Management Discussion and Analysis

Social and Environmental Capital

Resilience

/rı’zılı ns/

noun

The ability of a system to prepare for threats, absorb impacts, recover and adapt following persistent stress or a disruptive event.

Resilience is now on the mainstream sustainability agenda, in looking to build systems and capabilities to face challenges that business and society will have to face in this “exponential decade”. DFCC Bank is looking to build internal systems that are resilient in the face of significant changes in the economy and regulatory landscape, as well as add value to its customers by offering services that make them more resilient. Furthermore, the Bank is taking care of its own footprint as well as those in its portfolio to contribute towards greater resilience in its operations, those of its customers, and all its stakeholders, contributing towards a more resilient Sri Lanka.

Business coalitions highlight how companies can build resilience by taking actions that:

- Improve risk management

- Invest in human and social capital

- Better integrate sustainability

This means strengthened risk management with strong processes and systems, improved metrics, topics (staff well-being, diversity and inclusion, safety, etc.), disclosure, materiality assessment with stakeholder inputs, longer timeframes, scenario thinking, and finally a balance of Environmental, Social, and Governance (ESG) elements being addressed within sustainability, especially the Social.

DFCC Bank’s Sustainability Policy

It is recognised globally that the business case for sustainability has benefits that accrue to all stakeholders. As the expectations of stakeholders evolve, sustainability is no longer something that is considered optional or voluntary but is now a “must do” practice to future-proof the business against the demands of regulators and lenders. Sustainability is a key part of DFCC Bank’s Vision 2025 strategy and will be crucial in the Bank’s journey to becoming the most customer centric, digitally enabled bank that meets customers’ future needs.

In 2020, the Bank boldly developed its first formal Sustainability Policy, Strategy, and Plan for the period 2020 to 2030, building on its historical achievements in this area. This stems from a belief the Bank holds that it must contribute towards strengthening resilience among its stakeholders and also towards resilience in Sri Lanka, given the greater likelihood of uncertainties and challenges across the globe during the next decade. The Bank aims to create long-term stakeholder value through sustainability.

Sustainability vision

DFCC Bank to be the leading bank contributing towards Sustainability by 2030.

Sustainability purpose

Contributing towards a resilient Sri Lanka

The Bank believes that the best sustainability framework to adopt is the Triple Bottom Line (TBL) of People, Planet, and Profit (the three Ps). The Bank is committed to conducting its business in a responsible and inclusive manner that adds value to all its stakeholders on the economic, social, and environmental aspects of sustainability or People, Planet, and Profit.

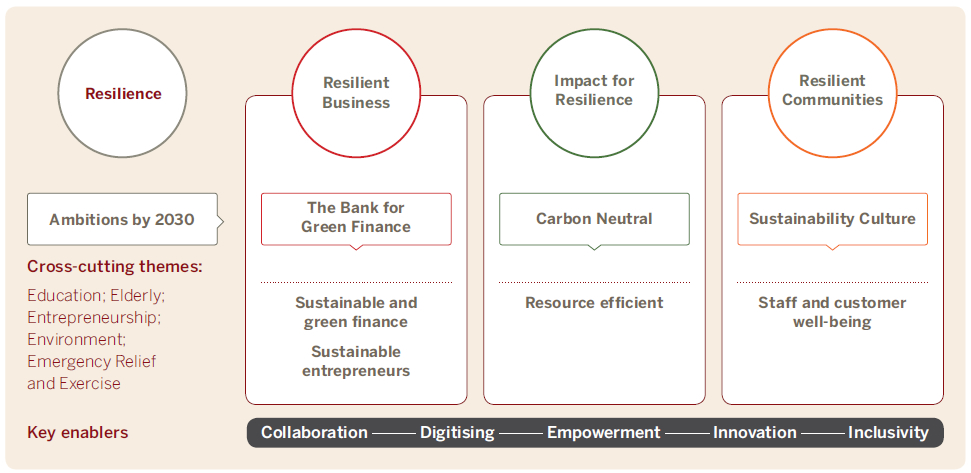

In applying the TBL framework to Vision 2025, the Bank has three key sustainability dimensions:

