The COVID-19 pandemic has changed people’s lives and livelihoods fundamentally and perhaps irreversibly. It has also impacted the banking industry in a number of dimensions, ushering in a new competitive landscape, stifling growth in some traditional product areas, prompting a new wave of innovation, recasting the role of branches whilst accelerating digitization in almost every sphere of banking.

Having navigated the immediate pressure of the COVID-19 crisis, banks play a pivot role in shaping the recovery and helping customers rebuild their financial security and business health. This requires banks to refocus on understanding their customers’ needs, and in parallel, nimble adaptations of strategies and business models to ensure efficiency and resilience, and creativity in confronting challenges and seizing new opportunities presented by the changing environment.

In adapting the Bank’s strategy to face the “new normal”, and play a significant role in shaping the recovery, the Bank analysed its external environment to identify matters arising from changes that were brought forth by the pandemic and emerging trends that were relevant to key stakeholder groups, as given below:

Figure – 03: Material Matters

| Political | Economic | Social | Technological | Environmental | Legal/Regulatory | |||||||

| Investors |

1. | Lack of desired level of policy consistency | 2. | Economic slowdown due to pandemic | 3. | Growing influence of social media | 4. | Unorthodox competition and financial disintermediation | 5. | Directions and guidelines to counter impacts of the pandemic | ||

| 6. | Lack of desired level of transparency and accountability | 7. | Depreciating currencies against USD | 8. | Demand for non-financial information and long termism | 9. | Compliance with new Basel requirements | |||||

| 10. | Downgrading of the Sovereign rating and its cascading effect on the banking industry | 11. | Demand for more transparency and accountability | 12. | Higher regulatory capital | |||||||

| 13. | High CAPEX requirements | 14. | New Banking Act | |||||||||

| Customers |

15. | Envisaged upturn in private sector credit and improvement in asset quality | 16. | Changing customer expectations | 17. | Migration towards digital platforms | 18. | Compliance requirements and regulations such as FATCA1, GDPR2, and BEPS3 | ||||

| 19. | Import restrictions | 20. | Cybersecurity threats | |||||||||

| Employees |

21. | Need to enhance productivity | 22. | Staff recruitment and retention becoming more challenging | 23. | Technology driving change in job skills | ||||||

| 24. | Health and safety |

25. | New working cultures | |||||||||

| Society and environment |

26. | Geopolitical conflicts | 27. | Declining worker remittances | 28. | Need to commit to Sustainable Development Goals (SDGs) | 29. | Increasing frequency and magnitude of natural disasters and poor disaster preparedness | ||||

| 30. | Corruption | 31. | Declining global competitiveness of Sri Lanka | 32. | Increasing conflicts | 33. | Increasing demand for green banking and green lending | |||||

| 34. | Increasing drug pedaling and drug and alcohol addiction | 35. | Pandemics hampering world trade and economy | |||||||||

| Business partners |

36. | A more collaborative approach | 37. | New technological advances such as AI, Robotics, blockchain | ||||||||

In the backdrop of these circumstances, during the year, we revisited the process of identification of material matters through a refreshed materiality assessment, to gain deeper insight and understanding into key areas of concern for stakeholders. The assessment also took into consideration the impacts of the COVID-19 pandemic.

The process followed is summarized below:

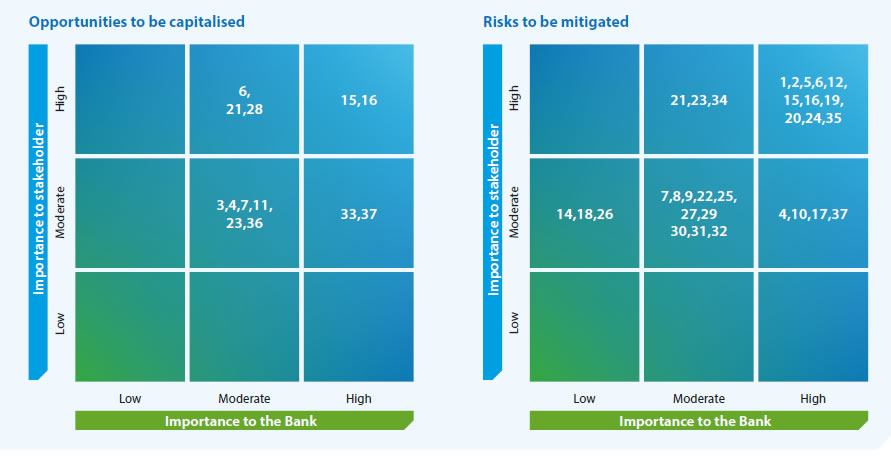

Even as these trends present risks, opportunities or both, the impact of these trends is felt by the stakeholders and the Bank alike on varying degrees. The risks emanating from the pandemic were felt across all of stakeholders at different magnitudes, and they outweighed the risks presented by other emerging trends. The matrices that follow, illustrate the topics that are material to the Bank according to their impact on stakeholders and the Bank itself. The Bank defines material matters as those that significantly affect the Bank’s ability to create value over the short, medium and long term. The materiality of each matter have been determined by its relevance, the magnitude of its impact, and the probability of occurrence.

