Corporate Governance

Hayleys has a policy of complying with established best practices in corporate governance

Highlights 2012/13

| Appointment of Mr. L.R.V. Waidyaratne as an Executive Director of Hayleys PLC Board with effect from 01st April 2013. | Appointment of Mr. Roshan Rajadurai and Mr. Rohan Goonetilleke to the Hayleys Group Management Committee. |

Strengthening of ethical road map for all Hayleys employees and Group companies known as ‘The Hayleys Way’- Code of Business Principles. |

Implementation of a whistleblower policy. |

Hayelys has a policy of complying with established best practices in corporate governance. The Board has adopted core values and Group standards which set out the conduct of staff in their dealings with shareholders, colleagues, customers and other stakeholders of the Group, which ensures positive workplace management, marketplace responsibility, environmental stewardship, community engagement, and sustained financial performance. This involves the maintenance of -

- an efficient organisational structure;

- systems for internal control and risk management;

- transparent internal and external reporting.

The Hayleys Governance Structure can be graphically depicted as follows:

Internal Governance Structure and Assurance

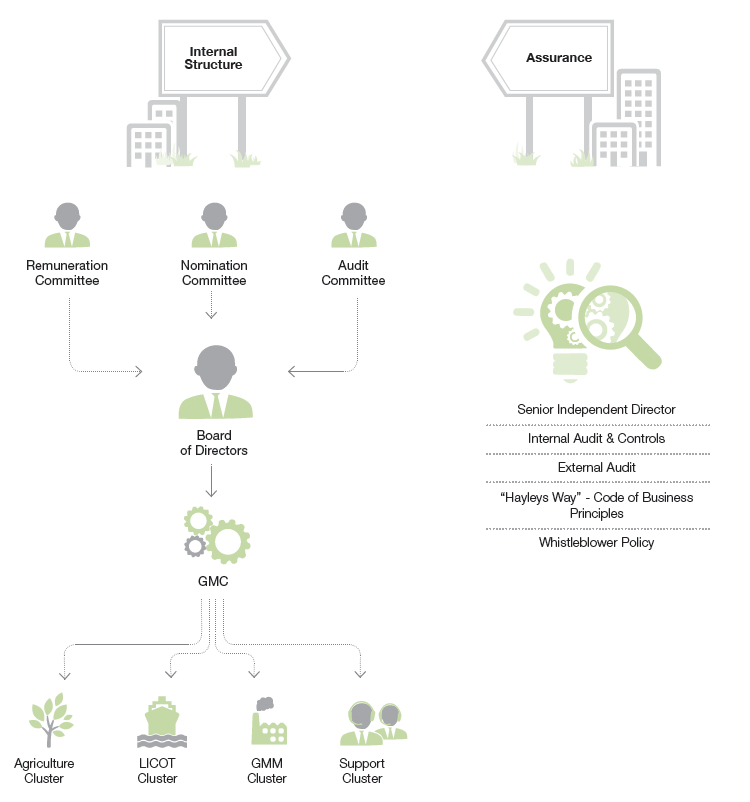

Internal governance encompasses the system of policies, processes and rules established by the Hayleys Board of Directors for the business to follow. It includes the reasons for which the Group operates and the roles various stakeholders play in pursuing and achieving those goals. Hayleys internal governance structure and assurance framework is outlined in the diagram given below.

Internal Governance Structure

Hayleys internal governance structure is established and overseen by the Board of Directors and designed to allow for effective and efficient decision-making and to meet Corporate Governance Standards. The Board of Directors has delegated authority to its committees on specific matters which are set out in written terms of reference in line with evolving best practice and the highest standards of corporate governance.

Group strategies are subjected to a comprehensive annual review by the Board and are discussed further as necessary during the year.

The Group Management Committee has been delegated authority to formulate strategies in respect of business units, seek approval for such strategies and implement them within the policy framework established by the Board.

The Sectors are required to align their strategies towards the achievement of the Group and Sector/Company Key Performance Indicators (KPIs). The annual budgeting process assists this and documents sector strategies and short-term objectives.

The main businesses of the Group are incorporated into four clusters - Agriculture, LICOT (Leisure, Infrastructure, Consumer, Transportation), Global Markets & Manufacturing and Support Services.

The achievement of targets through implementation of strategies formulated, current performance and the short-term outlook are reviewed at cluster review

meetings which are held monthly. Further, focused discussion takes place at monthly Group Management Committee meetings.

Internal Governance Structure and Assurance

The Board in understanding current business performance strives to ensure that there is transparency regarding significant risk exposures. It encourages a culture where there is open debate and discussion on the risks faced in achieving business objectives and on new projects and key investment initiatives.

In providing strategic direction, the Board will obtain and review all strategic options and initiatives under consideration. This will comprise an analysis of the options, resource constraints and related risk exposures to facilitate informed decision-making.

In this process Strategic Business Development Unit (SBDU) assists the Board in the following manner:

Project Appraisal Process

Hayleys has a structured process for new project proposals and investments. This process ensures several layers of reviews and deliberations and incorporates a number of diverse views prior to pursuing major investment decisions.

Project proposals typically originate from one of the sectors, whose business development teams or management would prepare a detailed feasibility study. This would include a macro analysis of the industry and competitive position, SWOT analysis of the project, financial feasibility, funding strategy, sensitivity analysis and regulatory considerations including taxation and risk and risk mitigation strategy.

The project proposal would then be subject to approval by the Board of Directors of the respective sector.

For projects above a certain investment threshold, approval would be required by the main board of Hayleys PLC. In such cases, the project proposal, once approved at sector level, would be sent to the Strategic Business Development Unit of Hayleys PLC.

The SBDU would conduct an independent review of the proposal, testing the assumptions in the proposal and where necessary obtaining further advisory services tapping the expertise from Hayleys PLC centre resources in areas such as legal, secretarial, taxation, HR and Finance.