Resilient Business

Contributing to sustainable economic growth

Impacts for Resilience

Promoting positive environmental and social impacts

Resilient Communities

Advancing sustainable workplaces and lifestyles

DFCC Bank has identified six cross-cutting themes (the six Es):

Education Elderly Entrepreneurship Environment Emergency Relief Exercise

The Bank will focus its sustainability efforts on these themes to maximise its impact. Sustainability will be powered through five key enablers: Collaboration, Digitising, Empowerment, Innovation, and Inclusivity. These enablers will help the Bank to realise its vision of sustainability and contribute towards a resilient Sri Lanka, while also actively contributing towards the UN Sustainable Development Goals (SDGs).

The overall vision of a sustainable DFCC Bank and its goals is conceptualised as follows:

DFCC Bank’s new Sustainability Strategy is linked to 12 SDGs:

The Bank’s sustainability activities will actively contribute towards specific SDG related targets and indicators.

The big goals for DFCC Bank

Key goals have been developed for the Bank with consideration for the developments in the global and local banking sector and building on the Bank’s past activities related to sustainability.

DFCC Bank seeks to be the bank specialising in environmental, energy, and sustainability-related project and advisory services.

Carbon neutrality is achievable with a combination of energy conservation, renewable energy, and purchasing of carbon offsets over time. Technological advances and changing economic policies impact positively on feasibility.

The goal is congruent with global sectoral good practices and trends in the financial sector in Sri Lanka, as well as the Government of Sri Lanka’s stated policy aim of 80% renewable energy by 2030 in Sri Lanka. The Bank will work in partnership with several organisations on renewable energy to achieve this goal. DFCC Bank also seeks to be a Clean Air Champion in Sri Lanka and will work with organisations on local air pollution mitigation actions.

The Bank seeks to advance sustainable workplaces and lifestyles via governance, inculcating sustainable workplace practices as well as lifestyles for clients and staff in general. This includes a range of elements from promoting diversity and inclusivity, to productivity-oriented wellness and sustainable consumption and lifestyle practices

Sustainability and Digitisation

Sustainability and digitisation are two big global trends in business. The COVID-19 pandemic has provided an urgent impetus for digitisation with the significant increase in digital customer interactions. Continued growth is expected to be seen in digital collaboration tools.

Sustainable practices include the use of technologies including digitisation, but also more broadly corporate digital responsibility. This means promoting ethical and sustainable business practices throughout the Bank.

While technology is the enabler, digitisation requires a 180° change in approach and attitude that is part and parcel of the Sustainability Strategy and Plan. Technology, digitisation, and often the new forms of working all aid new and sustainable ways of working at DFCC Bank. This feeds into long term productivity that will yield positive returns for all the Bank’s stakeholders. It also means lower use of resources such as paper, waste generation, staff and customer time, etc.

Digitisation allows the Bank to design for, measure, and manage resilience (or its capacity to absorb stress, recover critical functionality, and thrive in altered circumstances). This year has successfully tested the Bank’s capacity.

Digital platforms are the Bank’s business ecosystems that can increase its collective resilience via access to new capabilities, through increased flexibility, and by reducing the fixed cost of entry into businesses.

In moving forward, digitisation provides the Bank with an opportunity to contribute towards a post-pandemic Green Recovery where the costs of pollution and the benefits of environmental sustainability are increasingly recognised by the Bank’s stakeholders.

Implementing DFCC Bank’s Sustainability Vision

The Bank started implementing its new Sustainability Policy, Strategy, and Plan in 2020 along key areas of action, including:

- Creating a baseline of information on key sustainability aspects

- Setting up key structures and processes

- Starting with identified projects with support for developing criteria for identification of projects, metrics for monitoring, impact assessment, and reporting, along with building skills and process documentation with teams.

- Creating awareness of DFCC Bank’s Sustainability Strategy and its business case for sustainability, with strong engagement with staff and other key stakeholders that will motivate their active participation in the Bank’s activities.

- Strengthening the integration and practice of the Social and Environmental Management System (SEMS) within the organisation.

