Manufactured capital

People’s Leasing’s manufactured capital comprises our reach through an island-wide branch network, ICT infrastructure, and other property, plant, and equipment employed for our operations. The management of manufactured capital plays a key role to the success of the Organisation since it directly affects efficiency, customer satisfaction, profitability, and growth.

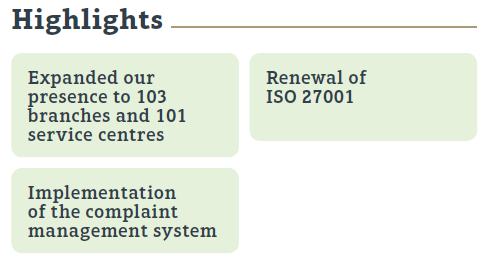

Opened gold loan units in 14 branches

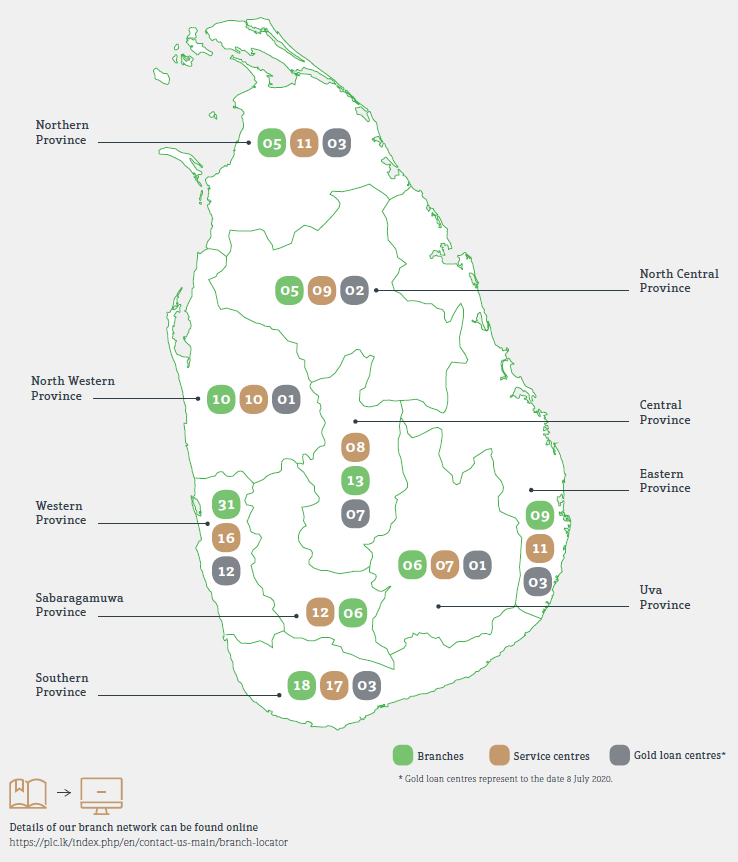

Our reach through an island-wide network

We continue to provide a heightened customer experience via our physical touch points throughout the island. We improve these touchpoints each year by integrating state-of-the-art technology. To provide our customers with easy access to our product portfolio we have expanded our presence to 103 branches and 101 service centres.

Widening our physical footprint

In considering the challenging business environment prevailed throughout the year, the Company did not focus on opening new branches. We instead focused on consolidating the performance of existing branches.

In our drive to continue to improve the delivery of our services, four branches were relocated to ensure greater convenience to our customers. We also look to improve on our existing infrastructure to better serve our customers. We have also collaborated with our parent company, People’s Bank to widen our reach.

This year we focused on expanding our new product “Gold loan” by opening Gold loan units in 14 branches.

Leveraging state-of-the-art IT infrastructure

ICT department heavily contributed on the Company performance through converting the business strategies in to reality in the sense of new product and features. It enhances overall business volume, expands clientele, upgrades the Company’s overall profitability. The ICT Department collaborates with other divisions in all operations.

