The content included in this Report has been recognised as representing the issues and considerations that could have the most impact on the Bank’s ability to create value and those that are most critical to the Bank and its stakeholders.

The topics were identified by the senior management of the Bank and have been ratified by the Chief Executive Officer. These topics are reviewed continuously to assess their relevance and materiality.

The Bank’s process for determining material content is shown below:

Each year the Bank seeks to widen the scope of its materiality analysis, beyond the topics proposed by the GRI guidelines, to include those topics that are relevant to the banking industry, the Bank’s value creation model and the operating landscape.

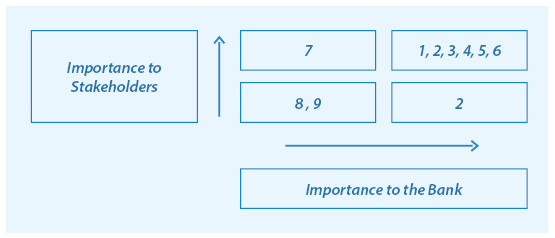

A sensitivity analysis, as shown in the table below, demonstrates the relevance and relative importance of the topics selected, to the Bank and to its stakeholders.

|

Material Topic |

Corresponding GRI topic |

Why is it material and topic boundary |

|

|

1 |

Earnings growth and profitability |

Economic performance |

Achieving sustainable growth in earnings is vital to driving shareholder value. The topic boundary is primarily internal, however, the Bank’s growth and profitability have a direct impact on its other external stakeholders |

|

2 |

Efficient processes |

Improving the efficiency of processes is essential to achieving sustainable profitability and enhancing customer experience. While the effort is internal, the impact of this topic is both internal and external |

|

|

3 |

Customer service |

Enhances customer experience and contributes to building a loyal customer base. The topic boundary is both internal and external |

|

|

4 |

Inclusive lending |

Indirect economic impact |

Meets one of the Bank’s founding objectives and contributes towards poverty alleviation. The impact of this topic is external and affects the customers and communities the Bank operates in. |

|

5 |

Employee value proposition |

Employment diversity and equal opportunity |

Employees are integral to achieving the Bank’s strategic objectives. Retention of employees is crucial to long term value creation. The topic boundary is internal |

|

6 |

Employee skill development |

Training and education |

“Quantum Leap” is the program designed to develop skills required to drive the Bank’s transformation agenda. Changing attitudes and nurturing a performance driven culture through skills development is a priority for the Bank. The boundary of the topic is internal. |

|

7 |

Responsible lending |

Customer privacy, marketing and labelling |

As a responsible corporate citizen, the Bank is committed to lending practices which are fair and responsible. This is considered vital to the sustainable creation of shared value. The topic boundary is external and extends to the Bank’s customers |

|

8 |

Preserving the environment |

Raw materials, Energy, Water, Effluents and Waste emissions |

As a financial services provider, the Banks impact on the external environment is limited. However, it is the policy of the Bank to use natural resources efficiently and minimise its environmental footprint. The topic boundary is internal and external |

|

9 |

Corporate Social Responsibility |

Local communities |

An important aspect of value creation by the Bank is its contribution to the well being and socio-economic progress of the communities it interacts with. The topic boundary is external |