | – | – | – | |||||||||

| 8. | Mr Edward Weerasinghe | 9 Oct. 2018 | 30 Dec. 2019 | Non-Executive | Independent | 7/8 | – | – | – | – | |||||||||

| 9. | Mr Rohan Pathirage | 10 July 2019 | Non-Executive | Non-Independent | 5/5 | – | – | – | 1/1 | ||||||||||

From 31 December 2019 to 18 February 2020

| Name of the Director | Date of Appointment | Retirement/Resignation | Executive/ Non-Executive | Independent/ Non-Independent | Board Meetings | Board Audit Committee Meetings | Board Integrated Risk Management Committee Meetings | Remuneration and Nomination Committee Meetings | Related Party Transactions Review Committee Meetings | ||||||||||

| 1. | Mr Pradeep Amirthanayagam | 8 April 2015 | 19 Feb. 2020 | Non-Executive | Independent | 1/1 | – | – | – | – | |||||||||

| 2. | Mr Rasitha Gunawardena | 29 Aug. 2016 | 25 June 2020 | Non-Executive | Non-Independent | 1/1 | – | – | – | – | |||||||||

| 3. | Mr Rohan Pathirage | 10 July 2019 | Non-Executive | Non-Independent | 1/1 | – | – | – | – | ||||||||||

| 4. | Mr Bonniface Silva | 30 Dec. 2019 | 19 Feb. 2020 | Non-Executive | Non-Independent | 1/1 | – | – | – | – | |||||||||

| 5. | Mr Ranjith Kodituwakku | 30 Dec. 2019 | 19 Feb. 2020 | Non-Executive | Non-Independent | 1/1 | – | – | – | – | |||||||||

| 6. | Mr Azzam A Ahamat | 30 Dec. 2019 | Non-Executive | Non-Independent | 1/1 | – | – | – | – | ||||||||||

From 19 February 2020

| Name of the Director | Date of Appointment | Retirement/Resignation | Executive/ Non-Executive | Independent/ Non-Independent | Board Meetings | Board Audit Committee Meetings | Board Integrated Risk Management Committee Meetings | Remuneration and Nomination Committee Meetings | Related Party Transactions Review Committee Meetings | ||||||||||

| 1. | Mr Sujeewa Rajapakse | 19 Feb. 2020 | Non-Executive | Non-Independent | 2/2 | – | – | – | – | ||||||||||

| 2. | Mr Rasitha Gunawardena | 29 Aug. 2016 | 25 June 2020 | Non-Executive | Non-Independent | 2/2 | – | – | – | – | |||||||||

| 3. | Mr Rohan Pathirage | 10 July 2019 | Non-Executive | Non-Independent | 2/2 | – | – | – | – | ||||||||||

| 4. | Mr Sudarshan Ahangama | 19 Feb. 2020 | Non-Executive | Non-Independent | 2/2 | – | – | – | – | ||||||||||

| 5. | Mr Clive Fonseka | 19 Feb. 2020 | Non-Executive | Non-Independent | 2/2 | – | – | – | – | ||||||||||

| 6. | Mr Chanura Wijetillake | 19 Feb. 2020 | Non-Executive | Independent | 2/2 | – | – | – | – | ||||||||||

| 7. | Mr Asoka Bandara | 19 Feb. 2020 | Non-Executive | Independent | 1/2 | – | – | – | – | ||||||||||

| 8. | Mr Azzam A Ahamat | 30 Dec. 2019 | Non-Executive | Non-Independent | 2/2 | – | – | – | – | ||||||||||

| 9. | Ms Coralie Pietersz |

1 Mar. 2020 |

Non-Executive |

Independent |

– | – | – | – | – | ||||||||||

Chairman’s role

The Chairman plays a significant role in maintaining the high standards of Corporate Governance. Leading the Board, he guides the CEO and the management and ensures the overall effectiveness of the Board, Board committees, and the Directors. He also ensures that each Director is given an opportunity to contribute to the decision making process and to exercise their independent judgement.

Evaluation of Board performance

Performance of the Board and the Board committee is annually reviewed through a confidential questionnaire prepared in line with the guidelines given in the Corporate Governance Charter of the Company.

Findings of the Board evaluation are analysed and presented by the Company Secretary to the Board. The Board and Board Committee evaluations for the financial year 2019/20 were commenced in June 2020, and the finding were tabled before the Board at its meeting held in July 2020. Based on the findings, it is duly affirmed that overall, the Board and its committees functioned effectively during the year under review. The Board has identified the areas that need to be improved, and are in agreement that appropriate action will be implemented to address same.

Assessment of independence

Annual assessment on the independence of the Directors was carried out in June 2020, based on the compliance criteria set out by Finance Companies (Corporate Governance) directions, Code of Best Practice on Corporate Governance issued by CA Sri Lanka and the Listing Rules of the CSE, and the findings were tabled before the Board at the meeting of the Board of Directors held in July 2020.

In assessing the independence, business relationship of the Director with the Group, with the members of the management and Company’s substantial shareholders and member’s length of service are taken in to account.

Board continuity

We believe that the continuity of the Board is an integral part in good governance. Therefore, the Board is constituted in a manner that diversified range of industrial knowledge, skills and experience including spheres covering economic, environmental and social factors are brought in to the Board.

Appointment of members to the Board is done subsequent to a cohesive deliberation on the suitability of proposed members by the Board based on the recommendations made by the Remuneration and Nomination Committee. The process of selection and appointment of Directors is provided for in the Corporate Governance Charter and the Articles of Association of the Company.

Induction and ongoing training

Continuous development of Directors is ensured through building up their expertise while developing an in-depth understanding of the business and of the operating market. The Directors are provided with an induction to provide themselves with effective knowledge in business, operations, financial affairs, Group’s value, governance framework and strategic position of the Company. Furthermore, the Directors are given an opportunity to familiarise themselves with their responsibilities as Directors as enumerated in the Corporate Governance Charter.

Moreover, any change in the relevant legislations, regulations and corporate governance and sector developments that could affect the Group covering a wide area including economic, social and environmental aspects are updated at the meeting to Board committees and to the full Board as appropriate.

Board Committees

Board has delegated certain of its functions to subcommittees comprised of members of the Board, who are appointed thereto after careful evaluation on their qualifications and experience on the relevant subject matter falling under the purview of the subcommittees. This enables the Board to allocate adequate time to matters within its sphere. The Committee mandates are periodically reviewed in line with the developments in the regulatory and Governance Framework. Each committee is responsible for fulfilling the duties entrusted to it in accordance with its respective mandate, to take action, monitor, advise and make recommendations to the Board. Thus, Committees are responsible to add value and transparency to the Board. The Committee Chairmen report to the Board on the activities of the respective committee at Board meetings and are accountable for the effective functioning of the Committees.

| Board Committee | Composition | Key Areas of Focus | Key Highlights of the Year |

| Board Audit Committee (BAC) |

|

|

|

| Board Integrated Risk Management Committee (BIRMC) |

|

|

|

| Remuneration and Nomination Committee (RNC) |

|

|

|

| Related Party Transactions Review Committee (RPTRC) |

|

|

|

Company Secretary

Company Secretary is appointed by the Board and is accessible by all the members of the Board. Company Secretary assists in developing the Board meeting agenda in consultation with the Chairman, coordinates the Board meetings and prepares and maintains the minutes of the Board meetings.

