Management Discussion and Analysis

Financial Capital

Financial performance

Overview

Despite the adverse macroeconomic challenges faced, DFCC Bank concluded the year ended 31 December 2020 with sound performance and growth. Whilst the country was in the process of recovering from the incidents of 2019, the banking industry in particular, being an essential service, was flung into unprecedented market conditions in the wake of the global COVID-19 pandemic. With the industry encountering various challenges from the first quarter, 2020 has been a year full of trials, having to work under the new normal. With many interruptions, significant growth momentum and development was observed in the period between June and October before the second wave of COVID hit.

DFCC Bank was equipped to handle each market situation, putting adaptability and customer-centricity to the forefront of each business process. Every effort was made to ensure that customers experienced uninterrupted banking facilities whilst significant changes were made to working arrangements in order to deliver a seamless banking experience.

DFCC Bank adapted to the “new normal”, innovating wherever possible and digitising processes in order to cater to an ever-evolving market. The Bank introduced several concessionary schemes to its clientele in accordance with the Directions/Guidelines of Central Bank of Sri Lanka extending financial and advisory support to all segments of customers.

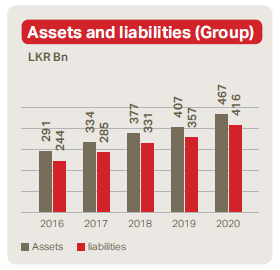

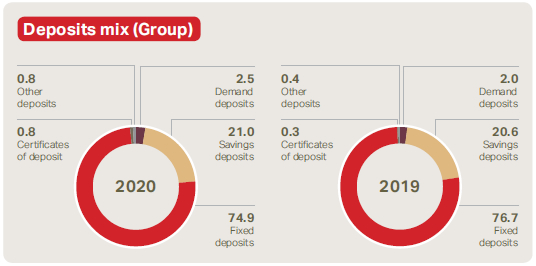

Low interest rates, reducing interest margins, restrictions on fee-based income and higher allowances for impairment of loans and advances due to uncertainties and potential implications of COVID-19 along with the two-month island-wide lockdown subdued economic activities both locally and globally, impacted the Bank’s performance during this year. Although 2020 was a challenging year, the Bank committed to deliver sustainable long-term value to its shareholders. The Bank’s total assets increased by LKR 60,180 Mn and recorded a growth of 15% from December 2019. This constitutes a loan portfolio growth of LKR 29,091 Mn to LKR 301,909 Mn compared to LKR 272,818 Mn as at 31 December 2019, recording an increase of 11%. The Bank’s deposit base as at 31 December 2020 increased to LKR 310,027 Mn from LKR 247,787 Mn as at 31 December 2019, a growth of 25%. Accordingly, loan-to-deposit ratio improved to 97% in December 2020

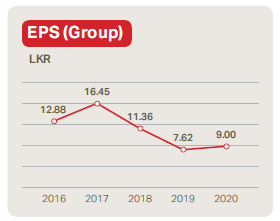

from 110% in December 2019. The Bank’s CASA ratio which represents the proportion of low-cost deposits increased to 23.8% by 31 December 2020 compared to 22.72% in December 2019. Profit after tax of the Bank grew by 15% to LKR 2,388 Mn, recording a growth in earnings per share (EPS) by 9.7% during the year 2020.

Income statement analysis

Profitability

DFCC Bank PLC, the largest entity within the Group, reported a profit before tax (PBT) of LKR 3,398 Mn and a profit after tax (PAT) of LKR 2,388 Mn for the year ended 31 December 2020. This compares with a PBT of LKR 2,989 Mn and a PAT of LKR 2,074 Mn in the previous year. However, profit recorded for 2019 includes the fair value loss on investment in Commercial Bank’s equity securities of LKR 939 Mn. With the view of concentrating on core banking profitability and re aligning the business model to meet the emerging trends, the Bank has reclassified the investment made in the equity securities of Commercial Bank of Ceylon PLC from fair value through profit or loss to fair value through other comprehensive income in accordance with the option given in the “Guidance Notes on Accounting Consideration of the COVID-19 Outbreak” issued by the Institute of Chartered Accountants of Sri Lanka. This reclassification reflected the efforts taken by the Bank to refocus on core business profitability.

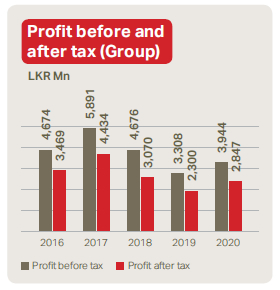

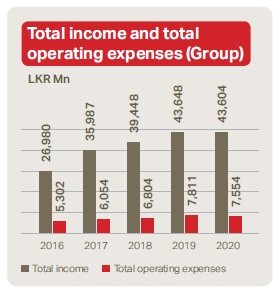

The Group recorded a PBT of LKR 3,944 Mn and PAT of LKR 2,847 Mn for the year ended 31 December 2020 as compared to LKR 3,308 Mn and LKR 2,300 Mn respectively in 2019. All the member entities of the Group made positive contributions to this performance.

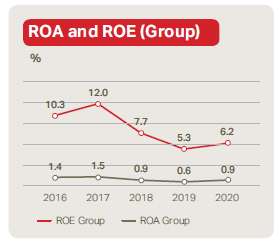

The Bank’s return on equity (ROE) improved to 4.93% in 2020 from 4.54% in 2019. The Bank’s return on assets (ROA) before tax was 0.78% and maintained at the same level as the previous year.

Net interest income

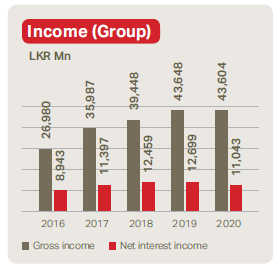

The Bank’s total income for the year 2020 was LKR 43,300 Mn compared to LKR 43,297 Mn in the previous period. Interest income accounted for 90% of the total income of the Bank. The Bank recorded LKR 11,007 Mn in net interest income (NII), which is a 13% decline year-on-year primarily due to a drop in AWPLR by more than 400 bps over the past 12 months and due to the business implications that arose after 18 March 2020 due to the pandemic situation and the monetary policy adopted by the Central Bank of Sri Lanka, including concessions granted as pandemic relief to borrowers. As a result, the interest margin decreased to 2.53% from 3.25% in 2019.

