![]()

As Sri Lanka’s largest private sector Bank, the Bank plays a pivotal role in influencing and shaping Sri Lanka’s advancement towards a more sustainable and inclusive economy. Demonstrating its spirit in the face of adversity, the Bank stood through the unprecedented disruptions to the global economy caused by the COVID-19 pandemic and remained well positioned to play an important role in economic recovery and restoration of livelihoods. The Bank adapted to new customer behaviour and preferences, restructured its internal operations, and recalibrated revenue models to successfully scale the challenging year. The Bank’s sustainability vision - “to be a responsible financial service provider by enabling and empowering people, enterprises and communities, towards environmentally-responsible, socially-inclusive and economically-enriching growth” – has never been so relevant. It was the unfailing commitment of the Bank’s employees that enabled the Bank to be there for its customers during the crisis, and therefore in the recovery phases as well. The numerous awards and accolades bears testament to the strength and mettle of the Bank.

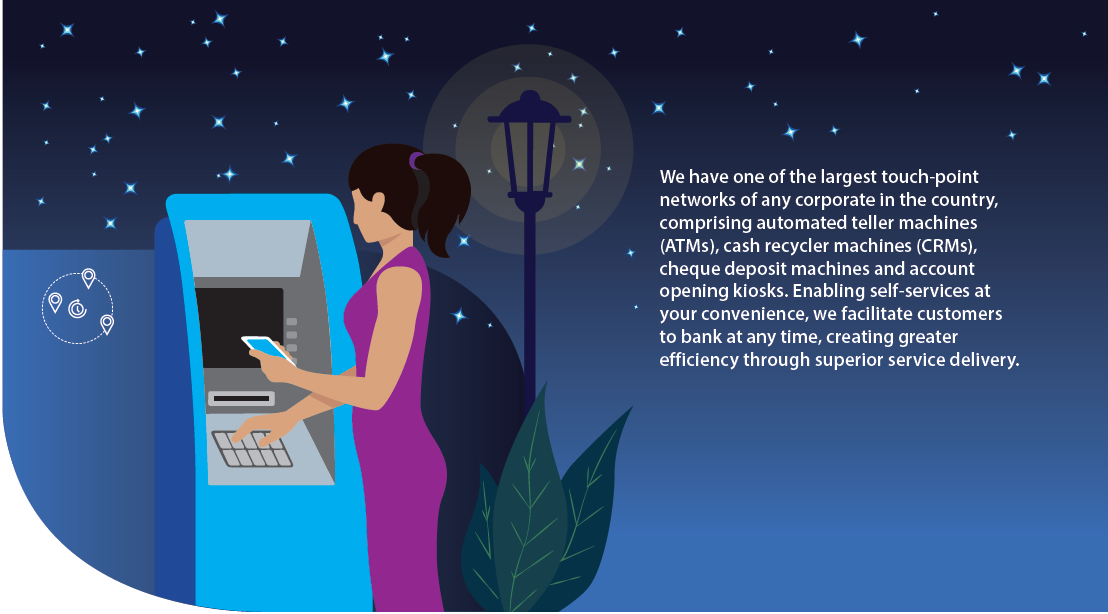

The Bank’s emphasis on operational excellence has long been the backbone of its success and a crucial factor in its sustained profitability. Speed, accuracy, and quality of delivery is a key differentiator in today’s banking landscape, where competition is fierce and an array of similar banking products and services saturate the market. The Bank continued to assess and streamline processes and make the most productive use of its resources throughout the year to meet customer expectations while remaining cost efficient.

While the Bank’s fundamental business of financial intermediation requires adherence to government regulations, having a “Social License," which is tangible evidence of ethical and conscientious behaviour is imperative to operate in a community of stakeholders. In this context, operational excellence encompasses, among other things, investments in the well-being of its stakeholders and environment. This balance of short-term and long-term interests forms the very essence of the Bank’s profitability.