Company Secretary assists the Chairman and the Board in implementing the corporate governance framework to

enhance long-term stakeholder interest and ensures compliance with relevant provisions in terms of Company’s Articles of Association, Rules and Regulations, Companies Act and Regulations of the Securities and Exchange Commission. Company Secretary ensures information flow within the Board, its subcommittees and the management.

Governance and ethics

Our commitment to sustainability

We recognise sustainability as one of the most pivotal factors to achieving the Company’s mission and the long-term competitiveness, and we believe that sustainability is the catalyst of our commercial success.

We have a dedicated CSR department focusing on the sustainable strategy of the Company. The Board has delegated the responsibility of co-ordination and monitoring of sustainability initiatives undertaken at various levels of the organisation to the CSR department, who in consultation with the Sustainability Governance Steering Committee engages with the shareholders in identifying economic, social and environmental factors which affect the Company’s operations, their risks and opportunities.

Periodical reports are presented by the CSR Department to the Board of Directors on a wide array of areas including the progress reports on the current sustainability initiatives, risks and opportunities arising from various economic, social and environmental factors affecting the business and the stakeholder concerns.

Management’s role in governance

Executive level committees formed at the management level ensure that the business operations are carried out within ethical and governance parameters defined by the Board. These management Committees implement the policies and strategies determined by the Board and manage the business and affairs of the Company to ensure the sustainable growth for all the stakeholders.

| Management Committee | Role of the Committee | Key matters taken up during the year | ||

| Assets and Liabilities Committee |

|

|

||

| Executive Integrated Risk Management Committee |

|

|

||

| Sustainability Governance Steering Committee |

|

|

Management of conflicts of interest

Our Code of Business Conduct and ethics requires all Directors and employees of the Company to refrain from using their position or confidential or price sensitive information as a benefit for himself or herself or to the benefit of any third party whether financial or otherwise.

The Directors are required to disclose to the Board of any potential conflict of interest which impairs his or her independent judgement. When a matter related to conflict of interest of a Director is taken into consideration, after declaring such interest, the Director refrains from engaging himself/herself in

the deliberation of such matter and avoids from voting thereon. The Company Secretary duly records such abstention in the minute.

The Related Party Transactions Policy of the Company provides clear directions on the categories of parties and persons who can be considered as related parties to the Company, in terms of the Related Party Transactions Policy. Self Declarations on Related Parties are obtained from the Directors enabling the identification of related parties well in advance. Our system continuously facilitates monitoring and reporting of related party transactions.

Role of the CEO

The CEO is the apex level executive position of the Company holding the responsibility of managing day to day operations with the support of the Management. CEO is accountable to the Board to recommend the Company’s strategy and its subsequent implementation to ensure that appropriate internal controls are in place to manage and assess the risk. He represents the management at the Board meetings.

Appraisal of CEO/GM

The CEO is responsible for operating the business in a manner which enables the achievement of the financial and non-financial targets set by the Board. The Performance of the CEO is appraised by the Board at the end of the financial year as well as at each Board meeting against set targets.

Succession plan for the Management

The Remuneration and Nomination Committee set up by the Board has recognised the importance of succession planning and leadership development plans. The current succession plan of the Company is under review by the Human Resources department to ensure the career development and the leadership development of the prospective successors to key positions of the Company.

Our approach to compliance

We are fortified with robust Compliance Policies and internal charters designed to institutionalise best corporate governance practices, support and maintain a transparent and effective internal control system as well as to manage risk and compliance.

Internal audit

Internal audit is responsible to provide an independent risk based oversight on the processes and controls within the Company to the Board Audit Committee and the Board to ensure the compliance with the relevant laws and regulations.

A set of appropriately qualified and well experienced employees are recruited at internal audit department to conduct risk based reviews, thus providing an assurance over financial, operational and IT functions.

The Board approved Audit Charter provides mandate and authority to the internal audit.

Internal control

Our internal control system facilitates the identification, evaluation and management of risks affecting the Group. These internal controls cover a wider area including financial, operational, compliance and information technology controls, risk management controls and mechanisms.

The effectiveness and the relevancy of the internal controls are reviewed by the Board with the assistance of the Board Audit Committee and the Board Integrated Risk Management Committee. The Board has obtained a certification from the external auditors on the process adopted by it on the system of internal controls over financial reporting.

Risk management

We have embedded risk management in our day to day business operations and strategic planning through a comprehensive risk management framework to ensure the identification and control of risks within the organisation.

A continuous process is in place for identifying, assessing, managing, monitoring and reporting on the level of risks encountered by the individual companies in the Group as well as the entire Group.

Compliance function

We have established a separate compliance function that directly reports to the Board Integrated Risk Management Committee, to ensure continuous compliance with existing and emerging regulations.

Refer pages 85 to 111 for detailed compliance tracker.

IT governance and cybersecurity

Information technology (IT) is a strategic asset that provides competitive benefit within a well-established IT governance structure.

Information security audits are carried out by the external auditors periodically to ensure the confidentiality, integrity and availability of our IT system.

The Board Integrated Risk Management Committee continuously monitors the implementation of the IT governance framework. The Head of ICT (Group) is accountable for the design, implementation and the execution of IT governance framework, and he provides regular updates on status of the material IT projects and related matters to the Board Integrated Risk Management Committee and to the Board. The Board has appointed the Head of ICT (Group) as the Chief Information Officer of the Company.

Engagement with shareholders

Our governance culture is committed to promote a fair and equitable treatment to all shareholders, so that the shareholders rights are respected and protected at all times. Thus, we ensure the maintenance of good stakeholder relationship to achieve our commercial viability.

Constructive use of Annual General Meeting (AGM)

The notice of the AGM is communicated individually to shareholders 15 working days prior to holding the same, and such notice includes the nature of the matters to be discussed at the meeting. If a shareholder is unable to attend the meeting, Articles of Association of the Company allows appointment of a proxy who is empowered to vote at the meeting on behalf of the shareholder, and the Board should be informed at least 48 hours before the scheduled time of the meeting appointing a proxy. The shareholders are able to actively engage in discussion on performance and Company related matters at the AGM.

