![]()

The Bank extends an unparalleled banking experience through a deep understanding of its customers – their needs, their preferences, their concerns – and responding with products and services that meet and even exceed their expectations. In a rapidly changing operating context, it also involves transforming internal mindsets and processes to remain agile and relevant. The Bank carefully segments its diverse customer base and tailors its services to cater to each group. This allows the Bank to deliver a differentiated value proposition that enhances its brand and elevates customer loyalty. Meeting the needs of customers, and providing such personalised support was vital in a year of economic recovery following the COVID-19 pandemic.

Customer Segmentation

Illustrated below is the customer segmentation, which enables the Bank to gain a deep knowledge and understanding of the customer and better align with their unique banking requirements.

Table – 08: Customer segmentation

| Criteria | High net-worth | Corporate | SME (Small and Medium Enterprises) | Micro customers | Mass market |

| Income/Size of relationship/Business turnover/Exposure | Individuals with banking relationships above set thresholds | Annual business turnover> Rs. 1.0 Bn. or Exposure> Rs. 250 Mn. | Annual business turnover< Rs.1.0 Bn. or Exposure< Rs. 250 Mn. | Exposure< Rs. 500,000 | Individuals not falling into other categories |

| Price sensitivity | High | High | Moderate | Low | Low |

| Products of interest | Investment | Transactional, trade finance, and project finance | Factoring, leasing and project financing | Transactional | Transactional |

| Number of transactions | Low | High | Moderate | Low | Low |

| Level of engagement | High | High | Moderate | Low | Low |

| Objective | Wealth maximisation | Funding and growth | Funding and growth | Funding and advice | Personal financial needs |

| Background | Business community/ Professionals | Rated, large to medium corporates | Medium business | Self-employed | Salaried employees |

| Number of banking relationships | Many | Many | Many | A few | A few |

| Level of competition from banks | High | High | Moderate | Low | Moderate |

Table – 09: Channel mix and target market on perceived customer preference

| Customer segment | Branches | Internet banking | ATMs | Call centre | Mobile Banking | Relationship managers | Business promotion officers | Premier banking units |

| High net-worth | √ | √ | √ | √ | √ | √ | √ | √ |

| Corporates | √ | √ | √ | √ | √ | √ | X | X |

| SMEs | √ | √ | X | √ | X | √ | √ | X |

| Micro | √ | X | √ | X | √ | X | X | X |

| Millennials | X | √ | √ | √ | √ | X | X | X |

| Mass market | √ | X | √ | √ | √ | X | X | X |

Figure – 12: Customer centricity

Responding to the COVID-19 pandemic

As a Systemically Important Bank (D-SIB) and the largest private sector bank in Sri Lanka, Commercial Bank is acutely aware of the crucial role it plays in meeting the needs of customers and providing personalised support, as the economy recovers from the pandemic. Being deeply conscious of the socio-economic strain that the pandemic has placed on the customers, the Bank evolved the way in which it operates, interacts and serves its customers over the year.

Bank’s response to the COVID-19 pandemic was realised through a series of measures as stated below:

- Adhering to the Ministry of Health guidelines and protocols to ensure the safety and wellbeing of customers and employees.

- Sustaining and keeping the customers afloat by facilitating debt relief measures for various impacted individuals and entities.

- Adjusting the ways of working and service delivery channels and providing the necessary infrastructure to support to customers. Especially with the rapid acceleration into digital channels and adoption of virtual infrastructure by customers, the Bank provided digital tools and concrete payment solutions to adapt their activities.

- “Bank-on-Wheels” service with mobile Cash Recycler Machines (CRMs) was launched following the extension of the travel restrictions necessitated by the third wave of the pandemic. Traversing Colombo and its suburbs and many other areas including towns in the Uva, Sabaragamuwa, Northern and Eastern provinces of Sri Lanka, this service facilitated both Commercial Bank customers and non-customers to conduct routine banking transactions in their own neighborhoods. The service was deployed across the Nation, offering services to a larger segment of the populace. A schedule with details of the routes of these units was posted daily on the Bank’s website and social media pages.

