Management Discussion and Analysis

Investor Capital

Investors are a key stakeholder in the Bank’s value creation process. One of the core objectives of the Bank is to maximise investor wealth by providing sustainable, long-term returns.

The Bank regularly engages with its investors and they are actively involved in shaping the Bank’s corporate behaviour.

Shareholder profile

The Bank had 11,526 shareholders as at 31 December 2020 (corresponding to a figure of 9,011 as at 31 December 2019), with 305,997,250 shares in issue. Institutions make up approximately 74% of the Bank’s share capital. 84% of the Bank’s share capital is held by local shareholders, both institutional and individual.

Share information

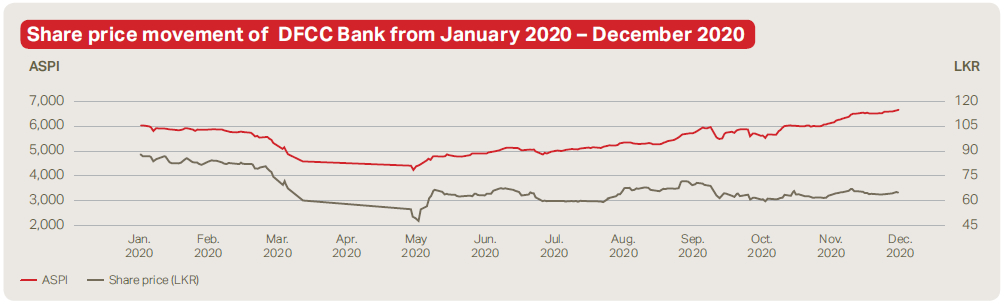

DFCC Bank share price information for the period 1 January 2020 – 31 December 2020