More specifically, the Bank carried out several activities, including:

- Communicating the new Sustainability Policy, Strategy, and Plan to staff through email flyers, weekly internal newsletter, CEO’s bulletin, and during training sessions and management meetings.

- All staff including the CEO taking the Sustainability Pledge

- Strengthening of the existing Management Subcommittee, headed by the CEO, to a cross-functional Executive Sustainability Management Committee with several C-level staff. The Committee will set priorities, launch and oversee task forces and other teams, and make strategic decisions on the implementation of our sustainability initiatives.

- Formation of several taskforces and committees to implement specific tasks, including wellness.

- Conducting a Sustainability Quiz to increase the knowledge on sustainability among the staff.

Impacts for resilience: 5s for resource and operational efficiency

5S is a system to reduce waste and optimise productivity, creating order and operational workplace efficiency. DFCC Bank has included its 5S activities as part of its overall sustainability strategy, particularly related to increased resource efficiency and minimising waste.

At DFCC Bank, 5S implementation started with the Branch Operations Department. All staff were trained in the theoretical and practical aspects of 5S for the Bank as well as at the individual level. It was then successfully implemented across the Department and later, onto the PFS Processing Centre, the Contact Centre, and Lean Management departments. All staff of 5S-compliant departments were given glass bottles to encourage eco-friendly practices within the Bank.

The Bank looks forward to rolling out 5S across all its departments as part of its ongoing sustainability initiatives in 2021.

Sustainability initiatives

The Bank continued to undertake its many sustainability initiatives during the year under review.

Sustainable Banking Initiative

DFCC Bank is a pioneering signatory to 11 Sustainable Banking Principles of the Sri Lanka Banks’ Association (SLBA) under the Sustainable Banking Initiative (SBI) and an active participant in this sectoral initiative. This includes training the Bank’s staff in environmental and social risk impact mitigation and management in credit transactions using the SBI’s resources. A total of 84 selected staff successfully completed the six e-learning modules on the SBI and obtained certificates during the year. In addition, both the CEO and DCEO completed the CEO’s module, providing a clear message to the Bank’s staff on the importance of knowledge on environmental and social risk management in the Bank’s lending portfolio.

Social and Environmental Management System

The Bank’s Sustainability Unit has implemented a Social and Environmental Management System (SEMS) that ensures the projects funded by the Bank meet the required environmental and social regulations, while also enabling clients to be more profitable and responsible.

The following activities were commenced from 2020 for all term loans over LKR 25 Mn:

- Conducting an environmental and social risk categorisation during the project appraisal for a total of 187 loans. This serves as a useful indicator for loan approving authorities and a decision tool on the level of environmental and social impact monitoring required for each transaction.

- Commenting on the environmental and social aspects in appraisal reports by the Sustainability Unit for the benefit of approving authorities

- Monitoring of the environmental and social aspects by the Sustainability Unit during the entire loan tenure.

Resilient Business: Supporting customers during the pandemic

During a particularly difficult year for the country and its citizens, the Bank assisted its customers through moratoriums within and beyond the scope of the guidelines issued by the CBSL. The Bank took further steps to provide its customers with added convenience during the year with the M-teller mobile service that was deployed in certain districts for cash collection at customers’ doorstep.

Resilient Business: Supporting SMEs and MSMEs

The Bank supported SMEs and MSMEs affected by the COVID-19 pandemic through moratoriums, in line with the CBSL guidelines. The “DFCC Sahanaya” concessionary loan scheme amounting to approximately LKR 2 Bn was launched to help SME/MSME exporters and aid in the revival of the sector.

The Bank launched the “DFCC Saubhagya” loan scheme aimed at innovative projects, employment generating projects, export oriented projects, livestock and agricultural projects, and other development projects that can help to support the economy.

DFCC Bank will continue to support sectors affected by the pandemic and provide financial and advisory support to SMEs in many sectors including agriculture, export, manufacturing, health, education, construction, and others in 2021. The Bank will place an increased focus on promoting environmental, energy, and sustainability projects and provide advisory services in line with its sustainability goal of becoming a bank for Green Financing.

