8

Compliance reports

Integrated risk management committee report

The Board of Directors of People’s Leasing & Finance PLC which is primarily responsible for the integrated risk management initiatives has delegated its authority to a Board subcommittee, the Integrated Risk Management Committee (“IRMC” or “Committee”) to review and assess the adequacy and effectiveness of the risk profile of the Company and the Group, In terms of Section 8 (3) of the Finance Companies (Corporate Governance) Direction No. 3 of 2008.

Terms of reference (TOR)

In compliance with the aforementioned Direction, The TOR clearly set out authority/delegations vested with the Committee, composition, responsibilities, meeting frequency and quorum, reporting and other procedures of the Committee.

In January 2019, the Committee reviewed its TOR and the same was subsequently approved by the Board.

Composition

The IRMC for the financial year 2018/19 comprised the following members and whose profiles are given on pages 27 to 28:

| Name of the Board subcommittee member | Directorship status | Membership status |

| Mr M P Amirthanayagam | Non-Executive, Independent Deputy Chairman/Senior Independent Director | Chairman |

| Mr Rasitha Gunawardana | Non-Executive, Non-Independent Director | Member |

| Mr M A M Rizwan | Non-Executive, Independent Director | Member |

| Mr A S Ibrahim (Chief Executive Officer/General Manager) | Non-Director | Member |

| Mr Sanjeewa Bandaranayake (SDGM – Operations) | Non-Director | Member |

| Mr Lionel Fernando (SDGM – Operations) | Non-Director | Member |

| Mr Rohan Tennakoon (DGM – Risk and Control) | Non-Director | Member |

Regular attendees by invitation

|

Ms Akila Samarasinghe – Deputy Manager – Risk and Control functions as the Secretary to the IRMC.

Meetings

The Committee held four (4) quarterly meetings during the year under review. The attendance of the members of the Committee was as follows:

| Name | Attended/ eligible to attend |

| Mr M P Amirthanayagam | 4/4 |

| Mr Rasitha Gunawardana | 4/4 |

| Mr M A M Rizwan | 4/4 |

| Mr A S Ibrahim | 4/4 |

| Mr Sanjeewa Bandaranayake | 4/4 |

| Mr Lionel Fernando | 3/4 |

| Mr Rohan Tennakoon | 4/4 |

Reporting to the Board

Minutes of the Committee which include the deliberations and conclusions reached were submitted to the subsequent IRMC meeting for the confirmation and adoption. All minutes of the meetings were formally approved by the Committee Chairman. Approved Minutes were also submitted to the Board seeking their views, concurrence and/or specific directions.

Activities

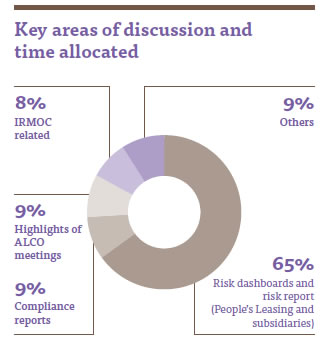

The IRMC effectively assisted the Board of Directors in performing its oversight role in relation to the internal/external risks faced by the Company in carrying out its business operations. All key risks tracked through Key Risk Indicators (KRIs) on a monthly basis are reviewed by the Committee at its quarterly meetings. The IRMC focused on the following activities during the year under review:

Strengthening risk governance structure

During the period under review, the Integrated Risk Management Operating Committee (IRMOC) was re-established as a management level committee to further strengthen the risk governance structure of the Company and support the Board, Board subcommittees and Corporate Management to manage the risks associated with the business operations of the Company in an integrated manner. The IRMOC is accountable to the IRMC.

- Reviewed the TOR of IRMOC submitted to the Committee upon the re-establishment of IRMOC and recommended for the Board approval.

- Reviewed the highlights of the IRMOC meetings on a quarterly basis.

Risk appetite and risk tolerance levels

- As part of annual review process, the Committee reviewed the Risk Tolerance Statement in October 2019.

- In reviewing the Risk Tolerance Statement, the factors such as strategic objectives of the Company, changes in macroeconomic environment and regulatory requirements etc., were considered by the Committee.

