Delivering and Deriving Value

Investors and the Economy

Group revenue grew by 13% to reach Rs. 74 bn, while profit before tax rose 96% to Rs. 5 bn.

Resources and Relationships

Our ability to create and preserve value over time has been a core element of the business model of the Hayleys Group over its 135-year history. We look at value creation as a two way process. On the one hand, it is a process where we create value to our external stakeholders - particularly our customers, employees, suppliers and business partners, as well as the local communities and environment in which we operate. It is about our use of and dependence on these various resources and relationships, and in turn how we have developed and benefited them over the years.

On the other hand, it is also about how they in turn enable us to create economic value that benefits us - our investors as well as the economy at large. It is this symbiotic relationship between our various forms of capital - financial, human, intellectual, social as well as the more abstract aspects such as goodwill, trust and integrity - that drive our business in delivering and deriving value.

Delivering Superior Shareholder Value

The Hayleys Group posted its best annual earnings in FY 2012/13 with Hand Protection, Purification and Transportation & Logistics sectors making significant contributions. Group turnover grew by 13% to reach Rs. 74 bn, while profit before tax rose 96% to Rs. 5 bn.

Recent investments in our Leisure & Aviation, Construction Materials and Energy sectors are making strong and growing contributions, while we remain optimistic on renewable energy development and are planning to further expand this portfolio. The holistic approach we have taken towards the Leisure & Aviation sector by combining hotels, travel agency, destination management and airline GSAs creates strong synergies that help us to take advantage of an industry earmarked for tremendous growth.

Following these strategic investments made in the recent past in the key growth sectors of the economy, Hayleys is now going through a period of consolidation to generate even stronger returns.

Financial Review

Group performance

Introduction

The review period saw the Group recording strong growth in most of its key business lines with significant improvements in core profitability. The Group achieved the highest ever profits in its operating history, with a profit before tax of Rs. 5.0 bn compared to Rs. 2.6 bn in 2011/12.

Convergence to SLFRS/LKAS

Hayleys PLC’s Financial Statements were prepared in accordance with Sri Lanka Accounting Standards (SLAS) until 31st March 2012. These Financial Statements for FY 2012/13 are the first Financial Statements prepared and presented in accordance with Sri Lanka Accounting Standards (SLFRS/LKAS) effective from 1st January 2012. Therefore, the Financial Statements of 2011 and 2012 were restated in line with the revised accounting standards. Detailed reconciliations and descriptions of the effect of the transition from the previous SLAS to SLFRS/LKAS on the Group’s equity and its net income are provided within Note 05 to the accounts.

Revenue

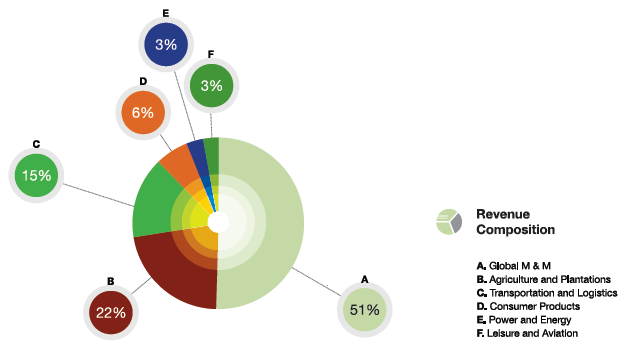

The Group’s revenue expanded 13% YoY to Rs. 74.3 bn during the review period, supported primarily by strong growth in its key Global Markets and Manufacturing and Transportation and Logistics sectors. The Global Markets and Manufacturing sector continues to be the largest contributor to Group Revenue with a share of 51%, followed by Agriculture and Plantations (22%) and Transportation and Logistics (15%).

Segmental Revenue

Within the Global Markets and Manufacturing segment, Hand Protection and Purification are the most prominent contributors to revenue with respective shares of 37% and 25% during the review period. Both these businesses along with the Transportation and Logistics sector performed exceptionally well, to achieve significant revenue growth.

The Global Markets and Manufacturing segment saw its revenue expanding by 11% YoY, despite a challenging global economic environment. Sector performance was upheld by the Group’s Hand Protection and Purification sectors which demonstrated remarkable resilience during the year. In Hand Protection, product innovation coupled with the dynamic pursuit of new markets enabled the sector to sustain its growth momentum. Meanwhile, in Purification, timely strategies to exploit the growing demand in emerging markets and aggressive marketing and promotion activities allowed the sector to record strong growth during the year. During the first half of the review period, both business lines also benefited from the depreciation of the Sri Lankan Rupee against the greenback.