Table 04 Material Matters, Risks, Opportunities, and how we manage

| Material Matters | Risks | Opportunities | How we manage | GRI Disclosure |

| Digital Transformation | The younger generation is more inclined to technology and their preference for personalised, convenient, and secure service is on the rise. The pandemic has sparked higher trajectory in the migration towards the use of digital products and services, increasing the need to continue digital innovation. Need to upskill the human capital to be on par with the technological changes. | Digital channels allow speedier and round the clock delivery of service at the finger tip of customer, leading to increased level of transactions and expanding reach. Digitalised processes freeing up employees from tasks, enabling higher customer interactions, establishing new connections. | The Bank takes a proactive approach on this sphere and has been many times the first in the market to launch new digital channels and products. Please refer the section on “Leading through Innovation ” for more details. | |

| Cyber Security | Cyber threats continue to increase globally and the need to protect the integrity and privacy of data is becoming important than ever before. The pandemic has fuelled the risk of cyber attacks and thefts. | Having a robust cyber security programme boosts customer confidence in embracing and using digital platforms and provides a distinctive advantage over competition in the digital banking space. | A high importance is placed on this critical aspect. Internationally recognised certifications we hold vets the robustness in our security systems. For more details please refer the sections “IT Operations and Security ” and section “IT risk ” in Risk Governance and Management report. | GRI 418: Customer Privacy |

| Downgrading of sovereign rating |

Reduction of international trade transaction volumes hampers the ability to raise foreign currency in the international market | Healthy mix of foreign currency portfolios and the Bank's regional presence supporting foreign currency liquidity supports the Bank's ability to sustain its foreign currency transactions. | The Bank's strength in the foreign currency mix in the balance sheet, built over the years and our regional presence has helped sustain our foreign currency operations. The section “Managing and Funding Liquidity ” provides insight on how the Bank managed the impacts of this material aspect. | |

| Transparency and Accountability | Non-disclosure of adequate information may give rise to reputation risks and regulatory pressures. Increased demand for forward looking strategic direction by investors over traditional past performance reporting | Increased transparency helps reduce risks of unwarranted suspicion and helps achieve faster resolution of issues and reputation-related risks. | The Bank's approach on transparency and accountability is discussed in detail in the section “Annual Corporate Governance Report ”. | |

| Talent Management | Among the risks brought about by the pandemic are the health and safety of the workforce, sustaining critical operations, sudden adjustments in the new working environment top the list. Staff recruitment and retention is becoming more challenging. | Adoption of digital means for remote working results in increasing technology related skills and rethinking working conditions that may improve work-life balance and reduction in costs. | Putting the safety of our employees first, our focus was more on providing a safe working environment for the staff and looking after the employees and their families affected by the pandemic. Getting employees adjusted to new ways of working and working conditions, the Bank invested in its Human capital. For more details please refer section “Operational Excellence ”. | GRI 401: Employment GRI 404: Training and Education GRI 405: Diversity and Equal Opportunity GRI 403: Occupational Health and Safety |

| New Regulations, Compliance requirements, and directives | Increased costs in implementation, modification, and monitoring of process. | Good governance is the bedrock of a sustainable business and helps boost stakeholder confidence. | The Bank is committed to being compliant to the letter and spirit and believes in commitment to good governance provides a strong footing for sustainable development. Please refer section “Annual Corporate Governance Report ”. | |

| Climate Change | Increasing frequency and magnitude of natural disasters may cause deterioration of asset quality, operational and reputational risks. The Bank may outpace the competition by responsible lending through Social and Environmental screening. | Increasing awareness and tendency towards renewable energy and greening of buildings and processes bring about green financing opportunities. Initiatives in countering impacts of carbon emissions. | Though the Bank’s own footprint is minimal, we endeavour to minimise the same through adopting green processes, moving to green buildings, and generating solar energy for our operations. However, the bank could influence a much higher impact through our lending to renewal energy generation, greening of processes, and screening for environmental impacts on businesses we lend to. How we do this is more described in the sections on Prudent Growth and Operational Excellence . | GRI 302: Energy GRI 305: Emission |