Fee and commission income

Fee and commission income in 2020 was primarily driven by lower levels of consumer spending resulting from COVID-19 which crystalised in the form of lower interchange income, international payments, foreign exchange and ATM reciprocity. However, the concentrated effort to increase non-funded business has materialised with a marginal increase therein to LKR 2,061 Mn for the year ended 31 December 2020 from LKR 2,046 Mn in the comparative period despite the adverse impact of the pandemic and reduction of some fees and charges by the Bank as required by the regulator.

Fees generated from loans and advances, and credit cards and fees collected from guarantees accounted for the majority of the fee and commission income.

Impairment charge on loans and other losses

The uncertain economic outlook and the potential future impacts of COVID-19 along with the moratorium schemes offered to customers to support recovery required amendments to our existing model used for the computation of Expected Credit Loss against our lending portfolio. Bank placed additional focus on the Expected Credit Loss (ECL) provision based on the internal models allowance for overlay computed based on stress testing the exposures to risk elevated sectors, and amendments to weightages assigned to macro economic scenarios to better reflect the potential implications of COVID-19 pandemic and the moratorium schemes introduced to support the recovery of the economy. The Bank also considered the long-term economic trend in calculating the impairment provision in line with the guidelines issued by The Institute of Chartered Accountants of Sri Lanka, as the extent of the economic downturn cannot be reasonably estimated. With the above, DFCC Bank continued to be prudent as in the past in assessing the quality of the credit portfolio and making adequate provisions. DFCC Bank’s non-performing loans (NPL) ratio moved up to 5.56% in December 2020 from 4.85% in December 2019 in line with the overall banking sector growth in NPLs. Considering all these factors, Bank’s total impairment charge increased by 98% from LKR 1,669 Mn in 2019 to LKR 3,298 Mn for the year ended 31 December 2020. Furthermore, as the impacts of the COVID-19 pandemic will continue to be felt for some time, the Bank continues to closely monitor its loan portfolio and provisioning levels.

Operating expenses

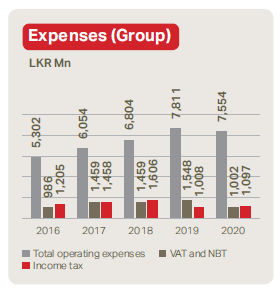

As a result of effective cost management procedures followed under the pandemic environment, the Bank was successful in recording a decline of 2% in total operating expenses to LKR 7,387 Mn in 2020. This was achieved while introducing many safety measures across the branch network in order to provide seamless service to customers and to secure a safety environment to the employees and all stakeholders. To better aid our internal processes, the Bank ’s timely investment in Google G-Suit enterprises enabled a smooth transition for our staff to work from home with minimal disruption to their day-to-day activities with zero impact on banking operations. During the year, the Bank created multiple channels for service delivery to access to customers and provide uninterrupted services during the pandemic situation which also contributed towards an increase in revenue streams, deposits and the Bank’s customer base. Careful monitoring and effective cost control measures adopted during the year helped to reduce the operating expenses to this level and resulted in a cost to income ratio of 48.97% for 2020.

Profit after tax (PAT)

The Bank recorded a PAT growth of 15% to LKR 2,388 Mn for the year 2020 compared to LKR 2,074 Mn in 2019. Bank’s total tax expense which includes financial services VAT (15%) and income tax (28%) is LKR 2,012 Mn year ended 31 December 2020. As a result, the Bank’s tax expense taken as a percentage of operating profit for the year stood at 46%.

Financial position analysis

Assets

Despite the challenges faced by the economy and the banking sector, DFCC Bank’s total assets increased by LKR 60,180 Mn, recording a growth of 15% from December 2019. This constitutes a loan portfolio growth of LKR 29,091 Mn to LKR 301,909 Mn compared to LKR 272,818 Mn as at 31 December 2019, an increase of 11%. Following the Bank’s prudent lending policies, it did not pursue aggressive growth, particularly to sectors that exhibited stress. The Bank has implemented a number of relief schemes in line with the directives from the Central Bank of Sri Lanka to support those customers affected. This includes over 1,826 “Saubagya” COVID-19 working capital loans amounting to LKR 10 Bn approved for affected customers. The Bank’s net asset value per share grew by 3% to LKR 161.30 from LKR 156.09 in 2019.

Liabilities

The liabilities increased by 16% over the previous year to LKR 415,720 Mn as at the year end. The main increase was due to the substantial growth in customer deposits of LKR 62,240 Mn. With the 25% increase in deposits, DFCC Bank was able to report loan to deposit ratio of 97.38%. The Bank’s CASA ratio, which represents the proportion of low cost deposits in the total deposits of the Bank, was 23.8% as at 31 December 2020. Funding costs for DFCC Bank

were also contained due to access to medium to long-term concessionary credit lines. When these concessionary term borrowings are considered, the ratio improved to 30.19% as at 31 December 2020.

DFCC Bank continued its approach to tap local and foreign currency related, long to medium-term borrowing opportunities.

Equity and compliance with capital requirements

DFCC Bank’s total equity increased to LKR 49,357Mn as at 31 December 2020 from LKR 47,480 in December 2019. The main contributor to the increase was the growth in retained earnings by LKR 1,424 Mn.

As per the relief measures introduced by the Central Bank of Sri Lanka, banks were permitted to release 50 basis points from the capital conservation buffers maintained to date. The Bank expects the debt moratorium and concessionary working capital loans introduced by the Central Bank of Sri Lanka to help the businesses to recommence their operations and reach normalcy soon. However, reduction in the cash flows from moratorium and delayed payments by customers who did not enjoy moratoriums are expected to have a negative impact on the earnings, cash flows and liquidity position of the Bank. Based on the internal assessment undertaken by the Bank, there is no significant adverse impact to the regulatory capital ratios maintained by the Bank. As a further reinforcement to Tier II Capital, the Bank has issued a listed, rated, unsecured, subordinated, redeemable debenture of LKR 4.5 Bn during the 4th Quarter of the year 2020.In order to support future growth as a full-service retail bank, the Bank has consistently maintained a capital ratio above the Basel III minimum capital requirements. As at 31 December 2020, the Bank recorded Tier I and total capital adequacy ratios of 10.82% and 15.76%, respectively, which are well above the minimum regulatory requirements of 8% and 12% including Capital Conservation buffer of 2%.