In certain instances where a more thorough investigation is warranted, particularly in cases of acquisition, a third party due diligence process will be initiated. Depending on the scope of the project, the due diligence would encompass financial, legal and other operational factors.

The project proposal along with the SBDU review and recommendation is then presented to the main Board of Hayleys PLC by the HGMC member in charge of the sector. Further deliberation would take place at the Board level and any required amendments will be made to the proposal prior to the final approval and implementation.

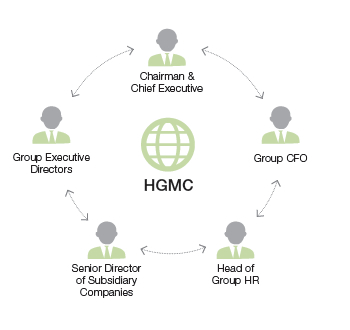

Hayleys Group Management Committee

Hayleys Group Management Committee (HGMC)

The Hayleys Board has delegated to the HGMC authority to formulate strategies in respect of business units, seek approval for this strategy and implement it within the policy framework established by the Board.

Sector strategies are presented in the annual budget planning process and are discussed and approved by the HGMC prior to submission to the Hayleys Board for approval.

All capital expenditure of Business Sectors are required to be tabled to the Boards of the respective companies.

Companies falling within each Sector are required to hold quarterly meetings at which all matters requiring the approval of the Boards of those companies will be tabled and considered.

The Responsibilities of the HGMC

- Recruitment, remuneration and discipline of all personnel

- Training and succession planning

- Negotiation with trade unions and manual and clerical personnel

- Approval of expenditure

- Supervision of financial authority

- Maintenance of safety and ethical standards

- Management of risk and following implicit and explicit guidelines set by the Group

- Safeguarding assets and avoiding deterioration of value through aging or obsolescence

- Providing support to the Board in pursuing Hayleys Group objectives and standards

While Group companies are subject to scrutiny by the Audit Committees, HGMC members are responsible to review risk management systems and internal control systems designed to protect assets, ensure proper records are maintained and reliable information is produced as required.

HGMC members are responsible for the recruitment, training and retention of senior management staff and ensuring succession for key functions. The Chairman and HGMC, in consultation with the Head of Group HR, have oversight for ensuring that succession plans are in place for all Sectors.

The Group Management Committee meets every month and actual financials are compared against budgets every month and forecast is done where necessary.

Copies of minutes of meetings of the Group Management Committee and of other review meetings are sent to all Directors including the Non-Executive Directors.

Internal Communication

Functional Clusters

Finance, corporate communications and HR clusters bring together representatives from the different parts of the Group. These clusters serve as a forum to communicate relevant matters, identify areas of special interest, debate these, and share best practices.

All financial controllers of Sectors are required to report in writing to the Group CFO on a quarterly basis, bringing to his notice any significant aspect of risk or concern regarding the business activities of their sector and the financial statements submitted by them. This reporting may be more frequent if circumstances warrant it. These are subject to discussion at the CFO Forum which takes place every 6 weeks so that matters are debated among the CFO’s of the Group.

CEO’s Forum

The CEO’s Forum, chaired by the Chairman and Chief Executive, is held quarterly. This Forum brings together management staff of all companies, enabling dissemination of information and clarification of questions relating to the Group. Guest speakers are also invited to make presentations on topical issues.

Assurance

Components of assurance make sure that the objectives of corporate governance are likely to be achieved and once they are achieved, ensuring they are used to realise the intended value.

Senior Independent Director

Since the role of Chairman and Chief Executive is combined, the appointment of the Senior Independent Director mitigates risk of an over-concentration of decision-making powers in one person. The Senior Independent Director is responsible for;

- Setting the Company’s values and standards and ensuring that its obligations to shareholders and others are understood and met.

- Upholding high ethical standards of integrity and probity.

- Supporting executives in their leadership of the business, whilst monitoring their conduct.

- Promoting high standards of corporate governance and compliance with the provisions of the Combined Code whenever possible.

- Chair meetings with the other Non-Executive Directors (without the Chairman being present) encouraging open dialogue, particularly regarding the Chairman’s performance.

- Be available to shareholders in case they have concerns which cannot, or should not, be addressed by the Chairman or Executive Directors.

- Act on the results of any performance evaluation of the Chairman.

- Maintain sufficient contact with major shareholders, when requested, to understand their issues and concerns thereby assisting the Board to develop a balanced understanding.

Internal Audit and Control

The Board is responsible for the Group’s internal control and its effectiveness. Internal control is established with emphasis placed on safeguarding assets, making available accurate and timely information and imposing greater discipline on decision-making. It covers all controls, including financial, operational and compliance control and risk management. It is important to state, however that any system can ensure only reasonable, and not absolute, assurance that errors and irregularities are prevented or detected within a reasonable time.

The Group’s Management Audit & System Review Department (MA & SRD) plays a significant role in assessing the effectiveness and successful implementation of existing controls and strengthening these and establishing new controls where necessary. The MA & SRD’s reports are made available to the Chairman & Chief Executive and the Chairman of the Audit Committee.

The Group also obtains the services of independent professional accounting firms other than the statutory Auditors to carry out internal audits and reviews to supplement the work done by the MA & SRD.

The Board has reviewed the effectiveness of the system of financial controls for the period up to the date of signing the accounts.

Information Technology

IT StrategyInformation Technology at Hayleys has turned to a more ‘Centralised Focus’.

The Central Services Division (Group IT) concentrates on providing Common Services to all the Sectors of Hayleys Group as well as corporate departments. IT within the Sectors concentrates more on Sector specific technology needs with the advice and recommendations from Central Services Division.

In order to achieve this objective, Hayleys IT has embarked upon consolidation exercises on various frontiers: Infrastructure services (email/internet), business systems and helpdesk services.

The consolidation of Common Infrastructure of Email/Internet related services being provided through Central Services allows Hayleys to standardise services across the Group and derive savings by avoiding duplication.