Highlights:

Cost to income ratio, Income per employee, Profit per employee Advances per employee and Deposits per employee have improved during 2021 (Refer Table 12)

Table – 12: Productivity and efficiency ratios

| 2021 | 2020 | 2019 | 2018 | 2017 | 5 year average | |

| Cost to Income ratio (Including taxes on financial services) (%) | 37.97 | 39.96 | 49.41 | 46.35 | 51.08 | 44.954 |

| Cost to Income ratio (Excluding taxes on financial services) (%) | 31.61 | 33.95 | 38.51 | 36.85 | 41.08 | 36.40 |

| Revenue per Employee (Rs. Mn.) | 31.720 | 29.605 | 29.377 | 27.462 | 22.954 | 28.224 |

| Profit per Branch (Rs. Mn.) | 82.251 | 57.050 | 59.320 | 61.557 | 59.219 | 63.879 |

| Profit per Employee (Rs. Mn.) | 4.654 | 3.238 | 3.363 | 3.490 | 3.328 | 3.615 |

A transformed working environment

The Bank continued to offer uninterrupted services to its customers and its stakeholders by taking the necessary measures to strengthen its readiness through the implementation of a comprehensive Business Continuity Management (BCM) framework. The BCM framework and the scope of the Bank’s Pandemic Plan was further expanded during the year under review by introducing additional measures to strengthen the Bank’s ability to deliver its critical and essential services to customers, safeguard employee wellbeing, comply with the regulatory requirements, and adhere to good governance principles. The key objectives of the BCM are to:

- Ensure service continuity by identifying the Bank’s key products, services and the supporting core banking systems, processes and protecting them against disruptions.

- Meet the predefined services levels after a disruption, including systemically important payment and securities settlement systems.

- Implement an effective incident and crisis management and a business continuity framework that minimises the impact of disruption while ensuring maximum resources availability to resume normal operations.

- Minimise the financial, legal and other operational risks arising from disruptions or failures.

- Protect human life and ensure their safety from hazards or dangers during work.

- Safeguard the brand image and reputation of the Bank.

Continuing operations while limiting exposure

To ensure continuity of operations and prevent infection exposure and spread, the Bank continued to work through split teams working at alternate sites, remote sites and working from home whilst following the established health protocols.

The following arrangements were made to maintain uninterrupted service whilst minimising staff exposed to the virus.

- Providing dedicated transport arrangements to staff in specialised units in order to report to work and reimbursing the personal transport cost of employees reporting to work during COVID-19 related lockdowns. Total staff traveling cost reimbursement amounted to Rs. 165.8 Mn. for the year under review.

- Changing the infrastructure of branches in order to enhance the safety of staff and customers by separating counters with a special glass panel.

- Providing safety equipment such as thermometers, gloves, masks, sanitizers to branches and disinfecting branch premises and ATM cubicles.

- Providing food, lodging, and transport for all mission critical staff who were required to report to work during the lockdowns.

- Deploying the Call Tree Notification System to convey instructions on logistics arrangements at short notice, and mobilise staff for shift-based work.

- Providing transfers to closer work locations for 328 staff members who faced travelling difficulties during the pandemic period to facilitate smooth functioning of business units.

- Expanding the scope of the Surgical and Hospitalization insurance of employees to include COVID cover. This allowed staff members and their immediate family to reimburse the cost of PCR and Rapid Antigen Testing (RAT). It also allows COVID positive staff members and their immediate family members to get treatment at Paid Intermediate Care Centers (ICCs). A total of 915 employees contacted COVID-19 in 2021, of whom 481 were admitted to Intermediary Care Centres (ICCs). To prevent the spread across the Bank, 3,554 PCR and RAT tests were conducted during the year at a cost of Rs 25.1 Mn. The Bank also spent Rs. 83.4 Mn. to take care of its COVID infected employees admitted to ICCs. Furthermore, dry ration packs were provided to COVID infected employees who were home quarantined, at a cost of Rs. 2.86 Mn.

- A series of special training sessions were conducted to educate outsourced security personnel on necessary COVID safety protocols and guide them to enforce mandatory mask wearing, sanitising and temperature checks at all entry points to the Bank.

- Granting special paid leave to staff members with underlying health conditions and expectant mothers to prevent their risk of exposure to the virus.

- Fine-tuning the communication plan to support pandemic related communication with staff members.

Table – 13: Readiness of BCP sites

| Location | Seating Capacity |

| Mount Lavinia | 39 |

| Piliyandala | 58 |

| Maradana | 50 |

Table – 14: COVID-19 related expenses

|

COVID-19 related expenses

|

||

| 2021 Rs. Mn. | 2020 Rs. Mn. | |

| Face Masks | 14.10 | 27.10 |

| Gloves | 4.10 | 4.80 |

| Hand Sanitizer | 23. 40 | 20.50 |

| Infrared Thermometers | 0.95 | 3.50 |

| Reimbursement of PCR and Rapid Antigen Tests | 25.10 | 3.80 |

| Intermediary Care Centers | 83.40 | – |

| Assistance packs for infected staff members | 2.86 | 0.50 |

Working securely from home

Work-from-home arrangements were facilitated for employees by providing necessary IT infrastructure and implementing guidelines on remote working. The security of the network was assured through an industry-leading remote access solution offering multiple layers of security. All employee engagement and development programs were migrated to digital platforms, ensuring collaboration and ongoing interaction.

