This note presents information about the Bank’s exposure to financial risks and the Bank’s management of capital.

8.1 Introduction and Overview

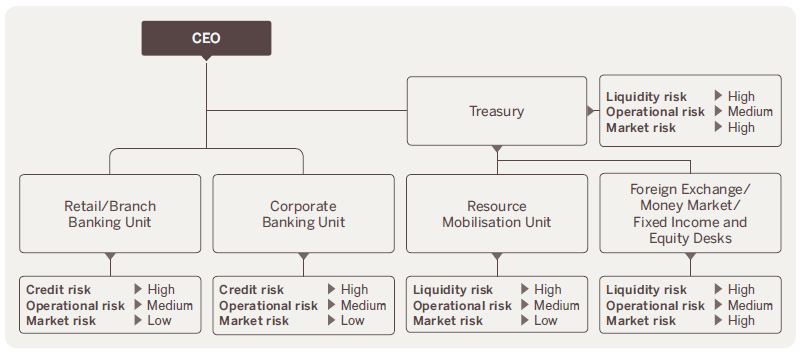

The Bank has exposure to the following key risks from financial instruments:

- Credit risk;

- Liquidity risk;

- Market risk; and

- Operational risks

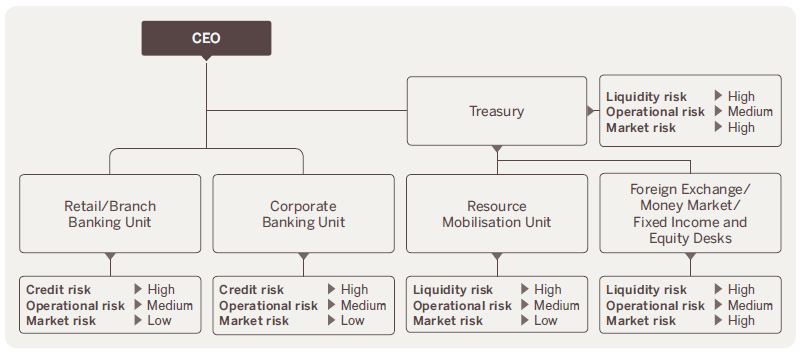

The following chart provides a link between the Bank’s main business units and the principal risks that they are exposed to. The significance of risk is assessed within the context of the Bank as a whole and is measured based on allocation of the regulatory capital within the Bank.

This note presents information about the Bank’s exposure to each of the above risks, the objectives, policies and processes for measuring and managing such risk.

Risk management framework

The Board of Directors has the overall responsibility for the establishment and oversight of the Bank’s risk management framework.

The Board Integrated Risk Management Committee (BIRMC) provides the Board, the assurance that risk management strategies, policies and processes are in place to manage events/outcomes that have the potential to impact significantly on earnings, performance, reputation and capital.

Bank’s risk management policies are established to identify and analyse the risks faced by the Bank, to set appropriate risk limits and controls, and monitor risk and adherence to limits. Risk management policies and systems are reviewed regularly to reflect changes in market conditions and the Bank activities. The Bank through its training and management standards and procedures, aims to develop a disciplined and constructive control environment in which all employees understand their roles and obligations.

Internal Audit undertakes both regular and ad hoc reviews of risk management controls and procedures, the results of which are reported to the Bank Audit Committee.

|

Page |

| 8.2 Credit risk |

|

| 8.2.1 Settlement risk |

175 |

| 8.2.2 Management of credit risk |

175 |

| 8.2.3 Credit quality analysis |

176 |

| 8.2.4 Collateral held and other credit enhancements |

177 |

| 8.2.5 Amounts arising from ECL |

179 |

| 8.2.6 Concentrations of credit risk |

182 |

| 8.2.7 Offsetting financial assets and financial liabilities |

182 |

| 8.3 Liquidity risk |

|

| 8.3.1 Management of liquidity risk |

183 |

| 8.3.2 Exposure to liquidity risk |

183 |

8.3.3 Maturity analysis for financial liabilities

and financial assets |

184 |

| 8.3.4 Liquidity reserves |

188 |

8.3.5 Financial assets available to

support future funding |

189 |

| 8.4 Market risk |

|

| 8.4.1 Management of market risk |

190 |

| 8.4.2 Exposure to market risk – Trading portfolios |

191 |

| 8.4.3 Exposure to market risk – Non-trading portfolios |

192 |

| 8.4.4 Interest rate risk |

192 |

| 8.4.5 Foreign exchange risk |

194 |

| 8.4.6 Market risk exposure for regulatory capital assessment |

195 |

| 8.5 Operational risk |

|

| 8.5.1 Capital Management |

195 |

8.2 Credit risk

Credit risk is the risk of financial loss to the Bank if a customer or counterparty to a financial instrument fails to meet its contractual obligations, and arises principally from Bank’s loans and advances to customers and other banks and investment in debt securities.

8.2.1 Settlement risk

The Bank’s activities may give rise to risk at the time of settlement of transactions and trades. “Settlement risk” is the risk of loss due to the failure of an entity to honour its obligations to deliver cash, securities or other assets as contractually agreed.

8.2.2 Management of credit risk

The Board of Directors, BIRMC and the Credit Committee are responsible for the oversight of credit risk. Management of credit risk includes the following:

- Formulating credit policies in consultation with business units covering collateral requirements, credit assessment, risk grading and reporting, documentary and legal procedures and compliance with regulatory and statutory requirements.

- Authority for establishing the authorisation structure for the approval and renewal of credit facilities is vested with the Board of Directors. Authorisation limits are allocated to business unit Heads. Approval by Branch Managers, Regional Managers, Head of Branch Banking, Head of Corporate Banking, Credit Committee or the Board of Directors would be required based on loan quantum and risk levels as appropriate.

- Reviewing and assessing credit risk: Bank credit assesses all credit exposures in excess of designated limits, before facilities are committed to customers by the business unit concerned. Renewals and reviews of facilities are subject to the same review process.

- Limiting concentrations of exposure to counterparties, industries (for loans and advances, financial guarantees and similar exposures), credit ratings and countries.

- Developing and maintaining the Bank’s processes for measuring ECL: This includes processes for:

– initial approval, regular validation and back-testing of the models used;

– determining and monitoring significant increase in credit risk; and

– incorporation of forward-looking information.

- Reviewing compliance of business units with agreed exposure limits, including those for selected industries, country risk, and product types. Regular reports on the credit quality of local portfolios are provided to bank credit, which may require appropriate corrective action to be taken. These include reports containing estimates of Expected Credit Loss (ECL) allowances.

- Providing advice, guidance and specialist skills to business units to promote best practice throughout the Bank in the management of credit risk.

Each business unit is required to follow Bank credit policies and procedures, and each business unit is responsible for the quality and performance of its credit portfolio and for monitoring and controlling all credit risks in its portfolios, including those subject to central approval.

Regular audits of business units and Bank Credit processes are undertaken by Internal Audit.

8.2.3 Credit quality analysis

The following table sets out information about the overdue status of loans and advances to customers in Stages 1, 2 and 3.

Loans to and receivables from customers at amortised cost – gross carrying amount

| As at 31 December |

2020 |

| In LKR '000 |

Stage 1 |

Stage 2 |

Stage 3 |

Total |

| Current |

183,303,084 |

8,446,879 |

2,200,563 |

193,950,526 |

| Overdue < 30 days |

65,112,665 |

9,292,992 |

2,618,816 |

77,024,473 |

| Overdue > 30 days |

2,302,688 |

24,412,315 |

19,542,611 |

46,257,614 |

| Total |

250,718,437 |

42,152,186 |

24,361,990 |

317,232,613 |

| As at 31December |

2019 |

| In LKR '000 |

Stage1 |

Stage2 |

Stage3 |

Total |

| Current |

182,849,726 |

5,014,881 |

5,427,262 |

193,291,869 |

| Overdue < 30 days |

34,802,427 |

3,459,297 |

1,043,267 |

39,304,991 |

| Overdue > 30 days |

6,368,696 |

28,894,745 |

17,364,492 |

52,627,933 |

| Total |

224,020,849 |

37,368,923 |

23,835,021 |

285,224,793 |

8.2.3.1 Gross carrying amount reports under Stage 2 above for the year 2020, include facilities amounting to LKR 5.4 Bn granted to Government Institutions, and are fully-guaranteed by Treasury. Accordingly no provision has been made in respect of these facilities. These facilities were classified under Stage 3 in 2019.

