Operating environment and our response

The market drivers

The COVID-19 pandemic has reshaped the world and the business environment with tumultuous economic and financial effects.

As a result, organisations have been compelled to transform to be sustainable and relevant. This requires smooth adaptation and agility of business models, confronting challenges creatively and capitalising on new opportunities.

Several key factors are shaping the operating context both locally and globally. Linked to these market drivers are challenges and opportunities that are general to the external environment and some that are specific to CDB. We have stated appropriate responses, after careful assessment of the impact of these drivers on our Company.

TECHNOLOGICAL CHANGE

Increasing adoption of technologies such as internet of things, blockchain, robotics, artificial intelligence (AI) and data analytics, and the pace of change, affect our ability to remain relevant to our customers as well as our competitiveness and the associated operational risk.

CHALLENGES

- Rapid innovations from fintechs and telcos with the challenge to integrate and up-scale digital innovations

- Complexity of managing technology, information and cyber risks

- Increased competition for specialised skills, such as information technology, data analytics and risk management

- Customer behaviour influenced by disruptions through fintechs and telcos

OPPORTUNITIES

- Opportunities for process automation and adoption of AI to decrease cost-to-serve and enhance customer service

- Customers increasingly adopting digital products

IMPACT ON CDB

- Upgrade legacy systems and implement agile ways of working across all business functions.

- Continuous improvement of monitoring and prevention to protect customers and the Company from the increasing sophistication of cybercrime, fraud risk and financial crime.

- Achieve cost-efficiencies through digitalisation.

OUR RESPONSE

- Delivering scalable, digital solutions that focus on customer needs and drive customer experience.

- Proactively adopt and embrace new technological knowhow and embed AI based solutions to strengthen our decision making and processes.

- The core banking solution has created a differentiation in terms of products on offer and service quality.

- Continuous investment in technology platforms, processes and controls including monitoring, enhancements and prioritisation of key issues.

MACRO-ECONOMIC ASPECTS

There are several aspects that impact the macro economy. The pandemic created severe pressure on the macro economy and customers across various segments in 2020. This impacts our ability to sustain business and achieve our business commitments.

CHALLENGES

- Slowdown in the economy

- Currency depreciation against the US Dollar

- Import restrictions

- Declining worker remittances

- Declining global competitiveness of Sri Lanka

- Increased credit risk defaults and lower recoveries

- Reduced cash inflows from loan repayments

- Reduced profit levels and capital depletion

- Higher provisioning requirements

OPPORTUNITIES

- Relief measures introduced by the CBSL and injection of liquidity to the system

IMPACT ON CDB

- Impact on Company’s profits due to higher loan provisioning requirements.

- Impact on Company’s credit rating.

- Extending the debt moratorium to affected customers as per the CBSL directions.

OUR RESPONSE

- NPLs were closely monitored at different levels based on the days past due (DPD). NPL was maintained at 7% as at 31 March 2021.

- Moratoriums were extended to 93,599 customers relating to Rs. 59 Bn. worth credit facilities as per the CBSL directions.

- Proactive management of credit portfolio risks.

- Diversification to other loan products such as credit cards, gold loans and rooftop solar etc.

MARKET DRIVEN FACTORS

The market interest rates remained low in 2020. The Standing Deposit Facility Rate (SDFR) and the Standing Lending Facility Rate (SLFR) were both reduced five times during the year to 4.5% and 5.5%, respectively, at year’s end and the Statutory Reserve Ratio (SRR) was reduced twice to 2% at year’s end. This affects our net interest margin and profitability.

CHALLENGES

- Compressing of the net interest margin

- Impact on profitability

OPPORTUNITIES

- Opportunities to grow the lending portfolio

- Opportunities to expand fee and commission income

IMPACT ON CDB

- Low interest rate regime resulted in increased early settlements

- Increased competition among banks and NBFIs due to decreasing gaps in fixed deposit rates given to customers

OUR RESPONSE

- Maintained the margins at required levels with optimal composition of assets and liabilities.

- Offering bundle of products through enhanced customer services.

GOVERNANCE, SOCIAL AND ENVIRONMENTAL MATTERS

Social and climate change risk impacts on our Company, our customers and the operating environment.