-EDIT-web-resources/image/PLC_Image.png)

Ranked No. 03 in Transparency in Corporate Reporting

(TRAC) which assessed top 50 Listed Companies

in Sri Lanka

Compliance with code of best practice on corporate governance

Compliance with the Code of Best Practice (The Code) issued by The Institute of Chartered Accountants of Sri Lanka – 2017

| Code reference | Principle and compliance | Status of compliance | Reference to report |

| The Company | |||

| A Directors | |||

| A.1 | The Board The Board of Directors of People Leasing & Finance (“the Company”) consists of nine eminent professionals from different disciplines such as banking, accounting and finance, business administration, management consulting, marketing, human resource management and legal, who are effective and dedicated to ensuring that the Company achieves its objectives. All Directors possess a range of skills, experience and knowledge complemented with high sense of integrity and independent judgement to provide leadership to the Company. |

Board of Directors | |

| A.1.1 | Conducting regular Board meetings The Board meets on a monthly basis and has met 11 times during the financial year to review the performance of the Company and its subsidiaries. The Board devoted a substantial time in evaluating the Company’s strategy, performance, risk profile and compliance with governance and other statutory requirements ensuring that appropriate and prompt action was taken to align the strategies and operations of the Company and the Group with the interests and expectations of all stakeholders. The structure and process of submitting information to the Board is documented in the Board approved Corporate Governance Charter of the Company. The Board meeting scheduled for 31 March 2020 was cancelled due to the island wide curfew imposed by the Government pursuant to threat of spread of the COVID-19 virus. In respect of the non-compliance with this provision, it has been confirmed by the CBSL that there will be no regulatory sanctions imposed on the Company. |

CG – Board Meeting | |

| A.1.2 | Roles and responsibilities of the Board The Board’s principal responsibilities and duties are defined in the Company’s Corporate Governance Charter and are updated to meet the requirements of the Code of Best Practice on Corporate Governance. |

||

| A.1.3 | Act in accordance with laws of the country The Board collectively as well as individually complied with the laws of the country that are applicable to the Company. The Company’s Corporate Governance Charter and the Code of Business Conduct and Ethics have been clearly formulated and, approved where procedures are in place for the Directors to seek independent professional advice when deemed necessary. |

||

| A.1.4 | Access to services of Company Secretary and removal of Company Secretary All Directors have access to the Company Secretary who is an Attorney-at-Law by profession. The Board is responsible for the appointment or the removal of the Company Secretary. |

CG – Company Secretary | |

| A.1.5 | Independent judgement of the Board The Board works as an effective and cohesive unit that draws on the strengths of each Director without placing undue reliance on any one individual. Thus, All Directors are free to exercise independent judgment in decision making by the Board on issues of strategy, performance, resource allocation and the conduct of business |

CG – The Board CG – Management of conflict of interest | |

| A.1.6 | Dedicate adequate time and effort to Board matters Members of the Board dedicate adequate time and effort at Board and Committee meetings in ensuring the effective discharge of their duties and responsibilities to the Company. Board Papers, Committee Papers and minutes are dispatched in advance of the scheduled meetings to the Directors. |

CG – Board Meetings CG – Key areas of focus of the Board during the financial year 2019/20 | |

| A.1.7 | Directors to call for resolutions in the best interest of the Company In the best interest of the Company, one-third of the Directors can call for a resolution to be presented to the Board. However, there were no such instances in the year under review. |

||

| A.1.8 | Induction and training for the Board When first appointed to the Board all Directors receive an induction and Management regularly updates Directors of any development on the Finance industry and new regulations. In addition Directors engage in Continuing Professional Development in their respective field. |

CG – Induction and Ongoing training | |

| A.2 | Division of business of the Board from the executive responsibility for management of the Company’s business The duties of the Chairman and the CEO are clearly defined where the Chairman is charged with the responsibility for providing leadership to the Board to drive towards the strategic vision and ensure the effectiveness of the Board whereas execution of the business operation of the Company with the assistance of the Senior Management is considered as the primary role of the Chief Executive Officer. |

CG – Chairman’s Role Role of the CEO | |

| A.2.1 | Separation of the roles of Chairman and the CEO There is a clear division of positions between the Chairman and CEO. The Chairman functions as a Non-executive Non-Independent Chairman whereas the CEO is the apex Executive Officer primarily responsible to conduct the business operations of the Company with the help of the Senior Management. |

||

| A.3 | Chairman’s role in preserving good Corporate Governance The Chairman is responsible for leadership of the Board, ensuring its effectiveness on all aspects and facilitating the contribution of all Board members on Board’s affairs while preserving good Corporate Governance. He is also responsible to ensure effective implementation of Board’s decisions, provide coherent leadership for the Company and understand the views of the shareholders and other stakeholders. |

CG – Chairman’s Role | |

| A.3.1 | Responsibility of the Chairman to conduct Board proceedings in a proper manner The role and responsibilities of the Chairman for preserving good corporate governance and running the Board in an orderly and effective manner is set out in the Company’s Corporate Governance Charter and is reviewed by the Board. |

||

| A.4 | Availability within the Board those with financial acumen and knowledge During the year 2019/20, the Board comprised members with academic and professional qualifications in banking, accounting and finance, business administration, management consulting, marketing, human resource management and legal. |

CG – Composition of the Board and financial acumen | |

| A.5 | Availability of balance of Executive and Non-Executive Directors in the Board All Directors are Non-Executive Directors |

||

| A.5.1 | Board to include at least three or one-third of total number of Directors, whichever is higher, to be Non-Executive Directors During the year 2019/20, the Board comprised only of Non-Executive Directors who bring a wealth of knowledge and experience covering a wide spectrum of topics and their views carried a significant weight in the Board’s decisions. All the members of the Board including the Chairman are Non-Executive Directors. |

CG – Composition of the Board and financial acumen | |

| A.5.2 | Need for three or two-third of Non-Executive Directors, whichever is higher, to be independent Only three of the nine Directors are deemed as Independent Directors as at 31 March 2020. |

||

| A.5.3 | Determination of independence of Directors All the Independent Non-Executive Directors of the Company during 2019/20 met the criteria for independence as set out in the applicable rules and regulations including Code of Best Practice on Corporate Governance (Code) and are deemed to be independent of management and free of business or other relationship that could materially interfere with the exercise of their unfettered and independent judgement. |

CG – Assessment of independence | |

| A.5.4 | Declaration of Directors on Independence During the year under review, self-declarations were submitted by each Non-Executive Director declaring his status of independency in terms of the applicable rules and regulations. |

CG – Assessment of independence | |

| A.5.5 | Board annual determination of independence or non-independence of each Non-Executive Directors Based on the annual declaration submitted by Directors the independence of Non-Executive Directors are evaluated annually to ensure compliance with the criteria for determining independence in line with the requirements of the applicable regulations and the Code. |

||

| A.5.6 | Appointment of Alternate Director by Non-Executive or Independent Directors to meet the same criteria No alternate Directors were appointed during the year 2019/20 |

N/A | |

| A.5.7 | Appointment of Senior Independent Director in the event the Chairman is not independent The Company has designated a Non-Executive Director as the Senior Independent Director in compliance with the Finance Companies (Corporate Governance) Directions. Hence, Mr M P Amirthanayagam, an Independent Non-Executive Director functioned as Senior Independent Director of the Company until he was appointed Chairman of the Company on 25 October 2019. Ms M Coralie Pietersz was appointed as Senior Independent Director with effect from 1 March 2020, subsequent to the appointment of the new Non-Independent Chairman Mr Sujeewa Rajapakshe. |

||

| A.5.8 | The Senior Independent Director should make themselves available for confidential discussions with other Directors The Board approved Terms of Reference for the Senior Independent Director appointed in terms of Finance Companies (Corporate Governance) Directions requires him/her to make himself/herself available for confidential discussions with other Non-Executive Directors who may have concerns which they believe have not been properly considered by the Board as a whole and call a meeting of the Non-Executive Directors if, in his opinion, it is necessary. Senior Independent Director ensures to be present at the Annual General Meeting of the Company where all shareholders are given the opportunity to express their concerns and question the Senior Independent Director on their concerns. |

||

| A.5.9 | Chairman to hold meetings exclusively with the Non-Executive Directors at least once each year During the year 2019/20, the Board comprised only Non-Executive Directors and therefore this need did not arise. |