The following table shows an analysis of counterparty credit exposures arising from derivative transactions. Derivative transactions of the Bank are generally fully collateralised by cash. For further discussion of collateral and other credit enhancements:

|

Derivative type |

| As at 31 December 2020 |

Forward |

SWAP |

Spot |

Cross currency SWAP |

Interest rate SWAP |

Total |

| In LKR ’000 |

Notional

amount |

Fair

value |

Notional

amount |

Fair

value |

Notional

amount |

Fair

value |

Notional

amount |

Fair

value |

Notional

amount |

Fair

value |

Notional

amount |

Fair

value |

| Derivative financial assets (Note 1) |

8,874,370 |

30,895 |

39,541,236 |

276,665 |

81,690 |

27 |

11,852,637 |

527,877 |

– |

– |

60,349,933 |

835,464 |

| Derivative financial liabilities (Note 2) |

8,881,730 |

(28,002) |

39,512,159 |

(239,805) |

81,739 |

(76) |

– |

– |

– |

– |

48,475,628 |

(267,883) |

| Note1 |

|

|

|

|

|

|

|

|

|

|

|

|

| Derivative financial assets by counterparty type |

|

|

|

|

|

|

|

|

|

|

|

|

| With banks |

6,128,972 |

22,862 |

39,541,236 |

276,665 |

81,690 |

27 |

11,852,637 |

527,877 |

– |

– |

57,604,535 |

827,431 |

| With other customers |

2,745,398 |

8,033 |

– |

– |

– |

– |

– |

– |

– |

– |

2,745,398 |

8,033 |

| Total |

8,874,370 |

30,895 |

39,541,236 |

276,665 |

81,690 |

27 |

11,852,637 |

527,877 |

– |

– |

60,349,933 |

835,464 |

| Note2 |

|

|

|

|

|

|

|

|

|

|

|

|

| Derivative financial liabilities by counterparty type |

|

|

|

|

|

|

|

|

|

|

|

|

| With banks |

6,125,797 |

(17,276) |

39,512,159 |

(239,805) |

81,739 |

(76) |

– |

– |

– |

– |

45,719,695 |

(257,157) |

| With other customers |

2,755,933 |

(10,726) |

– |

– |

– |

– |

– |

– |

– |

– |

2,755,933 |

(10,726) |

| Total |

8,881,730 |

(28,002) |

39,512,159 |

(239,805) |

81,739 |

(76) |

– |

– |

– |

– |

48,475,628 |

(267,883) |

|

Derivative Type |

| As at 31 December 2019 |

Forward |

SWAP |

Spot |

Cross currency SWAP |

Interest rate SWAP |

Total |

| In LKR’000 |

Notional

amount |

Fair

value |

Notional

amount |

Fair

value |

Notional

amount |

Fair

value |

Notional

amount |

Fair

value |

Notional

amount |

Fair

value |

Notional

amount |

Fair

value |

| Derivative financial assets (Note 1) |

1,135,594 |

8,624 |

48,887,233 |

112,011 |

141,332 |

143 |

10,453,667 |

510,660 |

– |

– |

60,617,826 |

631,438 |

| Derivative financial liabilities (Note 2) |

1,128,050 |

(2,448) |

49,730,379 |

(516,127) |

141,346 |

(156) |

– |

– |

– |

– |

50,999,775 |

(518,731) |

| Note1 |

|

|

|

|

|

|

|

|

|

|

|

|

| Derivative financial assets by counterparty type |

|

|

|

|

|

|

|

|

|

|

|

|

| With banks |

749,746 |

3,684 |

48,887,233 |

112,011 |

141,332 |

143 |

10,453,667 |

510,660 |

– |

– |

60,231,978 |

626,498 |

| With other customers |

385,848 |

4,940 |

– |

– |

– |

– |

– |

– |

– |

– |

385,848 |

4,940 |

| Total |

1,135,594 |

8,624 |

48,887,233 |

112,011 |

141,332 |

143 |

10,453,667 |

510,660 |

– |

– |

60,617,826 |

631,438 |

| Note2 |

|

|

|

|

|

|

|

|

|

|

|

|

| Derivative financial liabilities by counterparty type |

|

|

|

|

|

|

|

|

|

|

|

|

| With banks |

748,576 |

(2,448) |

49,730,379 |

(516,127) |

141,346 |

(156) |

– |

– |

– |

– |

50,620,301 |

(518,731) |

| With other customers |

379,474 |

– |

– |

– |

– |

– |

– |

– |

– |

– |

379,474 |

– |

| Total |

1,128,050 |

(2,448) |

49,730,379 |

(516,127) |

141,346 |

(156) |

– |

– |

– |

– |

50,999,775 |

(518,731) |

8.2.4 Collateral held and other credit enhancements

The Bank holds collateral and other credit enhancements against certain of its credit exposures. The following table sets out the principal types of collateral held against different types of financial assets.

Type of credit exposure:

| As at 31 December |

2020 |

2019 |

|

Gross loan

balance

LKR ’000 |

Security

value

LKR ’000 |

Gross loan

balance

LKR ’000 |

Security

value

LKR ’000 |

| Stage 1 |

|

|

|

|

| Cash collateral |

13,448,486 |

21,939,627 |

13,138,299 |

19,652,804 |

| Property, plant and machinery |

88,492,471 |

234,118,285 |

78,982,483 |

198,003,781 |

| Treasury guarantee |

4,184,616 |

8,019,987 |

3,614,059 |

7,328,863 |

| Others |

85,911,585 |

12,780,184 |

75,268,404 |

8,615,689 |

| Unsecured |

39,410,513 |

– |

34,397,223 |

– |

| Total |

231,447,671 |

276,858,083 |

205,400,468 |

233,601,137 |

| As at 31 December |

2020 |

2019 |

|

Gross loan

balance

LKR ’000 |

Security

value

LKR ’000 |

Gross loan

balance

LKR ’000 |

Security

value

LKR ’000 |

|

|

|

|

|

| Stage 2 |

|

|

|

|

| Cash collateral |

1,186,142 |

1,453,731 |

1,360,633 |

1,702,338 |

| Property, plant and machinery |

16,774,823 |

36,954,269 |

21,482,134 |

53,779,650 |

| Treasury guarantee (Note 8.2.3.1) |

5,194,358 |

6,043,468 |

– |

– |

| Others |

11,042,254 |

43,659 |

10,216,504 |

1,328,826 |

| Unsecured |

3,489,676 |

– |

2,087,073 |

– |

| Total |

37,687,253 |

44,495,127 |

35,146,344 |

56,810,814 |

| Stage 3 |

|

|

|

|

| Cash collateral |

181,950 |

235,006 |

76,026 |

89,403 |

| Property, plant and machinery |

10,015,522 |

14,402,036 |

7,679,725 |

17,449,496 |

| Treasury guarantee (Note 8.2.3.1) |

– |

– |

4,972,857 |

6,026,242 |

| Others |

6,670,291 |

21,594 |

4,313,852 |

22,272 |

| Unsecured |

6,102,588 |

– |

5,461,571 |

– |

| Total |

22,970,351 |

14,658,636 |

22,504,031 |

23,587,413 |

The above analysis does not include balances relating to lease rentals receivables.

8.2.4.1 Derivatives, reverse sale-and-repurchase agreements and securities borrowing

The Bank mitigates the credit risk of derivatives, reverse sale-and-repurchase agreements and securities lending by entering into master netting agreements and holding collateral in the form of cash and marketable securities.

DFCC requires counterparties to sign an ISDA master agreement (International Swaps and Derivative Association) in order to enter into swaps and other derivative transactions. The agreement outlines the terms and conditions to be applied to the derivative transactions agreed by DFCC and other parties. Any Dispute of the transaction will be handled according to the agreement terms.

The Bank’s sale-and-repurchase, and reverse sale-and-repurchase, transactions and securities borrowing and lending are covered by master agreements. A master agreement has to be signed by both parties to enter such transactions. All terms and conditions are stipulated in the master agreement.

8.2.4.2 Loan to value ratio of residential mortgage lending

The following tables stratify credit exposures by ranges of loan-to-value (LTV) ratio. LTV is calculated as the ratio of the gross amount of the loan to the value of the collateral. The valuation of the collateral excludes any adjustments for obtaining and selling the collateral. The value of the collateral is based on valuations made by independent professional valuers.

|

BANK/GROUP |

| As at 31 December |

2020

LKR ’000 |

2019

LKR ’000 |

| LTV ratio |

|

|

| Stage 1 |

|

|

| Less than 50% |

717,329 |

2,392,919 |

| 51%-70% |

1,233,058 |

3,060,380 |

| 71%-90% |

2,918,917 |

1,214,137 |

| More than 90% |

4,869,463 |

1,552,755 |

| Total |

9,738,767 |

8,220,191 |

| Stage 2 |

|

|

| Less than 50% |

118,112 |

690,096 |

| 51%-70% |

199,469 |

1,206,097 |

| 71%-90% |

573,666 |

503,044 |

| More than 90% |

836,927 |

536,146 |

| Total |

1,728,174 |

2,935,383 |

| Stage 3 |

|

|

| Less than 50% |

69,099 |

201,965 |

| 51%-70% |

155,804 |

342,236 |

| 71%-90% |

388,553 |

185,642 |

| More than 90% |

410,596 |

131,916 |

| Total |

1,024,052 |

861,759 |

| Carrying amount – amortised cost |

12,490,993 |

12,017,333 |

8.2.4.3 Assets obtained by taking possession of collateral

The Bank’s policy is to pursue timely realisation of the collateral in an orderly manner. The Bank does not generally use the non-cash collateral for its own operations.