The Transportation and Logistics sector’s revenue saw strong growth of 15% YoY during the year, although challenged by a multitude of external factors such as volatilities in freight rates and slowdown in Sri Lanka’s trade volumes. Performance during the year was assisted by the provision of services in the oil and gas industry and the acquisition of several large third party logistics contracts. The Group’s Plantations also recorded healthy performance during the year, with its consistent focus on quality enabling the Group to command higher than average auction prices for tea and rubber. Overall, all industry sectors recorded revenue expansion during the year.

Turnover from exports accounted for 63% of the Group’s total revenue during the year. Despite tighter global economic conditions in developed markets, the Group was able to increase its export income by around 20% to Rs. 48.1 bn during the year through expanding its presence in emerging economies. The Group contributed 3.17% to Sri Lanka’s export revenue during the period under review.

Earnings Before Interest and Tax

The Group’s profitability indicators showed significant improvement during the year, with gross profit expanding by 28%, double that of revenue growth. The Group’s consolidated gross margin thus widened to 23% in 2012/13, from 20% in the preceding year. This improvement was facilitated by the Group’s proactive measures to minimise wastage, improve efficiency of resources and focus on value addition. Furthermore, several of the Group’s key businesses such as Purification and Construction Materials benefited from favourable movements in commodity prices during the year.

The Group’s total overhead expenses increased by 11% to Rs. 8.3 bn during the year. The increase stemmed mainly from the Group’s manufacturing businesses, which were impacted by rising energy costs.

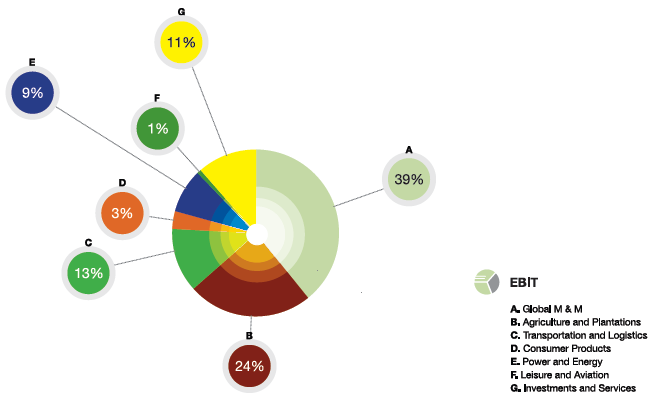

The Group’s consolidated EBIT grew 62% to Rs. 6.7 bn during 2012/13. In terms of composition, Global Markets and Manufacturing was the largest contributor to profitability during the year, with a share of 39% of EBIT. Purification and Hand Protection turned in strong performances during the year, the combined result of proactive action by the management to focus on value addition and innovation as well as favourable movements in the exchange rate and commodity prices. Both business lines achieved record profitability during the year, generating EBIT of over Rs. 1.3 bn each. The Fibre sector also recorded a commendable improvement in its core performance, with an increase in EBIT. During the year, the sector’s main focus was on leaner manufacturing and sectoral consolidation, which enabled it to achieve better profitability metrics. Meanwhile, the Group’s Construction Materials sector emerged as a strong performer during the year, with EBIT more than doubling to Rs. 413 mn in 2012/13. As post-war developments boomed, the Alumex Group was well positioned to benefit from its strong brand name, superior quality and state-of-the-art manufacturing techniques. On the other hand, the Group’s Textile division performed below expectations. The division incurred a loss before interest and tax of Rs. 260 mn during the year, although this was a marked improvement in comparison to losses of over Rs. 735 mn recorded last year. The operations of this sector have been restructured with new management personnel being brought in, whilst the short to medium term focus will be on streamlining its business processes.

The Plantations sector performed exceptionally well, supported by the strong recovery of tea prices during the latter part of the year although rubber prices remained relatively depressed. Meanwhile, the Agriculture sector performed commendably generating an EBIT of Rs. 761 mn during the year, despite being challenged by inclement weather conditions as well as tighter credit conditions which limited the sale of agricultural machinery.

Transportation and Logistics was a key contributor to profitability, with the sector crossing the Rs. 1.0 bn profit mark during the year. This profitability was achieved against the backdrop of Hayleys Advantis successfully securing new agencies as well as expanding its energy logistics services.

The Power and Energy sector saw increasing profitability contributions during the year, with sector EBIT nearly doubling during the year. The Nirmalapura 10 MW wind power plant obtained full connectivity to the national grid in 2012/13 and emerged as a prominent contributor to the sector’s profitability.

