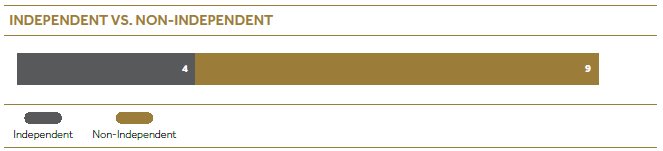

Corporate governance

GRI 102-18, 102-19, 102-22

CDB enterprise governance

Navigating the business operations through extremely complex environment and creating value to our stakeholders are challenging in the absence of a proper enterprise governance framework. As a responsible organisation, CDB considers ‘Enterprise Governance’ as one of the most critical components which is vital in achieving stakeholder value creation objective. Thus, CDB always strives to implement the right processes, structures, and relational mechanisms which in turn would achieve the established objective of the organisation.

COMPREHENSIVE GOVERNANCE FRAMEWORK AT CDB

CDB corporate governance

Sound and effective corporate governance practices are the basis of smooth, effective and transparent operations of CDB which ensures attracting investments, protecting shareholders’ and other stakeholders’ rights, and enhancing shareholder value. Accordingly, good corporate governance practices aid in maintaining a healthy relationship between shareholders and the management.

As we are required to comply with external/internal and mandatory/voluntary practices for continuous improvement to compliance, the Board is always committed to bolster the effectiveness of the Organisation governance models through responsible conduct, deepening competitive advantage through adding value, effective leadership, robust risk management, clear performance management, greater transparency and a sound ethical culture.

CDB considers ‘Enterprise Governance’ as one of the most critical components which is vital in achieving stakeholder value creation objectives.

Business governance at CDB

Business governance also contributes towards value creation through effective allocation of resources. Sustainable shared value creation emanates from accelerating the strategies and managing constraints in terms of operations, finance, human resources and information technology in an ever-changing world.

Operational

Automation of part of the business operations

Financial

PAT increased by 39%

Cost to income ratio 41%

Total capital ratio stood at 15.34%

Provision Coverage Ratio stood at 69%

Human Resources

Delivering an average of 21.5 hours of training per staff member

Introduction of CDB Virtual University

Information Technology

Introduction of the Sales App for the marketing team

Board committees

|

IRC Integrated Risk Management Committee Oversight responsibility for all areas of risk management including credit, market, operational, liquidity, cyber/ IT and strategic risks and ensures compliance with the entirety of the risk management policy framework and compliance with laws and regulations |

RC Remuneration Committee Monitors, evaluates and prepares for remuneration related matters |

AC Audit Committee Identifies any deficiencies in routines and the organisation in terms of governance, risk management and control |

||

|

RPTRC Related Party Transactions Review Committee Reviews in advance all proposed Related Party Transactions of the Company in order to ensure that related parties are treated on par with other shareholders and constituents of CDB |

NC Nomination Committee The shareholders’ governing body that nominates Board members and the Auditors and proposes their fees |

CC Credit Committee Formulates, reviews and revises policies and procedures for granting credit facilities, to be submitted for the approval of the Board of Directors whilst ensuring compliance with all statutory and regulatory requirements |

Management Committees

|

CMC Corporate Management Committee This is the highest management level committee in CDB. This Committee reviews the entire performance of CDB, with a view of formulating strategies and issuing directions to manage deviations |

ITSC IT Steering Committee Directs, reviews and approves IT strategic plans |

RCC Risk and Compliance Committee Reviews overall risk and compliance at CDB |

ALMC Asset-Liability Management Committee Reviews the funding strategy, liquidity management, asset liability mismatch as well as market risk exposures, management of liquidity risk and interest rate risks as primary objectives and manages various financial risks of the Company |

IC Investment Committee Assists the Board of Directors to discharge its statutory duties and its oversight responsibilities in relation to investment activities |