8.2.5 Amounts arising from ECL

8.2.5.1 Loss allowance

The following tables show reconciliations from the opening to the closing balance of the loss allowance by class of financial instrument. The basis for determining transfers due to changes in credit risk is set out in our accounting policy; see Note 17.

Financial assets at amortised cost – Loans to and receivables from other customers – ECL

|

2020 |

2019 |

|

Stage 1

LKR ’000 |

Stage 2

LKR ’000 |

Stage 3

LKR ’000 |

Total

LKR ’000 |

Stage 1

LKR ’000 |

Stage 2

LKR ’000 |

Stage 3

LKR ’000 |

Total

LKR ’000 |

| Balance at beginning |

901,871 |

1,563,877 |

9,940,734 |

12,406,482 |

786,161 |

2,355,958 |

8,423,457 |

11,565,576 |

| Transfer to Stage 1 |

662,248 |

(563,585) |

(98,663) |

– |

767,186 |

(706,463) |

(60,723) |

– |

| Transfer to Stage 2 |

(84,923) |

172,478 |

(87,555) |

– |

(60,275) |

109,101 |

(48,826) |

– |

| Transfer to Stage 3 |

(27,796) |

(173,925) |

201,721 |

– |

(17,410) |

(210,075) |

227,485 |

– |

| Net remeasurement of loss allowance |

(577,698) |

(161,992) |

1,788,137 |

1,048,447 |

(1,050,167) |

(422,215) |

1,727,227 |

254,845 |

New financial assets originated

or purchased |

432,750 |

232,572 |

1,227,042 |

1,892,364 |

476,987 |

439,272 |

419,288 |

1,335,547 |

| Write-off |

(712) |

(3,855) |

(27,398) |

(31,965) |

(611) |

(1,701) |

(741,068) |

(743,380) |

| Foreign exchange and other movement |

– |

– |

7,948 |

7,948 |

– |

– |

(6,106) |

(6,106) |

| Balance as at 31 December |

1,305,740 |

1,065,570 |

12,951,966 |

15,323,276 |

901,871 |

1,563,877 |

9,940,734 |

12,406,482 |

Financial assets at amortised cost-debt and other instruments – ECL

|

2020 |

2019 |

|

Stage 1

LKR ’000 |

Total

LKR ’000 |

Stage 1

LKR ’000 |

Total

LKR ’000 |

| Balance at beginning |

82,571 |

82,571 |

45,414 |

45,414 |

| Transferred from FVOCI during the year |

67,231 |

67,231 |

– |

– |

| Net remeasurement of loss allowance |

121,713 |

121,713 |

37,157 |

37,157 |

| Balance as at 31 December |

271,515 |

271,515 |

82,571 |

82,571 |

Loan Commitments and financial guarantee contracts

|

2020 |

2019 |

|

Stage 1

LKR ’000 |

Stage 2

LKR ’000 |

Total

LKR ’000 |

Stage 1

LKR ’000 |

Stage 2

LKR ’000 |

Total

LKR ’000 |

| Balance at beginning |

164,144 |

16,487 |

180,631 |

162,686 |

34,895 |

197,581 |

| Net remeasurement of loss allowance |

179,454 |

(3,195) |

176,259 |

1,458 |

(18,408) |

(16,950) |

| Balance as at 31 December |

343,598 |

13,292 |

356,890 |

164,144 |

16,487 |

180,631 |

8.2.5.2 Sensitivity of ECL to future economic conditions

The ECL are sensitive to judgements and assumptions made regarding formulation of forward looking scenarios and how such scenarios are incorporated into the calculations. Management performs a sensitivity analysis on the ECL recognised on material classes of its assets.

Sensitivity of factors used to determine impairment provisions

The uncertainty of the impact of COVID-19 introduces significant estimation uncertainty in relation to the measurement of the Bank’s allowance for expected credit losses. The rapidly evolving consequences of COVID-19 and government, business and consumer responses could result in significant adjustments to the allowance in future financial years.

Given current economic uncertainties and the judgment applied to factors used in determining the expected default of borrowers in future periods, expected credit losses reported by the Bank should be considered as a best estimate within a range of possible estimates.

The table below shows the sensitivity of the impairment provision of the Bank as at 31 December 2020 to a reasonably possible change in PDs, LGDs, and forward looking information.

|

Sensitivity effect on Statement of Financial Position |

|

Sensitivity effect

on Income

Statement |

|

Increase/(Decrease) in impairment provision |

|

|

Stage 1

LKR ’000 |

Stage 2

LKR ’000 |

Stage 3

LKR ’000 |

Total

LKR ’000 |

LKR ’000 |

| PD 1% increase across all age buckets |

997,988 |

225,291 |

– |

1,223,279 |

(1,223,279) |

| PD 1% decrease across all age buckets* |

(839,773) |

(225,284) |

– |

(1,065,057) |

1,065,057 |

| LGD 5% increase |

173,900 |

175,522 |

368,595 |

718,017 |

(718,017) |

| LGD 5% decrease* |

(173,877) |

(175,468) |

(368,583) |

(717,928) |

717,928 |

| Probability weighted economic scenarios |

|

|

|

|

|

– Worst case 4% decrease and base

case 4% increase |

(10,418) |

(8,223) |

– |

(18,641) |

18,641 |

– Worst case 4% increase and base

case 4% decrease |

10,418 |

8,214 |

– |

18,632 |

(18,632) |

* The PD/LGD decrease is capped to 0%, if applicable.

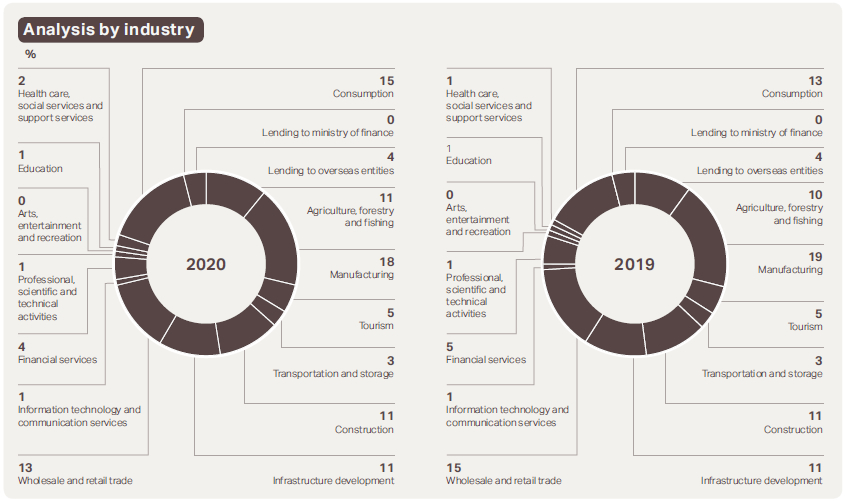

8.2.6 Concentration of credit risk

The Bank monitors concentrations of credit risk by sector and by geographic location. An analysis of concentrations of credit risk from loans and advances, loan commitments, financial guarantees and investment securities is shown below:

| In LKR ’000 |

Loans to and receivable from banks |

Loans to and receivable

from customers |

Investment in debt securities |

Loan commitments and financial guarantees issued |

| As at 31 December |

2020 |

2019 |

2020 |

2019 |

2020 |

2019 |

2020 |

2019 |

| Gross carrying amount |

4,152,717 |

– |

317,232,613 |

285,224,793 |

108,079,830 |

93,932,452 |

– |

– |

| Amount committed/guaranteed |

– |

– |

– |

– |

– |

– |

124,612,896 |

108,145,071 |

| Concentration by sector |

|

|

|

|

|

|

|

|

| Agriculture, forestry, and fishing |

– |

– |

34,483,557 |

28,282,969 |

– |

– |

9,554,167 |

11,139,531 |

| Manufacturing |

– |

– |

55,769,741 |

54,535,325 |

– |

– |

29,282,013 |

24,385,449 |

| Tourism |

– |

– |

15,990,359 |

13,393,587 |

– |

– |

2,612,852 |

7,977,653 |

| Transportation and storage |

– |

– |

9,108,654 |

9,434,389 |

– |

– |

643,732 |

1,105,107 |

| Construction |

– |

– |

34,175,044 |

32,559,866 |

– |

252,953 |

6,700,539 |

7,074,504 |

| Infrastructure development |

– |

– |

34,465,896 |

30,024,078 |

– |

– |

21,722,145 |

14,869,134 |

| Wholesale and retail trade |

– |

– |

41,871,503 |

44,195,272 |

– |

– |

31,324,334 |

24,342,484 |

| Information technology and communication services |

– |

– |

1,712,933 |

1,531,401 |

– |

– |

1,294,637 |

660,586 |

| Financial services |

4,152,717 |

– |

13,286,037 |

14,856,831 |

661,941 |

2,839,425 |

4,793,138 |

2,360,843 |

Professional, scientific, and

technical activities |

– |

– |

3,203,777 |

1,709,325 |

– |

– |

318,401 |

383,807 |

Arts, entertainment, and

recreation |

– |

– |

756,676 |

788,364 |

– |

– |

36,875 |

50,798 |

| Education |

– |

– |

3,751,677 |

1,471,284 |

– |

– |

1,631,020 |

283,802 |

Health care, social services,

and support services |

– |

– |

6,077,955 |

4,213,504 |

– |

– |

1,089,879 |

1,181,414 |

| Consumption |

– |

– |

50,166,517 |

36,783,616 |

– |

– |

9,093,307 |

7,229,734 |

| Lending to ministry of finance |

– |

– |

33,923 |

164,257 |

– |

– |

– |

– |

| Lending to overseas entities |

– |

– |

12,378,364 |

11,280,725 |

– |

– |

4,515,858 |

5,100,225 |

| Government |

– |

– |

– |

– |

107,417,889 |

90,840,074 |

– |

– |

| Other |

– |

– |

– |

– |

– |

– |

– |

– |

| Total |

4,152,717 |

– |

317,232,613 |

285,224,793 |

108,079,830 |

93,932,452 |

124,612,897 |

108,145,071 |

8.2.7 Offsetting financial assets and financial liabilities

Financial assets and financial liabilities are offset and the net amount presented in the statement of financial position when, and only when the Group currently has a legally enforceable right to set off the amounts and it intends either to settle them on a net basis or to realise the asset and settle the liability simultaneously.

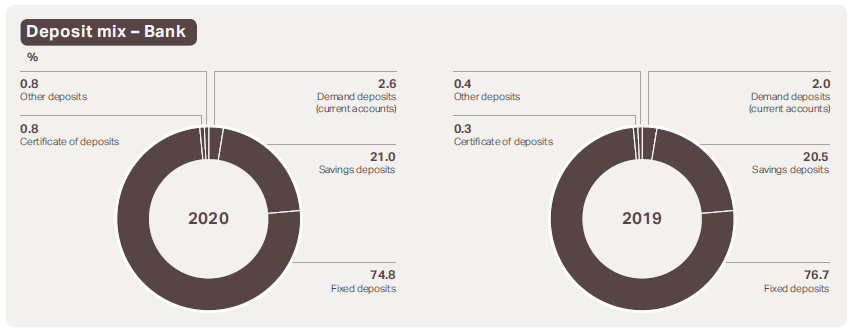

8.3 Liquidity risk

“Liquidity risk” is the risk that the Bank will encounter difficulty in meeting obligations associated with its financial liabilities that are settled by delivering cash or another financial asset. Liquidity risk arises from mismatches in the timing and amounts of cash flows, which is inherent to the Bank’s operations and investments.

8.3.1 Management of liquidity risk

The Bank’s Board of Directors sets the Bank’s strategy for managing liquidity risk and oversight of the implementation is administered by Assets and Liability Management Committee (ALCO). ALCO approves the Bank’s liquidity policies and procedures. Treasury manages the Bank’s liquidity position on a day-to-day basis and reviews daily reports covering the liquidity position of both the Bank and operating subsidiaries. A summary report, including any exceptions and remedial action taken, is submitted to ALCO on a monthly basis or ad hoc when predefined thresholds are breached.

The Bank’s approach to managing liquidity is to ensure, as far as possible, that it will always have sufficient liquidity to meet its liabilities when they are due, under both normal and stressed conditions, without incurring unacceptable losses or risking damage to the Bank’s reputation. The key elements of the Bank’s liquidity strategy are as follows:

Monitoring maturity mismatches, behavioural characteristics of the Bank’s financial assets and financial liabilities, and the extent to which the Group’s assets are encumbered and so not available as potential collateral for obtaining funding.

Monitoring the Bank’s liquidity through the Liquid Assets Ratio (statutory minimum is currently 20%) and Liquidity Coverage Ratios using a stock approach.

Effecting threshold limits relevant for liquidity management as part of the overall risk limits system of the Bank.

Carrying a portfolio of highly liquid assets, diversified by currency and maturity.

8.3.2 Exposure to liquidity risk – Regulatory liquidity (Bank)

| As at 31 December |

2020 |

2019 |

| Statutory liquid assets (LKR ’000) |

137,237,163 |

90,664,914 |

| Statutory liquid assets ratio (minimum requirement 20%) |

|

|

| Domestic banking unit (%) |

33.78 |

23.55 |

| Off-shore banking unit (%) |

35.45 |

53.07 |

| Liquidity coverage ratio (minimum requirement 90% in 2020 and 100% in 2019) |

|

|

| All currencies (%) |

204.44 |

140.53 |

| Rupee only (%) |

288.27 |

234.22 |

Details of the consolidated liquid assets ratio during the reporting period were as follows:

| As at 31 December |

2020 |

2019 |

| Average for the period |

31.98 |

25.70 |

| Maximum for the period |

34.99 |

26.91 |

| Minimum for the period |

28.27 |

24.15 |

8.3.3 Maturity analysis for financial liabilities and financial assets

The following tables set out the remaining contractual maturities of the Bank’s financial liabilities and financial assets.

| As at 31 December 2020 BANK |

Carrying

amount

LKR ’000 |

Up to

3 months

LKR ’000 |

3 to

12 months

LKR ’000 |

1 to 3 years

LKR ’000 |

3 to 5 years

LKR ’000 |

More than

5 years

LKR ’000 |

Total

LKR ’000 |

| Financial liability by type |

|

|

|

|

|

|

|

| Non-derivative liabilities |

|

|

|

|

|

|

|

| Due to banks |

14,909,937 |

3,631,087 |

3,765,692 |

7,513,158 |

– |

– |

14,909,937 |

Financial liabilities at amortised

cost – Due to depositors |

310,026,892 |

98,852,578 |

105,106,743 |

28,970,585 |

16,457,256 |

60,639,730 |

310,026,892 |

Financial liabilities at amortised

cost – Due to other borrowers |

46,847,076 |

12,641,905 |

10,124,287 |

12,393,268 |

3,553,834 |

8,133,782 |

46,847,076 |

| Debt securities in issue |

16,291,279 |

1,025,771 |

305,890 |

– |

8,764,378 |

6,195,240 |

16,291,279 |

| Other liabilities |

4,783,877 |

2,298,859 |

724,698 |

383,163 |

421,465 |

955,692 |

4,783,877 |

| Subordinated term debt |

19,357,497 |

617,851 |

1,173,506 |

8,956,610 |

8,404,530 |

205,000 |

19,357,497 |

|

412,216,558 |

119,068,051 |

121,200,816 |

58,216,784 |

37,601,463 |

76,129,444 |

412,216,558 |

| Derivative liabilities |

|

|

|

|

|

|

|

| Risk management: |

267,883 |

267,883 |

– |

– |

– |

– |

267,883 |

|

267,883 |

267,883 |

– |

– |

– |

– |

267,883 |

| Financial assets by type |

|

|

|

|

|

|

|

| Non-derivative assets |

|

|

|

|

|

|

|

| Cash and cash equivalents |

7,724,364 |

7,724,364 |

– |

– |

– |

– |

7,724,364 |

| Balances with Central Bank |

4,901,753 |

4,901,753 |

– |

– |

– |

– |

4,901,753 |

| Placements with banks |

15,414,287 |

15,414,287 |

– |

– |

– |

– |

15,414,287 |

Financial assets measured at

fair value through profit or loss |

609,717 |

564,837 |

– |

– |

– |

44,880 |

609,717 |

| Financial assets at amortised cost – Loans to and receivables from banks |

4,152,717 |

4,152,717 |

– |

– |

– |

– |

4,152,717 |

| Financial assets at amortised cost – Loans to and receivables from other customers |