Our people rising to the occasion

The Bank’s workforce has been its engine of successful value creation. The team of 5,072 diverse and highly competent employees are the greatest asset of the Bank and they have been fundamental in achieving the strategic aspirations of the Bank. During the extraordinary challenging year, the employees demonstrated a great adaptability to maintain business and serve its customers. Their commitment, dedication and efforts have been instrumental in facilitating customer experience, driving loyalty and brand value. Earning the trust and loyalty of its employees and ensuring they remain invested in the business is among the foremost priorities of the Bank. To this end, the Bank’s Human Resources Governance Model and Human Resource Development Policy together provide the foundational framework to develop people as a strategic resource, whilst ensuring every employee has equal opportunity to achieve their personal and professional growth ambitions. To build a strong employee brand and be the preferred employer in the sector, the Bank strives to create an enabling environment where employees can perform exceptionally, fulfill their potential, and feel connected to their purpose, their colleagues, and the organisation. The Bank empowers its people to be adaptive to remain relevant in a rapidly evolving banking landscape by promoting a culture of continuous learning.

Table – 15: Retention Rate (Maternity Leave)

| Number of Employees | 2021 | 2020 | 2019 |

| Availed leave during the year | 50 | 69 | 84 |

| Due to return during this year | 59 | 73 | 64 |

|

Returned during the year |

59 | 73 | 64 |

| Returned during prior year | 73 | 64 | 48 |

| Still employed after 12 months | 70 | 61 | 45 |

| Return ratio (%) | 100.00 | 100.00 | 100.00 |

| Retained ratio (%) | 95.89 | 95.31 | 93.75 |

Focusing on employee morale and safety

Health and safety of employees was a foremost priority of the Bank, during the year, and the Bank adopted an array of measures to safeguard its staff from the risk of cross infection (Please refer to section on continuing operations while limiting exposure for detailed information). The Bank continued to emphasise clear communication and flexibility to ensure the safety of all employees. Whilst the senior leadership took a hands-on approach, regularly communicating with staff, being personally available, and promoting a culture of openness and honesty about the situation, the Business Heads stayed in constant touch with their teams through formal and informal communications channels. A flexible approach was adopted taking into consideration different family situations and health conditions of the Bank’s diverse, multigenerational workforce. Every effort was made to accommodate employee preferences in working environment in both location and hours.

The Bank believes that upholding recognised standards and principles for labour practices, human rights and occupational health and safety is essential to remain productive. Especially in a challenging context, it was important to prevent burnout and exhaustion and bolster morale, and provide employees with an environment where they could flourish and drive the success of the Bank. Even through the difficult circumstances, camaraderie and team spirit of the staff remained strong and their productivity remained high and consistent.

Figure – 23: Employee communication channels

Remuneration and Job Security

Understanding the importance of affirming its financial commitments to its staff, especially in time of crisis, more than ever, the Bank placed high priority on continuing remuneration and ensuring job security to its employees. Therefore, despite the challenges arising from the pandemic, all employees were paid their full remuneration throughout 2021. Further, an average salary increment of 10% was granted to all employees. The annual performance appraisal was conducted for all employees and the applicable increments and bonus entitlements were paid as per the Bank’s Pay-for-Performance policy.

The Defined Contribution Pension Fund launched in 2020 to commemorate the centenary year covering employees who are not covered by the existing pension fund of the Bank is a significant initiative to enhance the value delivered to its employees.

Collective Bargaining

Demonstrating the strong collaborative partnership that Commercial Bank has built with the CBEU over the decades, the Collective Agreement with the Bank’s branch of the Ceylon Bank Employees’ Union (CBEU) was renewed in 2021 for a further 3-year period. All negotiations were conducted in the spirit of compromise with special consideration of the financial and other challenges brought about by the pandemic. The Management continues to maintain cordial relations with the two employee unions, which have yielded many benefits to both employees and the Bank.