CHALLENGES

- The increasing pace and evolving complexity of regulatory and statutory requirements across the financial services industry

- Increasing requirement for solutions that aid the transition to a low-carbon regime

- Increasing severity of penalties and regulatory sanctions for non-compliance

- A need for improved governance and transparency in business conduct

- Health and safety

OPPORTUNITIES

- Opportunities to create sustainable financial solutions

- Opportunities to create social entrepreneurship to solve societal challenges

- A strong and stable financial services sector

- Opportunities to support small and medium businesses who are the backbone of the Sri Lankan economy

- Commitment to sustainable development goals

IMPACT ON CDB

- Need to embed climate change considerations into business strategies to mitigate risks.

- Proactively seek opportunities to support a transition to a low carbon economy.

- Need to create new channels and customised products intended to uplift society.

- Need for a coordinated, comprehensive and forward-looking approach to evaluate, respond to, and monitor regulatory change.

- Need to incur increased costs to implement and manage regulatory changes and impacts on financial measures.

OUR RESPONSE

- Ongoing investment in people, processes and systems across the Company.

- Participating in regulatory and statutory advocacy groups across the industry.

- Engaging with communities and supporting initiatives as part of the Company’s commitment to uplift the society.

- Driving sustainability agenda aligned with corporate strategies.