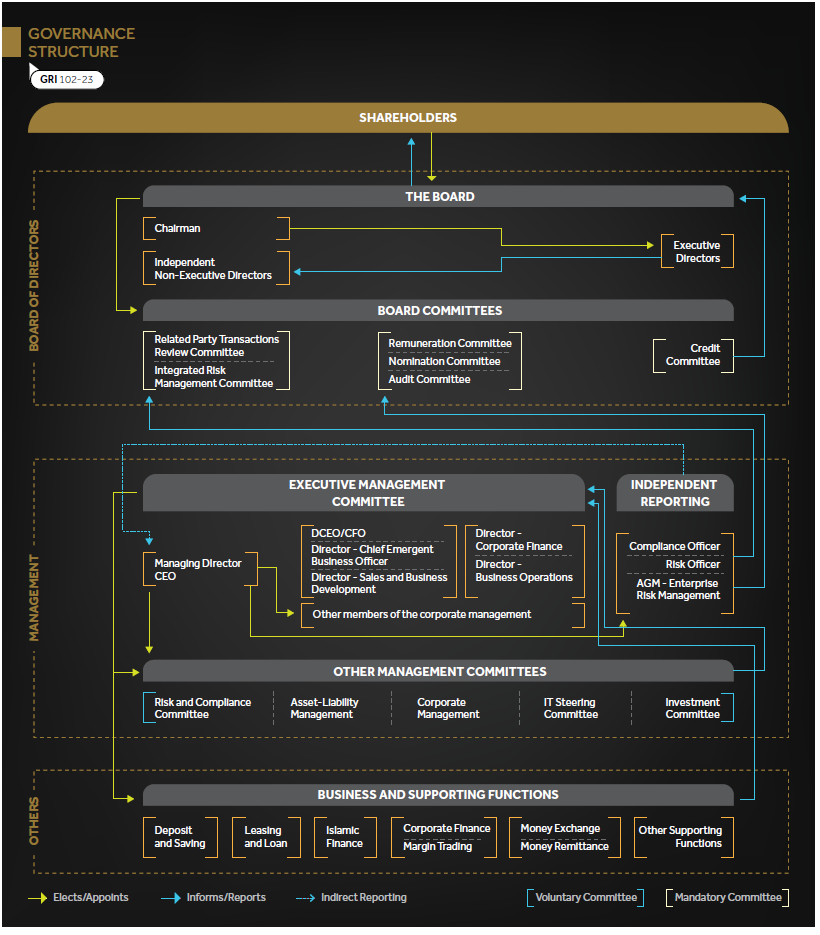

Highlights for the year 2020/21 of the robust regulatory compliance risk management programme

CDB as a financial service provider, requires to ensure zero non-compliance in order to protect the customers first and foremost and also the Organisation as a whole. Since compliance in financial institutions is becoming increasingly sophisticated with the growing regulatory demands, CDB has devoted substantial resources to adhere with all regulatory requirements. Even amidst the COVID-19 pandemic, numerous compliance requirements were put into effect by the regulators and CDB proactively and promptly enforced compliance across the Organisation through its “Compliance Culture”; an initiative taken during the last financial year.

