The Bank has closely aligned its Transformation Agenda to the UN Sustainable Development Goals. SDB Bank is in a unique position to influence the outcome of those goals since their main clientele are those for whom these goals have specifically been set. Recognising this synergy has been an important step for the Bank to establish their brand of product.

A diagram showing the contribution SDB Bank is making to achieving the Sustainability Development Goals is shown on page 49. Given the connection between the Bank’s strategic direction and the resultant benefits to the community SDB Bank serves, the outcome is not only the fulfilment of the SDGs but also the growing allegiance of its customers to the Bank.

SDB Bank has adopted modern developmental tools and penetrated the rural market by introducing technological advancements and educating the communities in their use. The benefits therefore have been two-fold with the population experiencing exposure to technology and their practical application and the Bank being able to streamline its operations to provide an efficient and effective level of service and engender customer loyalty to the institution and its business.

This is in perfect alignment with the Mission of the Bank which states that they “strive to become the most responsible financial institution” by providing high quality and innovative financial products and services to its Customers and operating in a culture of learning and continuous value creation.

The practice of “foster and maintaining the highest ethical standards at all levels of the Bank and its stakeholders.” has been the glue that has held the operations together and presented the Bank in a favourable light to all who choose to deal with it.

New products have been launched by the Co-operative Development Division in 2018:

- Co-operative Top Saver Savings Account, designed to encourage deposits in the co-operative sector.

- SDB Samoopa Saviya Loan scheme, a loan scheme for co-operative societies and other registered societies. The features of this product relate to –

- societies for society usage:

- societies to be on lent to members;

- society/Co-operative Development staff members.

The purpose for which these products have been designed to favour lending to business-oriented activities, with a small portion catering to fulfilling personal needs.

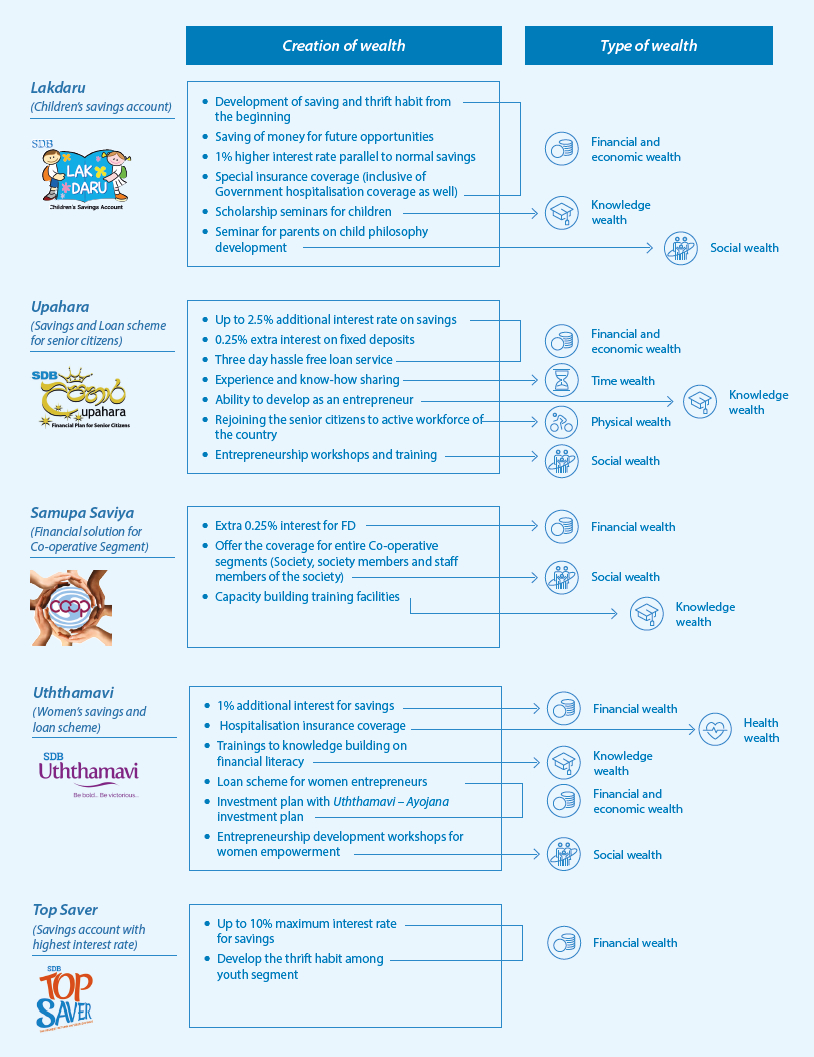

The array of products that have been made available to the Bank’s customers, serve their needs and continue to contribute to SDB Bank’s engagement with the public.

Savings products

“Lakdaru” - children’s savings account that offers valuable gifts, educational scholarships, hospitalisation insurance cover with higher rate of interest.

“Dayada” - children’s lump-sum investment plan designed for children under the age of 13 years, with a guaranteed return at maturity.

“Uththamavi” - a unique offering for women that inculcates savings habit and encourages entrepreneurship by providing financial assistance to develop their businesses. It is designed to be a total financial solution for women which includes savings, loans, insurance benefits, a fixed deposit scheme with hospitalisation benefits, skills development, and capacity building programmes for women entrepreneurs.

“Jawaya” - the financial tool that helps young Sri Lankan entrepreneurs to realise their dreams.

“Top Saver” - the savings account that offers the highest interest rate with unlimited withdrawals, VISA Debit Card and SMS service.

“Cooperative Top Saver” - the savings account specially designed for Co-operative Societies, that offers the highest interest rate with unlimited withdrawals and cash transfer facilities.

“Upahara” - a customised financial scheme for senior citizens that offers a higher return on their savings, encourages entrepreneurship, and to re-join Government and CEB pensioners in the workforce and make their contribution to the country’s economy.

“Ayojana” - a unique savings scheme that enables the customers to deposit a monthly amount at a higher interest rate for a specific time period. This account allows depositors to plan their long-term investments.

SDB Normal Savings – the SDB standard savings scheme which offers attractive rates of interest while increasing customer convenience through SDB ATMs or any other ATMs with the VISA logo

Loan facilities

“Samupa Saviya” - a unique loan scheme offered to co-operative societies, co-operative society members, and co- operative society staffs.

“Divi Saviya” - the SME loan scheme with multiple tools to fund micro, small, and medium enterprises

“Swarna Kirana” - the pawning service that offers higher advances for gold or gold jewellery at a minimum rate and satisfies the urgent need for cash.

“SDB Leasing” - the leasing facility for vehicles, equipment and machineries for agriculture, commercial, construction, personal use, and other purposes.

SDB Personal Loan – a personal loan scheme for permanent employees of government, semi-government, and the private sector.

Sonduru Sevana – housing loans for construction of a residence or purchase of property, purchase of land, extensions to completed or partially constructed houses, and alterations or repairs of existing residencies.

Uththamachara – a loan facility specially designed for families of retired war heroes, to support income generating activities.