The consolidation of Business Systems is planned through the initiative of the ‘SAP Transformation Programme’ to roll-out a common Enterprise Resource Planning (ERP) system across all Sectors of the Group, thereby initiating commonality of the main Business System. This allows Hayleys to have the uniformity of a common ERP solution, SAP. The ‘Transformation Programme’ has a duration of three years.

The consolidation of front-line PC support services function has been identified as an outsourcable function that can be obtained at a very competitive rate rather than building the skill in-house. Through consolidation of such services across the group we are able to exploit economies of scale. In addition, we are able to drive such services through strict Service Level Assurance (SLA) regimes to enable sustainable performance adherence.

Finally, the consolidation of IT personnel allows us to better utilise their skills sets and to build the appropriate teams to support Hayleys IT Strategy for future.

IT GovernanceIT Governance at Hayleys continues to play a vital role in the way we manage and control Information Technology related services. It allows us to establish standards that underpin Hayleys overall Vision for IT.

IT governance is controlled on multiple fronts: firstly, the ‘Structural Component’ that pertains to Hayleys IT activities to support the goals of the business and the people who manage those activities. Secondly the ‘Process Component’ that defines the IT decision making process as well as the policies that measure and control the way it is carried out at Hayleys.

Our policies and procedures are reviewed regularly to ensure that we align with changing needs of technology and the business.

IT Value and AlignmentThe Investments for IT projects and systems within Hayleys are made after careful consideration of their suitability for the related projects.

The Cost Benefit Analysis (CBA) will look to ascertain aspects such as cost savings, improved customer satisfaction, timely information availability and the balance between cost of investment and scale of operations.

IT Risk ManagementThe Risks associated with Information Technology at Hayleys are continually assessed as part of the Enterprise Risk Management Process.

The use of licensed software, closer monitoring of internet/email usage and other IT related operations (for compliance with the Hayleys ‘IT Use Policy’) and the use of antivirus, firewall servers/software, are some of the critical practices we deploy.

Business Critical Information is backed up/replicated at regular intervals and kept in secure offsite locations to meet statutory and other relevant compliances. In addition, Hayleys Business Critical Systems are duplicated as necessary in case of catastrophic failures.

External Audit

The external auditors of the holding company and all other local companies within the Group are Ernst & Young. They also provide different non-assurance services to the Group. The restrictions provided in terms of rulings issued by CSE and other commitments were taken in to consideration when entering in to the engagements with the Group auditor.

The knowledge and experience of the Audit Committees ensured effective usage of the expertise of the auditors, while maintaining independence, in order to derive a transparent set of Financial Statements. The Group maintains independence from financial and non-financial interests between auditors and re-assesses the same on a regular basis. The auditors certify this on an annual basis.

The fees paid for audit and non-audit services are separately disclosed in the Notes to the Financial Statements.

Code of Business Principles

For more than 135 years, Hayleys has demonstrated a commitment to doing business with integrity. We have expanded into new businesses and built a record of sustained growth, with diverse businesses in twelve different sectors of enterprise.

The Hayleys Way is an ethical road map that exists to guide the expectations of integrity of every employee of the Hayleys Group.

Principles & Scope- The Hayleys Group is committed to conducting its business operations with honesty, integrity and with respect to the rights and interests of all stakeholders.

- All Hayleys companies and employees are required to comply with the laws and regulations of the countries in which it operates.

- Every employee shall be responsible for the implementation of and compliance with the Code in his/her environment.

The statement provides guidelines by which the Hayleys Group conducts its businesses and operations in all the countries we operate in, within the following parameters

The Hayleys Way - The Ethical Road Map for Code of Conduct

Whistleblower Policy

Hayleys Group is committed to the highest standards of ethical, moral and legal conduct in operating its businesses. In line with this commitment, the Whistleblower Policy exists to provide a mechanism for employees to raise concerns where the interest of the organisation is at risk and is expected to provide an assurance that employees raising such concerns will be protected from reprisals and victimisation. This Policy applies to all individuals working at all levels within Hayleys Group.

Principles & ScopeThis Whistleblower Policy is intended to cover concerns raised by staff on the following matters.

Whistleblower Policy

Incorrect Financial reporting

Financial Fraud

Unlawful or improper conducts

Breach of the Code of Business Conduct,

Values and other Policies of the Group

Any other improper activity that may have a negative impact upon the ability of the Group to achieve its corporate objectives and which may cause damage to its image and reputation

External Governance Structure

As a responsible corporate body, the Group adheres to the regulations, codes and best practices etc. adopted by different governing bodies.

- Companies Act No. 7 of 2007

- Code of Best Practice on Corporate Governance issued jointly by CA Sri Lanka and Securities & Exchange Commission of Sri Lanka.

- Listing rules of the Colombo Stock Exchange

- Inland Revenue Act No. 10 of 2006 and subsequent amendments

- Exchange Control Act.

- Customs Ordinance

We set out below the corporate governance practices adopted and practiced by Hayleys, the extent of adoption of the Code of Best Practice on Corporate Governance issued jointly by the Securities and Exchange Commission of Sri Lanka and the Institute of Chartered Accountants of Sri Lanka and the Rules set out in Section 7.10 of the Colombo Stock Exchange’s Listing Rules on Corporate Governance.