Credit quality

Following The Bank’s prudent lending policies, it did not pursue aggressive growth particularly in sectors that exhibited stress. During the year, the Bank had a moderate growth in its loan book covering corporate, retail, and small and medium-size business segments. The expansion into new geographical areas and new customer segments increased the challenge to maintain a sustainable risk profile. The Bank continued to improve its pre and post credit monitoring mechanisms through changes to internal processes and timely actions. This has brought positive results in maintaining credit quality amidst stressed economic situation.

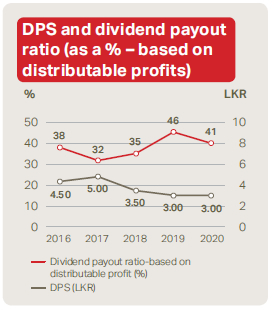

Dividend policy

The banking industry faced many challenges during the year from both the business and regulatory fronts due to the global pandemic. The adverse business environment became constraints for the growth of returns on equity. The minimum capital requirements became more stringent with the adoption of BASEL III. The Bank’s dividend policy seeks to maximise shareholder wealth whilst ensuring there is sufficient capital for expansion as it leverages its island-wide presence and investments in technology. Accordingly, the Board of Directors has approved a final dividend of LKR 3.00per share in the form of a scrip dividend for the year ended 31 December 2020, balancing the needs of shareholders with business plans. Accordingly, the dividend payout ratio for the year ended 31 December 2020 is 41% on the distributable profit.

Group performance

The DFCC Group consists of DFCC Bank PLC and its subsidiaries; DFCC Consulting (Pvt) Limited, Lanka Industrial Estates Limited (LINDEL), Synapsys Limited, its joint venture company Acuity Partners (Pvt) Limited (Acuity) and its associate company National Asset Management Limited (NAMAL). LINDEL is a 31 March reporting entity whilst the others are 31 December reporting entities. For the purpose of consolidated financials, 12 months results from 1 January to 31 December 2020 were accounted for in all Group entities. Financials of the 31 March entity was subject to a review by its External Auditor covering the period reported.

The Group made a profit after tax of LKR 2,847 Mn during the year ended 31 December 2020. This is compared to LKR 2,300 Mn made in the year 2019. DFCC Bank accounted for majority of the Group profit with profit after tax of LKR 2,388 Mn while LINDEL (LKR 208 Mn), Acuity (LKR 407 Mn), Synapsys (LKR 7 Mn) and DFCC Consulting (LKR 12 Mn) contributed positively by way of profit after tax to the Group. In the previous year, Synapsys, Acuity, DFCC Consulting and LINDEL reported profit after tax of LKR 36 Mn, LKR 190 Mn, LKR 11.6 Mn and LKR 177.6 Mn respectively. The associate company, NAMAL contributed LKR 0.6 Mn to the Group, compared to LKR 1.3 Mn in the year 2019. An Inter-company dividend of LKR 139.3 Mn was paid to DFCC Bank by LINDEL (LKR 85.8 Mn), DFCC Consulting (LKR 3.5 Mn) and Acuity (LKR 50 Mn) during the year.

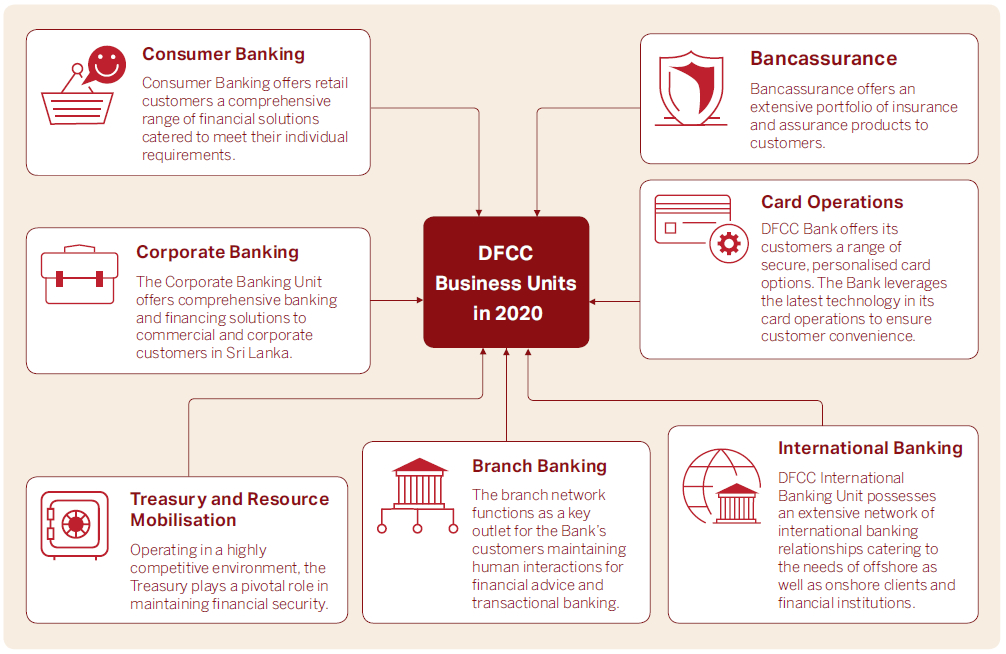

Consumer Banking

Retail banking

DFCC Bank offers a comprehensive range of financial solutions to its retail customers catered to meet their individual requirements. Customers can avail themselves of flexible financial solutions including personal loans, overdrafts, housing loans, vehicle loans, leasing, pensioners’ loans, and education loans. A range of attractive deposit products are also available that cater to individuals across target segments. Within the corporate structure, Retail Banking is divided into two separate units for assets and liabilities.

Assets

Housing loans

Housing loans are an integral part of DFCC’s retail lending portfolio and the consumer banking offering. Housing loans are offered to fixed income earners and professionals in the private and government sectors, as well as entrepreneurs. The product offering is extended to build, buy, or renovate one’s home, purchase a block of land, or a condominium apartment. DFCC Bank’s housing loans have the unique selling proposition of service, flexibility, and attractive interest rates.

Performance in 2020

Despite the healthy start at the beginning of the year, the portfolio experienced a lag by the end of Q1 due to the COVID-19 pandemic. Many industries, including travel and leisure, were affected by the pandemic and many lost their livelihoods.Although fixed income earners recovered quickly from the aftermath of the first wave of the pandemic, the challenges encountered by SME/self-employed individuals continued. Moratoriums were extended to the customers who requested them in accordance with the Central Bank guidelines, while the Bank also accommodated moratoriums to those in need who did not meet the CBSL criteria.