301,909,337 |

53,502,826 |

35,148,436 |

58,850,180 |

57,608,042 |

96,799,853 |

301,909,337 |

| Financial assets at amortised cost – Debt and other instruments |

31,604,175 |

5,374,610 |

13,359,011 |

10,929,576 |

1,940,978 |

– |

31,604,175 |

| Financial assets measured at fair value through other comprehensive income |

88,718,002 |

15,805,674 |

25,872,632 |

17,342,423 |

7,691,826 |

22,005,447 |

88,718,002 |

| Other assets |

1,999,405 |

1,921,049 |

13,550 |

11,747 |

31,747 |

21,312 |

1,999,405 |

|

457,033,757 |

109,362,117 |

74,393,629 |

87,133,926 |

67,272,593 |

118,871,492 |

457,033,757 |

| Derivative assets |

|

|

|

|

|

|

|

| Risk management: |

835,464 |

835,464 |

– |

– |

– |

– |

835,464 |

|

835,464 |

835,464 |

– |

– |

– |

– |

835,464 |

| As at 31 December 2019

BANK |

Carrying

Amount

LKR ’000 |

Up to

3 months

LKR ’000 |

3 to 12

months

LKR ’000 |

1 to 3 years

LKR ’000 |

3 to 5 years

LKR ’000 |

More than

5 years

LKR ’000 |

Total

LKR ’000 |

| Financial liability by type |

|

|

|

|

|

|

|

| Non-derivative liabilities |

|

|

|

|

|

|

|

| Due to banks |

24,594,828 |

9,464,866 |

5,791,329 |

9,338,633 |

– |

– |

24,594,828 |

| Financial liabilities at amortised cost – Due to depositors |

247,786,974 |

86,203,676 |

85,695,022 |

17,085,344 |

12,864,437 |

45,938,495 |

247,786,974 |

Financial liabilities at amortised cost –

Due to other borrowers |

47,307,556 |

9,107,966 |

9,149,713 |

14,000,752 |

6,154,080 |

8,895,045 |

47,307,556 |

| Debt securities in issue |

14,148,198 |

1,028,348 |

3,147,549 |

– |

3,783,024 |

6,189,277 |

14,148,198 |

| Other liabilities |

3,786,445 |

2,388,520 |

798,747 |

36,775 |

118,536 |

443,867 |

3,786,445 |

| Subordinated term debt |

16,859,914 |

657,461 |

2,227,817 |

940,482 |

8,948,215 |

4,085,939 |

16,859,914 |

|

354,483,915 |

108,850,837 |

106,810,177 |

41,401,986 |

31,868,292 |

65,552,623 |

354,483,915 |

| Derivative liabilities |

|

|

|

|

|

|

|

| Risk management: |

518,731 |

518,731 |

– |

– |

– |

– |

518,731 |

|

518,731 |

518,731 |

– |

– |

– |

– |

518,731 |

| Financial assets by type |

|

|

|

|

|

|

|

| Non-derivative assets |

|

|

|

|

|

|

|

| Cash and cash equivalents |

5,450,209 |

5,450,209 |

– |

– |

– |

– |

5,450,209 |

| Balances with Central Bank |

8,666,547 |

8,666,547 |

– |

– |

– |

– |

8,666,547 |

| Placements with banks |

165,030 |

165,030 |

– |

– |

– |

– |

165,030 |

Financial assets measured at

fair value through profit or loss |

5,307,066 |

251,593 |

– |

– |

– |

5,055,473 |

5,307,066 |

| Financial assets at amortised cost – Loans to and receivables from banks |

– |

– |

– |

– |

– |

– |

– |

| Financial assets at amortised cost – Loans to and receivables from other customers |

272,818,311 |

40,234,030 |

38,017,279 |

52,744,363 |

54,181,538 |

87,641,101 |

272,818,311 |

| Financial assets at amortised cost – Debt and other instruments |

30,147,032 |

4,966,191 |

2,630,013 |

18,639,478 |

3,911,350 |

– |

30,147,032 |

| Financial assets measured at fair value through other comprehensive income |

72,716,407 |

9,450,109 |

3,187,401 |

30,008,205 |

15,649,171 |

14,421,521 |

72,716,407 |

| Other assets |

2,148,567 |

1,425,425 |

278,065 |

130,296 |

21,491 |

293,290 |

2,148,567 |

|

397,419,169 |

70,609,134 |

44,112,758 |

101,522,342 |

73,763,550 |

107,411,385 |

397,419,169 |

| Derivative assets |

|

|

|

|

|

|

|

| Risk management: |

631,438 |

631,438 |

– |

– |

– |

– |

631,438 |

|

631,438 |

631,438 |

– |

– |

– |

– |

631,438 |

The following tables set out the remaining contractual maturities of the Group’s financial liabilities and financial assets.

| As at 31 December 2020

GROUP |

Carrying

Amount

LKR ’000 |

Up to

3 months

LKR ’000 |

3 to

12 months

LKR ’000 |

1 to 3 years

LKR ’000 |

3 to 5 years

LKR ’000 |

More than

5 years

LKR ’000 |

Total

LKR ’000 |

| Financial liability by type |

|

|

|

|

|

|

|

| Non-derivative liabilities |

|

|

|

|

|

|

|

| Due to banks |

14,909,937 |

3,631,087 |

3,765,692 |

7,513,158 |

– |

– |

14,909,937 |

Financial liabilities at amortised

cost – Due to depositors |

309,566,423 |

98,392,109 |

105,106,743 |

28,970,585 |

16,457,256 |

60,639,730 |

309,566,423 |

Financial liabilities at amortised

cost – Due to other borrowers |

46,847,076 |

12,641,905 |

10,124,287 |

12,393,268 |

3,553,834 |

8,133,782 |

46,847,076 |

| Debt securities in issue |

16,291,279 |

1,025,771 |

305,890 |

– |

8,764,378 |

6,195,240 |

16,291,279 |

| Other liabilities |

4,900,958 |

2,298,860 |

724,698 |

500,243 |

421,465 |

955,692 |

4,900,958 |

| Subordinated term debt |

19,357,497 |

617,851 |

1,173,506 |

8,956,610 |

8,404,530 |

205,000 |

19,357,497 |

|

411,873,170 |

118,607,583 |

121,200,816 |

58,333,864 |

37,601,463 |

76,129,444 |

411,873,170 |

| Derivative liabilities |

|

|

|

|

|

|

|

| Risk management: |

267,883 |

267,883 |

– |

– |

– |

– |

267,883 |

|

267,883 |

267,883 |

– |

– |

– |

– |

267,883 |

| Financial assets by type |

|

|

|

|

|

|

|

| Non-derivative assets |

|

|

|

|

|

|

|

| Cash and cash equivalents |

7,728,969 |

7,728,969 |

– |

– |

– |

– |

7,728,969 |

| Balances with Central Bank |

4,901,753 |

4,901,753 |

– |

– |

– |

– |

4,901,753 |

| Placements with banks |

15,431,962 |

15,431,962 |

– |

– |

– |

– |

15,431,962 |

Financial assets measured

at fair value through profit or loss |

609,717 |

564,837 |

– |

– |

– |

44,880 |

609,717 |

| Financial assets at amortised cost – Loans to and receivables from banks |

4,152,717 |

4,152,717 |

– |

– |

– |

– |

4,152,717 |

| Financial assets at amortised cost – Loans to and receivables from other customers |