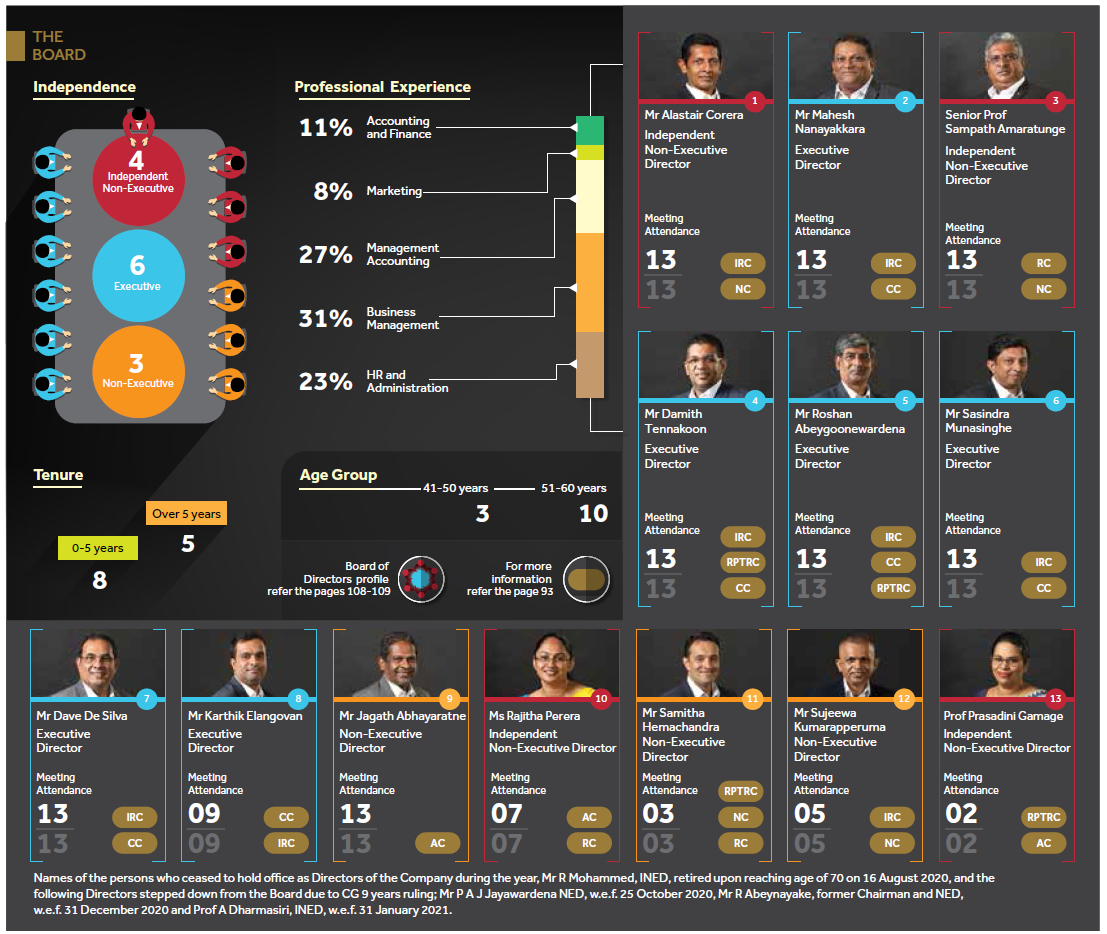

31%

of the Directors with Business managerial experience

38%

of the Directors had a tenure of over 5 years

Sound and effective corporate governance practices are the basis of smooth, effective and transparent operations of CDB which ensures attracting investments, protecting shareholders’ and other stakeholders’ rights, and enhancing shareholder value.

MD/CEO’s Responsibilities

Monitoring and reporting to the Board on the performance of CDB and its compliance with applicable legal and regulatory obligations

Developing CDB’s strategy for consideration and approval by the Board and its implementation thereafter

Developing and recommending budgets to the Board to support CDB’s mid and long-term strategy

Ensuring proper succession planning of the Executive committee and assessing their performance

Ensuring that CDB operates within the approved risk appetite

Chairman’s Responsibilities

To keep abreast of the activities of the Company and its Management in general

To develop and set the agendas for meetings of the Board in collaboration with the CEO

To assess and make recommendations to the Board annually regarding the effectiveness of the Board as a whole, the Committees of the Board and individual Directors

To call special meetings of the Board when required

To sit on other committees of the Board when required as determined by the Board

To ensure that the Directors are properly informed and that sufficient information is provided to enable the Directors to form appropriate judgements

Corporate governance disclosures

GRI 419-1

In our endeavour to strengthen governance at CDB, we complied with the provisions in all applicable codes and directions on corporate governance during the year ended 31 March 2021. Accordingly, CDB has adopted and is in compliance with voluntary requirements outlined in the “Code of Best Practice on Corporate Governance 2017”, issued by the Institute of Chartered Accountants of Sri Lanka (the ICASL) along with the mandatory requirements of Direction No. 03 of 2008 (Corporate Governance) and subsequent amendments issued by the Monetary Board of the Central Bank of Sri Lanka under the Finance Business Act No. 42 of 2011.

| Caption | ICASL Reference |

CBSL Rule Reference | Principle, Compliance and Implementation | Status of Compliance |

| The Board | ||||

| Board meetings | A.1.1 | 3 (1)/ 3 (3) & 3 (4) | Board meetings are held monthly with proper notice, mainly to review the performance of the Company and other matters referred to the Board by the heads of respective divisions, while special Board Meetings are convened whenever necessary. These meetings ensure that prompt action is taken to align the business processes to achieve the expectations of all stakeholders. All the Directors attended all the meetings that they were eligible for. (Attendance of Board meetings: Page 95). | |

| Responsibilities of the Board |

A.1.2 | 2 (1) | The Board is collectively responsible for the success of the Company. The Board formulates the business strategy and ensures that MD/CEO and the Management Team possess the skills, experience and knowledge to implement the strategy. It also ensures that effective systems are in place to secure integrity of the information, internal controls and risk management and compliance with all applicable laws and regulations. The Independent Directors are responsible for bringing independent judgment to decisions made by the Board. | |

| Compliance with laws and access to independent professional advice | A.1.3 | 2 (3) | A procedure has been put in place for Directors to seek independent professional advice, in furtherance of their duties, at the Company’s expense. This will be coordinated by the Board Secretary, as and when it is required. In addition, the Board is assisted by several Board sub-committees on various matters. | |