N/A | |

| A.5.10 | Matters that cannot be unanimously resolved to be recorded in Board Minutes The Directors’ concerns pertaining to unresolved matters are discussed and recorded by the Company Secretary in the Board minutes in sufficient detail. Further discussions on these matters are pursued at the next Board meeting with a view to resolving them. However, no such issues arose during the year under review. |

||

| A.6 | Supply of information The Company believes that reliable and timely information increases confidence among decision-makers within the Company and enables them to make good business decisions directly affecting business growth, profitability and sustainability. |

||

| A.6.1 | Management obligation to provide Board with appropriate and timely information The Management ensured that the Board was provided with timely, accurate, relevant and comprehensive information before the Board meeting every month, with adequate time for them to review the same and prepare for discussions. The Board made inquiries for additional information from the Management where necessary. Further, the Chairman ensured that all Directors were adequately briefed on issues arising at Board meetings. |

||

| A.6.2 | Need to provide the minutes, Agenda and papers required for a Board meeting at least seven (7) days before the meeting The agenda and Board papers are circulated a week prior to Board meetings. The minutes of the meeting are ordinarily provided to the Directors at least one week prior to the next Board meeting along with the Board Papers. |

||

| A.7 | Appointment to the Board A formal, transparent and a comprehensive procedure applicable to the selection and appointment of new Directors to the Board are provided in the Company’s Articles of Association and the Corporate Governance Charter. |

||

| A.7.1 | Establishment of Nominations Committee to make recommendations on new Board appointments A Remuneration and Nomination Committee has been established. |

Remuneration and Nomination Committee Report | |

| A.7.2 | Board Composition to be assessed annually During the annual self-evaluation process, the Board as a whole assesses its own composition to ascertain whether the experience and the exposure of the Board members are adequate to meet the strategic demands faced by the Company and findings of these assessments are taken in to consideration in the appointment of new Directors. |

CG – Evaluation of Board performance | |

| A.7.3 | Appointment of new Director to the Board to be disclosed to the shareholders The Board was reconstituted twice during the year under review, both of which were communicated to the shareholders with an immediate disclosure through the Colombo Stock Exchange. All together there were nine new appointments of Directors during the year under review. |

||

| A.8 | Re-election In terms of Article 27 (2) of the Articles of Association of the Company all Directors who have been appointed to the Board during the year retire at the next Annual General Meeting and are eligible for re-election by the shareholders. |

||

| A.8.1 | Non-Executive Directors should be appointed for specific terms subject to re-appointment Although the Non-Executive Directors are not appointed for a specified time period, they are nevertheless subject to re-election at the Annual General Meeting in terms the Articles of Association of the Company and to the provisions of the Companies Act relating to the removal of a Director. |

||

| A.8.2 | All Directors including the Chairman should be subject to election by the shareholders at the first opportunity after appointment and re-election at regular intervals In terms of Article 27 (2) of the Articles of Association of the Company, all Directors, including the Chairman, are subject to re-election by shareholders at the first opportunity after their appointment. Accordingly, the existing members of the Board as at the Annual Report date have offered themselves for re-election at the forthcoming Annual General Meeting. |

||

| A.8.3 | Communicating reason for resignation to the Board During the year under review, Mr Hemasiri Fernando, Chairman retired on 12 October 2019 upon reaching the age of 70 years. The resignations of Mr Jehan Prasanna Amaratunga, Mr Johnson Anthony Fernando, Mr Mohamed Rizwan Mohamed Anise, Dr Kennedy Degaulee Gunawardana, Mr N W A M U K K E Weerasinghe were approved by the Central Bank of Sri Lanka on 30 December 2019, and the resignations of Mr Pradeep Amirthanayagam, Mr Ranjith Kodituwakku, Mr M A Bonniface were approved by the Central Bank of Sri Lanka on 19 February 2020. The resignation of Mr Rasitha Gunwardana was approved by the Central Bank of Sri Lanka on 25 June 2020. Their letters of resignation were tabled before the Board for discussion and were submitted to the Central Bank of Sri Lanka for approval. Subsequent to obtaining approval from the Central Bank of Sri Lanka, immediate disclosures pertaining to the resignations were made to the public through the Colombo Stock Exchange. |

||

| A.9 | Appraisal of Board performance The Board periodically appraises their performance to provide them with an important opportunity to review whether they are meeting their fiduciary responsibilities and adding value to stakeholders. |

CG – Evaluation of Board Performance | |

| A.9.1 | Annual appraisal of Board and its’ Committees on its performance in the discharge of its key responsibilities In accordance with the Corporate Governance Charter of the Company, the Board carried out a comprehensive evaluation of its performance and its committees in June 2020. The full results of the Board evaluations were analysed by the Company Secretary and the findings were presented to the Board in July 2020. |

||

| A.9.2 | Annual self-evaluation of Board performance and Board committees The self-evaluation carried out by the Board in 2019/20 included an evaluation of the performance of the Board as a whole as well as of its committees. |

||

| A.9.3 | Review participation, contribution and engagement of Directors at the time of re-election Goals and targets of the Board have been clearly set out and evaluated at the end of each year. |

||

| A.9.4 | State how performance evaluations have been conducted in the Annual Report The process of self-evaluation of the Board carried out in 2019/20 was led by the Chairman and supported by the Company Secretary. The full results of the Board evaluations were then analysed and presented to the Board in July 2020, which duly affirmed that the Board and its committees operated effectively during the year under review. |

||

| A.10 | Disclosure of information in respect of Directors The Company places considerable importance to the timely disclosure of all relevant information to the shareholders enabling them to make informed decisions. |

Board of Directors | |

| A.10.1 | Annual Report to disclose specified information regarding Directors Profiles of the Directors, including their qualifications, expertise, experience and directorships, Directors’ status, attendance at Board and committee meetings and their other Board seats or equivalent positions and related party transactions of the Directors can be found in this Report |

CG – Attendance at Board and Board Committee Meetings – Related Party Disclosure | |

| A.11 | Appraisal of Chief Executive Officer (CEO) The Chief Executive Officer (CEO), the apex executive of the Company is delegated by the Board with the authority of detailed planning and implementation of the strategic objectives and policies of the Company and day-to-day operations of the Company in accordance with appropriate risk parameters and is assessed annually. |