301,909,337 |

53,502,826 |

35,148,436 |

58,850,180 |

57,608,042 |

96,799,853 |

301,909,337 |

| Financial assets at amortised cost – Debt and other instruments |

31,604,175 |

5,374,610 |

13,359,011 |

10,929,576 |

1,940,978 |

– |

31,604,175 |

| Financial assets measured at fair value through other comprehensive income |

88,718,002 |

15,805,674 |

25,872,632 |

17,342,423 |

7,691,826 |

22,005,447 |

88,718,002 |

| Other assets |

2,066,621 |

1,988,265 |

13,550 |

11,747 |

31,747 |

21,312 |

2,066,621 |

|

457,123,253 |

109,451,613 |

74,393,629 |

87,133,926 |

67,272,593 |

118,871,492 |

457,123,253 |

| Derivative assets |

|

|

|

|

|

|

|

| Risk management: |

835,464 |

835,464 |

– |

– |

– |

– |

835,464 |

|

835,464 |

835,464 |

– |

– |

– |

– |

835,464 |

| As at 31 December 2019

GROUP |

Carrying

Amount

LKR ’000 |

Up to

3 months

LKR ’000 |

3 to

12 months

LKR ’000 |

1 to 3 years

LKR ’000 |

3 to 5 years

LKR ’000 |

More than

5 years

LKR ’000 |

Total

LKR ’000 |

| Financial liability by type |

|

|

|

|

|

|

|

| Non-derivative liabilities |

|

|

|

|

|

|

|

| Due to banks |

24,594,828 |

9,464,866 |

5,791,329 |

9,338,633 |

– |

– |

24,594,828 |

Financial liabilities at amortised

cost – Due to depositors |

247,457,696 |

86,062,548 |

85,605,622 |

16,986,594 |

12,864,437 |

45,938,495 |

247,457,696 |

Financial liabilities at amortised

cost – Due to other borrowers |

47,307,556 |

9,107,967 |

9,149,713 |

14,000,752 |

6,154,080 |

8,895,045 |

47,307,556 |

| Debt securities in issue |

14,148,198 |

1,028,348 |

3,147,549 |

– |

3,783,024 |

6,189,277 |

14,148,198 |

| Other liabilities |

3,907,977 |

2,510,052 |

798,747 |

36,775 |

118,536 |

443,867 |

3,907,977 |

| Subordinated term debt |

16,859,914 |

657,460 |

2,227,817 |

940,482 |

8,948,215 |

4,085,939 |

16,859,914 |

|

354,276,169 |

108,831,241 |

106,720,777 |

41,303,236 |

31,868,292 |

65,552,623 |

354,276,169 |

| Derivative liabilities |

|

|

|

|

|

|

|

| Risk management: |

518,731 |

518,731 |

– |

– |

– |

– |

518,731 |

|

518,731 |

518,731 |

– |

– |

– |

– |

518,731 |

| Financial assets by type |

|

|

|

|

|

|

|

| Non-derivative assets |

|

|

|

|

|

|

|

| Cash and cash equivalents |

5,459,359 |

5,459,359 |

– |

– |

– |

– |

5,459,359 |

| Balances with Central Bank |

8,666,547 |

8,666,547 |

– |

– |

– |

– |

8,666,547 |

| Placements with banks |

200,441 |

165,030 |

35,411 |

– |

– |

– |

200,441 |

Financial assets measured

at fair value through profit or loss |

5,307,066 |

251,593 |

– |

– |

– |

5,055,473 |

5,307,066 |

| Financial assets at amortised cost – Loans to and receivables from banks |

– |

– |

– |

– |

– |

– |

– |

| Financial assets at amortised cost – Loans to and receivables from other customers |

272,818,311 |

40,234,030 |

38,017,279 |

52,744,363 |

54,181,538 |

87,641,101 |

272,818,311 |

| Financial assets at amortised cost – Debt and other instruments |

30,147,032 |

4,966,191 |

2,630,013 |

18,639,478 |

3,911,350 |

– |

30,147,032 |

| Financial assets measured at fair value through other comprehensive income |

72,716,407 |

9,450,109 |

3,187,401 |

30,008,205 |

15,649,171 |

14,421,521 |

72,716,407 |

| Other assets |

2,238,053 |

1,514,911 |

278,065 |

130,296 |

21,491 |

293,290 |

2,238,053 |

|

397,553,216 |

70,707,770 |

44,148,169 |

101,522,342 |

73,763,550 |

107,411,385 |

397,553,216 |

| Derivative assets |

|

|

|

|

|

|

|

| Risk management: |

631,438 |

631,438 |

– |

– |

– |

– |

631,438 |

|

631,438 |

631,438 |

– |

– |

– |

– |

631,438 |

The amounts in the table above have been compiled as follows:

| Type of financial instrument |

Basis on which amounts are compiled |

| Non-derivative financial liabilities and financial assets |

Undiscounted cash flows, which include estimated interest payments. |

| Issued financial guarantee contracts, and unrecognised loan commitments |

Earliest possible contractual maturity. For issued financial guarantee contracts, the maximum amount of the guarantee is allocated to the earliest period in which the guarantee could be called. |

| Derivative financial liabilities and financial assets held for risk management purposes |

Contractual undiscounted cash flows. The amounts shown are the gross nominal inflows and outflows for derivatives that have simultaneous gross settlement (e.g. forward exchange contracts and currency swaps) and the net amounts for derivatives that are net settled. |

| Trading derivative liabilities and assets forming part of the Group’s proprietary trading operations that are expected to be closed out before contractual maturity. |

Fair values at the date of the statement of financial position. This is because contractual maturities do not reflect the liquidity risk exposure arising from these positions. These fair values are disclosed in the “up to three months” column. |

| Trading derivative liabilities and assets that are entered into by the Bank with its customers |

Contractual undiscounted cash flows. This is because these instruments are not usually closed out before contractual maturity and so the Group believes that contractual maturities are essential for understanding the timing of cash flows associated with these derivative positions. |

The Bank’s expected cash flows on some financial assets and financial liabilities vary significantly from the contractual cash flows. The principal differences are as follows:

- demand deposits from customers are expected to remain stable or increase;

- unrecognised loan commitments are not all expected to be drawn down immediately.

8.3.4 Liquidity reserves

As part of the management of liquidity risk arising from financial liabilities, the Bank holds liquid assets comprising cash and cash equivalents, and debt securities issued by sovereigns, which can be readily sold to meet liquidity requirements. In addition, the Bank maintains agreed lines of credit with other banks and holds unencumbered assets eligible for use as collateral with central banks (these amounts are referred to as the “Bank’s liquidity reserves”).

The following table sets out the components of the Bank’s liquidity reserves

| As at 31December |

2020

Carrying amount

LKR ’000 |

2020

Fair value

LKR ’000 |

2019

Carrying amount

LKR ’000 |

2019

Fair value

LKR ’000 |

| Balances with Central Bank |

4,901,753 |

4,901,753 |

8,666,547 |

8,666,547 |

| Cash and cash equivalents |

7,724,364 |

7,724,364 |

5,450,209 |

5,450,209 |

| Placements with banks |

15,414,287 |

15,414,287 |

165,030 |

165,030 |

| Unencumbered debt securities issued by sovereigns |

98,472,348 |

98,472,348 |

80,357,323 |

80,357,323 |

| Total liquidity reserves |

126,512,752 |

126,512,752 |

94,639,109 |

94,639,109 |

8.3.5 Financial assets available to support future funding

The following table sets out the availability of the bank’s financial assets to support future funding.

|

|

Encumbered |

Unencumbered |

|

|

Note |

Pledged as

collateral

LKR ’000 |

Other*

LKR ’000 |

Available as

collateral

LKR ’000 |

Other**

LKR ’000 |

Total

LKR ’000 |

| 31 December 2020 |

|

|

|

|

|

|

| Cash and cash equivalents |

26 |

– |

– |

7,724,364 |

– |

7,724,364 |

| Balances with Central Bank |

27 |

– |

4,901,753 |

– |

– |

4,901,753 |

| Placements with banks |

28 |

– |

– |

15,414,287 |

– |

15,414,287 |

| Derivatives financial assets |

29 |

– |

– |

835,464 |

– |

835,464 |

| Financial assets measured at fair value through profit or loss |

30 |

– |

– |

609,717 |

– |

609,717 |

Financial assets at amortised cost –

Loans to and advances to banks |

31 |

– |

– |

4,152,717 |

– |

4,152,717 |

Financial assets at amortised cost –

Loans to and receivables from customers |

32 |

– |

– |

301,909,337 |

– |

301,909,337 |

Financial assets at amortised cost –

Debt and other instruments |

33 |

308,951 |

– |

31,295,224 |

– |

31,604,175 |

| Financial assets measured at fair value through other comprehensive income |

34 |

8,674,356 |

– |

80,043,646 |

– |

88,718,002 |

| Other assets |

42 |

– |

– |

– |

1,999,405 |

1,999,405 |

| Non-financial assets |

|

– |

– |

– |

7,208,066 |

7,208,066 |

| Total assets |

|

8,983,307 |

4,901,753 |

441,984,756 |

9,207,471 |

465,077,287 |

| 31 December 2019 |

|

|

|

|

|

|

| Cash and cash equivalents |

26 |

– |

– |

5,450,209 |

– |

5,450,209 |

| Balances with Central Bank |

27 |

– |

8,666,547 |

– |

– |

8,666,547 |

| Placements with banks |

28 |

– |

– |

165,030 |

– |

165,030 |

| Derivatives financial assets |

29 |

– |

– |

631,438 |

– |

631,438 |

| Financial assets measured at fair value through profit or loss |

30 |

– |

– |

5,307,066 |

– |

5,307,066 |

| Financial assets at amortised cost – Loans to and receivables from banks |

31 |

– |

– |

– |

– |

– |

| Financial assets at amortised cost – Loans to and receivables from other customers |

32 |

– |

– |

272,818,311 |

– |

272,818,311 |

Financial assets at amortised cost –

Debt and other instruments |

33 |

43,883 |

– |

30,103,149 |

– |

30,147,032 |

| Financial assets measured at fair value through other comprehensive income |

34 |

16,625,375 |

– |

56,091,032 |

– |

72,716,407 |

| Other assets |

42 |

– |

– |

– |

2,148,567 |

2,148,567 |

| Non-financial assets |

|

– |

– |

– |

6,846,673 |

6,846,673 |

| Total assets |

|

16,669,258 |

8,666,547 |

370,566,235 |

8,995,240 |

404,897,280 |

* Represents assets that are not pledged but that the Group believes it is restricted from using to secure funding, for legal or other reasons.

** Represents assets that are not restricted for use as collateral, but that the Group would not consider readily available to secure funding in the normal course of business.