The low interest regime came as a much-needed boost to the industry, thus making home ownership more affordable. The Bank took advantage of the low interest rates coupled with a host of attractive offerings and was able to attract many new customers looking at investment opportunities in residential real estate. The real estate industry witnessed a buyer’s market and attracted cash-rich investors to invest in real estate. The Bank introduced pre-approved housing loans with credit approval in just three working days, thus offering customers incredible convenience.

Despite the many challenges brought on by the pandemic, the Bank successfully launched several tie-ups with property developers during the year with special packages for selected projects such as Tri-Zen, Marina Square, Colombo City Centre, and Havelock City. The special packages included features such as grace periods, early settlement fee waivers, structured payment plans, and higher bank contribution on the investments. The Bank entered into MOUs with Tri-Zen by John Keells Properties and Havelock City by Mireka Homes to offer customers better financial solutions when purchasing apartments from the respective condominium projects.

The Bank’s team of experienced and trained staff throughout the branch network will ensure that the customer experience remains hassle free. Furthermore, understanding the busy schedules of its customers, the Bank is fully geared to serve them at their doorstep, thus saving them valuable time and money.

Outlook

Given that the real estate industry is currently experiencing a buyer’s market and interest rates are at low levels, the Bank expects a boost in the housing loan portfolio in 2021.

Leasing

DFCC Bank provides leasing solutions for SMEs, professionals, and individuals. As a pioneer in the leasing industry, DFCC Leasing carries a strong brand presence throughout the country with relationships that have thrived over generations. DFCC Leasing has been the core source of funding for many SME success stories.Leasing continues to be the core strength of the retail offering at DFCC Bank, with the largest contribution to the consumer asset book.

Performance in 2020

With the COVID-19 pandemic having a significant impact on the economic activities of the country and restrictions imposed by the Government on vehicle imports, the Bank’s leasing portfolio grew by 14% during the year 2020.

The Bank was committed to financially assisting leasing clients by providing moratoriums in line with the instructions of Central Bank of Sri Lanka. Customers in many sectors were affected by the COVID-19 pandemic and benefited from the concessions provided by the Bank.

It was not all doom and gloom as the second-hand market proved to be highly active, thus paving the way for many financing opportunities. Overall, the product did well despite the lockdown periods. The portfolio growth stemmed from both fixed income as well as the SME sectors. The majority of the leasing business for the Bank comes from out

of Colombo.

The Bank introduced an asset-based pricing model for the leasing product during the year, making its leasing offering more competitive in the market. The Bank launched many internal campaigns to motivate the Bank’s branch and sales staff, which reeled in the desired results.

Outlook

In 2020, the Bank’s focus was to maintain a healthy leasing portfolio while assisting its customers through the turbulent environment. The Bank will continue to maintain the growth momentum of the leasing portfolio by reaching to new market segments as well as working with its existing clientele in 2021.

Personal loans

Performance in 2020

The personal loans portfolio recorded a healthy growth of 34% in 2020.

The Bank offers a gamut of personal loan facilities for different individual segments catering to various needs. The circumstances during the year were challenging and customers faced many issues such as delays in receiving salaries, salary cuts, and loss of employment. Moratoriums were granted in accordance with the Central Bank guidelines as well as with increased flexibility to support the Bank’s customers.

Technology played a key role in helping the Bank to continue its functions and serve its customers throughout the lockdown periods. While workarounds were found for many processes, some processes which require the manual execution of documents had to be

held back.

A new personal loan product, the DFCC One Loan, was launched during the year to meet the need of the hour. The Bank had several individual customers, salaried and professionals, who found it difficult to service their liabilities due to the COVID-19 pandemic. The product provided these individuals an opportunity to consolidate their debt with an extended repayment period, while also being spared the hassle of settling multiple financial institutions on a monthly basis. The product was very well received, which is reflected in the growth numbers.

A loan scheme was launched for the Government pensioners to meet the needs of the segment with a comfortable monthly commitment coupled with an attractive rate of interest. The product had an extremely satisfactory response from the market.

A high-end loan product was also designed for DFCC Pinnacle customers with an extended loan tenure coupled with a host of offerings entitled to the Pinnacle segment. The Bank also continued to focus on professionals with special offerings to suit their requirements, as well as tailor-made salary offerings to employees in line with the Salary Plus and Prestige propositions. Education loans were also promoted with tie-ups with leading educational institutions.

Throughout the year, ATL, BTL, and digital campaigns were carried out as a communication platform for all personal loan segments.

Outlook

The Bank will continue its growth momentum in the personal loan segment with innovative offerings. Digital banking will play a vital role in offering customer convenience and service. The Bank will also continue to serve customers at their doorstep, while striving to further enhance customer satisfaction.

Gold-pledged lending

Performance in 2020

The “DFCC Ranwarama” pawning facility offered throughout the Bank’s branch network allows customers to pawn their gold or gold jewellery to meet their urgent cash requirements. The global gold prices reached its all-time high in Q3, resulting in one of the best years in the history of pawning for the Bank. The product recorded an exceptional growth of 30% in 2020 with a record performance. The Bank’s offering has been the best in terms of advance values and service.

Outlook

With DFCC Pawning, one does not only receive value for their gold but also safety for their most valued possessions. Despite an intensely competitive playing field, the Bank’s customer service is a key differentiator. The Bank will continue in its endeavours to grow the Gold portfolio in 2021.

Liabilities and trade business

The Liabilities and Trade Business Development Unit drives the growth of deposits and trade business across the Bank. The Unit works closely with the branch network and sales team to develop and implement strategies and key initiatives to achieve its goals.

Liabilities

Performance in 2020

Overall branch banking liabilities grew to LKR 214,410.2 Mn as at 31 December 2020 from LKR 126,876.5 Mn as at 31 December 2019.

The Bank’s promotional activities were focused heavily on building up CASA during the year to grow the deposit base. This was primarily done to reduce the Bank’s cost of funds in order to improve the competitiveness of the lending products.

Several key business initiatives and marketing campaigns were conducted throughout the year to give high priority for deposit mobilisation. A special

proposition was developed and rolled out during the first wave of the pandemic, offering relief through high interest rates on fixed deposits for customers above the age of 55 years. The campaign was a tremendous success and received a highly favourable response from customers.