Financial Relief Initiatives

At a time when Sri Lanka was in total lockdown, with no assurance when the country situation would return to normality, Commercial Bank set the trend in providing financial relief, especially to the SME sector under the Government stimulus package and the Bank’s own support schemes in 2020, which continued through 2021. Establishing a Centralised Credit Processing Unit, the Bank completed its SME Banking Transformation operation and became the largest lender to the SME sector among private sector banks via the “Saubhagya” scheme.

Consolidating its efforts under the umbrella of “Arunella”, a Financial Support Scheme that integrated multiple initiatives and guided by the Central Bank of Sri Lanka (CBSL) directives to provide focused and more efficient relief to customers, the Bank extended relief to diverse customers affected by the pandemic throughout the year 2021. This support scheme included a moratorium scheme, relief to non-performing borrowers, reduction of lending rates in tandem with the downward trend of interest rates in Sri Lanka, concessions for Credit Card holders, concessions and fee waivers and free digital services. It also included two special loan schemes - one for SMEs affected by COVID-19 and the other the “Dirishakthi COVID-19 Support Loan” scheme to assist micro enterprises disrupted by the pandemic.

Figure – 13: Segment analysis of Moratoriums Granted under COVID-19 – As at December 31, 2021

Figure – 14: Moratoriums granted under COVID-19 – As at December 31, 2021

Figure – 15: Bank funded loan schemes – As at December 31, 2021

Supporting SMEs and Micro Enterprises

The SME sector, which forms the backbone of the Sri Lankan economy, represents 80% of businesses and provides close to 35% of jobs in Sri Lanka. SMEs and Micro businesses remain the most vulnerable to economic shocks, struggling with funding issues and facing challenges in accessing medium and long-term finance. This was further exacerbated by the impact of COVID-19 on the country’s economy. Recognising that these sectors were in desperate need of relief, the Bank has been a pioneer in providing financial solutions to SME and micro enterprises. In recognition of the Bank’s efforts in identifying the needs of the hour of small and medium enterprises in the country and for providing tailor-made products and services to cater to this segment, the UK-based Global Business Outlook (GBO) awarded Commercial Bank as the “Best SME Bank” in 2021.

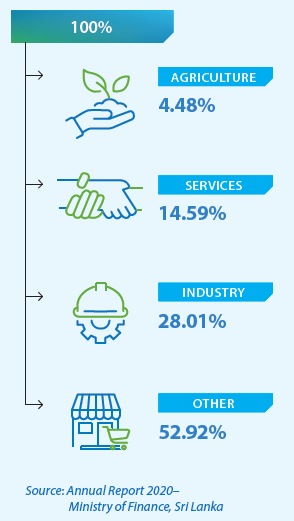

Among all state-owned, private and specialised banks in the country, Commercial Bank was the largest lender to Sri Lanka’s SME sector in 2020, according to the Annual Report of the Ministry of Finance published in 2021. Reaffirming its status as a systemically important bank in Sri Lanka, the Bank lent Rs. 163.98 Bn. or 21.57% of the Rs. 759.7 Bn. in loans provided to SMEs by 19 institutions, representing 23.82% of the total of 245,883 loans granted in the year under review. Furthermore, the Bank was also the highest lender to the ‘Industry’ sector dispensing Rs. 45.9 Bn. or 21.3% of the total via 9,654 loans. The support extended to the SME sector was further strengthened by the USD 50 Mn. loan secured from the CDC Group of the United Kingdom. The facility provides target funding directly to underserved SMEs, boosts jobs and promotes economic and social inclusion across Sri Lanka. The investment enabled the Bank to further strengthen financial support to local SMEs most in need of funding and provide access to necessary working capital.

Figure – 16: Composition of loans granted by Commercial Bank to the SME sector in 2020

The Bank rebranded the Microfinance loans as “Dirishakthi” with the aim of positioning the Microfinance product targeting a niche market. Following the rebranding, the maximum loan amount was increased from Rs. 300,000 to Rs. 1,000,000. A total of Rs. 1.140 Bn. was disbursed under the loan product coming under the umbrella of “Dirishakthi” in 2021.