Section A

This section covers Hayleys extent of adherence to the requirements of the Code of Best Practice on Corporate Governance issued by the Securities and Exchange Commission of Sri Lanka and The Institute of Chartered Accountants of Sri Lanka. This reflects Hayleys’s governance in the following six fundamental aspects:

- Directors

- Directors’ Remuneration

- Relations with Shareholders

- Accountability and Audit

- Institutional Investors

- Other Investors

| Corporate Governance Principles | SEC & ICASL Code Reference | Compliance Status | Hayleys Extent of Adoption | |||||||

A. DirectorsA.1 The BoardHayleys PLC is headed by an effective Board of Directors which consists of professionals and business leaders drawn from different backgrounds and their profiles are given in the Stewardship section. The Board of Directors of Hayleys PLC is responsible for governance of all companies which Hayleys actively manages. |

||||||||||

1. Board meetings |

A.1.1 |

Compliant |

The Board meets monthly to review the performance of the Company and its subsidiaries and takes strategic decisions relating to the Group’s Direction and other matters. Special Board meetings were also held as necessary. These meetings enhanced shareholder value and all stakeholder interests are considered in corporate decisions. Details of the meetings and attendance of the members are set out in Corporate Governance Section B. |

|||||||

2. Responsibilities of the Board |

A.1.2 |

Compliant |

The Board of Directors formulates and communicates business policy and strategy to assure sustained growth, and monitors its implementation. It ensures the Chief Executive and management team possess the skills, experience and knowledge to implement the strategy effectively, with proper succession arrangements in place. The Board ensures effective systems to secure integrity of information, internal controls and risk management, compliance with laws and regulations and ethical standards. The Board ensures all stakeholder interests are considered in corporate decisions and values and standards are set with emphasis on adopting appropriate accounting policies and fostering compliance with financial regulations. |

|||||||

3. Compliance with laws and seeking independent professional advice |

A 1.3 |

Compliant |

The Board collectively, and Directors individually, act in accordance with the laws and regulations of Sri Lanka as applicable to the Group. The Directors are permitted to obtain independent professional advice when required at the expense of Hayleys and will be co-ordinated through, Company Secretaries and Group Legal Department as and when it is necessary. |

|||||||

4. Company Secretary |

A.1.4 |

Compliant |

All Directors have access to the advice and services of the Company Secretary as necessary. The Company Secretary keeps the Board informed of new laws and revisions, regulations and requirements coming into effect which are relevant to them as individual Directors and collectively to the Board. Any question of the removal of the Company Secretary is a matter of the Board as a whole. |

|||||||

5. Independent judgment of Directors |

A.1.5 |

Compliant |

All Directors bring independent judgment to the scrutiny of decisions taken by the Board on issues of strategy, performance, resources and business conduct. |

|||||||

6. Dedication of adequate time and effort by the Directors |

A.1.6 |

Compliant |

The Chairman and members of the Board dedicate adequate time and effort to fulfill the duties as Directors of Hayleys PLC to ensure that the duties and responsibilities owed to the Group are satisfactorily discharged. In addition to attending Board Meetings , they have attended Sub-Committees and ensure that they allocate adequate time and effort to fulfil the duties as members of such Board Sub-Committees. Directors dedicate sufficient time before a meeting to review Board papers and call for additional information and clarification, and after a meeting to follow up on issues consequent to the meeting. |

|||||||

7. Training for new and existing Directors |

A.1.7 |

Compliant |

Every new Director and existing Directors are provided training on general aspects of directorship and matters specific to the industry where ever as necessary. Every Director recognises the need for continuous training and an expansion of the knowledge and skills required to effectively perform their duties as required. |

|||||||

| A. 2 Chairman and Chief Executive Officer

The Code requires a clear division of responsibilities between conducting of the business of the Board, and facilitating executive responsibility for management of the business. Though the functions of Chairman and Chief Executive are vested in one, the management structure established within the Group ensures this does not compromise the effective practice of corporate governance in the Group. |

||||||||||

8. Justification for the combining of the posts of Chairman and Chief Executive |

A.2.1 |

Compliant |

Though the functions of Chairman and Chief Executive are vested in one person, the management structure established within the Group ensures this does not compromise the effective practice of corporate governance in the Group. The Executive Directors and HGMC members are responsible for the businesses conducted by the Group and effectively function as CEOs of these businesses. Dr. H. Cabral, PC, Non-Executive Director functioned as Senior Independent Director throughout the year and he ensures governance within the Board is preserved and stakeholder concerns are addressed. |

|||||||

| A 3. Chairman’s Role

The Chairman is responsible for effective conduct of meetings of the Board; he preserves order and facilitates discharge of Board functions and Implementations of decisions taken. |

||||||||||

9. Role of the Chairman |

A.3.1 |

Compliant |

The Chairman is responsible for the efficient conduct of Board meetings and ensures, inter alia, that -

The Chairman maintains close contact with all Directors and, where necessary, holds meetings with Non-Executive Directors without Executive Directors being present. |

|||||||

| A 4. Financial Acumen

The Code requires the Board should ensure the availability within it of those with sufficient financial acumen and knowledge to offer guidance on matters of finance. |

||||||||||

10. Availability of sufficient financial acumen and knowledge |

A.4 |

Compliant |

The Board of Directors have experience in all Sectors where Hayleys is operating coupled with their academic background and also possess financial acumen and knowledge together with having significant business acumen leading private and public enterprises. The details of their qualifications are given in the Stewardship Section. |

|||||||

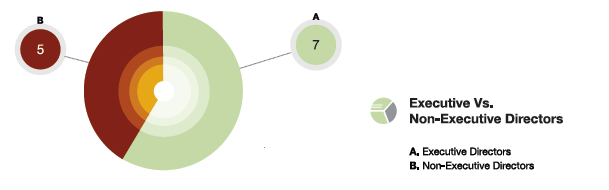

| A. 5 Board Balance

The Code requires the Board to have a balance of Executive and Non-Executive Directors so that no individual or small group of individuals can dominate the Board’s decision-making. |

||||||||||

11. Presence of Non-Executive Directors (NEDs) |

A.5.1 |

Non- Compliant |

Five out of twelve Directors are NEDs |

|||||||

|

||||||||||

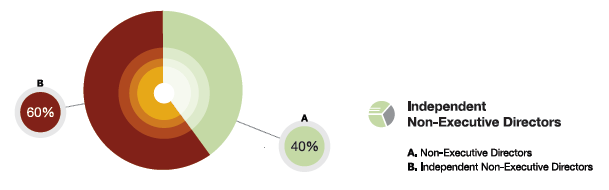

12. Independent Non-Executive Directors |

A.5.2 |

Compliant |

Three out of Five NEDs are independent which is above the minimum prescribed by the Code which is two or one-third of NEDs appointed to the Board whichever is higher. |