DFCC Bank was one of the first banks to launch the Special Deposit Account immediately after the CBSL guidelines were issued to increase foreign currency inflows to the country. Awareness was created among overseas client segments using social media and digital marketing, and the Bank was able to attract a significant amount of deposits under this proposition in different currencies from customers across

the world.

The DFCC Teen account was launched during the year by offering many attractive benefits to the teen segment. Several offline and online initiatives were implemented to increase financial literacy among children in partnership with many schools and educational institutions. Key business initiatives were carried out to coincide with World Children’s Day and the Thrift Month, where the DFCC Junior account achieved high level of visibility and business benefits.

Outlook

The Bank will continue to introduce new deposit propositions to different customer segments after carefully studying and understanding their needs. Special focus will be given to integrate the latest technologies with these propositions and make them attractive and unique in the market.

Trade business

Performance in 2020

Branch banking import limits grew 10% during the year, while export limits experienced a 22% growth in 2020.

Key import and export client segments were identified and engaged through highly focused initiatives. Customised propositions were extended to different sectors based on their business cycles and requirements. A selected team of staff from the branch network were deployed to give special focus in growing the trade business under close central supervision. Utilisation of trade facilities continued to remain at high levels due to close follow-up and monitoring.

Outlook

Despite the pandemic situation and import restrictions having a negative impact on trade business, the Bank remains confident of achieving its targets through new customer acquisition on a continuous basis and through increasing trade volumes of existing customers.

Corporate Banking

The Corporate Banking Unit offers banking and financial solutions to corporate customers in Sri Lanka. The Unit’s dedicated team of Relationship Managers serve large corporates and middle market enterprises, the public sector and non bank financial institutions. Corporate Banking solutions include working capital financing, trade financing, term funding, mergers and acquisition financing, cross border financing and transaction banking which includes payment and cash management solutions.

Performance in 2020

The Corporate Banking Unit grew the asset portfolio by 8% YoY compared to the 6% asset growth in 2019.

The overall deposit base of Corporate Banking Unit recorded a 10.5% growth from the previous year. The business unit continued to make noteworthy contribution to the Bank’s CASA base reporting a YoY growth of 16.6% with the acquisition of several high-volume CASA clients during 2020.

The Non-Funded Income (NFI) remains a key focus area in line with the overall business growth strategy of the Bank.

To be in line with the Government’s initiatives to support corporates impacted by COVID-19, the Unit offered working capital financing under the CBSL “Saubhagya” loan scheme for eligible sectors. The Unit also provided moratoriums to clients as per the instructions of CBSL and further relief measures outside of the CBSL scheme.

The Unit managed to achieve some landmark transactions during the year, including large ticket deals involving mergers and acquisitions and project financing.

Outlook

It is expected that the Unit will finance the expansion of businesses in the post-COVID era and continue to support corporate customers and business growth. The Unit views the financing of exporters as a crucial element of supporting the country’s economic recovery. Government-driven infrastructure development will also have a direct and indirect impact on the Bank’s construction sector clients and suppliers to construction companies. The Unit also sees opportunities in renewable energy and infrastructure projects, as well as mergers and acquisitions financing.

The Unit will aim to deepen existing relationships, increase wallet share by enhancing the income streams from customers, and seek reciprocity as an important requirement on all mandates. We will continue to leverage on our Payments and Cash Management proposition to drive CASA in 2021.

Treasury

DFCC Bank’s Treasury function is built on three pillars: The Front, Middle and Back Office.

The Treasury Front Office (TFO) reports directly to the Head of Treasury and is the income generating unit. Proprietary trading in foreign exchange and fixed income securities, income through customer-related transactions, and interest income from investments are the major avenues through which the Treasury Unit generates revenue. Furthermore, the Unit is responsible for managing the Bank’s liquidity ratios and several key regulatory ratios.

The Treasury Middle Office (TMO) is the pillar that engages in risk monitoring and reporting of TFO activities based on Board-approved limits, controls, and regulatory guidelines. The TMO independently reports to the Chief Risk Officer (CRO).

The Treasury Back Office (TBO) is the pillar that prepares, verifies, and settles all transactions executed by the TFO. The TBO independently reports to the Head of Finance/Chief Financial Officer (CFO).

Performance in 2020

The COVID-19 global pandemic had an adverse market impact on an unprecedented scale in 2020. In this light, the Treasury’s income generation through customer-related transactions were affected due to lower volumes, mainly brought about by import restrictions and island-wide lockdowns. This also led to lacklustre interbank markets. Fixed income securities trading activities however benefited by the steep drop in interest rates as the Government attempted to stimulate the credit growth through a lower interest rate regime.

At the height of the COVID-19 enforced lockdowns, through the use of digital technologies, the Treasury unit managed to perform its daily operations remotely without any disruptions, lapses, or complaints. Despite the many challenges 2020 brought, the Treasury Unit successfully concluded the year on a high note by overachieving the annual targets, contributing significantly to the Bank’s bottom line.

Outlook

Threats from the macro environment will continue to contribute to the uncertainty in 2021 while the downgrade in the country’s sovereign rating may also exacerbate challenges associated with external borrowing opportunities. However, the Treasury is optimistic that the markets will eventually bottom out and create new opportunities in 2021. The Treasury Unit consists of a team of experienced dealers and is well poised to provide its existing and newly onboarded clients with superior customer service.

Resource Mobilisation Unit

Falling under the direct purview of the Head of Treasury, the Resource Mobilisation Unit manages the Bank’s term funding, inter alia, credit lines, syndicated loans, the Bank’s equity portfolios related to strategic and non-strategic investments, investments in unit trusts, underwriting activities, and local and international debt issuances. The Unit coordinates with rating agencies in their reviews of the Bank’s National and International Rating. The Unit also supports the Bank’s budgeted growth by leveraging the relationships the Bank has built over time to secure funding at attractive terms.

The Unit raised over LKR 15,690 Mn in medium to long-term funds during the period under review.

Outlook

The Unit plans to expand its current scope of activities by taking over the existing margin trading activities and the proposed custodian banking service under its wings. The margin trading activity, which is currently limited to the Pinnacle Centre clients of the Bank,

is to be expanded across the entire branch network.

DFCC Bank’s equity investment portfolio

As per the IFRS 9 guidelines, the equity portfolio is broadly divided into two categories. They are investments measured at fair value through profit and loss (FVTPL) and fair value through other comprehensive income (FVTOCI).