A proactive, timely ICT strategy

Our ICT strategy comes under the overarching business strategy and takes into account the timely requirements that have emerged from the operating environment. It encompasses all operations and is integrated into our internal systems and processes. For instance, in the product development phase, we envisage the required ICT infrastructure including solutions, applications, and support. We utilise modern, state-of-the-art hardware as well as trained resource personnel who are equipped to handle any requirements. We leverage technology in our marketing efforts to reach a wider audience. The marketing division operates a Facebook page and Viber groups to address certain customer segments.

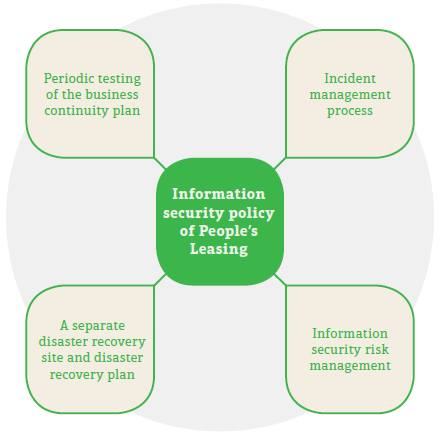

Combating cyber threats

One of the emerging threats at present is the increasing rate of cyber crime. Our customers are cognisant of the risks that technology entails. We consider the privacy of our customers an utmost priority and have taken every step to ensure the protection of sensitive data. We have invested heavily on firewalls and related upgrades in addition to the internal control system to combat cyber threats. The following diagram outlines our Information Security Policy:

Information security policy

Safeguarding the Company against the unauthorised use of information, especially electronic data, is of paramount importance to us.

Through our incident management process, any employee may lodge reports to the Chief Information Security Officer about any potential or actual breaches of security. We have a disaster recovery plan covering all areas of the Company, including aspects relating to data security with both onsite and offsite backups in secure environments. The Business Continuity Plan is tested once a year or more in collaboration with the information security team, to ensure data is securely backed up and provisions are adequate for the recovery of operations from any unforeseen adversity.

Initiatives in 2020

During the year, we have taken many steps to improve the efficiency of our ICT infrastructure. We also work in tandem with all other business segments of the Company to execute our strategic imperatives which principally involves enhancing customer experience, internal productivity and efficiency, and standardising service quality. The following initiatives were taken during the year:

We are in the process of adopting artificial intelligence (AI) into our business processes. We have taken the initial step of finalising and outlining our requirements to prospective vendors. The second phase will identify potential operations that will be converted in to AI processes, then the third phase would be to implement them. This is an ongoing initiative that will come to fruition in the near future.

We have also moved to the second phase in the upgrading of our Data Centre. Last year, we invested in the latest IBM power systems to the Data Centre. We hope to upgrade our virtualisation processes which will allow for more efficient utilisation of computer hardware and cloud computing. This upgrade will facilitate our exponential business requirements with high performance, low latency, and high availability.

The following are the other initiatives that were taken during the year:

- eMemo system implementation

- Complain management system implementation

- Fixed assets system implemented at PIL

- Ijarah, Musharaka floating rate modification

- Enhancement of leads management solution

- Raffle draw process

- Recovery diary

- New technology for fraud mitigation

- Selfie cash warrant deduction option

- System modifications relating to WHT tax change

- Common Electronic Fund Transfer Switch (CEFTS) implementation

- Gold loan system implemented in 14 branches

- Renewal of ISO 27001 information security management system certification

Future outlook

We will focus on enhancing the services of the current branch network and will not be looking into further branch expansions. In its stead, we will expand our gold units in branches after evaluation to offer our customers more convenience. Moreover, we will develop our IT capabilities even further since they facilitate our operations as evidenced by how the Company was effectively able to deal with the aftermath of the Easter attacks and the Covid-19 pandemic. We will introduce the following IT improvements in the coming year:

- Leads and sales force management solution

- Streamlined credit assessment by reducing expert’s involvement

- A new delinquency management solution

- Digitalisation of the entire credit documents printing process

Our ICT strategy comes under the overarching business strategy and takes into account the timely requirements that have emerged from the operating environment.