| Partnerships for Goals | Interruption to critical services could disrupt smooth execution of the Bank’s operations. Unorthodox competition and financial disintermediation may threaten the survival. | Collaboration with Fin-Tech could open up new avenues to reach untapped markets and evolve alongside changing customer expectations. Advancement in new technologies such as Artificial Intelligence, Robotics, and Block Chain could be used to boost operational excellence. | The Bank’s continued it efforts on building win-win partnerships and constantly seek avenues to turn the risks of evolving new technology for the development of our own products, services, and delivery. Described more on section “Leading through Innovation ”, section “Partnerships for the Goals ” and Events 2021 . | |

| Being Socially Responsible | Growing influence of social media and increasing awareness on socially accepted norms expected from business, if not properly managed could lead to losing social license to operate. | Social acceptance of being responsible augments the Bank's leadership position within the banking system contributes to sustainable development. | We believe in sharing the value created with the society we operate in through our CSR Trust, conducting capacity building programmes, and supporting the preservation of environment. Please refer section “Community Sustainability ”. | |

| Macroeconomic and Geopolitical risks | Though the severity has reduced overtime the pandemic-led disruptions continue to prevail with economies continuing to slowdown. Geopolitical tensions may impact certain sectors of the economy. |

Increased collaboration with business community especially with SMEs and micro sector, through the extension of reliefs on best repayment, rescheduling and education leads to stronger and sustainable relationships. Social distancing has increased the demand for digital products and with already sound digital infrastructure the Bank is poised for a higher share of the digital banking sphere. | Discussed within the section “Risk Governance and Management ”. | GRI 201: Economic Performance GRI 203: Indirect Economic Impact GRI 207: Tax |

The Bank’s strategies are reshaped to fit the time and are embedded in the Corporate Plan for execution by the Management together with underlying KPIs for measurement of successful implementation. Success in the Bank’s value creation journey under the four strategic imperatives is outlined in the section on “Management Discussion and Analysis ”.

Management approach

The Bank manages its material topics through its strategic planning process. This includes assigning responsibility to the heads of the relevant divisions of the Bank and allocating the required resources based on the significance of each material topic towards achieving the aforesaid strategic imperatives. To ensure achievement of its objectives with regard to its material topics, the Bank has embedded goals and targets, where relevant, into the KPIs of the Key Management Personnel and are reviewed at regular intervals.

Many policies have been instituted to guide its people to conduct activities in a responsible, transparent, and ethical manner in managing the material topics. The Board of Directors has duly adopted these policies, which are reviewed at predetermined intervals to stay current with the changing environment. The Integrated Risk Management Department monitors timely revision of these policies and reports to BIRMC.

Where relevant grievance mechanisms have been established with assigned responsibility to the relevant divisional heads to manage, address and resolve grievances. The Bank’s lending to its customers and dealings with its business partners are screened for social and environmental aspects.

Internal and external auditing and verifications are carried out to ensure adherence to internal controls, policies and procedures laid down to achieve the objectives of material topics. Findings are reported to the Board of Directors and/or to the respective Management Committees on a periodic basis for information and corrective action where necessary.

The awards and accolades received by the Bank over the years, amply demonstrate the effectiveness of this management approach.

Table – 05: GRI Disclosure on Material Matters

| Material topic | GRI Disclosure | |

| 1. | Lack of desired level of policy consistency | GRI 201: Economic Performance GRI 203: Indirect Economic Impact GRI 207: Tax |

| 2. | Economic slowdown due to pandemic | |

| 4. | Unorthodox competition and financial disintermediation | |

| 5. | Directions and guidelines to counter impacts of the pandemic | |

| 6. | Lack of desired level of transparency and accountability | |

| 10. | Downgrading of the Sovereign rating and its cascading effect on the Banking industry | |

| 12. | Higher regulatory capital | |

| 15. | Envisaged upturn in private sector credit and improvement in asset quality | |

| 16. | Changing customer expectations | |

| 17. | Migration towards digital platforms | |

| 19. | Import restrictions | GRI 201: Economic Performance |

| 20. | Cyber security threats | GRI 418: Customer Privacy |

| 21. | Need to enhance productivity | GRI 404: Training and Education |

| GRI 405: Diversity and Equal Opportunity | ||

| 23. | Technology driving change in job skills | GRI 401: Employment |

| GRI 404: Training and Education | ||

| GRI 405: Diversity and Equal Opportunity | ||

| 24. | Health and Safety | GRI 403: Occupational Health and Safety |

| 28. | Need to commit to Sustainable Development Goals (SDGs) | |

| 29. | Increasing frequency and magnitude of natural disasters and poor disaster preparedness | GRI 302: Energy GRI 305: Emissions |

| 33. | Increasing demand for green banking and green lending | |

| 35. | Pandemics hampering world trade and economy | |

| 37. | New technological advances such as AI, Robotics, Blockchain |