CG – Appraisal of CEO/GM |

|

| A.11.1 | Board in consultation with the CEO to set financial and non-financial targets to be met by the CEO All financial and non-financial targets are set by the Board in consultation with the CEO at the beginning of each financial year in line with the short, medium and long-term objectives and overall strategic plan of the Company. |

||

| A.11.2 | Performance of the CEO to be evaluated by the Board at the end of each fiscal year Assessment of the performance of the CEO by the Board is an ongoing process. The performance of the CEO is evaluated by the Board at the end of each financial year by comparing the performance of the Company with the financial and non-financial targets set at the beginning of the financial year. |

||

| B Directors Remunerations | |||

| B.1 | Remuneration procedure The Company has established a formal and transparent remuneration procedure in place for developing and effective remuneration policy to avoid potential conflict of interest. The Board has established a Remuneration Committee comprising solely of Non-Executive Directors with written terms of reference. There were no Executive Directors on the Board of the Company during the year 2019/20 and therefore, the necessity to consult the Chairman and/or CEO on their remuneration did not arise. |

Remuneration and Nomination Committee Report | |

| B.2 | Level and Make-up of remuneration The remuneration framework of the Company is sufficient to motivate and reward performance and complies with regulatory requirements and stakeholder expectations. There were no Executive Directors on the Board of the Company during the year under review and hence the need for attractive packages and performance related remuneration for such Directors is not applicable. Nevertheless, the Board is aware that the remuneration of Executive and Non-Executive Directors should reflect the market expectations and is sufficient enough to attract and retain the quality of personnel needed to run the Company and promote its long-term success. Therefore, the remuneration structure of the Company is reviewed from time to time with comparison to that of peers in the industry. Due to the relatively small size and scale of other companies in the Group, weight is given to the industry comparable when deciding on salary increase levels. However, the Group endeavours to maintain a consistent policy of remuneration across the Board. At present, the Company does not have any share option scheme for the Directors or employees. |

||

| B.3 | Disclosure of remuneration The Company has consistently applied the principle that its remuneration policy should be fair and competitive and should be reflective of the performance of the business. A Statement on Remuneration Policy and details of remuneration of the Board as a whole are detailed in this Report. |

Related party disclosure note |

|

| C Relations with shareholders | |||

| C.1 | Constructive use of Annual General Meeting (AGM) and conduct of General Meetings The Board uses an Annual General Meeting to communicate the Group’s performance with shareholders and encourages their active participation. Annual Report containing the Notice of Meeting is sent along with the Form of Proxy to the shareholders 15 working days prior to the date of the AGM required by the statute. The Company proposes separate resolutions on each substantially separate issue giving shareholders the opportunity to vote on each such issue separately. The adoption of the Annual Report of the Board of Directors, the Financial Statements of the Company and the Report of the Auditors thereon are considered as a separate resolution. Proxy votes together with the votes of the shareholders present at the AGM are considered by the Company for each resolution. The Company records all proxy votes to indicate to the Chairman the level of proxies lodged on each resolution and the number of votes for and against such resolution. “Votes withheld” are not counted in the calculation of the proportion of the votes for and against resolutions. The Chairman of the Board ensures that the Chairmen of Board subcommittees and the Senior Independent Director are present at the AGM to answer any query by shareholders. The former Senior Independent Director and the Chairmen of the Board subcommittees prior to the reconstitution of the Board effective 19 February 2020 were present at the previous years’ AGM held on 31 July 2019 and no queries were raised by the shareholders. |

CG – Engagement with shareholders | |

| C.2 | Communication with shareholders Recognising the importance of two-way communication with its stakeholders, the Board has adopted a comprehensive policy that governs communications with its shareholders and other stakeholders. The Communication Policy is based on four guiding principles, efficiency, transparency, clarity and cultural awareness and feedback. The Communication Policy, which forms an integral part of the Corporate Governance Charter of the Company was reviewed and approved by the Board. The Company Secretary and the Corporate Affairs Division maintains records of all correspondence received from shareholders and direct the same to appropriate channels for resolution. All major issues and concerns of shareholders are referred to the Board. Upon receipt of instructions from the Board or other relevant channel on issues/concerns referred to them as above, the Company Secretary or the Corporate Affairs Division revert to the respective shareholder with an appropriate response. Shareholders can contact the Company Secretary, whose details are given below, on matters relating them, Ms Lakmini Kottegoda Company Secretary People’s Leasing & Finance PLC 1161, Maradana Road Colombo 8 Sri Lanka. Phone : +94 11 263 1103 Fax : +94 11 248 1500 The Senior Independent Director is available to discuss with shareholders any major issues that cannot be resolved through normal channels. |

CG – Communication and engagement with shareholders | |

| C.3 | Major and material transactions The Board recognises that strong transparent disclosure is central to shareholder ability to exercise ownership rights. During the year, there were no major or material transactions engaged in or committed to by the Company as defined by Section 185 the Companies Act No. 01 of 2007. |

||

| D Accountability and audit | |||

| D.1 | Financial and Business Reporting (The Annual Report) The Directors are aware of their responsibility to present a balanced and understandable assessment of the Company’s financial position, performance, business model, governance structure, risk management, internal controls and challenges, opportunities and prospects. Due care has been exercised to ensure that all statutory requirements are complied within the Annual Report and the issue of interim accounts on a timely basis and regulatory reports were filed by the due dates. Prior to approving the Financial Statements covering a particular financial period, the Board obtains the declaration of the CEO and the Chief Financial Officer on their responsibility in respect of financial reporting. The Company has in place a Related Party Transaction (RPT) Policy and it adequately discloses Related Party Transactions. The Code of Business Conduct and Ethics of People’s Leasing (“the Code”) requires each member of the Board to determine whether he/she has a potential or actual conflict of interests arising from personal relationships, external associations and interest in material matters which may have a bearing on his/her independent judgment. The Code also requires Directors who have such a potential or actual conflict of interests to immediately disclose it to the Board of Directors as soon as he/she becomes aware of it and records thereof are maintained by the Company Secretary in the Interest Register. |

Annual Report of the Board of Directors on the Affairs of the Company Directors Responsibility for Financial Reporting Directors’ Statement on Internal Control over Financial Reporting Independent Auditor’s Report Management Discussion and Analysis Related Party Transactions Review Committee Report Related Party Disclosure (Note) | |

| D.2 | Risk management and internal control The Board is responsible in determining the risk appetite for achieving the strategic objectives of the Company and ensuring that the Company maintains an adequate system of internal control and for reviewing its effectiveness. The Company’s internal controls are designed to support the identification, evaluation and management of risks affecting the Group. These cover financial, operational, compliance and information technology controls, as well as risk management policies and mechanisms. Risks and controls are reviewed and monitored regularly for relevance and effectiveness. The Board Integrated Risk Management Committee (BIRMC) and the Board Audit Committee (BAC) assist the Board in this regard. Further, the Company has its own in-house Internal Audit Department. The Internal Audit Department of the Company carries out regular reviews on the risk management measures and internal controls system including internal controls over financial reporting and reports their findings to the Board Audit Committee, who then on behalf of the Board, undertakes a detailed monitoring and reviewing of the said controls and risk management measures. The minutes of the Board Audit Committee meetings together with the Committee’s findings on internal controls and risk management functions are submitted at the meetings of the Board of Directors periodically. |