| Advice and Services of the Company Secretary | A.1.4 | 3 (5) & 3 (7) | All secretarial matters for which clarification is needed by the Board are referred to the Company Secretary who has the required qualifications as set out in the Companies Act. The Company Secretary provides all information after obtaining necessary professional advice, whenever required to do so. All Board members have access to the Company Secretary to ensure that proper Board procedures are followed and that all applicable rules and regulations are complied with. The consent of all Board members is required for the removal of the Company Secretary. | |

| Independent judgment of Directors | A.1.5 | 2.4 | None of the Directors held executive responsibilities in their capacity as Non- Executive Directors. The Non-Executive Directors do not have any business interests that could materially interfere with the exercise of their independent judgment. Directors are required to disclose all transactions with the Company, including those of their close family members as required by the relevant Sri Lanka Accounting Standards and the Companies Act. The Board has taken steps to ensure that conflicts and potential conflicts of interest of Directors are disclosed to the Board. | |

| Dedication of adequate time and effort for matters of the Board | A.1.6 | 2.5 | The Board members dedicate adequate time and effort to fulfil their duties as Directors of the Company (both before and after the Board meetings) to ensure that the duties and responsibilities owed to the Company are discharged accordingly. In addition to attending Board meetings, they attended Sub-committee meetings and also made decisions via circular resolutions where necessary.

The Board Sub-committees include:

|

|

| Resolutions to be presented | A.1.7 | One-third of Directors can call for a resolution to be presented to the Board. | ||

| Training for new and existing directors | A.1.8 | Both new and existing Directors of the Company are provided guidelines on general aspects of directorship and industry specific matters. During the year, presentations were made to the Board/ Board Sub-committees by the Company from time to time on industry specific matters and regulatory updates and the Directors attended a number of meetings with the Corporate Management Teams to familiarise themselves with the Company strategy, operations and internal control. Director training focus areas for 2020/21 were

|

||

| Situation of insolvency | 2 (6) | No such situation arose during the year. | ||

| Inclusion of proposals by all Directors in the agenda | 3 (2) | The Company Secretary facilitates any request made by the Directors at the meeting or otherwise and ensures that the said matters and proposals are included in the agenda for the next meeting for discussion. | ||

| Management function delegated by the Board | 6 (1) & 6 (2) | The Board annually evaluates the delegated authority process to ensure that the delegation of work does not materially affect the ability of the Board as a whole in discharging its functions. | ||

| Chairman and Chief Executive Officer (CEO) | ||||

| Division of responsibilities of the Chairman and MD/CEO | A.2.1 | 2 (2) & 7 (1)/ 7 (11) | The roles of the Chairman and the MD/Chief Executive Officer are separate in the Company. The Chairman is an Independent Non-Executive Director while the Managing Director serves as an Executive Director of the Company. This is to ensure a balance of power in strategic and operational decisions authority such that no one possesses unfettered powers of decisions. The Chairman is responsible for leading, directing and managing the work of the Board to ensure that it operates effectively and fully discharges its legal and regulatory responsibilities. The MD/CEO’s role is primarily to conduct the business operations of the Company with the help of the Corporate Management. | |

| Chairman’s Role | ||||

| Role of the Chairman | A.3.1 | 7 (4) - 7 (10) | The Chairman’s main role is to lead and manage the Board and ensure effectiveness in all aspects of its role. The Chairman of the CDB is an Independent Non-Executive Director. The Chairman’s role encompasses that;

|

|

| Financial Acumen | ||||

| Availability of sufficient financial acumen and knowledge | A.4.1 | The Chairman is a Chartered Financial Analyst and a Fellow Member of The Chartered Institute of Management Accountants UK while MD/CEO is a member of the Chartered Institute of Management Accountants of UK. In addition, the Board includes one member of the Institute of Chartered Accountants of Sri Lanka and three members of the Chartered Institute of Management Accountants of UK. Directors’ profiles are given on pages 108 to 109. | ||

| Balance of the Board | ||||

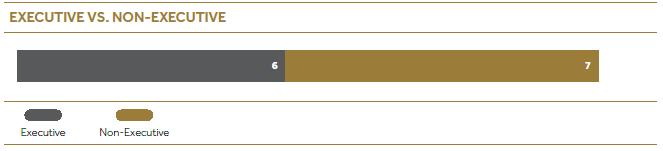

| Presence of Non-Executive Directors | A.5.1 | 4 (1)/ 4(6) & 4 (7) | During the FY 2020/21, seven of the thirteen Directors were Non-Executives (NED) which is well above the minimum prescribed by this code which is two NEDs or equivalent to one third of the total number of Directors, whichever is higher. This ensures that the views of NEDs carry a significant weight in the decisions made by the Board.