Furthermore, the Dirishakthi COVID-19 support loan scheme continued to provide the working capital requirement of micro and small entrepreneurs affected by the pandemic.

Obtaining Support of SMEs in promoting Green Initiatives of the Bank

Commercial Bank was the first bank in the nation to achieve Carbon Neutral Status. In order to make SMEs and Businesses a part of this initiative and to support Government’s objective of promoting the renewable energy sector, the Bank re-launched a dedicated loan scheme named “Diribala Green Development Loan” Scheme targeting financing of Solar Power Systems of SMEs/ Business clients.

The Loan scheme is specially designed to provide medium-term financing with attractive interest rates and flexible repayment plans.

Supporting the agronomy of Sri Lanka

In its commitment to support the agronomy of the country, Commercial Bank continued to partner with several leading corporates to launch “Agri Leasing” facilities at low rentals and flexible payment plans, taking into consideration the seasonal income patterns of farmers and cultivation months. The facilities are designed to increase the productivity of cultivations by providing high-quality machinery and tractors at attractive discounts to farmers. A total of 619 Agri lease facilities amounting to Rs. 1.358 Bn. were disbursed during the year 2021.

Offering the lowest gold pawning rate in the country, the Bank launched the Agri Gold Loan facility during the year, to support those engaged in agriculture, fisheries, and livestock farming. This facility ensures privacy, exclusivity, maximum security of jewelry, and instant funds in the time of need and the service is offered without any service charge, stamp duty, or other hidden charges.

Non-Financial Support for SMEs and Micros

The Bank continued to cater to the SME sector in several other ways beyond direct financial assistance.

The membership of ComBank Biz Club, launched with the objective of providing SMEs with extensive networking opportunities and support beyond lending, grew by 830 to 4,866 members by end of 2021. An initiative was taken to launch an exclusive Credit Card for SMEs and members were enabled to receive economic updates and alerts on new business developments via email and SMS and provided free registration for online banking facilities. The Biz Club members are entitled to free financial advisory services and invitations to exclusive business seminars, which are beneficial to the development of their businesses. The Bank has assisted over 9,000 SME customers to date with financial literacy programmes.

The total facilities evaluated in 2021 under the new credit-scoring model introduced in 2020 was 2,581. This has facilitated a simplified evaluation process and ensured the lending quality and efficiency.

Automated Field Cash Collection (AFCC) which was launched to offer doorstep cash collection services to micro entrepreneurs was expanded to two selected locations in the Northern Region. With a total of four locations, this initiative is used as a launching pad to encourage micros to move in to the digital space.

Through a variety of channels, the Bank, conducted awareness, vocational training, and financial literacy programs and workshops for SMEs and micros in diverse sectors of business across the Nation. During the year, the Bank conducted a series of webinars for 512 SMEs including Biz Club members, exporters and women SMEs (WSME). Two webinars were conducted, one on the theme of “Digitalization and use of digital tools in business” for MSMEs and the other on “Export Opportunities to Great Britain” for exporters.

“Dirishakthi Value Chain Development Program” was launched to strengthen the rural value chains, focusing on segments such as dairy, tea small holders, coir, spices and ground nut. An in-kind grant was introduced to formulate sustainable solutions to increase efficiency and the productivity of selected value chains. An incentive scheme was introduced under the same program to strengthen the relationships and welfare activities of Community Based Organizations (CBO), considered as business facilitators. A special incentive was given for introducing their members to the Bank for financial services as well.

The Bank conducted capacity building programs for micro entrepreneurs under the “Dirishakthi Sustainable Entrepreneurship Development Program” A series of new initiatives were implemented to further support the Bank’s sustainability initiative under financial inclusion. These included providing an opportunity to display and sell products of selected entrepreneurs during the programs, distribution of plants to selected participants, encouraging environmental protection by avoiding one time use plastics and continuous impact assessment of the program for ongoing improvement and development. The Bank conducted nine programs during the year under review, benefitting 696 micro entrepreneurs.

