Stakeholders

Stakeholder Identification, Stakeholder Engagement, Materiality Mapping, and responding to our most valued stakeholders

Stakeholders are individuals or groups that have a considerable impact on our operations. We understand the importance of clear, transparent, consistent engagement with our stakeholder groups, and have implemented strategies to meet their expectations. We maintain a number of formal mechanisms to remain linked to our stakeholder groups. In addition, we also share responsibility for such linkage across the Organisation at every point of contact with our stakeholders.

Stakeholder identification

Being a responsible and inclusive financial solutions provider, we strive to promote sustainable development in Sri Lanka. From our vision, mission, purpose, and our code of ethics, we uphold our commitment to act responsibly towards our most valued stakeholders.

Our stakeholders are the individuals, groups, and organisations that significantly affect or could be significantly affected by our strategy execution and how we conduct our business activities.

Trends observed in our operating environment

As we focus on delivering value to stakeholders, we need to identify material topics where we believe we can make a positive impact. These topics are also determined by identifying the following trends observed in our operating environment in connection with our core business activities.

- Financial inclusion is increasingly becoming a national priority

- Political instability

- Technological innovation

- Regulatory developments

- Protection and privacy controls in digitalising finance

- High-impact weather events

- Unexpected disease outbreaks

- Climate change

- Increased competition from competitors and new digital service providers

- Rapidly changing customer expectations and behaviours

- Demand for artificial intelligence

Stakeholder engagement

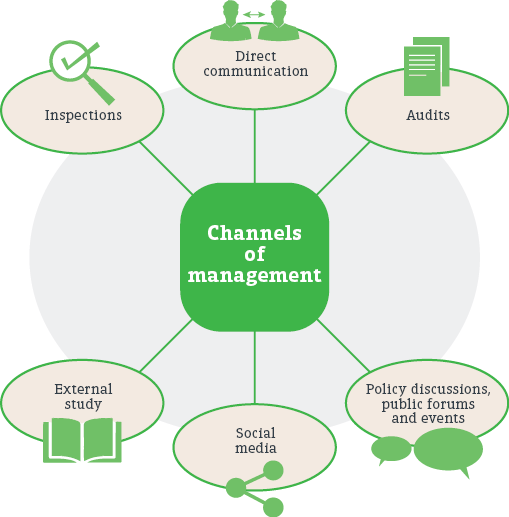

We engage with our stakeholders through a decentralised stakeholder engagement approach all the year round and we use various engagement platforms appropriate to the needs of each stakeholder group.

We understand that our sustainable growth is dependent on our key stakeholder perceptions of value we create for them. Hence, we value feedback from them about their concerns and perceptions of value engaging with our stakeholders through the following channels.

Stakeholder engagement, frequency, their concerns, and our response

| Stakeholder | Mode of engagement | Frequency | Key concerns | Our response | |

Investors |

Annual Report | Annually | Balanced performance, transparency Consistent bottom line Business continuity ESG concerns Migration to digital channels Reputation, credibility and Brand Image Lower operational costs Asset quality, reduced NPL Plans for growth |

Release and publish of information on integrated performance

Performance driven culture Prudent risk management practices/Corporate governance framework Optimise resource use Invest and encourage in house developers to develop digital channels Accolades and rankings by independent institutions/rating agencies Effective resource optimisation, performance-based rewards Stringent cost management systems Customer advisory services Strategies to deliver sustainable value |

|

| Interim Financial Statements | Quarterly | ||||

| Annual General Meeting | Annually | ||||

| Disclosures and Announcements to CSE | As Required | ||||

| Corporate Website | Ongoing | ||||

| Email and telephone | Ongoing | ||||

| Written communication | As required | ||||

| Press releases | As required | ||||

| One-to-one meetings | As required | ||||

Customers Customers |

Print, electronic and social media | Ongoing | Financial stability of the Company Product/service-related information Accessibility, convenience Migration to digital channels Financial literacy, advisory, relationship management Cost of borrowing, ROI Speedy service Complaints Stable ratings Health, safety, and wellbeing Customer privacy |

Increased presence on social and print media on new products and corporate news Continued trilingual clear communication Promoted tech driven financial platform “PLC Online” towards increasing accessibility Continued in-house training for staff on digital channels Continued customer financial advisory through trained staff Continued to offer customised products to suit customer income pattern/investment plan Reduced time taken for decision making through e-memo system Streamlined customer complaint resolution process Streamlined formal customer complaint resolution process Introduced Covid-19-related safety measures at our points of contact Strengthened customer data privacy through system based controls |

|

| Written communication | As required | ||||

| Call centre, Branch network | 24x7, Business hours | ||||

| Tech-based platforms | Ongoing | ||||

| Customer visits | Ongoing | ||||

| Day-to-day business interactions | Ongoing | ||||

| Corporate website | Ongoing | ||||

| Press releases | As required | ||||

| Advertisements/propaganda campaigns | As required | ||||

| Outreach CSR initiatives | As required | ||||

| One to one dialogue | As required | ||||

Employees Employees |

Management Committee Meetings | As required | Materiality concerns

Future plans for sustainable growth Business continuity Employee awareness Operational changes Make staff future ready Employee recognition and achievement Up skilling and career progression Employee Health and Safety Business ethics Remuneration and other benefits |

