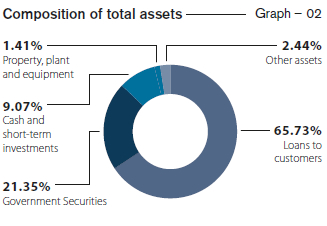

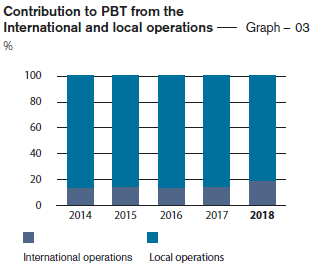

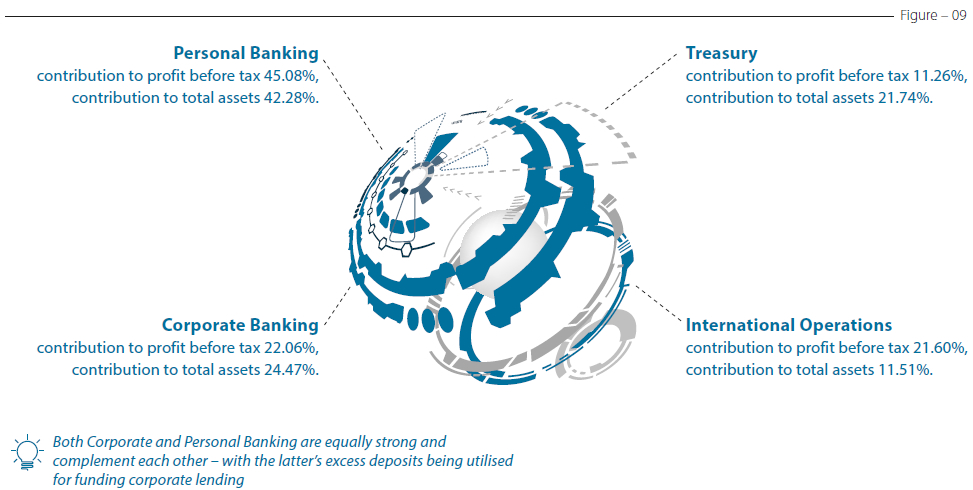

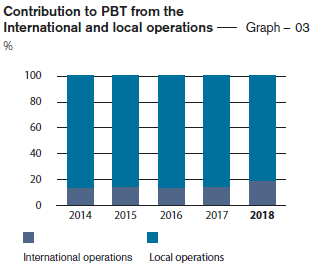

The Bank is fairly diversified across its four main business segments of Personal Banking, Corporate Banking, Treasury and International Operations. This diversification also extends across our funding mix, as described previously, as well as our products, customer segments, rates, and tenure among other factors as discussed further in this Report. Our Operations in Bangladesh now accounts for 9.42% of

total assets and 19.20% of profit before taxes, while the overseas subsidiaries in the Maldives, Italy, and Myanmar account for 1.13% of Group’s assets and 0.94% of Group’s profit before taxes.

* Based on management accounts.

Diversifying our lending portfolio

With a fairly well diversified loans-to-customers portfolio across several industry sectors, the Bank’s exposure to any particular sector does not exceed 10% of the total

Key contributors to the loans to customers growth came from term loans, overdrafts, and import loans. Heightened focus on Small and Medium Enterprises (SMEs), new customer acquisition, higher Single Borrower Limit, etc. contributed to strong growth in this portfolio. By diversifying our advances portfolio which is composed of different products, including currencies, commodities, loans, and mortgages for example, the Bank continues to mitigate risks and remain open to market opportunities. While this allows us to enhance asset quality, performance, and resilience, it also helps us to minimise portfolio concentration risk. The Bank is also mindful to include companies with mixed ratings in its portfolio while implementing efficient risk monitoring practices to have a balanced portfolio with the optimum risk return trade off.