As at 31 December 2020, the combined cost of investments in DFCC Bank’s holdings of quoted shares [excluding the investment in the voting shares of Commercial Bank of Ceylon (CBC) PLC], unquoted shares, and unit holdings amounted to LKR 1,911.36 Mn. Corresponding fair value of the same portfolio stood at LKR 2,344.47 Mn.

Composition of the equity portfolio as at 31 December 2020

| Cost LKR Mn |

Fair value LKR Mn |

|

| Quoted share portfolio – FVTOCI (excluding CBC voting) | 1,364.09 | 1,520.94 |

| Quoted share portfolio – FVTPL* | 33.81 | 44.88 |

| Unit Trust portfolio* | 506.16 | 564.84 |

| Unquoted share portfolio | 7.30 | 213.81 |

| Total | 1,911.36 | 2,344.47 |

* Reflects the original investment cost

A part of the quoted share portfolio and unquoted share portfolio mentioned in the above table is carried at fair value through other comprehensive income on the statement of financial position, while Unit Trust portfolio and part of the quoted portfolio have been categorised under fair value through profit and loss.

During the period under review, the Bank divested a part of its mature stocks in quoted shares and Unit Trust investments, thus realising a capital gain of LKR 204.25 Mn. Furthermore, the Bank recorded unrealised capital gains of LKR 11.07 Mn to the profit and loss statement through the portfolio categorised under FVTPL. The Bank also made new investments in quoted shares to the value of LKR 540.58 Mn and LKR 2.5 Bn in unit trust investment.

DFCC Management sought approval to reclassify the Commercial Bank of Ceylon (CBC) equity portfolio recorded under fair value through profit and loss into the portfolio of fair value through other comprehensive income. Approval was granted by the Central Bank of Sri Lanka and the Technical Committee of CA Sri Lanka. Accordingly, the portfolio was reclassified and recorded under the category of FVTOCI from the 1st quarter of 2020.

Subsequent to the reclassification, the corresponding value of the investment in CBC categorised under fair value through other comprehensive income stood at LKR 10,778.61 Mn, against a cost of LKR 8,133.66 Mn.

Outlook

Given the current and expected positive momentum in the equity market, the Unit is optimistic that the year 2021 will be a year of opportunities.

Branch Banking

The DFCC Bank branch network is a key outlet for the Bank’s customers, playing a vital role in maintaining human interactions for financial advice and transactional banking. As DFCC expands its physical presence across the island, the Bank grows its different customer segments, including the retail, SME, and MSME categories.

Performance in 2020

The COVID-19 pandemic challenged how branch banking had to operate in the context of social distancing. Adhering to all health and safety guidelines, the branch banking team across the island was committed to offer a seamless banking experience to all its valued customers. The Bank took steps to make the lives of its customers easier by bringing a mobile ATM to their doorstep during the lockdown period and having Bank branches open from 9am to 12noon.

Despite all the challenges in 2020, Branch Banking grew 13% in loans and advances and the consumer segment grew 18%. Deposits grew by 38% in 2020 with a CASA ratio of 20% in the same period.

The branch network continued to expand with the opening of a flagship five-storey branch in Kurunegala and the state-of-the-art Pinnacle Centre in the heart of Colombo. DFCC Bank also relocated the Kiribathgoda, Malabe, and Moratuwa branches for the convenience of its customers. With the opening of the state-of-the-art DFCC Pinnacle Centre in Colombo 07, DFCC Bank elevated its exclusive service offerings aimed at affluent customers who maintain deposits over LKR 10 Mn. The Pinnacle proposition offers customers a range of products and services with bespoke financial services.

Outlook

The Bank took a more focused approach in segmenting the retail customers by way of catering to the needs and aspirations of each target group. The Salary Plus segment focused on engaging the mass salaried customers to assist in their financial requirements to uplift their living standards and enable them to reach their life goals. The Salary Partner proposition is aimed at the upper mass segment of customers, catering to the needs of the life builders and life creators. The next proposition is Prestige, where the Bank introduced tailor-made efficient banking solutions creating aspirational values. In creating a distinct brand identity and exclusivity to cater to the affluent segment, the Premier proposition was revamped and upgraded to the Pinnacle proposition with the aim of providing an unparalleled experience to the clientele.

Although the COVID-19 pandemic hampered promotional efforts around the refreshed Pinnacle proposition, it did not dampen the response to the new premium offering. Footfall has tripled since the new branch opened and raised the profile of the Bank.

The Pinnacle Banking Unit grew its client base by 30% in 2020 and registered a growth of 42% in deposits and 35% in advances.

MSME’s

DFCC Bank remains true to its roots as a specialised development bank, being a growth partner for businesses of all sizes. The Bank recognises that the MSMEs of today could be the big businesses of tomorrow and acts as financier and growth partner to support their sustenance and expansion and catalyse outcomes. As part of the Bank’s commitment to foster financial inclusion, the MSME Division was established in 2016 to support small entrepreneurs and self-employed citizens to operate and grow their businesses from the ground up.

As the MSME sector is generally considered a risky segment and underserved, DFCC Bank recognises that by focusing on meeting the financial requirements of smaller businesses, the outstation branches can build a pipeline of customers that will become a part of the retail base. The MSME Unit offers two key products to the MSME sector: small business loans, which are similar to the developmental loans that DFCC Bank historically provided as a development bank, and value chain financing, which is a novel approach to sustainably financing the value chain that enables the growth and increased competitiveness of stakeholders across the value chain. DFCC Bank also partners with the CBSL and various international agencies such as the International Fund for Agricultural Development (IFAD) through the Smallholder Agriculture Partnership Programme (SAPP) attached to the Ministry of Agriculture to provide farmers with additional funding through grants. This helps to increase productivity and savings, which can be used to improve the education of their children and build better sanitary facilities.

The MSME Unit’s approach is to work closely with the partners of key value chains such as tea smallholders, tea factories, dairy farmers, milk collectors, and dairy processing companies. The Unit’s staff are actively engaged in selling small business loans where they can create the most beneficial impacts. For agri financing, the Unit targets progressive farmers who use high quality inputs and sophisticated farming practices and employ smaller farmers and workers in the community. This helps to mitigate the risks that would normally be associated with such a business model, while ensuring that communities can also develop sustainably.

