Business Model

Materiality

As part of DFCC Bank’s development of its new Sustainability Strategy and Plan in 2020, the Bank reached out to its stakeholders to better understand their concerns and the relevance of their priorities against economic, environmental, governance, and social issues.

Inclusivity is vital to the Bank in its sustainability journey. The Bank believes in its stakeholders’ right to be heard and accounting for the impact it has on them and vice versa. Materiality is knowing what concerns are important to the Bank and its stakeholders.

Materiality = Relevance + Magnitude of Impact + Probability of Occurrence

Stakeholder engagement is a part of good sustainability practices designed to contribute towards identifying and addressing:

- Significant impacts related to business operations and strategy;

- Stakeholders significantly impacted; and

- Stakeholders with significant potential to influence the Bank.

The Bank has eight stakeholder groups, including Investors/Shareholders, Customers, Employees, Business Partners, Regulators, Communities, Advocacy Groups (media and I/NGOs), and Industry Associations.

The Bank’s external environment includes economic, environment, governance, and social-related trends. The Bank’s Sustainability Strategy and Plan needs to account for relevant trends, i.e., those that are material.

Through materiality analysis, the Bank determines aspects that are of importance to its stakeholders and to the Bank with respect to its economic, social, and environmental agenda for sustainable value creation. The following trends have been identified:

- Increased demand for Green Financing (environmentally friendly projects and investments) with sector specific expertise, e.g., renewable energy

- Health and wellness-enhanced productivity

- Empowered staff, including special focus on female staff

- Collaboration and teamwork

- Enhanced productivity, process efficiencies with investment in staff knowledge and skills (training and knowledge development)

- Increased resource efficiency, e.g., decreasing energy and paper usage, minimising wastage, etc.

- Healthy and attractive workplace culture that attracts and retains diverse and excellently performing staff

- Clarity on career progression

- Customer centric services and engagement

- Increasingly differentiated and evolving customer needs on financial services, including wealth management advisory services

- New technologies for customer investment and use, e.g., smart/precision agriculture, pollution control, energy efficient technologies, etc.

- Increased demand for convenient, remote, streamlined, and flexible services

- Increasing demand for new and innovative services

- Trend towards purposeful and responsible business, i.e., businesses committed to making a positive impact on society/solving challenges that affect society while also making profits

- Need to improve financial literacy

- Specialised MSME services, including non-financial services

- Partnerships and collaborations with professional apex bodies

- Increasing entrepreneurs and MSMEs involvement in creating positive social and environmental impacts

- Increased use and influence of social media

- Increased investment in sustainability initiatives, including using less resources, address environmental and social impacts, CSR, disaster relief, etc.

- Economic performance

- Increased demand for transparent reporting on non-financial information including environmental and social issues

- Compliance with the Sri Lanka Banks’ Association’s (SLBA) Sustainable Banking Initiative (SBI) principles

- Need to contribute towards UN Sustainable Development Goals (SDGs)

- Negative outlook for the banking sector

- Increasingly competitive business environment

- Building resilient business strategies including sustainability

- Sustainable sourcing and supply chains

- Decent work or fair waged jobs

- Entrepreneurial skills training for the self-employed

- Education and skills building opportunities

- Increased frequency and scale of natural disasters and poor preparedness

- Environmental and social impacts from economic activities

- Increasing importance of organisational reputation

- Declining trends in exports

- Need to improve business resilience

- Use of new technologies, e.g., digitisation, Artificial Intelligence, robotic process automation, etc.

- Growth of MSMEs

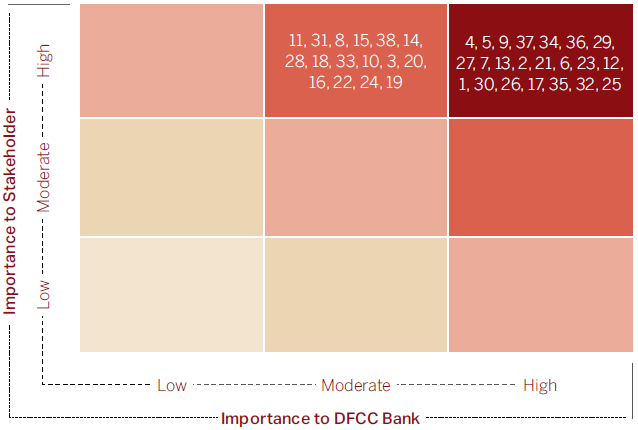

These trends have been mapped on the GRI Standards two-dimensional matrix:

As per the Materiality Matrix, the Bank will take note of stakeholder priorities in designing its Sustainability Strategy and Plan with the priority areas for the Bank to pursue.

Management approach

By engaging effectively with stakeholders, the Bank can map a portfolio of activities. The careful execution of these activities can lead the Bank to generate and deliver value to its stakeholders and derive value accordingly. This process helps to achieve the strategic goal of ensuring the credibility of the Bank’s sustainability plans and its operations, while also helping to establish strong relationships with customers, empower employees with mutually rewarding careers, generate steady returns for investors, establish mutually beneficial and profitable partnerships with partners, and act responsibly towards society and the environment.

The Management Discussion and Analysis section in this Annual Report discusses the initiatives that the Bank has undertaken during the period under review in further detail.