8.4 Market risk

“Market risk” is the possibility of losses arising from changes in market variables such as interest rates, equity prices, foreign exchange rates, and credit spreads. The objective of the Bank’s market risk management is to manage and control market risk exposures within acceptable parameters to ensure the Bank’s solvency while optimising the return on risk.

8.4.1 Management of market risk

The Bank separates its exposure to market risks between trading and non-trading portfolios. Trading portfolios mainly include positions arising from market making and proprietary position taking, together with financial assets and financial liabilities that are managed on a fair value basis and non-trading portfolios from positions arising from financial investments measured at Fair Value through Other Comprehensive Income (FVOCI) and financial investments at amortised cost and from derivatives held for risk management purposes.

Overall authority for market risk management is vested with the Board of Directors through the Board Integrated Risk Management Committee (BIRMC). The operational authority for managing market risk is vested with ALCO. Foreign exchange risk is managed within approved limits

of the Bank.

The Bank employs a range of tools to monitor and limit market risk exposures. These are discussed below, separately for trading and non-trading portfolios.

The following table sets out the allocation of assets and liabilities subject to market risk between trading and

non-trading portfolios.

|

|

|

Market risk measure |

| In LKR ’000 |

Note |

Carrying

amount

LKR ’000 |

Trading

portfolio

LKR ’000 |

Non-trading

portfolio

LKR ’000 |

| 31 December 2020 |

|

|

|

|

| Assets subject to market risk |

|

|

|

|

| Cash and cash equivalents |

26 |

2,895,117 |

– |

2,895,117 |

| Placements with banks |

28 |

15,414,287 |

– |

15,414,287 |

| Derivative financial assets |

29 |

835,464 |

835,464 |

– |

| Financial assets measured at fair value through profit or loss |

30 |

609,717 |

609,717 |

– |

Financial assets at amortised cost –

Loans to and receivables from banks |

31 |

4,152,717 |

– |

4,152,717 |

Financial assets at amortised cost –

Loans to and receivables from other customers |

32 |

301,909,337 |

– |

301,909,337 |

| Financial assets at amortised cost – Debt and other instruments |

33 |

31,604,175 |

– |

31,604,175 |

Financial assets measured at fair value through other

comprehensive income |

34 |

88,718,002 |

– |

88,718,002 |

| Liabilities subject to market risk |

|

|

|

|

| Due to banks |

44 |

14,909,937 |

– |

14,909,937 |

| Derivative financial liabilities |

29 |

267,883 |

267,883 |

– |

| Financial liabilities at amortised cost – Due to depositors |

45 |

310,026,892 |

– |

310,026,892 |

| Financial liabilities at amortised cost – Due to other borrowers |

46 |

46,847,076 |

– |

46,847,076 |

| Debt securities in issue |

47 |

16,291,279 |

– |

16,291,279 |

| Subordinated term debt |

51 |

19,357,497 |

– |

19,357,497 |

|

|

|

Market risk measure |

| In LKR ’000 |

Note |

Carrying

amount

LKR ’000 |

Trading

portfolio

LKR ’000 |

Non-trading

portfolio

LKR ’000 |

| 31 December 2019 |

|

|

|

|

| Assets subject to market risk |

|

|

|

|

| Cash and cash equivalents |

26 |

926,842 |

– |

926,842 |

| Placements with banks |

28 |

165,030 |

– |

165,030 |

| Derivative financial assets |

29 |

631,438 |

631,438 |

– |

| Financial assets measured at fair value through profit or loss |

30 |

5,307,066 |

5,307,066 |

– |

| Financial assets at amortised cost – Loans to and advances to banks |

31 |

– |

– |

– |

Financial assets at amortised cost –

Loans to and receivables to customers |

32 |

272,818,311 |

– |

272,818,311 |

| Financial assets at amortised cost – Debt and other instruments |

33 |

30,147,032 |

– |

30,147,032 |

Financial assets measured at fair value through other

comprehensive income |

34 |

72,716,407 |

– |

72,716,407 |

| Liabilities subject to market risk |

|

|

|

|

| Due to banks |

44 |

24,594,828 |

– |

24,594,828 |

| Derivative financial liabilities |

29 |

518,731 |

518,731 |

– |

| Financial liabilities at amortised cost – Due to depositors |

45 |

247,786,974 |

– |

247,786,974 |

| Financial liabilities at amortised cost – Due to other borrowers |

46 |

47,307,556 |

– |

47,307,556 |

| Debt securities in issue |

47 |

14,148,198 |

– |

14,148,198 |

| Subordinated term debt |

51 |

16,859,914 |

– |

16,859,914 |

8.4.2 Exposure to market risks – Trading portfolios

The principal tool used to measure and control market risk exposure within the Bank’s trading portfolios is VaR. The VaR of a trading portfolio is the maximum estimated loss that can arise with a specified probability (confidence level) in the portfolio over a specified period of time (holding period) from an adverse market movement.

The VaR model used by the Bank is based on a 99% confidence level and assumes 1, 10 and 60-day holding periods (Depending on product type). The VaR model used is based mainly on historical simulation. Taking account of market data, and observed correlation between different markets and prices, the model generates a wide range of plausible future scenarios for market price movements.

Although VaR is an important tool for measuring market risk, the assumptions on which the model is based give rise to some limitations, including the following:

- The holding period assumes that it is possible to hedge or dispose of positions within that period. This may not be the case for illiquid assets or in situations in which there is severe market liquidity.

- A 99% confidence level does not reflect losses that may occur beyond this level. Even within the model used, there is a 1% probability that losses could exceed the VaR in any given period.

- VaR is calculated does not reflect exposures that may arise on positions during the trading day.

- The use of historical data as a basis for determining the possible range of future outcomes does not cover all possible scenarios, especially those of an exceptional nature.

- The VaR measure is dependent on the Bank’s position and the volatility of market prices. The VaR of an unchanged position reduces if market price volatility declines and vice versa.

The limitations of the VaR methodology are recognised by supplementing VaR limits with other position and sensitivity limit structures, including limits to address potential concentration risks within each trading portfolio. In addition, the Bank uses a wide range of stress tests to model the financial impact of a variety of exceptional market scenarios on individual trading portfolios and the Bank’s overall position. The Bank determines the scenarios as follows:

- sensitivity scenarios consider the impact of any single risk factor or set of factors that are unlikely to be captured within the VaR models;

- technical scenarios consider the largest move in each risk factor without consideration of any underlying market correlation; and

- hypothetical scenarios consider potential macro-economic events – e.g., periods of prolonged market illiquidity, reduced fungibility of currencies, natural disasters or other catastrophes, health pandemics, etc.

The analysis of scenarios and stress tests is reviewed by ALCO.

8.4.2.1 Equity price risk

Equity price risk is part of market risk which is defined as the risk of possible losses arising from the equity market investments due to changes in the market prices of the invested shares. The Bank is exposed to equity prices risk through its investments in the equity market which has been shown in the FVOCI portfolio and the trading portfolio.

Financial assets measured at fair value through profit or loss portfolio

| Parameter |

Position as at

31 December

2020

LKR ’000 |

Position as at

31 December

2019

LKR ’000 |

| Marked-to-market value of the total quoted equity portfolio |

44,880 |

4,777,423 |

| Value-at-risk (under 99% probability for a quarterly time horizon) |

28.93% |

12.35% |

Maximum possible loss of value in the marked-to-market value of the portfolio as

indicated by the VaR over a quarterly period |

12,984 |

590,012 |

| Unrealised gains in the trading equity portfolio reported in the fair value reserve |

11,069 |

2,612,462 |

Equity price risk is quantified using the Value at Risk (VAR) approach based on the Historical Loss Method. Historical three-year portfolio returns is adopted to compute VAR as a measure of the equity prices risk exposure by the Bank. This VAR computation for the equity trading portfolio considers a quarterly time horizon.

8.4.3 Exposure to market risks –

Non-trading portfolios

Financial assets measured at fair value through other comprehensive income

| Parameter |

Position as at

31 December

2020

LKR ’000 |

Position as at

31 December

2019

LKR ’000 |

| Marked-to-market value of the total quoted equity portfolio |

12,299,552 |

8,812,702 |

| Value-at-risk (under 99% probability for a quarterly time horizon) |

27.48% |

18.20% |

Maximum possible loss of value in the marked-to-market value of the portfolio as

indicated by the VaR over a quarterly period |

3,379,917 |

1,603,912 |

| Unrealised gains in the trading equity portfolio reported in the fair value reserve |

2,801,795 |

4,476,529 |

Equity price risk is quantified using the Value at Risk (VaR) approach based on the Historical Loss Method. Historical three-year portfolio returns is adopted to compute VaR as a measure of the equity prices risk exposure by the Bank. This VAR computation for the equity Trading portfolio considers a quarterly time horizon.