Reaching diverse customer groups

The diversity of customers is another strength of the Bank. Understanding the different financial services requirements of its customers, the Bank has segmented this stakeholder group into five primary segments in order to better cater to them (refer Table 06). This also allows us to align our value proposition in terms of products, services and delivery channels as illustrated in Table 07.

Customer segmentation Table – 06

|

Criteria

|

Corporate

|

SME

|

Micro customers

|

Mass market

|

High net-worth

|

|

Income/Size of relationship/Business turnover/Exposure

|

Annual business turnover> Rs. 750 Mn./Exposure> Rs. 250 Mn.

|

Annual business turnover< Rs. 750 Mn./ Exposure< Rs. 250 Mn.

|

Exposure< Rs. 500,000

|

Individuals not falling into other categories

|

Individuals with banking relationships above set thresholds

|

|

Price sensitivity

|

High

|

Moderate

|

Low

|

Low

|

High

|

|

Products of interest

|

Transactional, trade finance, and project finance

|

Factoring, leasing and project financing

|

Transactional

|

Transactional

|

Investment

|

|

Number of transactions

|

High

|

Moderate

|

Low

|

Low

|

Low

|

|

Level of engagement

|

High

|

Moderate

|

Low

|

Low

|

High

|

|

Objective

|

Funding and growth

|

Funding and growth

|

Funding and advice

|

Personal financial needs

|

Wealth maximisation

|

|

Background

|

Rated, large to

medium corporates

|

Medium business

|

Self-employed

|

Salaried employees

|

Business community/Professionals

|

|

Number of banking relationships

|

Many

|

Many

|

Few

|

Few

|

Many

|

|

Level of competition from banks

|

High

|

Moderate

|

Low

|

Moderate

|

High

|

The type of segmentation illustrated here provides the Bank with greater knowledge and understanding of the customer and enables it to better align with the banking requirements of each category (refer Table 07).

Channel mix and target market on perceived customer preference Table – 07

|

Customer segment

|

|

Branches

|

Internet

banking

|

ATMs

|

Call centre

|

Mobile

Banking

|

Relationship

managers

|

Business

promotion

officers

|

Premier

banking

units

|

|

Corporates

|

|

√

|

√

|

X

|

√

|

X

|

√

|

X

|

X

|

|

SMEs

|

|

√

|

√

|

X

|

√

|

X

|

X

|

X

|

X

|

|

Micro

|

|

√

|

X

|

√

|

X

|

√

|

X

|

X

|

X

|

|

Mass:

|

|

|

|

|

|

|

|

|

|

|

Millennials

|

|

X

|

√

|

√

|

√

|

√

|

X

|

X

|

X

|

|

Others

|

|

√

|

√

|

√

|

√

|

√

|

X

|

√

|

X

|

|

High net-worth

|

|

√

|

√

|

√

|

√

|

√

|

√

|

√

|

√

|

The four business lines, Personal Banking, Corporate Banking, Treasury and International Operations, work in collaboration with each other and the various service units of the Bank to drive growth and further strengthen the Bank’s brand.

Serving the diverse personal banking needs of our customers remains a key focus for the Bank with many technological enhancements being made to increase convenience and security during the year, for example in areas such as mobile banking and credit cards. Providing advisory services to our corporate customers will be a key priority over the years that follow

( refer Customer centricity).