Materiality

GRI 103-1, 103-2, 103-3, 203-1, 203-2, 203-3

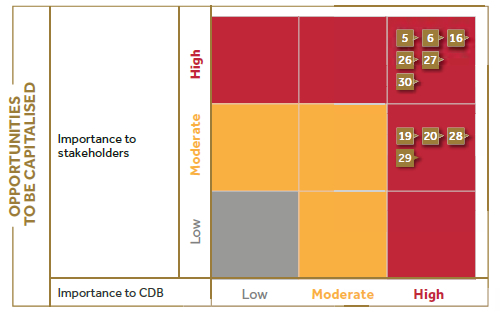

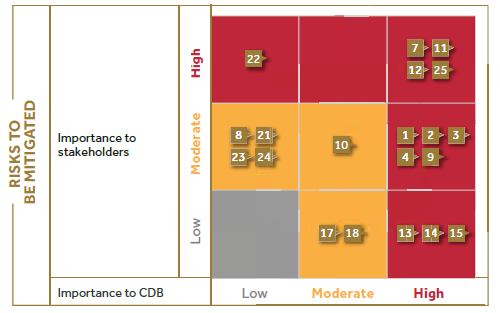

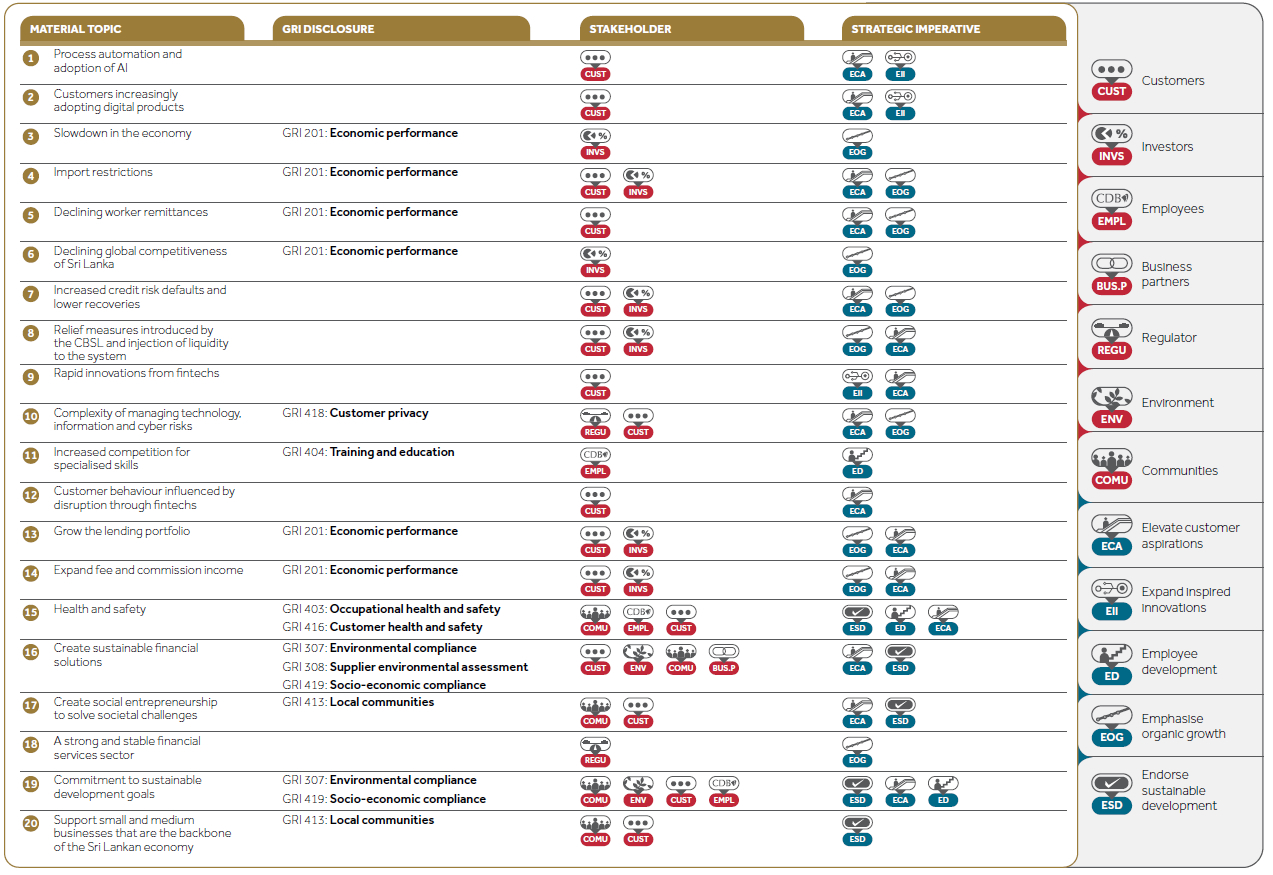

The above market drivers create trends that present risks, opportunities or both. They have an impact on our stakeholders and our Company on varying degrees. The matrices that follow illustrate the topics that are material to our Company according to their impact on stakeholders and our Organisation. We define material matters as those that significantly affect our ability to create value over the short, medium, and long term. We have determined the materiality of each matter by its relevance, the magnitude of its impact, and the probability of occurrence.

In this section, we look at topics that have the most impact on our value creation process. We view value creation in terms of the needs and priorities of our stakeholders and the context of the constantly changing environment within which we operate.

Our management approach

GRI 102-47

The material topics are managed through our strategic planning process. Each material topic is linked to achieving one or several strategic imperatives as indicated in the table below. This is done by assigning responsibility to the heads of the relevant divisions of our Organisation, allocating necessary resources based on the significance of each material topic towards achieving the relevant strategic imperatives. To ensure these material topics are achieved, we have embedded goals and targets where relevant into the KPIs. These are reviewed at regular intervals.

In managing these material topics, we have formulated policies to guide our people to conduct activities in a responsible, ethical, and transparent manner. These policies, which are duly adopted by the Board of Directors, are reviewed at predetermined intervals to stay current with the changing environment.

Formal grievance mechanisms are in place to address and resolve grievances. Lending to our customers and dealings with our business partners are screened for social and environmental aspects. All internal controls, policies, and procedures laid down to achieve the objectives of material topics are subject to internal and external auditing and verification to ensure adherence. We report the findings to the BOD and/or Management Committees on a periodic basis for information and corrective action where necessary. The numerous awards and accolades received by our Company demonstrate the effectiveness of the management approach we have adopted.