|||||||

|

||||||||||

13. Independence of NEDs |

A.5.3 |

Compliant |

All Independent NEDs are independent of management and free of any business or other relationship that could reasonably be perceived to materially interfere with the exercise of their unfettered and independent judgment. |

|||||||

14. Annual Declaration |

A.5.4 |

Compliant |

Each NED submits a declaration of independence/non independence in a prescribed format. |

|||||||

15. Determination of independence of the Directors |

A.5.5. |

Compliant |

The Board has determined the independence of Directors based on the declarations submitted by the NEDs as to their independence, as a fair representation and will continue to evaluate their independence on this basis annually. Independent Non-Executive Directors are - |

|||||||

16. Senior Independent Director |

A.5.6 |

Compliant |

Since the Chairman and Chief Executive is the same person, |

|||||||

17. Confidential discussions with Senior Independent Director |

A.5.7 |

Compliant |

Senior Independent Director is available for confidential discussions with other Directors who may have concerns which pertain to significant issues that are detrimental to the Group. |

|||||||

18. Chairman’s meetings with NEDs |

A.5.8 |

Compliant |

Chairman meets with NEDs only, without the Executive Directors being present as whenever necessary or at least once in each year. |

|||||||

19. Recording of concerns in Board minutes |

A.5.9 |

Compliant |

Concerns raised by the Directors which cannot be unanimously resolved during the year, if any recorded in the Board minutes with adequate details |

|||||||

| A. 6 Supply of Information

The Code requires the Board should be provided with timely information in a form and of a quality appropriate enabling them to discharge their duties. |

||||||||||

20. Management’s obligation to provide appropriate and timely information to the Board. |

A.6.1 |

Compliant |

Directors are provided with monthly reports on performance, minutes of review meetings and such other reports and documents as necessary. The Chairman ensures all Directors are properly briefed on issues arising at meetings. The minutes, agenda and papers required for Board meeting are provided (at least 7 days prior to the meeting) to facilitate its effective conduct. |

|||||||

21. Adequate time for effective conduct of the Board meetings. |

A.6.2 |

Compliant |

The minutes, agenda and papers required for Board meeting are provided in advance to facilitate its effective conduct |

|||||||

| A. 7 Appointments to the Board

The Code requires having a formal and transparent procedure for the appointment of new Directors to the Board. |

||||||||||

22. Nomination Committee |

A.7.1 |

Compliant |

Nomination Committee makes recommendations to the Board on all new Board appointments. The Terms of Reference for Nomination Committee are similar to the one set out in Schedule A in this Code. Nomination Committee of Hayleys PLC consists of the following Directors: Nomination Committee Name of Member The Board believes it is appropriate for the Chairman and Chief Executive to chair this committee and that the composition of the Committee ensures its balance. |

|||||||

23. Assessment of Board-Composition by the Nomination Committee |

A.7.2 |

Compliant |

The Nomination Committee annually assesses Board-composition to ascertain whether the combined knowledge and experience of the Board matches the strategic demands facing the Company. The findings of such assessment are taken into account when new Board appointments are considered. |

|||||||

24. Dislosure of required details of new Directors to shareholders. |

A.7.3 |

Compliant |

Following details of new Directors are disclosed on their appointment to the Colombo Stock Exchange, selected newspapers and Annual Report:

|

|||||||

| A. 8 Re-election

The Code requires all Directors should be required to submit themselves for re-election at regular intervals at least once in every three years. |

||||||||||

25. Appointments of NEDs, Chief Executive and Directors in the Board |

A.8.1 A.8.2 |

Compliant |

The provisions of the Company’s Articles require a Director appointed by the Board to hold office until the next Annual General Meeting and seek re-appointment by the shareholders at that meeting. The Articles call for one-third of the Directors in office to retire at each Annual General Meeting. The Directors who retire are those who have served for the longest period after their appointment/re-appointment. Retiring Directors are generally eligible for re-election. The names of Directors submitted for election or re-election is accompanied by a résumé to enable shareholders to make an informed decision on their election. The Chief Executive does not retire by rotation |

|||||||

| A. 9 Appraisal of Board Performance

The Code requires the Board should periodically appraise their own performance in order to ensure that Board responsibilities are satisfactorily discharged. |

||||||||||

26. Annual performance evaluation of the Board and its Committees |

A.9.1 A.9.2 |

Compliant |

The Chairman and Remuneration Committee evaluates the performance of the Executive Directors periodically. The Board undertakes an annual self evaluation of its own performance and of it Committees. |

|||||||

27. Disclosure of performance evaluation criteria |

A.9.3 |

Compliant |

Please refer Remuneration Committee Report. |

|||||||

| A.10 Disclosure of information in respect of Directors

The Code requires the shareholders should be kept advised of relevant details in respect of Directors. |

||||||||||

28. Details in respect of Directors |

A.10.1 |

Compliant |

The Following information in relation to Directors is disclosed:

|

|||||||

| A.11 Appraisal of Chief Executive

The Code requires the Board to assess the performance of the Chief Executive |

||||||||||

29. Setting Annual targets and appraisal of the performance of the Chief Executive by the Board. |

A.11.1 A.11.2 |

Compliant |

Prior to the commencement of each financial year the Board in consultation with the Chairman/CEO, set reasonable financial and non-financial targets which are in line with short, medium and long-term objectives of Hayleys, achievement of which should be ensured by the Chief Executive. A monthly performance evaluation is performed at which actual performance is compared to the budget. The Chief Executive is responsible to provide the Board with explanations for any adverse variances together with actions to be taken. |

|||||||

B. Directors’ RemunerationB.1 Remuneration ProcedureThe Code requires establishing a formal and transparent procedure for developing policy on executive remuneration and for fixing remuneration packages of individual Directors and no Director is involved in deciding his own remuneration. |