Diversity

The Bank believes a diverse workforce and inclusive culture will improve the quality of decision-making, drive innovation, enhance resilience and strengthen its ability to serve all customer segments across Sri Lanka. The Bank remains committed to the principles of equal opportunity irrespective of gender, age, race, disability or religion in all its HR management processes. The Bank’s Sexual Harassment policy aims to honour the fundamental rights of every employee to work in a safe, dignified and respectful environment free from discrimination, bullying and harassment. Whilst including as part of the orientation training for new recruits, the Bank conducts regular refresher sessions to ensure that all employees remain aware of the contents and interpretation of this policy. All expectant mothers across the Bank were granted special leave from May 01, 2021 onwards, to ensure their safety against the third wave of the pandemic.

In recognition of the Bank’s commitment to the principles of equal opportunity in its Human Resources Management processes including recruitment policy, benefits and pay, training and development opportunities, and policies on abuse and harassment, the Bank was honoured at the inaugural Women Friendly Workplace awards by the Satyn Magazine and CIMA in 2021.

Table 16: Female workforce

| As at December 31, | 2021 | 2020 |

| No. of female employees | 1,201 | 1,106 |

|

Female employees in Senior Management positions as a percentage of total employment (%) |

0.92 | 0.92 |

| Percentage of female employees promoted (%) | 16.80 | 21.80 |

| Percentage of females recruited (%) | 35.5 | 27.21 |

|

Percentage of females in key geographical locations (of all female employees in the Bank) |

||

| – Western Province (%) | 75.78 | 76.22 |

| – Outstations (%) | 24.22 | 23.78 |

| Percentage of female exits (includes retirees) | 31.00 | 32.87 |

Table 17: Employee by Type and Gender

| As at December 31, 2021 |

Sri Lanka

|

Bangladesh

|

Total

|

|||

| Count | Percentage (%) | Count | Percentage (%) | Count | Percentage (%) | |

| Female | 1,115 | 23.33 | 86 | 29.35 | 1,201 | 23.68 |

| – Permanent | 1,114 | 23.31 | 70 | 23.89 | 1,184 | 23.34 |

| – Contract | 1 | 0.02 | 16 | 5.46 | 17 | 0.34 |

| Male | 3,664 | 76.67 | 207 | 70.65 | 3,871 | 76.32 |

| – Permanent | 3,663 | 76.65 | 180 | 61.43 | 3,843 | 75.77 |

| – Contract | 1 | 0.02 | 27 | 9.22 | 28 | 0.55 |

|

Employees-Bank |

4,779 | 100.00 | 293 | 100.00 | 5,072 | 100.00 |

| Outsourced Employees | ||||||

| – Female | 149 | 41.74 | 6 | 6.06 | 155 | 33.99 |

| – Male | 208 | 58.26 | 93 | 93.94 | 301 | 66.01 |

|

Employees-Outsourced |

357 | 100.00 | 99 | 100.00 | 456 | 100.00 |

All employees of the Bank are full time employees.

Table 18: Employee by Category and Gender – Total Bank

| As at December 31, 2021 |

Age 18-30 years

|

Age 31-50 years

|

Age over 50 years

|

Total

|

%

|

|||

| Male | Female | Male | Female | Male | Female | |||

| Corporate Management | – | – | 3 | – | 23 | 5 | 31 | 0.61 |

| Executive Officers | 97 | 52 | 1,411 | 328 | 190 | 92 | 2,170 | 42.78 |

| Junior Executive Assistants and Allied Grades | 993 | 272 | 907 | 297 | 21 | 60 | 2,550 | 50.28 |

| Banking Trainees | 172 | 94 | 4 | – | – | – | 270 | 5.32 |

| Office Assistants and Others | – | – | 13 | 1 | 37 | – | 51 | 1.01 |

|

Total |

1,262 | 418 | 2,338 | 626 | 271 | 157 | 5,072 | 100.00 |

Training and Development

Training and Development is a vital component of the Bank’s Human Resource Development Philosophy. Following a robust training and development strategy to provide both individual and collective learning opportunities for its staff, the Bank focuses predominantly on equipping its staff with up-to-date, relevant skill-sets and necessary competencies to thrive in a rapidly changing banking environment. Driving operational excellence, improving product knowledge, customer service, marketing and communication, innovation, leadership development, soft skills, sustainability, industry trends, digital technology adoption and compliance are key areas of emphasis of employee development. Following the pandemic, the majority of training programs were conducted virtually, enabling employees a more "anytime, anywhere" approach of providing multiple continuous training experiences.