Material aspects

GRI 102-47

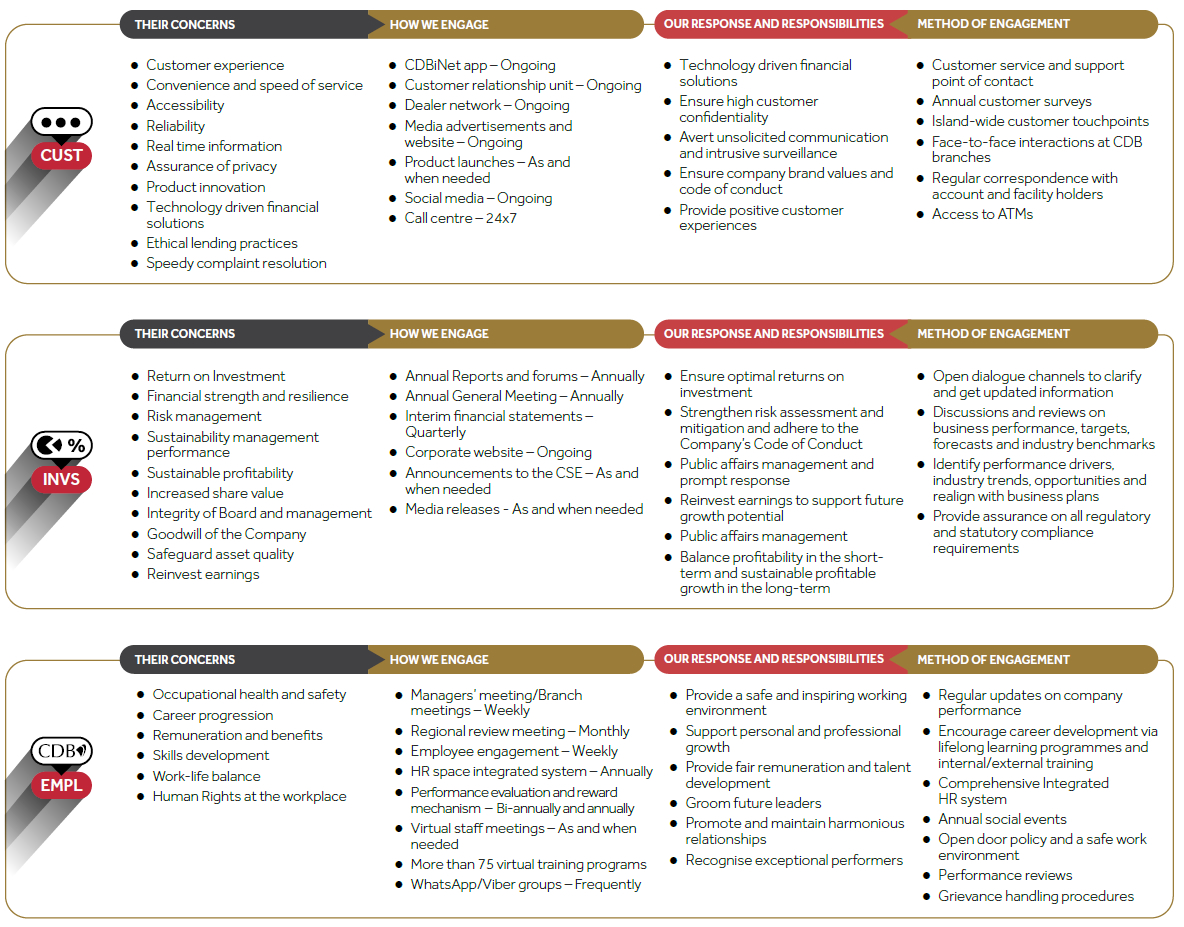

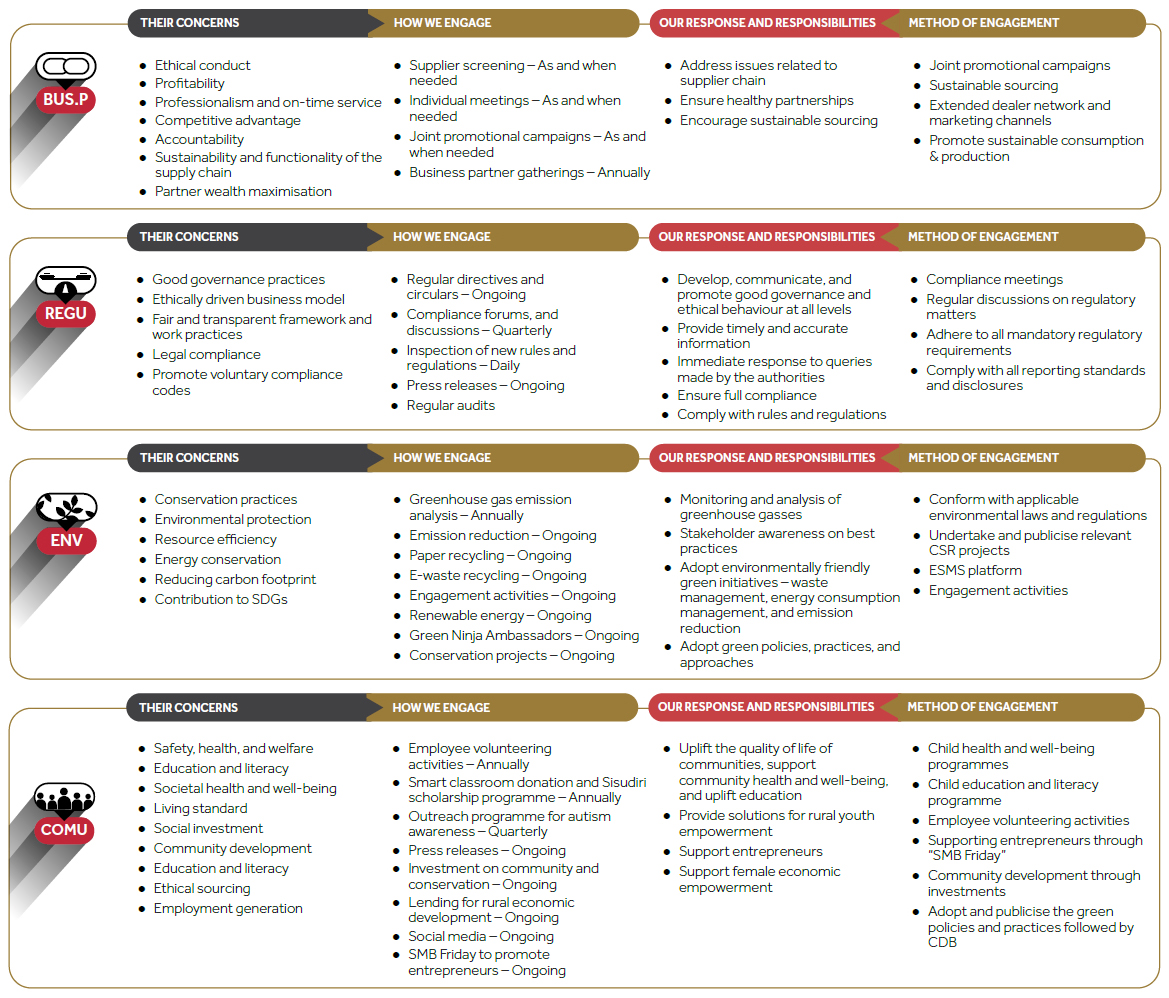

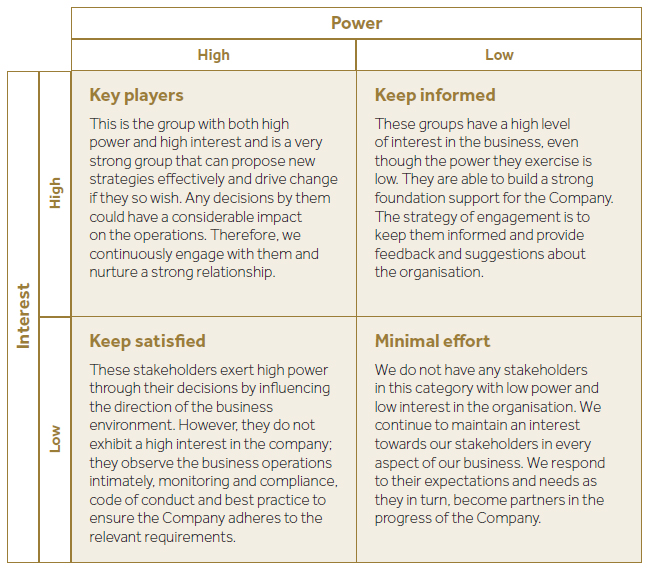

Our Stakeholders

Our principal stakeholders are investors, customers, business partners, regulators, employees, the community and the environment. We balance the needs of stakeholders over the short and long term to deliver sustainable performance.

Our engagement and relationship with stakeholders enable us to create value for our Company and our stakeholders. The changes brought about by the pandemic impacted the manner, the level, and the frequency of engagement with our stakeholders. Based on the feedback received from our stakeholders, we continue to work on improving our business model and strategic planning processes.

Engaging with our stakeholders

GRI 102-40, 102-42, 102-43, 102-44