3

Putting enterprise in context

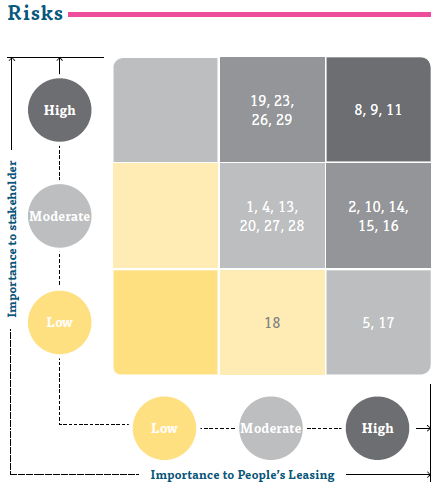

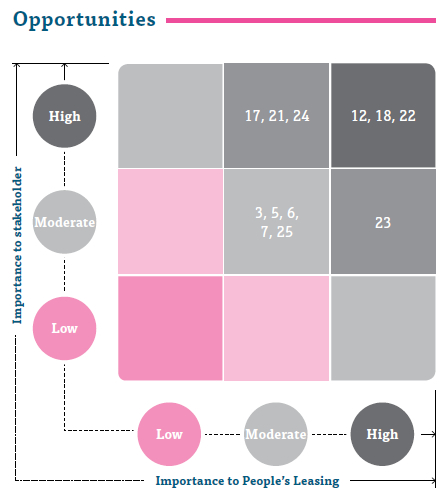

Risks and opportunities

At People’s Leasing, we are focused on being a responsible corporate citizen; one that devotes its energies and resources to operating a sustainable business. The focal point of our strategy is the creation of value: delivering value to stakeholders just as much as we derive value from them.

In this Report, we look at topics that have the most impact on our value creation process. We view value creation in the context of the constantly changing environment within which we operate and the needs and priorities of our stakeholders.

Materiality

To assess both internal and external matters of material importance, we conduct a rigorous materiality assessment. How material or important a topic is was assessed by its relevance to People’s Leasing or our stakeholders and its significance. How significant it is was determined by the probability of occurrence and the magnitude of its impact.

Key impacts

The outcome of this study results in the corresponding environmental, social, and governance matters being identified and their impact on our operating environment being assessed. We use these findings to determine any risks and opportunities that may be of concern to the sustainable operations of the Company and our key stakeholder groups.

GRI 102-47Identifying and assessing

During the year under review, we analysed our external environment to identify matters arising from emerging trends and their relevance to key stakeholder groups. The following overarching trends were identified:

1. Funds outflows from developing and emerging market economies

2. The lack of structural reforms for increase in productivity

3. Need to contribute towards achieving SDGs

4. Increasing migration

5. Growing influence of digital marketing

6. Energy crisis and gradual shift to non-renewable energy

7. Growing ESG concerns in lending

8. Sluggish GDP and economic growth/challenges to future economic growth/increased cost of living

9. Political uncertainty and rising ethnic conflicts

10. Sharp depreciation of the rupee

11. Poor performance of the CSE

12. Promotion of tourism

13. Sri Lanka’s downward slide on the global competitiveness index

14. Deteriorating asset quality of the financial sector

15. Frequent changes to local fiscal and monetary policies (increased borrowing costs, taxes)

16. Financial disintermediation

17. Unorthodox competition from fin-techs, tech giants and telcos

18. Growing role of technology

19. Cyber security/ATM card skimmers

20. Significant and mounting regulatory requirements

21. Investors growing interest on Company’s future potential

22. Changing customer expectations

23. Competencies to adapt to changes in the market

24. Increasing emphasis on entrepreneurship

25. Strategic public-private partnerships

26. Vulnerability to natural disasters

27. Undermet and unmet societal priorities including poor investment on early childhood/education, healthcare, access to quality water and sanitation

28. Diminishing forest cover

29. Increased negative effects of global warming

These trends were mapped as follows:

| Political | Economic | Social | Technological | Environment | Legal/ regulatory | |

| Investors | 9 |

3 11 12 13 14 16 21 |

20 |

|||

| Customers | 1 8 10 15 |

7 22 |

5 18 19 |

|||

| Employees | 2 4 17 |

23 |

||||

| Business partners | 25 |

|||||

| Society | 24 27 |

29 |

||||

| Environment | 6 26 28 |

3

Relates to all stakeholdersThe risks and opportunities arising from the trends were prioritised according to their relevance for our long-term strategy, competitive positions, and value drivers. After completing the analysis described previously, we mapped the above according to their impact on our stakeholders and the Company, categorising them as risks, opportunities or both, as portrayed in the matrices that follow.

We then formulated our strategic imperatives and strategies based on the outcomes of this analysis.