In partnership with DirectPay, the Bank expanded its suite of services and products such as micro lending and pay-day loans and offered its merchants and customers effective ways of making supply chain payments. The services include fully-integrated payment Point-of-Sale devices to discover new markets and inventory management solutions with payment integration on Card and LankaQR payments for SME businesses and corporates in Sri Lanka. Additionally, “SimplePay”, a simplified ecommerce platform was launched to enable digital payments especially for SME merchants.

Banking on Women

The Bank's commitment to women's empowerment continues to be evident in its products that support women's health and wellbeing, career advancement, education, access to finance, and financial independence. In its efforts to build dedicated products and services to cater to women with the vision to become the “Bank of choice for women” by year 2023, Commercial Bank launched the exclusive Women Banking vertical named “Anagi Women Banking” in October 2021. Women make up the majority of Sri Lanka’s population, and the Bank recognises the important role they play in the economic growth of the country. A range of new financial and non-financial products and services were launched including the Anagi Business Loan for women SMEs, Anagi Instant Loan for salaried women, Anagi Credit Card, insurance for women customers, and entrepreneurship skill development programs for women. Capacity building programs were conducted for 278 women micro entrepreneurs during the year. The number of women SME customers increased to 5,903 in 2021 and the number of facilities granted increased to 16,139 in 2021.

Prioritising Customer Experience

Adopting a customer centric approach, the Bank remained committed to delivering an excellent customer experience through all decisions that are taken and systems implemented within the Bank. Whilst a full description of the Bank’s digital projects is provided in the next section, some of the broader customer initiatives conducted during 2021 are noted here.

The Commercial Bank website; which is the most searched banking website in Sri Lanka, was re-launched as a trilingual resource, with a series of cutting-edge enhancements. An indispensable tool for millions of customers and information seekers, the website provides content in English, Sinhala and Tamil with an ultra-smooth interface with interactive multimedia material, enhanced navigation, experience-customisation, smarter search options and tools, and resources that make it extra user-friendly and informative. The revamped website offers further convenience to the growing number of customers visiting the site through their devices for speedy and smooth banking operations. As a leader in technology-enabled convenience in the banking sector, Commercial Bank has enhanced customer service by providing access to information in a simplified manner and facilitating visitors to customise their experience online with the Bank. Furthermore, the website is focused on generating more user leads as well. A total of 7,011,270 visitors patronized the site in 2021, reflecting an increase of 5% compared to the previous year.

The Home Loans promotion was launched with a special rate of 7% per annum for Government and Public sector salaried employees and at a reduced rate of 8.25% per annum for other sectors, with discounts of up to 40% from selected suppliers of building materials and fittings. Furthermore, the Bank offers the lowest interest rates in the country for long-tenor Home Loans and is the only bank in the country to provide the benefit of fixed interest rates on Home Loans repayable over a period of up to 20 years. A range of flexible repayment plans are offered as well to suit the earnings, projected income, and terminal benefits of the borrowers.

An image based customer request process flow was implemented to provide total visibility to customer requests. “The Service Portal” – a Customer Relationship Management solution was introduced to maintain a central repository for customer complaints and improve the overall quality of customer service. Furthermore, a consolidated contact number +94 11 235 3353, was launched for customer convenience.

Going forward, the Bank will develop a chatbot to improve customer engagement through cost effective channels, implement an outbound calling facility and strengthen the teams to deliver a unified experience across channels at the Contact Center.

Card and Cashless Initiatives

The fastest growing cards business in Sri Lanka, the Commercial Bank cards continued to enjoy the market leadership in credit and debit card combined usage. Commercial Bank cards achieved several milestones in 2021. These include, becoming the market leader in e-commerce acceptance (IPGs) in Sri Lanka recording a 65% increase YoY, being the second highest acquirer in overall acceptance in the market and winning the SLASSCOM robotic automation project competition for the Banking and Finance sector for Credit Card process automation. The Bank continued to make significant strides in championing credit and debit card and other cashless payments during the year under review.