||||||||||

30. Establishment of the Remuneration Committee |

B.1.1 |

Compliant |

The Remuneration Committee decides on the remuneration of the Chairman/Chief Executive and the Executive Directors and sets guidelines for the remuneration of the management staff within the Group. The Chairman/Chief Executive is not a member of this Committee. Please refer Remuneration Committee Report for the terms of reference for Remuneration Committee. |

|||||||

31. Composition of the Remuneration Committee |

B.1.2 |

Compliant |

The Remuneration Committee consists of Non-Executive Directors and the Chairman of this Committee is appointed |

|||||||

32. Chairman and the members of the Remuneration Committee |

B.1.3 |

Compliant |

The Remuneration Committee consists of following Dr. H. Cabral, PC - Chairman Name of Member |

|||||||

33. Determination of remuneration |

B.1.4 |

Compliant |

The Board as a whole determines the remuneration of |

|||||||

34. Consultation of the Chairman and access to professional advice. |

B.1.5 |

Compliant |

Remuneration Committee consults the Chairman about its proposal relating to the remuneration of other Executive Directors and have access to professional advice from within and outside Hayleys PLC, in discharging their responsibilities. |

|||||||

| B.2 The Level and make up of remuneration

The Code requires the levels of remuneration of Directors should be sufficient to attract and retain the Directors. The proportion of remuneration of Executive Directors should be linked to corporate and individual performance. |

||||||||||

35. Executive Director’s remuneration package |

B.2.1 |

Compliant |

The Remuneration Committee provides the packages needed to attract, retain and motivate Executive Directors of the quality required. |

|||||||

36. Comparisons of remuneration with other companies |

B.2.2 |

Compliant |

The Remuneration Committee ensures that the remuneration of executives of each level of management is competitive and in line with their performance. Surveys are conducted as and when necessary to ensure that the remuneration is competitive with those of comparative companies. |

|||||||

37. Comparisons of remuneration with other companies in the Group. |

B.2.3 |

Compliant |

The Remuneration Committee reviews data concerning Executive pay among the Group Companies. |

|||||||

38. Performance related elements of remuneration of Executive Directors |

B.2.4 |

Compliant |

A performance based incentive has been determined by the remuneration committee to ensure that the total earnings of the executives are aligned with the achievement of objectives and budgets of the group companies. |

|||||||

39. Executive share options |

B.2.5 |

N/A |

Presently the Group does not have an Executive Share Option Scheme. |

|||||||

40. Executive Directors’ remuneration |

B.2.6 |

Complaint |

The Remuneration Committee follows the provisions set out in Schedule D of the Code as required. |

|||||||

41. Early termination of Executive Directors |

B.2.7 B.2.8 |

N/A |

No special early termination clauses are included in the contract of employment contract of Executive Directors that would entitle them to extra compensation. However any such compensation would be determined by the Board of Directors. |

|||||||

42. Levels of remuneration for NEDs |

B.2.9 |

Compliant |

Remuneration for NEDs reflect the time commitment and responsibilities of their role, taking into consideration market practices. NEDs are not included in share options as there is no scheme in existence. |

|||||||

| B.3 Disclosure of Remuneration.

The Code requires to contain a Statement of Remuneration policy and details of remuneration of the Board as a whole. |

||||||||||

43. Disclosure of Remuneration |

B.3.1 |

Compliant |

Please refer section B.1.32 for the member in the Remuneration Committee and Remuneration Committee Report or the remuneration policy. Please refer Note 10 to the Financial Statements for the total Directors’ Remuneration. |

|||||||

C Relations with ShareholdersC.1 Constructive use of the Annual General Meeting (AGM) and conduct of General MeetingsThe Code requires the Board to use the AGM to communicate with shareholders and should encourage their participation. |

||||||||||

44. Use of proxy votes |

C.1.1 |

Compliant |

Hayleys PLC has in place an effective mechanism to count all proxies lodged on each resolution, and the balance for and against the resolution, after it has been dealt with on a show of hand, except where a poll is called. |

|||||||

45. Separate resolution for all separate issues at the AGM |

C.1.2 |

Compliant |

Hayleys PLC proposes a separate resolution at the AGM on each substantially separate issue. And also adoption of the Annual Report of the Board of Directors on the affairs of Hayleys PLC, Statement of Compliance and the Financial Statements with the Independent Auditors’ Report is considered as a separate resolution. |

|||||||

46. Availability of all Board Sub-Committee Chairmen |

C1.3 |

Compliant |

The Chairman of Hayleys PLC ensures the Chairmen of the Audit, Remuneration and Nomination Committees to be available to answer questions at the AGM. |

|||||||

47. Adequate notice of the AGM |

C.1.4 |

Compliant |

A copy of the Annual Report including financial statements, notice of the meeting and the Form of Proxy are sent to shareholders 15 days prior to the date of the AGM as required by the Statute in order to provide the opportunity to all shareholders to attend the AGM. |

|||||||

48. Procedures of voting at General Meeting |

C.1.5 |

Compliant |

A summary of the procedures governing voting at a General Meeting is circulated to shareholders with every notice of the General Meeting. |

|||||||

| C.2 Major Transactions

The Code requires the Directors to disclose to shareholders all proposed corporate transactions, which if entered in to, would materially alter the Hayleys PLC net assets and the consolidated group net asset base. |

||||||||||

49. Disclosure on ‘major transactions’. |

C.2.1 |

Compliant |

During the year, there were no major transactions as defined by Section 185 of the Companies Act No. 07 of 2007 which materially affect the net asset base of Hayleys PLC or consolidated group net asset base. Transactions, if any, which materially affect the net asset base of Hayleys PLC, will be disclosed in the Quarterly/ Annual Financial Statements. |

|||||||

D. Accountability and AuditD.1 Financial ReportingThe Code requires the Board to present a balanced and understandable assessment of Hayleys PLC’s financial position, performance and prospects. |

