Sector Reviews

Purification

Business Domain

The Purification Sector, led by Haycarb, is the world’s largest manufacturer of coconut shell-derived activated carbon for the global purification market with manufacturing facilities in Sri Lanka, Thailand and Indonesia supported by marketing offices in the UK, Australia and USA. The Sector also has related businesses such as the construction and operation of turnkey projects for raw and waste water treatment. The Sector comprises of 14 companies, 5 of which are based locally.

Key Performance Indicators

| Indicator | Measure | Unit | FYE 31st March | ||

| 2013 | 2012 | 2011 | |||

| Growth | Revenue | Rs. mn | 10,161 | 8,509 | 6,407 |

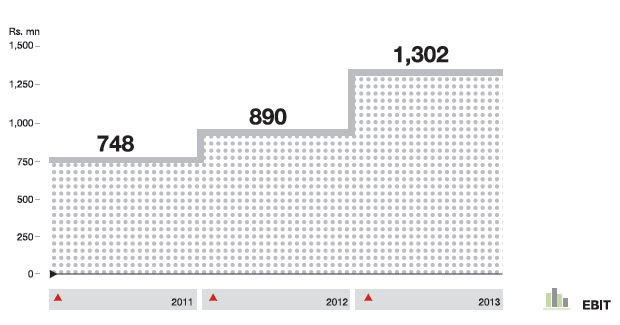

| Earnings Before Interest and Tax | Rs. mn | 1,302 | 890 | 748 | |

| Profit After Tax | Rs. mn | 1,026 | 523 | 574 | |

| Assets (Avg.) | Rs. mn | 7,457 | 5,518 | 4,071 | |

| Capital Employed (Avg.) | Rs. mn | 5,867 | 4,465 | 3,082 | |

| Profitability | Return on Average Capital Employed* | % | 22 | 20 | 24 |

| Liquidity | Current Ratio | Times | 1.54 | 1.78 | 2.34 |

| Stability | Gearing | % | 30 | 31 | 11 |

| Asset utilisation | Asset Turnover Ratio | Times | 1.36 | 1.54 | 1.57 |

| Productivity | Ebit per Employee | Rs. mn | 1.36 | 1.02 | 0.92 |

* Excluding Real Estate

Operations

The Sector operated in the back drop of a slowdown in the major world economies, especially in Europe and Japan, and escalation of costs in all our manufacturing locations.

The strong customer relationships and brand positioning that enabled the Company to maintain volumes to its key customers, marketing efforts that lead to the acquisition of strategic new accounts, the successful market penetration and expansion strategies implemented in growing markets such as Indonesia, Thailand and West Africa were factors that enabled the sector to operate activated carbon manufacturing facilities at full capacity throughout the year. The other factors that contributed positively were the increase in sales of value added and high margin products, the stability of the main raw material, coconut shell charcoal and the depreciation of the local currency against the US dollar even though this was partly offset by raw material imports.

There were notable manufacturing cost escalations in all geographies due to the increases in energy and wage costs. Lean initiatives helped to contain costs and improve efficiencies.

The Group capital expenditure relating to the enhancement and expansion of manufacturing and laboratory facilities, introduction of information systems and improvements to worker and staff facilities, remained at high levels for the second year in succession, as the sector positioned the required assets and resources for growth.

The relationships with charcoal suppliers in Sri Lanka, India, Thailand and Indonesia were further strengthened and Haycarb invested in charcoal and shell collection networks in Sri Lanka.

With a 17% global market share and maintaining its position as the world’s leader in its business segment, Haycarb Group posted a landmark Rs. 1.2 bn profit before tax for FY 2012/13.

Strategies in Action

The marketing resources in Sri Lanka and overseas were strengthened as the sector implements a marketing plan to capture a larger share of markets in Central and Eastern Europe, China, West Africa, South America and emerging markets in Asia and untapped market segments in traditional markets such as Japan, USA and South Korea.

Emphasis on developing and marketing value added high margin products that have shown positive results will be given high priority and focus. Satisfactory progress was made in the Ultracarb Project during the year, with Haycarb moving forward towards formal certification of its range of carbons for the Energy Storage sector by major customers in this market segment. NSF certification was obtained for manufacturing factories in Thailand and Indonesia, and ISO systems implementation is expected to be completed within the next few months.

Significant expansion of the manufacturing capacity over the next two to three years will be a key driver of the future strategy. In September 2012 100% equity of Shizuka Company Ltd. Thailand was acquired in September 2012 through the Joint Venture, Carbokarn Company Ltd. in Thailand. Haycarb Value Added Products Private Limited was incorporated in Sri Lanka during the year as a fully owned subsidiary, to manufacture and export value added activated carbon products and the plant will be commissioned in the ensuing financial year. Considering the potential for activated carbon market, availability of coconut shell charcoal and leveraging on the experience and strength of successfully operating the existing manufacturing facility in North Sulawesi, Haycarb plans to expand its manufacturing base further in Indonesia. In January 2013, PT Haycarb Palu Mitra Company was incorporated as a joint venture to undertake the commissioning of a new greenfield manufacturing plant in Central Sulawesi, Indonesia. The new facility is expected to come on stream during the early part of 2013/14. Haycarb has set in motion the plan to further expand the Company’s manufacturing foot print, primarily off shore.

Puritas will remain a key focus point of growth as it leverages on valued strategic partnerships built during the last two years, and plans to engage in large and medium scale Government projects for water and sewage treatment.

Haycarb is amongst the first in Sri Lanka to register and trade in carbon credits under the Kyoto Protocol through its subsidiary Recogen (Pvt) Ltd. It will focus on introducing less capital intensive environment friendly charcoaling methods in conjunction with the initiatives to broaden the charcoal supply network in Sri Lanka. Haycarb continues to build on and maintain the sustainability and green focus in its operations throughout the world.

Outlook

External conditions such as spiraling energy costs, strengthening of currencies in some of the key manufacturing bases, increases in wage costs and overheads together with the increases in charcoal pricing experienced in Sri Lanka and India poses challenges that can impact Haycarb’s margin potential. Whilst the Sector operates in an environment of volatility, we believe the correct strategies outlined above can mitigate risk and pave the way to growth.