3

Putting enterprise in context

Operating environment

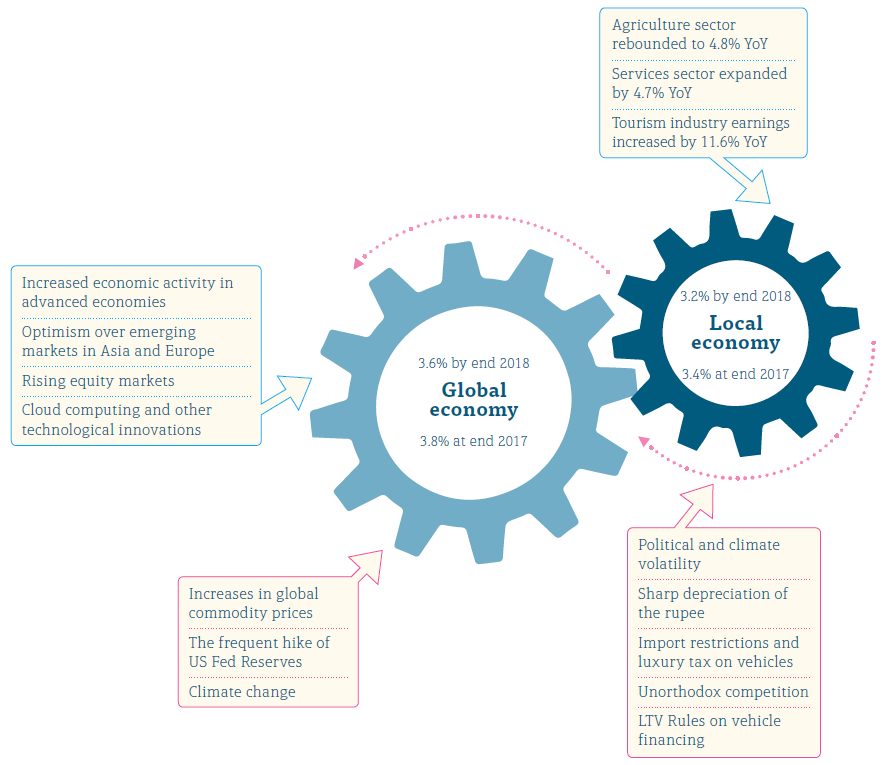

Our growth, during the year under review, must be viewed in the context of global economic activity which impacted our local economy, which in turn impacted our business. Local GDP growth reached 3.2% by end 2018, below the IMF and ADB forecasts of 4.3% and 3.8% respectively, and comparatively lower than regional economies which have experienced GDP growth of up to 7%.

This figure illustrates both the forces that drove global and local growth ( [[ icon ]] ) as well as those that stymied growth ( [[ icon ]] ). For a complete list of risks and opportunities that affected our business please refer Risks and Opportunities Section on pages 64 and 65.

The US dollar continued to strengthen, resulting in funds outflow from the domestic financial market increasing pressure on Sri Lanka’s exchange rate and foreign exchange reserves. Repercussions could well include the further depreciation of the rupee in 2019.

Tough times

Sri Lanka’s trade deficit had widened to USD 10,343 million by 31 December 2018, an increase of 7.53% in comparison to 2017. This was a result of import expenditure growth of 5.97% outpacing export earnings growth of 4.66%. The exchange rate came under pressure from capital outflows, particularly from Government rupee securities, tightening conditions in the global markets, and speculation in the domestic market.

World economic outlook projections

| Company | 2019 (Forecast) | 2018 | 2017 |

| World Output | 3.3 | 3.6 | 3.8 |

| Advanced Economies | 1.8 | 2.2 | 2.4 |

| United States | 2.3 | 2.9 | 2.2 |

| Euro Area | 1.3 | 1.8 | 2.4 |

| Japan | 1.0 | 0.8 | 1.9 |

| United Kingdom | 1.2 | 1.4 | 1.8 |

| Emerging Market and Developing Economies | 4.4 | 4.5 | 4.7 |

| Russia | 1.6 | 2.3 | 1.5 |

| China | 6.3 | 6.6 | 6.9 |

| India | 7.3 | 7.1 | 6.7 |

| ASEAN-5 | 5.1 | 5.2 | 5.3 |

Relieving the pressure

Several short-term measures were taken in an attempt to relieve the pressure on the exchange rate, but even so the Sri Lankan Rupee depreciated by 19% against the US dollar in 2018, the sharpest drop in a decade. The rupee depreciation comes on top of tax increases, fuel hikes, multiple strikes, and weather-related problems, bookended by local government elections and a constitutional crisis. They all significantly impacted the business and financial activities of our target market.

Sri Lanka is reported to have USD 5.9 billion. in external debt repayments in 2019, including an international sovereign bond of USD 1 billion which matured in January and was repaid.

Headline inflation in the country remained in low single digits while core inflation too remained restrained. The tight monetary policy remained throughout 2018 as well. Structural reforms such as the new Inland Revenue Act and the introduction of fuel pricing formula were introduced in line with the Government’s Policy of revenue driven fiscal consolidation.

Optimistic vibes

On a more positive note, Sri Lanka also ascended 11 places to be ranked 100 among 190 countries in the World Bank’s Ease of Doing Business Index. However, greater encouragement – for instance improved efficiency in the process for registering exporters – could also make it easier for SMEs to flourish and enter international markets.

While the terrorist attacks on 21 April 2019 have negatively impacted the country, Sri Lanka’s ranking as the top tourist destination for 2019 by Lonely Planet, which may increase the country’s chances of achieving tourist arrival targets and accelerate annual earnings from the industry. This could have a knock-on impact on the leasing sector with Micro business and SME owners being able to capitalise on this opportunity.