The Leisure and Aviation sector was impacted by capacity building initiatives during the year, which are expected to bear fruit over the medium to long term. EBIT declined 20% to Rs. 58 mn during the year; this was due to the major development carried out at the Group’s city hotel, The Kingsbury which was closed for a major part of the year. On the other hand, the Group’s resorts arm, the Amaya Group continued to be a significant profit contributor to the sector.

The Consumer Products Sector too recorded a weakening of performance as the depreciation of the exchange rate resulted in an escalation in the price of imports and lower consumer demand.

EBIT Margins

The Group’s consolidated EBIT margin improved to 9% during the year, compared to 6% the year before. Several key business lines such as Purification, Hand Protection, Transportation & Logistics and Plantations saw widening profitability margins.

Finance Income and Finance Cost

The Group’s finance income more than doubled to Rs. 1.4 bn during 2012/13, supported by foreign exchange gains generated on receivables from subsidy. Meanwhile, total finance costs increased by 44% to Rs. 3.1 bn during the year, affected by the relatively higher market interest rates in line with the tighter monetary policy stance adopted by the government. The bulk of the finance expenses arise at Holding Company level and the Agriculture sector. Meanwhile, the Group’s interest coverage levels were at 2.2 times.

Taxation

The Group’s total tax expense was Rs. 1.41 bn during 2012/13, an increase of 54% relative to the previous year. The effective tax rate reduced from 36% in 2011/12 to 28% in 2012/13, supported by increased profit contributions by the Group’s manufacturing businesses which attract a relatively lower tax rate and reduced negative results of the Group’s Textiles sector.

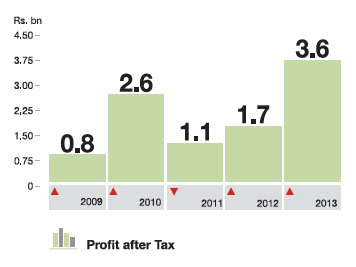

Profit After Tax

The Group achieved its highest ever profit after tax of Rs. 3.62 bn during 2012/13. The review period’s profitability reflects an improvement of 120% from last year’s profit levels. All business lines other than Consumer Products and Leisure & Aviation demonstrated increased PAT levels, whereas the Group’s Textiles sector trimmed losses in comparison to previous years. The largest contributors to the Group’s PAT were Hand Protection, Purification, and Transportation & Logistics.

Return on Capital Employed

The Group’s key business sectors including Hand Protection, Purification, Transportation and Logistics and Plantations recorded significant improvements in ROCE during the period under review. Consequently, Group ROCE increased from 11.5% in 2011/12 to 16.2% in 2012/13.

Cash Flow and Liquidity Position

The Group’s operational cash flows improved significantly during the year, supported by the healthier performance of several key businesses. Net cash inflow from operating activities amounted to Rs. 4.4 bn during the year, compared to Rs. 1.3 bn in 2011/2012. Meanwhile, capital expenditure for the year was Rs. 5.15 bn, mainly reflecting development expenditure of The Kingsbury, capacity additions of the Amaya Group and the expansion of manufacturing facilities by the Group’s Purification sector.

Balance Sheet Strength

Total Assets

The Group’s total assets increased by Rs. 9 bn to reach Rs. 75 bn during the year. The increase was mainly from additions to the property, plant & equipment (PPE), primarily in the Leisure & Aviation sector. Additionally, revaluation of land amounted to Rs. 2.6 bn during the year, also contributing to the increase in PPE.

Working Capital

The Group’s net working capital requirements declined marginally during the year, as trade payables increased in line with the Group obtaining more favourable credit terms from its suppliers. Meanwhile, trade receivables also increased during 2012/13, owing to larger business volumes as well as extended credit periods. Inventory levels remained more or less unchanged during the year.

Capital Structure

With regard to the capital structure, the maturity of the Group’s assets and liabilities are well matched. For instance, the Group’s current assets amounted to Rs. 30.2 bn whereas its current liabilities were Rs. 29.5 bn by end-2012/13. Meanwhile, the Group’s non-current assets of Rs. 44.6 bn were matched with its equity (Rs. 33.6 bn) and non-current liabilities Rs. 11.8 bn). Total assets were funded through shareholders’ funds (30%) and short-term liabilities (39%). Meanwhile, long-term liabilities and minority interest funded 16% and 15% of the asset base respectively.

Borrowings

The Group’s total debt increased by 8% to Rs. 23.6 bn by end-2012/13. This is mainly attributable to increased borrowings at the Group’s Leisure and Aviation sector to fund the development at The Kingsbury. This sector’s debt thus increased by Rs. 2.3 bn during the year. The Holding Co. also saw debt levels increasing by 47% during the year, mainly in order to strengthen the Textile sector through subscription to a rights issue and the Leisure Sector. Overall, Global Markets and Manufacturing, Leisure & Aviation and the Holding Co. accounted for the bulk of the Group’s debt.