|

|

| Independent Directors | A.5.2 | 4 (4) | During the FY 2020/21, four out of seven Non-Executive Directors were independent as defined by the Code.

|

|

| Independence evaluation review | A.5.3 | All four independent Directors were independent of management and free of any business or other relationship that could impair their independence. | ||

| Signed declaration of Independence | A.5.4 | All Non-Executive Directors of the Company have made written submissions as regards their independence against the specified criteria set out by the Company, which is in line with the requirements of Schedule K of the Code. | ||

| Determination of independence of the Directors by the Board | A.5.5 | The Board has determined the independence of Directors based on the declarations submitted by the NEDs, as to their independence, as a fair representation and will continue to evaluate their independence on this basis annually. No circumstances have arisen for the determination of independence by the Board, beyond the criteria set out in the Code. | ||

| Appointment of an Alternative Director | A.5.6 | 4 (5) | When an alternative Director is appointed, requirements of the Code are met. However, such a situation has not arisen. | |

| Senior Independent Director | A.5.7 | 7 (2) | N/A | |

| Confidential discussion with the Senior Independent Director | A.5.8 | N/A | ||

| Meeting of Non -Executive Directors | A.5.9 | Chairman meets with the Non-Executive Directors without the presence of MD/CEO, on a need basis. | ||

| Recording of concern in Board minutes | A.5.10 | 3 (9) | Minutes of all meetings are duly recorded in sufficient detail and retained by the Company Secretary under the supervision of the Chairman. There were no concerns raised by the Directors during the year, which needed to be recorded in the Board meeting minutes. | |

| Supply of Information | ||||

| Information to the Board by the Management | A.6.1 | The Board was provided with timely and appropriate information by the Management by way of Board Papers and proposals. The Board sought additional information as and when required. Corporate and Senior Management made presentations on issues of importance. The Chairman ensured that all Directors were briefed on matters arising from Board Meetings. The Directors have free and open contact with the Corporate and Senior Management of the Company. | ||

| Adequate time for effective Board meetings | A.6.2 | 3 (6) & 3 (8) | The Board was provided with timely and appropriate information by the Management by way of Board Papers and proposals. The Board sought additional information as and when necessary. The Company Secretary prepares the agenda and keeps the minutes of meetings. Refer to page 85 for further details on Board meetings. | |

| Appointments to the Board | ||||

| Nomination Committee and Assessment of Board composition | A.7.1 & A.7.2 | 4 (9) | The Board as a whole annually assesses Board-composition to ascertain whether the combined knowledge and experience of the Board matches the strategic demands facing the Company. The findings of such assessment should be taken into account when new Board appointments are considered and when incumbent Directors come up for re-election. Refer to page 119 for the details of the Nomination Committee and its composition.

During the financial year 2020/21, five new Directors were appointed. An Executive Director, Mr E Karthik was appointed w.e.f. 01 July 2020. Two Independent Non-Executive Directors, Ms P R W Perera and Prof P N Gamage were appointed w.e.f. 16 August 2020 and 31 January 2021 respectively while two more Non-Executive Directors, Mr S Kumarapperuma and Mr E R S G S Hemachandra were appointed to the Board w.e.f 25 October 2020 and 31 December 2020 respectively. |

|

| Disclosure of details of new Directors to shareholders | A.7.3 | When the new Directors were appointed to the Board, a brief resume of each new Director including the nature of his/ her experience, the names of Companies in which the Director holds Directorship, membership in the Board Sub-committees etc., are informed to the Central Bank of Sri Lanka and the Colombo Stock Exchange in addition to disclosing this information in the annual report. | ||

| Appointment of an employee as a Director | 4 (3) | Mr E Karthik was appointed as an Executive Director w.e.f. 1 July 2020 | ||

| Appointment to fill a casual vacancy | 4 (10) | No such appointments occurred during the financial year 2020/21. | ||

| Holding office in more than 20 companies | 5 (2) | No Director holds such positions | ||

| Re-election | ||||

| Appointment of Non-Executive Directors | A.8.1 | Articles of Association of the Company requires, each Non-Executive Director to retire by rotation once in every three years and is required to stand for re-election by the shareholders at the Annual General Meeting. The proposed re-election of Directors is subjected to prior review by the full Board. | ||

| Re-election by the Shareholders | A.8.2 | Refer comment above. | ||

| Resignation of a Director |

A.8.3 | 4 (2)/ 4 (11) & 5 (1) | During the financial year, four Directors relinquished their Directorships at CDB.