| 1 January to 31 December 2020 |

1 January to 31 December 2019 |

|

| Price indices | ||

| ASPI | 6,774.22 | 6,129.21 |

| S&P SL20 | 2,638.10 | 2,936.96 |

| Share price | ||

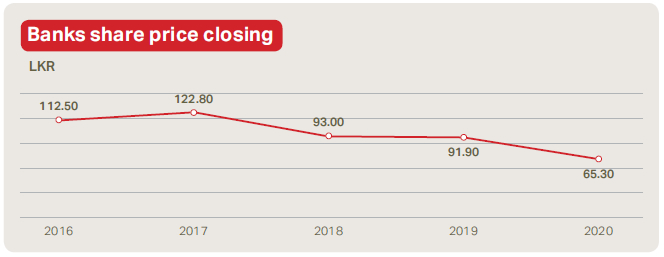

| Lowest price (LKR) | 47.90 | 67.00 |

| Highest price (LKR) | 91.80 | 99.30 |

| Closing price (LKR) | 65.30 | 91.90 |

| Market capitalisation | ||

| Value (LKR Mn) | 19,982 | 27,955 |

| Percentage of total market cap (%) | 0.67 | 0.98 |

| Rank | 37 | 22 |

| Value of shares traded | ||

| Value (LKR Mn) | 6,379 | 429 |

| Percentage of total market turnover (%) | 1.61 | 0.25 |

| Rank | 13 | 61 |

| Days traded | ||

| Number of days traded | 209 | 240 |

| Total number of market days | 209 | 241 |

| Percentage of market days traded (%) | 100 | 99.58 |

| Frequency of shares traded | ||

| Number of transactions | 42,692 | 7,675 |

| Percentage of total frequency | 1.39 | 0.64 |

| Rank | 39 | 41 |

Distribution of shareholding

Categories of shareholders

| As at | 31 December 2020 | 31 December 2019 | ||||

| Shareholding, % | Foreign | Local | Total | Foreign | Local | Total |

| Individual | 10.11 | 15.56 | 25.67 | 7.67 | 6.85 | 14.52 |

| Institutional | 5.97 | 68.36 | 74.33 | 20.42 | 65.06 | 85.48 |

| 16.08 | 83.92 | 100.00 | 28.09 | 71.91 | 100.00 | |

Distribution of shareholding by size

| As at | 31 December 2020 | 31 December 2019 | ||||

| Share range | Number of shareholders |

Total holding |

% | Number of shareholders |

Total holding |

% |

| 1 – 1,000 | 6,826 | 2,071,399 | 0.68 | 5,892 | 1,789,102 | 0.59 |

| 1,001 – 5,000 | 3,342 | 7,104,636 | 2.32 | 2,363 | 4,906,129 | 1.62 |

| 5,001 – 10,000 | 550 | 3,944,760 | 1.29 | 321 | 2,308,487 | 0.76 |

| 10,001 – 50,000 | 628 | 13,246,914 | 4.33 | 322 | 7,012,828 | 2.30 |

| 50,001 – 100,000 | 73 | 5,152,680 | 1.69 | 45 | 3,324,099 | 1.09 |

| 100,001 – 500,000 | 77 | 15,003,200 | 4.90 | 40 | 7,316,408 | 2.41 |

| 500,001 – 1,000,000 | 8 | 5,854,098 | 1.91 | 4 | 2,605,646 | 0.85 |

| 1,000,000 and above | 22 | 253,619,563 | 82.88 | 24 | 274,926,057 | 90.38 |

| 11,526 | 305,997,250 | 100.00 | 9,011 | 304,188,756 | 100.00 | |

Public holding as at 31 December 2020

| As at | 31 December 2020 | 31 December 2019 |

| Public holding percentage (%) | 62.6 | 62.6 |

| Number of public shareholders (Nos.) | 11,511 | 8,996 |

| Float adjusted market capitalisation (LKR Mn) | 12,500 | 17,488 |

| Applicable option as per CSE Listing Rule 7.13.1 (a) | Option 1 | Option 1 |

Twenty major shareholders of the Bank as at 31 December 2020

| As at | 31 December 2020 | 31 December 2019* | ||

| Name of Shareholder/Company | Number of shares |

% | Number of shares |

% |

| Hatton National Bank PLC A/c No.1 | 45,624,242 | 14.91 | 45,354,596 | 14.91 |

| Bank of Ceylon No.2 A/c | 38,266,153 | 12.51 | 38,039,994 | 12.51 |

| Mr M A Yaseen | 30,599,724 | 10.00 | 30,418,875 | 10.00 |

| Sri Lanka Insurance Corporation Ltd-Life Fund | 27,741,118 | 9.07 | 26,509,832 | 8.71 |

| Employees’ Provident Fund | 24,513,876 | 8.01 | 24,368,995 | 8.01 |

| Melstacorp PLC | 22,516,691 | 7.36 | 22,383,614 | 7.36 |

| Seafeld International Limited | 17,822,125 | 5.82 | 17,716,794 | 5.82 |

| Mr H H Abdulhusein | 9,000,000 | 2.94 | – | |

| Renuka City Hotels PLC | 6,968,052 | 2.28 | 6,926,870 | 2.28 |

| People's Leasing & Finance PLC/Don & Don Holdings (Pvt) Limited | 4,673,501 | 1.53 | 210,008 | 0.07 |

| Renuka Hotels PLC | 4,097,577 | 1.34 | 4,073,360 | 1.34 |

| Employees Trust Fund Board | 4,011,661 | 1.31 | 3,987,952 | 1.31 |

| Akbar Brothers (Pvt) Limited A/c No. 1 | 2,599,019 | 0.85 | 2,578,688 | 0.85 |

| Cargo Boat Development Company PLC | 2,513,052 | 0.82 | 2,498,200 | 0.82 |

| Sri Lanka Insurance Corporation Limited – General Fund | 2,166,551 | 0.71 | – | |

| Anverally International (Pvt) Limited | 2,056,639 | 0.67 | 1,682,148 | 0.55 |

| Stassen Exports (Pvt) Limited | 1,908,067 | 0.62 | 1,896,791 | 0.62 |

| Mr K P R B De Silva | 1,574,516 | 0.51 | – | |

| Crescent Launderers and Dry Cleaners (Pvt) Limited | 1,491,362 | 0.49 | 1,482,548 | 0.49 |

| Seylan Bank PLC/Senthilverl Holdings (Pvt) Limited | 1,333,476 | 0.44 | – | |

| Total of the 20 major shareholders | 251,477,402 | 82.19 | ||

| Other shareholders | 54,519,848 | 17.81 | ||

| Total | 305,997,250 | 100.00 | ||

* Shareholding as at 31 December 2019 of the twenty largest shareholders as at 31 December 2020.

Return to shareholders – Bank

| Description | 2020 | 2019 |

| Profit for the year (LKR Mn) | 2,388 | 2,074 |

| Return on total assets (%) * | 0.78 | 0.77 |

| Net assets per share (LKR) | 161.30 | 156.09 |

| Earnings per share (LKR) | 7.83 | 7.14 |

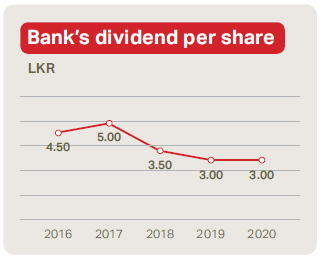

| Dividend per share (LKR) | 3.00 | 3.00 |

* After eliminating fair value reserve.

Financial return

DFCC Bank strives to regularly provide high shareholder returns through profitable and sustainable performance. The Directors approved a first and final dividend of LKR 3.00 per share by way of a scrip dividend for the year ended 31 December 2020.

Dividends are based on growth in profits, while taking into consideration future cash requirements and the maintenance of prudent ratios.