8.4.4 Interest rate risk

The principal risk to which non-trading portfolios are exposed is the risk of loss from fluctuations in the future cash flows or fair values of financial instruments because

of a change in market interest rates.

Duration analysis as at 31 December 2020

| Portfolio |

Face

value

LKR ’000 |

Marked-to

market value

LKR ’000 |

Duration |

Interpretation of duration |

| Treasury securities measured at FVOCI/LKR Bonds |

69,328,224 |

75,272,434 |

1.53 |

Portfolio value will decline approximately by 1.53% as a result of 1% increase in the interest rates |

| Treasury securities measured at FVOCI/Sovereign Bonds |

1,311,660 |

931,706 |

1.66 |

Portfolio value will decline approximately by 1.66% as a result of 1% increase in the interest rates |

Market risk exposure for interest rate risk in the trading portfolio as at 31 December 2020 is Nil. Market risk exposure for interest rate risk in the FVOCI Rupee portfolio as at 31 December 2020 is depicted by duration of 1.53%.

This level of interest rate risk exposure in the Rupee FVOCI portfolio can be interpreted as a possible potential loss in the marked-to-market value amounting to LKR 1,154 Mn,

as at 31 December 2020.

Market risk exposure for interest rate risk in the FVOCI US Dollar portfolio as at 31 December 2020 is depicted by duration of 1.66%.

This level of interest rate risk exposure in the FVOCI US Dollar portfolio can be interpreted as a possible potential loss in the marked-to-market value amounting to LKR 15.4 Mn, as at 31 December 2020.

8.4.4.1 Potential impact to NII due to change in market interest rates

Overall up to the 12-month time bucket, the Bank carried a net liability sensitive position. This sensitivity will vary for each time bucket up to the 12-month period where up to one month there is a net asset sensitive position.

The interest rate risk exposure as at 31 December 2020 is quantified based on the assumed change in the interest rates for each time period and is given in table below:

|

Over 0 up to

1 month

LKR ’000 |

Over 1 up to

3 months

LKR ’000 |

Over 3 up to

6 months

LKR ’000 |

Over 6 up to

12 months

LKR ’000 |

Over

12 months

LKR ’000 |

| 31 December 2020 |

|

|

|

|

|

| Cash and cash equivalents |

317,034 |

– |

– |

– |

– |

| Placements with banks |

15,414,287 |

– |

– |

– |

– |

| Loans to and receivables from banks |

4,152,717 |

– |

– |

– |

– |

| Loans to and receivables from other customers |

151,094,075 |

24,374,012 |

12,864,586 |

16,170,593 |

89,643,442 |

| Investment securities |

4,861,228 |

16,635,784 |

5,113,290 |

34,151,804 |

47,046,209 |

|

175,839,341 |

41,009,796 |

17,977,876 |

50,322,397 |

136,689,651 |

| Due to banks |

1,792,092 |

7,927,554 |

– |

– |

5,000,000 |

| Deposits from customers |

89,795,761 |

58,804,855 |

68,468,382 |

53,354,008 |

30,962,639 |

| Due to other borrowers |

7,492,850 |

12,453,461 |

10,591,793 |

1,239,278 |

15,069,694 |

| Debt securities in issue |

– |

– |

– |

– |

16,291,279 |

| Subordinated liabilities |

– |

– |

– |

1,791,357 |

17,566,140 |

|

99,080,703 |

79,185,870 |

79,060,175 |

56,384,643 |

84,889,752 |

| Net rate sensitive assets/(liabilities) |

76,758,638 |

(38,176,074) |

(61,082,299) |

(6,062,246) |

51,799,899 |

| Assumed change in interest rates (%) |

0.50 |

1.00 |

1.50 |

2.00 |

– |

| Impact |

383,793 |

(349,947) |

(687,176) |

(60,622) |

– |

| Total net impact if interest rates increase |

– |

– |

– |

(713,952) |

– |

| Total net impact if interest rates decline |

– |

– |

– |

713,952 |

– |

|

1 month to 0

LKR ’000 |

Over 1 up to

3 months

LKR ’000 |

Over 3 up to

6 months

LKR ’000 |

Over 6 up to

12 months

LKR ’000 |

Over

12 months

LKR ’000 |

| 31 December 2019 |

|

|

|

|

|

| Cash and cash equivalents |

333,741 |

– |

– |

– |

– |

| Placements with banks |

165,030 |

– |

– |

– |

– |

| Loans to and receivables from banks |

– |

– |

– |

– |

– |

| Loans to and receivables from other customers |

151,965,068 |

7,780,400 |

12,106,527 |

14,419,459 |

78,745,361 |

| Investment securities |

338,257 |

9,499,387 |

3,357,174 |

2,852,941 |

77,802,123 |

|

152,802,096 |

17,279,787 |

15,463,701 |

17,272,400 |

156,547,484 |

| Due to banks |

6,502,929 |

8,129,761 |

2,148,769 |

2,566,164 |

5,000,000 |

| Deposits from customers |

75,196,582 |

54,615,104 |

49,236,046 |

55,107,361 |

8,177,872 |

| Due to other borrowers |

9,178,922 |

8,835,038 |

10,163,228 |

3,435,505 |

15,511,272 |

| Debt securities in issue |

– |

– |

3,000,000 |

– |

10,000,000 |

| Subordinated liabilities |

– |

– |

2,000,000 |

– |

14,000,000 |

|

90,878,433 |

71,579,903 |

66,548,043 |

61,109,030 |

52,689,144 |

| Net rate sensitive assets/(liabilities) |

61,923,663 |

(54,300,116) |

(51,084,342) |

(43,836,630) |

103,858,340 |

| Assumed change in interest rates (%) |

0.50 |

1.00 |

1.50 |

2.00 |

|

| Impact |

309,618 |

(497,751) |

(574,699) |

(438,366) |

|

| Total net impact if interest rates increase |

|

|

|

(1,201,198) |

|

| Total net impact if interest rates decline |

|

|

|

1,201,198 |

|

The Bank has assumed that the assets and liabilities are repriced at the beginning of each time bucket and has also taken into account the remaining time from the repricing date up to one year.

8.4.5 Foreign exchange risk

Foreign exchange risk in net open position (NOP)/unhedged position of Bank

The following table indicates the DFCC’s exchange rate risk exposure based on its size of the NOP/unhedged positions in the foreign currency assets/liabilities. By 31 December 2020, DFCC carried a USD equivalent net open/unhedged “Oversold” position of LKR 3.56 Mn. The impact of exchange rate risk is given below:

|

Amount |

| Net exposure – USD equivalent |

(1,901,534) |

| Value of position in LKR ’000 |

(356,309) |

| Exchange rate (USD/LKR) as at 31 December 2020 |

187.38 |

| Possible potential loss to Bank – LKR ’000 |

|

| – If Exchange rate (USD/LKR) depreciates by 1% |

(3,563) |

| – If exchange rate depreciates by 10% |

(35,631) |

| – If exchange rate depreciates by 15% |

(53,446) |

The estimated potential exchange loss is off set by the interest gain due to interest differential between Sri Lankan Rupee and the respective foreign currencies.

8.4.6 Market risk exposures for regulatory capital assessment

Under the standardised approach of Basel III with effect from July 2017, market risk exposures are quantified for regulatory capital purposes. The computation results as at 31 December 2020 are as follows:

|

Risk-weighted

assets

LKR ’000 |

Quantified

possible

exposure

LKR ’000 |

| Interest rate risk |

12,554,742 |

1,506,569 |

| Equity price risk |

18,450 |

2,214 |

| Foreign exchange and gold risk |

383,258 |

45,991 |

| Total |

12,956,450 |

1,554,774 |

8.5 Operational risk

“Operational risk” is the risk of direct or indirect loss arising from a wide variety of causes associated with the Bank’s processes, personnel, technology, and infrastructure, and from external factors other than credit, market and liquidity risks. Operational risks arise from all of the Bank’s operations.

The Bank’s objective is to manage operational risk so as to balance the avoidance of financial losses and damage to the Bank’s reputation with overall cost effectiveness and innovation. In all cases, Bank’s policy requires compliance with all applicable legal and regulatory requirements.

The following are included in the process of the operational risk management in the Bank:

- a. Monitoring of the Key Risk Indicators (KRIs) for the departments/functions under the defined threshold limits using a traffic light system. Develop Risk and Control Self-Assessments to identify the risk exposure of all processes.

- b. Operational risk incident reporting system and the independent analysis of the incidents by the IRMD, and recognise necessary improvements in the systems, processes and procedures.

- c. Analyse downtime of the critical systems, attrition information, exit interview comments and complaints to identify operational risks and recommend mitigating controls. The key findings of the analysis are evaluated at the ORMC and the BIRMC meetings in an operational risk perspective.