Board Audit Committee Report Board Integrated Risk Management Committee Report Directors’ Statement on Internal Control over Financial Reporting |

|

| D.3 | Audit Committee The Board Audit Committee assists the Board of Directors in its general oversight of financial reporting, internal controls and functions relating to internal and external audits. The Charter of the Board Audit Committee, which is periodically reviewed and revised with the concurrence of the Board of Directors, clearly defines the Terms of Reference of the Board Audit Committee. The Charter demonstrates that activities of the Board Audit Committee are in line with the Code and the directions issued by the Central Bank of Sri Lanka. As at 31 March 2020, the Board Audit Committee comprised three Directors, all of whom were Non-Executive Directors. Two Directors of the Committee were Independent Non-Executive Directors. The current Chairman of the Audit Committee, Ms Miriam Coralie Pietersz has been appointed to the Board with effect from 1 March 2020 as a Non-Executive Independent Director. She is an Associate Member of the Institute of Charted Accountants in England and Wales and a Fellow member of The Institute of Chartered Accountants of Sri Lanka. She has over 25 years of extensive experience at senior level in auditing, finance, accounting in several industries in both private and public sectors. Prior to her appointment, Mr Jehan Amaratunga was the Chairman of the Audit Committee who resigned from the Board with effect from 30 December 2019. He is a Fellow Member of The Institute of Chartered Accountants of Sri Lanka and a Fellow Member of the Chartered Institute of Management Accountants – UK, and has over 30 years of extensive experience in finance and management. The Company’s External Auditor is the Auditor General in terms of Section 55 of the National Audit Act No. 19 of 2018. The Auditor General has appointed Messrs Ernst & Young, Chartered Accountants to assist to perform the audit of the Company for the financial year ended 31 March 2020, under the provision of Article 154 (4) (a) of the Constitution of the Democratic Socialist Republic of Sri Lanka. |

Board Audit Committee Report | |

| D.4 | Related Party Transactions Review Committee The Board has approved a Comprehensive Related party Transaction manual setting out the procedure to ensure that no “Related party” of the Company as defined in LKAS 24 is given more favourable treatment than that accorded to third parties in the normal course of business. The Company has set up a Related Party Transactions Review Committee to oversee the related party transactions of the Company. As at 31 March 2020, the Related Party Transactions Review Committee comprised three Directors, all of whom are Non-Executive Directors. Two Directors of the Committee including the Chairman to the Committee are Independent Non-Executive Directors. The Related Party Transactions Review Committee operates within clearly defined Terms of Reference approved by the Board. The duties and responsibilities of the Committee as set out in the said Terms of Reference, are in line with the Code and the directions issued by the Central Bank of Sri Lanka. |

Related Party Transaction Review Committee Report | |

| D.5 | Code of Business Conduct and Ethics The Company has a strong organisational culture of entrenched values, which forms the cornerstone of its behaviour towards all stakeholders. These values are embodied in a written statement of values, which serves as the Company’s Code of Business Conduct and Ethics and is continually reinforced. The Company has in place a comprehensive Code of Business Conduct and Ethics applicable to all Directors and employees of the Company. The Code has been circulated to all the Directors and employees and has been published in the Company’s intranet to ensure strict compliance with same. The Code of Business Conduct and Ethics that embodies the corporate values was reviewed and updated in line with recommended best practices. The Board is not aware of any material violations of any of the provisions of the Code of Business Conduct and Ethics by any Director or Key Management Personnel of the Company. The Company has in place an effective mechanism for identification of information that could be perceived as price sensitive information and prompt disclosure of same to the relevant regulatory authorities. The Company has in place an established process for monitoring and disclosing of related party transactions set out in detail in the Board approved related party transaction guide of the Company. Further, The Code of Business Conduct and Ethics entails as part of it, a comprehensive policy and processes governing dealings by the Directors, KMPs and employees in the shares of the Company. |

Annual Report of the Board of Directors on the Affairs of the Company | |

| D.6 | Corporate Governance Disclosures The Company is resolute in its commitment to operating in an ethical and transparent manner and staying accountable to its stakeholders. The Company believes that corporate governance is not just a destination, but a journey to persistently progress in sustainable value creation. |

Compliance with Code of Best Practice on Corporate Governance | |

| Shareholders | |||

| E Institutional Investors | |||

| E.1 | Shareholder voting The Company is committed to promoting effective and open communication with all shareholders, transparently and regularly in order to facilitate a mutual understanding of the respective objectives of the parties. The Board and the Management strive to be accessible to both institutional and private investors and proactively encourage all shareholders to participate at the Company’s Annual General Meeting (AGM). The Annual General Meeting (AGM) is used as a forum to have a structured and objective dialogue with shareholders on matters that are relevant to the general membership. Additionally, the Company has an ongoing programme of dialogue and meetings with institutional shareholders, where a wide range of relevant issues is discussed. |

||

| E.2 | Evaluation of governance disclosures Disclosure is an essential element of a robust corporate governance framework as it provides the basis for informed decision-making by shareholders, stakeholders and potential investors in relation to capital allocation, corporate transactions and financial performance monitoring. Sufficient attention has been given to the interests of institutional investors and they are at liberty to give due weight when exercising their voting rights on resolutions relating to the Board structure and the composition. |

||

| F Other Investors | |||

| F.1 | Investing/Divesting Decision The Company places a high degree of importance on maintaining good relationships and communications with institutional investors and private investors alike and ensures that they are kept informed of significant Company developments in order to give them the critical information they need to value their investments. Individual shareholders are at liberty to carry out adequate analysis or seek independent advice on their investing, holding or divesting decisions. |

||

| F.2 | Shareholder Voting General Meetings provide the principal opportunity for the Board to meet investors and for the Chairman to explain the Company’s progress and receive questions from its owners, the shareholders Individual shareholders are encouraged to participate at General Meetings and cast their votes. |

||

| G Internet of things and cybersecurity | |||

| People’s Leasing Group’s IT policies by which the Company is governed, comprehensively cover IT discipline, use of licensed software, closer monitoring of the usage of the internet, email and mail server and the use of antivirus and firewall servers and software. The functions of the Chief Information Security Officer are delegated to the Head of IT of People’s Leasing Group. Risks relating to IT matters including that arising from cybersecurity are discussed at Board meetings and Board Integrated Risk Management Committee meetings. Information Technology Auditors are used whenever they deem that expert advice is required. The review of Information Security was carried out by the External Consultants periodically. |

CG – IT governance and cybersecurity |

||

| H Environment, Social and Governance (ESG) | |||

| H.1 | ESG Reporting Corporate sustainability reporting aims to deliver information in such a way that it provides decision-making value to investors, customers, employees and other relevant groups who have a stake in the Company or who are in some way affected by the Company’s actions. Environment, Society and Governance (ESG) aspects are considered as an important part of the Company’s values and the Board is aware of its responsibility to ensure that such aspects are linked closely with the company strategy. ESG reporting of the Company is a reflection of how the Company has performed and achieved long-term economic value, assumed corporate responsibility and contributed to sustainable development. Thus, this Annual Report has been prepared in the form of an integrated report that covers sustainability reporting parameters. |

Financial capital Natural capital Social and relationship capital Stakeholder engagement | |

Compliance with Finance Companies Direction

Compliance with the Finance Companies (Corporate Governance) Direction No. 03 of 2008 and amendments thereto as specified in Finance Companies (Corporate Governance – Amendment) Directions No. 04 of 2008 and No. 06 of 2013 issued by the Central Bank of Sri Lanka.

