Our Value Creation Model

Commercial Bank’s business model primarily revolves around financial intermediation and maturity transformation , two essential activities required for the economic development of the country. It is through these two activities that the Bank delivers value to and derives value from its stakeholders.

Financial intermediation and maturity transformation

Financial intermediation refers to the intermediary role the Bank plays between various stakeholders – depositors and borrowers, importers and exporters, money remitters and beneficiaries, entrepreneurs and investors, tax authorities and tax payers and so on. Maturity transformation refers to the process of converting short-term funds into long term lending and investments.

Capitals

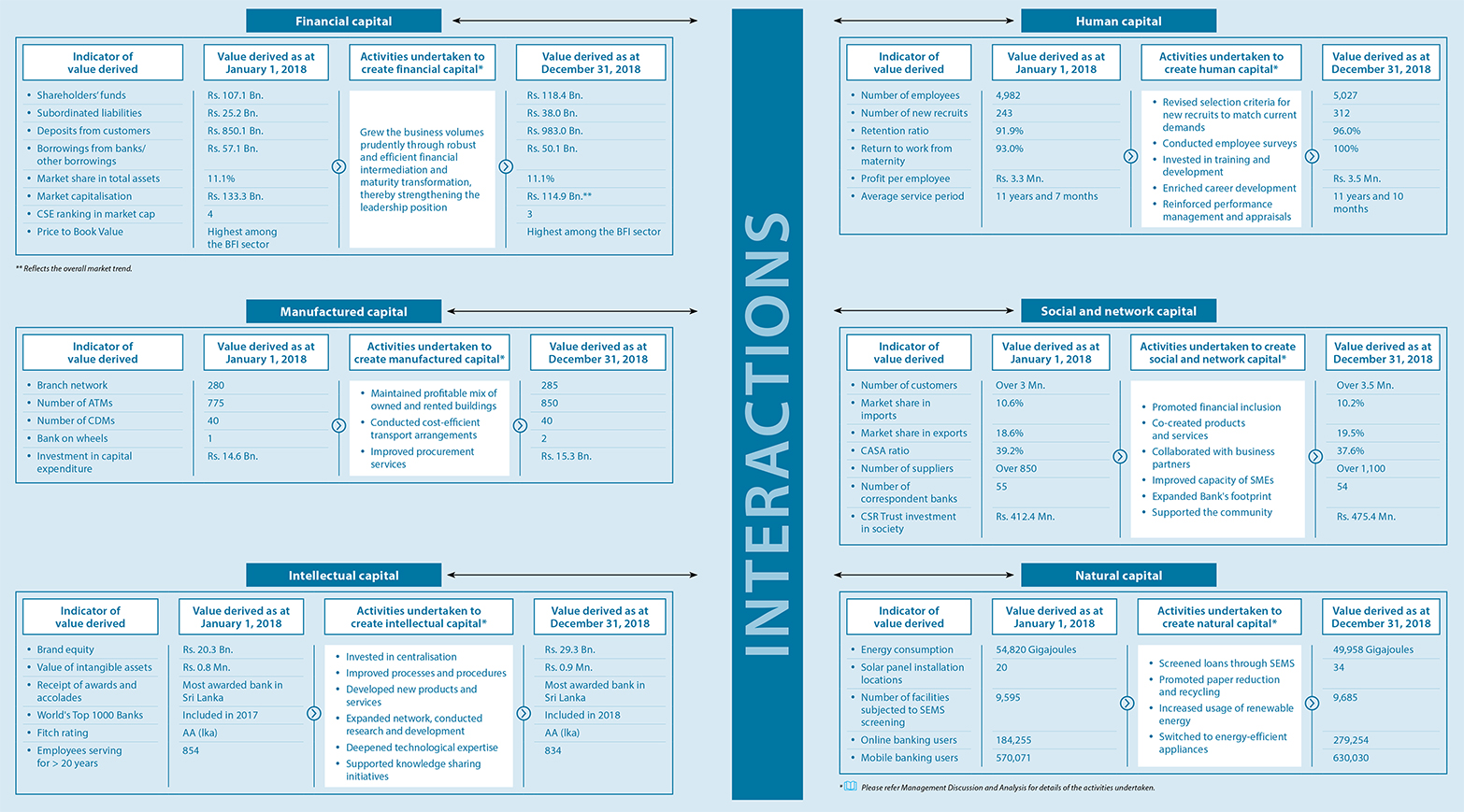

By delivering value over a period close to a century of operations, the Bank has been able to build a base of loyal stakeholders who takes a long-term view of the Bank whom we respectfully call “capitals”. Besides financial and intellectual capitals that reside within the Bank, we call these stakeholders capitals – as in customer capital, investor capital, human capital and so on – since, although not owned by the Bank, they provide “inputs” for our activities that enable delivery of value to and deriving of value from them, leading to creation of value for all stakeholders. Through the activities we undertake in furtherance of financial intermediation and maturity transformation and also as a result of the interactions among these various capitals, we are able to augment the capitals, a reflection of value created. Refer diagram on pages 22 and 23 for the amount of the capitals the Bank had as at 1 January 2018 (inputs), a summary of activities undertaken during the year to deliver value to the various stakeholders and the amount of the capitals the Bank had as at December 31, 2018 (outputs).

