Customers

GRI 103-1, 103-2, 103-3

Delivering a premium service

We give high priority to customers’ emotional connection with our brand. This is essential to spur customer activity, elevate our brand and strengthen customer loyalty. We interact with customers focused on simplicity, transparency, clarity and empathy, fulfilling their diverse aspirations.

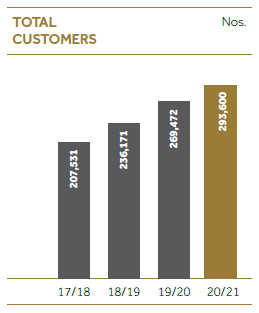

Growth in our customer base

The effectiveness of this strategy is evident by the steady growth in our customer base over the years.

We develop insight-driven customer value propositions with a focus on customer lifecycle management. This enables us to forge deep relationships through a life-stage/ecosystem approach. We constantly improve access to financial services through our extensive and accessible network comprising physical outlets, call centre, digital platforms and access through strategic partners. Increasingly, we focus on the development of new technology-based solutions that elevate customer convenience. We also focus on strengthening customer security and privacy through state-of-the-art technology and data management.

Despite the challenges of operating during the COVID-19 pandemic, technology enhancements and investments introduced over the years increased our interactions with our customers. We were able to provide solutions to their financial requirements effectively and seamlessly. During the year, we effected several improvements to enhance our service delivery to customers.

- The application journey was digitised where possible in order to provide quicker handling time on end-to-end application processing. All forms were digitalised with the use of optical character recognition (OCR) technology to automate data extraction while data entry functions were performed by BOTs to ensure speedy service. This has resulted in a reduced turnaround time.

- The CDB Flexi Capture App, is one of the most revolutionary apps in the industry, which is used to upload all loan applications and customer onboarding documents by our sales team from any place and at any time using a smart phone while assuring data security.

- Head of Branch was granted delegated authority limits to approve loans at any time of the day without visiting the branch. 90% of our loans can be approved through this process to deliver a speedy and a hassle-free service to our customers.

- Centralised CRIB checking process enables our marketing staff to make speedy decisions on loan/lease facilities by requesting and receiving CRIB reports while on the move from anywhere, anytime.

- Robotic process automation (RPA) based entry process for loan account creation, credit card entries, customer onbording and savings account creation were channelled through BOTs in December 2020. This facilitated the smooth functioning of our processes even through the pandemic-related lockdowns. Since December 2020, all credit files, and credit card applications were submitted through this RPA process.

Especially following the COVID-19 movement restrictions, we worked hard to ensure our customers could continue to conduct their financial transactions and remain in charge of their finances. Whilst providing the full range of daily financial support, we extended extra help to our customers in these challenging times. Staying close to our clients and listening to their needs enable us to look for tailor-made solutions.

The detailed analysis of the customers who obtained moratoriums are given in the CFO’s Analysis page 27.

Customer onboarding

GRI 102-6

Customer onboarding processes have been made simplified and efficient by adopting technology. Flexi Capture App, is a mobile phone enabled document submission app, given to our field-based marketing staff in order to submit application forms from customer’s location and at the time convenient to the customer. Know your customer (KYC) was conducted at the customer’s doorstep through a screening app, assuring privacy of data and adhering to all required regulations. As a result customer account opening takes place from anywhere, anytime. Especially following the COVID-19 pandemic, digital onboarding of customers facilitated our clientele to access their financial facilities and conduct transactions seamlessly. During the year under review, our customer base increased by 9%, largely supported by our digital channels.

During the year ended 31 March 2021, 43% of the client creations and 41% of the savings account openings were done through BOTs.