| Rule reference | Principle and compliance | Status of compliance | Reference to report |

| A Responsibilities of the Board of Directors | |||

| 2 (1) | Strengthening the Safety and Soundness of the Company | ||

| (a) | Approving and overseeing strategic objectives and corporate values | ||

| The strategic objectives of the Company are predicated on the Vision and Mission statements of the Company and corporate values are embedded in the Code of Business Conduct and Ethics which have been communicated to employees at all levels. The Board plays an active role in setting the strategic objectives of the Company, ensuring that it focuses on converting the Company’s Mission and Vision into Action. While the Board has delegated the task of implementing the set goals/objectives to the Management of the Company, the Board constantly monitors and reviews the Company’s performance, vis-à-vis targets, being proactive in identifying any setbacks. |

|||

| (b) | Approving overall business strategy including risk policy and management procedures | ||

| A strategic plan was approved in 2018 for the three financial years upto 2021, A strategic plan covering the next three year 2022-2024 is in the process of being formulated. | |||

| (c) | Risk management | Board Integrated Risk Management Committee Report Risk Management | |

| The Board as a whole remains primarily responsible for the overall risk framework of the Company. Board Integrated Risk Management Committee, on behalf of the Board, identifies risks and ensures implementation of appropriate systems to manage risks prudently and reports to the Board on a quarterly basis. | |||

| (d) | Communication with stakeholders | ||

| Recognising the importance of two-way communication with its stakeholders, the Board has adopted a comprehensive policy that governs communications with its shareholders and depositors, creditors, borrowers, suppliers and other related stakeholders. | |||

| (e) | Reviewing Internal Control systems and Management Information Systems (MIS) | ||

| The Board has the overall responsibility for ensuring that the Company maintains an adequate system of internal control and for reviewing its effectiveness. The Board Audit Committee, on behalf of the Board undertakes the detailed monitoring and reviewing of the internal controls and reports to the Board on its findings on a quarterly basis. The Management Information Systems (MIS) are reviewed by the Board for accuracy and integrity of the same through review of MIS Procedure Manual Outline/Guideline of the Company. |

|||

| (f) | Key Management Personnel (KMP) | ||

| The Board of Directors, Chief Executive Officer, Deputy General Managers of the Company and the Compliance Officer have been identified and designated as the Key Management Personnel of the Company. | |||

| (g) | Authority and responsibility for the Board and Key Management Personnel | ||

| Principle duties and responsibilities of the Board of Directors and the Chief Executive Officer are set out in detail in the Corporate Governance Charter of the Company. The Key Functions/responsibilities of the Deputy General Managers (KMPs) have been defined and approved by the Board and included in their respective job descriptions. The respective delegated authority limits of the Chief Executive Officer and the Deputy General Managers have also been defined by the Board. |

|||

| (h) | Oversight of affairs of the Company by KMP | ||

| Affairs of the Company are reviewed and discussed by the Board at Board meetings on a monthly basis. At these meetings, Key Management Personnel are represented by the Chief Executive Officer who apprises the Board on the operations and performance of the Company against set targets. Affairs of the Company are also reviewed and discussed by the Senior Management at management level. |

|||

| (i) | Assess effectiveness of governance practices | ||

| The Articles of Association of the Company and the Corporate Governance Charter provide for the general procedure applicable to selection and appointment of Directors of the Company. Presently, the Directors of the Company, other than the Non-Executive Independent Directors, are recommended by the parent, People’s Bank and appointed by the Board in terms of the Articles of Association. The appointments of Key Management Personnel are made by the Board on the recommendation of the Chief Executive Officer. The management of conflicts of interests is addressed in a timely manner. In terms of the Code of Business Conduct and Ethics of the Company, each member of the Board has a responsibility to determine whether he/she has a potential or actual conflict of interest arising from personal relationships, external associations and interest in material matters which may have a bearing on his/her independent judgment. Directors who have an interest in a matter under discussion make a disclosure of his/her interest therein and refrain from engaging themselves in the deliberations on that matter and from voting thereon. Self-declarations on potential conflicts of interest are obtained from the Directors at the time of their appointment to the Board and subsequently as and when it is required. These declarations together with the interests disclosed by the Directors at Board meetings assist the Company to manage conflicts (if any) in an effective manner. The effectiveness of the Board’s own governance practices including determination of its weaknesses was assessed by the Board through a self-evaluation of the Board carried out in June 2020. |

|||

| (j) | Succession plan for KMP | ||

| The Board has approved a Succession Plan for Key Management Personnel in October 2018. | |||

| (k) | Regular meetings with KMP’s | ||

| The Key Management Personnel are represented at monthly meetings of the Board of Directors by the Chief Executive Officer of the Company who apprises the Board of any concerns/critical issues raised by the Key Management Personnel at their meetings. Furthermore, where relevant, the Key Management Personnel are invited to participate in Board and Board Subcommittee meetings to review policies, establish lines of communication and monitor progress towards corporate objectives. | |||

| (l) | Understanding the regulatory environment | ||

| The Board is well versed with the Group’s values, business, operations, financial affairs, governance framework and strategic position of the Company. Regular updates on changes to relevant legislations, regulations and corporate governance as well as sector developments that could affect the Group and its operations covering a wide spectrum of topics including economic, social and environmental aspects are provided to the Board Committees at each meeting and as appropriate, to the full Board. A Summary of the contents of the regulatory requirements and relevant ratios are submitted to the Board on a regular basis for their awareness of the Company’s standing with regard to regulatory environment. |

|||

| (m) | Hiring and oversight of External Auditors | ||

| The Company’s External Auditor is the Auditor General in terms of Section 55 of the National Audit Act No. 19 of 2018. The Auditor General has appointed Messrs Ernst & Young, Chartered Accountants to assist to perform the audit of the Company for the financial year ended 31 March 2020, under the provision of Article 154 (4) (a) of the Constitution of the Democratic Socialist Republic of Sri Lanka. | |||

| 2 (2) | Appointment of the Chairman and CEO and defining and approving their functions and responsibilities | ||

| The Board has appointed the Chairman and the Chief Executive Officer. Their roles are separate and have been defined in the Corporate Governance Charter of the Company. | |||

| 2 (3) | Obtaining independent professional advice by the Directors | ||

| The Corporate Governance Charter provides for the Directors to seek the advice of the Company Secretary and other professional independent advice on matters related to the exercise of their duties and responsibilities, at the expense of the Company. However, no such advice was sought by any of the Directors during the financial year 2019/20. | |||

| 2 (4) | Managing conflict of interest | ||

| In terms of the Code of Business Conduct and Ethics of the Company, each member of the Board has a responsibility to determine whether he/she has a potential or actual conflict of interests arising from personal relationships, external associations and interest in material matters which may have a bearing on his/her independent judgement. Directors who have an interest in a matter under discussion make a disclosure of his/her interest therein and refrain from engaging themselves in the deliberations on that matter and from voting thereon. Such abstentions from decisions are duly recorded by the Company Secretary in the minutes. | |||

| 2 (5) | Availability of formal schedule of matters specifically reserved for the Board | ||