|

|

| Appraisal of Board Performance | ||||

| Annual appraisal of Board performance and that of its committees | A.9.1 & A.9.2 | 2 (8) | The Board annually evaluated its performance against the annual objectives set at the beginning of the year. The performance of Board sub-committees was also evaluated against the objectives of the respective sub-committees. | |

| Level of contribution, and engagement of each Director at the time of re-election |

A.9.3 | The Board already has a robust process to review the participation, contribution and engagement of each Director at the time of re-election. | ||

| Disclosure of criteria used for the performance evaluation | A.9.4 | Refer to the “Report of the Remuneration Committee” on page 120 of the Annual Report for details of the criteria considered for the performance evaluation of the Board. | ||

| Disclosure of Information in respect of Directors | ||||

| Details in respect of Directors | A.10.1 | 4 (8) | Details of Directors are given on pages 108 to 109 of this Annual Report. | |

| Relationship between Chairman and CEO and other Directors | 7 (3) | There are no material relationships between the Chairman/the CEO and/or other members of the Board which will impair their respective roles. | ||

| Appraisal of CEO | ||||

| Financial and non-financial targets for CEO | A.11.1 | The MD/CEO‘s performance objectives are aligned with the business sustainability of the Company. The performance targets for the MD/CEO are set at the commencement of every financial year by the entire Board which are in line with, the medium and long-term objectives of the Company. | ||

| Annual evaluation of the performance of CEO | A.11.2 | There is an ongoing process to evaluate the performance of MD/CEO against the financial and non-financial targets set as described above which is followed by a formal annual review by the Board at the end of each financial year. | ||

| Directors’ Remuneration Procedures | ||||

| Remuneration Committee | B.1.1 | The Remuneration Committee is responsible for assisting the Board with regard to the remuneration policy for the Executive Directors and the Corporate Management, and for making all relevant disclosures. The Committee determines and agrees with the Board, the broad policy framework for the remuneration of the MD/CEO. The MD/CEO participates in meetings by invitation in deciding the remuneration of the Corporate Management in order to recruit, retain and motivate the Corporate Management Team. | ||

| Composition of the Remuneration Committee | B.1.2 & B.1.3 | The following Non-Executive Directors served on the Remuneration Committee during the financial year.

|

||

| Remuneration of Non-Executive Directors | B.1.4 | The Board as a whole decides the remuneration of the Non-Executive Directors. The Non-Executive Directors receive a fee for being a Director of the Board and an additional fee for either chairing or being a member of a Committee. | ||

| Consultation of the Chairman and access to professional advice | B.1.5 | Inputs of the Chairman are obtained by his involvement as a member of the said sub-committee. External professional advice is sought by the Remuneration Committee, on a need basis through the Board Secretary. |

||

| The Level And Make up of Remuneration | ||||

| Level and make up of remuneration | B.2.1 - B.2.9 | The Board is mindful of the fact that the remuneration of Executive and the Non-Executive Directors should reflect the expectation of the Company and sufficient enough to attract and retain the quality of Directors needed to run the Company. The remuneration package of the MD/CEO is structured to link rewards to corporate and individual performance. The Company’s remuneration framework for the CEO is designed to create and enhance value for all CDB’s stakeholders and to ensure that there is strong alignment between the short-term and long-term interests of the Company. | ||

| Remuneration of the Non-Executive Directors | B.2.10 | Non-Executive Directors receive a nominal fee in line with the market practices as disclosed in this Annual Report. Non-Executive Directors do not participate in performance-related incentive schemes. |

||

| Disclosure of remuneration | ||||

| Disclosure of Directors’ remuneration in the Annual Report | B.3.1 | Refer the Remuneration Committee Report on page 120 for disclosure on the names of the Remuneration Committee members and the remuneration policy of the Company. Also refer Note 45 to the Financial Statements on page 213 for the aggregate remuneration paid to Executive and Non-Executive Directors. | ||

| Relations with Shareholders | ||||

| Arranging Notice of AGM and related papers to be sent to shareholders |

C.1.1 | The Company ensures that all the notices relevant for the AGM are disseminated well before the meeting and as per the stipulated regulatory timelines. | ||

| Separate resolution for all separate issues | C.1.2 | Separate resolutions are proposed for all substantially separate issues to provide shareholders with the opportunity to deal with each significant matter separately. This mechanism promotes better stewardship while assuring the transparency in all activities of the Company. | ||