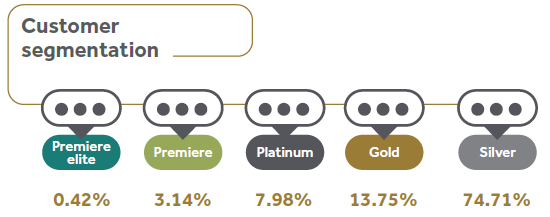

Customer segmentation

Once a customer is onboarded, we segment our customers to extend an unparalleled experience. We do this by understanding their needs, preferences and concerns and responding with our products and services to meet and exceed the diverse customer expectations. We use business intelligence to do a comprehensive analysis of customers. Our target is to sell at least two product categories to 50% of our customers by 2022. A tele sales unit was established in 2020 to coordinate with potential customers, to covert the lead into a sales and Affinity App is used to manage the customer life cycle and customer account management process.

Tailor-made solutions catering to life cycle of customers

We constantly innovate and develop our range of financial products and services to enhance customer satisfaction and experience. We have replaced legacy digital channels, with next-generation platforms to reduce inefficiencies in resource utilisation and extend an exemplary customer service that leads to increased customer satisfaction and loyalty. Interactions with our customers, through point-of-sale devices, ATMs, internet banking or call centre and in branches, are opportunities to understand them better. This information enables us to tailor customer solutions, to meet their specific requirements. Our products cater to every life stage of our customers. With technological disruption and smart financial engineering, we use our digital capabilities to create focused customer value propositions, enabling customers to evaluate real-life options and make lifestyle decisions through the customer ecosystem. We offer both conventional and check-in products. We have reached a credit card base of 10,000 and built a savings portfolio of Rs. 2.9 Bn. In view of having an idea of the value of each customer to CDB, the Customer Life Time Value Model has been brought into the customer strategy and each customer has been rated based on the products, product values and the relationship with CDB. This model shall be used in the future as a supportive tool for evaluating and decision making on customer loyalty and retention.

OUR PRODUCT PORTFOLIO

Given below are our conventional and check-in products.

GRI 102-2

Service based on future potential of customers

We aim to meet the aspirations of lower and middle-income segments and thereby elevate their living standards, giving them a feeling of prestige and recognition by empowering their aspirations. By adopting an “Account Manager” concept, we create lasting relationships with our customers offering a personalised service, meticulously attending to their financial needs and providing the best financial solutions to cater to their requirements. In order to progress a systematic implementation in the account manager concept, the existing sales force App Affinity has been deployed. Thereby the relevant account managers may track the required interactions with their customers.