Resilient Communities: Home gardening

DFCC Bank promoted home gardening during the lockdown periods and continued to do so after it was lifted. The Bank provided home gardening kits comprised of compost, pots made of recycled plastic, and vegetable seeds to its customers and staff. The aim was to promote home gardening as a means of strengthening self-reliance and food security, and generate an appreciation of the benefits of a more sustainable lifestyle.

Resilient Communities: Strengthening the financial literacy of communities

The Bank continued its financial literacy programme, “Sahaya Hamuwa”, to enhance the knowledge base of the communities it works with. The Bank has conducted over 50 workshops since the programme started in 2017 and engaged over 7,000 entrepreneurs across the country. Due to the pandemic, restrictions were placed on community gatherings and limited the workshops that were to be conducted during the year. Three workshops were conducted across the branch network before the lockdowns were implemented and seven workshops were conducted online. The Bank also streamed videos on entrepreneurship development through social media.

Education and Entrepreneurship: Caritas Sri Lanka-SEDEC programme

DFCC Bank teamed up with Caritas Sri Lanka-SEDEC to launch a scholarship programme as part of its CSR initiatives. The programme provides financial assistance targeted at the youth of vulnerable low-income families to continue their education without interruption, with a focus on entrepreneurship. The scholarship programme will have a duration of five years and have a minimum of 100 recipients at a given time.

Entrepreneurship: Supporting women entrepreneurs

The Bank has been developing a banking proposition that will enable women to fully benefit from financial services and promote women entrepreneurship development. This will be rolled out in 2021.

Environment: Tree planting campaign

The Sustainability Unit continued the tree planting campaign to commemorate staff birthdays for the fourth consecutive year with the participation of the Bank’s staff and their families, including the CEO.

Environment and Exercise: Cycling at Pinnacle Centre

The Bank promoted cycling for a healthy work-life balance as part of its new Sustainability strategy and organised a cycling event in October to coincide with the opening of the new Pinnacle Centre in Colombo 07. The Pinnacle Centre has been designed to accommodate cycling enthusiasts and is equipped with changing rooms and shower facilities

for customers.

Environment and Resource Efficiency: Waste management

A “Clean-up Day” was held throughout the Bank in September 2020 to coincide with the “World Clean-up Day” for the third consecutive year. Active participation by the staff on this day resulted in the removal of many unwanted items, leading to cleaner and spacious work areas. Arrangements were also made by the Sustainability Unit to collect e-waste and plastic from the Bank premises and from staff, which were then handed over to Central Environment Authority (CEA) approved recycling companies.

Environment and Resource Efficiency: Reducing resource consumption

The Bank has instituted taskforces to assess baseline consumption of several resources, including its usage of paper, electricity, water, and other resources during the year.

DFCC Bank’s sustainable future

The Bank’s commitment to sustainability is integrated into its business planning and operations by establishing and maintaining a transparent, time-sequenced Sustainability Strategy and Plan with further detailing of its goals and tracking the relevant metrics for the implementation of the Bank’s corporate sustainability policy objectives.

The Bank embodies the change it wishes to see by raising its employees’ awareness of sustainability and responsible behaviour through relevant training on sustainability and by instituting systems to assess the Bank’s portfolio through SEMS. This will further strengthen them to play a pivotal role in implementing the Bank’s Sustainability Policy.

DFCC Bank is deeply committed to comply, and to encourage its clients, to comply with all applicable environmental and social laws, rules, and regulations of Sri Lanka at all times and, when applicable, with international best practice standards.

Recognition for sustainability in 2020

Association of Development Financing Institutions in Asia and the Pacific (ADFIAP) Awards 2020

- Merit Award – Outstanding Development Project Awards for Human Capital Development for the #TogetherWeGrow HR initiative

- Merit Award – Outstanding Development Project Awards for Corporate Social Responsibility for the “Samata English” (English for All) initiative Global Sustainable Finance Awards 2020 – Karlsruhe, Germany

- Certificate of Merit for Outstanding Sustainable Project Financing for success in granting loans to dairy farmers as a group loan

Partnerships for sustainability

The Bank aims to develop strategic alliances with sustainability minded individuals and organisations to partner in moving forward.