During the year under review, the Bank embarked on a Leadership Development Program for Regional Managers conducted by an internationally recognised trainer. The Bank also commenced developing a moodle based learning management system, in-house to enhance the learning experience of employees. In addition, an identified group of potential branch Managers were enrolled to a Leadership Development Program conducted by Postgraduate Institute of Management (PIM) where they will be undergoing a continuous professional development program. Special Virtual training programs were conducted targeting Branch Managers, Assistant Branch Managers, and Junior Executive Officers covering technical and soft skills. Further, several virtual training programs were conducted covering areas such as Recoveries and NPL Management, Anti-Money Laundering and Compliance and Credit Risk Management, information security, impairment assessment in view of the new Directions issued by the CBSL on migration of regulatory reporting in line with SLFRS 9 etc. among others.

Table 19: Training statistics

| 2021 | 2020 | 2019 | 2018 | |

| Total training cost (Rs. Mn.) | 22.955 | 15.183 | 54.695 | 47.119 |

| Total training hours | 79,928 | 43,961 | 142,950 | 130,754 |

| Total e-learning hours | 7,756 | 7,161 | 1,111 | 1,309 |

| Percentage of training through e-learning (%) | 9.70 | 14.01 | 0.77 | 0.99 |

| Total investment on virtual training (Rs. Mn.) | 16.958 | 3.455 | 0.315 | 0.333 |

Sri Lanka’s first Carbon Neutral Bank

Sustainability is the cornerstone of the Bank’s corporate ethos, influencing every aspect of the organisation. Being the first Bank in Sri Lanka to achieve the carbon neutral status as affirmed by Climate Smart Initiatives (Pvt) Ltd. and being awarded the Best Corporate Citizen Sustainability Award for 2021 by the Ceylon Chamber of Commerce are strong testaments of the Bank’s deep commitment towards best practices in sustainability at every employee level. The Bank’s multifaceted Green initiatives that contributed to its carbon neutrality status and achieving its Green Goals include lending to support eco-friendly operations, migrating customers to paperless banking, reducing consumption of non-renewable energy, water, and other resources in its own operations, and support to community initiatives that help conserve habitats and the environment. The Bank’s sustainable banking practices have been designed on the basis that sustainable success is a balancing act – between continuity and change, stability and disruption, being conservative and bold. It involves enhancing shareholder returns without compromising its responsibility to the society and the environment.

Additionally, the Bank has numerous commitments including a mangrove restoration project in Koggala, a marine turtle conservation initiative to protect the biodiversity of the ocean, and support to the “Thuru Mithuru” initiative of the Sri Lanka Army to promote self-sufficiency in essential food.

Managing our Footprint

The Bank pioneered a mandatory social and environmental screening process for its project lending activities and was the first bank in Sri Lanka to venture into Green Financing. Furthermore, the Bank revolutionised digital banking by introducing features in its “Flash” mobile application to measure and offset customer impact on the environment. Embedding its climate strategy into its core product and service offering, the Bank also finances projects that focus on renewable energy, energy and resource efficiency, waste management, emission reductions, smart agriculture and green buildings. The Bank’s Green Financing is geared towards the fight against climate change, meeting the United Nations Sustainable Development Goals 7 and 12: Affordable and Clean Energy, and Responsible Consumption and Production.

With Sri Lanka facing growing energy demands and having set a national ambition to become energy self-sufficient by 2030 and reach 100 percent renewable energy generation by 2050, the Bank increased its support towards development of clean energy resources and energy efficiency initiatives. Securing a USD 50 million loan from the CDC Group of UK marked the first climate investment in Sri Lanka by the Group, to bolster the country’s efforts to help reduce greenhouse gas emissions and bring about a cleaner and more sustainable future to the island. This provides the capital that allows the Bank to extend credit toward renewable and climate-supportive projects.

Green buildings and initiatives

Since being the first Bank to be awarded the Green Building certification by the Green Building Council of Sri Lanka for its Galle Fort branch, the Bank has further expanded its portfolio of green buildings to include Jaffna Branch and the Trincomalee branch. Over the years, the Bank has systematically increased its investment in solar PV systems to meet the energy needs of its branch network. As at December 31, 2021, Rs. 251 Mn., has been invested to commission solar systems at 61 of its branches including branches operating in Bank owned buildings of which 09 are fully powered by solar energy and the remaining partially dependent on the national grid to fulfill their energy requirements.