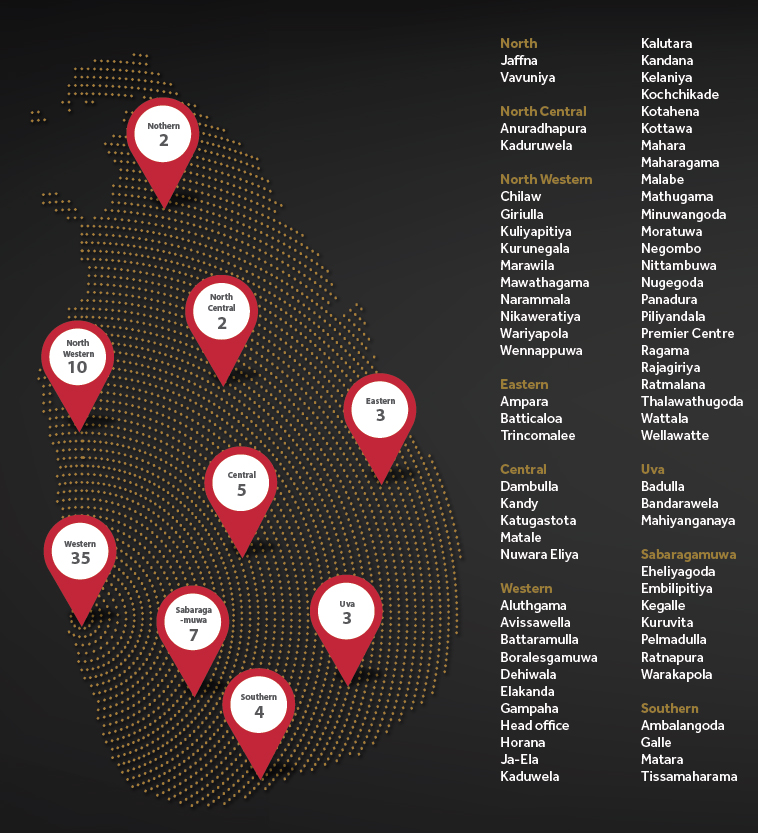

Expanding customer touchpoints

We provide financial services to our customers and clients through a multi-channel approach. Our customers are provided with a choice of engagement platforms from various digital solutions to call centre to face-to-face engagements in branches and relationship managers. During 2020, COVID-19 was a powerful catalyst that accelerated the migration to digital processes and services, by both consumers and businesses. This was due to social distancing that created a surge in demand for online commerce, contactless payments and digital cash transfers. Our value proposition is "Tech with a touch” which encompasses people-enabled technology.

The following statistics indicate the adoption of our digital products by customers.

Our customer touchpoint map

GRI 102-4, 102-6

Efficient customer care

GRI 418-1

Our focal point of contact for customers to make inquiries, requests, complaints, and provide feedback is our dedicated 24/7 customer contact centre which provides trilingual service. This omni channel contact centre has an efficient queuing mechanism with call history on agent interface, predictive dialling facility, call barging/call whispering and real-time monitoring facilities. The call back service ensures a call back within an hour of any abandoned call. During the year under review a total of 207,021 calls were received by the call centre of which 192,160 calls were answered and 13,995 calls were abandoned. A total of 169,435 calls were answered within the threshold. A toll free “Missed Call Service” was implemented enabling customers to contact the CDB contact centre, where an agent would contact the client back directly for a missed call given.

The statistics of our call centre for 2020/21 are as follows:

Marketing campaigns, promotions, and marketing communications

GRI 206-1

By implementing a clear marketing and branding strategy, we support our customers to make informed decisions. All our communications are conducted in a transparent manner maintaining ethical marketing practices. All relevant information in terms of product and services are disclosed in three languages (English, Sinhala and Tamil).

43%

of the client creation were done through BOTs

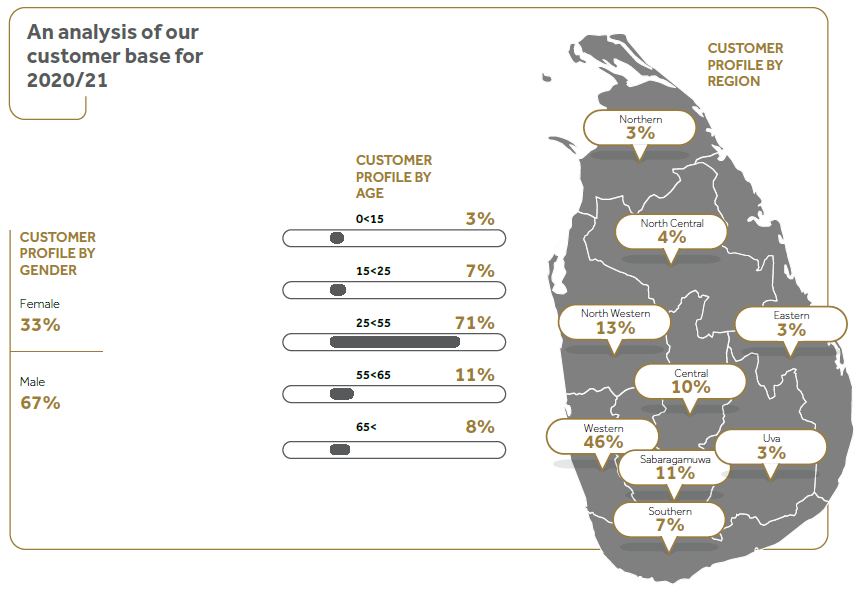

33%

of our customer base are female

- 25th Anniversary celebrations:

In commemoration of our 25th anniversary celebrations, we initiated a 360 degree communication campaign under the theme of “Empowering a Smart & Sustainable Sri Lanka,” which is our theme for the next decade. This campaign was extended to both above the line (ATL) and below the line (BTL) platforms while ensuring presence in the digital space.