Despite the increase in debt, the Group’s gearing levels (as reflected by Debt/Debt+ Equity) declined from 43% in 2011/12 to 41% in 2012/13 as the equity was strengthened by stronger profit retention. Meanwhile, debt coverage metrics improved during the year in line with the overall healthier performance; debt to EBIT improved to 3.5 times during the year, compared to 5.2 times in 2011/12.

The Group’s debt profile tilted more towards long-term borrowings during the year, although short-term borrowings still account for a bulk 70% of total debt. Long-term borrowings accounted for an increased 30% of debt in 2012/13, compared to 26% the year before. Looking ahead, the Group intends to substitute its relatively expensive short-term debt with longer-term funding. In this vein, the Group intends to seek foreign funding sources and approach the public debt market through debenture issues.

Investments

The Group’s total investments were Rs. 5.36 bn during the year.

| Sector | Investment |

| Leisure | Major development at the Group’s city hotel. |

| Capacity expansion at Amaya Hills, adding 24 four-star rooms. | |

| Purification | Capacity expansion through the acquisition of a 100% stake in Shizuka Company Ltd., Thailand. |

| Transportation & Logistics | Hayleys Advantis increased its stake in Mountain Hawk Express. |

| Textiles | Investment in Rights Issue to increase Share Capital. |

Shareholder Returns

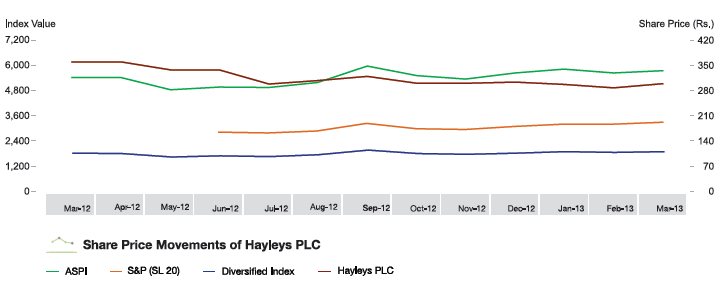

Share Price Movements

Sri Lanka’s share market recorded much volatility during the year ended March 2013, affected by the relatively higher yields on fixed income securities, exchange rate volatility and tight liquidity conditions. During the year, the All Share Price Index increased slightly by 6%, whereas the S&P SL 20 Index gained 17% since its introduction in June 2012. Meanwhile, the Hayleys PLC share price although declining during the first part of the year, picked up slightly towards the latter part of the year, to close the year at Rs. 298.70. Overall market capitalisation of Hayleys PLC shares was Rs. 22.4 bn by end March 2013.

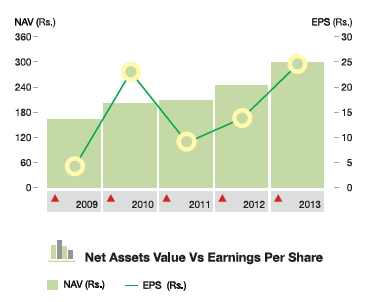

Earnings Per Share and P/E Ratio

The Group’s EPS almost doubled from Rs. 13.84 in the previous year to Rs. 24.72 during the review period. During the last 5 years, the Group’s EPS has expanded by a compound annual growth rate of 56%.

With regard to the Price/Earnings ratio, the share was trading at 12.08 times by end March 2013, compared to 26.01 times the previous year. This is resultant from the decline in the Company’s share price in parallel to growth in its EPS.

Net Asset Value

The net assets per share increased by 22% to Rs. 299.46 during the period under review. Therefore, by the end March 2013, it was trading at a price-to-book value of 1.0 x.

Dividends

The Company has proposed a first and final dividend of Rs. 4.50 per share for the period under review (2011/12 - Rs. 4.00 per share)