Performance in 2020

The MSME Unit works with tea smallholders and small scale dairy farmers and continues to look for opportunities in new segments. In 2020, the Unit launched a supplier financing scheme, breaking into a relatively untapped market. Furthermore, the Unit also introduces these customers to other products from the Bank such as deposits and cards, thus developing and contributing to the Bank’s other lines of business.

The combined impact of the 2019 attacks and the global pandemic took its toll on some small businesses, leading some to shut down. However, the moratorium helped most businesses and many were able to recover. The Unit achieved its targets during the year, despite hindrances. Approximately half of the Unit’s portfolio is split between agriculture and MSMEs, with approximately half of MSME loans being focused on agriculture. The Unit also focused on farmers who primarily cultivate food crops and sugar cane, which has proven to be a successful initiative.

The Bank approaches MSMEs differently to other NBFIs and banks that service the sector by offering larger loans averaging approximately LKR 350,000. The Unit deals with a large volume of small ticket loans and can process up to 400 loans per month. This renders the traditional one-on-one loan appraisal mechanism quite inefficient, hence the Unit developed a new efficient mechanism to better serve the 7,000-strong customer base that it has built over the past four years.

Outlook

The Unit currently deals with many administrative processes that are complex and handled manually. The launch of the new core banking system will help the Unit to transform and transition to more digital workflows and adopt a data-driven model to drive the business forward. There will be an increased focus on growing the portfolio by acquiring relatively big MSMEs. In this regard, the Unit aims to be more customer centric through propositions and to work more closely with the suppliers of agriculture exports, who deal with high volumes but are underbanked. Customers will be provided with increased convenience through cash collection at their doorstep. The Unit will introduce a banking proposition enabling women to fully benefit from financial services and promote female entrepreneurship development; currently, 35% of MSME customers are female. Besides liability products, the Unit will also be promoting leasing products in 2021.

Challenges persist and are particularly harmful to this segment. The ongoing pandemic, the threat posed by climate change, import restrictions, and the macro environment creates uncertainty. However, the segment is resilient and current government policies are consistent, which is important as the segment’s strong health is vital to support the economy.

SMEs

The branch banking team committed to supporting SMEs affected by the COVID-19 pandemic by offering moratoriums and new facilities, including the “Saubhagya COVID-19” loan schemes to help revive their business ventures. “DFCC Sahanaya”, a DFCC Bank-funded credit line, was also launched to provide financial assistance to grow SMEs and support the economy.

Outlook

The Bank will continue to provide financial and advisory services to SMEs in many sectors including agriculture, exports, manufacturing, health, education, construction contributing to economic growth. In addition, the bank will render its support to SMEs who are affected by the pandemic to revive and sustain their business ventures.

There will be an increased focus on promoting environmental, energy, and sustainability-related projects and advisory services inline with the Bank’s sustainability goal of becoming a bank for Green Financing.

International Trade and Remittances

DFCC Trade and Remittances Unit is divided into five divisions namely Imports, Exports, International Remittances, Correspondent Banking, and Offshore banking to ensure the efficient and timely delivery of services to internal and external customers. Apart from the above, Lanka Money Transfer which handles worker remittance also operates as a separate business unit where operational functions are handled by Trade and Remittances.

Performance in 2020

The pandemic presented a more challenging business environment especially for the Import, export and remittance business due to the frequent changes introduced by the respective regulatory authorities to the existing import and export control regulations and foreign exchange regulations. Stringent import restrictions imposed by the regulatory body with a view of curtailing foreign exchange outflow of the country negatively impacted the main line of business including the Letter of Credit (LC) issuance for vehicle importation which account for substantial volume of the total business activities under normal circumstances. Apart from the regulatory aspects, strict isolation measures prevailed across the country mainly during the first quarter which severely impacted overall business activities. With the outbreak of the second wave in early October, restrictions imposed in most parts of Western Province caused slowdown in the recovery process. However, with the easing of these measures thereafter, near normal level business volumes were recorded during the latter part of fourth quarter.

Despite the import restrictions and other challenges, our team of experts were able to explore new avenues to facilitate the client’s requirements while ensuring all regulatory requirements are adhered to. New trade products/solutions were introduced to customers enabling them to overcome many difficulties faced due to the pandemic related global lockdowns and restrictions. We ensured branch/business units/customers are provided timely information and further educated the concerned parties on the latest changes and developments. Our efforts resulted in recording an increase of 2.19% in fee and commission income generated from trade and remittances business in year 2020 over the corresponding year of 2019.

The staff of the Unit worked tirelessly throughout the lockdown period overcoming various challenges and ensured uninterpreted functionality of the Unit. Working from home option was not possible for majority of the staff due to most of the trade related transactions are executed based on physical original documents and timelines of processing the documents are critical to the clients who run the risk of incurring financial losses for delays. The Correspondent Banking division played a vital role in strengthening the existing relationships with international banks and timely execution of trade transactions despite the international rating downgrading of the country. Furthermore, new correspondent banking relationships were established during the period strengthening our global presence

Outlook

The market continues to be challenging and the Unit remains mindful of the environment it operates in and undergoes continuous improvements and stays abreast of the latest market developments. Digitalisation of workflows is just one of the continuous improvements that the Unit is undertaking.

The Trade team is committed and geared to offer customised trade solutions according to ever changing dimensions of client requirements and help clients to take their businesses to the international arena beyond market boundaries while adhering to the changing nature of local regulatory requirements. We are hopeful business activities will record a slow recovery through the 2nd and 3rd quarter of 2021 while strict import restrictions are in place throughout 2021.

Remittances

The Lanka Money Transfer (LMT) platform is used to facilitate worker remittances to the country. DFCC Bank has representation in 12 countries through 24 exchange companies. This network enables funds to be transferred in real time from these countries to any bank account in Sri Lanka.

Performance in 2020

The pandemic did not appear to slow down worker remittance inflow to the country. In 2020, the Unit processed approximately 40,000 transactions worth USD 30 Mn, up from 36,000 transactions worth USD 32.4 Mn in 2019. The business continues to grow and the presence of the LMT platform is expanding to more countries, including UK, Japan, South Korea, Australia, Singapore, Hong Kong, and Israel.

Outlook

In 2021, six exchange companies in Italy, Australia, Japan, and Israel will be added to the LMT platform. DFCC Remittance Services will be signing up with MMBL Money Transfer to accept money transfers through Western Union, MoneyGram, and Ria Money Transfer.