- CDB iNet campaign:

The importance of digital platforms were felt by Sri Lankans following the pandemic. In this context, we revived the CDB iNet app under the “Be Smart & Stay Safe” campaign, encouraging Sri Lankans to stay indoors and conduct their financial transactions the smarter way using the app. The campaign highlighted the key features of the app, such as CDB iTransfer (money transfer via social media platforms), placing digital fixed deposits with CDB iDeposits and ease of paying insurance, credit cards, utility bills and lease rentals from the comfort and safety of the home.

- CDB cards all year round campaign:

CDB introduced a year round campaign for the first time in Sri Lanka with the objective of onboarding new customers to CDB with a key focus on the debit card. This initiative also complemented an operational innovation which facilitated speedy customer account opening. This allowed us to open customer accounts and issue debit cards on the spot at the supermarkets itself, and bring in an exciting flair to the campaign with offers from all the leading supermarkets. The offer was also extended for eye wear and foot wear as well. This campaign was advertised on the television and print media while ensuring strong presence on digital media. The campaign was driven at ground level with supermarket activations via the branch network.

- CDB iDepost campaign:

As an extension to the “Be Smart & Stay Safe” campaign, we highlighted the digital fixed deposit feature of CDB iNet. This campaign was launched to improve awareness of CDB iDeposit and encourage people to place digital fixed deposits from anytime anywhere with a minimum deposit of Rs. 5,000. CDB iDeposit campaign was targeted at youth, encouraging them to save for the future while making it affordable and feasible to place fixed deposits from anywhere, anytime using their mobile phone or any other smart device. This campaign was driven on digital media while ensuring a wider reach through television and print media.

- CDB Leasing with Cash Lease & Aspired Lease campaign:

In tandem with the National focus of spurring local businesses, encouraging entrepreneurship, and allowing especially youth to actively contribute to national GDP, CDB Leasing communications were given an innovative twist to support these national interests.

Through CDB Cash Lease campaign we encouraged people to use their vehicle as an asset to finance their business and education requirements without selling. their vehicle

- Aspired Lease campaign provided an elevation to the lifestyle, by highlighting that a person can upgrade to their aspired vehicle through our facilities.

Mystery customer survey

Mystery customer market research technique is implemented to evaluate the level of customer service, quality, and consistency extended by the front office staff of our branch network. This qualitative research is undertaken through an observation tracker for each branch. Individual performance is assessed based on customer care, selling skills, knowledge, and interpersonal skills while Company performance is assessed based on facilities, documentation, branch ambience, and overall aspect of CDB. The survey is conducted for all branches and patpat.lk inquiries and the call centre. The results of the survey are updated to an online dashboard within 24 hours for speedy decision making.

Customer privacy

GRI 418-1

Our investments in latest technology helps us to combat cybercrime. Our staff are trained on protecting customer information under the CBSL guidelines on customer protection. Stringent information security features are in place at CDB including limited access, passwords, segregation of duties, data backup systems, signing of non-disclosure agreements, limited out bound mail access, and fire walls. Customer privacy has been further strengthened by stringent purview of our Risk Management Committee, Compliance Department, and Internal Auditors. No complaints were reported with regard to breach of customer privacy or misuse of customer information during the year under review.

Compliance

GRI 206-1 , 416-2, 417-2, 417-3

The rights of our customers are protected by the CDB customer charter. During the period under review, there were no instances of non-compliance related to product and service labelling or marketing communication guidelines. Neither were any incidents of non-compliance pertaining to anti-competitive behaviour, anti-trust, and monopoly practices as well. Further, there were no substantiated complaints pertaining to breaches of customer privacy and losses of customer data.

No incidents of non-compliance concerning the health and safety impacts of products and services were recorded.

Future priorities

Going forward we will implement Net Promoter Score, launch the Account Manager concept across all our branches and facilitate onboarding of customers through video calls. Furthermore, we will introduce a Customer Life Cycle Value rating system. More focus will be given to automating data entry process , ruled based sanctioning process along with the payment process to reduce process time and effectively allocate resources and optimise usage.