Business operations continuity post Easter attacks and during Covid-19

Engaged staff at different levels to develop strategic plan for the Company Operational changes based on performance reviews and uncertainty in operating environment Inspire staff and update staff on latest developments Work from home facility during Covid-19, welfare events, support staff in sports events to promote their talents Develop knowledge, skills and competencies of staff Premier Awards’ to recognise and reward outstanding staff performance Established a platform to raise employee concerns Introduced Covid-19-related safety measures at our points of contact Promoted voluntarily compliance on “responsible business” criteria Amidst disturbed operations corporate management forwent benefits to incentivise staff |

|

| Strategic Planning Session | Annually | ||||

| Corporate communication via e-mail/circular | As required | ||||

| Social media groups and text messages | Periodically | ||||

| Technology driven platforms | Periodically | ||||

| Online learning, in house training, Toastmasters Club | Ongoing | ||||

| Annual Employee Recognition Awards | Ongoing | ||||

| People’s Leasing Employee Union | Ongoing | ||||

| Operational guidelines | Ongoing | ||||

| Employee grievances | Ongoing | ||||

Suppliers and business partners |

Direct Dialogue | As required | Ethical sourcing Profitability New business opportunities Fair price On time delivery Compliance Responsible labour practices Responsible environmental practices |

Regularly engaged with suppliers to monitor performance Screened suppliers for their responsible business practices Reviewed and updated credentials to select ethical suppliers Encouraged innovation for reliable suppliers Encouraged suppliers to expand business Continued sourcing from SMEs Continued fair sourcing practices Provided advisory services to support suppliers grow |

|

| Supplier appraisals | Annually | ||||

| Supplier registration | Annually | ||||

| Field visits | Periodically | ||||

| Memorandums of Understanding | As required | ||||

| Service agreements | Annually | ||||

| Written communication (letters/emails) | As required | ||||

| Telephone conversations | As required | ||||

Community and Environment |

Corporate website | Ongoing | Engaging in anti-social activities

Unmet/undermet infrastructure needs Public service improvement Lack of financial literacy Guidance on business development Limitations in vocational education Responsible lending Advancement of Sustainable Development Goals (SDGs) Health, safety, and wellbeing Community empowerment and capacity building Violation of environment related laws Transactions with potential risks Optimising resource use Responsible sourcing Environmental pollution Declining forest cover Climate change |

Ensured minimum negative direct social impact of our operations

Invested in public infrastructure development Invested in public service improvement Created financial literacy Provided financial advisory Continued vocational scholarships to support vocational education Continued educational scholarships to support school education Contributed towards the advancement of SDGs Educated stakeholders on Covid-19 prevention Supported to resolve community-based national priorities Ensured minimum negative direct environmental impact of our operations Continued education of staff and customers on environment friendly business practices Provided e-learning and classroom-based training for frontline staff on responsible lending Calculated carbon footprint for the 7th time/Invested Rs. 3.32 million on outreach green CSR initiatives Disbursed 1.87 billion worth green vehicle facilities Responsibly disposed 3,558kg worth of hazardous electronic waste Worked collaboratively with customers to mitigate identified environmental risks |

|

| Direct communication | As required | ||||

| Dialogue with institutions, community leaders and Community Based Organisations (CBOs) | As required | ||||

| Public events and training/awareness programmes | As required | ||||

| Outreach CSR initiatives | As per CSR Plan | ||||

| Field visits and credit evaluations | As required | ||||

| Press releases | As required | ||||

| Social media | On a regular basis | ||||

| Sponsorships | As requested | ||||

| Telephone conversations and written communication | Ongoing | ||||

| Outreach CSR initiatives | Periodically | ||||

| Environment Management System | Annually | ||||

| Carbon footprint data tracking exercise | As required | ||||

| Environment-related awareness/training programmes | As required | ||||

| Field visits and credit evaluations | As required | ||||

| Press releases | Ongoing | ||||

Government and regulatory institutions |

On-site review by the CBSL | As required | Compliance and good governance

Cybersecurity, action against financial crime New regulations Supporting SMEs and economic growth Voluntary compliance Payment of taxes/fees/levies Prevention of corruption |

Complied with mandatory legislation, rules and other regulatory requirements

Introduced Covid-19-related safety measures at our points of contact Shared insights and technical expertise on key industry related policy issues Supported the development of ethical business Voluntarily complied with codes and best practices Continued alternative payment plans during customers’ financial distress Complied with transparent reporting |

|

| Dialogue with policymakers and regulators | As required | ||||

| Press releases | As required | ||||

| Directives and circulars | As required | ||||

| Corporate website | Ongoing | ||||

| Review Meetings | As required | ||||

| Compliance reports | As required |