The “Q+ Payment App” of the Bank, which is the first payment app to be certified and launched under LANKAQR standards of the CBSL, reached over 100,000 customer registrations in 2021, exceeding the target of 50,000. The app enabled instant settlement of Credit Card outstanding and pre-paid Card top-ups for app users, free of charge. These additions have enabled ComBank Credit Cards to be settled through multiple customer touch points including CRMs,CDMs, ATMs, through the web using Cards or the QR codes, through LankaPay as an interbank transfer or through Commercial Bank’s Digital Banking App; Flash. The new “Q+ Online Pay” facility was launched across 3,300+ merchants to further enhance convenience and to uphold the digital payments among cardholders.

The value of issuer transactions recorded a YoY growth of 30% and 59% for Credit and Debit Cards respectively. Self-registration option for Credit Card e-statements was enabled and promoted to enhance customer convenience further. Over 27% of cardholders enrolled for Credit Card e-statements facility as at end 2021.

Being the first and only bank in Sri Lanka to issue the UnionPay Credit and Debit Cards in the Island, the Bank enhanced the payment experience of UnionPay QR Wallet holders during the year. In collaboration with UnionPay International (UPI), QR code payment acceptance was enabled in Sri Lanka, becoming the first Sri Lankan bank to issue a unified QR code under LANKAQR specifications that includes the UnionPay QR code. The code can be integrated to local merchant websites to facilitate e-commerce transactions. QR payment was facilitated for other apps as well.

An all-in-one POS device was deployed allowing the processing of transactions via VISA, Mastercard, UnionPay, LankaPay and JCB cards as well as QR-based wallet payments under LANKAQR. Furthermore, the device is equipped to accept EMV/Chip, Magstripe, NFC and QR-based transactions, offering customers the convenience of paying via the platform of their choice, quickly and securely.

A new dimension in convenience was brought for ComBank credit card holders by facilitating automated utility bill payment, preventing accumulation of arrears due to unpaid bills and saving customers from delinquency fees and disconnection of utility services due to delayed payments. Furthermore, customers can earn Max Loyalty Rewards points that can be redeemed at many reputed merchant outlets island-wide.

“Call and Convert” – Flexi Payment Plan facility was enabled for the Credit Card holders paying for education, health or insurance-related products and services and for online purchases during the year. A total of 61,648 Easy Payment Plans (EPP) were offered during the year under review. Additionally, VISA ATM Acquiring was enabled in the Maldives and the online payments through Q+ Payment App was launched as well.

Figure – 17: Growth in ComBank Debit and Credit cards (based on Usage)

30% YoY Growth

Credit card usage (2021)

59% YoY Growth

Debit card usage (2021)