Card Operations

Card operations at DFCC Bank revolve around three verticals: credit card issuance, debit card issuance, and merchant acquisition.

Performance in 2020

In 2020, the team introduced different credit cards aimed at several tiered salaried segments, launched co-branded cards, and the Pinnacle card to affluent customers to add more diversity to the card portfolio mix. Several initiatives were undertaken to improve the issuance of cards through the implementation of a workflow system to electronically submit applications, thus improving the processing efficiency, and submitting the card application via the Bank’s website which made it easier for customers to apply for a card online without having to visit a branch during the lockdown. To increase the convenience of transactions, the Automated Bill Settlements mode was launched for cardholders to make recurring payments, card payments were enabled 24x7 through CRMs and ATMs, the DFCC Pay app was launched to support digitally enabled electronic transactions, and credit card features were added to DFCC Virtual Wallet. To drive cardholder spend, several value-added discounts were offered at specific merchants and additional CashBack percentages were offered for the affluent card base on specific categories to drive the card’s top of mind recall.

Debit cards were converted from magstripe to chip cards and new features such as tap and pay and online purchasing were introduced. Two new card designs were introduced, including a vertical design for Platinum cardholders. Similar to how the credit cards business was segmented for different propositions, the debit cards business also underwent a similar segmentation so that the cards better reflect each customer segment. There are over 100,000 debit cards in force.

Merchant acquisition is the newest focus of the card operations team. The Point-of-Sale machines to accept payments for goods and services were launched to the market alongside the option to facilitate instalment payment plans directly from the terminals. A sharing arrangement to accept AMEX cards was also implemented. The QR payment acceptance drive was also fully enabled with the Bank actively being involved in the CBSL-driven initiatives to popularise cashless payments. Currently, approximately 562 terminals are out in the market.

Recognition of DFCC Bank is shifting away from being viewed as a development bank and more towards being a fully fledged commercial bank. The card operations team has worked hard at boosting this recognition and looked at reaching out to new segments in offering the Bank’s cards. The government sector was just one of the segments that the Bank focused on with great success. The corporate cards were also revamped after the team identified how customers ideally wanted to use them.

The CBSL implemented a series of measures for banks to ease pressures on Sri Lankans during the pandemic. As a relatively new entrant to the market, these measures were passed on diligently to cardholders, though it impacted the business’ bottom line.

The cards in force steadily grew to 35,102 and the cardholder spend surpassed LKR 4.2 Bn, indicating that the cards are resonating in the cardholders’ minds. The cards portfolio grew to LKR 2.2 Bn, which is also a significant indicator of the cardholder stickiness towards the brand.

Outlook

2020 was a year of looking at the market and the Bank’s offerings in a new light; 2021 will be a year of scaling up the card issuance and merchant acquisition operations. The new core banking system will incorporate many aspects for the cards business which will greatly increase efficiency, visibility, and facilitate enhanced system functionalities. The card operations team will start card personalisation locally, complete the addition of MasterCard to its portfolio and card acceptance devices, implement further QR code functionalities, launch an Internet Payment Gateway service, and revamp the DFCC Pay app to add scalability and progress with launching co-branded cards. The team will continue to focus on popularising tailor-made products and services to unbanked and under banked segments in the country.

Bancassurance

Established in 2014 to diversify the Bank’s operations to drive the “other income” segment while safeguarding its mortgage assets, customer wealth and their well-being, the Bancassurance business offers an extensive portfolio of insurance and assurance products to customers.

The product portfolio includes long-term solutions such as life insurance, pension plans, higher education plans, protection covers, and wealth management solutions. Short-term solutions include asset cover products such as motor insurance, fire insurance, marine covers, machinery covers, hospitality covers, etc. The Bancassurance Unit offers hassle-free claim settlements, bespoke insurance packages, and free consultations to its customer base and product customisation to meet their specific needs and requirements.

The Bancassurance Unit works to raise awareness on personal well-being, wealth planning, wealth management, and risk mitigation associated with businesses to its customers. The Unit has a partnership with the Bank’s long-term life insurance partner, AIA Insurance Lanka Ltd, to provide life insurance, and general insurance solutions are sourced through all reputed insurers in Sri Lanka by the Bank’s appointed insurance broker.

Performance in 2020

The Bancassurance Unit facilitated 18,067 non-life policies in 2020 and successfully negotiated claims amounting to LKR 98.4 Mn for both life and non-life policies. The Unit initiated 2,462 life cover policies during the year.

As the pandemic started to grip the nation, the Unit was still feeling the effects of the 2019 Easter Sunday attack. General insurance took a great hit as it is tied to loans and leases disbursed by the Bank, which did not meet expectations. However, the Unit was able to maintain income levels due to strong renewals, with approximately 80% of existing business being retained.

The shift to working from home brought its fair share of challenges but it also brought about innovation in the way the Unit handles business; Partner AIA Insurance developed an Adobe digital signature workflow so that contracts could be signed via email. This has helped to accelerate the processing of smaller policies tremendously.

The first ever virtual AIA-DFCC CEO’s Club Awards Night was held on Microsoft Teams to recognise and celebrate the Bank’s staff for their exceptional achievements in providing protection to the Bank’s customers.

The Bank held 64 Bancassurance Month events, including customer forums, across the branch network. Approximately half of the events were conducted through virtual platforms due to the pandemic and contributed to the recovery and uptick of business in Q3 and Q4 2020.

Outlook

Although the Bancassurance Unit’s efforts were hampered by the pandemic during 2020, much like other insurance companies, the Unit will target an LKR 1 Bn top line from General insurance in 2021. The market remains ripe for exploration and the Bank is exploring several innovative options to grow the business, including looking to Sri Lankans living and working abroad. Life insurance penetration in the country remains low but the pandemic has the potential to help those with disposable income to consider investing in insurance, and the Unit will continue to target such potential customers as well as increasing the appeal to a wider base through convenient facilities such as instalment schemes and credit card cashback offers.

Onboarding customers through digital channels such as the Bank’s website, Virtual Wallet, and ATM machines is being developed to boost the sales of smaller policies. Leveraging technology will be key to enhancing the performance of the Unit going forward, such as using data analytics to better identify what kind of products are suited to specific customers. The Unit is also looking into using the Call Centre and SMS platform to raise awareness of insurance products and capture leads.