Table 20: Energy consumption

| Indicator (Gigajoules) | 2021 | 2020 | 2019 | 2018 |

| Energy consumption | 42,906 | 45,045 | 50,296 | 49,958 |

| Solar Power Generated | 6,068 | 5,613 | 6,530 | 1,767 |

| Solar Power Generated as a % of Energy Consumption | 14.14 | 12.46 | 12.98 | 3.54 |

Recognised as the most progressive banking institution in Sri Lanka, we play a vital role as an advocate and driver of sustainability in our Nation. Our commitment to preserving the environment is reflected through our responsible lending protocols which include a mandatory social and environmental screening process and becoming the first carbon-neutral bank in Sri Lanka. Our positioning as a predominant bank in climate financing and environmental consciousness in the South Asia region was affirmed by the International Finance Corporation (IFC) by conferring two Climate Assessment for Financial Institutions (CAFI) awards in 2021.

Aligning with the UN Sustainable Development Goals (SDGs)

As a leader in the country’s banking sector, the Bank recognises its position of responsibility as a financial institution in influencing and shaping the transition to a more sustainable green, and inclusive economy. Therefore, the Bank has committed to the global mandate of achieving the United Nation’s Sustainable Development Goals (SDGs) by the year 2030, agreed on by 193 countries, and has also aligned its sustainability priorities and operations with the SDGs. Based on a process of principled prioritisation, the Bank supports 7 out of the 17 SDGs as most aligned to its sustainability and responsible banking ethos and operations, allowing for a more focused and targeted approach yielding a greater impact.

Quality Education |

Gender Equality |

Affordable and Clean Energy |

Decent Work and Economic Growth |

Industry, Innovation and Infrastructure |

Responsible Consumption and Production |

Partnership for the Goals |

Community sustainability

The Bank makes a conscious effort to integrate CSR into its core business activities, to create opportunities for shared value. This approach allows the communities to learn, grow and thrive together with the Bank. The Bank’s nationally significant contributions through its CSR Trust, includes education, healthcare, environment and community development. In the past decade, the Bank has contributed immensely to improve the lives of Sri Lankans by reaching out to communities and conducting over 900 CSR projects supporting education, healthcare and culture. The Bank’s largest contribution is towards IT education in Sri Lanka, through the donation of 253 fully-equipped IT laboratories to schools and other institutions and partnering the “Smart Schools Project” to introduce a comprehensive digital Learning Management System (LMS) to 65 schools in the country. The Bank also funds a 150-hour IT hardware course conducted in collaboration with SLT Campus (Pvt) Ltd. and CISCO Networking Academy in selected schools and has partnered with the Academy to offer an “IT Essentials” course for teachers and students free of charge.

Playing an active role in supporting people and institutions at the frontlines of the battle against COVID-19, the Bank donated critical medical equipment worth of Rs. 26.3 Mn. to over 25 Government hospitals in 2021. Recognising that the Sri Lanka’s labour force is one of the most crucial factors in development, the Bank supports young Sri Lankans find rewarding careers in collaboration with the Vocational Training Authority (VTA).

Partnership for the Goals

The partnerships forged over the years and the new collaborations pursued with public, private and non-governmental organisations both locally and internationally, offer vital support in the achievement of its sustainability strategy. The synergies derived through these partnerships in terms of knowledge sharing and capacity building go a long way in augmenting expertise, building the internal capacity and improving the efficacy of the Bank’s sustainability initiatives. The Bank takes pride in being an active member of the following platforms:

- Sri Lanka Banks’ Association Sustainable Banking Initiative – Core Group Member since inception

- UN Global Compact Sri Lanka – Steering Committee Member

- Biodiversity Sri Lanka – Founder Member

The Bank’s business partners that facilitate the smooth operations of its business, providing technology platforms, market access, and necessary materials and other services required in the normal course of business form important links in the supply chain that ultimately deliver value to all stakeholders. During the year under review, the Bank engaged with an over 1,400 business partners.

Working closely to educate suppliers regarding the e-procurement system launched in 2020 to assist suppliers to manage pandemic related challenges, a majority of the critical supplier base was on-boarded to the new fully automated e-procurement system by mid-2021. The Bank also began assessing the level of social and environmental compliance of potential suppliers to confirm their alignment with national regulations and global best practices.

Figure – 24

The Bank’s Business Partners

Critical to operations

- Utility services providers

- Software suppliers

- Material suppliers

- Travel and Transport

Extend our reach

- Correspondence banks

- Franchise partners

- Exchange houses

- FinTech companies

Infrequent engagement

- Premises providers

- Contractors

- Professional services providers

Maintenance

- Staff welfare

- Waste management

- Communication

- Human Resource providers

- Asset suppliers

- Debt collection agencies