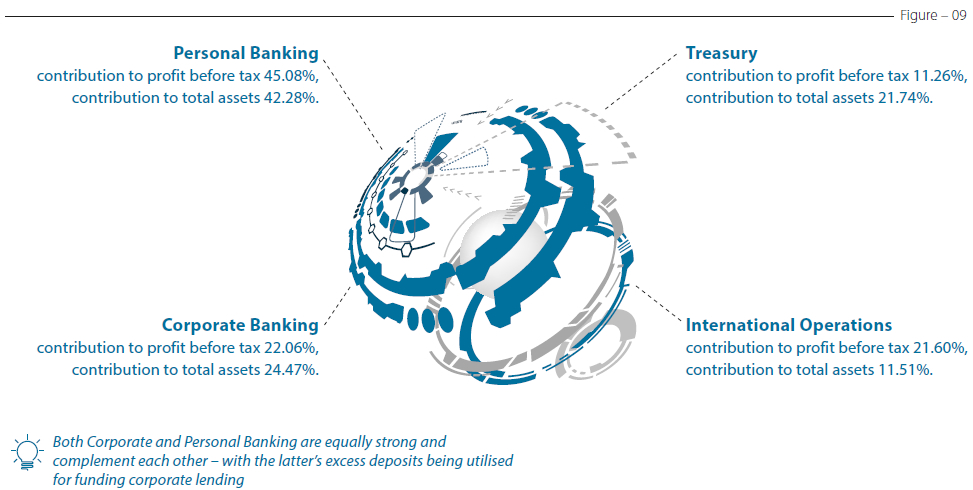

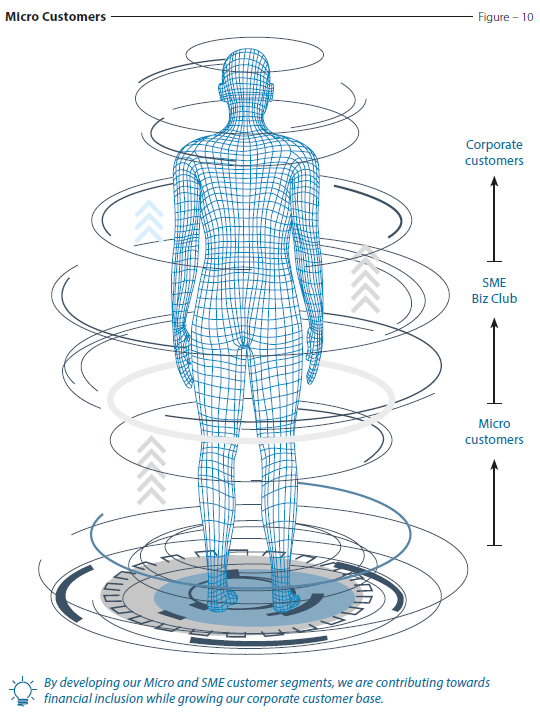

We continue to be the one of the largest financier to the SME segment in the country. Launched in 2017, the Commercial Bank Biz Club – the first of its kind in Sri Lanka, continued to bring SME customers together in order to create new business opportunities and to provide them with support that goes beyond lending ( refer supporting SME customers). For instance, the Bank helps introduce accounting software package vendors to this customer group to boost their knowledge of accurate book keeping, continuing to support them as they master this vital business skill. This year our Personal Banking and Corporate Banking arms joined forces to propel SME customers on a journey that will help many of them to move up the life cycle to the position of a corporate customer.

While such upward mobility is good for business, it also means that we must continually canvass new SME customers to this segment which would otherwise dwindle. Our focus on financial inclusion over the years has already provided us with a wealth of potential customers.

The Bank’s Agricultural and Micro Finance Units (AMFUs) have taken the effort to extend banking services to the unbanked and under-banked in the rural areas of the country ( refer Strengthening ties with Micro customers). Now many of our Micro customers are ready to be introduced to the SME Sector – an outcome that is serving the Bank in good stead.

As more top-tier SME customers move into

the Bank’s corporate customer segment,

fresh Micro customers

are channelled into the group while many are groomed to join the SME cluster over the next few years by contributing towards a sustainable ecosystem, as we strive to contribute towards Sustainability Development Goal 1: No Poverty

During the year under review, a series

of town hall meetings were conducted

across the country to ensure that all employees were aware of our plans to

serve the SME segment.