| The Corporate Governance Charter of the Company contains a formal schedule of matters specifically reserved to the Board for its decision. | |||

| 2 (6) | Disclosure of probable solvency issues | ||

| No such situation has arisen during the year 2019/20. Furthermore, the liquidity position of the Company is reported to the Director of the Department of Supervision of Non-Bank Financial Institutions on a weekly basis. | |||

| 2 (7) | Publish Corporate Governance Report on compliance with the Direction in the Annual Report | Compliance with Finance Companies Direction | |

| The Board includes in the Company’s Annual Report, an annual corporate governance report setting out the compliance with the Direction. | |||

| 2 (8) | Self-assessment of Directors | ||

| The Board has adopted a scheme of self-assessment to be undertaken by each Director annually, the procedure of which is set out in the Corporate Governance Charter of the Company. In accordance therewith, the Board carried out a comprehensive evaluation of its performance and its committees in June 2020. Each member of the Board except for Ms Coralie Pieterz, who was appointed to the Board effective 1 March 2020, and therefore did not attend meetings during the financial year 2019/20, carried out a self-assessment of his/her effectiveness as well as the Board Committees. The full results of the Board evaluations were analysed by the Company Secretary and the findings were presented to the Board in July 2020. |

|||

| B Meetings of the Board | |||

| 3 (1) | Regular Board meetings | ||

| Board meetings are usually held at monthly intervals unless the business exigencies demand the convening of meetings at shorter intervals. The Board met Eleven times for the financial year 2019/20 and obtaining the Boards’ consent via circulation was kept to a minimum of six instances. The Board meeting scheduled for 31 March 2020 was cancelled due to the island wide curfew imposed by the government pursuant to threat of spread of the COVID-19 virus. |

|||

| 3 (2) | Directors to include matters and proposals in the agenda | ||

| All Directors are provided an equal opportunity to include proposals for promotion of business and management of risk in the agenda for regular meetings. The procedure applicable to this is set out in the Company’s Corporate Governance Charter. | |||

| 3 (3) | Notice of Board meetings | ||

| The date of the next Board meeting is collectively agreed to by the members present during the previous Board meeting and subsequently communicated to all the members, so as to ensure that at least 7 days’ notice is given of a meeting. Reasonable notice is given of any other special Board meeting. | |||

| 3 (4) | Attendance of Directors at Board meetings | CG – Attendance at Board and Board Committee meetings | |

| No Director has been absent for three consecutive meetings. | |||

| 3 (5) | Appointment of a Company Secretary | ||

| An Attorney-at-law with adequate experience has been appointed by the Board as the Company Secretary. The Company Secretary advises the Board and ensures that matters concerning the Companies Act, Board procedures and other applicable rules and regulations are followed. |

|||

| 3 (6) | Delegating responsibility to the Company Secretary | ||

| The function of preparing the Agenda for Board meetings has been delegated by the Chairman to the Company Secretary and accordingly, the Company Secretary is responsible for the same. | |||

| 3 (7) | Access to service and advice of Company Secretary | ||

| As provided for by the Corporate Governance Charter of the Company, all Directors have access to the Company Secretary who is an Attorney-at-Law by profession. | |||

| 3 (8) | Maintenance of minutes of Board meeting | ||

| The Company Secretary maintains the minutes of Board meetings with sufficient details and the same is available for inspection by any Director in accordance with the procedure laid down in the Corporate Governance Charter of the Company. | |||

| 3 (9) | Recording minutes of Board meetings in sufficient detail | ||

| The Company Secretary records the proceedings of the meetings and the decisions taken thereat in sufficient detail so as to satisfy all the requirements specified in this rule. | |||

| C Composition of the Board | |||

| 4 (1) | Number of Directors on the Board | ||

| As at the end of 2019/20, there were nine Directors on the Board thus, complying with the requirement |

|||

| 4 (2) | Period of service of a Director | ||

| The period of service of all the Directors during 2019/20 was below nine years. | |||

| 4 (3) | Appointment, election or nomination of an employee as a Director | ||

| The Company does not have any Executive Directors. | |||

| 4 (4) | Board balance and criteria for independence | ||

| The Board comprised three Non-Executive Independent Directors as at the end of 2019/20 who met the one-fourth criteria for independence as specified in this rule. Self-declarations were obtained from all Non-Executive Independent Directors confirming their suitability to be designated as ‘independent’ in terms of the criteria in this rule. Pursuant to the reconstitution of the Board on 30 December 2020 there was only one Independent Director on the Board until the new Board was appointed on 19 February 2020. Upon request by the Company, Central Bank of Sri Lanka granted an extension to comply with this provision until 15 February 2020. |

|||

| 4 (5) | Alternate Director | ||

| No alternate Directors were appointed during the year. | |||

| 4 (6) | Skills and experience of Non-Executive Directors to bring an objective judgement | Board of Directors | |

| The Board comprises solely Non-Executive Directors who possess academic and professional qualifications in diverse fields. Their mix of skills and business experience is a major contribution to the proper functioning of the Board and its committees. | |||

| 4 (7) | Quorum at Board meetings | ||

| Since all of the Directors of the Company during the year 2019/20 were Non-Executive Directors, the required quorum (one half of Directors being Non-Executive Directors) was met at all meetings of the Board convened for the year. | |||

| 4 (8) | Disclosure of independent Non-Executive Directors, Board composition in corporate governance communications and in the Annual Report | ||

| The Independent Non-Executive Directors are identified as such in corporate communications where necessary. | |||

| 4 (9) | Formal and transparent procedure for appointment of new Directors | ||

| The Articles of Association of the Company and the Corporate Governance Charter provides for the general procedure applicable to selection and appointment of Directors of the Company. Upon the nominees being found to be “fit and proper” for appointment as Directors of the Company, approval of the Director of Department of Supervision of Non-Bank Financial Institutions of the Central Bank of Sri Lanka is obtained for the same. All appointments made to the Board during the year 2019/20 complied with the above procedure. | |||

| 4 (10) | Re-election of Directors appointed to fill a casual vacancy | ||

| In terms of Article 27 (2) of the Articles of Association of the Company all Directors, including those appointed to fill casual vacancies, are subject to re-election by shareholders at the first Annual General Meeting following their appointment. | |||

| 4 (11) | Disclosure of resignations/removal of Directors | ||

| All resignations/removals and appointments of Directors are informed to the shareholders, with sufficient details, via immediate notification to the Colombo Stock Exchange, after approval for the same has been obtained from the Director of Department of Supervision of Non-Bank Financial Institutions of the Central Bank of Sri Lanka in terms of the applicable regulations. | |||

| D Fitness and propriety of Directors | |||

| 5 (1) | Age of Directors should not exceed 70 | ||

| There are no Directors who are over 70 years of age. Mr Hemasiri Fernando (Non-Executive Non-Independent Chairman) reached the age of 70 years on 12 October 2019 and retired from the office of Chairman of the Company with effect from that date. |

|||

| 5 (2) | Holding office in more than 20 companies | Board of Directors | |

| There are no Directors who hold office as a Director of more than 20 companies. | |||

| E Delegation of functions | |||

| 6 (1) | Delegation of Board functions | ||