Besides the value derived as reflected in the enhanced positions of the other capitals, the two broader categories of income - net interest income from fund based operations and fee and commission income from fee based operations – enable the Bank to enhance its financial capital. Fund based operations involve the process of borrowing from depositors and others incurring interest expenses and lending such funds to borrowers and investors earning interest income. The interest margin which is the difference between the lending rate and the borrowing rate compensates the Bank for credit risk, funding risk and the interest rate risk. All other services provided by the Bank not involving funds are fee-based operations. Reflecting efficient financial intermediation, the Bank generated 70.57% of its total operating income by way of net interest income (80% in 2017) and the balance from fee based sources, exchange profit, trading gains and recoveries of loans written off/provisions reversals for the year 2018.

Gearing

Financial intermediation and maturity transformation cause the business model of banks to substantially differ from other business organisations. Principal difference is the substantially lower Return on Assets (ROA) which is less than 2% in general in stark contrast to between 10% – 20% earned by corporates in other sectors. This prompts banks to resort to the process of gearing in order to make the returns to the investors attractive in terms of Return on Equity (ROE). Gearing involves expanding the business volumes by mobilising more and more funding from depositors and other providers of funds to the banks and lending or investing such funds to grow the loan book, and investment portfolios on the strength of a given amount of capital.

Gearing primarily remains the foundation of our business model, which enables us to operate at around 10 times higher business volumes compared to the shareholders’ equity. It is our license to mobilise deposits from the public that has made it possible. However, we are well aware that gearing exposes the Bank to a multitude of internal and external risks. In addition, certain emerging global developments are now threatening to disrupt this conventional business model. As you would read later in this Report, the Bank has established a sound risk management framework with necessary oversight of the Board of Directors and thereby has been able to successfully manage such risks.

Stakeholder returns

As shown in Table 5, Commercial Bank has been able to improve its profitability over the years while prudently maintaining gearing at acceptable levels. This improvement in profitability reflects the net impact of the value we have been able to create by delivering value to and by deriving value from our stakeholders. From investors’ perspective, this value creation is reflected in the returns the Bank has been able to generate for them in terms of earnings, dividends and appreciation in market price of shares. The market capitalisation of the Bank’s shares remained the highest among the Banking, Finance and Insurance institutions as at end 2018 while its shares ranked third among all listed companies in the Colombo Stock Exchange as at end 2018. Further details on the performance of the Bank’s shares are found in the section on “Investor Relations” in the chapter on Annexes.

While growing organically and in the domestic market, the Bank has taken steps to leverage the inorganic and regional growth opportunities, primarily to geographically diversify its risk exposures and sources of revenue and thereby enhance its sustainability of operations and long-term value creation.

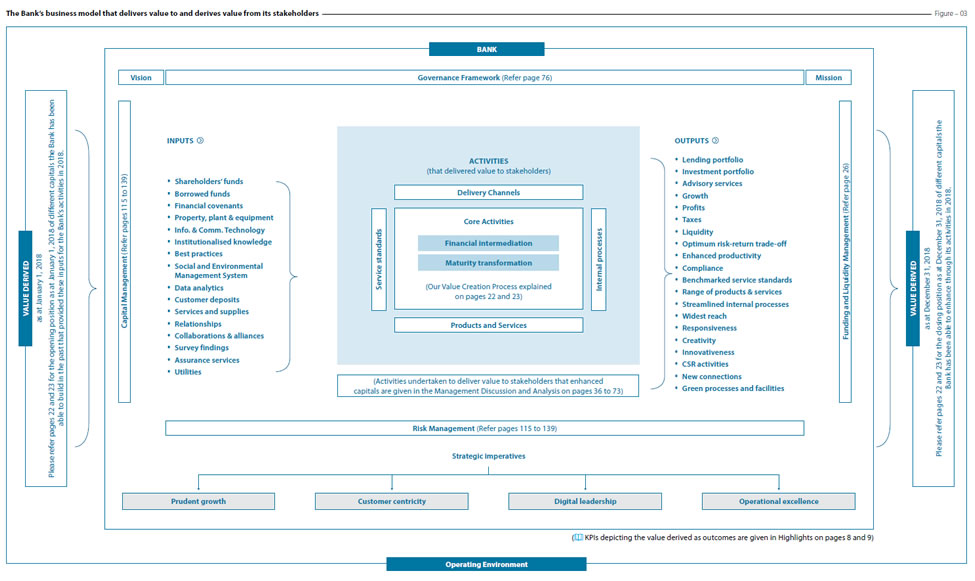

Our business model

The diagram overleaf depicts the inputs used and the activities undertaken to deliver value to the stakeholders in the process of financial intermediation and maturity transformation, the two primary activities of the Bank. It also illustrates the consequent outputs generated by deriving value from them.

The Bank’s business model that delivers value to and derives value from its stakeholders