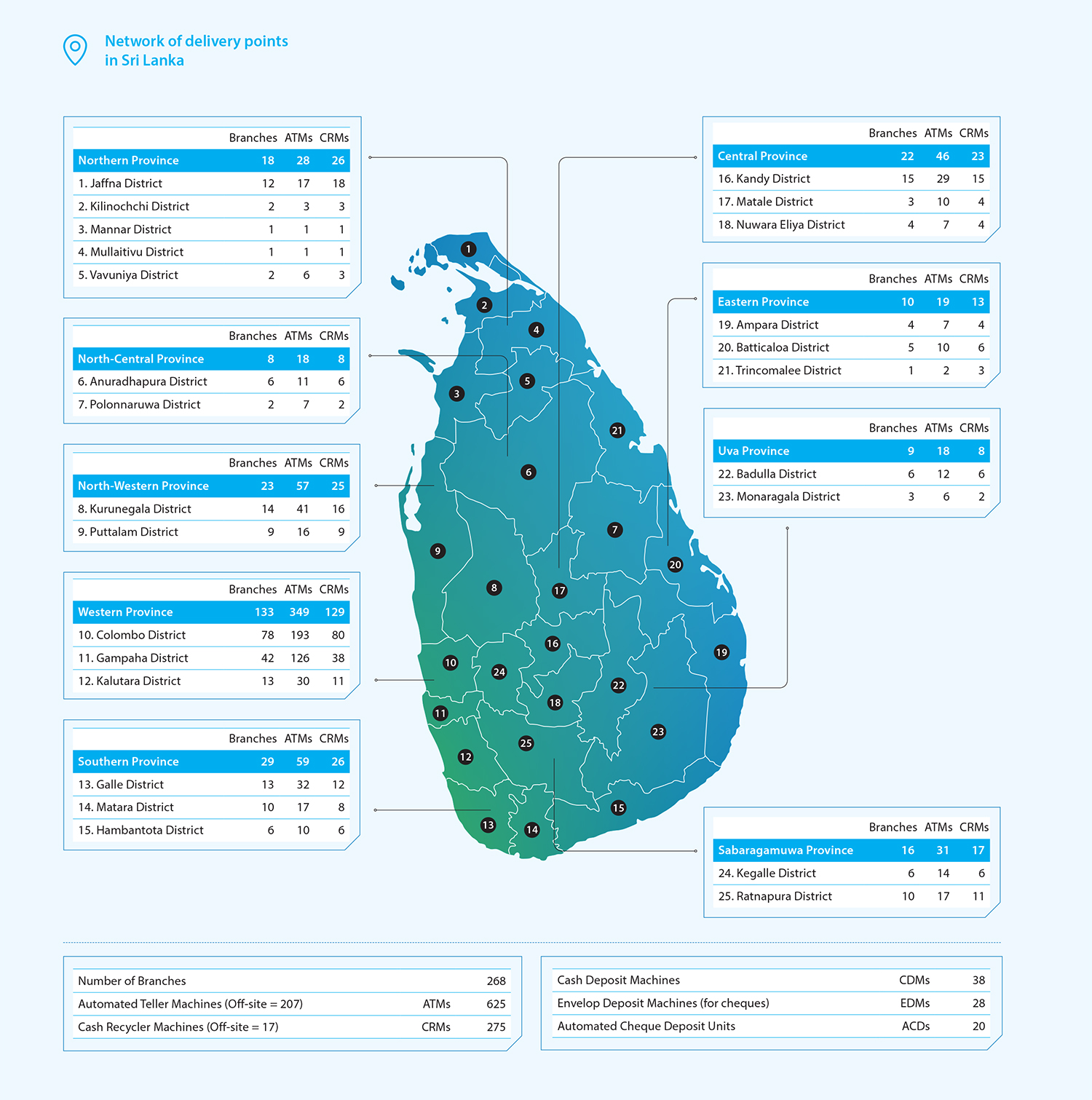

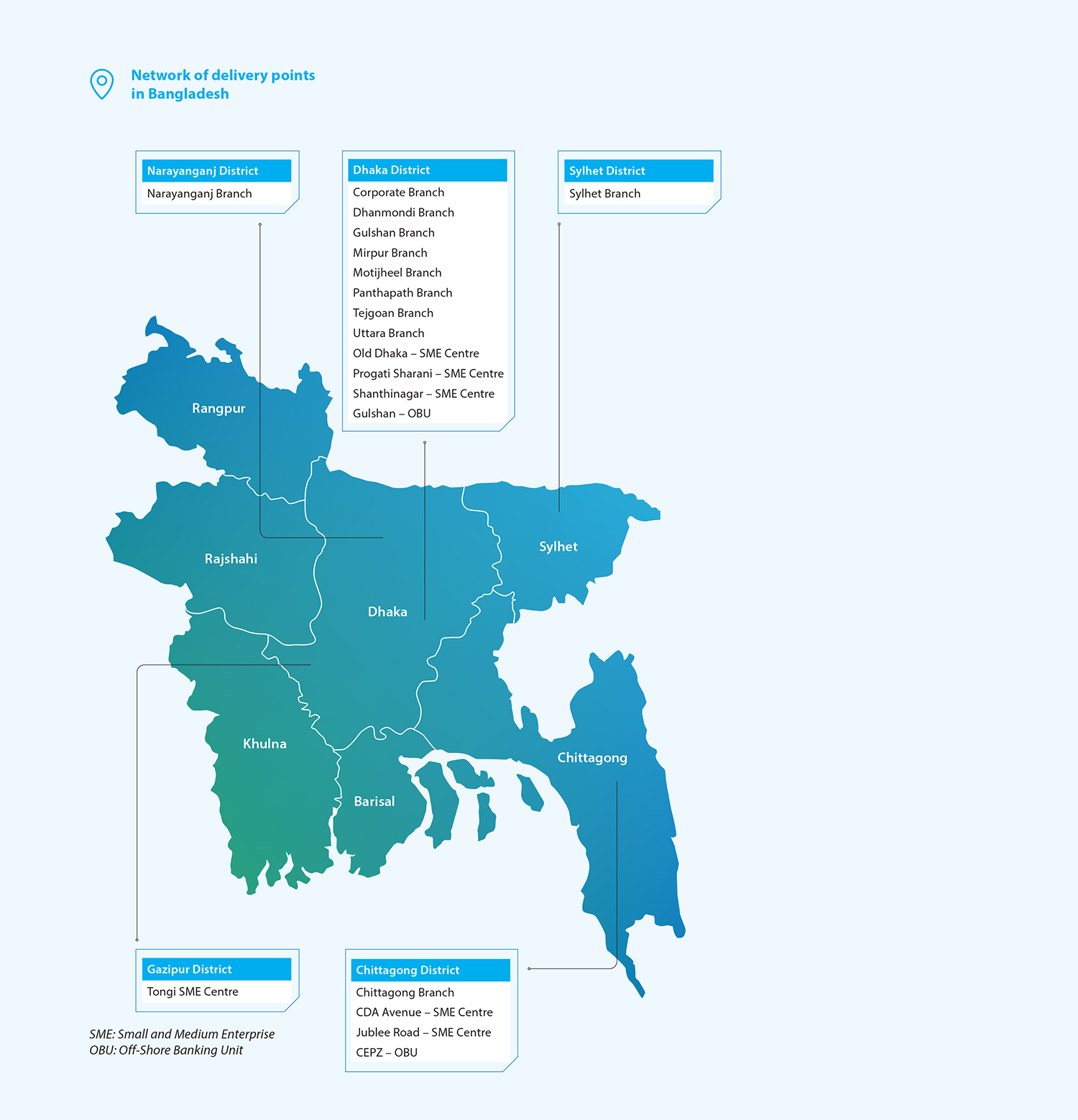