Providing treasury services diversely

Key player in interbank foreign exchange and fixed income securities

Contributed 19% of Bank’s assets through fixed income securities

Mobilised USD 394 Mn. by way of foreign currency borrowings at year end

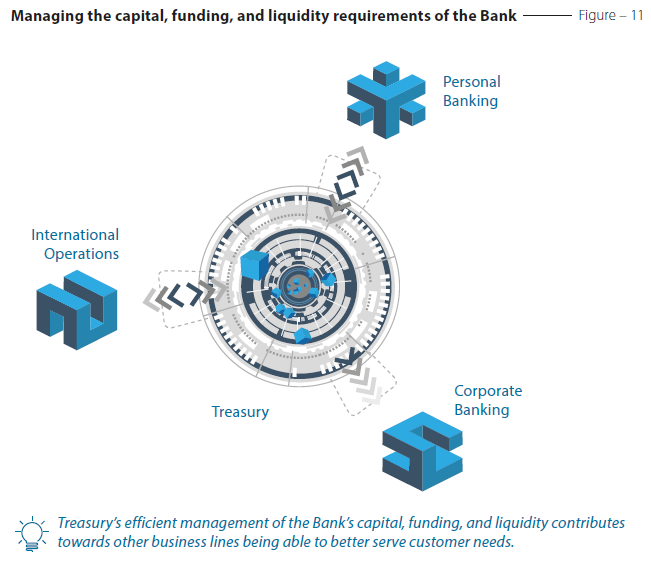

Responsible for managing the Bank’s balance sheet, our Treasury plays a vital role in maintaining the financial security and stability of the Bank. By efficiently managing the capital, funding, and liquidity requirements of the Bank the Treasury helps other business lines to meet customer needs unhindered.

Our Treasury arm is a market maker, continuing to offer products that help manage market risk – interest rate and exchange rate risks in particular – and underlying margins and mismatches in assets and liabilities.

Having one of the largest Fixed Income Securities portfolios in Sri Lanka, which accounted for around 19.15% of the Bank’s total assets, the Treasury successfully supported the liquidity position of the Bank, and made a significant contribution to earnings during the year. Handling a large business volume while being a low cost base for the Bank, the Treasury Division’s assets require relatively lower capital allocation.

While rising US dollar interest rates may have an impact on our cost of borrowings in the short and medium term, through our business in Bangladesh we were able to mitigate the impact by lending in US dollars. Given the current financial climate, the Bank abandoned its usual policy of using excess US dollars to generate rupees and invest in rupee Treasury Bills and Bonds. Instead, rupees were converted back to US dollars to invest in USD denominated Sri Lanka Government Bonds. As a result, the Bank’s foreign currency bond portfolio saw a significant increase. These products, some of which were tax efficient, contributed towards improving the Net Interest Margin (NIM). The Bank also received the CBSL approval to invest in long term Sri Lanka Sovereign Bonds, special approval to invest in National Savings Bank bonds and DFCC bonds resulting in higher investment income.

The setting up of their own treasuries by a number of corporates in the country can be considered both a challenge and an opportunity. While this makes maintaining margins challenging, it also makes it easier for the Bank to provide this customer segment with new products such as foreign currency options, interest rate derivatives, structured deposits and other hedging mechanisms.

Customer relationship-building programmes conducted during the year include –

- Annual train journey and overnight stay with 100 customers (a 15-year tradition)

- Talk by overseas analysts on economic outlook

- Regular client meetings and luncheons

- Customer-friendly technology innovations

- Training and development of dealers to keep them abreast of new developments

Reaching diverse geographical locations

Geographical diversification allows us to mitigate risks in instances such as extreme weather which can be disastrous for sectors such as agriculture but have less of an impact on other industries. However, such diversification exposes the Bank to a wider investment arena that includes a range of asset classes, but it also provides more robust opportunities for growth.