| Use of proxy votes | C.1.3 | The Company has an effective mechanism to record all proxy votes and proxy votes lodged for each resolution prior to the general meeting. | ||

| Availability of all Chairmen of Board Sub committees at the AGM |

C.1.4 | The Chairman of the Company ensures that the Chairman/Chairperson of all Board appointed Sub committees are present at the AGM to answer the questions under their purview. | ||

| Adequate notice of the AGM to shareholders together with the summary of the procedure | C.1.5 | A Form of Proxy and a copy of the Annual Report are dispatched to all shareholders together with the notice of meeting detailing the summary of procedure as per legal requirements giving adequate notice to shareholders. This provides an opportunity to all shareholders to attend the AGM based on their voting status and obtain clarifications for matters of interest to them. | ||

| Communication with shareholders | C.2.1 - C2.7 | The Company has implemented the relevant communication channels, disclosed the policy and methodology and other requirements of the Code for communication with shareholders. | ||

| Major and Material transactions | C.3.1 - C.3.2 | During the year there were no major transactions as defined by Section 185 of the Companies Act No. 7 of 2007 which materially affected CDB’s net asset base. Transactions, if any, which materially affect the net assets of the Company, will be disclosed in the quarterly/annual Financial Statements. Further, all these transactions (if any, during the financial year) are reviewed by the Board Related Party Transactions Review Committee headed by an Independent Non-Executive Director of CDB. | ||

| Financial and Business Reporting |

||||

| Reports to public and, Regulatory and Statutory reporting | D.1.1 - D.1.3 | 10 (1) | CDB has reported a true and fair view of its financial position and performance for the year ended 31 March 2021 and at the end of each Quarter of 2020/2021. In the preparation of Financial Statements, CDB had strictly complied with the requirements of the Companies Act No. 07 of 2007, the Finance Business Act No. 42 of 2011 and amendments thereto. They are prepared and presented in conformity with Sri Lanka Accounting Standards. CDB has complied with the reporting requirements prescribed by the regulatory authorities such as the Central Bank of Sri Lanka, the Colombo Stock Exchange, the Securities and the Exchange Commission of Sri Lanka. Financial statements are published in newspapers in all three languages on 29 June 2021. | |

| Directors report in the Annual report | D.1.4 | The Directors’ Report given in this Annual Report covers all areas of this section as required by the direction. Please refer pages 4 to 5 for the Directors’ Report. | ||

| Statement of Directors’ and Auditors’ responsibility for the financial statements, Report/ statement on Internal Controls |

D.1.5 | The Statement of Directors’ responsibility for Financial Reporting is given in this Annual Report as required by the direction, and the Auditor’s reporting responsibility is given in their audit report in the financial statements of this Annual Report. | ||

| Management Discussion and Analysis | D.1.6 | Our value creation story (MD&A) is given in this Annual Report as required by the direction. | ||

| Declaration by the Board that the business is a going concern and summoning an EGM to notify serious loss of capital | D.1.7 | This is given in the Directors’ Report. Further likelihood of such occurrence is remote. However, should the situation arise, an EGM will be called for and shareholders will be notified. | ||

| Disclosure of Related Party Transactions | D.1.8 | 9 (2) - 9 (4) | Relevant Related Party Transactions are adequately and accurately disclosed in the Annual Report. Further, all the related party transactions are reviewed by the BRPTR Committee. | |

| Minimum disclosures | 10 (2) | All required disclosures have been made in the Annual Report. Please refer pages 91 to 128. | ||

| Board appointed committees | ||||

| Board appointed two subcommittees | 8 - 8 (3) | The Audit Committee and Integrated Risk Management Committee are functioning as per the requirements of this direction. | ||

| Risk Management and Internal Control | ||||

| Review of the risks the Company is facing and evaluation of the Internal Control System | D.2.1 & D.2.5 | The Company has established a comprehensive framework of policies and procedures for risk management and internal controls, which are regularly reviewed and updated. The Company's Audit Committee ensures that there is an effective internal control and financial reporting system by adopting the following measures: (i) Audits are conducted by the Internal Audit Department, in areas involving high risks as identified in the annual internal audit plan. (ii) A structured process is in place for loss reporting, control exception reporting and compliance breach reporting. (iii) A comprehensive checklist is used to follow up on the status of implementation of all audit recommendations. | ||

| (iv) Periodic Branch Audits are performed on the Company’s branch operations. The Company obtained the External Auditor’s certification on the effectiveness of the internal control mechanism on financial reporting. | ||||