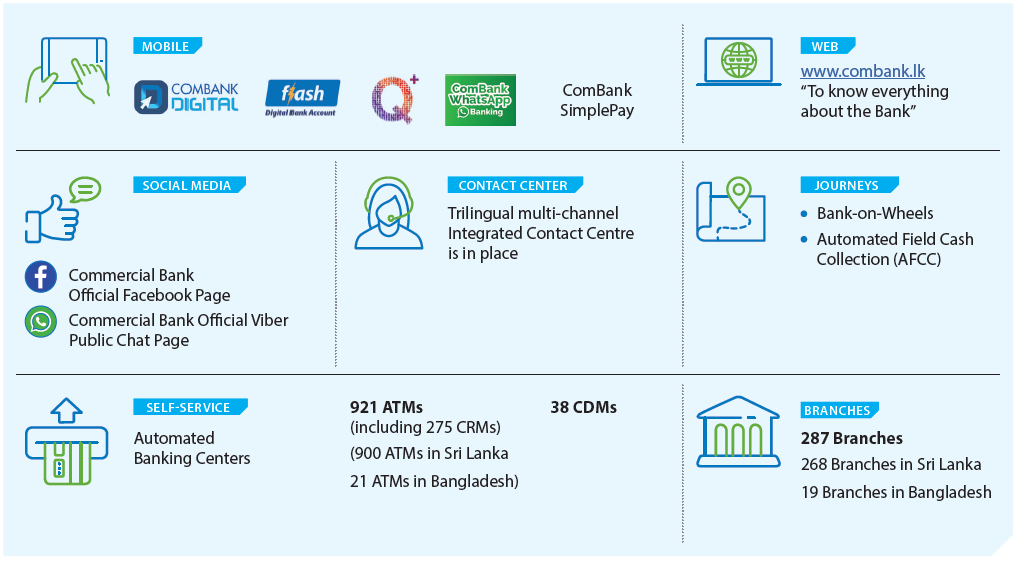

Network of delivery points in Sri Lanka and Bangladesh