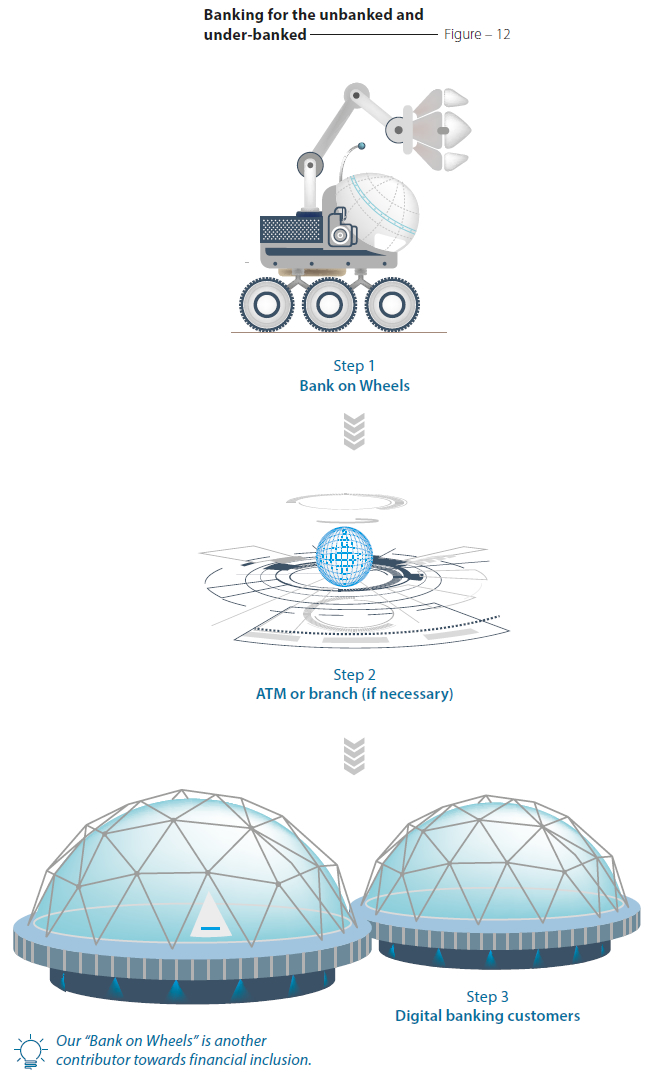

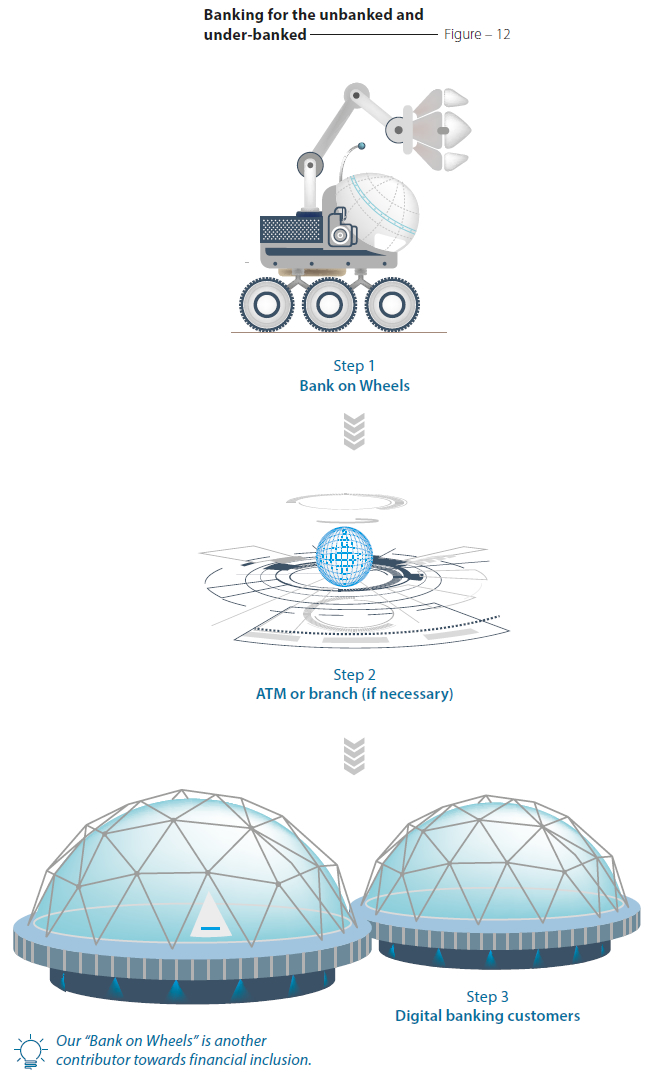

Within Sri Lanka, geographical diversification also helps us steer away from densely populated industry sectors and discover underserved markets. For instance, while we serve many of the country’s top-tier conglomerates, our 16 AMFUs have long been instrumental in furthering financial inclusion in the country, bringing banking and banking technology to the unbanked and under-banked segments of the community through innovations such as our “Bank on Wheels”.

This innovative idea introduced in 2017 is unique in Sri Lanka’s banking landscape because unlike those of peers, it is a completely equipped, and automated mobile bank.

Managed by branches in the North and the East of the country, these vehicles visit communities which are hard-to-reach at a specific time each week, providing a range of basic over-the-counter banking facilities.

With an employee at hand to help customers to use the Bank’s automated channels on board, our ‘’Bank on Wheels’’,

not only brings banking to rural communities but

also converts them to digital banking users – gearing them for the

future of banking

This banking channel is more cost efficient as it allows the Bank to get to know a community and its banking needs, and introduce them to digital banking with the intention of setting up a mini banking unit or branch to serve them depending on the demand.

This year, the Bank piloted the second such mobile banking unit and will look

at launching more to extend its reach.

Each vehicle is affiliated with a branch

and connected online to the main

banking system.

One of the Bank’s key strengths is its island-wide network of 266 branches, many of which remain open on public, bank, mercantile holidays and weekends.

Exploring new and diverse channels

The new digital platform purchased from Fiserv will be operational in 2019 to provide customers with a seamless digital banking experience. We have also invested in Data Analytics which will provide us a detailed picture of customer trends allowing us to be where the customer is, when needed.

Commercial Bank

will be a pioneer in

offering customers an omni-channel banking experience in Sri Lanka