||||||||||

50. Board’s responsibility for statutory and regulatory reporting |

D.1.1 |

Compliant |

The Board has recognised the responsibility to present regulatory and statutory reporting in a balanced and understandable manner. When preparing quarterly and annual financial statements, Hayleys complied with the requirements of the Companies Act No. 07 of 2007 and prepared and presented them in accordance with Sri Lanka Accounting Standards. Hayleys PLC has complied with the reporting requirements prescribed by the Colombo Stock Exchange. |

|||||||

51. Directors’ Report in the Annual Report |

D1.2 |

Compliant |

The Directors Report given on Financial Report section covers all areas of this section. |

|||||||

52. Statement of Directors’ and Auditor’s responsibility for the financial statements |

D1.3 |

Compliant |

The “Statement of Directors’ Responsibilities” is given on Financial Report section. The “Independent Auditors’ Report” on page 179 For the Auditor’s responsibility. |

|||||||

53. Management Discussion Analysis |

D.1.4 |

Compliant |

Please refer “Management Review and Preview” . |

|||||||

54. Declaration by the Board on the going concern of the Business |

D.1.5 |

Compliant |

Please refer “Annual Report of the Board of Directors on the Affairs of the Company” and the” Statement of Directors’ Responsibilities” |

|||||||

55. Summon an EGM to notify serious loss of capital |

D.1.6 |

Compliant |

Reason for such an EGM has not risen as yet but would be complied with if such a situation arises. |

|||||||

| D.2 Internal Control

The Code requires the Board to maintain a sound system of internal control to safeguard shareholders’ investments and the Hayleys’ assets. |

||||||||||

56. Annual review of the effectiveness of Group’s system of internal controls |

D.2.1 |

Compliant |

The Board is responsible for the Group’s internal control and its effectiveness. Internal control is established with emphasis placed on safeguarding assets, making available accurate and timely information and imposing greater discipline on decision making. It covers all controls, including financial, operational and compliance control and risk management. It is important to state, however that any system can ensure only reasonable, and not absolute, assurance that errors and irregularities are prevented or detected within a reasonable time. The Group’s Management Audit & System Review Department (MA & SRD) plays a significant role in assessing the effectiveness and successful implementation of existing controls and strengthening these and establishing new controls where necessary. The MA & SRD’s reports are made available to the Chairman & Chief Executive and the Chairman of the Audit Committee. The Group also obtains the services of independent professional accounting firms other than the statutory auditors to carry out internal audits and reviews to supplement the work done by the MA & SRD. The Board has reviewed the effectiveness of the system of financial controls for the period up to the date of signing the accounts. There is a direct channel between the Head of MA & SRD and the Chairman of the Audit Committee without the interference of any Directors or Executives. |

|||||||

57. Reviewing the need for internal audit function |

D.2.2 |

N/A |

This is not applicable as the Group’s Management Audit & System Review Department (MA & SRD) is responsible for internal audit function. |

|||||||

| D.3 Audit Committee

The Code requires the Board to establish formal and transparent arrangements for considering how they should select and apply accounting policies, financial reporting and internal control principles and maintaining an appropriate relationship with the external auditors. |

||||||||||

58. Composition of the Audit Committee |

D.3.1 |

Compliant |

Audit Committee consists of; W.D.N.H. Perera Dr. H. Cabral. PC R.P. Pathirana Hayleys Group Services (Pvt) Ltd., serves as its Secretary. The Audit Committee helps the Group achieve a balance between conformance and performance. |

|||||||

59. Duties of the Audit Committee |

D.3.2 |

Compliant |

The Audit Committee keeps under review the scope and results of the audit and its effectiveness, and the independence and objectivity of the auditors. Review of nature and extent of non-audit services provided by the auditors to seek balance objectivity and independence. |

|||||||

60. Terms of Reference of the Audit Committee |

D.3.3 |

Compliant |

The Terms of Reference of the Audit Committee have been agreed to by the Board. This addresses the purpose of the Committee, its duties and responsibilities including the scope and functions of the Committee. |

|||||||

61. Disclosures of the Audit Committee |

D.3.4 |

Compliant |

Names of the members of the Audit Committee disclosed under item 58 of this code section on the “Audit Committee Report” and the disclosure of the independence of the Auditors is disclosed under the section on the “External Audits” in the “Audit Committee Report” of this Report. |

|||||||

| D.4 Code of Business Conduct and Ethics

The Code requires Hayleys PLC to adopt a Code of Business Conduct & Ethics for Directors, and members of senior management team and must promptly disclose any waivers of the Code for Directors or others. |

||||||||||

62. Disclosure of Code of Business Conduct and Ethics. |

D.4.1 |

Compliant |

A comprehensive Corporate Governance and Code of conduct and business governance has been adopted by the Board and is in compliance and any violations are taken for consideration. |

|||||||

63. Affirmation of the Code of Business Conduct and Ethics |

D.4.2 |

Compliant |

Refer the Chairman and Chief Executive’s Message |

|||||||

| D.5 Corporate Governance Disclosures

The Code requires the Directors to disclose the extent to which Hayleys PLCs’ adheres to established principles and practices of good Corporate Governance. |

||||||||||

64. Disclosure of Corporate Governance |

D.5.1 |

Compliant |

This report on Corporate Governance sets out the manner and extent to which Hayleys PLC has complied with the principles and provisions of the Code. |

|||||||

ShareholdersE. Institutional InvestorsE.1 Shareholder VotingThe Code requires Institutional shareholders to make considered use of their votes and encourages to ensure their voting intentions are translated to practice. |

