Economic, social, environmental, political, and regulatory factors significantly influence the Bank’s operating environment and to some degree, affects the value it creates and the results it achieves. The impact is largely dependent however on how the Bank responds to these challenges.

The concentration of the Bank’s business is at the grassroot levels of society. In keeping with the Bank’s commitment to meet the needs of this sector, it has developed the unique SANASA Eco System of banking.

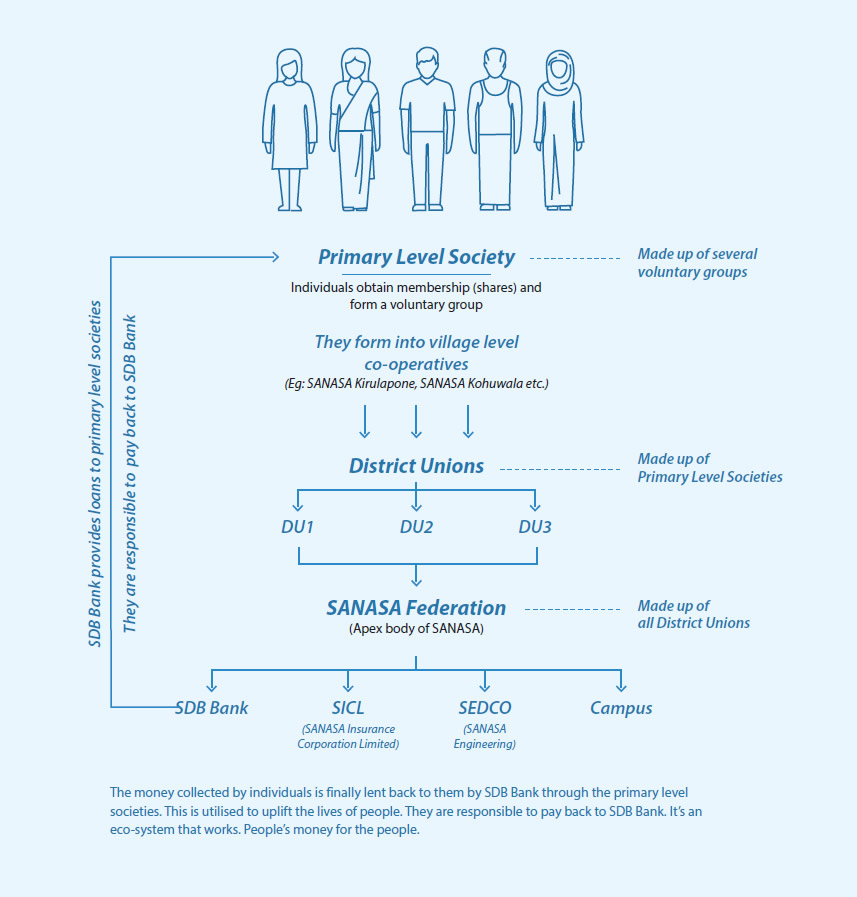

The System involves the creation of primary level societies through multiple groups of individuals. Each group of individuals collectively contribute to a society by investing in shares of that society and through membership fees. The system is propagated through the formation of a multitude of separate societies, along the lines of co-operatives.

These societies are affiliated to geographically dispersed District Unions, who in turn belong to the apex body called the SANASA Federation.

The SANASA Development Bank PLC (SDB Bank), SANASA Insurance Corporation Limited, SEDCO (SANASA Engineering) and SANASA Campus, all function under the patronage of the SANASA Federation.

One of the sources of finance for SDB Bank is the collection of funds via the primary level societies.

The members of the primary level societies are principally those who are encouraged to start and/or develop their cottage industries, microbusinesses, and even small businesses. These businesses, now find themselves in a position where finance no longer needs to be a constraining factor in the development of their businesses. They are in a position to expand and grow their businesses by accessing funds through the primary level society.

The Bank, in the normal course of business, lends money to these individuals through the primary level societies, to enable them to service the needs of its members. The members, by borrowing through the society in turn, are able to develop and grow their businesses.

The close relationship of members to each of these societies, instils a sense of responsibility and discipline in servicing these borrowings without default. This provides a sense of security to SDB Bank in lending to these societies who have the responsibility of collecting their dues from its members.

The double benefit of this method of operating, is the access that SDB Bank has to low cost finance, in the form of investments by members in each society and their membership fees and the reliability of repayments from its members to each society. The result is the ability of the Bank to make available loans and advances at a lower cost, that eventually benefits the customer.

This business model encourages the participation of individuals in the rural environment in business mechanics through their investment and access to borrowings. It exposes them to the processes, responsibilities, and structures of conducting a business and hence their empowerment to be productive members of society.

In addition to the banking aspect of business, the Federation is also responsible for the functioning of its insurance and engineering arms of business and importantly the upliftment of education through their Campus. Membership of the societies, enables the members and their families to further their advancement in society through training and education which may otherwise have been inaccessible through the mainstream avenues of further education.

This forms the cornerstone of the Bank, in living up to its proposition that “Every Enterprise Matters”.

In proactively driving the Bank’s agenda forward, it adopted a strategic approach to transform the direction of its activities.

By keeping its finger on the pulse of the market, it determined that the microeconomic segment of the market, together with the SMEs, needed greater attention in terms of availability of finance and growth of its activities. While the credit risk of this sector could prove to be a negative factor, SDB Bank put in place processes to strengthen its credit evaluation processes while at the same time reducing the time taken to process applications.

Given the coverage of mobile devices amongst the population, it was necessary to increase digital access to its processes and products. SDB Bank has responded quickly and effectively to this requirement.

SDB Bank is extremely conscious of the needs of the stakeholder. Understanding and effectively responding to the stakeholders’ needs is critical in meeting the end goals of delivering a satisfactory service and managing a sustainable business. The Bank put in place a stakeholder engagement process to meet and exceed those needs.