With the regulator’s approval, we will be able to offer customers the ability to carry out banking functions from registration to loan requisition and account application online.

Combined with Flash, our digital bank account which is accessible via smart phone ( refer Fortifying digital leadership), our moniker as “the Nation’s bank” is further fortified as we continue to extend the horizons of banking. In the near future, Flash will be customised to be in Sinhala and Tamil to ensure wider reach and greater ease of use. The Bank has taken initial steps to extend Flash, beyond Sri Lankan shores to both Bangladesh and Maldives.

In addition to internet banking, the Bank has its network of branches and its network of 830 ATMs ( refer Optimising resources for details).

Reaching out through a range of subsidiaries

Non-financial subsidiaries of the Bank deliver non-core banking activities, allowing the Bank to focus on products and services that cater to the ever-evolving banking needs of existing and potential customers. While growing organically in the domestic market, the Bank has taken steps to leverage inorganic and regional growth opportunities through subsidiaries, primarily to geographically diversify its risk exposures and sources of revenue, thereby enhancing its sustainability of operations and long-term value creation ( refer for an update on Subsidiaries and associates).

Reaching out to other overseas customers

The Bank’s presence in Bangladesh, the Maldives, Italy and Myanmar provides the Bank with greater insulation against local economic and political instability

Global Remittances

The Bank began its global remittances business in 2003, first entering Kuwait and gradually expanding to other countries.

The Bank currently has 118 remittance partners for Combank eExchange, a number that continues to grow. In addition, it has integrated with renowned international money transfer system such as Western Union, RIA, Moneygram, Xpress Money and Cash Express for real time remittances.

17.5% of the total remittances received to the country are forwarded through the Bank.

With its Business Promotion Officers placed in key markets around the world to cater to the banking needs of Sri Lankans working in these markets, the Bank offers products and services including money transfer facilities via our e-Exchange remittance services.