- Reviewed the risk profile of People’s Leasing against those Board-approved risk tolerance levels on a quarterly basis.

Assessment of management level committee

- Reviewed the adequacy and effectiveness of the functions carried out by ALCO by reviewing the annual assessment performed against its TOR.

Credit risk

- Reviewed the portfolio quality covering the following:

– Non-performing loan analysis based on assets and products

– Sector-wise credit concentration

– Compliance with the Single Borrower Limits etc. - Reviewed the quarterly progress of identified asset categories with high NP ratios for its consistent improvement in the asset quality.

- Reviewed the adequacy of impairment coverage and stress test results performed for credit risk.

- Reviewed the highlights of the IRMOC meeting which include the deliberations carried out with regard to the credit risk.

Liquidity and market risk

- Reviewed the adequacy of liquid assets maintained and the maturity mismatch, sensitivity analysis, interest rate repricing gaps including the stress

test results. - Reviewed the highlight reports of ALCO meetings submitted to the Committee on a quarterly basis in assessing the effectiveness of liquidity and market risk management.

Operational risk

- Reviewed key operational risk indicators established in respect of ICT, Human Resources, Frauds etc.

- Reviewed the progress of Business Continuity Plan Implementation

process and the adequacy of disaster recovery plans.

Regulatory and compliance risk

- Reviewed the Company’s compliance with the regulatory requirements and monitored against the risk tolerance levels.

- Reviewed the compliance reports submitted by the Compliance Officer to assess the Company’s compliance with laws, regulations, regulatory guidelines, internal controls and approved policies in all areas of Company operations.

- Reviewed the adequacy of capital in line with new capital adequacy requirement of Central Bank of Sri Lanka applied with effect from 1 July 2018.

Strategic risk

- Reviewed the effectiveness of strategies implemented in response to the changes in the business environment.

- Reviewed strategic risk indicators against the risk tolerance levels.

Assessing the risk profile of subsidiary companies

During the year under review, in line with the Finance Companies (Corporate Governance) Direction, No. 3 of 2008, Section 8 (3) (b), the following subsidiary companies submitted Risk Dash-board/key risk indicator reports to the IRMC enabling the Committee to review the risk profile of each subsidiary company and the overall risk profile of People’s Leasing Group. Highlights of subsidiary company reviews are given below:

-

People’s Insurance PLC (PI)

– The Committee reviewed the underwriting quality, investment concentrations together with KRIs of default risk, operational risk, strategic risk, compliance risk on a quarterly basis.

– The Committee reviewed the PI’s Compliance to the Risk-Based Capital Model regulated by the Insurance Regulatory Commission of Sri Lanka (formerly known as Insurance Board of Sri Lanka).

-

People’s Micro-commerce Ltd. (PML)

– PML involves in the business of providing micro-lending facilities to ensure financial inclusivity of the under privileged, rural and urban population and operates with a different risk profile.

– The Company’s risk profile was quarterly reviewed by the Committee against set risk tolerance limits.

-

Other subsidiaries

– IRMC quarterly reviewed the Risk Dash-board reports and Risk Indicator reports submitted by People’s Leasing Fleet Management Limited and People’s Leasing Property Development Limited respectively.

The secretary to the committee coordinated with aforementioned subsidiaries of People’s Leasing.

Respective officers of subsidiary companies who are participating on invitation briefed the Committee with the relevant information through various risk indicators and additional information.

Others

- Worked closely with the Corporate Management, Senior Management and Key Management Personnel supervising broad risk categories (credit, market, liquidity, operational and strategic risks) and made decisions on behalf of the Board within the framework of the authority and responsibility assigned to the Committee.

- Supervised the procedures of Integrated Risk Management responsibilities pertaining to risk management strategies, policies and processes.

- Recommended corrective action to mitigate the effects of specific risks at levels beyond the risk tolerance levels approved by the Board and on the basis of Company’s policies, regulatory and supervisory requirements.

During the year under review, the IRMC extended its support in line with the risk appetite and tolerance framework, in the execution of overall business strategy emphasising the upside and downside risks which can have an impact on the Company.

M P Amirthanayagam

Chairman

Integrated Risk Management Committee

13 June 2019