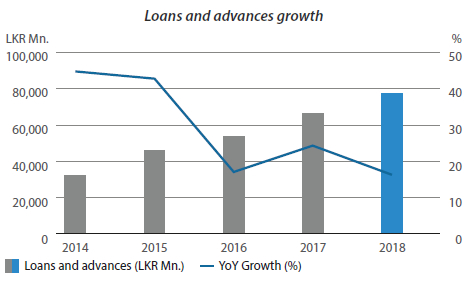

The transformation of SDB Bank began in 2014 as the Bank planned to increase their Equity to LKR 5 Bn. by the end of 2015 and the asset base to LKR 100 Bn. by end December 2018. The equity is now at over LKR 7 Bn. and the Asset base was LKR 97 Bn. at 31 December 2018.

The next milestone was to convert the focus of the Bank from the micro sector to the SME sector. The Organisation was re-structured with an emphasis on 3 main pillars – SME, Retail and Co-operatives. Business generated from the 3 pillars has now moved from a prior concentration to 28%, 66% and 6% respectively.

In addition, as part of the transformation process, the credit approval structure was revamped and centralised, a tele-collection centre was established to manage the recovery process, the credit administration function was de-centralised to 4 different locations, Treasury and Risk Management were revamped and good practices with sufficient internal controls were introduced.

The loan approval process was automated from the previous manual system. The efficiency levels have increased and processing time has been reduced, resulting in achieving the desired volumes of business.

Internet and mobile banking are expected to be launched in 2019.

Meanwhile, 64% of all loans are now subject to floating interest rates.

When it comes to lending the Bank follows International Corporate Social Responsibility (ICSR) principles, which covers environmental, social and governance aspects.