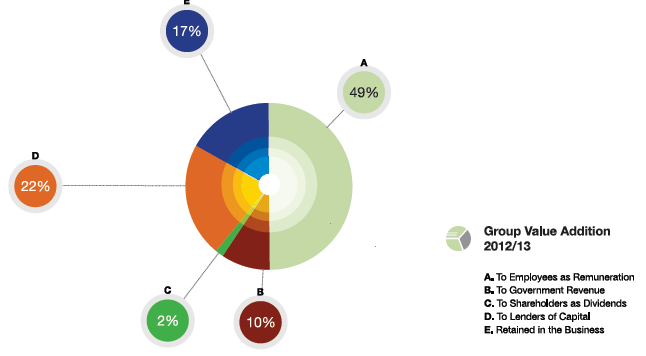

Direct Economic Value Generated and Distributed

| Share % |

2012/13 Rs. mn |

Share % |

2011/2012 Rs. mn |

|

| Revenue | – | 74,302 | – | 65,807 |

| Cost of materials and services bought in | – | (54,276) | – | (49,381) |

| Sub Total | – | 20,026 | – | 16,425 |

| To Employees as remuneration | 49 | 9,934 | 48 | 8,582 |

| To Government Revenue | 10 | 1,911 | 14 | 3,132 |

| Sri Lanka | 8 | 1,638 | 12 | 2,944 |

| Overseas | 2 | 273 | 2 | 188 |

| To Shareholders as dividends | 2 | 338 | 3 | 300 |

| To Lenders of capital | 22 | 4,444 | 14 | 2,085 |

| Interest on borrowings | – | 2,678 | – | 1,477 |

| Non controlling interest | – | 1,766 | – | 608 |

| Retained in the business | 17 | 3,399 | 21 | 2,326 |

| Depreciation | – | 1,883 | – | 1,592 |

| Profit retained | – | 1,516 | – | 734 |

| 100 | 20,026 | 100 | 16,425 |

Risks Arising from Climate Change

Climate change has the potential to affect business in numerous ways by way of extreme weather patterns, droughts, floods and the like. These pose challenges for material sourcing, manufacturing and distribution. We are also mindful that climate change could result in new laws and regulations which in turn affect our operations both financially and operationally. Therefore, we are committed to making a positive difference, using energy responsibly and addressing climate change in various ways as discussed in the section on Society and Environment that follows.

We will briefly explore the potential impact of climate change on our industry sectors that are most vulnerable.

Manufacturing

Three of our key manufacturing sectors are dependent on plantation crops, namely, coconut and rubber, which are thus vulnerable to adverse weather patterns. Hayleys Fibre is dependent on a steady supply of coconut fibre, while the Purification sector on coconut shells. Any disruption in supply will negatively impact production. The Hand Protection Sector is dependent on natural rubber latex as its primary input.

Agriculture

Hayleys Agriculture, by the very nature of its sector, is highly vulnerable to climate change. Crop outputs are determined by variations in atmospheric temperatures, concomitant changes which alter precipitation patterns and the physiological response of crops to the disparity of carbon dioxide levels in the atmosphere, and other relevant factors. For example, wind patterns directly affect rubber output while it also affects the quality of tea.

Further, crop diseases can affect supplies of fruits and vegetables, while weather influenced changes impact the demand for products such as flower seeds.

Services

Global warming impacts the operation of sea ports, winds and storms affect efficiency of cargo operations while droughts and floods limit cargo movement. All these adversely impact revenue and profitability of our operations.

Individual business units and sectors manage these risks, along with other non-climate related risks. Risk management is discussed on pages 158 to 164 of this Annual Report.

Policy on Patronising Locally Based Suppliers

Supplier relationships are integral to our success - as a business, and as a corporate citizen. We encourage all our Group companies to source goods and services locally and in addition to supporting local suppliers. Key factors considered when selecting suppliers are quality, price on time delivery, reliably and, if applicable, credit terms.

Significant Indirect Economic Impacts of our Operations

Over the years the Group has provided opportunities and resources that enable people and communities to raise their standard of living. We are also mindful of our ability to grow in markets where economic need is often greatest.

In Fibre manufacturing we engage in initiatives to uplift the living standards of poor communities to increase their purchasing power, which in turn has a positive impact on the company. We engage in skill improvement and knowledge sharing activities to enhance the quality of the entire value chain.

The Hand Protection sector is involved in a special programme to uplift the living condition of small scale latex suppliers in the Monaragala district. This FirstLight initiative is founded on the principle of fair trade in rubber latex, thus empowering farmers to be self-reliant, while at the same time enabling us to secure reliable suppliers. This programme was recognised by Enterprise Asia under the ‘Investment in People’ Award category in 2012.

In the Plantation sector, Kelani Valley Plantations PLC and Talawakelle Tea Estates PLC invest in communities through housing, schooling, scholarships and medical care to the estate community, through the ‘A Home for Every Plantation Worker’ project. Land was also provided to rear over 1,000 cattle while making available over 100 acres of land for vegetable cultivation. In turn, these measures also serve to retain workers on the plantations, as the sector as a whole faces labour shortages.

Through its involvement in numerous infrastructure development projects across Sri Lanka, our Transportation & Logistics sector has made a significant contribution towards economic development in the rural areas of the country.