Business Model

Strategic Direction and Outlook

The Bank has formulated a strategy that determines its direction and scope in the short, medium, and long term. The strategy has been designed with developing resilience in a constantly changing operating environment in mind and thus building a sustainable bank. Development of the strategy took into consideration the Bank’s business model, the market environment, the Bank’s stakeholder relationships, material issues, as well as the vision, mission, and values of the Bank.

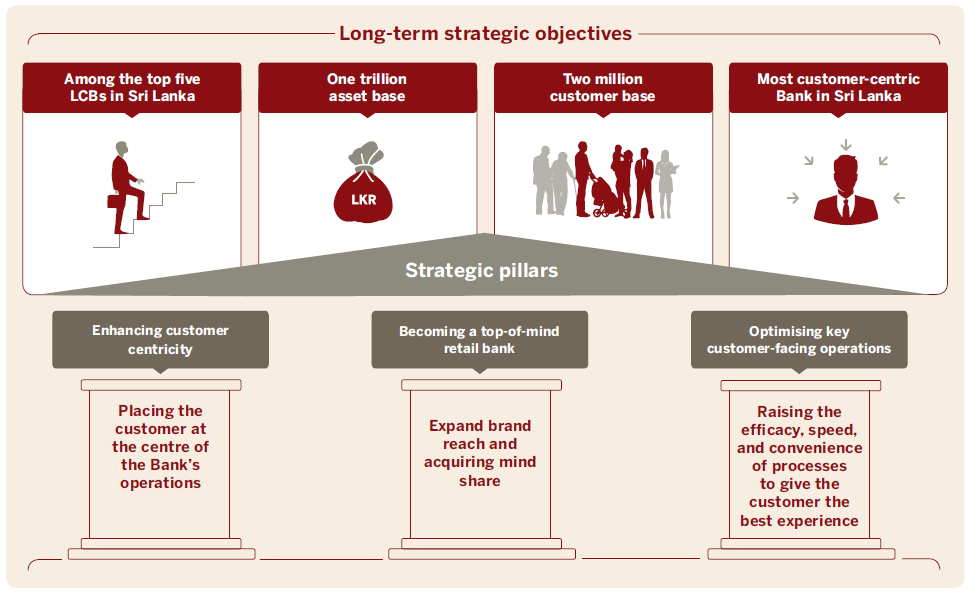

In 2019, the Bank introduced a new strategic framework, Vision 2025. The strategy outlines the Bank’s objectives and the goals it wishes to achieve by 2025: to be among the top five commercial banks in Sri Lanka; to achieve LKR 1 Tn asset base; to grow the Bank’s customer base to two million; and to become the most customer centric bank in Sri Lanka. Vision 2025 is built upon three strategic pillars: enhancing customer centricity; becoming a top-of-mind retail bank; and optimising key customer-facing operations.

Vision 2025

Key to ensuring that the Bank achieves its goals is its continued investment in its people, processes, and the tools to implement its strategy and monitor its progress. In 2020, the Bank accelerated certain aspects of its strategy as a result of the pandemic shifting priorities. Google Workspace was implemented during the year and played a critical role in the shift to working from home. The new core banking system will be launched in 2021 and will further facilitate the Bank’s digital-first approach and augment its operational, digital, and data-related capabilities.

Strategic outlook

When the Bank crafted its Vision 2025 strategy, the world was a vastly different place. However, the strategy was designed to allow the Bank to be agile and flexible during times of turmoil and this aspect of the strategy was put to the test during 2020. The digitisation of the Bank had to be significantly accelerated to accommodate the new restrictions and requirements that were imposed due to the pandemic. Simultaneously, new guidelines, controls, and directions by regulators as well as the economic realities meant that the Bank’s plans

had to be re-engineered to work with

the new norms.

Aspects about the industry that the Bank had previously assumed would become the norm by 2025, such as the digital-first approach and branchless banking, became the norm in 2020. The Bank had to rework its plans while also accommodating the almost overnight shift to working from home. Although these changes occurred sooner than anticipated, they were still aligned with the long-term goals of the Bank’s strategy. The focus on certain sectors also had to be re-evaluated for the transformed operating environment. Sectors such as the leisure sector had to take a backseat while priority was given to other sectors that were considered critical, such as the agriculture, pharmaceutical, IT, education, service, export, and other essential sectors.

To deal with the pandemic, the Bank established the “War Room” initiative, a centralised command centre where project teams could co-locate and visually communicate project activities. Four key focus areas and teams were established through the initiative: deposit mobilisation, manage debt moratorium, cost optimisation, and strengthen alternative channels.

Deposit mobilisation

The team prioritised bringing deposits and building the Bank’s liability base in the aftermath of the pandemic by identifying the key sectors that will emerge and sustain themselves in the short to medium term.

Manage debt moratorium

The team was dedicated to managing customers who utilised the moratoriums to ensure that obligations were fulfilled by the end of the moratorium period and non-performing loans were kept to a minimum, while assisting customers in fully utilising the benefits of the CBSL’s support schemes.

Cost optimisation

The team focused on improving the Bank’s cost-to-income ratio and executing cost-saving activities across the Bank.

Strengthen alternative channels

The team focused on adapting to and capitalising on the alternate channels that were embraced during the pandemic, including digital, cards, and the Contact Centre. The Contact Centre played a crucial role in serving customers remotely and ensuring that customer-facing processes continued smoothly, as well as proactively reaching out to customers to generate business for the Bank.

The uncertainty that was present in 2020 is likely to continue well into 2021. The Bank will focus on helping its customers across all sectors to build back stronger for the post-COVID recovery and ensure business continuity. Special focus will be given to exports, services, and SMEs, as these will be critical to strengthening the country’s economy. The pandemic has also inspired the Bank to start thinking about new models of banking that diverge from traditional banking, as working from home and digital banking look set to continue for the foreseeable future. The Bank’s Pinnacle proposition aimed at high-net-worth customers was well received in 2020, as the Bank looked to providing customers with value-adding bespoke services and solutions that complemented their active lifestyles beyond the standard banking propositions. The Pinnacle proposition will continue to be expanded upon in 2021. Sustainability considerations will also play a bigger role in all aspects of the Bank’s operations and business as it works towards becoming the bank recognised for Green Financing by 2030.

As Vision 2025 proves itself to be a resilient strategy, 2021 will see the Bank continue its journey of becoming a data-driven, digital-first bank with a customer centric approach.