||||||||||

65. Communication with shareholders |

E.1.1 |

Compliant |

There are regular meetings with shareholders (based on their requests) on matters which are relevant and of concern to the general membership. Voting of the shareholders is critical in carrying out a resolution at the AGM. The Chairman ensures the views of the shareholders are communicated to the Board as a whole. Shareholders are provided with Quarterly Financial Statements and the Annual Report, which the Group considers as its principal communication with them and other stakeholders. These reports are also made available on the Group’s website and are provided to the Colombo Stock Exchange. Any information that the board considered as price sensitive is disseminated to the shareholders as necessary. Shareholders may bring up concerns they have, either with the Chairman & Chief Executive or the Group’s Secretarial Department as appropriate. Discussions are held with Institutional Investors, involving the Chairman, and other Executive Directors where necessary. This process is supported by the SBDU and the CAU. During these meetings, the Directors ensure protection of share price sensitive information that has not been made available to the company’s shareholders. |

|||||||

| E.2 Evaluation of Governance Disclosures

The Code requires the Institutional investors to give due weight to all relevant factors drawn to their attention. |

||||||||||

66. Due weight by Institutional Investors. |

E.2.1 |

Compliant |

The Institutional Investors are encouraged to give due weight to all relevant matters relating to the Board structure and composition. |

|||||||

F. Other InvestorsF.1 Investing/Divesting Decision |

||||||||||

67. Individual shareholders |

F.1 |

Compliant |

||||||||

| F.2 Shareholder Voting

Individual investors are encouraged to carry out adequate analysis or seek independent advice in investing or divesting decisions. |

||||||||||

68. Individual shareholders voting |

F.2 |

Compliant |

Individual shareholders are encouraged to participate in General Meetings of companies and exercise their voting rights. |

|||||||

Section B

This section covers Hayleys extent of adherence to the requirements of the Continuing Listing Requirements Section 7.10 on Corporate Governance Rules for Listed Companies issued by the Colombo Stock Exchange. This reflects Hayleys’ level of conformance to CSE’s Listing Rules which comprises of following fundamental principles.

- Non-Executive Directors

- Independent Directors

- Disclosures relating to Directors

- Remuneration Committee

- Audit Committee

| CSE Rule Reference | Corporate Governance Principles | Compliance Status | Hayleys Extent of Adoption |

| 7.10.1(a) | Non-Executive Directors | Compliant | Five out of twelve Directors are Non-Executive Directors |

| 7.10.2(a) | Independent Directors | Compliant | Three of Five Non-Executive Directors were Independent |

| 7.10.2(b) | Independent Directors | Compliant | All NEDs have submitted their confirmations on Independence as per the criteria set by Hayleys PLC, which is in with the regulatory requirements. |

| 7.10.3(a) | Disclosure relating to Directors | Compliant | The Board assessed the independence declared by the Directors and determined the Directors who are independent and disclosed same in item 15 of SEC & CASL A.5.5. |

| 7.10.3(b) | Disclosure relating to Directors | Compliant | The Board has determined that all Non-Executive Directors except for Mr. K.D.D. Perera and Mr. W.D.N.H. Perera satisfy the criteria for "independence" set out in the Listing Rules. |

| 7.10.3(c) | Disclosure relating to Directors | Compliant | Please refer Stewardship section for the brief resume of each Director. |

| 7.10.3(d) | Disclosure relating to Directors | Compliant | Disclosed the appointments of new Directors to the Colombo Stock Exchange when it is disclosed to the public. Brief resumes of the Directors appointed during the year have been provided to the Colombo Stock Exchange. |

| 7.10.5 (a) | Composition of Remuneration Committee | Compliant | As at 31st March, 2013, Committee comprises of five Non-Executive Directors. |

| 7.10.5(b) | Functions of Remuneration Committee | Compliant | Please refer item 30 of the SEC & CASL Code table on page 126 for the details of the functions of the Remuneration Committee. |

| 7.10.5(c) | Disclosure in the Annual Report relating to the Remuneration Committee | Compliant | Names of the Remuneration Committee members are given in the item 32 of the SEC & CASL Code table. The report of the Remuneration Committee is given on the Financial Report and the remuneration paid to Directors is given in the note 10 to the Financial Statements. |

| 7.10.6(a) | Composition of Audit Committee | Compliant | As at 31st March, 2013, the Committee comprises of three Non-Executive Independent Directors and one Non-Executive Director. Chairman of the Audit Committee is an Independent Non-Executive Director. The Chief Executive and Chief Financial Officer attend meetings by invitation. Chairman of the Audit Committee is a passed finalist of The Institute of Chartered Accountants Sri Lanka. Please refer Board of Directors for further details. |

| 7.10.6(b) | Audit Committee Functions | Compliant | Please refer item 59 of the SEC & CASL Code for the details of the functions of the Audit Committee. |

| 7.10.6(c) | Disclosure in the Annual Report relating to Audit Committee | Compliant | The names of the Audit Committee members and the Report of the Audit Committee has been given on page 152 The basis of determination of the independence of the auditor is also given in the Audit Committee Report. |

Board and the Committee attendance. The number of meetings of the Board and Board Committees and individual attendance by members as follows:

| Name | Directorship Status | Board | Audit Committee |

| Mr. A.M. Pandithage (Chairman & Chief Executive) | Executive | 14/14 | n/a |

| Mr. M.R. Zaheed | Executive | 14/14 | n/a |

| Mr. J.A.G. Anandarajah (Retired w.e.f. 31st March, 2013) | Executive | 13/14 | n/a |

| Mr. K.D.D. Perera | Non-Executive | 5/14 | n/a |

| Mr. W.D.N.H. Perera | Non-Executive | 10/14 | 1/9 |

| Mr. S.C. Ganegoda | Executive | 13/14 | n/a |

| Mr. H.S.R. Kariyawasan | Executive | 9/14 | n/a |

| Dr. H. Cabral PC | Independent Non-Executive | 9/14 | 4/9 |

| Dr. K.I.M. Ranasoma | Executive | 10/14 | n/a |

| Mr. L.T. Samarawickrama | Executive | 12/14 | n/a |

| Mr. R.P. Pathirana | Independent Non-Executive | 9/14 | 5/9 |

| Mr. M.D.S. Goonetilleke | Independent Non-Executive | 13/14 | 9/9 |