| Internal audit function | D.2.3 | The Company already has an Internal Audit Department, which is responsible for the internal audit function. | ||

| Reviews of the process and effectiveness of risk management and internal controls | D.2.4 | The Audit Committee carries out reviews of the process and effectiveness of risk management, internal controls and reports to the Board on a regular basis. | ||

| Audit Committee | ||||

| Composition of the Audit Committee | D.3.1 | The Company's Audit Committee consists of three members all of whom are Non-Executive Directors. The Committee operates within clearly defined terms of reference. Details of the members, invitees and the Secretary of the Committee are found in the Audit Committee Report in this Annual Report. Please refer pages 115 to 117 for the Audit Committee Report. |

||

| Duties of Audit Committee - Ensuring the objectivity and independence of External Auditors and terms of reference of the Audit Committee |

D.3.2 | The Committee maintains an appropriate relationship with the External Auditors, KPMG (Chartered Accountants) to ensure their objectivity and independence. The payments to External Auditors for Audit and Non-Audit services are disclosed in the Directors’ Report of this Annual Report. In addition, the Company has established an internal audit function which operates independently and has direct access to the Audit Committee. The External Auditors do not have any relationship (other than that of Auditor) and any interest in the Company. | ||

| Disclosure of the Audit Committee | D.3.3 | Names of the members of the Audit Committee and the scope of the Committee are given in this Annual Report under the Audit Committee Report. | ||

| Related Party Transactions Review Committee | ||||

| Related Party Transactions Review Committee | D.4.1 - D.4.3 | Please refer to the BRPTRC note on pages 122 to 123 and the RPT on pages 212 to 215. | ||

| Code of Business Conduct and Ethics | ||||

| Code of Business Conduct and Ethics | D.5.1 - D.5.3 | The Company has developed a Code of Business Conduct and Ethics for all team members, which addresses conflict of interest, corporate opportunities, confidentiality of information, fair dealing, protecting and proper use of the Company’s assets, compliance with applicable laws and regulations and encouraging the reporting of any illegal or unethical behaviour etc. | ||

| Affirmation by the Chairman that there is no violation of the code of conduct and ethics | D.5.4 | Refer to the Chairman’s Statement in the Annual Report for details. | ||

| Corporate Governance Disclosure | ||||

| Disclosure of Corporate Governance | D.6.1 | 2. (7) | This requirement is met through the presentation of this Report. | |

| Institutional investors | ||||

| Shareholder Voting | E.1 | Institutional shareholders are required to make considered use of their votes and encouraged to ensure their voting intentions are translated into practice. The Annual General Meeting is used to have an effective dialogue with the shareholders on matters which are relevant and of concern to the general membership. | ||

| Evaluation of Governance Disclosures | E.2 | Institutional investors are encouraged to give due weight to all relevant factors in the Board structure and composition. | ||

| Other investors | ||||

| Investing/Divesting Decision | F.1 | Individual shareholders are encouraged to carry out adequate analysis or seek independent advice on their investing, holding or divesting decisions. | ||

| Shareholder Voting | F.2 | Individual shareholders are encouraged to participate in general meetings and exercise their voting rights. | ||

| Internet of Things and Cyber Security | ||||

| Process of mitigating cyber security threats |

G.1 | During the financial year, CDB carried out internal and external IT vulnerability test with the assistance of external parties in order to mitigate cyber security threats. Further, these external parties conducted several Board presentations on the findings and on local/global best practices. | ||

| Environment, Society and Governance (ESG) | ||||

| ESG Reporting | H.1 - H.1.1 | Please refer to the Report on Environment/Society/Regulator sections on pages 56 to 69. | ||

| Environmental Factors | H.1.2 - H.1.2.1 | Please refer to the Report on Environment section on pages 56 to 63. | ||

| Social Factors | H.1.3 - H.1.3.1 | Please refer to the Report on Society section on pages 64 to 66. | ||

| Governance | H.1.4 - H.1.4.1 | Please refer to the Report on Regulator section on pages 67 to 69. | ||

| Board Role on ESG Factors |

H.1.5 - H.1.5.1 | Please refer to the Key Framework and Compliance Report on pages 56 to 69. | ||

| Sustainability Reporting | ||||

| Principles of Sustainability Reporting | G.1.1 - 1.7 | The Company has adopted the relevant principles and procedures of the Code to develop a sustainable business environment and disclosures are made in the Annual Report. | ||

| Transitional provision | ||||

| Transitional and other general provisions | 11 (1) - 11 (6) | The Company has complied with transitional provisions when applicable. |